CFO Attributes

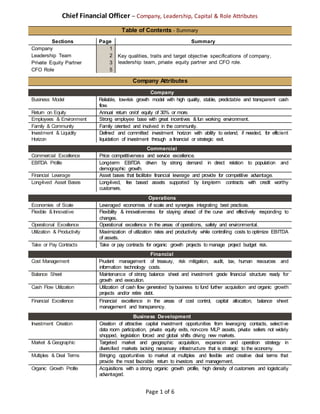

- 1. Chief Financial Officer – Company, Leadership, Capital & Role Attributes Page 1 of 6 Table of Contents - Summary Sections Page Summary Company 1 Key qualities, traits and target objective specifications of company, leadership team, private equity partner and CFO role. Leadership Team 2 Private Equity Partner 3 CFO Role 5 Company Attributes Company Business Model Reliable, low-risk growth model with high quality, stable, predictable and transparent cash flow. Return on Equity Annual return on/of equity of 30% or more. Employees & Environment Strong employee base with great incentives & fun working environment. Family & Community Family oriented and involved in the community. Investment & Liquidity Horizon Defined and committed investment horizon with ability to extend, if needed, for efficient liquidation of investment through a financial or strategic exit. Commercial Commercial Excellence Price competitiveness and service excellence. EBITDA Profile Long-term EBITDA driven by strong demand in direct relation to population and demographic growth. Financial Leverage Asset bases that facilitate financial leverage and provide for competitive advantage. Long-lived Asset Bases Long-lived, fee based assets supported by long-term contracts with credit worthy customers. Operations Economies of Scale Leveraged economies of scale and synergies integrating best practices. Flexible & Innovative Flexibility & innovativeness for staying ahead of the curve and effectively responding to changes. Operational Excellence Operational excellence in the areas of operations, safety and environmental. Utilization & Productivity Maximization of utilization rates and productivity while controlling costs to optimize EBITDA of assets. Take or Pay Contracts Take or pay contracts for organic growth projects to manage project budget risk. Financial Cost Management Prudent management of treasury, risk mitigation, audit, tax, human resources and information technology costs. Balance Sheet Maintenance of strong balance sheet and investment grade financial structure ready for growth and execution. Cash Flow Utilization Utilization of cash flow generated by business to fund further acquisition and organic growth projects and/or retire debt. Financial Excellence Financial excellence in the areas of cost control, capital allocation, balance sheet management and transparency. Business Development Investment Creation Creation of attractive capital investment opportunities from leveraging contacts, selective data room participation, private equity exits, non-core MLP assets, private sellers not widely shopped, legislation forced and global shifts driving new markets. Market & Geographic Targeted market and geographic acquisition, expansion and operation strategy in diversified markets lacking necessary infrastructure that is strategic to the economy. Multiples & Deal Terms Bringing opportunities to market at multiples and flexible and creative deal terms that provide the most favorable return to investors and management. Organic Growth Profile Acquisitions with a strong organic growth profile, high density of customers and logistically advantaged.

- 2. Chief Financial Officer – Company, Leadership, Capital & Role Attributes Page 2 of 6 Leadership Team Attributes Leadership Team Vision & Values Quality, innovative and growth oriented mission, vision and value statements around sources of true value, clearly understood by all stakeholders. Strategic Plans In support of vision and values, clearly understood by all stakeholders. Laws & Controls Controls, risk, reporting, monitoring, authority decision levels, regulatory compliance, policies and procedures. Structure & Culture Best practice structure of internal and external stakeholders with strong culture of communication, collaboration, creativity, quickness, growth investment mindset, performance, accountability, training and development. Assets & Processes Quality and innovative assets, equipment and tools with balanced, efficient and consistent processes that are simple to follow. Products & Services Differentiation from competition in customer value propositions. Growth Development Strong process around acquisitions, organic growth projects, new customer development, operations, cash flow management and lending sources. Stages & Cycles Ability to quickly adapt and change business plan as needed based on external forces. Commercial Team Structure & Incentives Right commercial structure around each business unit with aligned targets, incentives and rewards to encourage the right behaviors. Market Analysis Size and growth potential, resource drivers, trends, potential customers, competition and value propositions needed for current and future operating areas. Benchmarks & Identification Measurement of business units and assets to leader’s key benchmarks in the market for identification of opportunities by challenging the status quo and old ways of thinking and identifying and implementing hidden value within existing businesses. Target Customer Defined target with right risk profile, contract structure, pricing and long-term commitment. Becoming a long-term partner and part of planning and strategy cycle with most profitable customers and segments while walking away from less attractive. Maximize Core Maximization of customer volume capacity based on contract structure and pricing. Value Proposition: Focusing on differentiation from competition that better meets customer’s needs and provides for competitive advantage. Decide, design and delivery. Decide - identify most attractive sectors and markets of the value chain. Define value propositions to offer in the future and set strategic and financial goals that are realistic. Design - develop detail understanding of customer needs. Prioritize most attractive customer segments. Design differentiated products and services. Delivery - align commercial energy to priority segments. Price and contract to reflect capital intensive value to customer. Optimize current assets in terms of utilization, contracts and pricing. Define appropriate midstream channel mix based on economics, trends and risk. Maximize commercial team's effectiveness around customer acquisition (right kind & diversity) and loyalty. Economic Analysis Sound economic evaluation process in place for pricing and structuring contracts and agreements. Operations Team Value Proposition Value proposition to customer with reliable, consistent, quality and innovative services. Utilization Productivity Expand utilization capacity around all assets for maximum productivity. Economies of Scale Maximization when available through organic growth and acquisitions. Repairs & Maintenance Efficient and effective repairs and maintenance process around all assets to ensure the continued flow of product for customers. Project Management Efficient and effective project development process to ensure projects come in on time and budget. Measurement & Analysis Effective and efficient measurement and analysis process for accuracy of billing and EBITDA. Safety & Environmental Deliver reliable, safe and efficient energy services. Ensure we are meeting and exceeding all environmental and safety regulations.

- 3. Chief Financial Officer – Company, Leadership, Capital & Role Attributes Page 3 of 6 Human Resources Team Employer Brand Strong employer brand that is creative and provides for the employee value proposition; strong brand of payroll, benefits, incentives, development and culture. Engagement of Superstars Engagement of superstars. Maintaining an employee base of high performers and a strong process in moving low performers out. Training & Development Training and development of employees around company’s vision, values and strategy. Recruitment Recruitment of the best and brightest with the right technical and operating experience. Seeking motivated and engaged employees in support of goals, plan and culture. Communications Creation, development and maintenance of a strong consistent communication process with employees. Manager Advice Providing advice to managers on employee issues as needed. Information Technology Team Technology & Cost Utilization of best of class technology to become more efficient and provide creative and innovative solutions around all of our assets and services to help reduce costs. Technology Experience Experience in the application of technology within industry coupled with access to a vast network of experts. Private Equity/Board Attributes Aligned Interest & Partnership Interest & Partnership Alignment of interest and long-term partnership approach in creation of strong foundation for a successful investment. Culture & Values Shared culture and values between private equity firm and portfolio company. Industry Devotion Tactical familiarity and devotion to portfolio company’s industry. Tangibility Brings more than capital to the table. Reputation & Record Reputation and track record of being a good partner. Incentive Program Attractiveness of equity incentive program. Culture & Values Culture Culture and people are everything to entrepreneurs as they carry the burden of each employee’s professional and personal lives. What makes the company special and thrive, requires great care from a partner. Values Core values are key to a process driven approach and focus, and as such, partners need to be additive and complementary. Partner should strive to achieve the entrepreneur’s vision and create a legacy for the company’s founders and team. Side of Table Instead of sitting on the other side of the table from portfolio company, partner needs to sit on the same side, take time tounderstand what motivates them and forge strong alignment of interests. Flexibility & Creativity Flexible & Creative Partner should be flexible and creative in structuring the best transaction for everyone involved, working closely on a common definition of success from onset of relationship, creating investment strategies that align with goals of management team. Open Mind Operating with an open mind to new ideas and ways of doing things and possess an urgency in getting things done as creative problem solvers. Responsive & Quick Being available and responsive, ensuring nimble and quick decisions, helping seize the opportunities at hand. Patience & Focus Patience Patience and a defined investment horizon focused on building fair partnerships centered on lasting success versus market timers or quick results. From the start of a relationship, exit strategies need to be developed that make sense for everyone involved. Long-Term Vision Partner with a long-term vision that incorporates their financial strength and creativity, deep industry relationships and entrepreneurial mindset at every stage of a company’s lifecycle. Focus Focus by management and partner on the technical, operational and economic aspects of investments drives success. The collective operational background and investment experience allows for thoughtful insight and the proper allocation of resources.

- 4. Chief Financial Officer – Company, Leadership, Capital & Role Attributes Page 4 of 6 Collaboration & Teamwork Like-minded management and partner who value the power of partnership and trust are integral to success. There needs to be a collaboration to develop and implement strategic plans that match both parties' long-term goals and are actionable from the start. Strategy Buy & Build Growth Empowered by a supportive culture and a proprietary value creation process. Industry Knowledge Investment approach needs to start with deep industry knowledge and research. Significant knowledge in industries poised for growth, allows access to potential opportunities as a partner rather than just an investor throughout entire investment life cycle. Customer-Driven Partner should collaborate with company’s management team on a customer-centric strategic plan. Identify opportunities that improve the business’s value proposition, providing more products, services, and capabilities and positioning the business for accelerated long-term growth. Operational Excellence Strives for each platform investment to become a larger more-established industry leader with operational excellence while maintaining the energy, agility, and nimbleness of an entrepreneurial enterprise. Industry Leadership Partner should help management strengthen the foundation of the business, accelerate internal growth, and complete strategic add-on acquisitions. This combination of objectives positions a company to become a partner and solution to its customers, creating a differentiated business model with high barriers-to-entry and superior valuation. Business Development Seek niches and premiums, identifying underserved areas of investment and opportunities where inefficiencies exist. Large markets are generally efficient, capital is readily available and no premium exists. Concentrate on investments that facilitate premiums and best in class teams. Experience Beyond Bottom Line Partner should provide management team partners with financial, operational and industry insight that goes beyond the bottom line. Technical Experience Partner should have technical experience as engineers, operators, and business owners. Regulatory Experience Deep understanding of regulated businesses, competitive markets and the dynamics of transitioning from a highly regulated market to a more competitive market. Advisory Board Assist in identifying macroeconomic trends in the industry, conducting due diligence on specific opportunities, recruiting management for portfolio companies and sourcing transactions. Investment & Research Partner with extensive investment capabilities, diligently and systematically researching possible industry segments, reaching across a vast network of relationships and participating in industry events. Providing for certainty, agility, consistency and value-added propositions. Deal Sourcing & Relationships Deal Sourcing Development of differentiated investment theses, enhancing deal flow by profiling industries, screening companies and devising plans to approach targets. Developing knowledge and sourcing advantages to mitigate and lower risk Relationships & Reputation Experience that spans all relevant aspects of industry with vital network of deep relationships brought to bear in value-adding ways for portfolio company. Analysis & Integration Assessing performance improvement opportunities in pursuit of rapid returns by helping management develop strategic blueprints for the acquired companies, leading workshops that align management with strategic priorities and directing focused initiatives. Financing Innovative Financings Innovative financings for portfolio companies that help them lower their cost of capital and exit at higher values. Financing Capabilities Experience in helping arrange financing for portfolio companies and projects from a variety of sources; public and private equity markets, public and private debt markets, bank debt markets and non-recourse project financings. Cash Flow Focus Focusing on investments and strategies that have durable growing cash flows for capital appreciation. A focus on yield plus growth cash flow that shortens the duration of investments and lowers volatility.

- 5. Chief Financial Officer – Company, Leadership, Capital & Role Attributes Page 5 of 6 Excessive Leverage Leveraging can amplify gains and losses equally and lead to permanent loss. A balanced focus on return “of” capital and return “on” capital. CFO Position Attributes Guidance, Direction & Control Strategic Plan Strategy development with CEO covering all aspects of the business. Setting and executing a strategy of growth and profitability and serving as an effective business- oriented partner to other members of the management team. Policies & Procedures Controls and standards to safeguard company assets. Risk Management Financial and physical risk management. Corporate Activities Assisting in directing, administering, and coordinating corporate activities in accordance with policies, goals, and objectives established by the CEO and Board. Financial & Operating Reporting Reporting Processes - Reporting processes and systems that ensure financial reports to senior management and external stakeholders are accurate, appropriate, properly integrated, timely, consistent and clear. ERP System - Evaluating and deploying an ERP system to meet current and future business needs. Ensuring that appropriate financial and management systems are in place. Data & Analytics –Translation of monthly financial and operating analytics and data that is impactful and actionable for the business in support of operational decision- making. Budgets & Forecasts Preparation of annual budgets and rolling 12-month financial and cash flow forecasts. Cost & Revenue Ensuring maximized cost savings and revenue opportunities. Governance & Leadership Leadership & Vision Effectively interacting with and influencing across the organization creating a followership and driving the company to new levels of success through a collaborative partnership mindset with strong capabilities to build relationships across and outside the organization to influence key decision makers and execute deals. Ability to make compelling arguments through articulate and concise communication. Operations-Oriented Operations-oriented financial executive with extensive experience in leading companies with substantial organic growth and M&A activity profiles. Business Acumen Strategic, “business-driven” financial instincts with an understanding of the operational and commercial business levers and the interrelationships between driving results from both a P&L and cash flow perspective. Architect Skills Strong team leadership capability and a demonstrated history of building companies and teams including people, assets, systems and processes in support of EBITDA and ROE growth. CEO Partnership Proactively driving efforts supporting the CEO in making key strategic decisions for how the company will grow EBITDA at favorable CAPEX multiples, maintaining a strong balance sheet and providing superior investor returns. Business Partner A trusted thought partner to senior leadership team, effectively interacting and communicating with the CEO, Board of Directors and Business Unit Operations toincrease business value through attainment of operational and financial goals. Continuous Improvement Reputation for driving continuous improvement and accountability without eroding an entrepreneurial culture. History of making decisions and recommendations that achieve an optimal outcome. Financing Private Equity Extensive experience interacting with private equity investors and other external stakeholders, representing the company in financial and business matters and ensuring their needs are met. Banking Relationships Deep experience sourcing and dealing with banking lenders and managing their expectations through ownership of balance sheet. Superior reputation, track record and long standing relationships with variety (type and size) of secure lending institutions. Team Structure & Processes

- 6. Chief Financial Officer – Company, Leadership, Capital & Role Attributes Page 6 of 6 Finance Function A best-in-class, scalable finance function with the ability to organize, integrate, and analyze a wide range of financial, operational, competitor and marketplace information with a demonstrated ability to truly forecast in a way that delivers actionable insights for the business. Finance Team A high-performing finance organization, successfully attracting, developing and retaining top talent. Engagement of team through enthusiasm and excitement about the business, strategy and achieving results. Financial Operations Maintaining overall responsibility for the financial operations of the company, including; planning and analysis, cash and capital management, forecasting and budgeting, accounting, audit, and tax. ERP Systems Complete understanding of ERP systems with extensive experience evaluating and implementing ERP system solutions that drive business continuity, collaboration, productivity, and connectivity. Financial Expert Viewed as expert in understanding, communicating and educating the organization about the financial implications of business decisions going beyond financial modeling. Cash Management Effective cash management process balancing liquidity growth objectives against lending expectations. Growth & Development Business Development Extensive experience with a diversified portfolio of petroleum energy M&A transactions and organic growth and green-field development projects, including sourcing, economic valuation, structuring, negotiations, due diligence, integration and transformation. Financing & Capital Responsibility for adiversification of strategic growth funding initiatives including private and public debt and equity. Proper capital structuring and cash flow management in support of optimal liquidity event valuation. Structuring & Negotiations Meaningful contributions to major contract structuring, negotiation, oversight, costing evaluations and pricing. Markets & Adaption Understanding of market conditions (threats/opportunities) and making recommendations on how to adapt strategy to changing market conditions. Liquidity & Exit Experience and key role in positioning and preparing companies for successful liquidity events within defined investment horizons. Personal Characteristics Presence & Communication Strong executive presence and crisp communication skills. Thriving in an environment marked by frequent, daily communication and interaction with internal and outside stakeholders. Accountability & Relationships A strong, mature, proactive leader promoting a culture of accountability, building strong working relationships cross-functionally between the finance and operations teams. Integrity Impeccable integrity. Decisive & Driven Decisive and driven, yet even-keeled and professional. Culture Assimilation Ability to quickly assimilate into the culture of the company and work effectively as a business partner with the entire senior management team, especially the CEO. Team Oriented Ability to both lead and support team goals. Developing & Mentorship A dedicated coach and mentor who is committed to recruiting and developing talent.