EY India Attractiveness Survey 2015 – Top Reasons to Invest to Invest in India

•

4 gefällt mir•3,151 views

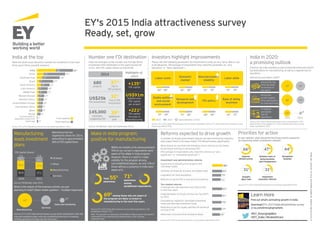

Investors see India speeding up pace towards becoming world's top destinations for manufacturing. Check out this detailed infographic on what’s activating growth in India.

Melden

Teilen

Melden

Teilen

Downloaden Sie, um offline zu lesen

Empfohlen

Empfohlen

Presentation from NRF 2022: Retail’s Big Show

Kiri Katterhenry, Bain & Company Inc.

Carla Nasr, Bain & Company Inc.The 360 supply chain: Bain & Company examines changes needed to make supply c...

The 360 supply chain: Bain & Company examines changes needed to make supply c...National Retail Federation

Weitere ähnliche Inhalte

Was ist angesagt?

Presentation from NRF 2022: Retail’s Big Show

Kiri Katterhenry, Bain & Company Inc.

Carla Nasr, Bain & Company Inc.The 360 supply chain: Bain & Company examines changes needed to make supply c...

The 360 supply chain: Bain & Company examines changes needed to make supply c...National Retail Federation

Was ist angesagt? (20)

The Diversity Imperative: 14th Annual Australian Chief Executive Study

The Diversity Imperative: 14th Annual Australian Chief Executive Study

Apache Hadoop Summit 2016: The Future of Apache Hadoop an Enterprise Architec...

Apache Hadoop Summit 2016: The Future of Apache Hadoop an Enterprise Architec...

Navigating a digital-first home furnishings market

Navigating a digital-first home furnishings market

MGI: From poverty to empowerment: India’s imperative for jobs, growth, and ef...

MGI: From poverty to empowerment: India’s imperative for jobs, growth, and ef...

The Accelerating Growth of Frictionless Commerce | A.T. Kearney

The Accelerating Growth of Frictionless Commerce | A.T. Kearney

Race in the workplace: The Black experience in the US private sector

Race in the workplace: The Black experience in the US private sector

The 360 supply chain: Bain & Company examines changes needed to make supply c...

The 360 supply chain: Bain & Company examines changes needed to make supply c...

Unleashing Competitiveness on the Cloud Continuum | Accenture

Unleashing Competitiveness on the Cloud Continuum | Accenture

Fintech New York: Partnerships, Platforms and Open Innovation

Fintech New York: Partnerships, Platforms and Open Innovation

2021 Women in the Workplace News and Media Briefing

2021 Women in the Workplace News and Media Briefing

A.T. Kearney 2017 State of Logistics Report: Accelerating into Uncertainty

A.T. Kearney 2017 State of Logistics Report: Accelerating into Uncertainty

#BainWebinar Next Generation Industrial Performance Post COVID-19

#BainWebinar Next Generation Industrial Performance Post COVID-19

PwC’s new Golden Age Index – how well are countries harnessing the power of o...

PwC’s new Golden Age Index – how well are countries harnessing the power of o...

World Economic Forum: The power of analytics for better and faster decisions ...

World Economic Forum: The power of analytics for better and faster decisions ...

A.T. Kearney Consolidation of the US Banking Industry

A.T. Kearney Consolidation of the US Banking Industry

Andere mochten auch

Andere mochten auch (14)

Digital Europe: Pushing the frontier, capturing the benefits

Digital Europe: Pushing the frontier, capturing the benefits

New models of healthcare, Oliver Wyman at For Later Life 2014

New models of healthcare, Oliver Wyman at For Later Life 2014

Hotelmarkt Deutschland: München weiter auf Wachstumskurs

Hotelmarkt Deutschland: München weiter auf Wachstumskurs

Achieving digital maturity: Adapting your company to a changing world

Achieving digital maturity: Adapting your company to a changing world

Winning competition through organizational agility

Winning competition through organizational agility

A.T. Kearney Energy Transition Institute - 10 Facts, An Introduction to Energ...

A.T. Kearney Energy Transition Institute - 10 Facts, An Introduction to Energ...

Ähnlich wie EY India Attractiveness Survey 2015 – Top Reasons to Invest to Invest in India

Ähnlich wie EY India Attractiveness Survey 2015 – Top Reasons to Invest to Invest in India (20)

Presentation on #MakeInIndia for Indian School of Business, Mohali

Presentation on #MakeInIndia for Indian School of Business, Mohali

India FDI-Current Status, Issues and Policy Recommendations

India FDI-Current Status, Issues and Policy Recommendations

Mirae_Asset_The_Case_for_India_Standing_Out_from_the_Crowd.pdf

Mirae_Asset_The_Case_for_India_Standing_Out_from_the_Crowd.pdf

Inc42’s Annual Indian Tech Startup Funding Report 2019

Inc42’s Annual Indian Tech Startup Funding Report 2019

Vibrant Gujarat - Innovation & Knowledge Sector Profile

Vibrant Gujarat - Innovation & Knowledge Sector Profile

Foreign direct investment in india an analytical study

Foreign direct investment in india an analytical study

Mehr von EY

Mehr von EY (20)

Quarterly analyst themes of oil and gas earnings, Q1 2022

Quarterly analyst themes of oil and gas earnings, Q1 2022

EY Price Point: global oil and gas market outlook, Q2 | April 2022

EY Price Point: global oil and gas market outlook, Q2 | April 2022

EY Price Point: global oil and gas market outlook, Q2 April 2021

EY Price Point: global oil and gas market outlook, Q2 April 2021

Tax Alerte - Principales dispositions loi de finances 2021

Tax Alerte - Principales dispositions loi de finances 2021

EY Price Point: global oil and gas market outlook (Q4, October 2020)

EY Price Point: global oil and gas market outlook (Q4, October 2020)

Liquidity for advanced manufacturing and automotive sectors in the face of Co...

Liquidity for advanced manufacturing and automotive sectors in the face of Co...

IBOR transition: Opportunities and challenges for the asset management industry

IBOR transition: Opportunities and challenges for the asset management industry

Fusionen und Übernahmen dürften nach der Krise zunehmen

Fusionen und Übernahmen dürften nach der Krise zunehmen

EY Price Point: global oil and gas market outlook, Q2, April 2020

EY Price Point: global oil and gas market outlook, Q2, April 2020

Kürzlich hochgeladen

Kürzlich hochgeladen (20)

Collective Mining | Corporate Presentation - May 2024

Collective Mining | Corporate Presentation - May 2024

Nicola Mining Inc. Corporate Presentation May 2024

Nicola Mining Inc. Corporate Presentation May 2024

Osisko Gold Royalties Ltd - Corporate Presentation, May 2024

Osisko Gold Royalties Ltd - Corporate Presentation, May 2024

Osisko Development - Investor Presentation - May 2024

Osisko Development - Investor Presentation - May 2024

Financial Results for the Fiscal Year Ended March 2024

Financial Results for the Fiscal Year Ended March 2024

Corporate Presentation Probe Canaccord Conference 2024.pdf

Corporate Presentation Probe Canaccord Conference 2024.pdf

EY India Attractiveness Survey 2015 – Top Reasons to Invest to Invest in India

- 1. EY's 2015 India attractiveness survey Ready, set, grow India at the top Manufacturing leads investment plans Rank the three most attractive markets for investment in the next three years (three possible answers) Number one FDI destination Source: fDi Markets, May and September 2015. 680 projects US$25b 145,000 total jobs created by FDI 2014 37% rise in FDI projects 32% rise in FDI investment 39% additional jobs +135% FDI capital US$91m highest ever FDI capital per project +221% FDI capital increase in manufacturing Highlights of 1H15 Investors highlight improvements India in 2020: a promising outlook ©2015EYGMLimited.AllRightsReserved.EYGno.AU3557.EDNone. Learn more Find out what’s activating growth in India Download EY’s 2015 India attractiveness survey at ey.com/emergingmarkets @EY_EmergingMkts @EY_India | #IndiaAttract Please rate the following parameters for investment in India as very, fairly, little or notIndia has emerged as the number one Foreign Direct Investment (FDI) destination in the world during the 1H15, with FDI capital inflows of US$30.8b. at all attractive. (Percentage of respondents who rated the parameter as “very attractive” or “fairly significant”) What is the nature of the business activity you are planning in India? (Open-ended question — multiple responses) Source: EY's 2015 India attractiveness survey (total respondents: 265 with overseas expansion plans, who are considering entering or increasing existing operations in India over the next year). Manufacturing Services Sales and marketing FDI capital (share) Source: fDi Markets, May 2015. 20132014 36.8 45.5 15.1 2.6 37.1 37.0 23.1 2.8 Services Manufacturing Retail Strategic 21% 42%62% Labor costs 86% 82% Domestic market 81% 82% Labor skills 76% 78% 76% 70% Stable political and social environment 74% 59% Research and development 72% 69% FDI policy 68% 60% Ease of doing business 67% 57% Manufacturing has regained its share for 2014, amounting to approximately 46% of FDI capital flows. Source: EY's 2015 India attractiveness survey (respondents: 250, asked to half of the sample); EY's 2014 India attractiveness survey (total respondents: 502). 20142015 Among the top three growing economies in the world Among the world’s leading three destinations for manufacturing A regional and global hub for operations 29% 37% 24% 35% 9% 21% Investors see India speeding up pace toward becoming one world's top destinations for manufacturing, as well as a regional hub for operations. How do you see India in 2020? 2% 1% 6% 9% 9% 10% 11% 12% 17% 18% 21% 27% 38% 47% 60% Can't say Commonwealth of Independent States (CIS) Russia Japan Sub-Saharan Africa Central Eastern Europe Northern Africa Western Europe Middle East Latin America North America Brazil Southeast Asia China India 32% 15% 12% 5% 10% 3% 4% 4% 3% 3% 3% 3% 1% First mention Total mentions Source: EY's 2015 India attractiveness survey (total respondents 505). What impact do you think the following recent reforms by the Indian Government will have in attracting FDI? (Percentage of respondents who rated the reforms as “very significant” or “somewhat significant”) Investment and administrative reforms Tax-related reforms Investment in infrastructure projects and 100 Smart Cities 89% 83% 75% 71% 83% 81% Schemes on financial inclusion and Digital India Legislation for land acquisition Reforms to permit FDI in insurance and defense Corporate tax rate reduction from 30% to 25% in next four years Implementation of Goods and Service Tax (GST) by 2016 Favorable tax regime for real estate investment trusts and alternate investment funds 78% Reduction in tax for royalty and fees for technical services (FTS) 77% Deferment of General Anti-Avoidance Rules 65% Reforms expected to drive growth A number of recent government reforms are well received by investors, who expect them to increase India’s FDI attractiveness significantly. Source: EY's 2015 India attractiveness survey (total respondents 505). Priorities for action In your opinion, what should be the three priority measures for improving India’s investment climate? Improve infrastructure 66% Enhance ease of doing business and transparency 47% Streamline taxation 44% Simplify labor laws 31% Implement economic reforms 31% 2015 2014 Improvements in 2015 Source: EY's 2015 India attractiveness survey (total respondents 505); EY's 2014 India attractiveness survey (total respondents 502).Source: EY's 2015 India attractiveness survey (total respondents: 505). Total 55% awareness 71% awareness among established respondents 69% among those who are aware of the program are likely to invest in manufacturing in the next five years Within six months of its announcement, 55% of our survey’s respondents were aware of the Make in India program. However, there is a need to create visibility for the program among non-established players, as only 10% of those without a presence in India were aware of it. Make in India program: positive for manufacturing Note: The question on awareness of the Make in India program was asked to respondents from manufacturing-related sectors, with overseas expansion plans. Source: EY’s 2015 India attractiveness survey (total respondents: 234, established in India: 173.) FDI investment Macroeconomic stability