QSE Rises 1.3% on Real Estate, Industrial Gains

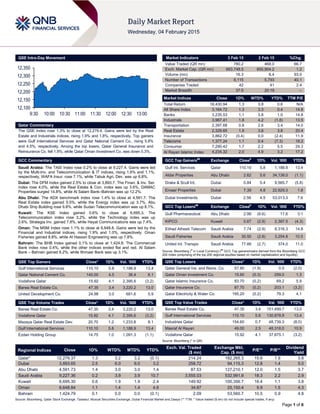

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 1.3% to close at 12,279.4. Gains were led by the Real Estate and Industrials indices, rising 1.9% and 1.8%, respectively. Top gainers were Gulf International Services and Qatar National Cement Co., rising 5.8% and 4.5%, respectively. Among the top losers, Qatar General Insurance and Reinsurance Co. fell 1.9%, while Qatar Oman Investment Co. was down 0.3%. GCC Commentary Saudi Arabia: The TASI Index rose 0.2% to close at 9,227.4. Gains were led by the Multi-Inv. and Telecommunication & IT indices, rising 1.6% and 1.1%, respectively. WAFA Insur. rose 7.1%, while Tabuk Agri. Dev. was up 6.8%. Dubai: The DFM Index gained 2.5% to close at 3,893.7. The Finan. & Inv. Ser. index rose 4.0%, while the Real Estate & Con. index was up 3.6%. DAMAC Properties surged 14.8%, while Al Salam Bank–Bahrain was up 12.2%. Abu Dhabi: The ADX benchmark index rose 1.4% to close at 4,591.7. The Real Estate index gained 5.5%, while the Energy index was up 3.7%. Abu Dhabi Ship Building rose 9.8%, while Sudan Telecommunication was up 8.1%. Kuwait: The KSE Index gained 0.6% to close at 6,695.3. The Telecommunication index rose 3.2%, while the Technology index was up 2.6%. Strategia Inv. gained 7.8%, while Hayat Communications was up 7.4%. Oman: The MSM Index rose 1.1% to close at 6,648.8. Gains were led by the Financial and Industrial indices, rising 1.9% and 1.0%, respectively. Oman Fisheries gained 8.8%, while Al Hassan Engineering was up 7.8%. Bahrain: The BHB Index gained 0.1% to close at 1,424.8. The Commercial Bank index rose 0.4%, while the other indices ended flat and red. Al Salam Bank – Bahrain gained 6.2%, while Ithmaar Bank was up 3.1%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Gulf International Services 110.10 5.8 1,188.9 13.4 Qatar National Cement Co. 140.00 4.5 36.4 6.1 Vodafone Qatar 15.92 4.1 2,395.6 (3.2) Barwa Real Estate Co. 47.35 3.4 3,220.2 13.0 United Development Co. 24.98 3.0 681.6 5.9 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Barwa Real Estate Co. 47.35 3.4 3,220.2 13.0 Vodafone Qatar 15.92 4.1 2,395.6 (3.2) Mazaya Qatar Real Estate Dev. 20.70 1.2 1,233.8 8.1 Gulf International Services 110.10 5.8 1,188.9 13.4 Ezdan Holding Group 14.75 1.0 1,091.3 (1.1) Market Indicators 3 Feb 15 2 Feb 15 %Chg. Value Traded (QR mn) 780.2 468.0 66.7 Exch. Market Cap. (QR mn) 663,748.5 655,904.2 1.2 Volume (mn) 16.3 8.4 93.0 Number of Transactions 8,115 5,793 40.1 Companies Traded 42 41 2.4 Market Breadth 37:5 20:19 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,430.94 1.3 3.8 0.6 N/A All Share Index 3,164.72 1.3 3.3 0.4 14.8 Banks 3,235.53 1.1 3.8 1.0 14.8 Industrials 3,967.41 1.8 4.2 (1.8) 13.5 Transportation 2,397.68 0.8 2.6 3.4 14.0 Real Estate 2,329.65 1.9 3.6 3.8 20.4 Insurance 3,862.72 (0.4) 0.0 (2.4) 11.9 Telecoms 1,377.24 1.1 0.4 (7.3) 18.2 Consumer 7,290.42 1.7 2.2 5.5 29.3 Al Rayan Islamic Index 4,234.32 2.0 4.9 3.2 17.2 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Gulf Int. Services Qatar 110.10 5.8 1,188.9 13.4 Aldar Properties Abu Dhabi 2.62 5.6 34,138.0 (1.1) Drake & Scull Int. Dubai 0.84 5.4 9,565.7 (5.8) Emaar Properties Dubai 7.39 4.8 22,629.3 1.8 Dubai Investments Dubai 2.56 4.5 53,013.3 7.6 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Gulf Pharmaceutical Abu Dhabi 2.98 (6.6) 17.6 3.1 KIPCO Kuwait 0.67 (2.9) 2,387.5 (4.3) Etihad Atheeb Telecom Saudi Arabia 7.74 (2.9) 8,316.3 14.8 Saudi Fisheries Saudi Arabia 30.50 (2.8) 3,254.8 10.5 United Int. Transpo Saudi Arabia 77.66 (2.7) 374.0 11.0 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar General Ins. and Reins. Co. 57.80 (1.9) 0.5 (2.0) Qatar Oman Investment Co. 15.60 (0.3) 259.0 1.3 Qatar Islamic Insurance Co. 83.70 (0.2) 69.2 5.9 Qatar Insurance Co. 87.70 (0.2) 203.1 (3.2) Qatar Electricity & Water Co. 195.20 (0.2) 79.3 4.1 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Barwa Real Estate Co. 47.35 3.4 151,499.7 13.0 Gulf International Services 110.10 5.8 130,878.9 13.4 Industries Qatar 154.60 0.7 48,739.3 (8.0) Masraf Al Rayan 49.00 2.5 48,318.0 10.9 Vodafone Qatar 15.92 4.1 37,875.1 (3.2) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,279.37 1.3 3.2 3.2 (0.1) 214.24 182,265.3 15.6 1.9 3.8 Dubai 3,893.65 2.5 6.0 6.0 3.2 258.72 94,115.3 12.8 1.4 5.0 Abu Dhabi 4,591.73 1.4 3.0 3.0 1.4 87.53 127,210.1 12.0 1.5 3.7 Saudi Arabia 9,227.36 0.2 3.9 3.9 10.7 3,555.03 532,991.8 18.3 2.2 2.9 Kuwait 6,695.30 0.6 1.9 1.9 2.4 149.92 100,356.7 16.4 1.1 3.8 Oman 6,648.84 1.1 1.4 1.4 4.8 34.87 25,150.4 9.9 1.5 4.3 Bahrain 1,424.79 0.1 0.0 0.0 (0.1) 2.09 53,560.7 10.5 0.9 4.8 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,100 12,150 12,200 12,250 12,300 12,350 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose 1.3% to close at 12,279.4. The Real Estate and Industrials indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari shareholders. Gulf International Services and Qatar National Cement Co. were the top gainers, rising 5.8% and 4.5%, respectively. Among the top losers, Qatar General Insurance and Reinsurance Co. fell 1.9%, while Qatar Oman Investment Co. was down 0.3%. Volume of shares traded on Tuesday rose by 93.0% to 16.3mn from 8.4mn on Monday. Further, as compared to the 30-day moving average of 13.8mn, volume for the day was 17.7% higher. Barwa Real Estate Co. and Vodafone Qatar were the most active stocks, contributing 19.8% and 14.7% to the total volume respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings and Global Economic Data Earnings Releases Company Market Currency Revenue (mn) 4Q2014 % Change YoY Operating Profit (mn) 4Q2014 % Change YoY Net Profit (mn) 4Q2014 % Change YoY Banader Hotels Co.* Bahrain BHD – – – – -0.1 NA Source: Company data, DFM, ADX, MSM (* FY2014 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 02/03 US US Census Bureau Factory Orders December -3.40% -2.40% -1.70% 02/03 EU Eurostat PPI MoM December -1.00% -0.70% -0.30% 02/03 EU Eurostat PPI YoY December -2.70% -2.50% -1.60% 02/03 UK Markit CIPS UK Construction PMI January 59.1 57.0 57.6 02/03 UK Markit CIPS UK Construction PMI January 59.1 57.0 57.6 02/03 Spain Spanish Labour Ministry Unemployment MoM Net ('000s) January 78.0 88.0 -64.4 02/03 Italy ISTAT CPI EU Harmonized MoM January -2.40% -2.40% 0.00% 02/03 Italy ISTAT CPI EU Harmonized YoY January -0.40% -0.40% -0.10% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar AHCS reports QR577.1mn net profit in FY2014, recommends 10% cash dividend – Aamal Company (AHCS) reported a net profit attributable to shareholders of QR577.1mn in FY2014, indicating an increase of 13.9% on a YoY basis. The earnings were supported by increased net profit at its industrial manufacturing (QR51.7mn in FY2014, up 128.3% YoY) and trading & distribution (+32.8% YoY to QR114.9mn). Reported EPS increased to QR0.96 in FY2014 from QR0.85 in FY2013. AHCS’ revenue grew 0.8% YoY to QR2.14bn in FY2014. Meanwhile, AHCS’ board of directors has recommended a 10% cash dividend and 5% bonus shares, which will have to be approved by the general assembly scheduled to be held on March 16, 2015. (QSE) QCB auctions T-bills worth QR4bn on February 3 – The Qatar Central Bank (QCB) has auctioned treasury bills worth QR4bn on February 3, 2015, for which it received bids totaling QR8bn. T-bills worth QR2bn with a three-month maturity period were auctioned at a yield of 0.86%. T-bills worth QR1bn with a six-month maturity period were sold at a yield of 0.89%, while T- bills worth QR1bn with a nine-month maturity period were auctioned at a yield of 0.96%. (QCB) CBQK concludes QR1bn finance deal for key Ashghal project – The Commercial Bank of Qatar (CBQK) has successfully concluded a financing arrangement of QR1bn in extended financing facilities to Joannou & Parakskevaides (Overseas) Limited for the award of the West Corridor construction project for the Public Works Authority (Ashghal). The contract was awarded to the joint venture Joannou & Parakskevaides (Overseas) Limited (75%) and J&P Avax S.A. (25%), valued at QR1.7bn with an estimated date of completion by 2016. CBQK led the club deal along with one of the major regional banks for facilitating finance in excess of QR1bn. (QSE) IQCD and MPHC confirms planned shutdown of production facilities – Industries Qatar (IQCD) and Mesaieed Petrochemical Holding Company (MPHC) have announced planned shutdowns of their production facilities in 1Q2015. The planned major maintenance shutdowns for MPHC’s newest facilities, RLOC and Q-Chem II are also included in the schedule. (QSE) UDCD unit launches operations under new name – United Technology Solutions (UTS), a wholly-owned subsidiary of United Development Company (UDCD), master developer of The Pearl-Qatar has officially launched its operations extending knowledge-based technical and business solutions and services to The Pearl-Qatar and the rest of country. UTS was formerly operating under the name United Facilities Solutions. (Bloomberg) MCCS BoD meeting on February 25 – Mannai Corporation’s (MCCS) board of directors will meet on February 25, 2015 to discuss the financial results ending December 31, 2014. (QSE) Overall Activity Buy %* Sell %* Net (QR) Qatari 66.16% 74.28% (63,330,934.15) Non-Qatari 33.84% 25.73% 63,330,934.15

- 3. Page 3 of 6 QGMD BoD meeting on February 18 – Qatar German for Medical Devices Company (QGMD) board of directors will meet on February 18, 2015 to discuss the financial results ending December 31, 2014. (QSE) Indosat EGM approves board appointments – Ooredoo’s (ORDS) Indonesian subsidiary, PT Indosat Tbk has announced that it has approved a number of changes to its boards of commissioners and Independent directors, following an Extraordinary General Meeting held on January 28, 2015. The changes come following the appointment of a number of board members to ministerial and other senior positions in Indonesia, and the appointment of HE Sheikh Abdullah Bin Mohammed Bin Saud Al-Thani as the CEO of the Qatar Investment Authority. As part of the changes, HE Sheikh Abdullah Bin Mohammed Bin Saud Al-Thani has resigned from the role of President Commissioner of Indosat. In addition, Rachmad Gobel has resigned as the company's Commissioner, due to his appointment as the Minister of Trade, Republic of Indonesia, and Mr. Rudiantara has resigned as the Company's Independent Commissioner, following his appointment as Minister of Communication & Information, Republic of Indonesia. (Bloomberg) International S&P reaches $1.5bn deal with US – Credit rating firm Standard & Poor's (S&P) will pay $1.5bn to resolve a collection of lawsuits over its ratings on mortgage securities that soured in the run-up to the 2008 financial crisis, concluding one of the US government's most ambitious cases tied to the housing collapse. The settlement comes after more than two years of litigation as S&P tried to beat back allegations that it issued overly rosy ratings in order to win more business. S&P parent McGraw Hill Financial Inc said it will pay $687.5mn to the US Department of Justice, and $687.5mn to 19 states and the District of Columbia, which had filed similar lawsuits over the ratings. Recently, the firm reached a separate $125mn settlement with public pension fund California Public Employees’ Retirement System, which had sued S&P in 2009, claiming its inaccurate ratings caused the firm hundreds of millions of dollars in losses. The US sued S&P in 2013 after initial settlement talks broke down, seeking $5bn and accusing the ratings agency of defrauding investors. S&P argued that its ratings were protected under the First Amendment right to free speech, and described the lawsuit as retaliation for the firm downgrading the credit rating of the US. (Reuters) PMI: UK construction growth unexpectedly rebounds in January – A business survey showed the growth across British construction companies rebounded unexpectedly in January after a slow end to 2014, boosted by improving order books and rising confidence. The Markit/CIPS construction purchasing managers' index (PMI) rose to 59.1 from December's 17-month low of 57.6, topping all Reuters forecasts. While the official data last week showed the construction output shrank at the end of last year at the fastest pace since 2012, the recent PMI pointed to better months ahead. The growth strengthened across housing, commercial and civil engineering as new orders piled up at the fastest rate in three months. Optimism about the 2016 increased for the first time in three months, albeit from only a little from December's 16-month low. (Reuters) Smaller jobless rise in January takes edge off Spain's labor market gloom – The number of registered jobless in Spain rose in January as employers shed workers hired for the Christmas holiday season. However, the rate of increase slowed from previous years, suggesting the ailing labor market may have touched bottom. The latest Labor Ministry data showed joblessness rose 2.4%, or by 113,097 people, from December to 4.8mn. The rise was the first since October. However, the ministry said it was also the smallest gain in the first month of the year since 2007, and in seasonally adjusted terms the figure fell by 3,907 people. Unemployment has soared in Spain than in any other European Union country bar Greece since a decade- long property bubble burst six years ago and, based on the labor market survey data from the national statistics office, the rate was 26% in 4Q2013. However, the recent stronger-than- expected economic growth has fueled hopes the worst may be over, and the headcount in the still battered construction sector rose by 3,486 in January. (Reuters) Italy PM Renzi says wants to help Greece within EU framework – Italian Prime Minister Matteo Renzi said that he wanted to help Greece, but said this did not mean he would always agree with the new Greek government led by Alexis Tsipras. Renzi said that he did not discuss details of Greece's plan to renegotiate its debt repayment program with creditors. However, he added that Italy would be ready to "listen and discuss" the proposals Greece brings before European institutions. (Reuters) Japan wages show sign of pick-up in welcome news for Abe – Japanese wage earners' cash earnings rose in December and declines in real wages slowed for a second month, a positive sign for policy makers' plan to recharge a recession-hit economy though doubts remain about the prospects for sustained growth in wages. The labor ministry data showed reflecting improved corporate earnings even as the broader economy struggled, special payments, predominantly including bonuses, rose 2.6% YTD to December. A ministry official said winter bonuses could likely grew for the second straight year, helping boost the overall wages. The total cash earnings grew 1.6% YTD to December, up for the 10th straight month. Real wages adjusted for inflation fell 1.4% YoY in December – down for the 18th straight month – but the pace of falls slowed from the prior month's 2.7% drop. (Reuters) China January HSBC services PMI at six-month low, more stimulus expected – A private survey showed China's service sector grew at the slowest pace in six months in January as growth in new business weakened, raising expectations that policy makers may unveil more stimulus steps to avert a sharper slowdown in the world's second-largest economy. The HSBC/Markit Services Purchasing Managers' Index(PMI) slowed to 51.8 in January – the weakest since July 2014 – from December's 53.4, but remained above the 50-point in activity on a monthly basis. The weakening performance of the services sector, which has helped cushion the broader impact of a cooling manufacturing sector, could fan market concerns about China's economic slowdown in 2015. (Reuters) Regional Alpen Capital: GCC retail sector sales to reach $284.5bn by 2018 – According to a report by Alpen Capital, sales in the GCC retail industry are expected to grow at a CAGR of 7.3% during 2013 to 2018 and will reach $284.5bn. As per the report, the food retail sales growth is anticipated to outperform the non-food retail sales due to higher demand for healthier and high-value food in the region. Sales among GCC supermarkets and hypermarkets are expected to reach $59.3bn by 2018, translating into a five-year CAGR of 9.2%. This growth is expected to be driven by increasing disposable income and modernization of the industry. Alpen Capital’s Managing Director, Sameena Ahmad said the retail industry continues to maintain a positive momentum due to key factors such as robust economic growth, rising purchasing power, growing population

- 4. Page 4 of 6 comprising a large proportion of expatriates, changing consumption patterns and increasing penetration of international retail players. (GulfBase.com) IMF: GCC oil export losses to hit $300bn in 2015 – According to the International Monetary Fund (IMF), oil export losses for GCC countries are expected to reach $300bn in 2015 (21 percentage points of GDP), leading to a fiscal deficit, while the proposed hike in the US rates is likely to tighten financial conditions in the GCC region. As a result, current account surpluses of GCC countries are projected to decline in 2015 to 1.6% of GDP. Their fiscal surplus stood at 4.6% of GDP in 2014, which is now projected to turn into a deficit of 6.3% of GDP in 2015. Qatar is expected to witness fiscal deficit of 1.5% of GDP in 2015, the UAE (3.7%), Saudi Arabia (10.1%), Bahrain (12.1%) and Oman (16.4%). (Gulf-Times.com) Strategy&: Gulf banks plan to sell bonds to boost reserves – According to a study by Strategy&, fast-growing Gulf Arab banks plan to bolster their reserves by issuing capital boosting bonds. The banking sector in the GCC region needs to have an additional $35bn of capital by 2019. While Gulf banks have very high capital adequacy ratios, their rapid expansion, and the fact they operate in emerging markets with lower sovereign ratings than the core developed economies mean that they will need more capital in coming years. The Basel III standards, now being implemented across the world, will require banks to hold more capital. (GulfBase.com) Reuters: Gulf banks underwrite region's aviation boom – According to Reuters, cash-rich Gulf banks are becoming bigger players in the region's aviation boom, helping carriers like Emirates, Qatar Airways (QA) and Etihad Airways to fund their fleet expansion. Figures from the European plane maker Airbus revealed that 47% of its aircraft deals in the Middle East in the first 11 months of 2014 were funded by local banks, up from 17% for 2013 as a whole. Further, opportunities for more funding are huge; Emirates has placed $107.5bn worth of aircraft on order with Boeing and Airbus over the coming few years. Similarly, the order books for QA and Etihad are about $57.7bn and $28.59bn, respectively at list prices. (Reuters) MoCI: 17,000 real estate units to be sold in KSA – The Saudi Ministry of Commerce & Industry (MoCI) announced that the number of real estate units ready for sale across various regions of Saudi Arabia amounts to more than 17,000, which are valued at around SR20bn by 2014-end. According to statistics from the MoCI, the total number of licensed real estate units for sale in all regions of the Kingdom stood at 17,258 real estate units, which comprises of 14,834 housing units, 354 office units, eight commercial units and 2,070 land development units worth a total value of around SR19.3bn. (GulfBase.com) Al Alamiya completes rump offering and rights allocation – Al Alamiya for Cooperative Insurance Company announced that the period for subscription for the new shares amounting to 20mn shares has ended. The number of subscribed shares during the first and the second subscription period amounted to 19.57mn totaling SR195.66mn, with a coverage percentage of 97.83% of the new shares. In addition, the company announced the end of the rump offering period. During this period, 433,885 shares were offered to institutional investors. The offering coverage percentage was 842%, and the average subscription price stood at SR54.49. The total amount of the rump shares amounted to SR23.64mn. (Tadawul) Al Othaim, AGAD to establish new JV in KSA – Abdullah Al Othaim Markets Company (Al Othaim) has entered into a binding shareholder agreement with AGAD United Company for Investment (AGAD), a sister company of AlBaik Food Systems Company Ltd. Under the agreement’s terms, the entities will establish a limited liability company in Saudi Arabia for obtaining exclusive license rights to operate AlBaik restaurants in Al Qassim region. Al Othaim will hold a 25% stake, while the remaining 75% stake will be held by AGAD in the newly formed entity that will have a share capital of SR100mn. The term of the agreement is 25 years, which is renewable by mutual consent of the parties. (Tadawul) Jadwa: KSA consumption growth likely to be strong in 2015 – According to a report by Jadwa Investment, the recent Royal decrees, which reinforced the view that the Saudi government will not cut its expenditure due to lower oil prices, will add renewed confidence among investors. Data for December 2014 showed healthy growth in consumer spending, which is expected to continue in 2015. The Jadwa report found that real income per capita grew by 1% YoY to reach $21,101 in 2014, after remaining flat in 2013. In contrast, the growth in real non-oil income per capita slowed to 2.4% in 2014, as compared to a growth of 3.6% in 2013. (GulfBase.com) DIA set for record retail sales on China buyers – Dubai International Airport (DIA) has set its sights on becoming the world’s top hub for retail sales in 2015 as a flood of Chinese passengers add to a shopping spree. According to Colm McLoughlin, Vice Chairman of Dubai Duty Free (DDF), spending at DIA should reach $2.1bn in 2015, up from $1.9bn last year, when 80 days of runway repairs reduced receipts by about $50mn. He said that Chinese passengers, who make up about 5% of DIA’s total throughput, contributed 13% of DDF’s revenue in 2014, countering a decline in spending by Russians after the weakening of the ruble. (Bloomberg) Arabtec wins two contracts worth AED375mn from Emaar – Arabtec Holding, through its subsidiary Arabtec Construction has recently won two contracts worth AED375mn from Emaar Properties in Dubai. The first project includes townhouse villas in Emaar’s Al Mira Residential Project, which is due for delivery by May 2016. The second contract worth AED166mn is related to the construction of a number of villas in the Arabian Ranches project, which are due for delivery by March 2016. (DFM) DP World tops pan-Arab governance index – DP World has ranked first in the S&P/Hawkamah Pan Arab ESG Index, a pan- Arab governance index for the second year. The index ranks the transparency and disclosure of regional listed companies based on Environmental, Social & Corporate Governance (ESG) metrics. Companies that score highly on this index are regarded as sustainable and are more attractive to long-term investors, since the index identifies the best governed and the more environmentally and socially responsible companies. (GulfBase.com) Abu Dhabi cuts oil prices to six-year lows – Abu Dhabi, which holds around 6% of the world’s crude oil, has cut the export prices for its crude for the seventh consecutive month and to the lowest since 2009 amid a global price slump. According to a statement by Abu Dhabi National Oil Company (ADNOC), Murban crude, its main grade was sold for $46.4 per barrel in January 2015, which is 23% below December’s level. ADNOC also cut the price for its Das crude blend, pumped from offshore fields in the Persian Gulf, to $45.9 per barrel for January from $59.8 per barrel in December. (Bloomberg) Abu Dhabi Ports boosts quick oil spill response – Abu Dhabi Ports has completed a program to significantly boost its response capabilities for a quick oil spill in the busiest commercial ports. The program with an investment of around AED2mn includes the purchase of 20 specialized equipment containers, a dedicated speed boat, two new trucks of which

- 5. Page 5 of 6 one is equipped with a crane, and comprehensive training for 75 staff members. The majority of the specialized equipment containers are located at Khalifa Port, reflecting its size and the number of ships docking at the port. Others have been distributed to Zayed Port, the Free Port and Musaffah. (GulfBase.com) CBRE: Abu Dhabi’s home rents to grow slowly in 2015 – According to CBRE Group, Abu Dhabi’s residential rents, which surged after the government removed a cap on rate increases in 2013, will climb at a slower pace in 2015. Home rents rose 3% in 4Q2014 as compared to 3Q2014, and were 17% higher on a YoY basis. Matthew Green of CBRE said that despite the rising housing stock, the Abu Dhabi residential market continues to outperform most other segments. Construction of about 35,000 homes is expected to be completed over the next three years. Most of the new supply will be in new developments, which will attract residents looking to move away from inferior properties. (Bloomberg) CBK reports KD49.12mn net profit in FY2014 – The Commercial Bank of Kuwait (CBK) achieved a net profit of KD49.12mn in FY2014, as compared to KD23.53mn in FY2013. EPS amounted to 34.9 fils in FY2014 as against 16.7 fils a year earlier. Meanwhile, CBK’s board of directors recommended a cash dividend of 18%. (Bloomberg) Warba Bank earns KD0.12mn net profit in FY2014 – Warba Bank reported a net profit of KD0.12mn in FY2014 as compared to net loss of KD3.71mn in FY2013. EPS amounted to 0.12 fils in FY2014 as against loss per share of 3.71 fils in 2013. (Bloomberg) Bahrain government lists Islamic Sukuk – Bahrain Bourse has announced the listing of Government Islamic Lease Securities (Sukuk), issued by the Central Bank of Bahrain on behalf of the Government of Bahrain, effective from February 3, 2015. The BHD250mn securities were issued at a par value of BHD1 each on January 19, 2015 for a period of 10 years. The returns on these securities will be paid every six months on January 19 and July 19 every year throughout the period of the issue. The annual rate of return will be 5.50%. (Bahrain Bourse) Banader not to distribute dividends – Banader Hotels Company’s board of directors has decided not to distribute dividends to its shareholders for the financial year ended December 31, 2014. (Bahrain Bourse) Arcapita Bank sells PODS for $1bn – Bahrain-based Arcapita Bank has sold PODS Inc., a moving & storage company, to Ontario Teachers’ Pension Plan in a deal worth more than $1bn. Arcapita acquired PODS in December 2007 and the exit will take its proceeds to $2bn, returned to investors over the past 18 months. (Bloomberg)

- 6. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 QSE Index S&P Pan Arab S&P GCC 0.2% 1.3% 0.6% 0.1% 1.1% 1.4% 2.5% 0.0% 0.6% 1.2% 1.8% 2.4% 3.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,260.42 (1.1) (1.8) 6.4 MSCI World Index 1,715.22 1.2 2.2 0.3 Silver/Ounce 17.30 0.5 0.3 10.2 DJ Industrial 17,666.40 1.8 2.9 (0.9) Crude Oil (Brent)/Barrel (FM Future) 57.91 5.8 9.3 1.0 S&P 500 2,050.03 1.4 2.8 (0.4) Crude Oil (WTI)/Barrel (FM Future) 53.05 7.0 10.0 (0.4) NASDAQ 100 4,727.74 1.1 2.0 (0.2) Natural Gas (Henry Hub)/MMBtu 2.67 1.3 (0.5) (10.9) STOXX 600 370.28 2.0 2.5 2.5 LPG Propane (Arab Gulf)/Ton 54.75 4.8 16.5 11.7 DAX 10,890.95 1.8 3.5 4.8 LPG Butane (Arab Gulf)/Ton 63.50 0.0 3.3 1.2 FTSE 100 6,871.80 2.2 2.8 1.8 Euro 1.15 1.2 1.7 (5.1) CAC 40 4,677.90 2.3 3.2 3.8 Yen 117.57 0.0 0.1 (1.8) Nikkei 17,335.85 (1.3) (1.9) 1.1 GBP 1.52 0.8 0.7 (2.6) MSCI EM 976.50 1.3 1.5 2.1 CHF 1.08 0.5 (0.4) 7.6 SHANGHAI SE Composite 3,204.91 2.4 (0.3) (1.8) AUD 0.78 (0.1) 0.4 (4.7) HANG SENG 24,554.78 0.3 0.2 4.0 USD Index 93.60 (1.0) (1.3) 3.7 BSE SENSEX 29,000.14 (0.4) 0.1 8.1 RUB 65.23 (4.5) (6.1) 7.4 Bovespa 48,963.66 2.8 3.5 (4.3) BRL 0.37 1.2 (0.5) (1.6) RTS 786.69 5.5 6.7 (0.5) 176.4 140.3 128.3