Growth and Development in Mexico

•

1 gefällt mir•2,801 views

Background information on Mexico and a couple of practice exam questions

Melden

Teilen

Melden

Teilen

Downloaden Sie, um offline zu lesen

Empfohlen

Empfohlen

Weitere ähnliche Inhalte

Was ist angesagt?

Was ist angesagt? (20)

Emerging Economies of the World: A Study | November 2016

Emerging Economies of the World: A Study | November 2016

Selling to Brazil, Chile & Colombia- Toolkit for Success

Selling to Brazil, Chile & Colombia- Toolkit for Success

THE IMPACT OF TRADE LIBERALIZATION ON ECONOMIC GROWTH; THE CASE OF SUB-SAHARA...

THE IMPACT OF TRADE LIBERALIZATION ON ECONOMIC GROWTH; THE CASE OF SUB-SAHARA...

Dr. Alejandro Diaz Bautista, Nafta Renegotiation, NAFTA at 15, UAM Economics ...

Dr. Alejandro Diaz Bautista, Nafta Renegotiation, NAFTA at 15, UAM Economics ...

Professor Alejandro Diaz-Bautista Conference University of San Diego, Septemb...

Professor Alejandro Diaz-Bautista Conference University of San Diego, Septemb...

Ähnlich wie Growth and Development in Mexico

An overview of the Mexican economy from JPMorgan Mexico's Chief Economist Gabriel LozanoGabriel Lozano | The Mexican Economy | Global Cities Initiative

Gabriel Lozano | The Mexican Economy | Global Cities InitiativeBrookings Metropolitan Policy Program

Ähnlich wie Growth and Development in Mexico (20)

Time to ditch the mexican stereotypes - Financial Times

Time to ditch the mexican stereotypes - Financial Times

International Assignmentpart iThe Chinese Univ.docx

International Assignmentpart iThe Chinese Univ.docx

Latin American Economic Outlook 2013 SME Policies for Structural Change

Latin American Economic Outlook 2013 SME Policies for Structural Change

Mexico means opportunity at Global Business Summit, Hard Rock Cafe

Mexico means opportunity at Global Business Summit, Hard Rock Cafe

Gabriel Lozano | The Mexican Economy | Global Cities Initiative

Gabriel Lozano | The Mexican Economy | Global Cities Initiative

Private initiative and financial inclusion - Latin America between two models

Private initiative and financial inclusion - Latin America between two models

Latin America’s emerging sectors:A closer look at fintech and renewable energy

Latin America’s emerging sectors:A closer look at fintech and renewable energy

International eco project mexico - section b - group 7 final

International eco project mexico - section b - group 7 final

Mehr von tutor2u

Mehr von tutor2u (20)

Poverty Reduction Policies in Low Income Countries

Poverty Reduction Policies in Low Income Countries

Growth and Development in Mexico

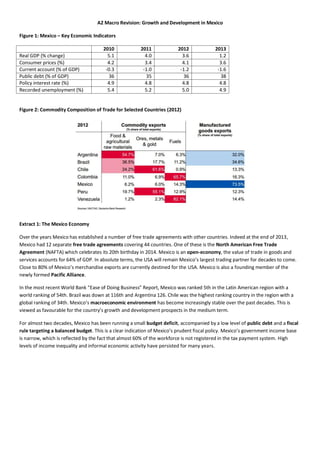

- 1. A2 Macro Revision: Growth and Development in Mexico Figure 1: Mexico – Key Economic Indicators 2010 2011 2012 2013 Real GDP (% change) 5.1 4.0 3.6 1.2 Consumer prices (%) 4.2 3.4 4.1 3.6 Current account (% of GDP) -0.3 -1.0 -1.2 -1.6 Public debt (% of GDP) 36 35 36 38 Policy interest rate (%) 4.9 4.8 4.8 4.8 Recorded unemployment (%) 5.4 5.2 5.0 4.9 Figure 2: Commodity Composition of Trade for Selected Countries (2012) Extract 1: The Mexico Economy Over the years Mexico has established a number of free trade agreements with other countries. Indeed at the end of 2013, Mexico had 12 separate free trade agreements covering 44 countries. One of these is the North American Free Trade Agreement (NAFTA) which celebrates its 20th birthday in 2014. Mexico is an open-economy, the value of trade in goods and services accounts for 64% of GDP. In absolute terms, the USA will remain Mexico’s largest trading partner for decades to come. Close to 80% of Mexico’s merchandise exports are currently destined for the USA. Mexico is also a founding member of the newly formed Pacific Alliance. In the most recent World Bank “Ease of Doing Business” Report, Mexico was ranked 5th in the Latin American region with a world ranking of 54th. Brazil was down at 116th and Argentina 126. Chile was the highest ranking country in the region with a global ranking of 34th. Mexico’s macroeconomic environment has become increasingly stable over the past decades. This is viewed as favourable for the country’s growth and development prospects in the medium term. For almost two decades, Mexico has been running a small budget deficit, accompanied by a low level of public debt and a fiscal rule targeting a balanced budget. This is a clear indication of Mexico’s prudent fiscal policy. Mexico’s government income base is narrow, which is reflected by the fact that almost 60% of the workforce is not registered in the tax payment system. High levels of income inequality and informal economic activity have persisted for many years.

- 2. Extract 2: The Pacific Alliance The Pacific Alliance is a newly established Latin American trade bloc, with some features of further economic integration. Its current member states are Chile, Colombia, Mexico, and Peru; all countries that border the Pacific Ocean. Costa Rica is expected to join shortly. The main goals of the Pacific Alliance are To ensure tariff free circulation of goods and services To provide free circulation of capital and people To foster economic growth, development and competitiveness To increase ties to the world, especially to Asia-Pacific The Pacific Alliance accounts for 37% of Latin America's GDP. Mexico has benefitted from large amounts of direct foreign investment, in the automotive, manufacturing, aviation, information technology and tourism. The total value of FDI has exceeded $75bn over the last ten years. Extract 3: Growth and prosperity in a two-speed Mexican economy (2013 McKinsey Institute Report) Mexico has struggled for three decades to raise trend growth rates. Despite a series of market-opening reforms, including the North American Free Trade Agreement, Mexico’s real GDP growth has fallen behind that of other similar developing nations, both in Asia and in Latin America. As a result, GDP per capita and other improvements in living standards have stagnated. Mexico has a serious productivity challenge that can be traced to what is often called the “two Mexicos”—a highly productive modern economy and a low-productivity traditional economy. The two Mexicos are moving in opposite directions: while the modern sector flourishes, competes globally, and raises productivity rapidly, in traditional Mexico (with very small, often informal enterprises), productivity is plunging. Traditional Mexico is creating more jobs than modern Mexico and therefore shifting labour from high productivity work to low-productivity work. Productivity has grown 5.8% a year in modern firms but has fallen 6.5% a year in traditional firms Employees in traditional bakeries are 1/50 th as productive as those in largest modern companies Manufacturing in Mexico is 24% as productive as in the USA, even though top plants exceed the US average The rapid expansion of the Mexican labour force due to population growth has 72 percent of overall economic growth since 1990 – this is now coming to an end Since 1981, GDP growth in Mexico has averaged 2.3% a year. In 2012, the output of the average Mexican worker was about $17.90 per hour in purchasing power parity, still below the $18.30 per hour of 1981. Mexican GDP per capita, which was 12 times China’s in 1980, is now only 25 percent higher, and, at current growth rates, China could surpass Mexico by 2018. Mexico has become one of the world’s top 15 global manufacturing economies (by gross value added) and one of the top five auto producers, with assembly plants of seven global automakers and operations of leading global parts suppliers. Annual production at the ten largest Mexican plants rose from 1.1 million vehicles in 1994, the year NAFTA went into effect, to nearly 2.9 million in 2012. Many Mexican plants are regarded as world-class, and some exceed average US productivity levels. Nearly 70 percent of the value of car exports from Mexico is based on imported parts. Exam Practice Questions: To what extent is continued low productivity in the Mexican economy a barrier to economic growth? (12) With reference to the information provided and your own knowledge, to what extent might membership of the Pacific Alliance be significant in promoting economic development in the Mexican economy? (15)