Multiplan Initiation

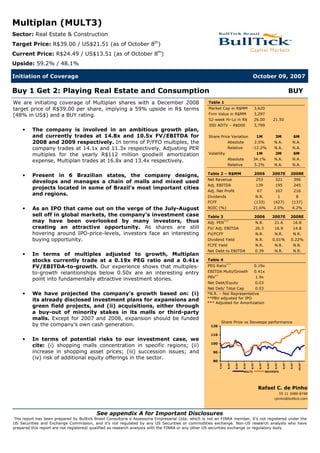

- 1. Multiplan (MULT3) Sector: Real Estate & Construction Target Price: R$39.00 / US$21.51 (as of October 8th) Current Price: R$24.49 / US$13.51 (as of October 8th) Upside: 59.2% / 48.1% Initiation of Coverage October 09, 2007 Buy 1 Get 2: Playing Real Estate and Consumption BUY We are initiating coverage of Multiplan shares with a December 2008 Table 1 target price of R$39.00 per share, implying a 59% upside in R$ terms Market Cap in R$MM 3,620 Firm Value in R$MM 3,297 (48% in US$) and a BUY rating. 52-week Hi-Lo in R$ 26.00 21.50 30D ADTV – R$000 3,799 The company is involved in an ambitious growth plan, • and currently trades at 14.8x and 10.5x FV/EBITDA for Share Price Variation 1M 3M 6M 2008 and 2009 respectively. In terms of P/FFO multiples, the Absolute 2.0% N.A. N.A. company trades at 14.1x and 11.3x respectively. Adjusting PER Relative -12.2% N.A. N.A. Volatility 1M 3M 6M multiples for the yearly R$112 million goodwill amortization Absolute 34.1% N.A. N.A. expense, Multiplan trades at 16.8x and 13.4x respectively. Relative 5.2% N.A. N.A. Table 2 – R$MM 2006 2007E 2008E Present in 6 Brazilian states, the company designs, • Net Revenue 253 321 396 develops and manages a chain of malls and mixed used Adj. EBITDA 139 195 245 projects located in some of Brazil’s most important cities Adj. Net Profit 67 167 216 and regions. Dividends N.R. 1 8 FCFF (133) (427) (137) ROIC (%) 21.6% 2.0% 4.2% As an IPO that came out on the verge of the July-August • sell off in global markets, the company’s investment case Table 3 2006 2007E 2008E may have been overlooked by many investors, thus Adj. PER*** N.R. 21.6 16.8 creating an attractive opportunity. As shares are still FV/ Adj. EBITDA 26.3 16.9 14.8 hovering around IPO-price-levels, investors face an interesting FV/FCFF N.R. N.R. N.R. buying opportunity. Dividend Yield N.R. 0.01% 0.22% FCFE Yield N.R. N.R. N.R. Net Debt to EBITDA 0.39 N.R. N.R. In terms of multiples adjusted to growth, Multiplan • stocks currently trade at a 0.19x PEG ratio and a 0.41x Table 4 PEG Ratio*** FV/EBITDA-to-growth. Our experience shows that multiples- 0.19x EBITDA Multi/Growth 0.41x to-growth relantionships below 0.50x are an interesting entry PBV** 1.9x point into fundamentally attractive investment stories. Net Debt/Equity 0.03 Net Deb/ Total Cap 0.03 We have projected the company’s growth based on: (i) *N.R. – Not Representative • **PBV adjusted for IPO its already disclosed investment plans for expansions and *** Adjusted for Amortization green field projects, and (ii) acquisitions, either through a buy-out of minority stakes in its malls or third-party malls. Except for 2007 and 2008, expansion should be funded Share Price vs Ibovespa performance by the company’s own cash generation. 120 110 In terms of potential risks to our investment case, we • 100 cite: (i) shopping malls concentration in specific regions; (ii) increase in shopping asset prices; (iii) succession issues; and 90 (iv) risk of additional equity offerings in the sector. 80 7/07 8/07 8/07 8/07 8/07 8/07 9/07 9/07 9/07 9/07 10/07 MULT3 IBOVESPA Rafael C. de Pinho 55 11 3089-8748 rpinho@bulltick.com See appendix A for Important Disclosures This report has been prepared by Bulltick Brasil Consultoria e Assessoria Empresarial Ltda. which is not an FINRA member, it’s not registered under the US Securities and Exchange Commission, and it’s not regulated by any US Securities or commodities exchange. Non-US research analysts who have prepared this report are not registered/ qualified as research analysts with the FINRA or any other US securities exchange or regulatory body

- 2. Investment Thesis Multiplan: a premium player in Brazil’s mall industry From roughly 350 existing shopping malls in Brazil, as per ABRASCE’s (Brazilian Shopping Multiplan controls 9 top Centers Association) data, we estimate that around 30 should be considered “top” quality quality malls in Brazil… assets given their positioning, long-run track record and recognized brands in their regions. From those, 9 are controlled by Multiplan, a remarkable stake vis-à-vis its competitors. Another point worth stressing out is the fact that from its 12 malls portfolio, Multiplan … ruling out from rental directly controls 9 and actively manages the remaining. The advantages of control are prices to stores mix and clear, as it allows the company to rule out on expansions, store mix repositioning, expansion decisions. marketing initiatives and managerial decisions. Multiplan itself had, in the past, growth limitations imposed by an unaligned partner; thus, management perceives controlling malls as of strategic importance. Exhibit 1: Operational figures, Multiplan vs. peers GLA ( 000 m2 ) # of Shoppings Company Ticker Cpny Stake Total Controlled Managed Total BRMALLS BRLM3 353 788 8 25 30 GENERAL SHOPPING GSHP3 119 140 4 6 6 IGUATEMI IGTA3 153 353 2 12 12 MULTIPLAN MULT3 318 475 10 13 13 Source: Companies Due to its preeminent and long-term leadership in the shopping mall industry, the Leadership in malls attracts company has been able to attract some of the most important chains in Brazilian top quality anchors, commerce sector to anchor its malls, besides being the starting point for some worldwide creating customer flows… known brands operations in Brazil, such as Nike’s or Starbucks’. Multiplan’s malls are definitely the ones of choice for any company willing to hit a diversified, yet very well positioned client mix in Brazil. Exhibit 2: Sample of Anchor Stores present at Multiplan malls Source: Multiplan and Bulltick Additionally, the superior mall performance coupled with long dated relationships with …thus reinforcing its most of its clients allows the company to have above-average bargaining power when re- bargaining power with negotiating rental contracts. satellite stores. 2

- 3. Organic Growth Drivers Expansions in existing malls and real estate developments It was not so long ago when Multiplan had two major obstacles to grow: (i) its long-dated An unaligned partner and partner, the Bozano group, which was divesting from most of its assets, thus having a capital limitations delayed limited appetite for new projects; and (ii) capital limitations. growth plans in the past. With the recent capital markets developments in Brazil, both restrictions were removed Recent capital injections and Multiplan paved the way to growing its businesses. In 2006, through a capital allowed the company to injection made by the Ontario Teacher’s Pension Fund, the company acquired the trace ambitious growth Bozano’s stake, consolidating its’ control over most of its portfolio. plans. In addition, recently, the company decided to list its shares in the BOVESPA, capitalizing itself to cope with the ambitious growth plans traced after Bozano’s departure. Exhibit 3 below details the company’s expansion plans for the coming years. Exhibit 3: Multiplan’s planned GLA additions Type of Additional Addition Shopping Openning Stake Addition GLA Multiplan Park Shopping Barigui Expansion 3Q08 2,188 90% 1,969 Barra Shopping Sul Green Field 3Q08 51,978 100% 51,978 Park Shopping Brasília Expansion 4Q08 3,072 60% 1,843 Ribeirão Shopping Expansion 2Q09 6,793 76% 5,176 Diamond Mall Expansion 2Q09 5,299 90% 4,769 Anália Franco Expansion 2Q09 11,786 30% 3,536 Vila Olímpia Green Field 2Q09 26,417 30% 7,925 Barra Shopping Expansion 4Q09 3,462 51% 1,769 Park Shopping Brasília Expansion 2Q10 3,346 60% 2,008 BH Shopping Expansion 4Q10 12,735 80% 10,188 Park Shopping Barigui Expansion 4Q11 14,784 90% 13,306 Barra Shopping Sul Expansion 4Q14 21,638 100% 21,638 163,498 77% 126,105 Source: Multiplan An important aspect of the investment plan above is that most of the additions to current Expansions take place on GLA should come from expansions in existing shopping malls. These should not require consolidated malls, at lower land acquisitions or the basic construction needed in green field projects, thus, costing costs… less. Additionally, expansions normally take place on already consolidated malls, where rental revenues should be peaking. As a result, expansions should yield higher returns and, as a matter of fact, the company … yielding better returns. stated in its 2Q07 results release that it targets 20% unleveraged return rates for expansions vis-à-vis 15% on green field projects. In order to implement its expansion strategy, Multiplan normally acquires land in excess Expansion opportunities are of what is needed for the initial mall project, keeping the excessive land as part of its generated by buying cheap parking lot, for example. As the shopping consolidates, within a couple of years from and in-excess lands nearby opening, the company starts to add more stores, entertainment complexes and other malls. kinds of customer attractions, thus increasing GLA considerably, besides reinforcing people flow and enlarging the shopping’s area of influence. 3

- 4. The best example of this strategy can be seen on Exhibit 4 which details the steps executed in Barra Shopping throughout its story. Exhibit 5 shows other expansion examples by comparing some of Multiplan malls’ initial and current number of shops. Exhibit 4: The Barra Shopping complex Source: Bulltick Research, Multiplan and Google Exhibit 5: Expansions in existing malls No. of stores Current No. of Shopping Opening Year Openening stores 1979 130 291 BH Shopping 218 218 1981 Ribeirão Shopping 120 581 1981 Barra Shopping 160 488 1982 Morumbi Shopping 122 241 1983 Park Shopping Brasília 225 225 1996 Diamond Mall 39 39 1999 New York City Center 237 237 1999 Shopping Anália Franco 181 181 2003 Park ShoppingBarigui Source: Multiplan On top of allowing for malls to expand, buying land in excess also has a secondary Extra land creates benefit, which is creating opportunities for other kinds of real estate investments opportunities of mixed use surrounding the malls, thus, transforming them into mixed use projects. projects. In order to implementing these strategies without being exposed in cash for too long, Land is bought away from Multiplan’s classic development would be away from more crowded neighborhoods, most expensive areas… buying cheaper land, anticipating urban developments years ahead of competitors. Among the company’s portfolio, two examples that followed this pattern were BH shopping and Barra Shopping, founded in 1979 and 1981, in Belo Horizonte and Rio de Janeiro respectively. A neighborhood was almost inexistent in these areas prior to the shopping openings. 4

- 5. Nonetheless, both were well served in terms of roads and access to their cities. It is …although in the cities’ growing direction. worth highlighting that, a couple of years later, the city “moved” towards these malls, thus, creating value through the land appreciation that followed. Investors should bear in mind, though, that these opportunities do not lie on any sort of speculation, other than the assumption that land surrounding a top quality shopping mall will appreciate. Since the company is the one in charge of deciding where to put the mall, we view the assumption as fair enough. Exhibit 6: View of Barra da Tijuca – 1981 As an example, in 1981 Barra da Tijuca was on the early stages of development when Multiplan opened Barra Shopping. Source: Multiplan Exhibit 7: View of Barra da Tijuca – 2007 Currently, Barra remains the fastest growing area in Rio de Janeiro. Source: Bulltick and Google 5

- 6. Last but not least, following its IPO, the company announced investments to build two Additional investments, going forward, should commercial towers and a hotel in association with WTorre in São Paulo, near Morumbi replicate the model in other Shopping. Besides being coherent with the strategy described above, Exhibit 8 shows our malls. estimate for additional yearly revenues to be captured with these buildings. As these estimates were based solely on our assumptions (the company basically disclose the size of the land and planned use for it) we, have conservatively not included them in our valuation model. Exhibit 8: Estimate of revenues – Commercial Building with Wtorre Land Area (m2) 40,000 Construction Factor - Vertical Building 3.50 2 Total Area (m ) 140,000 Gross Leasable Area (m2) - 85% 119,000 2 Monthly Rent (R$/m ) - AAA building 70.00 Total Yearly Revenues - R$ 000 99,960 Multiplan's Stake on Revenues - 50% 49,980 Source: Bulltick The company has also disclosed an investment contiguous to the Parque Barigui Shopping, in Curitiba, where it acquired land through a financial swap. It will build another commercial development as well as an expansion to the mall. It is important to mention that the region where Barigui is located has been growing at a very dynamic pace over the last few years. 6

- 7. Green field projects Multiplan currently has two green field projects under development: Barra Shopping Sul (BSS) and Shopping Vila Olímpia. BSS is located in Porto Alegre, one of the most important state capitals in Brazil. Its BSS will add roughly 52,000 opening is scheduled for 3Q08 and will add 51,978 square meters of GLA to Multiplan, m2 of GLA and be 100% being 100% controlled by the company. The project foresees the first expansion, of controlled by Multiplan. 21,638m2, opening by 2014. With record-breaking 90% of contracts for the mall’s area already signed more than a year ahead of its opening, BSS can already be considered a tremendous success. As for Shopping Vila Olímpia, it will be located in one of the fastest growing Shopping Vila Olímpia will neighborhoods of the city of São Paulo, surrounded by several office buildings, which be located in a dynamic and should generate enough demand for its 26,417m2 GLA. Multiplan’s participation is 30% growing business region in and it should manage the mall. The company does not hold the control of the São Paulo. development as it has been invited to participate by Grupo Victor Malzoni. Exhibit 9 details the geographic positioning of Shopping Vila Olímpia, as well as the presence of large commercial buildings in the region. It is also worth mentioning that this region will hold two other malls to be opened by 2008: JHSF’s Cidade Jardim and another one by Wtorre and Iguatemi, which should create some competition over Vila Olímpia. However, we remind investors that up to this point, these three malls’ strategies and Although competition is focus are different: Vila Olímpia should be a niche mall, serving the increasing presence expected, Vila Olímpia of business people in the region with restaurants and some day-to-day shopping, while should focus on the niche of serving the commercial the other two should be more focused on upscale brands and luxury items. buildings. Exhibit 9: Shopping Vila Olímpia - Strategic positioning Source: Bulltick, Google 7

- 8. Inorganic Growth Opportunities Not differently from most real estate sub-sectors, the shopping malls segment in Brazil is Mall segment is another very fragmented with several family-owned players or with smaller groups with isolated fragmented sub-sector of investments in malls for diversification purposes. As a consequence, the sector exhibits Brazil’s real estate industry. innumerous acquisition opportunities that capitalized players such as BR Malls, Multiplan and Iguatemi intend to exploit. In Multiplan’s case, more than a source of inorganic growth, our opinion is that Instead of targeting GLA acquisitions are evaluated much more on a strategic basis, other than only by that of growth, Multiplan seeks growth purposes. As an example, we show in Exhibit 10 an overview of the company’s strategic sense on malls in Belo Horizonte, including the recently acquired Patio Savassi. acquisitions. Exhibit 10: Multiplan’s assets in Belo Horizonte Controlling the three main malls in Belo Horizonte’s richest areas is a competitive advantage… Source: Bulltick, Google The only rival within the richest area in the city, Patio Savassi acquisition created a hard- … reinforcing the profitability implied in the to-penetrate fortress in the area, as far as competition is concerned. Besides, the mall currently generates R$653/m2 of revenue yearly, versus Multiplan’s BH Shopping and deal. Diamond Mall’s respective R$1,060/m2 and R$845/m2, which leads us to envisage potential revenue gains as contracts start to be renegotiated going forward. Besides third party acquisitions, Multiplan has a series of minority shareholders in the Minority stakeholders in its malls portfolio should be malls it controls, as a result of its past capital limitations. Consequently, these should be, Multiplan’s main acquisition in our view, the company’s main acquisition targets. On top of increasing the stakes it targets. holds in premium malls, these purchases should allow for some fixed cost dilution as these malls are already being managed by Multiplan. As it can be seen in Exhibit 11, the minorities in Multiplan’s malls are mostly pension funds. The rationale behind the sale of their participation in the malls is based on liquidity: as now the stock exchange is a feasible vehicle to play investments in Brazilian malls, pension funds could be willing to divest from the real assets to go into shares, leaving some liquidity discount on the table for Multiplan. Besides, some funds have limitations in terms of exposure to a specific asset class such as real estate. 8

- 9. Exhibit 11: Shareholder structures, Multiplan malls Shopping Company Stake % Multiplan 51% Most of Multiplan’s malls PREVI - Pension Fund 19% have pension funds as Barra Shopping FAPES - Pension Fund 15% minority shareholders. SISTEL - Pension Fund 10% Carvalho Hosken - Construction Co. 5% Multiplan 50% New York City Center PREVI - Pension Fund 50% Multiplan 56% PREVI - Pension Fund 13% Philips - Pension Fund 9% Morumbi Shopping SISTEL - Pension Fund 8% FUNCEF - Pension Fund 9% FAPES - Pension Fund 4% Solução Imobiliária - Development Co. 1% Multiplan 80% BH Shopping Usiminas - Pension Fund 20% Anália Franco 70% Shopping Anália Franco Multiplan 30% Multiplan 60% Park Shopping PREVI - Pension Fund 25% IRB 15% Multiplan 76% Ribeirão Shopping PREVI - Pension Fund 20% PreviHab - Pension Fund 4% Multiplan 90% Park Shopping Barigui J. Malucelli Adm. Bens 10% Source: Multiplan 9

- 10. Management: A competitive advantage In contrast to some of its peers, Multiplan exhibits one of the most experienced Long-term management management teams in the sector. Its five top managers average 23 years of experience with proven track record. A in real estate and 20 years within Multiplan. plus to the story. Exhibit 12: Multiplan’s Board of Directors Name Position Profession José Isaac Péres Chairman Economist Eduardo Kaminitz Péres Vice-Chairman Business Administration Leonard Peter Sharpe Director Economist Andrea Mary Stephen Director Business Administration Edson de Godoy Bueno Director Doctor José Carlos de A.S. Barata* Director Engineer Manoel Joaquim R. Mendes Director Engineer Source: Multiplan * Independent Member Exhibit 13: Multiplan’s Management Years in Years in Name Position Profession Multiplan Real Estate José Isaac Péres CEO Economist 33 33 Eduardo Kaminitz Péres VP Business Administration 19 19 VP, IRO - 23 Mário A.N. de Paula Engineer, Lawyer Alberto José dos Santos Director Accountant 32 32 Marcello Kaminitz Barnes Director Engineer 17 17 Source: Multiplan Besides having a proven track record in the sector, the management team has gone through the ever-changing macroeconomic scenarios in Brazil over the last 30 years. Achieving success for such a long time in a mostly illiquid business in Brazil, per se, is an accomplishment. In addition, Multiplan’s management was responsible for forging many of the trends which shaped the industry in Brazil over its existence. Mr. José Isaac Peres history mixes with the one of shopping malls in Brazil. At the age of Mr. Peres is hard to 66, Mr. Peres still pursues long-term objectives, as the ones it did over its successful substitute, though matching career. Nonetheless, investors should bear in mind that substitutes from within the executives should come from within the company. company are available, in case Mr. Peres decides to retire a few years in the future. 10

- 11. Valuation We defined Multiplan’s end of 2007 target price using a DCF-based model. In order to Our DCF-model discounted reach our target price we discounted cash flows to the firm (FCFF) at a WACC of 10.58% cash flows to the firm in R$ terms. We also applied a 4.50% nominal perpetuity growth in R$ terms. Exhibit 14 (FCFF) at 10.58% of WACC depicts our discount rates, target capital structure, the resulting WACC and valuation outcomes. Exhibit 14: Valuation Summary US Risk Free Rate 4.5% Brazil Country Risk 1.75% Beta 0.85 Equity Risk Premium 6.0% LT R$ Depreciation 2.0% Ke (R$) 13.35% Weight - Equity 60.00% Cost of Debt, in R$, Before Taxes 9.8% Effective Tax Rate 34.0% Kd (R$) 6.44% Weight - Debt 40.00% WACC (R$) 10.58% Forecasted Period 2008 – 2018 Nominal Perpetuity Growth 4.50% December 2008 PT - R$/ share 39.00 Source: Bulltick It is important to note that free cash flows are on positive territory most of the time Shoppings are strong cash except for 2007 and 2008, two years when the company should perform heavy generators. Except for ’07 and ’08, the company’s cash investments including the building of Barra Shopping Sul and Shopping Vila Olímpia. generation suffices to Shopping centers are good cash generators, with low maintenance needs, most of which finance expansion plans. are paid by the shops. CAPEX is composed basically by malls expansion and acquisitions. Exhibit 15 details our forecasted free cash flows for the 2007 – 2012 period. Exhibit 15: Free cash flows (R$ millions) 2007E 2008E 2009E 2010E 2011E 2012E EBITDA 173 245 351 437 528 616 Taxes (5) (10) (32) (60) (118) (156) Change in Assets (243) (41) 6 6 8 (18) CAPEX (352) (331) (186) (232) (201) (160) FCFF (427) (137) 138 151 218 282 Source: Bulltick Main Valuation Assumptions Among our DCF-model main assumptions, we cite: (i) the YoY premium over inflation for rent/m2 for the malls; (ii) the CAPEX/m2 assumption for green field projects, expansions and acquisitions; (iii) third party malls acquisitions and (iv) the shopping centers and parking lots gross margins. On a given month, a store rent is defined between the higher of: (i) a fixed minimum amount calculated over the store’s location and size; or (ii) a percentage of the store’s total sales over the month. Multiplan currently works out its contracts in order to capture as much as possible the fixed minimum and normally succeeds in implementing this strategy based on its malls’ superior sales performance. 11

- 12. Nonetheless, it is interesting to note that over the last few years, as a direct result of the country’s economic stability, monetary easing process and real-income gains, Brazilian families took advantage of abundant credit in order to satisfy its consumption desires. Exhibit 16 presents data on shopping mall sales over the last 6 years in Brazil. In addition, year-to-date Multiplan’s malls posted 18% YoY growth in stores’ sales. Exhibit 16: Shopping Mall Sales in Brazil 2000-2006 50 44 45 40 Shopping Sales (R$ billions) CAGR '00-'06: 11.4% 40 37 35 32 30 28 25 25 23 20 15 2000 2001 2002 2003 2004 2005 2006 Source: CB Richard Ellis Besides the strong growth in shopping sales, which in our opinion should continue over the next few years, Multiplan works towards raising its rental rates at 4% yearly in real terms. Currently, 95% of the company’s stores rental revenues come from minimum rental. All in all, for 2007 and 2008, our model assumes that, besides a real 4% annual readjustment to the minimum rental, Multiplan should be able to capture an extra 4% increase in rental/m2 based on shopping sales growth. For the sake of being conservative, after that we have decreased both gains gradually until reaching a 2% real annual gain, which we have maintained until the end of our forecast period. As for our CAPEX assumptions, besides using the guidance given by Multiplan for 2007 and 2008 we estimated a CAPEX/m2 also based on the 2007/2008 guidance, reaching R$4,000/m2 for expansion projects and R$4,500/m2 for green field projects. As for acquisitions, we based our assumption on the weighted average price of the latest acquisitions done by the company over the last 2 years, which reached R$6,725/m2. Applying a conservative 20% premium to that number to account for the increased acquisition activity in the sector during the last year, our model assumes R$8,000/m2. Additionally, in regards to the potential third-party malls acquisitions, we assumed 100,000m2 to be purchased by the company. Acquisitions are, at best, hard to quantify and especially tricky when it comes to their timing. Our solution for the matter was to dilute them at a 20,000m2/year rate in our model to avoid much distortion. Finally, our gross margins assumptions for shopping rentals and parking lots are flat going forward at 83% and 35% respectively. For shopping rentals, we based our forecast on past performance, while for parking lots we preferred to be conservative compared to the 48% margin reported by the company in 2Q07, given the lack of information regarding margin in the business in past periods. 12

- 13. Sensitivity Analysis On Exhibit 17 we show sensitivity analysis based on the variation of WACC and long-term growth rates. Exhibit 17: Sensitivity Analysis Mkt. Cap. at Target (R$ MM) 5,764 4.00% 4.25% 4.50% 4.75% 5.00% 8,107 8,451 8,838 9,275 9,773 8.58% 6,551 6,763 6,995 7,252 7,536 9.58% 5,474 5,613 5,928 6,106 10.58% 5,764 4,686 4,782 4,885 4,996 5,115 11.58% 4,085 4,154 4,227 4,305 4,388 12.58% Year End '08 Fair Price (R$/Share) 39.0 4.00% 4.25% 4.50% 4.75% 5.00% 54.8 57.2 59.8 62.8 66.1 8.58% 44.3 45.8 47.3 49.1 51.0 9.58% 37.0 38.0 40.1 41.3 10.58% 39.0 31.7 32.4 33.1 33.8 34.6 11.58% 27.6 28.1 28.6 29.1 29.7 12.58% Upside (%) 0.6 4.00% 4.25% 4.50% 4.75% 5.00% 124.0% 133.5% 144.2% 156.2% 170.0% 8.58% 81.0% 86.8% 93.3% 100.3% 108.2% 9.58% 51.2% 55.1% 63.8% 68.7% 10.58% 59.2% 29.5% 32.1% 35.0% 38.0% 41.3% 11.58% 12.8% 14.8% 16.8% 18.9% 21.2% 12.58% FV/EBITDA 09 at Target 15.5 4.00% 4.25% 4.50% 4.75% 5.00% 22.2x 23.2x 24.3x 25.5x 26.9x 8.58% 17.7x 18.3x 19.0x 19.7x 20.6x 9.58% 14.7x 15.1x 16.0x 16.5x 10.58% 15.5x 12.4x 12.7x 13.0x 13.3x 13.7x 11.58% 10.7x 10.9x 11.1x 11.3x 11.6x 12.58% P/FFO 09 at Target 18.4 4.00% 4.25% 4.50% 4.75% 5.00% 25.9x 27.0x 28.3x 29.7x 31.2x 8.58% 20.9x 21.6x 22.4x 23.2x 24.1x 9.58% 17.5x 17.9x 19.0x 19.5x 10.58% 18.4x 15.0x 15.3x 15.6x 16.0x 16.4x 11.58% 13.1x 13.3x 13.5x 13.8x 14.0x 12.58% 13

- 14. What is not included in our numbers We consider our valuation for the company to be conservative as we preferred to stick Our model priced in just only to the recurring and already detailed investment plans announced by Multiplan. In recurring items, as well as that sense, among the items not included into our model, we cite: (i) the company’s disclosed and already residential real estate investments, (ii) its recently announced investments near Morumbi detailed investment plans. Shopping and Shopping Barigui, (iii) any tax benefit to be gained due to goodwill on acquisitions and (iv) we maintained the company’s stake on upcoming mall expansions. Regarding real estate residential investments, the company participates in some Non-recurring residential developments on an opportunistic basis and as per its offering memorandum has a land investments were left aside. bank of R$740 million in potential sales value. As we lack more detailed information on the execution flow of these investments, we preferred not to take them into account in our valuation model. Two new investments of this kind were recently added to the company’s portfolio as: (i) office buildings and a hotel near Morumbi shopping; and (ii) a mixed use project with commercial building and an expansion to be added to Shopping Barigui. For the Morumbi investment, though, as an exercise, shown in the investment thesis section of this report, we calculated the potential revenue accretion for the company once the buildings are completed. One of the basis of the shopping center sector case in Brazil is based on consolidation. As Acquisitions were priced in such, we did consider some acquisitions in our model. Most of these acquisitions in Brazil without considering any should include the recognition of goodwill when companies are incorporated to the potential tax benefit they buyer’s balance sheet, and a consequent tax benefit should be created. As the potential may create. amount of goodwill to be created is something difficult to measure, we preferred not to consider any in our model. Finally, we have also considered that the current stakes in each individual mall should be We also maintained maintained whenever Multiplan executes an expansion, as per its investment plan. As all Multiplan’s stake in malls partners in the malls have preference rights up to their stakes when Multiplan proposes flat, as if all partners would expansions, we decided to consider all of them should go for the projects when the time follow suit in expansion to decide comes up. If they are not to follow Multiplan on the investments, then the plans going forward. company has an additional opportunity to grow inorganically by investing in its expansion projects. As a matter of fact, the situation described above already occurred in 2006, when the company decided to expand Morumbi Shopping. As some of its partners did not invest, Multiplan holds a 90% stake on the GLA of the expansion, vis-à-vis a prior stake of 51.7% on the mall by that time. 14

- 15. Risks In terms of potential risks to the investment case, we cite: (i) shopping malls concentration in specific regions; (ii) increase in shopping asset prices; (iii) succession issues; and (iv) risk of additional equity offerings in the sector. In regards to malls concentration, the monetary easing process in Brazil, besides creating Risks include mall a strong growth in consumption, turned prior unfeasible projects into potential concentration in some competitors for existing projects in more valuable areas. As an example, we cite attractive areas… Multiplan’s Vila Olímpia mall. Please refer to our investment thesis section for further details. As for the risks of rising mall participation prices, besides the natural price appreciation … rising asset prices for acquisitions… given the positive economic moment and consequent improvement in consumption, the strong acquisition activity created in the sector by the so-called consolidator peers may put additional pressure over valuations. This limits Multiplan’s ability to grow inorganically as we assume management will not perform unaccretive acquisitions. As any company centralized in its founder figure, Multiplan will also bear succession risks. … succession risks… Substituting Mr. Peres seems to be a tough task. Although we do not envisage Mr. Peres retiring in the coming years, as of today the company has not disclosed any clear succession plans. It is our opinion, though, that the company has executives from within its management team that can perform the task. As occurred with homebuilders, the shopping center segment is very fragmented and … and upcoming IPO’s in after four players were successfully capitalized in the BOVESPA, it is reasonable to the sector. assume others should be planning to follow suit. As a matter of fact, a fifth company, Aliansce, filed and almost issued shares, but withdrew its IPO due to market conditions. New offerings could create an overhang of shares in the sector, impacting Multiplan’s stocks performances. 15

- 16. Brief Company Description Founded 30 years ago by Mr. José Isaac Peres (CEO), Multiplan is one of the largest and Multiplan is a 30-year old leading mixed used projects developers in Brazil. The company designs, develops and mixed use projects manages a chain of malls located in some of the most important cities and regions of developer. Brazil. With a stake of 63.7% over a total gross leasable area (GLA) of 241,539 square meters With a 63.7% stake over distributed through 10 malls, the company is taking advantage of the favorable macro- 241,639m2 of GLA. economic scenario either to expand its existing base or to develop green field projects. Exhibit 18 shows detailed information on the company’s shoppings and their geographical positioning. Exhibit 18: Multiplan’s portfolio and geographic positioning GLA NOI City Shopping Stake ( 000 m2 ) ( R$ MM ) Pátio Savassi 17.5 - 84% Belo BH Shopping 35.5 9.5 80% Horizonte Diamond Mall 20.8 4.6 90% Brasília Park Shopping 39.3 6.5 60% Curitiba Park Shopping Barigui 41.4 5.2 90% Porto Barra Shopping Sul 66.4 - 100% Alegre Ribeirão Ribeirão Shopping 39.1 5.1 76% Preto Barra Shopping 69.3 21.6 51% Rio de Janeiro New York City Center 22.1 2.2 50% Morumbi Shopping 55.0 19 56% São Paulo Shopping Anália Franco 39.3 8.2 30% Shopping Vila Olimpia 26.4 - 30% Source: Multiplan Recently listed in the BOVESPA’s Level II of corporate governance practices, the company Listed in BOVESPA’s Level II extended to all shareholders the rights of the Novo Mercado including tag along rights by of corporate governance its current by-laws. Exhibit 19 shows the company’s current shareholding structure. practices… Exhibit 19: Multiplan’s shareholding structure Peres Family Ontario Teachers Free Float 19,5% ON 30,8% ON 49,7% ON 100% PN 40,3% Total 25,0% Total 34,7% Total MULTIPLAN Source: Multiplan and Bulltick As it can be observed above, the only requirement of the Novo Mercado not fulfilled by … granting all “Novo the company is in regards of having 100% of common shares in the capital, as the Mercado” rights to its Ontario Teachers Pension fund holds preferred shares on the back of the fund’s by-laws. shareholders. 16

- 17. Multiplan’s Earnings Estimates Income Statement (R$ MM) 2006 2007E 2008E 2009E 2010E 2011E 2012E Stores Rental 193 250 328 433 525 623 715 Services 45 47 52 65 77 88 102 Key Money 14 9 12 33 43 54 65 Parking 9 33 41 42 44 46 48 Real Estate Sales 16 10 - - - - - Others 0 - - - - - - Gross Revenues 276 351 433 573 688 811 929 Deductions (24) (30) (37) (49) (59) (69) (79) Net Revenues 253 321 396 525 630 742 850 - Operational Expenditures (231) (283) (299) (329) (354) (297) (292) Net Operating Income 22 37 97 196 276 445 559 Financial Results (34) (0) 18 (7) (8) (8) (8) Non-Operational Results 1 1 - - - - - EBT (11) 38 115 189 268 437 550 Income Tax (13) (6) (12) (31) (58) (116) (154) Minority Interest (8) 0 - - - - - Net income (32) 32 103 158 210 322 396 Depreciation & Amortization 101 136 147 155 160 83 58 EBITDA 123 173 245 351 437 528 616 Adjustments 17 22 - - - - - Adjusted EBITDA 139 195 245 351 437 528 616 Funds from Operations 107 228 348 509 647 850 1,013 NOI Margin 9% 12% 25% 37% 44% 60% 66% Adjusted EBITDA Margin 55% 54% 62% 67% 69% 71% 72% Adjusted Net Margin N.R. 17% 26% 30% 33% 43% 47% Free Cash Flow 2006 2007E 2008E 2009E 2010E 2011E 2012E EBITDA 123 173 245 351 437 528 616 Taxes 27 (5) (10) (32) (60) (118) (156) Change in Assets 65 (243) (41) 6 6 8 (18) CAPEX (348) (352) (331) (186) (232) (201) (160) FCFF (133) (427) (137) 138 151 218 282 Balance Sheet 2006 2007E 2008E 2009E 2010E 2011E 2012E Assets Cash and Equivalents 11 402 88 10 10 10 10 Accounts Receivable 66 73 100 126 152 177 198 Inventories 27 27 37 46 56 65 73 Fixed Assets 612 941 1,237 1,381 1,565 1,713 1,815 Goodwill 480 367 255 142 29 - - Other 87 364 509 655 721 842 1,028 Total Assets 1,283 2,174 2,226 2,361 2,534 2,806 3,124 Liabilities Short Term Debt 24 27 27 27 27 27 27 Payables 5 7 10 13 16 18 20 Long Term Debt 34 52 52 52 52 52 52 Other 183 160 132 146 159 187 206 Equity 1,036 1,927 2,005 2,123 2,280 2,522 2,819 Total Liabilities 1,283 2,174 2,226 2,361 2,534 2,806 3,124 Source: Multiplan and Bulltick 17

- 18. Multiples and Return Metrics Multiples 2006 2007E 2008E 2009E 2010E 2011E 2012E Adjusted PER* N.A. 21.6x 16.8x 13.4x 11.2x 10.3x 9.1x FV / Adjusted EBITDA** 26.3x 16.9x 14.8x 10.5x 8.4x 7.0x 6.0x P / FFO 52.6x 21.5x 14.4x 11.6x 9.8x 9.0x 8.0x P / Adjusted FFO** 42.4x 19.0x 14.4x 11.6x 9.8x 9.0x 8.0x P / FCFF N.R N.R N.R 26.2x 24.0x 16.6x 12.8x Market Cap / GLA (R$ / m2) 15,623 14,986 11,406 10,040 9,217 8,497 8,116 Return Metrics 2006 2007E 2008E 2009E 2010E 2011E 2012E ROE* 9.4% 9.8% 11.0% 13.1% 14.7% 14.6% 14.8% ROIC* 29.3% 9.0% 10.0% 12.6% 14.0% 13.8% 13.9% ROA* 6.1% 8.4% 9.8% 11.8% 13.2% 13.1% 13.4% Source: Bulltick * Adjusted for Goodwill Amortization **Adjusted for IPO non-recurring costs 18

- 19. Macroeconomic Assumptions 2007E 2008E 2009E 2010E 2011E 2012E 2013E 2014E Inflation 4.0% 4.0% 4.0% 4.0% 4.0% 4.0% 4.0% 4.0% Selic Rate (Year End) 11.25% 10.50% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Selic Rate (Average) 12.25% 10.88% 10.25% 10.00% 10.00% 10.00% 10.00% 10.00% Exchange Rate (Year End) 1.85 1.95 1.99 2.03 2.07 2.11 2.15 2.20 Exchange Rate (Average) 1.99 1.90 1.97 2.01 2.05 2.09 2.13 2.17 GDP Growth 4.5% 4.0% 4.0% 4.0% 4.0% 4.0% 4.0% 4.0% TJLP 6.3% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% Libor 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% Source: Bulltick 19

- 20. APPENDIX A IMPORTANT DISCLOSURES Bulltick Brasil Consultoria e Assessoria Empresarial Ltda. is an affiliate of Bulltick LLC (The Firm). Bulltick LLC may do business with the companies covered in this report, as a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report only as a single factor in making their investment decision. A. CONFLICTS OF INTEREST Bulltick Brasil Consultoria e Assessoria Empresarial Ltda, or its affiliates, currently has, or has had within the past 12 months, Multiplan as client and/or received compensation for products and services provided to this company. Bulltick Brasil Consultoria e Assessoria Empresarial Ltda, or its affiliates, managed or co-managed a public offering of securities for Multiplan in the past 12 months, received compensation for investment banking services from Multiplan in the past 12 months. Neither Bulltick Brasil Consultoria e Assessoria Empresarial Ltda nor any of its affiliates own equity securities of any of the subject companies. Analyst compensation is determined by Bulltick Brasil Consultoria e Assessoria Empresarial Ltda management and is not linked to specific transactions or recommendations. B. ANALYST CERTIFICATION I, Rafael Pinho, author of this report, hereby certify that all of the views expressed in this report accurately reflect my personal views about any and all of the subject issuer(s) or securities, no part of my compensation was, is , or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. I have not received any compensation from any of the subject companies in the past 12 months. I also certify that neither I nor any member of my household serves as a director, officer, or advisory board member of any of the subject companies in this report. C. INVESTMENT RATING Investment ratings are determined by the ranges described below: BUY: Total return of securities expected to be above 18% (in dollar terms) in the following 12 months NEUTRAL: Total return of securities expected to be below 18% (in dollar terms) and above 8% (in dollar terms) in the following 12 months. SELL: Total return of securities expected to be below 8% (in dollar terms) in the following 12 months. Price Target: The valuation method used to determine the price targets in this report were based on the discounted cash flow methodology. D. RISK RATINGS Risks for the achievement of the target prices defined in this report include major change in our base case macro- economic scenario, increase in interest rates and in the Brazil risk, reduction in the expectations for demand for real estate in Brazil and impact on already listed stocks of new IPOs in Brazil´s real estate sector. Based on last 6 months volatility of subject companies, and comparing them to the volatility of the Bovespa Index (Ibovespa) in the same period, we define each subject company´s relative volatility in the following way: Multiplan High. 20

- 21. OTHER DISCLOSURES Bulltick Brasil Consultoria e Assessoria Empresarial Ltda and its subsidiaries, affiliates, shareholders, directors, officers, employees, and licensors (“The Bulltick Parties”) will not be liable (individually, jointly, or severally) to you or any other person as a result of your access, reception or use of the information contained in this document for indirect, consequential, special, incidental, punitive, or exemplary damages, including, without limitation, lost profits, lost savings and lost revenues (collectively, the “Excluded Damages”), whether or not characterized in negligence, tort, contract, or other theory of liability. The information contained in this document has been obtained from sources believed to be reliable, although its accuracy and completeness cannot be guaranteed. All opinions, projections, and estimates constitute the judgment of the author as of the date of the report and these, plus any other information contained in the report, are subject to change without notice. Prices and availability of financial instruments also are subject to change without notice. Bulltick Brasil Consultoria e Assessoria Empresarial Ltda and its affiliated companies have not taken any steps to insure that the securities referred to in this report are suitable for any particular investor. The Report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. Securities mentioned in the report are subject to investment risks, including the possible loss of the principal amount invested. Any decision to purchase securities mentioned in the Report must take into account existing public information on such a security or any registered prospectus. The financial instruments mentioned in this document may not be eligible for sale in some countries. The Report is not to be construed as providing investment services in any jurisdiction where the provision of such services would be illegal. Bulltick Brasil Consultoria e Assessoria Empresarial Ltda, its affiliated companies, and/or its officers, directors, or shareholders, may from time to time have long or short positions in the financial instruments of the companies mentioned in this document, engage in securities transactions in a manner inconsistent with this report, buy or sell from customers on a principal basis, or serve in an advisory capacity. Investing in non-US securities, including ADRs, may entail certain risks. The securities of non-US issuers may not be registered with, and may not be subject to the reporting requirements of the US Securities and Exchange Commission. There may be limited information available on foreign securities. Foreign companies are generally not subject to uniform audit and reporting standards, practices and requirements comparable to those in the US Securities of some foreign companies may be less liquid and their prices more volatile than securities of comparable US companies. In addition, exchange rate movements may have an adverse effect on the value of an investment in a foreign stock and its corresponding dividend payment for US investors. The information contained in the report is privileged and confidential and intended solely for the recipients who have been specifically authorized to receive it and it may not be further distributed. Bulltick Brasil Consultoria e Assessoria Empresarial Ltda and its affiliates accept no liability whatsoever for the actions of third parties. Should you receive this message by mistake you are hereby notified that any disclosure reproduction, distribution, or use of this message is strictly prohibited. The Report may provide the addresses of, or contain hyperlinks to, websites. Except to the extent to which the Report refers to the website material of the Bulltick Brasil Consultoria e Assessoria Empresarial Ltda or any of its affiliates, the Firm has not reviewed the linked site. Equally, except to the extent to which the Report refers to website material of Bulltick Brasil Consultoria e Assessoria Empresarial Ltda or any of its affiliates, the Firm takes no responsibility for, and makes no representation or warranties whatsoever as to, the data and information contained therein. Such address or hyperlink (including addresses or hyperlinks to website material of Bulltick Brasil Consultoria e Assessoria Empresarial Ltda or any of its affiliates) is provided solely for your convenience and information and the content of the linked site does not in any way form part of this document. Accessing such website or following such link through the Report or the website of Bulltick Brasil Consultoria e Assessoria Empresarial Ltda or any of its affiliates shall be at your own risk and Bulltick Brasil Consultoria e Assessoria Empresarial Ltda or any of its affiliates shall have no liability arising out of, or in connection with, and such referenced website. 21