Persistent System advised to book profit despite growth visibility

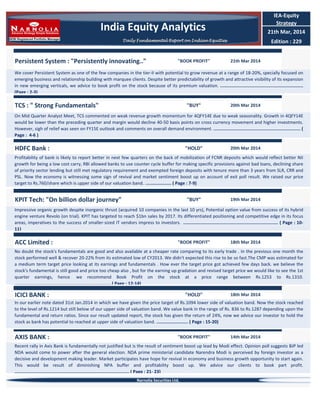

- 1. 21th Mar 2014 We cover Persistent System as one of the few companies in the tier-II with potential to grow revenue at a range of 18-20%, specially focused on emerging business and relationship building with marquee clients. Despite better predictability of growth and attractive visibility of its expansion in new emerging verticals, we advice to book profit on the stock because of its premium valuation. ............................................................... (Page : 2-3) AXIS BANK : ICICI BANK : "HOLD" 18th Mar 2014 In our earlier note dated 31st Jan.2014 in which we have given the price target of Rs.1094 lower side of valuation band. Now the stock reached to the level of Rs.1214 but still below of our upper side of valuation band. We value bank in the range of Rs. 836 to Rs.1287 depending upon the fundamental and return ratios. Since our result updated report, the stock has given the return of 24%, now we advice our investor to hold the stock as bank has potential to reached at upper side of valuation band. ........................ ( Page : 15-20) "BOOK PROFIT" 14th Mar 2014 Recent rally in Axis Bank is fundamentally not justified but is the result of sentiment boost up lead by Modi effect. Opinion poll suggests BJP led NDA would come to power after the general election. NDA prime ministerial candidate Narendra Modi is perceived by foreign investor as a decisive and development making leader. Market participates have hope for revival in economy and business growth opportunity to start again. This would be result of diminishing NPA buffer and profitability boost up. We advice our clients to book part profit. ....................................................................................... ( Page : 21- 23) No doubt the stock's fundamentals are good and also available at a cheaper rate comparing to its early trade . In the previous one month the stock performed well & recover 20-22% from its estimated low of CY2013. We didn't expected this rise to be so fast.The CMP was estimated for a medium term target price looking at its earnings and fundamentals . How ever the target price got achieved few days back. we believe the stock's fundamental is still good and price too cheap also , but for the earning up gradation and revised target price we would like to see the 1st quarter earnings, hence we recommend Book Profit on the stock at a price range between Rs.1253 to Rs.1310. ......................................................................... ( Page : 12-14) IEA-Equity Strategy 21th Mar, 2014 Edition : 229 ACC Limited : KPIT Tech: "On billion dollar journey" "BUY" 19th Mar 2014 Impressive organic growth despite inorganic thrust (acquired 10 companies in the last 10 yrs), Potential option value from success of its hybrid engine venture Revolo (on trial). KPIT has targeted to reach $1bn sales by 2017. Its differentiated positioning and competitive edge in its focus areas, imperatives to the success of smaller-sized IT vendors impress to investors. ........................................................................ ( Page : 10- 11) HDFC Bank : "HOLD" 20th Mar 2014 Profitability of bank is likely to report better in next few quarters on the back of mobilization of FCNR deposits which would reflect better NII growth for being a low cost carry, RBI allowed banks to use counter cycle buffer for making specific provisions against bad loans, declining share of priority sector lending but still met regulatory requirement and exempted foreign deposits with tenure more than 3 years from SLR, CRR and PSL. Now the economy is witnessing some sign of revival and market sentiment boost up on account of exit poll result. We raised our price target to Rs.760/share which is upper side of our valuation band. .................... ( Page : 7-9) Persistent System : "Persistently innovating.." "BOOK PROFIT" TCS : " Strong Fundamentals" "BUY" 20th Mar 2014 On Mid Quarter Analyst Meet, TCS commented on weak revenue growth momentum for 4QFY14E due to weak seasonality. Growth in 4QFY14E would be lower than the preceding quarter and margin would decline 40-50 basis points on cross currency movement and higher investments. However, sigh of relief was seen on FY15E outlook and comments on overall demand environment. .................................................................. ( Page : 4-6 ) "BOOK PROFIT" 18th Mar 2014 Narnolia Securities Ltd, India Equity Analytics Daily Fundamental Report on Indian Equities

- 2. Persistent System. Footing on Product Business, and working aggressively on new emerging services; 11% Key facts from Management Interview to Media( on 20 th March,2014) 1M 1yr YTD Absolute 1.1 76.8 85.7 Rel. to Nifty 3.4 75.8 82.3 Current 2QFY14 1QFY14 Promoters 38.96 38.96 38.96 FII 18.26 15.28 14.84 DII 18.78 21.23 19.31 Others 24 24.53 26.89 3QFY14 2QFY14 (QoQ)-% 3QFY13 (YoY)-% 432.75 432.37 0.1 332.98 30.0 104.3 100.8 3.5 82.4 26.6 64.2 60.8 5.6 49.5 29.7 24.1% 23.3% 80bps 24.7% (60bps) 14.8% 14.1% 70bps 14.9% (10bps) 2 (5) Persistent system is expecting to see IP led growth at a range of 18-19% in FY14E and 20%+ in FY15E driven by HPCA without any addition of new IPs. At same point of time, they are also looking to scale strong potential of rCloud after adding new capabilities. EBITDA Margin PAT Margin Company update Book Profit Persistent management suggests that deal pipeline are looking strong and seeing good activity and traction in the market across the board. Its focus on some of newer technologies like cloud, analytics and mobility, M2M, digital transformation are gaining a lot of traction because of pickup in demand environment. Because of actively investment in these themes, management is very confident to see healthy growth. View and Valuation: The company’s focus is shifting greater proportion to IP led services and company has marquee clientele in cutting-edge technologies around cloud, mobility, digital and analytics; witnessing faster growth. Considering the company’s premium valuation, we advice “Book Profit” on the stock. At a CMP of Rs 1059, stock trades at 13.4x FY15E earnings. Our view could be change with management guidance, higher currency flactuations and post earnings of coming quarter. Financials Revenue EBITDA We cover Persistent System as one of the few companies in the tier-II with potential to grow revenue at a range of 18-20%, specially focused on emerging business and relationship building with marquee clients. Despite better predictability of growth and attractive visibility of its expansion in new emerging verticals, we advice to book profit on the stock because of its premium valuation. Change from Previous Previous Target Price 960 Upside 1% PAT (1) Persistent System is setting up a unit related to product and Product services, named it “ Accelerite” to manage efficiently. They are taking some of its IP led products into this Accelerite. We expect that company is able to compete as a product company, which “Accelerite” will in the market. (2) Management expects that the overall trends are looking good on Industry per se and new emerging segment will play a major role for growth. Now, clients are moving into new changes and focusing into new services and solution. (3) For 4QFY14E, muted set of growth could be seen and expecting Intellectual Property (IP) growth this quarter. (4) The business outlook though is very positive in the sense, and they are seeing good opportunities, good pipeline growth and many good interesting deals being signed. Average Daily Volume 12139 Market Data BSE Code 533179 NSE Symbol Nifty Share Holding Pattern-% 6483 Stock Performance "Persistently innovating.." CMP 1059 Target Price 1070 On recent management Interview, Persistent System announced its new footing of dedicated product business unit “Accelerite” to align its business strategy combined with Products and IP (Intellectual Property) based on SMAC (Social, Mobility, Analytics, Cloud) platform. PERSISTENT 1 year forward P/E-x Rs, Crore (Source: Company/Eastwind) Mkt Capital (Rs Crores) 52wk Range H/L 1220/477 Please refer to the Disclaimers at the end of this Report. 4236 "Book Profit" 21st Mar' 14 Narnolia Securities Ltd,

- 3. 3 Persistent System. (Source: Company/Eastwind) Operating Metrics Financials Please refer to the Disclaimers at the end of this Report. Narnolia Securities Ltd, 2QFY12 3QFY12 4QFY13 1QFY13 QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 Top1 16.0% 15.9% 17.2% 17.8% 20.7% 21.1% 21.6% 21.2% 22.5% 19.8% Top 5 38.6% 37.0% 36.6% 33.5% 36.3% 37.3% 36.7% 34.7% 36.4% 36.9% Top 10 49.4% 48.3% 48.8% 45.3% 47.0% 49.4% 47.9% 46.0% 47.3% 46.9% Onsite - Linear 12665 12387 12603 12789 12863 12772 14014 14567 14283 14510 Offshore - Linear 3803 3778 3895 3898 3978 4032 4143 4111 4109 4179 Yeild per Employee(excld- Trainee) 3208 3247 3350 3345 3746 3817 3769 3602 3919 3934 Total Employee 6900 6706 6628 6536 6370 6719 6970 7144 7457 7602 Attrition 17.7% 17.4% 18.3% 18.9% 16.9% 16.0% 14.4% 14.2% 14.0% 13.2% Utilization rate %(xclude IP Led ) 73.8% 74.1% 71.7% 74.1% 75.2% 77.3% 72.5% 70.0% 71.7% 72.9% Billing Rate-USD/ppm Employee Metrics Client Concentration Rs in Cr, FY10 FY11 FY12 FY13 FY14E FY15E Sales 601.16 775.84 1000.3 1294.5 1666.59 2061.72 Employee Cost 368.74 481.62 599.05 719 899.96 1123.64 Cost of technical professionals 0 30.67 41.68 54 91.66 113.39 Other expenses 86.05 105.24 135.2 218 291.65 366.99 Total expenses 454.79 617.53 775.93 990.78 1283.28 1604.02 EBITDA 146.37 158.31 224.37 303.72 383.32 457.70 Depreciation 33.52 42.39 61.1 78 100.55 93.54 Other Income 11.23 34.44 34.44 34.44 55.00 72.16 EBIT 112.85 115.92 163.27 225.44 282.76 364.16 Interest Cost 0 0 0.00 0.03 0.05 0.05 Profit (+)/Loss (-) Before Taxes 124.08 150.36 197.71 259.851 337.71 436.28 Provision for Taxes 9.05 10.62 55.09 75.37 92.03 119.98 Net Profit (+)/Loss (-) 115.03 139.74 142.62 184.481 245.69 316.30 Growth-% (YoY) Sales 1.2% 29.1% 28.9% 29.4% 28.7% 23.7% EBITDA 60.2% 8.2% 41.7% 35.4% 26.2% 19.4% PAT 74.1% 21.5% 2.1% 29.4% 33.2% 28.7% Expenses on Sales-% Employee Cost 61.3% 62.1% 59.9% 55.5% 54.0% 54.5% Other expenses 14.3% 13.6% 13.5% 16.9% 17.5% 17.8% Tax rate 7.3% 7.1% 27.9% 29.0% 27.3% 27.5% Margin-% EBITDA 24.3% 20.4% 22.4% 23.5% 23.0% 22.2% EBIT 18.8% 14.9% 16.3% 17.4% 17.0% 17.7% PAT 19.1% 18.0% 14.3% 14.3% 14.7% 15.3% Valuation: CMP 310 366.7 409.2 541 1059 1059 No of Share 4 4 4 4 4 4 NW 639.0 747.1 840.5 1018.3 1212.5 1477.3 EPS 28.8 34.9 35.7 46.1 61.4 79.1 BVPS 159.7 186.8 210.1 254.6 303.1 369.3 RoE-% 18.0% 18.7% 17.0% 18.1% 20.3% 21.4% P/BV 1.9 2.0 1.9 2.1 3.5 2.9 P/E 10.8 10.5 11.5 11.7 17.2 13.4

- 4. TCS Key facts from Management Commentary: 1M 1yr YTD Absolute -5.9 29.9 67.2 Rel. to Nifty -13.3 18.8 57.1 Current 2QFY14 1QFY14 Promoters 73.9 73.96 73.96 FII 16.33 16.09 15.67 DII 5.26 5.58 5.90 Others 4.51 4.37 4.47 3QFY14 2QFY14 (QoQ)-% 3QFY13 (YoY)-% 21294 20977.2 1.5 16069.93 32.5 6686.76 6633.0 0.8 4660.49 43.5 5333.43 4633.3 15.1 3549.61 50.3 31.4% 31.6% (20bps) 29.0% 240bps 25.0% 22.1% 290bps 22.1% 290bps 4 Average Daily Volume 1011877 NSE Symbol TCS Now, revenue in 4QFY14E could be a bit lighter than what we had expected post 3QFY14 earnings. We are not much surprise on comments on weak revenue as well as ramping down on margin picture for current quarter. We believe that the 1QFY15E, the first seasonally strong quarter of the year, is the stern litmus test of TCS’s confidence for FY15E. (1) For 4QFY14E, revenue would be lower than preceding quarter because of seasonal impacts, and domestic revenue may clock negative growth largely impacted by upcoming general election. However, no pressure would be seen on revenue for FY15E. (2)Margin would decline by 40-50 basis points on cross currency movement and higher investments. However, company is expecting no hiccups on margin for long- term prospect. (3) The company is very optimistic on Europe, US and UK growth could be inline. Latin America will see good growth. Europe will continue to do well, and the US and the UK will be close to industry average. Middle East and APAC could be seen on flattish node. (4) Across vertical, Media and Entertainment has reported better, Telecom remains challenged. While, there could be some ray of growth because of higher penetration in Europe. 52wk Range H/L 2384/1300 Mkt Capital (Rs Crores) 433985 Previous Target Price 2360 Upside 23% Change from Previous 6% Market Data BSE Code 532540 Mid Quarter's Analyst Meet: Lower than expected growth for 4QFY14E, but still better outlook for FY15E than FY14E, " Strong Fundamentals" CMP 2041 Target Price 2510 Company update Buy On Mid Quarter Analyst Meet, TCS also commented on weak revenue growth momentum for 4QFY14E followed by Infosys due to weak seasonality. Growth in 4QFY14E would be lower than the preceding quarter and margin would decline 40-50 basis points on cross currency movement and higher investments. However, sigh of relief was seen on FY15E outlook and comments on overall demand environment. 1 year forward P/E Rs, Crore (Source: Company/Eastwind) Please refer to the Disclaimers at the end of this Report. (5) Currency will play a small role with marginal impact of cross currency movement and average currency movement. There may be some accounting changes related to recognition of forex gains or losses, but it is not likely to be material. View and Valuation: We continue to remain positive on its demand outlook and margin profile, the management expects for robust deal pipeline going forward and also expects to materialize its emerging space like Digital as well as Cloud, Mobility, Analytics and Big data. We expect, TCS will be star performer in growth sense than other peers. Hence, we are maintaining 17% (revised from 18%) revenue growth in dollar term for FY14E because of improved demand environment, while NASSCOM expects 12-14% for the Industry. At a price of Rs 2041, it is trading at 18x FY15E earnings, We maintain" BUY" view on the stock with a target price of Rs 2510. Financials Revenue EBITDA EBITDA Margin PAT Margin Share Holding Pattern-% Nifty 6524 Stock Performance PAT "BUY" 20th Mar' 14 Narnolia Securities Ltd,

- 5. 5 Considering above growth factors, we are not expecting any major concern with company's growth. The company is also focussed to drive operational improvements in the business and aims to expand reach in non-traditional markets and servicelines. (Source: Company/Eastwind) We expect 1% (QoQ) revenue growth in USD term for 4QFY14E, Unlike Infosys, TCS comments are based on potential impact from seasonally lower demand in its biggest market (US and Europe) and weak domestic demand environment. On previous comments, management had already quoted regarding demand volatility at home because of upcoming poll. Comparing with its nearest rival Infosys, TCS is not facing largely with any specific issue. Despite a weak commentary on 4QFY14E, management is aggressively confident to report better numbers in FY15E with healthy demand outlook. We are considering following factors for its growth story in FY15E. Healthy Demand Environment: TCS is much confident on healthy demand outlook and expects that FY15E could be better year than FY14E propelled by better discretionary spending in the US. Management suggests that except India, other emerging markets (contributes 18-19% of revenue) continue to see healthy demand. Also, in its FY15 revenue growth models, India (contributes 7% of sales) is the only market which TCS expects to be weak. TCS. Is there any setback? Please refer to the Disclaimers at the end of this Report. No sign of any ramp down: Management suggests that Continental Europe will likely grow ahead of overall company growth in FY15E. On vertical front, smaller verticals such as Energy & Utilities, Transportation and Life sciences & Healthcare might grow ahead of overall company average. While, its mature verticals like BFSI and Retails could grow flattish, Telecom continues to face structural issue. Contracts wins from continental Europe could change the shape of verticals. Still, we are not seeing any project ramp down. New emerging business on demand: A part of legacy business, the emerging opportunities in helping large corporations tap areas such as social media and data analytics are seen as increasingly contributing to the IT sector's next phase of growth. TCS and its Indian competitors are winning a significant share of several 2nd and 3rd generation renewal contracts as western companies look to both cut costs and modernise their IT infrastructure. Sales (USD) and Sales growth-% Narnolia Securities Ltd,

- 6. 6 (Source: Company/Eastwind) Financials Please refer to the Disclaimers at the end of this Report. TCS. Narnolia Securities Ltd, Rs, Cr FY10 FY11 FY12 FY13 FY14E FY15E Net Sales-USD 6339.0 8187.0 10171.0 11569.0 13531.7 16012.2 Net Sales 30029.0 37325.1 48894.3 62989.5 81731.2 96073.3 Employee Cost 10879.6 13850.5 18571.9 24040.0 30060.7 35547.1 Overseas business expenses 4570.1 5497.7 6800.5 8701.9 11565.0 13930.6 Services rendered by business associates and others 1262.0 1743.7 2391.3 3763.7 4952.9 5764.4 Operation and other expenses 4622.8 5054.3 6694.8 8443.9 10044.8 12009.2 Total Expenses 21334.4 26146.2 34458.5 44949.6 56623.4 67251.3 EBITDA 8694.6 11178.9 14435.8 18040.0 25107.8 28822.0 Depreciation 601.8 686.2 860.9 1016.3 1279.2 1503.7 Amortisation 59.1 49.1 57.1 63.7 57.5 76.7 Other Income 272.0 604.0 428.2 1178.2 1348.6 1921.5 Extra Ordinery Items 0.0 0.0 0.0 0.0 0.0 0.0 EBIT 8033.7 10443.6 13517.9 16960.1 23828.6 27318.3 Interest Cost 16.1 26.5 22.2 48.5 35.9 33.8 PBT 8289.6 11021.2 13923.8 18089.8 25141.3 29206.0 Tax 1197.0 1830.8 3399.9 4014.0 5933.3 7009.4 PAT 7092.7 9190.3 10524.0 14075.7 19208.0 22196.5 PAT (Reported PAT) 7000.6 9068.6 10414.0 13917.4 19208.0 22196.5 Sales-USD 29.2% 24.2% 13.7% 17.0% 18.3% Sales 8.0% 24.3% 31.0% 28.8% 29.8% 17.5% EBITDA 21.3% 28.6% 29.1% 25.0% 39.2% 14.8% PAT 31.8% 29.6% 14.5% 33.7% 36.5% 15.6% EBITDA 29.0% 30.0% 29.5% 28.6% 30.7% 30.0% EBIT 26.8% 28.0% 27.6% 26.9% 29.2% 28.4% PAT 23.6% 24.6% 21.5% 22.3% 23.5% 23.1% Employee Cost 36.2% 37.1% 38.0% 38.2% 36.8% 37.0% Overseas business expenses 15.2% 14.7% 13.9% 13.8% 14.2% 14.5% Services rendered by business associates and others 4.2% 4.7% 4.9% 6.0% 6.1% 6.0% Operation and other expenses 15.4% 13.5% 13.7% 13.4% 12.3% 12.5% Tax rate 14.4% 16.6% 24.4% 22.2% 23.6% 24.0% CMP 780.8 1182.5 1322.0 1563.0 2041.0 2041.0 No of Share 195.7 195.7 195.7 196.0 196.0 196.0 NW 18466.7 24504.8 29579.2 38645.7 49940.0 62991.6 EPS 36.2 47.0 53.8 71.8 98.0 113.2 BVPS 94.4 125.2 151.1 197.2 254.8 321.4 RoE-% 38.4% 37.5% 35.6% 36.4% 38.5% 35.2% Dividen Payout ratio 28.1% 50.8% 37.5% 41.2% 41.2% 41.2% P/BV 8.3 9.4 8.7 7.9 8.0 6.4 P/E 21.5 25.2 24.6 21.8 20.8 18.0 Margin -% Expenses on Sales-% Valuation Growth-%

- 7. HDFC Bank 741 760 720 3 6 1M 1yr YTD Absolute 11.8 15.1 15.1 Rel.to Nifty 4.7 4.8 4.8 Current 4QFY13 3QFY1 3Promoters 22.7 22.7 22.7 FII 34.9 33.6 34.9 DII 9.3 9.8 6.6 Others 33.1 33.8 34.2 Financials Rs, Cr 2011 2012 2013 2014E 2015E NII 10543 12885 15811 18713 22944 Total Income 14878 18668 22664 26604 30835 PPP 7725 9391 11428 14516 15572 Net Profit 3926 5167 6726 8453 9119 EPS 84.4 22.0 28.7 36.0 38.9 7 Change from Previous HDFC Bank Vs Nifty Share Holding Pattern-% 4.17 lakhs Nifty 6524 Mkt Capital (Rs Cr) Please refer to the Disclaimers at the end of this Report. (Source: Company/Eastwind) Stock Performance In last quarter, HDFC bank has raised FCNR deposits to the tune of $3.4 bn nearly about Rs.21000 cr through RBI special window which carry interest rate of 3.5% while normal deposits rate are in the range of 6.5% to 7%. HDFC Bank raised larger chunk of monies in compare to other banks like SBI and ICICI bank. SBI and ICICI bank raised monies through FCRN deposits to the tune of $2bn each. Further incremental foreign deposits with tenure are more than 3 years are exempted from SLR, CRR and PSL lending. This would help bank to lower cost of fund by 75 bps to 100 bps and hence margin expansion. Bank management guided margin would be in the range of 4.1% to 4.5% going forward. Mounting bad loans have major cause of worry; RBI allowed banks to use 33% of counter cycle, floating provisions for specific provisions Recently RBI allows banks to use 33% of counter cycle provisioning buffer, floating provisions for making specific provisions against impaired accounts which would help bank to make lower provisions and hence boost up earnings. HDFC bank reported very strong asset quality with GNPA and net NPA stood at 1% and 0.3% at the end of December quarter. Bank would use counter cycle buffer, floating provisions for specific provisions and make lower fresh provisions. This would be the result of boosting up profitability. Average Daily Volume Counter cycle provisions and floating provisions are represented as capital reserves that bank need to build up in good times and can only use for contingencies under extra circumstance. This is the first time when central bank allows to use since the reserve were created starting 2010. At the end of quarter all banks reported Rs.1.71 trillion of GNPA, the rise of 39.4% YoY. In a very rough estimate, banking system has nearly about Rs. 2 trillion in bad loans and another Rs.4 trillion loans are being restructured pipeline out of total Rs.82 trillion. Company update HOLD CMP Target Price We have raised our price target to Rs.760/share on account of bank’s likely to get benefit from FCNR deposits mobilization that it had recently raised. We value bank in the range of Rs.660 to Rs.760 per share on the back of current fundamental and prevailing economic scenario. Now the economy is witnessing some sign of revival and market sentiment boost up on account of exit poll result. HDFC bank is likely to see earnings boost-up in near term on account of mobilization of FCNR deposits which would reflect better NII for being a low cost carrying in nature, recently RBI allow banks to use 33% of buffer/floating provisions for bad loan and declining of low yielding PSL share in overall lending. Previous Target Price 176874 Raised foreign deposits higher amount in comparison to peers; likely to report better NII for being low cost in nature Market Data Upside 750/528 BSE Code 500180 NSE Symbol HDFCBANK 52wk Range H/L "HOLD" 20th March.,2014 Narnolia Securities Ltd,

- 8. 8 Source:Eastwind/Company HDFC BANK Please refer to the Disclaimers at the end of this Report. Share of PSL down sharply; release fund would be deployed in high yield sector Recently share of PSL in HDFC bank came sharply but bank already met PSL target of 40% which means addition fund would be deployed in high yield segment which would reflect in NII growth. According to RBI, bank’s need to spend 40% in net advance in priority sector lending and HDFC bank are among those which have highest share in PSL in private bank category. Additionally fund raised fund through FCNR deposits with tenure more than 3 years are exempted from SLR, CRR and PSL means bank would have higher fund for deploying in sector those are high yield in nature. Valuation & View HDFC bank is expected to report better earnings on the back of (a) likely to get benefit from FCRN deposits mobilization, (b) recent RBI allow bank to use 33% of counter cycle buffer provisions for specific provisions, this would help bank to make lower provisions and hence profitability and (c) share of additional PSL lending would be deployed in high yielding sector. We have raised our price target to Rs.760/share which is upper side of our valuation band. Valuation Band Narnolia Securities Ltd,

- 9. 9 HDFC BANK Financials Source: Eastwind/ Company Please refer to the Disclaimers at the end of this Report. Narnolia Securities Ltd, P/L 2011 2012 2013 2014E 2015E Interest/discount on advances / bills 15085 21124 26822 32002 40213 Income on investments 4675 6505 7820 9311 10952 Interest on balances with Reserve Bank of India 148 137 282 373 373 Others 20 108 141 65 65 Total Interest Income 19928 27874 35065 41751 51603 Others Income 4335 5784 6853 7891 7891 Total Income 24263 33658 41917 49642 59494 Interest on deposits 8028 12690 16321 20281 24337 Interest on RBI/Inter bank borrowings 1336 2253 2889 4571 4278 Others 20 47 44 44 44 Interest Expended 9385 14990 19254 23038 28659 NII 10543 12885 15811 18713 22944 NII Growth(%) 25.7 22.2 22.7 18.4 22.6 Other Income 4335 5784 6853 7891 7891 Total Income 14878 18668 22664 26604 30835 Total Income Growth(%) 20.3 25.5 21.4 17.4 15.9 Employee 2836 3400 3965 4231 5342 Other Expenses 4317 5878 7271 7857 9921 Operating Expenses 7153 9278 11236 12087 15263 PPP( Rs Cr) 7725 9391 11428 14516 15572 Provisions( Incl tax provision) 3799 4224 4701 1751 6453 Net Profit 3926 5167 6726 8453 9119 Net Profit Growth(%) 33.2 31.6 30.2 25.7 7.9 Key Balance Sheet Data Deposits 208586 246706 296247 355496 426596 Deposits Growth(%) 24.6 18.3 20.1 20 20 Borrowings 14394 23847 33007 50785 47529 Borrowings Growth(%) 11.4 65.7 38.4 54 -6 Loan 159983 195420 239721 299651 365574 Loan Growth(%) 27.1 22.2 22.7 25 22 Investment 70929 97483 111614 114580 156461 Investment Growth(%) 21.0 37.4 14.5 3 37 Eastwind Calculation Yield on Advances 9.4 10.8 11.2 10.7 11.0 Yield on Investments 6.6 6.7 7.0 8.1 7.0 Yield on Funds 7.7 8.9 9.3 10.1 9.9 Cost of deposits 4.3 5.6 6.0 6.5 6.2 Cost of Borrowings 9.4 9.6 8.9 9.0 9.0 Cost of fund 4.2 5.5 5.8 5.7 6.0 Valuation Book Value 545.5 127.5 154.3 189.4 222.3 P/BV 4.3 4.1 4.1 3.5 3.0 P/E 27.8 23.6 21.8 18.7 17.3

- 10. KPIT Tech. Key Facts from recent Management Interview to media (on 12 th March, 2014) 1M 1yr YTD Absolute -4.7 52.9 - Rel. to Nifty -12 41.9 - Current 2QFY14 1QFY14 Promoters 22.53 22.87 24.25 FII 41.96 36.42 32.79 DII 6.99 11.12 10.93 Others 28.52 29.59 32.03 3QFY14 2QFY14 (QoQ)-% 3QFY13 (YoY)-% 677.93 702.76 (3.5) 567.02 19.6 103.5 108.1 (4.3) 94.1 10.0 66.7 66.7 0.0 48 39.0 15.3% 15.4% (10bps) 16.6% (130bps) 9.8% 9.5% 30bps 8.5% 130bps 10 EBITDA Margin PAT Margin We expect that the company would report better earnings with margin ramp up and signing of larger deals in next couple of quarters. Now, we upgrade our view on the stock from “Neutral” to “Buy” with a price target of Rs 185. At a CMP of Rs 160, stock trades at 9.5x FY15E EPS. Financials Revenue EBITDA PAT SAP revival and Auto Engineering Services shape; a growth driver in near term, Upside BSE Code 532400 Price Performance Rs, Crore Please refer to the Disclaimers at the end of this Report. Incremental revenue by REVOLO and Systime: As per the management comment, its dream project “REVOLO Technology” REVOLO would play a key role to report an incremental growth in FY15E. KPIT’s acquisition Systime from Integrated Enterprise Services (IES) segment would report healthy growth prospects at least over the next couple of years. View and Valuation: Impressive organic growth despite inorganic thrust (acquired 10 companies in the last 10 yrs), Potential option value from success of its hybrid engine venture Revolo (on trial). KPIT has targeted to reach $1bn sales by 2017. Its differentiated positioning and competitive edge in its focus areas, imperatives to the success of smaller- sized IT vendors impress to investors. NSE Symbol KPIT Stock Performance 3103 Average Daily Volume 144511 "On billion dollar journey" CMP 160 Target Price 185 SAP business back to growth trajectory: KPIT’s revenue has been facing growth related issues on account of deficit in SAP business (contributes 24% of sales). Profitability on SAP business was also a challenge for the company. On 3QFY14 revenues from SAP was down by 10% (QoQ). However, on the back of deal signings and visible deal pipeline, SAP should return into growth path in 4QFY14E and FY15E. Considering healthy demand environment in FY15E, We expect that USD revenue growth in SAP could be in double digits. Previous Target Price - Company update Buy 16% Change from Previous - Market Data Expectation of margin improvement: The decline in SAP revenue has impacted the overall margins, and margin was seen almost flat at 15.4% in 2QFY14 and 3QFY14. We expect that profitability from SAP business would support to shape up its margin in next couple of quarters. Even, Utilization rate in SAP has declined to below 90% at onsite and below 70% mark at offshore. This is expected to improve in FY15E. Management expects to see PAT margin at double digit by next couple of quarters. Auto Engineering Services; a growth driver: The global Automotive Industry has witnessed a strong revival. US industry sales in 2013 finished at 15.6 million vehicles, up 7.6% from 2012, and China became the first country in which more than 20-million vehicles were sold in any given year. Considering healthy demand outlook in Auto Industry, KPIT is seeing exports growth above the industry rates, driven by demand for services around safety systems, intelligent driving, hybrid electric cars, fuel efficiency etc. Management expects revenues from Auto Engineering to exceed 30% of the company’s revenues, in the next 3 years, as KPIT expected to achieve the mark of USD1b in revenues. 6517 Mkt Capital (Rs Crores) Share Holding Pattern-% Nifty 52wk Range H/L 189/92 "BUY" 19th Mar' 14 Narnolia Securities Ltd,

- 11. 11 KPIT Tech Operating Metrics Please refer to the Disclaimers at the end of this Report. Financials (Source: Company/Eastwind) Narnolia Securities Ltd, 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 No. of Customers Added 4 3 4 2 5 6 3 3 No. of Active Customers 169 172 176 178 183 189 192 195 Customers with run rate of >$1Mn 59 65 69 72 78 78 78 78 Top Client – Cummins 19.5% 20.6% 19.7% 19.1% 16.6% 16.8% 16.5% 17.9% Top 5 Clients 33.0% 36.3% 35.2% 36.8% 35.2% 38.6% 38.0% 38.2% Top 10 Clients 42.2% 44.0% 43.7% 45.2% 44.0% 47.3% 46.3% 47.6% DSO 90 75 75 70 75 77 75 76 Total Employee 7719 7873 8111 8286 8321 8456 8816 9136 Onsite Utilization 94.5% 94.7% 94.5% 92.8% 94.3% 94.2% 92.4% 88.1% Offshore Utilization 74.3% 74.1% 74.7% 72.9% 74.1% 73.4% 72.9% 71.3% Client Metrics Client Concentration Employee Metrics Rs, Cr FY10 FY11 FY12 FY13 FY14E FY15E Net Sales-USD 153.76 224.07 306.71 410.46 445.78 535.96 Net Sales 731.64 987.05 1500.00 2238.63 2692.54 3215.75 Employee Cost 265.92 529.95 771.78 1140.79 1378.58 1640.03 Other expenses 304.70 308.82 511.97 762.32 902.00 1061.20 Total Expenses 570.62 838.77 1283.75 1903.11 2280.58 2701.23 EBITDA 161.02 148.28 216.25 335.52 411.96 514.52 Depreciation 30.80 41.12 44.49 47.16 54.42 67.93 Other Income 1.20 6.74 13.82 11.74 12.12 24.12 Extra Ordinery Items -26.45 0.00 10.05 -1.30 -21.05 16.08 EBIT 130.22 107.16 171.76 288.36 357.54 446.59 Interest Cost 2.74 3.78 7.32 13.99 24.31 24.56 PBT 128.68 110.12 178.26 286.11 345.35 446.15 Tax 16.91 15.49 43.67 76.55 96.70 122.69 PAT 111.77 94.63 134.59 209.56 248.65 323.46 Sales-USD -11.7% 45.7% 36.9% 33.8% 8.6% 20.2% Sales-INR -7.8% 34.9% 52.0% 49.2% 20.3% 19.4% EBITDA -12.2% -7.9% 45.8% 55.2% 22.8% 24.9% PAT 169.6% -15.3% 42.2% 55.7% 18.7% 30.1% EBITDA 22.0% 15.0% 14.4% 15.0% 15.3% 16.0% EBIT 17.8% 10.9% 11.5% 12.9% 13.3% 13.9% PAT 15.3% 9.6% 9.0% 9.4% 9.2% 10.1% Employee Cost 36.3% 53.7% 51.5% 51.0% 51.2% 51.0% Other Exp 41.6% 31.3% 34.1% 34.1% 33.5% 33.0% Tax rate 13.1% 14.1% 24.5% 26.8% 28.0% 27.5% CMP 115.00 168.05 122.90 99.0 160.0 160.0 No of Share 7.90 8.70 17.80 19.28 19.28 19.28 NW 387.11 603.19 712.55 1036.23 1269.09 1570.00 EPS 14.15 10.88 7.56 10.87 12.90 16.78 BVPS 49.00 69.33 40.03 53.75 65.82 81.43 RoE-% 28.9% 15.7% 18.9% 20.2% 19.6% 20.6% Dividen Payout ratio 6.4% 6.8% 4.9% 7.9% 6.3% 7.0% P/BV 2.35 2.42 3.07 1.84 2.43 1.96 P/E 8.13 15.45 16.25 9.11 12.41 9.54 Valuation Expenses on Sales-% Margin -% Growth-%

- 12. ACC Ltd. 1253 1257 1257 0% 0% 500410 19634 9817 6063 Holcim eyeing Jaypee Group's cement grinding plant in Panipat 1M 1yr YTD Absolute -3.5 -22.3 -21.0 Rel. to Nifty -1.9 -24.4 -22.8 Cureent 3QCY13 2QCY13 Promoters 50.3 50.3 50.3 JP Associates looks to exit JV with SAIL FII 20.0 20.9 19.5 DII 12.9 11.9 11.7 Others 16.8 16.9 18.6 Management Quotes : Financials : Q4CY13 Y-o-Y % Q-o-Q % Q4CY12 Q3CY13 Net Revenue 2792 -12.2 8.6 3180 2570 EBITDA 361 -9.3 26.2 398 286 Depriciation 153 -3.2 6.3 158 144 Interest Cost 12 -55.6 9.1 27 11 Tax -36 -190.0 -170.6 40 51 PAT 278 16.3 129.8 239 121 (In Crs) 12 Please refer to the Disclaimers at the end of this Report. Stock Performance-% Share Holding Pattern-% 1 yr Forward P/B Holcim Cements has expressed interest in the grinding unit which has an annual capacity of 1.5 million tonnes per annum and the talks are at a preliminary stage. Holcim wants to expand its presence in North India through this strategic asset and will take a call if this potential deal can be routed through ACC cements.ACC Cements has a cement plant nearby in Himachal Pradesh and if JP's grinding unit is absorbed, it would be beneficial logistically and even in terms of costs. JP Associates,looking to sell its entire stake in its cement joint ventures with SAIL to cut down its debt.The company is likely to part with its 74% stake in Bhilai and Bokaro cement plants that together have an installed capacity of 4.3 mtpa. As per the story , the company is eying around Rs. 2900 crore from the deal with cement major ACC.The deal with ACC if it happens would imply enterprise value of USD 147 per MT as against USD 127 per MT it got for Gujarat plant sale. 52wk Range H/L 1355/912 CMP Upside Change from Previous Result Update Book Profit Nearly we saw a upward rally in stocks due to the forecasting of a stable government after election by the market players. The sentimental effect on market is on positive side ,hence the low valued stock like ACC took very less time like one month to come to its near fare value, which we had estimated for a medium term target. No doubt the stock's fundamentals are good and also available at a cheaper rate comparing to its early trade . In the previous one month the stock performed well & recover 20-22% from its estimated low of CY2013. We didn't expected this rise to be so fast.The CMP was estimated for a medium term target price looking at its earnings and fundamentals . How ever the target price got achieved few days back. we believe the stock's fundamental is still good and price too cheap also , but for the earning upgradation and revised target price we would like to see the 1st quarter earnings, hence we recommend Book Profit on the stock at a price range between Rs.1253 to Rs.1310. NSE Symbol Target Price Previous Target Price Nifty Market Data BSE Code ACC Source - Comapany/EastWind Research According to Management the economic environment in the country was sluggish, thus impacting the demand for cement and concrete. As a result, the company's cement volumes remained almost flat. The company appears not enthusiastic for demand growth going forward. Based on current demand indications, we do not foresee any significant improvement in the cement. Mkt Capital (Rs Crores) Average Daily Volume (Nos.) "Book Profit" 18th March' 14 Narnolia Securities Ltd,

- 13. Outlook Valuation And Recommendation Company Description : Margin Gap Margin Gap CY11 CY12 CY13 CY14E 10237 11358 11169 13027 191 263 219 219 10428 11621 11389 19723 2199 2384 2384 0 1940 2219 2299 0 8316 9162 9540 10942 1921 2197 1848 2084 510 569 584 639 97 115 52 50 215 391 132 323 1276 1050 1094 1292 17.7 18.8 13.8 15.3 13 ACC Limited (ACC) is engaged in manufacture of cement & ready mixed concrete. The Company has grinding plants in Karnataka and clinkering line in Maharashtra. The Company’s subsidiaries include ACC Mineral Resources Limited, Lucky Minmat Limited, Bulk Cement Corporation (India) Limited, National Limestone Company Private Limited and Encore Cement and Additives Private Limited. The Company is subsidiary of Ambuja Cement India Private Limited. Cement prices witnessed an increase during Oct-Nov,13 but also witnessed a sharp fall during Dec,13 which has contributed towards lower average realizations for the year for the company.Further,with a strong balance sheet with zero debt and better dividend yield of 3%,we continue to remain positive despite near term challenges.We revise our estimates downwards to factor in lower demand growth scenario. At current price of Rs 1253, stock is trading at 2.8x P/B and 2.8x P/B on CY14 estimates.Valuation looks good for this company,but we would like to see the 1st quarter for earning upgrading hence we recommend Book Profit on the stock at a price range between 1253 to 1310. Company has made several capacity expansion plans in the region. ACC is replacing the existing facilities at Jamul, Chhattisgarh with a clinker plant with an annual production capacity of 2.8 MT and local grinding capacity of 1.1 MT of cement, while a new plant with annual capacity of 2.7 MT is scheduled to be built in Kharagpur. The capacity expansion plant will increase the company's total cement production capacity to 35 MT from the existing 30 MT.On a QoQ basis, the EBITDA/tonne improved 10.4% due to an improvement in realisations & comparatively lower increase in total expenditure/tonne, it shows a positive view for the further quarters.onsidering the expansion plans we expect 4% growth in sales volume and 10% growth in realization for CY14. Interest Cost Total Income Depriciation ACC Ltd. P/L PERFORMANCE Net Revenue from Operation Other Income Cement Sales Volume Cement Realization Cement Realization Cement Realization Per Ton Analysis Per Ton Analysis Cement Realization Source - Comapany/EastWind Research Tax PAT ROE% Power and fuel Freight and forwarding Expenditure EBITDA Narnolia Securities Ltd,

- 14. CY10 CY11 CY12 CY13 6281 6979 7372 7813 510 506 85 0 14 0 0 0 188 126 157 89 1581 816 661 642 1466 1051 1227 1081 11041 11921 11928 12101 77 48 39 40 5230 6359 5893 6040 1564 370 314 322 283 461 566 880 926 1113 1134 1122 249 266 303 397 1086 1660 681 506 162 279 325 340 11041 11921 11928 12101 CY10 CY11 CY12 CY13 3.2 3.1 3.6 2.7 57.4 68.7 73.8 57.6 3.0 2.6 2.7 3.6 19.1 8.0 5.8 5.7 19632 20180 26240 20296 18.7 16.5 19.4 19.2 12.7 10.5 11.9 12.5 2.8 2.5 2.1 2.7 14.6 15.2 16.3 12.3 0.1 0.1 0.0 0.0 1.0 1.3 1.4 1.4 Trading At : 14 Source - Comapany/EastWind Research Long-term provisions Cash and bank balances ACC Ltd. Total equity Long-term borrowings Short-term borrowings B/S PERFORMANCE Trade receivables Short-term loans and advances RATIOS Total Assets Short-term provisions Total liabilities Inventories Long-term loans and advances Capital work-in-progress Trade payables EV Creditors to Turnover% P/E EV/EBIDTA P/B EPS Debtor to Turnover% Intangibles Tangible assets Debt/Equity Current Ratio Dividend Yield% ROCE% Narnolia Securities Ltd,

- 15. 1214 1287 1094 6 18 1M 1yr YTD Absolute 23.7 7.4 7.4 Rel.to Nifty 15.3 -2.0 -2.0 Current 4QFY13 3QFY1 3Promoters 66.7 64.1 64.1 FII 11.0 13.2 13.6 DII 15.4 15.3 15.6 Others 6.9 7.4 6.7 Financials Rs, Cr 2011 2012 2013 2014E 2015E NII 10739 10734 13866 17734 21111 Total Income 42252 18237 22212 27035 30413 PPP 10950 10386 13199 16762 18856 Net Profit 6093 6465 8325 10658 11955 EPS 52.9 56.0 72.2 92.3 103.6 15 Change from Previous ICICI Bank Vs Nifty Share Holding Pattern-% 3.58 lakh Nifty Please refer to the Disclaimers at the end of this Report. (Source: Company/Eastwind) Stock Performance 52wk Range H/L Average Daily Volume 140141 Asset quality continued to be concern, impairment asset were higher at QoQ, Management remained cautious on asset quality On asset quality front, bank saw some deterioration as impaired assets (GNPA + Restructure Asset) to loan increased from 5.3% to 5.7% sequentially. According to bank’s management it would remain at elevated level going forward. However bank has lower exposure towards corporate segment where slippage risk is relatively high in current scenario. Total loan in corporate debt restructure was to tune of 30 bn(0.9% of loan). However GNPA showed some strength sequentially and was improved slightly to 3.07% from 3.10% while net NPA stood at 0.94% versus 0.85% due to lower loan loss provision made. But provision coverage ratio remained at 70% level, so nothing to worry about. Target Price In our earlier note dated 31st Jan.2014 in which we have given the price target of Rs.1094 lower side of valuation band. Now the stock reached to the level of Rs.1214 but still below of our upper side of valuation band. We value bank in the range of Rs. 836 to Rs.1287 depending upon the fundamental and return ratios. Since our result updated report, the stock has given the return of 24%, now we advice our investor to hold the stock as bank has potential to reached at upper side of valuation band. CMP Previous Target Price Mkt Capital (Rs Cr) Strong operating performance led by healthy balance sheet growth ICICI Bank reported revenue growth of 23.5% YoY led by strong operating performance and healthy non interest income. Strong growth in NII was led by margin expansion on year on year basis which further led by strong growth in loan and higher deposits base. Bank’s loan grew by 16% YoY supported by retail and oversea loan while deposits grew by 11%. Credit deposits for the quarter was 102% largely liquidity came from borrowing fund but strong base of CASA kept cost of fund under control. Operating cost increased by 15.7% YoY but CI ratio remained under control. Operating leverage increased sequentially due to higher expansion towards branch expansion. Overall it remained in the range of 0.40% to 0.45%. ICICI BANK Market Data Upside 758 BSE Code 532174 NSE Symbol ICICIBANK Company Update HOLD "HOLD" 18th March 2014 Narnolia Securities Ltd,

- 16. 16 ICICI BANK Please refer to the Disclaimers at the end of this Report. Margin expansion led by stable NIM and healthy loan growth ICICI bank NIM was stable at 3.32% sequentially led by stable NIM and retail loan. Bank’s CASA was strong at 43%+ on which current account growth of 13.2% and saving account growth of 17.5% ahead of private sector banks. Overall CASA reported 16% YoY growth and in percentage to total deposits, it stood at 42.9% at the end of 3QFY14. Bank’s loan grew by 16% YoY led by retail loan which grew by 22% YoY and share in retail loan increased from 35% to 37% at the end of December quarter. Loan growth from oversea branches was also supportive, registered growth of 24% YoY. Share of oversea loan composition was 28% at the end of quarter, an increase of 200 bps YoY. Growth of CASA trend Narnolia Securities Ltd,

- 17. 17 ICICI BANK Please refer to the Disclaimers at the end of this Report. ICICI Bank NIM remain healthy Healthy loan growth led by retail and oversea loan growth Non Interest Income ICICI Bank’s total income grew by 23.5% YoY was due to non interest income growth of 26.5% YoY in fee income registered growth of 12.8% YoY. Dividend and other income growth was higher at 85% owing to higher dividend income from life insurance subsidiary whereas treasury income grew by 78% YoY. Overall healthy growth in non interest income was due to bank saw reversal of M2M provisions on bond and equity portfolio. Composition of non interest income to total revenue Source: Company/Eastwind NIM was stable at sequnetial basis led by strong loan growth and CASA base Narnolia Securities Ltd, Loan Composition (Rs Cr) 3QFY13 2QFY14 3QFY14 YoY Gr. QoQ Gr. Domestic Corporate 98074 103598 104779 6.8 1.1 Retails Business 100081 115039 122076 22.0 6.1 Overseas Branches 73699 84531 91474 24.1 8.2 SME 14912 14618 14303 -4.1 -2.2 % of loan Domestic Corporate 34.2 32.6 31.5 Retails Business 34.9 36.2 36.7 Overseas Branches 25.7 26.6 27.5 SME 5.2 4.6 4.3 Non Interest Income 3QFY13 2QFY14 3QFY14 YoY Gr. QoQ Gr. Core fee income 17.71 19.94 19.97 12.8 0.2 Dividend & Other Income 1.93 2.51 3.57 85.0 42.2 Treasury Income 2.51 -0.79 4.47 78.1 - Rs.Cr 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 NII 1991 2204 2312 2510 2411 2506 2712 3105 3193 3371 3499 3803 3820 4044 4256 OtherIncome 1681 1578 1749 1641 1643 1740 1892 2228 1880 2043 2215 2208 2484 2166 2801 TotalIncome 3672 3782 4061 4150 4054 4246 4604 5333 5073 5414 5714 6011 6305 6210 7057 %ofOtherIncometoNII 84.4 71.6 75.6 65.4 68.1 69.4 69.8 71.8 58.9 60.6 63.3 58.1 65.0 53.6 65.8

- 18. 18 Please refer to the Disclaimers at the end of this Report. ICICI BANK Operating Expenses and Employee Cost Source: Company/Eastwind Total expenses increased by 15.7% YoY in which employee cost and other operating cost were increased by 6% and 23% YoY respectively. Cost to income ratio was remained flat at 37.1% sequentially while operating leverage (operating cost to total asset) increased slightly from 0.41% to 0.46% but remained under control. This was due to branch expansion. Asset quality remain under pressure Bank reported deterioration in asset quality (GNPA) in sequential basis by 3.7% in absoluter term. In percentage to gross advance, GNPA stood at 3.07% versus 3.1% in previous quarter (marginally improved). Sequentailly cost to income ratio remained satble. Management guided CI ratio would be below of 40% in FY14. Operating leverage remain ed stable but sequentially up led by higher operating expansion largely due to branch expansion cost Operating leverage increased sequentially but remained under control. The rise of operating leverage was due to increased expansion towards branch expansion. Narnolia Securities Ltd,

- 19. 19 ICICI BANK Source: Company/Eastwind Please refer to the Disclaimers at the end of this Report. Provisions were declined by 0.6% QoQ taking net NPA increased by 15.3% QoQ. In percentage to net advance, this ratio stood at 0.94% versus 0.85% in previous quarter. Lower provisions made PCR to 70.1% versus 73.1% in previous quarter. Bank’s impair asset (GNPA+ Restructure asset) were 5.7% of advance at the end of quarter from 5.3% in previous quarter and 5% in last quarter. Bank management guided asset quality stress would remain at elevated level. According to the company, corporate debt restructure pipeline presently is Rs.30 bn which is 0.9% of loan. Asset quality remained concern. Management expects it to remained elevated level going forward. Outstanding CDR at 0.9% of loan Valuation & View At the current price of Rs.1214, bank is trading at 1.8 times of FY14E book value. We value bank in the range of Rs.836 to Rs.1287 depending upon fundamental and return ratio. Our base case assumption was deposits growth of 12%, loan growth of 17% in FY14 and margin at current level. Improvement and deterioration from base and bull case would driven the price movement in either side. We advance our clients to hold the stock as bank has potential to reach upper side of value band. Valuation Band 1 Yr forward P/BV 1 Yr forward P/E Narnolia Securities Ltd,

- 20. 20 ICICI BANK Financials & Assuption Source: Company/Eastwind Please refer to the Disclaimers at the end of this Report. Narnolia Securities Ltd, Quarterly Result 2011 2012 2013 2014E 2015E Interest/discount on advances / bills 19098 22130 27341 31646 34992 Income on investments 9181 9684 11009 11785 13220 Interest on balances with Reserve Bank of India 469 491 543 184 184 Others 1334 1238 1182 946 946 Total Interest Income 30081 33543 40076 44561 49342 Others Income 31513 7503 8346 9302 9302 Total Income 61595 41045 48421 53863 58644 Interest on deposits 11315 14304 16889 18217 20402 Interest on RBI/Inter bank borrowings 1683 1469 2087 0 0 Others 6345 7035 7234 10146 11364 Interest Expended 19343 22808 26209 27812 28840 NII 10739 10734 13866 16749 20502 Other Income 31513 7503 8346 9302 9302 Total Income 42252 18237 22212 26051 29804 Employee 4393 3515 3893 4451 5096 Other Expenses 26910 4335 5120 5441 6229 Operating Expenses 31302 7850 9013 9892 11325 PPP( Rs Cr) 10950 10386 13199 16159 18478 Provisions 4631 1583 1803 2592 2853 PBT 0 8803 11397 13567 15626 Tax 0 2338 3071 4071 4688 Net Profit 6093 6465 8325 9496 10938 Balance Sheet DEPOSITS 259106 255500 292,614 321,875 360,500 Deposits Growth 7.3 -1.4 14.5 10.0 12.0 Borrowings 125839 140165 145,341 158,535 177,560 Borrowings Growth(%) 8.8 11.4 3.7 9.1 12.0 Investment 209653 159560 171,394 187,360 209,843 Growth(%) 12.5 -23.9 7.4 9.3 12.0 Advances 256019 253728 290,249 339,592 380,343 Growth(%) 13.4 -0.9 14.4 17.0 12.0 Eastwind Calculation Yield on Advances 7.5 8.7 9.4 9.3 9.2 Yield on Investments 4.7 6.4 6.7 6.3 6.3 Cost of deposits 4.4 5.6 5.8 5.7 8.0 Cost of Borrowings 6.4 6.1 6.4 6.4 6.4 Cost of fund 5.0 5.8 6.0 0.0 5.9 Valuation Book Value 480 524 578 643 682 P/BV 2.3 1.7 1.5 1.6 1.5 P/E 5.5 7.3 9.4 9.2 10.6

- 21. AXIS BANK 1385 1340 1220 -3 10 1M 1yr YTD Absolute 25.2 -1.9 -1.9 Rel.to Nifty 17.9 -11.1 -11.1 Promoters 33.9 33.9 33.9 FII 43.2 43.4 40.7 DII 9.7 4.9 8.8 Others 13.2 17.8 16.6 Financials Rs, Cr 2011 2012 2013 2014E 2015E NII 6566 8026 9666 12224 14775 Total Income 11238 13513 16217 19146 21697 PPP 6377 7413 9303 11206 12367 Net Profit 3340 4224 5179 5826 6934 EPS 81.4 102.2 110.7 124.2 148.2 21 (Source: Company/Eastwind) Stock Performance Average Daily Volume Target Price Previous Target Price Upside Nifty 6493 Mkt Capital (Rs Cr) Change from Previous Axis Bank Vs Nifty Share Holding Pattern-% 26.18 cr 532215 NSE Symbol Axis bank’s low cost deposits CASA has grown faster than peers like ICICI bank and is stable at 43% at the end of 3QFY14. Bank’s management expects it to reach at 46% in FY15E which would help to keep cost of deposits under control and hence margin expansion. In loan growth parameter, Axis bank expects loan growth higher than industry growth by 2%. Incremental loan growth would come from SME and retail sector while corporate loan book is expected to remain sluggish. Bank’s capital adequacy ratio is close to 17% in which tier -1 capital of 12.5% much healthier than peers indicating no need to raise money for long tenure in near term. ROA at pre provisioning profit is at 3% indicating strong capability to delivered profit once asset quality issue resolve. Stress loan (GNPA+ Restructure asset) is remained at 3.7% of advances but it might go up as bank has significant exposure in power (5.54%) and Infrastructure (7.33%) where slippage risk is relatively high in present economy scenario. Provision coverage ratio reported by bank is 78% with technical write off which would provides some cushion on earnings. Axis bank still have 46% of loan exposure in large corporate where profitability uncertain due to ongoing recession. Therefore on asset quality front, bank would still have to face tough time as per our view. We believe market sentiment in recent days are boosted up on the hope that BJP led NDA would come to power after the general election and revive economy. The domestic equity market is supported by opinion poll result which suggests BJP led NDA coming to power after the forthcoming election. Over the last few months, the estimated numbers of seat, the NDA may win has increased from 165-175 to 220- 230 seats. The prime ministerial candidate of NPA Narendra Modi is known for his development in Gujarat. Domestic as well as foreign investors are in hope that Indian economy would come at track and business opportunity would start again. Banking stocks are rallied more than other sectors in hoping of reducing fresh NPA creation. 64823 Domestic equity market boost-up by economy revival sentiment Key positive trigger Key negative trigger Company Updated BOOK PART PROFIT CMP In last one month, Axis Bank has outperformed Bank Nifty and CNX Nifty by 6% and 18% respectively and is now trading at more than 1.7 times of FY14E book value which is above of our upper side of valuation band. We value bank in the range of 1.5 to 1.7 times of book lower than its peers group largely due to some exposure in stress sector specially in infra and power companies where slippage risk are relatively high. We value bank in the range of Rs.1220 to Rs.1340 per share that implying book value multiple of 1.5 to 1.7 based on current fundamental and return ratios. The rise of stock price is supported by opinion poll result which suggests BJP led NDA would come in power. NDA prime ministry candidate Narendra Modi is perceived by foreign investor as a decisive and development making leader and would rescue economy.AXISBANK Market Data BSE Code "BOOK PART PROFIT " 14th March, 2014 Narnolia Securities Ltd,

- 22. 22 Quarterly Result AXIS BANK Source: Eastwind/Company Please refer to the Disclaimers at the end of this Report. Narnolia Securities Ltd, QuarterlyResult 3QFY14 2QFY14 3QFY13 %YoYGr %QoQGr 3QFY14E Variation Interest/discountonadvances/bills 5557 5394 4907 13.3 3.0 5748 3.4 Incomeoninvestments 2110 2143 2014 4.8 -1.5 2235 5.9 InterestonbalanceswithReserveBankofIndia 49 35 25 97.7 39.4 35 -29.2 Others 73 37 19 277.1 95.6 38 -47.4 TotalInterestIncome 7789 7609 6965 11.8 2.4 8056 3.4 OthersIncome 1644 1766 1615 1.8 -6.9 1774 7.9 TotalIncome 4628 4703 4110 12.6 -1.6 4780 3.3 InterestExpended 4805 4672 4470 7.5 2.8 5049 5.1 NII 2984 2937 2495 19.6 1.6 3006 0.8 OtherIncome 1644 1766 1615 1.8 -6.9 1774 7.9 TotalIncome 4628 4703 4110 12.6 -1.6 4780 3.3 Employee 655 644 615 6.5 1.7 0 OtherExpenses 1358 1309 1134 19.8 3.8 0 OperatingExpenses 2013 1953 1749 15.1 3.1 2008 -0.3 PPP(RsCr) 2615 2750 2362 10.7 -4.9 2772 6.0 Provisions 202 687 387 -47.7 -70.5 752 271.4 PBT 2413 2062 1975 22.2 17.0 2020 -16.3 Tax 808 700 628 28.8 15.5 687 -15.0 NetProfit 1604 1362 1347 19.1 17.7 1333 -16.9 BalanceSheetDate NetWorth 37649 36224 27027 39.3 3.9 37558 -0.2 Deposits 262398 255365 244501 7.3 2.8 272935 4.0 Loan 211467 201303 179504 17.8 5.0 214892 1.6 Assetqualtiy(RsCr) GNPA 3008 2734 2275 32.2 10.0 - NPA 1003 838 679 47.8 19.7 - %GNPA 1.4 1.4 1.3 - %NPA 0.5 0.4 0.4 -

- 23. 23 AXIS BANK FINANCIALS & ASSUPTION Source: Eastwind/Company Please refer to the Disclaimers at the end of this Report. Narnolia Securities Ltd, Income Statement 2011 2012 2013 2014E 2015E Interest Income 15155 21995 27183 31198 38490 Interest Expense 8589 13969 17516 18974 23716 NII 6566 8026 9666 12224 14775 Change (%) 31.2 22.2 20.4 26.5 20.9 Non Interest Income 4671 5487 6551 6922 6922 Total Income 11238 13513 16217 19146 21697 Change (%) 25.3 20.2 20.0 18.1 13.3 Operating Expenses 4860 6100 6914 7940 9330 Pre Provision Profits 6377 7413 9303 11206 12367 Change (%) 22.4 16.2 25.5 20.5 10.4 Provisions 3033 3189 4124 2402 2461 PBT 3345 4224 5179 8804 9906 PAT 3340 4224 5179 5826 6934 Change (%) 34.8 26.5 22.6 12.5 19.0 Balance Sheet Deposits( Rs Cr) 189166 219988 252614 290506 334081 Change (%) 34 16 15 15 15 of which CASA Dep 77758 91412 112100 124917 143655 Change (%) 18 18 23 11 15 Borrowings( Rs Cr) 26268 34072 43951 51266 58956 Investments( Rs Cr) 71788 92921 113738 129873 149354 Loans( Rs Cr) 142408 169760 196966 228481 265037 Change (%) 36 19 16 16 16 Valuation Book Value 460 549 708 813 942 CMP 1404 1146 1304 1174 1174 P/BV 3.1 2.1 1.8 1.4 1.2

- 24. Narnolia Securities Ltd 402, 4th floor 7/ 1, Lords Sinha Road Kolkata 700071, Ph 033-32011233 Toll Free no : 1-800-345-4000 email: research@narnolia.com, website : www.narnolia.com Risk Disclosure & Disclaimer: This report/message is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Narnolia Securities Ltd. (Hereinafter referred as NSL) is not soliciting any action based upon it. This report/message is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any from. The report/message is based upon publicly available information, findings of our research wing “East wind” & information that we consider reliable, but we do not represent that it is accurate or complete and we do not provide any express or implied warranty of any kind, and also these are subject to change without notice. The recipients of this report should rely on their own investigations, should use their own judgment for taking any investment decisions keeping in mind that past performance is not necessarily a guide to future performance & that the the value of any investment or income are subject to market and other risks. Further it will be safe to assume that NSL and /or its Group or associate Companies, their Directors, affiliates and/or employees may have interests/ positions, financial or otherwise, individually or otherwise in the recommended/mentioned securities/mutual funds/ model funds and other investment products which may be added or disposed including & other mentioned in this report/message.