Canada MTDC Market Assessment Supply and Providers

•

1 gefällt mir•229 views

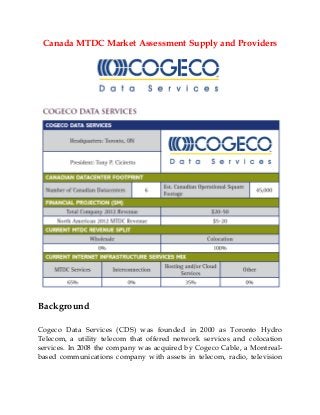

Cogeco Data Services (CDS) was founded in 2000 as Toronto Hydro Telecom, a utility telecom that offered network services and colocation services. In 2008 the company was acquired by Cogeco Cable, a Montreal-based communications company with assets in telecom, radio, television and media. CDS’s presence stretches from the eastern reaches of Quebec to Windsor, Ontario.

Melden

Teilen

Melden

Teilen

Downloaden Sie, um offline zu lesen

Empfohlen

Empfohlen

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investorsFalcon Invoice Discounting

Weitere ähnliche Inhalte

Kürzlich hochgeladen

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investorsFalcon Invoice Discounting

Kürzlich hochgeladen (20)

Pre Engineered Building Manufacturers Hyderabad.pptx

Pre Engineered Building Manufacturers Hyderabad.pptx

Falcon Invoice Discounting: Aviate Your Cash Flow Challenges

Falcon Invoice Discounting: Aviate Your Cash Flow Challenges

Power point presentation on enterprise performance management

Power point presentation on enterprise performance management

Mifepristone Available in Muscat +918761049707^^ €€ Buy Abortion Pills in Oman

Mifepristone Available in Muscat +918761049707^^ €€ Buy Abortion Pills in Oman

Falcon's Invoice Discounting: Your Path to Prosperity

Falcon's Invoice Discounting: Your Path to Prosperity

Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: Empowering Your Business Growth

Falcon Invoice Discounting: Empowering Your Business Growth

The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait![The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait

Horngren’s Cost Accounting A Managerial Emphasis, Canadian 9th edition soluti...

Horngren’s Cost Accounting A Managerial Emphasis, Canadian 9th edition soluti...

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Lundin Gold - Q1 2024 Conference Call Presentation (Revised)

Lundin Gold - Q1 2024 Conference Call Presentation (Revised)

Falcon Invoice Discounting: Unlock Your Business Potential

Falcon Invoice Discounting: Unlock Your Business Potential

Lucknow Housewife Escorts by Sexy Bhabhi Service 8250092165

Lucknow Housewife Escorts by Sexy Bhabhi Service 8250092165

Empfohlen

Empfohlen (20)

Product Design Trends in 2024 | Teenage Engineerings

Product Design Trends in 2024 | Teenage Engineerings

How Race, Age and Gender Shape Attitudes Towards Mental Health

How Race, Age and Gender Shape Attitudes Towards Mental Health

AI Trends in Creative Operations 2024 by Artwork Flow.pdf

AI Trends in Creative Operations 2024 by Artwork Flow.pdf

Content Methodology: A Best Practices Report (Webinar)

Content Methodology: A Best Practices Report (Webinar)

How to Prepare For a Successful Job Search for 2024

How to Prepare For a Successful Job Search for 2024

Social Media Marketing Trends 2024 // The Global Indie Insights

Social Media Marketing Trends 2024 // The Global Indie Insights

Trends In Paid Search: Navigating The Digital Landscape In 2024

Trends In Paid Search: Navigating The Digital Landscape In 2024

5 Public speaking tips from TED - Visualized summary

5 Public speaking tips from TED - Visualized summary

Google's Just Not That Into You: Understanding Core Updates & Search Intent

Google's Just Not That Into You: Understanding Core Updates & Search Intent

The six step guide to practical project management

The six step guide to practical project management

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

Unlocking the Power of ChatGPT and AI in Testing - A Real-World Look, present...

Unlocking the Power of ChatGPT and AI in Testing - A Real-World Look, present...

Canada MTDC Market Assessment Supply and Providers

- 1. Canada MTDC Market Assessment Supply and Providers Background Cogeco Data Services (CDS) was founded in 2000 as Toronto Hydro Telecom, a utility telecom that offered network services and colocation services. In 2008 the company was acquired by Cogeco Cable, a Montreal- based communications company with assets in telecom, radio, television

- 2. and media. CDS’s presence stretches from the eastern reaches of Quebec to Windsor, Ontario. Currently the company has three datacenter facilities in Toronto and, as a result of its acquisition of Quiettouch, a small facility in Vancouver (primarily used as a backup facility). CDS’s downtown Toronto facility, which is primarily devoted to the delivery of managed services, offers 13,500 square feet of usable floor space and is segmented into two suites. The two other sites are located west of the central business district and provide colocation in conjunction with managed services. The company’s original datacenter space provides 5,000 square feet of operational floor space and is filled to capacity. The second, built in 2007, which is south of the first, offers 20,000 square feet of operational floor space and employs advanced backup power systems (bi-fuel and diesel generators) and interstitial flooring. CDS is building a datacenter in Barrie, a suburb north of Toronto, which at total buildout will accommodate 100,000 square feet of net usable datacenter capacity. The first phase, which will provide between 5,000 and 10,000 operational square feet, is scheduled to open sometime in Q2 2013. Following the construction in Barrie, the company has plans to open facilities in Oakville and Montreal – we can expect more details surrounding these two facilities later. All CDS datacenters are designed to CSAE 3416 standards, and built with high power density per square foot. CDS continues to build upon the advances in cooling techniques, airflow and design that the company will also use in its other facilities. We believe that with such high-quality equipment and practices, CDS will experience healthy traction as it develops further as a player in the Toronto managed IT, cloud and datacenter markets. CDS comes up against pure-play colocation providers, but leverages its own network and managed services to try to differentiate itself. The company also competes with the large Canadian telecom incumbents but feels that its ability to be flexible (to offer colo¬cation, managed IT services and IaaS) and the fact that it has a proprietary network are advantages. The

- 3. company also says it runs up against large system integrators from time to time. CDS’s customer base is marked by medium to large enterprises that have between 250 and 10,000 employees. About 60% of its customers are based in the Greater Toronto Area (GTA) and the remainder is based in Greater Montreal Area (GMA) and US. The company sees uptake from the following industry verticals: financial services, health care (including major hospitals), education, media and broadcasting, and technology. The company’s downtown Toronto customers tend to deploy their mission- critical or latency-sensitive applications in the downtown facility, so they can quickly tend to their servers if necessary and deploy their disaster- recovery workload in the other CDS datacenters. This is sometimes flipped, considering Toronto is experiencing commercial sprawl outside the central business district. CDS cites that the Toronto market has a relatively sophisticated customer base and has observed that nearly all customers looking to outsource their workloads for the first time already leverage virtualization or a third-party IaaS approach to some capacity. Cogeco Cable views CDS as an opportunity for growth in the business services market and supports the subsidiary’s push to advance its service offering in the managed IT, datacenter and cloud services space. We have also gotten a sense that the company is interested in a service-intensive business that drives higher revenue per square foot. MTDC Services CDS offers colocation, managed IT and cloud services. Most incoming business is interested in managed datacenter services and a healthy percentage leverages a hybrid colocation/private cloud product. FIGURE 37: Cogeco Data Services – Canadian MTDC Footprint

- 4. FIGURE 38: Cogeco Data Services – Canadian MTDC Pipeline Expansion Strategy CDS constructed its first datacenter in 2001, which offered basic colocation services. In 2007, CDS built a second facility to complement its existing space and moved into the managed services space. Subsequently, the company added to its network and data¬center assets through the acquisitions of Quiettouch (a Toronto-based managed IT services provider) and MTO Telecom (a Montreal-based carrier). The Quiettouch acqui¬sition greatly augmented CDS’s cloud assets, marking its entry in the managed IT and cloud services market. By Q1 2013 CDS will have six active facilities that will offer 100,000 square feet of operational datacenter capacity.

- 5. CDS has three projects in the pipeline – the first to go live is a facility in the Toronto suburb of Barrie. The company also intends to build in Oakville, another suburb of Toronto in addition to the 100,000-gross-square-foot datacenter in Montreal. Our Assessment Although CDS’s usable datacenter footprint is modest for the time being, we expect the company will soon be a force to be reckoned with, considering its pipeline proj¬ects for Barrie, Oakville and Montreal. CDS’s current infrastructural standard is praise¬worthy and its new capacity will definitely contend with the highest-quality Canadian providers. We also commend Cogeco Cable for allowing CDS to operate relatively independently, so it may hastily react to the fluctuating dynamics of an evolving market. CDS ought to re-brand, as Primus Business Services has, to further convey that it is a nimble business in an emergent industry, and not a bureaucratic telecom. In addition, disconnecting CDS from Cogeco could facilitate interesting spin-off opportunities in the future. Even though few details regarding CDS’s Montreal project have been disclosed, the industry has reacted positively to its expected entrance into the capacity-constrained market. The Montreal customer base is highly localized and prefers to patronize local business; the fact that CDS’s parent company, Cogeco Cable, is headquartered in Montreal, will likely assist its go to market strategy. The Montreal customer base has been demanding a viable alternative and we believe CDS will experience rapid uptake. ABOUT 451 RESEARCH 451 Research, a division of The 451 Group, is a leading global analyst and Data Company focused on the business of enterprise IT innovation. Clients of the company — at end-user, service-provider, and vendor and investor organizations— rely on 451 Research’s insight through a range of

- 6. syndicated research and advisory services to support both strategic and tactical decision-making. © 2012 451 Research, LLC and/or its Affiliates. All Rights Reserved. Reproduction and distribution of this publication, in whole or in part, in any form without prior written permission is forbidden. The terms of use regarding distribution, both internally and externally, shall be governed by the terms laid out in your Service Agreement with 451 Research and/or its Affiliates. The information contained herein has been obtained from sources believed to be reliable. 451 Research disclaims all warranties as to the accuracy, completeness or adequacy of such information. Although 451 Research may discuss legal issues related to the information technology business, 451 Research does not provide legal advice or services and their research should not be construed or used as such. 451 Research shall have no liability for errors, omissions or inadequacies in the information contained herein or for interpretations thereof. The reader assumes sole responsibility for the selection of these materials to achieve its intended results. The opinions expressed herein are subject to change without notice.