Frauds and Scams in India

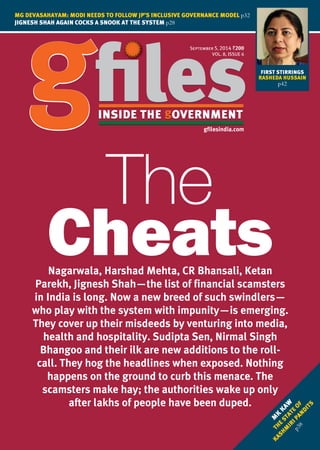

- 1. September 5, 2014 ` VOL. 8, ISSUE 6 gfilesindia.com MG DEVASAHAYAM: MODI NEEDS TO FOLLOW JP’S INCLUSIVE GOVERNANCE MODEL p32 JIGNESH SHAH AGAIN COCKS A SNOOK AT THE SYSTEM p28 M K KAW THE STATE OF KASHM IRIPANDITS p38 Nagarwala, Harshad Mehta, CR Bhansali, Ketan Parekh, Jignesh Shah—the list of financial scamsters in India is long. Now a new breed of such swindlers— who play with the system with impunity—is emerging. They cover up their misdeeds by venturing into media, health and hospitality. Sudipta Sen, Nirmal Singh Bhangoo and their ilk are new additions to the roll- call. They hog the headlines when exposed. Nothing happens on the ground to curb this menace. The scamsters make hay; the authorities wake up only after lakhs of people have been duped. FIRST STIRRINGS RASHEDA HUSSAIN p42

- 2. COVER STORY scam chit funds www.gfilesindia.com10 gfiles inside the government vol. 8, issue 6 | September 2014 Cheat funds Financial scams and scandals rock the country on a regular basis. Promising quick money to gullible small investors, these scamsters make a killing and then vanish into thin air. And what does the system do—it is caught napping each and every time. Still, no efforts are made to plug the loopholes and strengthen prevention efforts. Neeraj Mahajan reports

- 3. 11www.indianbuzz.com gfiles inside the government vol. 8, issue 6 | September 2014 S UNANDA, the wife of a peon in an advertising agency, secretly invested Rs 1,000 every month in a ‘chit fund’ which promised to pay her double the amount after one year with interest. She deposited the money for 10 months in lieu of a plain paper receipt, before the bubble burst. She found a double lock on the door of the chit fund office. She was one of the many investors whose dreams were shattered by unscrupulous and dubi- ous operators in the financial market. Two chit fund companies— SunmargWelfareSocietyandAmazon Capital— were rapped by the Reserve Bank of India (RBI) for misusing its name while soliciting depos- its from the public. Kolkata-based MPS Greenery Developers Ltd col- lected `1,520 crore from investors without any valid registration. MPS not only flouted the guidelines laid down in 2009 but also ignored the specific prohibition by the Securities and Exchange Board of India (SEBI) not to raise money in any new or existing schemes. Tarun Trikha, the promoter of TVI Express (Travel Ventures International) was arrested at Delhi’s IGIAirportwhiletryingtofleetoNepal after allegedly robbing more than one lakh people in India and some 70 lakh people across the globe, promising them attractive holiday packages and incentives like luxury cars and jets. None of those who joined his online venture ever got their money back. In 2010, when Mercedes launched its SUV in India, the first person to buy it was Anukul Maiti, chairman and managing director of iCore group. His prized possessions included a Mercedes GL 350 CDI, a BMW 7 series sedan, a Toyota Land Cruiser Prado, a Tata Safari, a Maruti Swift and a Tata Indigo. Starting off as a manufacturer of FMCG products like paints, toothpastes and tooth- brushes, he branched off into finan- cial markets. His group companies included iCore E Services, iCore Gems & Jewellery, Durgapur Cement, Riju Cement, iCore Planet, iCore Iron and Steel, iCore Paints, iCore Housing Finance Corporation, iCore Apparel, Mega Mould India and iCore Super Cement. The flamboyant Maiti also leveragedhisfriendshipswithfilmand sports personalities like Jaya Prada, Mahima Chaudhry, Karisma Kapoor, Bhaichung Bhutia and Harbhajan Singh for endorsment of his brands. A former vice-president of Mohun Bagan, Maiti is being investigated by the Serious Fraud Investigation Office (SFIO) for allegedly duping investors with money-pooling schemes. Maiti has reportedly gone underground. Chand Mohammed, a Trinamool Congress MLA, and his personal assistant were accused of threatening depositors who wanted their money back after their chit fund company, Peace Valley Agro- projects and Industries Limited, failed. But the local police refused to register complaints against the MLA and others associated with the fraudulent company. Unscrupulous and fraudulent companies are known to cheat investors and raise money through various floating ponzi schemes prohibited under the Prize Chits and Money Circulation Schemes (Banning) Act, 1978. The investment plans include daily deposit, monthly instalments and lump-sum invest- ment.Afterraisingthemoneythrough public offers like illegally collecting deposits in violation of the Companies Act, floating sham collective invest- ment schemes (CIS) in violation of the SEBI Act; and collecting money from the public by posing as Non-Banking Financial Companies (NBFCs) in vio- lation of the RBI Act, many of these companies “vanish”. Most of these unregistered NBFCs and Section 25 companies claim to be registered with the RBI and offer high returns ranging from 25 per cent to 30 per cent on deposits—well above the RBI’s upper limit. The smooth operators managing these companies manage to camouflage their activi- ties by operating in the twilight zone between equities and listed debt to escape financial sector regulatory controls. Many of the companies operating chit fund businesses are not chit fund companies in the eyes of the law and are simply misusing public money. Most of them, like Saradha, were formed under the Companies Act, 1956, and registered with the Ministry of Corporate Affairs. They are thus violating the provisions of the Companies Act. Kirit Somaiya, a BJP MP, informed the Lok Sabha during Zero Hour that unregulated chit fund compa- nies in Maharashtra have allegedly duped around 10 lakh small inves- tors of `10,000 crore. A number of such small investors spread across Maharashtra committed suicide after being taken in by these fly-by-night chit fund companies. Many chit fund companies operating in West Bengal, Odisha, Bihar and Assam are not even registered as chit funds—their activi- ties are more in the nature of multi- Many of the companies operating chit fund businesses are not chit fund companies in the eyes of the law and are simply misusing public money. Most of them are violating the Companies Act, 1956.

- 4. COVER STORY scam chit funds www.gfilesindia.com12 gfiles inside the government vol. 8, issue 6 | September 2014 level marketing, collective invest- ments or other money-circulation schemes which are broadly known as ‘ponzi’ schemes. T HE Ministry of Corporate Affairs released a list of 89 chit fund companies, including the Kolkata-based Rose Valley Group, Saradha Group, Prayag Group, Seashore and Artha Tatwa Group, against whom several complaints had been received. Many of these com- panies, including Rose Valley Real Estate & Construction, MPS Greenery Developers, Osian’s Connoisseurs of Art Pvt Ltd and Saradha Realty, have had strictures passed against them. Faced with intense regulatory pressure, several Multi-State Credit Cooperative Societies (MSCCSs), including Artha Tatwa, Rajiv Gandhi Memorial, Utkal, SBL, Sai Kishore and Mideast, put a lock on their offic- es and were not traceable. Subsequent threatsbytheRegistrarofCooperative Societies (RCS) of Odisha to liquidate these societies and cancel their reg- istrations also proved futile as these MSCCSs continued to receive depos- its from the public. More than 500 such entities are at present under the regulatory scanner. Many more of them are running illegal schemes in different parts of the country. Those running these schemes typically I T is no joke how the cash-rich and well-connected chit fund operators make a mockery of the law and manage to browbeat regulators. With a staff strength of just 16, the SEBI's regional office in Kolkata hardly has the strength to stand up against big money and political connections. Also, there is lack of clarity about roles of different agencies like MCA, SEBI, RBI, State governments and registered co-operative societies. The result is that individuals and companies take advantage of the loopholes in legal provisions to raise money from gullible investors. Some of the exemptions provided under Section 11 (AA) of the SEBI Act, 1992, leave scope for people to take a stand that their scheme is not a collective investment scheme (CIS) and that they have got relevant licences/approvals from the competent authorities. Despite a clear definition that no entity is allowed to run a CIS scheme without obtain- ing the Certificate of Registration from SEBI, out of 552 pros- ecutions launched, SEBI managed to get judgments in only 156—28 per cent—cases till March 31, 2011. These include 85 convictions, 36 cases where the accused was declared proclaimed offender, 21 cases in which accused was dis- charged, seven compounded (fully), five compounded (partly) and two withdrawn by SEBI. The remaining 396— almost 72 per cent—cases are pending in various courts. The solution lies in either bringing everything under one principal regulator or completely removing or pruning the exemptions under Section 11 (AA). Till that happens, it is going to be an unequal battle all the way—a battle being fought with hands tied behind the back. Round #1, SEBI vs Saradha Group: An interesting cat and mouse game went on between SEBI and the Saradha Group. Since the day it started, Saradha Group’s two-pronged strat- egy was to stay ahead of the regulators and focus on keep- ing the local commission agents happy by offering them attractive gifts and 25–40 per cent commission on deposits. In hindsight, the Group’s biggest mistake was to try and bypass the legal requirements under the Indian Companies Act, 1956, which categorically states that a company cannot raise capital from more than 50 people without the permis- sion of SEBI. This formed the backdrop for the Group’s first encounter with SEBI in 2009. The Group tried to checkmate SEBI by opening 200 new companies to create a complex multi-layered corporate structure. SEBI was not impressed and pursued the investigations in 2010. The Saradha Group then decided to change its modus operandi and branch off into CIS—tour packages, forward travel, hotel bookings, timeshare, real estate and infrastructure finance—in West Bengal, Jharkhand, Assam and Chhattisgarh. The investors were told that they would get high returns after a fixed peri- od and the funds collected were fraudulently diverted into chit funds to keep them away from SEBI scrutiny. When SEBI CAT AND MOUSE GAMES SEBI PLAYED promise huge returns to investors and tend to run away after amassing large amounts of money. Investors have lost `236 crore in ponzi schemes and fraudulent chit fund companies that downed their shutters overnight in Andhra Pradesh

- 5. 13www.indianbuzz.com gfiles inside the government vol. 8, issue 6 | September 2014 triedtowarntheWestBengalGovernmentabouttheGroup's activities in 2011, the Group changed course once again by buying and selling shares in listed companies and siphon- ing off the proceeds to unidentified accounts. In 2012, SEBI finally declared that the Group's activities were CIS, not chit fund, and asked it to stop all investment schemes. But the Group continued its operations till it collapsed in April 2013. Round #2, SEBI vs Pearls Group: In what is touted as the biggest ever crackdown in India, SEBI questioned the legality of Pearls Agrotech Corporation Ltd (PACL) running a CIS scheme in the garb of a real estate company and ordered immediate closure of the unauthorised CIS. “Investment Schemes of PACL Limited are wound up and all the monies mobilisedthroughsuchschemesarerefundedtoitsinvestors with returns which are due to them," SEBI’s 92-page order said. SEBI also requested the Ministry of Corporate Affairs to initiate the process of winding up PACL Limited, which, among others, was constructing a mega 250-acre residential township in Bathinda, the parliamentary constituency of Sukhbir Singh Badal’s wife and Union Food Processing Minister Harsimrat Kaur. Nirmal Singh Bhangoo, the Group head, allegedly cheated over 5.85 crore investors of `45,000 crore after getting them to invest in a scheme, under which they were promised agricultural land that did not exist. The SEBI Chairman, vide his order dated February 20, 2002, held that Pearls Golden Forest Ltd (PGFL), another Pearl Group company, was conducting CIS activities in violation of CIS regulations. PGFL challenged the order before the Punjab and Haryana High Court which upheld SEBI's order and stated that PGFL was liable to repay investors. The matter is pending before the Supreme Court. In a parallel order, the Rajasthan High Court on November 28, 2003, held that PACL’s schemes did not fall within the definition of CIS. SEBI challenged this order. It is also pending before the Supreme Court. Round #3, SEBI vs Rose Valley Group: A team of SEBI officials on an inspection visit to the Rose Valley Group’s office was not allowed to even enter the premises. Similarly, a team of KPMG auditors, commissioned by SEBI to conduct ‘forensic audit’, was not allowed to flip through the company's books of accounts. The Rose Valley Group and other chit fund companies engaged Trinamool Congress MP Kalyan Banerjee to file multiple cases in Calcutta High Court and over a dozen district civil courts. Banerjee also appeared for Sumangal Industries that floated 'potato bonds' promising 20-100 per cent returns in 15 months, while Pratap Chatterjee, son of former Lok Sabha speaker Somnath Chatterjee, took up the cudgels on behalf of MPS Greenery. The result is that, despite complaints against companies like Rose Valley, MPS Group, Sun Plant Group and Sumangal Industries, SEBI and other agencies haven’t been able to initiate criminal prosecution proceedings or effectively prevent them from raising money in an "unauthorised manner". companies. At least 27 of them are registered in Kolkata alone. West Bengal and the North-Eastern states are the favourite hunting grounds for illegal money collection activities. At least 62 dubious chit fund companies are known to have amassed close to `15,000 crore from unsuspecting depositors in West Bengal. Countless small and unregistered money laundering firms are known to be operating in North and South 24-Parganas, Malda and Birbhum districts of West Bengal. Many of these agro and chit fund companies directly own or indirectly control the media. Most of these companies raise money from the public through shady deals but manage to buy political and police protection using the media as a protective shield. T HE Saradha Group, which went bust, had interests in realty, cement, agro and education sectors but also ran The Bengal Post (English), Sokalbela daily (Bengali) and Channel 10 TV news channel. The group’s flagship company, Saradha Realty India launched in 2008, has a consortium of nearly 100 compa- nies, including Saradha Properties, Saradha Biogas Production, Saradha There were widespread protests against the Saradha Group in West Bengal since 2007. Such cases include names like Abhaya Gold, Omkar Jewellers, Dasara Chit Fund, Redamma scam and Apple Tree Chits. According to the Ministry of Corporate Affairs, West Bengal has the highest number of chit fund

- 6. COVER STORY scam chit funds www.gfilesindia.com14 gfiles inside the government vol. 8, issue 6 | September 2014 T HE issue of frauds by compa- nies figured in the Lok Sabha on March 14, 2013. Two MPs, DB Chandregowda from Karnataka and Adhi Sankar from Tamil Nadu, raised the issue in Question Hour, asking the Ministry of Corporate Affairs to reply whether the government had any re- cords of the number of dubious com- panies, including fly-by-night opera- tors, who had duped investors and the number of investors who have been cheated into making investments in these companies. They sought details of such cases alongwith the estimat- ed amount of investments involved therein and the action taken against such companies. The then Minister of State (Inde- www.gfilesindia.com14 gfiles inside the government vol. 8, issue 6 | September 2014 Multipurpose Himghar, Saradha Livestock Breeding and Saradha Ad Agency. But Sudipta Sen, the smooth talk- ing owner of the Saradha Group, offers a perfect example of how the media can be used to build bridges with all sorts of investors and politi- cians. He had Trinamool MP Satabdi Roy acting as his brand ambassador. Chief Minister Mamata Banerjee, who reportedly sold her paintings to the Group for `1.8 crore, used to grace his functions, while her Transport Minister, Madan Mitra, headed the employees’ union and publicly encouraged people to invest in the company. A former Naxalite whose real name was Shankaraditya Sen, the Group owner reportedly went to jail before resurfacing with a changed name and identity as Sudipta Sen. He started working as a real estate broker in Kolkata before switching to money- circulating schemes in mid-2000. G AUTAM Kundu, the owner of the Rose Valley Group of companies, started off as an LIC agent before expanding into hotels, tourism, food, entertainment and offering an amalgam of insur- ance and small savings schemes. The Group’s media division owns four television channels. Brand Value Communications, a Group company, owns News Time Bangla, News Time Assam, News Time Orissa and Rupasi Bangla TV channels besides Dhoom MusicandDhoomBangla.RoseValley Patrika brings out a broadsheet daily called Khabar 365 Din and Cinema Ebong, a film magazine. Kundu’s investments in Kolkata Knight Riders (KKR) IPL team (Seasons V and VI) made Shah Rukh Khan, Gautam Gambhir and Brendon McCullum agree to shoot for Rose Valley’s ad films. As the owner of a handful of An eye on fraudsters pendent charge) in the Corporate Af- fairs Ministry, Sachin Pilot put on re- cord that action had been taken against “certain companies which have raised funds through initial public offer but thereafter are not traceable. The Minis- try has also taken action against certain companies which have failed to repay deposits to public violating Section 58A of the Companies Act, 1956.” He further said that “complaints of cheating by companies which prom- ised high rates of interests to investors have been received in 87 cases... In these cases, inspection under Section 209A and investigation under Section 234 of the Companies Act, 1956, has been ordered.” The reply mentioned that 669 companies came to the notice newspapers and TV channels, he was at one point of time paying monthly salaries to around 1,200 journalists and technicians—all of whom had to sing his praises and promote his business or lose their jobs. One of the chit fund companies under the SEBI’s scrutiny had inter- ests in poultry and real estate but also managed to get itself listed with both BSE and NSE, leveraging the strength of its TV channel in Durgapur. Similarly, Rice Group, active in the field of education, launched the Swabhumi newspaper. LAW UNTO THEMSELVES In its heydays, the Saradha Group was promising allotment of plots or flats with an attractive ‘money back’ option for investors who chose to cancel the booking and wanted their money back with compound interest ranging from 12 per cent to 14 per cent. In a detailed letter, Sen describes how the idea to siphon off such large amounts of money and starting a chit fund company was sold to him by Shib Narayan Das in 2008. Das was introduced to him by his drivers Ratan and Dipu. As part of the deal, Das and his team would retain 30 per cent while Sen could invest the rest, which had to be returned to depositors after 10-12 years at the rate of 12 per cent per annum. Sen found the idea attractive and so, on July 8, 2008, he started Saradha Realty India Ltd and appointed Das as its director and shareholder. “Truly, I did not know that money from the people is in violation of the regulating authorities like SEBI and RBI,” he wrote. According to him, by the time he realised all this, it was too late and a number of powerful politicians in West Bengal, Assam, Odisha and Jharkhand started demanding money, “using him” and “backstabbing” him.

- 7. 15www.indianbuzz.com gfiles inside the government vol. 8, issue 6 | September 2014 15www.indianbuzz.com gfiles inside the government vol. 8, issue 6 | September 2014 of Corporate Affairs conducts Inves- tor Awareness Programmes (IAPs) for making the public aware of the various instruments of investments available to them. Similarly, RBI issues notice in newspapers regularly to caution the public against the design of entities in collection of deposits illegally. SEBI also conducts IAPs across the coun- try and has recently launched public- ity campaigns through electronic and print media. Editors of newspapers are also sensitised to exercise caution for accepting advertisements pertaining to acceptance of deposits by un-incor- porated bodies.” He further added, “the RBI is in the process of undertak- ing a comprehensive campaign aimed at alerting the public against falling prey to the ponzi schemes and other monetary malpractices.” of SEBI for conducting operations in violation of SEBI (Collective Investment Schemes) Regulations, 1999. “The amount collected by these companies was Rs 7,435 crore. Out of these com- panies, 75 have been wound up and the money refunded to the investors. Also, 552 companies were prosecuted and convictions were secured in 124 cases.” Pilot said, “There are certain compa- nies which have floated fraudulent in- vestment deposits mobilizing schemes (also called ponzi schemes) under various guises and are liable for action under the Prize Chits and Money Cir- culation Schemes (Banning) Act, 1978. This Act is administered by the Ministry of Finance (Department of Financial Services) through the State govern- ments and figures of prosecution etc. are not being maintained centrally.” On being asked whether the govern- ment proposed to develop a fraud pre- diction model that would forewarn law enforcement agencies about any suspi- cious movement of money in the mar- ket and strengthen its market research and analysis, the Minister replied that, “a Steering Committee had been con- stituted to develop a ‘Fraud Prediction Model’ aimed at generating alerts for prevention of fraud and malfeasance. It is also proposed to revamp the exist- ing Market Research & Analysis Unit (MRAU) in the Serious Fraud Investiga- tion Office (SFIO) to enable it to func- tion as an intelligence unit. On the measures taken by the gov- ernment to sensitise the people about investment scenario in the country and to address the problem, Pilot enumer- ated a number of steps. “The Ministry Documents seized during the searches revealed that the company had collected `2,100 crore from the people. Out of this, `400 crore was spent on political payments and more than `550 crore was spent on 35 per cent commissions to agents. After deducting other expenses, `850 crore was left to pay the investors. But, in a clear case of shuttering the stable after the horses had bolted, the West Bengal government proposed to levy additional tax on cigarettes to com- pensate the victims of the Saradha chit fund scam. A NOTHER kingpin in the chit fund business, the Pune-based Sai Prasad Group owned by Balasaheb Bhapkar, Vandana Bhapkar and Shashank Bhapkar and its two companies, M/s Sai Prasad Foods Limited and Sai Prasad Properties Limited, has a case against it in the Madhya Pradesh High Court, two SEBI orders and seven FIRs against it in Rajasthan, Odisha and UP. But despite these orders and investigations, the Sai Prasad Group continued to run illegal chit fund schemes. The Group’s strategy was to offer heavy incentives to make inves- tors plough their money into fake and bogus entities. They were ille- gally running Collective Investment Schemes without permission from SEBI, violating the provisions of the SEBIAct,1992,PrizeChitsandMoney Circulation Schemes (Banning) Act, 1978, Maharashtra Protection of Interests of Depositors (In Financial Establishments) Act, 1999, and the Indian Penal Code, Companies Act, 1956 and Reserve Bank of India Act, 1934. The Sai Prasad Group recruited about 12 lakh agents to lure the investors. A CBI inquiry against the Group, ordered by the Madhya Pradesh High Court in 2012, indicted the compa- nies with illegally receiving deposits by floating instalment and lump- Rose Valley chit fund operator managed to mop up over Rs 4,000 crore from the public before its collapse

- 8. COVER STORY scam chit funds www.gfilesindia.com16 gfiles inside the government vol. 8, issue 6 | September 2014 COVER STORY www.gfilesindia.com16 gfiles inside the government vol. 8, issue 6 | September 2014 THE STARRED QUESTION NO. 244 FOR ANSWER IN LOK SABHA ON 14-03-2013 State-wise list of Vanishing Companies S.No. Name of the Vanishing Company State 1 Aashi Industries Ltd (Formerly known as Aashi Pharmachem Ltd.) Gujarat 2 Bhavna Steel Cast Ltd. Gujarat 3 Citizen Yarns Ltd. Gujarat 4 Cromakem Ltd. Gujarat 5 Frontline Financial Services Ltd. Gujarat 6 Genuine Commodities Development Co. Ltd. Gujarat 7 Girish Hotels Resorts and Health Farms Ltd. Gujarat 8 Growth AgroIndustries Ltd. Gujarat 9 Kesar Greenfield International Ltd Gujarat 10 Lyons Industrial Estate Enterprises Ltd (formerly known as Lyons Range Finance Ltd.) Gujarat 11 Manav Pharma Ltd. Gujarat 12 Marine Cargo Company Ltd. Gujarat 13 Naisargik Agritech (India) Ltd. Gujarat 14 Naturo Pest Ltd. Gujarat 15 Nishu Fincap Ltd. (Formerly known as Medha Finance & Securities Ltd.) Gujarat 16 Pur Opale Creations Ltd (formerly known as Nuline Glassware (India) Ltd.) Gujarat 17 Protech Circuit Breakers Ltd. Gujarat 18 Protech Switchgears Ltd. Gujarat 19 Shree Yaax Pharma & Cosmetics Ltd. Gujarat 20 Shreeji Dyechem Ltd. Gujarat 21 Shri Mahalaxmi Agricultural Developments Co. Ltd. Gujarat 22 Spil Finance Ltd. Gujarat 23 Super Domestic Machines Ltd. Gujarat 24 Sushil Packagings (India) Ltd. Gujarat 25 Tirth Plastics Ltd. Gujarat 26 Topline Shoes Ltd Gujarat S.No. Name of the Vanishing Company State 27 Aditya Alkaloids Ltd. Andhra Pradesh 28 Canara Credit Ltd. Andhra Pradesh 29 Daisy Systems Limited Andhra Pradesh 30 Imap Technologies Limited Andhra Pradesh 31 Kamakshi Housing Finance Ltd. (Presently known as Kisha Impex Ltd. Andhra Pradesh 32 Deccan Petroleum Ltd. Andhra Pradesh 33 Orpine Systems Limited Andhra Pradesh 34 Chhakri Tyres & Tubes Ltd. or Rhino Tyres Ltd. (Presently known as Raam Tyres Ltd.) Andhra Pradesh 35 Sequel Soft India Limited Andhra Pradesh 36 Sibar Media & Entertainment Limited Andhra Pradesh 37 Sibar software services India) Ltd Andhra Pradesh 38 Swal Computers Ltd Andhra Pradesh 39 Visie Cyber Tech Ltd. Andhra Pradesh 40 Ambuja Zinc Ltd. Bihar 41 Bodh Gaya Ceramics Ltd. Bihar 42 Cilson Organics Ltd. Bihar 43 Shree Vaishnavi Printing and Dyeing Ltd. Bihar 44 Carewell Hygiene Products Ltd Chandigarh 45 Sukhchain Cements Ltd. (formerly known as Ganapati Cements Pvt. Ltd.) Chandigarh 46 Kedia Infotech Ltd (formerly known as Grives Hotels Ltd.) Delhi 47 Hoffland Investments Ltd. (formerly known as Vadra Investments Ltd.) Delhi 48 Simplex Holdings Ltd Delhi 49 Star Electronics Ltd. Delhi 50 Zed Investments Ltd. Delhi 51 Flora Wall Coverings Ltd. Karnataka scam chit funds

- 9. 17www.indianbuzz.com gfiles inside the government vol. 8, issue 6 | September 2014 17www.indianbuzz.com gfiles inside the government vol. 8, issue 6 | September 2014 S.No. Name of the Vanishing Company State 52 Ocean Knits Limited Karnataka 53 Hi-Tech Drugs Ltd Madhya Pradesh 54 Madhyavart Exxoil Ltd Madhya Pradesh 55 Rajadhiraj Industries Ltd. Madhya Pradesh 56 South Asian Mushrooms Ltd. Madhya Pradesh 57 Sterling Kalk Sand Bricks Ltd. Madhya Pradesh 58 Caldyn Aircon Ltd Maharashtra 59 Gobal Exhibitions Ltd. (Formerly known as Global Network Ltd.) Maharashtra 60 Hitesh Textile Mills Ltd. Maharashtra 61 Ichakalanji Soya Ltd. Maharashtra 62 Pashupati Cables Ltd. Maharashtra 63 Realtime Finlease Ltd. Maharashtra 64 Rusoday & Company Ltd. Maharashtra 65 Sparkle Foods Ltd. Maharashtra 66 Vipul Securities Ltd. Maharashtra 67 Universal Vita Alimentare Ltd. Orissa 68 Hallmark Drugs and Chemicals Ltd. (formerly known as Lifeline Drugs Ltd.) Punjab 69 Amigo Exports Ltd. Tamil Nadu 70 Crestworld Marines Ltd. Tamil Nadu S.No. Name of the Vanishing Company State 71 Ma Capital Market Services Ltd. Tamil Nadu 72 Nagarjuna Jiyo Industries Ltd. Tamil Nadu 73 PK Vaduvammal Finance & Investments Ltd.( Presently known as Novel Finance (I) Ltd. Tamil Nadu 74 Panggo Exports Ltd. Tamil Nadu 75 Sai Graha Finance and Engineering Ltd. Tamil Nadu 76 Shyam Printers & Publishers Ltd. Tamil Nadu 77 AVR Securities Ltd. Tamil Nadu 78 Global Blooms India Ltd. Tamil Nadu 79 Rizvi Exports Ltd. Uttar Pradesh 80 Shefali Papers Ltd. Uttar Pradesh 81 Siddhartha Pharmachem Ltd. Uttar Pradesh 82 Vidiani Agrotech Industries Ltd. Uttar Pradesh 83 Asian Vegpro Industries Ltd West Bengal 84 Kiev Finance Ltd West Bengal 85 Oriental Remedies and Herbals Ltd West Bengal 86 SSK Fiscal Services Ld West Bengal 87 Saket Extrusions Ltd West Bengal Action taken against Vanishing Companies Details Total Total Number of Vanishing Companies 87 Companies against which prosecutions filed u/s 62/63, 68 & 628 of the Companies Act, 1956 85 Companies where FIRs filed/ registered under IPC 87 S.NO. Name of the State No. of Complaints received Prosecutions filed for violation of Section 58A of the Companies Act, 1956 1. Delhi & Haryana 76 03 2. Punjab & Himachal -- 03 3. Rajasthan 02 04 4. Gujarat 02 05 5. Madhya Pradesh 05 04 6. Tamil Nadu 06 7. Kerala 02 01 8. Maharashtra 51 06 9. Orissa -- 02 10. Hyderabad 34 04 11. Karnataka 04 04 Total 182 36 THE STARRED QUESTION NO. 244 FOR ANSWER IN LOK SABHA ON 14-03-2013 State-wise/ UT-wise list of number of complaints received for non-payment of deposits and penal action taken

- 10. COVER STORY scam chit funds www.gfilesindia.com18 gfiles inside the government vol. 8, issue 6 | September 2014 WEST BENGAL (1) M/s. Vibgyour Allied Infrastructure Ltd. (2) M/s. Rose Valley Real Estates Constructions Ltd. (3) M/s. Rose Valley Industries Ltd. (4) M/s. Silver Valley Communications Ltd. (5) M/s. Rose Valley Food Beverage Ltd. (6) M/s. Rose Valley Marketing India Ltd. (7) M/s. Rose Valley Infotech Pvt. Ltd. (8) M/s. Rose Valley Hotels and Entertainments Ltd. (9) M/s. Rose Valley Projects Ltd. (10) M/s. Rose Valley Patrika Ltd. (11) M/s. Rose Valley Films Ltd. (12) M/s. Modern Investment Traders Pvt. Ltd. (13) M/s. Rose Valley Travels Pvt. Ltd. (14) M/s. Brand Value Communications Ltd. (15) M/s. Rose Valley Housing Development Finance Corporation Ltd. (16) M/s. Rose Valley Airlines Ltd. (17) M/s. Rose Valley Fashions Ltd. (18) M/s. Rupasi Bangla Projects India Ltd. (19) M/s. Rupasi Bangla media and Entertainments Ltd. (20) M/s. Rose Valley Realcom Ltd. (21) M/s. Saradha Realty India Ltd. (22) M/s. RTC Properties India Ltd. (23) M/s. RTC Real Trade India Ltd. (24) M/s. Jasoda Real Estate Ltd. (25) M/s. Saradha Printing & Publication Pvt. Ltd. (26) M/s. Saradha Agro Development Ltd. (27) M/s. Saradha Biogas Production Pvt. Ltd. (28) M/s. Saradha Tour and Travels Pvt. Ltd. (29) M/s. Saradha Automobiles India Ltd. (30) M/s. Saradha Constructions Company Pvt. Ltd. (31) M/s. Saradha Shopping Mall Pvt. Ltd. (32) M/s. Saradha Education Enterprise Ltd. (33) M/s. Saradha Exports Ltd. (34) M/s. Goldmine Agro Ltd. (35) M/s. Tower Infotech Pvt. Ltd. (36) M/s. Chakra Infrastructure Ltd. (37) M/s. Gold Field Agro Ltd. (38) M/s. Golden Life Agro India Ltd. (39) M/s. Golden Pariwar Holding and Developers India Ltd. (40) M/s. Goldmine Food Products Ltd. (41) M/s. Hallo India Express Sales Ltd. (42) M/s. Happy Life Realty (India) Ltd. (43) M/s. ICore E-Service Ltd. (44) M/s. MPS Aqua Marine Products Ltd. (45) M/s. MPS Greenery Developers Ltd. (46) M/s. MPS Industries & Agro Research Ltd. (47) M/s. MPS Resorts and Hotels Ltd. (48) M/s. Prayag Agrotech Pvt. Ltd. (49) M/s. Prayag Infotech Hi-Rise Ltd. (50) M/s. Prayag Infra Realtors Ltd. (51) M/s. Prayag Micro Finance (52) M/s. Rahul Heights Ltd. (53) M/s. Rahul Hi-Rise Ltd. (54) M/s. Ramel Industries Ltd. (55) M/s. Shine India Agro Industries Ltd. (56) M/s. Silicon Projects India Ltd. (57) M/s. Sunshine Agro-Infra Ltd. (58) M/s. Sunshine India Land Developers Ltd. (59) M/s. URO Agro India Ltd. (60) M/s. URO Autotech Ltd. (61) M/s. URO Hotels and Resorts India Ltd. (62) M/s. URO Hygenic Goods Ltd. (63) M/s. URO Infotech Ltd. (64) M/s. URO Infra Realty India Ltd. (65) M/s. URO Life Care Ltd. (66) M/s. URO Trexim Ltd. (67) M/s. URO Walkers Ltd. (68) M/s. Vasundhara Realcon Ltd. (69) M/s. Vibgyor Allied Industries Ltd. (70) M/s. Vishwamitra India Consultancy Services Ltd. (71) M/s. Vishwamitra India Multi-Developers Ltd. (72) M/s. Waris Hospital & Diagnostic Centre Ltd. (Now Waris Healthcare Ltd.) (73) M/s. Waris Telecom Services Ltd. (Waris Tel International Ltd.) RAJASTHAN (1) M/s. PACL (India) Ltd. (2) M/s. Goldsukh Trade India Ltd. TAMIL NADU (1) M/s Unipay 2U Marketing Pvt. Ltd. (2) M/s Unipay Creative Business Pvt. Ltd. (3) M/s Unipay 2U Production Pvt. Ltd. (4) M/s. Goldquest International Pvt. Ltd. (5) M/s. Questnet Enterprises India Pvt. Ltd. KARNATAKA (1) M/s Unigateway 2U Trading Pvt. Ltd. DELHI (1) M/s Speakasia Online Pte. (Unregistered) (2) M/s. Basil International Ltd. (3) M/s. Vamshi Chemicals Ltd. (4) M/s. Appeline Cosmetics & Toiletries Ltd. (5) M/s. Basil Express Ltd. UTTAR PRADESH (1) M/s. Nixcil Pharmaceuticals Specialties Ltd. THE STARRED QUESTION NO. 244 FOR ANSWER IN LOK SABHA ON 14-03-2013 State wise list of companies against which complaints received for indulging in Ponzi/ MLM Schemes COVER STORY www.gfilesindia.com18 gfiles inside the government vol. 8, issue 6 | September 2014 scam chit funds

- 11. 19www.indianbuzz.com gfiles inside the government vol. 8, issue 6 | September 2014 Dubious companies sum payment plans against the sale of land units, plants and livestock. The CBI report concluded that the contract entered by the company with its investors violated Section 3 (1), 3 (2) and 3(4) of the Madhya Pradesh Investor Protection Act, 2000, Section 58B (5 and 5A), and 58 of the RBI Act, 1934, and Sections 4, 5, and 6 of the Prize Chits and Money Circulation Schemes (Banning) Act, 1978 and Section 420 of the Indian Penal Code. Another such prominent case is from Punjab. The Pearls Group pro- moted by Nirmal Singh Bhangoo, positioned itself as a government undertaking “endorsed by the Union Ministry of Corporate Affairs” to make nearly five crore investors invest over Rs 45,000 crore in mul- ti-level marketing (MLM) pyramid schemes and other ponzi deals. The investors were given the false assur- ance that they would be provided agricultural plots of land, but in real- ity a sizeable part of the money was redirected to foreign countries like Australia. The group allegedly used this money to purchase the Sheraton Mirage Resort and Spa in Gold Coast, Queensland, through its subsidiary Pearls Australasia. Bhangoo’s Pearls Agrotech Corporation Ltd (PACL) and Pearls Golden Forest Ltd (PGFL) and their associates were siphoning off funds in 1,000 bank accounts of a maze of firms all over India. PACL alone had 256 branches nationwide. The CBI registered a case against PGFL, PACL Limited and their pro- moters—Bhangoo and Sukhdev Singh—for cheating and criminal conspiracy and seized their pass- ports to prevent them from slipping out of the country. But how does this help the investors? Bhangoo’s com- panies are still in business and con- tinue to collect money from gullible investors. The Catch-22 situation for millions of small investors is either to keep depositing their recurring deposit EMIs every month and lose much more, or to stop paying and forget the previous amounts paid. The whole operation was channelised through a network of five lakh com- mission agents, who were paid 15-40 per cent commission. A series of raids on the company offices in New Delhi, Chandigarh, Mohali, Ropar and Jaipur yielded data relating to the deposits and mis- utilisation of funds. One of the ways adopted by PACL to cheat investors was to forge land registry documents of farmers and show them to investors in other states to lure more and more people into the net. AccordingtoCBIsources,thegroup was never in a position to repay all its deposits. A sizeable chunk of money collected from the investor deposits was used to buy barren land and fund foreign acquisitions. The leftover

- 12. COVER STORY scam chit funds www.gfilesindia.com20 gfiles inside the government vol. 8, issue 6 | September 2014 money was used to honour the pre- mature withdrawals of recurring and fixed deposits and also those deposits nearing maturity. As a result, pay- ments for recurring deposits which matured in 2013 were delayed by over six months. On top of that, investors had to be paid an additional 12.5 per cent interest on maturity. The Group could never recover from the strain of 2011 when thou- sands of panic-stricken inves- tors withdrew their money, fearing an imminent financial collapse. It had reached the stage where the money col- lected from new investors was perpetually less than the payouts or returns due to old investors. In other words, it had all the makings of a doomed ponzi scheme. The youngest of the three sons of Gurdyal Singh, a farmer who migrat- ed from Pakistan and settled in Atari village in Ropar district, Bhangoo is a Jatt-Sikh from Punjab. A small time dairy farmer, he started his career as an agent of Peerless Finance. This is where he learnt the tricks of finance and investment but had to leave the job after he allegedly com- mitted some irregularities. Bhangoo founded Pearls Group in 1983 in asso- ciation with RK Sayal, the founder of (now defunct) Golden Forests India Limited, as one of the eight promot- er-directors of PGFL which quickly became one of India’s fastest growing firms and largest private landholders. Another of his companies, Gurwant Agrotech, which started by selling magnetic pillows and therapeutic products, was rebranded as Pearls Agrotech Corporation and subse- quently as PACL India in 1996. In a short time, it managed to amass over Rs 20,000 crore in deposits from the public. Encouraged by the success in the Indian market, Bhangoo made a dramatic entry into the Australian property market in 2009 and appoint- ed Australian cricketer Brett Lee as the company’s international ambas- sador. Things started happening for him when the Gold Coast Sheraton Mirage property, developed by failed tycoon Christopher Skase, went up for sale and Pearls paid $62m for it in 2009 and spent another $30m renovating the 296-room property. B HANGOO’S empire today includes tourism, media, enter- tainment and insurance compa- nies. In a filing before the Registrar of Companies, PACL claimed to be India’s biggest corporate landowner, with possession of 1.85 lakh acre— nearly 20 times the land owned by the biggest realty concerns. But what the figures try to hide is the fact that most of this is unusable tracts of desert wasteland purchased along the India-Pakistan border in Barmer district of Rajasthan. Another big catch for the CBI are Sambit Khuntia, Pradip Sethy, Chandrika Patnaik, Radhakrishna Padhi and Jhuma Chakravorty— directors of Artha Tatwa (AT) Group—an Odisha-based chit fund and multi-crore ponzi scheme opera- tor which allegedly mopped up over `500 crore from small investors and owned an Odisha Premier League team. Khuntia’s luck ran out when the CBI sleuths found him hiding in the well in the backyard of his house. The searches at the residences of other directors of the chit fund com- pany also revealed incriminating documents. All this was the fallout of month-long searches at 60 locations in Mumbai and Odisha. Searches were also carried out at the residence of stockbroker Deepak Parekh, who allegedly helped Artha Tatwa obtain licences from SEBI and MCX. CBI seized `28 lakh in cash from the house of BJD MP Ramachandra Hansda. BJD MLA Pravata Tripathy was allegedly charging protection money from the group while two for- mer MLAs, Subarna Naik of BJD and Hitesh Bagarti of BJP, were also alleg- edly hand-in-glove with the company. Similarly, TV producer Priti Bhatia, who floated a media com- pany with Pradip Sethi the disgraced CMD of the AT Group, currently in jail for allegedly defrauding over `1,000 crore from investors, Bikash Swain, the owner of Surya Prabha Sudipta Sen, the mastermind behind the Saradha Group, has been taken into custody

- 13. COVER STORY scam chit funds www.gfilesindia.com22 gfiles inside the government vol. 8, issue 6 | September 2014 newspaper, and Manoj Dash, owner of Kamyab TV, having close links with the Group, were also searched. The AT Group and its network of 20 organisations owns over 122.73 acres of land in Puri, Khurda, Balasore and Ganjam district of Odisha. Similarly, Rose Valley chit fund operator managed to mop up over `4,000 crore from the public before its collapse. The company was oper- ating over 1,000 bank accounts in different parts of the country and collected more money than the Saradha Group. But when the Justice RK Patra Commission of inquiry sent notices to Rose Valley Real Estates & Constructions Ltd, Adarsh Wealth Ventures Ltd, Flourish Development India Ltd, Artha Tatwa Multipurpose Cooperative Society Ltd, Seashore Multipurpose Cooperative Ltd, Astha International Ltd and Sastra Enterprises, the notices were returned by the postal department with the endorsement ‘addressee left’. This means that the compa- nies gave wrong addresses in their affidavits filed before the commission, which received more than 800,000 complaints on affidavits from inves- tors. Later, there was a move to attach the properties of five financial enti- ties—Flourish India, Saradha Group, Sastra Enterprises and Seashore Group. The Economic Offences Wing seized 204 acres of land held by the Seashore Group, 1,364 acres of the Saradha Group, 234 acres of the Artha Tatwa Group and 24 acres of Flourish India. Another such case includes that of Bhausaheb Chavan, a former banker, and his wife, Aarti, who used their contacts to get several of Chavan’s former bank customers to invest in KBC Multi Trade promoted by them. Bhausaheb’s magic offering was to make his investors ‘crorepatis’ within a few months and he promised 20-30 per cent commission to ‘agents’ to lure more people into the ‘get-rich-quick’ schemes. The husband-wife duo col- lected over `2,000 crore within four years before going underground. KBC’s over-ambitious Multi Trade’s scheme offered three-times return on investment in 30 months. According to unconfirmed reports, Bhausaheb may have fled to Singapore along with his family, leaving thousands of investors in a financial crisis. I N another case, Rameshwar Poddar, CMD, and two devel- opment officers of Ramuel chit fund were arrested in Kolkata on charges of murder and cheating to the tune of `2,500 crore. Rubi Gan, a widow, lodged an FIR naming Poddar in the murder of her husband Prashanta Gan. Ramuel Group and Golden Parivar have earlier been accused of ‘shadowy’ deals to cheat people of their life’s savings. Both Golden Parivar and Ramuel Group have not reimbursed the due amounts to their clients over the past year. Incidentally, the offices of both Golden Parivar and Ramuel Group, in the same building, are locked. Both the companies started opera- tions in Kalimpong in 2010. Golden Parivar managed to collect about `20 lakh while Ramuel Group amassed `25 lakh. Today, both companies are unable to repay their customers. Previously, Basil, Rose Valley, Axis Multi-Developer, Prayag Group and Gulshan Group pleaded inability to reimburse investors. g With inputs from Ajit Ujjainkar Trinamool MP Satabdi Roy was the brand ambassador of Saradha Group