Weitere ähnliche Inhalte

Kürzlich hochgeladen (20)

Hansson

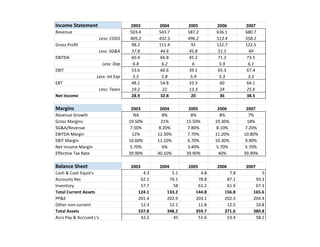

- 1. Income Statement 2003 2004 2005 2006 2007

Revenue 503.4 543.7 587.2 636.1 680.7

Less: COGS 405.2 432.3 496.2 513.4 558.2

Gross Profit 98.2 111.4 91 122.7 122.5

Less: SG&A 37.8 44.6 45.8 51.5 49

EBITDA 60.4 66.8 45.2 71.2 73.5

Less: Dep 6.8 6.2 6 5.9 6.1

EBIT 53.6 60.6 39.2 65.3 67.4

Less: Int Exp 5.5 5.8 5.9 5.3 3.3

EBT 48.1 54.8 33.3 60 64.1

Less: Taxes 19.2 22 13.3 24 25.6

Net Income 28.9 32.8 20 36 38.5

Margins 2003 2004 2005 2006 2007

Revenue Growth NA 8% 8% 8% 7%

Gross Margins 19.50% 21% 15.50% 19.30% 18%

SG&A/Revenue 7.50% 8.20% 7.80% 8.10% 7.20%

EBITDA Margin 12% 12.30% 7.70% 11.20% 10.80%

EBIT Margin 10.60% 11.10% 6.70% 10.30% 9.90%

Net Income Margin 5.70% 6% 3.40% 5.70% 5.70%

Effective Tax Rate 39.90% 40.10% 39.90% 40% 39.90%

Balance Sheet 2003 2004 2005 2006 2007

Cash & Cash Equiv's 4.3 5.1 4.8 7.8 5

Accounts Rec 62.1 70.1 78.8 87.1 93.3

Inventory 57.7 58 61.2 61.9 67.3

Total Current Assets 124.1 133.2 144.8 156.8 165.6

PP&E 201.4 202.9 203.1 202.3 204.4

Other non-current 12.3 12.1 11.8 12.5 10.8

Total Assets 337.8 348.2 359.7 371.6 380.8

Accs Pay & Accrued L's 42.2 45 51.6 53.4 58.1

- 2. Long-term Debt 91.6 82.8 73.8 65.8 54.8

Owner's Equity 204 220.4 234.3 252.4 267.9

Total L's & E's 337.8 348.2 359.7 371.6 380.8

Accounts Rec 62.1 70.1 78.8 87.1 93.3

Plus: Inv 57.7 58 61.2 61.9 67.3

Less: Acc Pay & Accrued L's 42.2 45 51.6 53.4 58.1

NWC 77.6 83.1 88.4 95.6 102.5

Cash Flow Statement

Cash From Operating Assets 2003 2004 2005 2006 2007

Net Income 28.9 32.8 20 36 38.5

Plus: Dep 6.8 6.2 6 5.9 6.1

Less: Increase in AR 3.1 8 8.7 8.3 6.2

Less: Increase in Inv 0.5 0.3 3.2 0.7 5.4

Plus: Increase in AP 0.3 2.8 6.6 1.8 4.7

Total Cash From Operations 32.4 33.5 20.7 34.7 37.7

Cash From Investing 2003 2004 2005 2006 2007

CapEX 7.3 7.7 6.2 5.1 8.2

Plus: Increases other Non-

Current Assets 0.5 -0.2 -0.3 0.7 -1.7

Total Cash Used for Investing 7.8 7.5 5.9 5.8 6.5

Cash From Financing 2003 2004 2005 2006 2007

Repayment of Debt 8 8.8 9 8 11

Plus: Dividend Payments 14.4 16.4 6.1 17.9 23

Cash Used in Financing 22.4 25.2 15.1 25.9 34

- 5. Market Value Net Debt Enterprise Value Equity Beta Revenue EBITDA EBIT Net Income BV

Cthleen Sinclair 298.9 1329.6 1628.5 2.22 1346.8 255.3 163.4 21.5 -1112.8

General Health & Beauty 319.3 63.1 382.4 1.95 446.1 61.9 51.9 23.8 204.2

Women's Care Company 498.6 55.3 553.9 1.14 397.3 52.7 49.3 77 43.7

Skin Care Enterprises 1204.2 371.9 1576.1 1.35 1247.6 155.8 125.4 65.3 316.2

Hansson-current 49.8 317.7 1.26 680.7 73.5 67.4 38.5 267.9

Hansson- with expansion 107.6 514.5 ( 1.48) 765.7 82.2 72.1 41.3 267.9

EBITDA EBIT Earnings

Cthleen Sinclair 19% 12.10% 1.60%

General Health & Beauty 13.90% 11.60% 5.30%

Women's Care Company 13.30% 12.40% 19.40%

Skin Care Enterprises 12.50% 10.10% 5.20%

Hansson-current 10.80% 9.90% 5.70%

Hansson- of expansion 10.27% 5.56% 3.34%

Common Ratios

Total Debt Debt-Equity Equity Multiplier Long-term Debt Total Asset Turnover ROE ROA

Hansson-current 0.30 0.42 1.42 0.17 1.79 0.14 0.10

Hansson- with expansion 0.37 0.40 1.59 #REF! 1.80 0.15 0.097

- 7. Weighted Average Cost of Capital

Assumptions 2007 w/ Expansion

Risk-free Rate 3.75% 3.75%

Market Risk Premium 5% 5%

Est. Beta 1.26 ( 1.48)

CAPM Ke 10.05% 11.15%

Tax Rate 40% 40%

Est. EBITDA Multiple 7

Est. Enterprise Value 514.5

E/V 90.30% 79.10%

Existing Net Debt 49.8 49.8

Plus: Expansion Debt 57.8

Total Est. Debt 107.6

D/E 18.59% 25.4%

D/V 9.70% 20.90%

Assumed Debt Beta 0 0

Estimated Cost of Debt 7.75% 7.75%

WACC 9.53% 9.79%

Comparables D/V D/E Equity Beta Debt Beta Asset Beta

General Health & Beauty 16.50% 19.80% 1.95 0 1.74

Women's Care Company 10% 11.10% 1.14 0 1.07

Skin Care Enterprises 23.60% 30.90% 1.35 0 1.14

AVG 16.70% 20.60% ( 1.48) ( - ) ( 1.32)

- 9. Net Present Value

Year Year 0 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

(+)Depreciation 4000 4000 4000 4000 4000 4000 4000 4000 4000 4000

(-) CAPX 1000

Intial Capital Outlay -12817 12817

(+/-) Changes in Working Capital -11728 -1219 -1272 -1314 -1364 -1409 -365 -372 -380 -387

Cash Flow 2,834 4,284 4,959 6,162 7,155 8,052 8,376 8,677 8,947 9,562

Total -1000 -17711 7065 7687 8848 9791 10643 12011 12305 12567 25992

Discount Rate 9.79%

NPV $36,933.58

Sensitivity Analysis 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14%

$61,409.38 $56,186.91 $51,436.04 $47,109.11 $43,163.80 $39,562.45 $36,271.51 $33,261.03 $30,504.28 $27,977.35 $25,658.81

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Total Revenue 84,960 94,120 103,040 112,800 122,880 132,600 135,320 138,040 140,760 144,160

(-) Total COGS 69,610 ( 75,639) ( 82,738) ( 89,731) ( 97,370) ( 104,837) ( 106,804) ( 108,811) ( 110,869) ( 112,979)

Gross Margin 15,350 18,481 20,302 23,069 25,510 27,763 28,516 29,229 29,891 31,181

(-) SG&A 6627 7341 8037 8798 9585 10343 10555 10767 10979 11244

EBITDA 8,723 11,140 12,265 14,270 15,926 17,420 17,961 18,462 18,912 19,936

(-) Depreciation $4,000) $4,000) $4,000) $4,000) $4,000) $4,000) $4,000) $4,000) $4,000) $4,000)

EBIT 4,723 7,140 8,265 10,270 11,926 13,420 13,961 14,462 14,912 15,936

(-) Tax @ 40% 1889 2856 3306 4108 4770 5368 5584 5785 5965 6374

Net Income 2,834 4,284 4,959 6,162 7,155 8,052 8,376 8,677 8,947 9,562

Changes in Net Working Capital

Balance Sheet Data: Year 0 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Accounts Receivable (DSO x Sales / 365) 11080 12243 13449 14697 15991 17330 17677 18030 18391 18758

Plus: Inventory (DSI x COGS / 365) 7171 7791 8524 9246 10030 10801 11003 11209 11421 11639

Less: Accounts Payable (DPO x COGS / 365) 6522 7086 7753 8410 9123 9824 10008 10196 10389 10587

Net Working Capital 11728 12948 14219 15533 16898 18307 18671 19044 19423 19811

Change in Working Capital 11728 1219 1272 1314 1364 1409 365 372 380 387

Property, Plant & Equipment 45000 41000 37000 33000 29000 25000 21000 17000 13000 9000 5000

Total Invested Capital 45000 52728 49948 47219 44533 41898 39307 35671 32044 28423 24811

Sales 84,960 94,120 103,040 112,800 122,880 132,600 135,320 138,040 140,760 144,160

- 10. COGS 69,610 ( 75,639) ( 82,738) ( 89,731) ( 97,370) ( 104,837) ( 106,804) ( 108,811) ( 110,869) ( 112,979)

Days Sales Outstanding (DSO) 47.6x 47.6x 47.6x 47.6x 47.6x 47.6x 47.6x 47.6x 47.6x 47.6x

Days Sales Inventory (DSI) 37.6x 37.6x 37.6x 37.6x 37.6x 37.6x 37.6x 37.6x 37.6x 37.6x

Days Payable Outstanding 34.2x 34.2x 34.2x 34.2x 34.2x 34.2x 34.2x 34.2x 34.2x 34.2x

Investment Proposal

Cost components Amount Est. Life (yrs) Dep.

Facility Expansion $10,000) 20 $500)

Manufacturing Equipment 20,000 10 2,000

Packaging Equipment 15,000 10 1,500

Working Capital 12,817 0

Total Investment $57,817) $4,000)

Financial Assumptions

Revenue Projections 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Total Capacity (000's) 80,000 80,000 80,000 80,000 80,000 80,000 80,000 80,000 80,000 80,000

Capacity Utilization 60% 65% 70% 75% 80% 85% 85% 85% 85% 85%

Unit Volume 48,000 52,000 56,000 60,000 64,000 68,000 68,000 68,000 68,000 68,000

Selling Price Per Unit (2% g) 1.77 1.81 1.84 1.88 1.92 1.95 1.99 2.03 2.07 2.12

Revenue 84,960 94,120 103,040 112,800 122,880 132,600 135,320 138,040 140,760 144,160

Production Costs 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Raw Materials Per unit 1% 0.94 0.95 0.96 0.97 0.98 0.99 1.00 1.01 1.02 1.03

Manufacturing Overhead 3% 3,600 ( 3,708) ( 3,819) ( 3,934) ( 4,052) ( 4,173) ( 4,299) ( 4,428) ( 4,560) ( 4,697)

Maintenance Expense 3% 2,250 ( 2,318) ( 2,387) ( 2,459) ( 2,532) ( 2,608) ( 2,687) ( 2,767) ( 2,850) ( 2,936)

Salaried Labor Costs 640 662.4 1028.4 1064.4 1468.8 1520 1573.6 1628.8 1685.6 1744.8

Hourly Labor Costs 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Cost Per Hourly Employee 40000 41400 42840 44340 45900 47500 49180 50900 52680 54520

Total Hourly Labor Cost (000's) 18000 19582 21806 24165 26714 29355 30393 31456 32556 33693

Total Labor Cost 18,640 20,245 22,834 25,230 28,183 30,875 31,967 33,085 34,242 35,438

SG&A / Revenue 7.80% 7.80% 7.80% 7.80% 7.80% 7.80% 7.80% 7.80% 7.80% 7.80%

Working Capital Assumptions 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Days Sales Outstanding 47.6 47.6 47.6 47.6 47.6 47.6 47.6 47.6 47.6 47.6

Days Sales Inventory 37.6 37.6 37.6 37.6 37.6 37.6 37.6 37.6 37.6 37.6