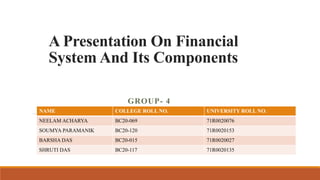

A Presentation On Financial System And Its Components soma.pptx

- 1. A Presentation On Financial System And Its Components GROUP- 4 NAME COLLEGE ROLL NO. UNIVERSITY ROLL NO. NEELAM ACHARYA BC20-069 71R0020076 SOUMYA PARAMANIK BC20-120 71R0020153 BARSHA DAS BC20-015 71R0020027 SHRUTI DAS BC20-117 71R0020135

- 2. INTRODUCTION • A financial system plays a vital role in the economic growth of a country. When the system functions properly, it channelizes funds from savers to investors. By increasing productivity. • Financial system is a concept derived from the wide concept of finance. • The financial system is a system that allows the transfer of money between savers and investors. • It plays an important role in global, national, regional, institutional and individual areas Financial system Financial market Financial institutions Financial instruments Financial service

- 3. MEANING Financial system refers to all the securities, intermediaries and markets that exist to make transfers from savers to borrowers possible .It includes households, corporate sectors, market and governments. financial system is related with three terms: Money, Credit and Finance. Financial system money finance credit MONEY • Medium of exchange or means of payments CREDIT • Sum of money to be refunded with interest FINANCE • Refers to monetary resources including ownership securities and debts

- 4. Functions of Financial System •Mobilization of savings/ Link between savers and investors •Capital Formation •Selection of Projects •Payment Mechanism: •Transfer of Resources/resources allocation •Minimizing the Risk/ Risk management •Reducing the Cost of Transactions

- 5. Types of Financial System • Formal (organized) financial system: This is also known as organized financial system because it comes under the purview of Ministry of Finance (MOF), Reserve Bank of India (RBI), Securities Exchange Board of India (SEBI), and regulatory bodies • The informal financial system consists of individual money lenders, groups of persons operating as associations, partnership firms consisting of local brokers’ pawn brokers and non-banking financial intermediaries such as finance, investment and chit fund companies. These people have a system and they have their own rules on how they should function in their day-to-day activities. Formal financial system Financial institutions Financial instruments Financial services Financial market

- 6. Components of Indian financial system

- 7. Financial Institutions • Meaning: Financial Institutions are business organizations serving as a link between savers and investors and so help in the credit allocation process. • The financial institutions are classified into term lending institutions, refinance institutions, investment institutions and state level institutions. These are also to be classified into banking and non-banking institutions. • Non- banking institutions The examples of non banking institutions are as under: a. Mutual funds b. Provident and pension funds c. Small savings Organizations d. Life insurance corporation (LIC) Banking institutions Commercial bank Cooperative bank Regional rural bank Foreign bank

- 8. Financial markets • Financial markets refers to any market place where buyers and sellers participate in trading of assets such as shares , bonds , currencies and other financial instruments. • Financial markets are essential players in the economic Development of the nation . They function as facilitating originations in the savings-investment process and act as an effective part of a financial system. • Types of financial markets :- Financial market Capital market Primary market Secondary market Money market

- 9. Financial instruments / assets • In any financial transaction, these should be a creation or transfer of financial asset. Hence, the basic product of any financial system is the financial asset. A financial asset is one which is used for production or consumption or for further creation of assets. • Financial assets are defined as “an asset that derives value because of contractual claim”. Characteristics of financial instruments 1. Liquidity 2. Marketing 3. Collateral value 4. Transferability Classification of financial instruments Term financial instruments Short term Medium term Long term Type based security primary secondary innovative

- 10. Financial services • “Financial Services can be defined as the products and services offered by institutions like banks of various kinds for the facilitation of various financial transactions and other related activities in the world of financial like loans, insurance, credit cards, investment opportunities and money management as well as providing information on the stock market and other issues like market trends.” Classifications of financial services leasing factoring Bills discounting loan Fund based services Portfolio management Loan syndication Corporate counselling Foreign collaboration Fee based services

- 11. Important Types of Financial Services A. Banking services :- • Keeping money safe while allowing withdrawals when needed • Provide overdraft agreements . • Issuance of cheque books . • Provide wealth management and tax planning services. B.Foreign exchange services :- • Currency exchange • Wire transfer • Foreign currency banking