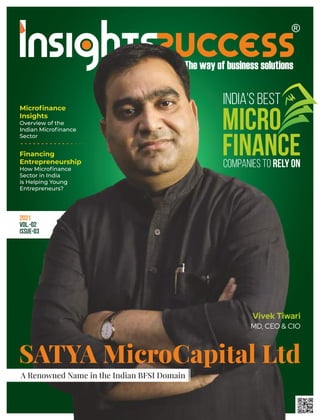

India's best micro finance companies to rely on..

- 1. 2021 VOL.-02 ISSUE-03 Microfinance Insights Overview of the Indian Microfinance Sector Financing Entrepreneurship How Microfinance Sector in India is Helping Young Entrepreneurs? INDIA'S BEST MICRO FINANCE COMPANIES TO RELY ON A Renowned Name in the Indian BFSI Domain Vivek Tiwari MD, CEO & CIO

- 4. Editor’s Note hat holds you back from achieving your goals is Woften poor finances. Without proper finance, you can’t take your plans into action, grow your business or start a new one. And when a huge group faces a financial crisis holding them back from coming out of a poverty line it affects the nation’s economy as a whole. What would be your action in such a case? When you lack finances to achieve your goals, you opt for a loan from financial institutions. Post-independence when India was fighting a huge battle with poverty, Microfinancing in the 1980s brought a ray of hope to empower the citizens below the poverty line. Self- Employed Women’s Association (SEWA) in Gujarat became the first initiative in the microfinance sector which formed SEWA bank in 1974. Since its inception, the bank has been helping women and small business owners on rural grounds by providing credit to help grow their businesses. Since then, individuals and families in rural and urban India have been taking the benefit of small loans to provide the necessary support to grow their businesses and support families. The major USP that sets the Microfinance Institutions (MFIs) apart from formal financial institutions is accessibility. MFIs provide loans to the low-income fraction helping them establish better financial stability and help small-scale businesses flourish. In a country with a 1.3 billion population where one-third population relies on the agriculture sector and related jobs, SILVER LINING OF THE MICROFINANCE SECTOR “Your problem is to bridge the gap which exists between where you are now and the goal you intend to reach.” – Earl Nightingale, American author, and radio speaker.

- 5. the microfinance sector has been among the game-changers to strengthen the Indian economy. To those who face difficulty in accessing formal financial banking services, Microfinance Institutions (MFIs) in India have been a major financial help to bridge the gap between their needs and savings. So, what is the current scenario of the microfinance sector? How has it survived the recent crisis when some of the major financial institutes had to fold as an aftereffect of the COVID-19 pandemic? The answer recites in the bottom line of the pyramid – microfinance consumers who by being consistent with the loan repayments have formed a strong backbone of the microfinance sector. The government has also played its part by running poverty alleviation programs from time to time. The microfinance sector, as we see it today, is going strong by extending its loan disbursement services to more rural parts of India. Today, MFIs are providing financial support to small-scale businesses as well as the self-employed who do not have convenient access to major financial and banking services. All the micro-financial institutes today either run as NGOs registered under trusts or societies or as Non-financial Banking Companies. (NBFCs). Despite the impressive growth Microfinance institutes face major challenges such as financial illiteracy, the major section still being unbanked, insufficient funds, and high- interest rate. However, amid all the challenges and just waking from the COVID-19 crisis the best microfinance companies are playing a key role in finding a silver lining of the microfinance sector in India. The latest issue of Insights Success, “India's Best Micro Finance Companies to Rely On” feature a few of the flourishing microfinance companies that not only help the consumers survive but have been empathetic and strong support throughout the pandemic to their consumers when the panic of losing income and missing loan repayment deadlines was high. This issue will highlight some of the major names in the microfinance sector who are marching towards financial inclusivity with their allied financial services and extended loan disbursement to the poor and unemployed. So just sit back and relax while flipping through the pages of this latest issue of Insights Success. You might stumble across some of the articles created by our in-house writers. Read away! Darshan Parmar Managing Editor DarsHP darshan@insightssuccess.com

- 6. Eduvanz Financing Empowering Learners with Innovative Education Loans Inditrade Capital Ltd Empowering Lives through Impeccable Finance Solutions UPMA Uplifting Rural and Semi-urban Localities by Enabling Microfinance Satin Creditcare Driving Financial Inclusion Financial Planning Insights Major Factors of Financial Planning for Business and Personal Growth 28 CXO 24 18 36 40 Microfinance Exclusive

- 7. COVER STORY CO NT EN TS Articles 22 Financing Entrepreneurship How is the Microfinancing Sector in India Helping Young Entrepreneurs? 32 Microfinance Insights Overview of the Indian Micro Finance Sector SATYA MicroCapital Ltd A Renowned Name in the Indian BFSI Domain 10

- 9. Management Brief Company Name Inditrade Capital Ltd Kadambelil Paul Thomas Managing Director and CEO Satya Microcapital Ltd Rakesh Kumar CEO Asirvad Microfinance Limited ESAF Microfinance and Investments (P) Ltd Satin Creditcare Eduvanz Financing Private Limited Ujjivan FinancialServices Pvt Ltd Asirvad Microfinance Limited is an NBFC promoted by IIT & IIM alumni Mr. S V Raja Vaidyanathan and his family since 2007. Eduvanz financially empowers learners with innovative education loans. ESAF Small Finance Bank (ESAF SFB) the new age social bank continues to redefine the banking experience to all the stakeholders. Inditrade Capital, is a digitally-driven lender that seeks to leverage technology to serve the financially under-served and marginalized. Light Microfinance is a Non-Banking Finance Company registered with the Reserve Bank Of India. Satin Creditcare offers a diversified suite of products to serve the under-privileged segments of the society. Satya Microcapital offers microloans from 10k to 200k rupees to the unbanked and underserved section of the society at the bottom of the pyramid in the rural and the marginalized belt of the country. Ujjivan Small Finance Bank (USFB) Limited is among the leading small finance banks in the country. Light Microfinance HP Singh Managing Director Nitin Chugh CEO and Managing Director Vivek Tiwari Managing Director UPMA UPMA is the association of Microfinance Institutions operating in the State of Uttar Pradesh. Sudhir Sinha Project Manager V P Nandakumar Managing Director and CEO Varun Chopra Founder and CEO Sudip Bandyopadhyay Chairman FINANCECompanies TO RELY ON INDIA'S BEST MICRO

- 10. Copyright © 2021 Insights Success Media and Technology Pvt. Ltd., All rights reserved. The content and images used in this magazine should not be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior permission from Insights Success Media and Technology Pvt. Ltd. Reprint rights remain solely with Insights Success. Printed and Published by Insights Success Media and Technology Pvt. Ltd. Follow us on : www.facebook.com/insightssuccess/ https://twitter.com/insightssuccess Cover Price : RS. 150/- RNI NUMBER: MAHENG/2018/75953 Editor-in-Chief Sumita Sarkar Managing Editor Darshan Parmar Assisting Editor Ananda Das Contributing Writer Vrushali Rakhunde Chief Designer Asha Bange Designing Head Priyanka Rajage Co-designers Deepanjali , Vivek Operations Head Megha Mishra Business Development Manager Nandan Deshpande Asst. Manager Ashwini Pahurkar Business Development Lead Tejswini Whaval Business Development Executive Kirti Vidhate Technical Head Pratiksha Patil Technical Specialist Amar Sawant Digital Marketing Manager Amol Wadekar SME-SMO Executive Atul Dhoran Circulation Manager Tanaji Insights Success Media Tech LLC 555 Metro Place North, Suite 100, Dublin, OH 43017, United States Phone - (614)-602-1754 Email: info@insightssuccess.com For Subscription: www.insightssuccess.com Insights Success Media and Technology Pvt. Ltd. Off. No. 22 & 510, Rainbow Plaza, Shivar Chowk, Pimple Saudagar, Pune, Maharashtra 411017 Phone - India: +91 7410079881/ 82/ 83/ 84/ 85 Email: info@insightssuccess.in For Subscription: www.insightssuccess.in Corporate Offices: sales@insightssuccess.com FEBRUARY, 2021 We are also available on

- 12. A Renowned Name in the Indian BFSI Domain COVER STORY Our vision is to be a catalyst for the socio-economic upliftment of five million households by the year 2025. India's Best Micro Finance Companies to Rely On

- 13. Vivek Tiwari MD, CEO & CIO

- 14. The advent of technology has maximized the speed of information flow and capital, automated transactions, controlled and data analytics, improved customer experience, reduced transactional costs, and increased efficiency and customer outreach. The growth of digitalization has led to the influx of tremendous amount of knowledge about the customer base. It has also enhanced the transparency quotient within the external and internal audience of many organizations. One such company having the similar attributes is SATYA MicroCapital Ltd. Intimacy is also being fostered and its team is also in a state to learn about the company’s potential customers based on data gathered via operational workflow. This landscape has enabled SATYA to be innovative using new ways to reach out and engage with its customers along with providing perks like increased pace of work, and the team is also in a state to quickly access the knowledge base. “Therefore, it has led us to believe that technology is having a profound and intense impact on our operations,” says the team of SATYA MicroCapital. The foundation of SATYA was laid in October 2016, which was followed by the unprecedented arrival of demonetization. “Despite this we powered through and commenced our operations on January 1, 2017,” conveys Vivek Tiwari, MD, CEO & CIO of SATYA MicroCapital. This enabled people to have doubts on SATYA - the recently established microfinance institution, which was a new entry in the Indian MFI space, back then. It was one of the most challenging times endured by the organization when its only aim was to get grounded into the industrial ecosystem. With undying dynamism and compassion, team SATYA maintained their calm and dedicatedly affixed the name of the organization in BFSI terrain. There was a time when reputed investors did not place their interest in the company as it was new in the marketplace. The initial investments made in the company was done by accumulating savings of 18 employees who joined SATYA in its early phase. By sheer demonstration of the fact that unsecured lending to honest and trustworthy micro entrepreneurs is still Our mission is to be a preferred choice for the people at bottom of pyramid in creation of their enterprise and livelihood through holistic approach.

- 15. fruitful, SATYA has revitalized the confidence of lenders and investors back in the sector. Having a goal of creating a difference in the livelihoods of destitute via lending of 30k – 40k rupees, SATYA has expanded its terrestrial presence in more than 152 districts of 21 states catering to more than five lakh households in its operational journey of four years. Dynamic Offerings SATYA offers microloans from 10k to 200k rupees to the unbanked and underserved section of the society at the bottom of the pyramid in the rural and the marginalized belt of the country, based on a strong credit assessment and a centralized approval system on a self-sustainable and a commercial viability model. The product offerings encapsulate multifarious microloans ranging from SME Lending, Emergency Loan, Health Insurance with 24 x 7 Doctor-on-Call Facility to Hospicash, and Micro Business Loan Products. SATYA caters to those who seek credit help in the several focus sectors for their income generation and income growth purpose such as agriculture, animal husbandry, business/trade, production/services, and for water sanitation purposes. SATYA, despite being in a cash-heavy microfinance industry, revived back on growth track after the infamous demonetization was announced by the government in November 2016. Since then, the company has witnessed a lot of emerging and disrupting trends. Digitalization, cashless transactions, adaptation of technology in MFI space, timely advancement of industry product mix and improvised loan underwriting are to name a few. COVID-19 and liquidity crunch are the latest add-ons in the list of challenges. However, with slew of measures announced by the central government in support of NBFC - MFIs and resilience portrayed by the sector since time immemorial, a pavement of hope is making its way to further opportunities and growth. Amidst this crisis, the company has ensured that prime importance is given to the health of not only its clients and employees but their family members as The fundamental aim of providing microfinance services is to alleviate poverty and elevate the life state of underserved people via making them financially independent.

- 16. Vivek Tiwari was born in a middle-class family in Sultanpur, Uttar Pradesh. At the age of nine years, he got enrolled in Navodaya Vidyalaya which was built under the New Education Policy in 1986, whose ethos and values has helped shape his personality today. He imbibed the learnings and values of self-sufficiency, independence post senior secondary during hostel life. It was this early time in his life, when Vivek inculcated a balance between his emotional and practical approach. The roots of prodigious leadership were also within family genes which he received as a gift from his grandfather. He holds a postgraduate diploma in Rural Development and Management from the Institute of Engineering and Rural Technology, Allahabad. Vivek has fundamentally contributed to the microfinance sector since formative years. He is attributed for the geographical shift of microfinance from South India to North India and for accelerating the growth and scale of MFIs in Northern parts of India. Before laying the foundation of SATYA, Vivek ardently worked in the development sector for more than 15 years with expertise in microfinance and lending portfolio of more than 10,000 crores. He worked with Gujarat-based, Vardan Microfinance where he initiated operations based on the Grameen Model and trained and developed workforce at middle level management. He has also worked with CASHPOR Micro Credit. He also actively worked in certain developmental projects supported by UNICEF and NABARD. Subsequently, he worked with Satin Creditcare Network Ltd (SCNL) as Chief Operating Officer (COO) for more than eight years. Pioneering Banking Correspondent Lending for banks, he has successfully implemented the WSHG (Women Self Help Group) and National Rural Livelihood Mission (NRLM). Vivek has also been felicitated with the BFSI Leadership Award as well as Bharat Jyoti Award by India International Friendship Society. Recently, he was bestowed with Most Promising Business Leaders of Asia Award by Economic Times at the 5th Edition of Asian Business Leaders Conclave 2020. He is also a certified professional of Concentration in Management Program from Boulder Microfinance Training, Italy. Vivek was appointed as the Managing Director of SATYA, with the responsibility of spearheading the Company’s strategic efforts and driving its expansion in the field of microfinance. He has more than two decades of experience in the development sector. His proficiency outlines extreme focus on the innovative deployment of technological framework for incubating responsible lending, financial inclusion, social entrepreneurship, and impact investing within national boundaries. Vivek Tiwari has driven SATYA with complete digitization driven innovative business processes like Digital Repayment Collections and Disbursements becoming a market leader by commencing cashless INR 500 crore collections for the very first time in the industry. A Man with Great Ethos Vivek Tiwari MD, CEO & CIO SATYA MicroCapital Ltd. Vivek was felicitated in an event organized by The Economic Times, Asian Business Leaders Conclave 2020 as one of the Most Promising Business Leaders of Asia.

- 17. well. “We initiated a free of cost Digital OPD to address their medical concerns and provide ease of access to experienced medical professionals,” states Vivek. Since early March, the company has floated the ‘Work-From-Home’ policy and even continues to provide flexible roster plans wherever possible. “Even as our field officers visit the clients and go about their daily operations, we ensure that all preventive measures are strictly adhered to,” says Vivek. SATYA has equipped its 2,000+ staff across the country with health kits (including gloves, face masks, sanitizers, immunity boosting homeopathy medicines, etc.) For the ones who unfortunately contracted this disease, the company has specially curated a Health Insurance Plan- ‘COVID CARE’ to help with their medical and other related expenses. SATYA’s team has continually disseminated government authorized information about this pandemic and ensured that a good follow-up has been maintained not only with the employees but with its clients as well through the SATYA Client Connect App. Proper training and skill-building techniques are continued to be imparted either through physical or virtual means. “We have even modified and created loan products according to the needs and demands of our clients keeping in mind the challenges faced during this crisis time,” shares Vivek. In future, SATYA will successfully expand its presence across PAN India. It will actively operate across the nation, thereby more aggressively providing dynamic services to a wider section of people. The microfinance industry is on the cusp of a digital transformation right now and SATYA is moving towards the same in a vigorous manner and is well on its way to quickly emerge as a ‘Fintech Company’. Despite the pandemic scare around and a severe dent in the national economy, the efforts of our team have remained robust.

- 18. Subscribe Today CORPORATE OFFICE Insights Success Media and Technology Pvt. Ltd. Off No. 22 & 510, Rainbow Plaza, Shivar Chowk, Pimple Saudagar, Pune, Maharashtra 411017. Phone - India: 020- 7410079881/ 82/ 83/ 84/ 85 USA: 302-319-9947 Email: info@insightssuccess.in For Subscription : www.insightssuccess.in Cheque should be drawn in favour of : INSIGHTS SUCCESS MEDIA AND TECH PVT. LTD. Stay in touch. Subscribe to Insightssuccess Get Insightssuccess Magazine in print, & digital on www.insightssuccess.in www.insightssuccess.in

- 20. Empowering Learners with Innovative Education Loans Technology and education have always maintained a synergy from the start. Sharing of knowledge and the gathering of information is integral to education and facilitation of which is made crucial by technology. Hence, their dynamics are quite complex. Yet, if derived and leveraged properly, it can create wonders in the field of learning and development process of the people. There is one such company working with a similar approach to bring education and technology to everyone’s attention and striving to make a difference, which is Eduvanz. The company is on a mission to make education and skilling universally accessible by providing easy, transparent, and speedy financial assistance to learners using an innovative technology solution. The Mumbai-based fintech, Eduvanz, founded in 2016 by Varun Chopra (IIT Madras) and Raheel Shah (IIM Ahmedabad), has helped thousands of learners with its Study Now and Pay Later loans across Universities, Edtechs, Skilling Academies, Certifications, Schools and Test prep centers. Varun Chopra acts as the CEO while Raheel Shah is the Chief Business Officer who looks at the alliances and partnerships. Both the cofounders bring in more than 15 years of experience each across functions and roles including Investment banking, consulting, and outsourcing industries. In an interview with Insights Success, Varun and Raheel share the journey of Eduvanz in facilitating access to education to all learners by providing innovative education loans. Below are the highlights of the interview between Founders of Eduvanz and Insights Success: Enlighten us with the journey of your company so far. Eduvanz financially empowers Learners with innovative education loans. As a new-age fintech NBFC dedicated exclusively to the Education industry, Eduvanz has introduced student-friendly loans starting from 0% interest rates, flexible tenures, fast turnaround time, and full transparency on loan decisions. Before starting up Eduvanz, we founded CurrEQlum in 2015-2016. CEO VARUN CHOPRA www.insightssuccess.in 18| FEB 2021

- 21. CurrEQlum was founded to impart life skills in classrooms across India using games, props and analytics. Their first start-up helped them understand the market better and paved the way for Eduvanz. As of date, we have given >25,000 Loans, >300 Crs disbursal. During the pandemic, the number of unique customers has grown 4x, with monthly disbursals growing by ~3x. Investments/Grants in the company/organization with names of investors/donors. Raised $5 million in a Series A round led by venture capital firm Sequoia Capital India. Secured $2 million from social-impact investment firm Unitus Ventures and Michael and Susan Dell Foundation in a pre-series A round. Give a detailed summary of the key personality(s) life before and after their entry into the microfinance space . Right from the start, we were motivated by the opportunity to generate measurable social impact, create meaningful financial returns, and build sustainable ecosystems. While working on our previous venture - CurrEQlum, we interacted with hundreds of parents across India regularly. During this time, we discovered a problem commonly faced “ Ed a provide low c , smar loan t financ skil base educationa training t learner by a majority of Parents - the unavailability of easy, fast, and affordable financial assistance for paying the school fees or tuition fees. The problem was more acute for families looking to enroll their children in new programs such as job-oriented vocational training courses as well as coaching classes or test prep classes. Banks are too focused on larger ticket loans associated with Higher Education to create meaningful solutions for this segment. In addition to this, their lending criteria tends to marginalize first-time borrowers and cash earning families and does not recognize the thousands of training institutes and new-age online institutes across India. The problem is further magnified across Tier 1/2/3 cities. In such scenarios, Banks either decline the business, or charge very high-interest rates - resulting in discontinued education, underutilized infrastructure, and lost opportunities. Thus, we realized there exists a big opportunity for Eduvanz that nobody else was working Chief Business O cer RAHEEL SHAH “ www.insightssuccess.in FEB 2021 | 19 India's Best Micro Finance Companies to Rely On

- 22. upon. We spent months on research including interviews with parents, institutes, recruiters, and students. We realized that a new lending entity needed to be built - one that gets all the stakeholders (parents, students, institutes, etc) on the same platform and ensures that each stakeholder is held accountable for its role. By doing so, Eduvanz was able to build loan solutions that addressed the concerns of each stakeholder – thus, learners could leverage fast, cheap, and flexible financial loans from Eduvanz for learning career- building skills. Kindly talk about the exclusive products and services offered by your company. Eduvanz was formed with a vision to facilitate quality education across all learning requirements from K-12 to higher education. It was set up to fill up the gap considering the huge demand for loans that enable learners to Study/Learn Now and Pay Later. Eduvanz enables students to study now, pay later in easy pocket-friendly monthly installments at 0% interest rates. The aim is to unlock the potential of individuals and become the preferred option for all education financing requirements. The mission is to empower students to pursue an education of their choice and enable them to make informed decisions by providing free financial resources and unbiased advice. - Skill-based loan: Our focus has been on Skill Based . Programs. Thus, we have developed a strong competency in this segment to deliver high returns for Institutes. - Possible Interest-Free EMIs: Customized Loan Products with the possibility of Interest-Free/Low-Cost EMIs. - Faster Decision: Decision within hours of receiving the documents. - Tech-Driven Product with detailed dashboards to drive sales for institutes. Eduvanz has integrated its technology with the educational institutes or platforms to have a smooth process of loan sanctions just via a few clicks, without the need of submitting physical documents. This integration of educational institutions and financial lenders benefits the end consumer, with low/no-cost financing help on the go on a real-time basis which differentiates it from other lenders. Eduvanz is looking to replace the middle counselor and from merely acting as a financial lender, be capable to guide the student to the best institute along with placement capabilities. The interest directly comes from the institutes and not the borrowers, the technological integration ensures the performance of the students is being tracked and the installments are being paid on time. What is in the pipeline: - We are in the process of launching a credit card product. - We are building India’s first virtual counselor where students will be suggested the course and institutes basis their skill set and the aspiration. How the technological advancements and innovation in the microfinance space has impacted/enhanced the business of your company? Technology platforms being used by Eduvanz: We use proprietary artificial intelligence (AI) based algorithms and predictive analytics to provide loans based on the future employability of learners. Using the mobile app, end-to-end processing from Loan Application to Credit Assessment to Disbursal happens completely online in a matter of a few hours. What does the future look like for your company in terms of growth and expansion? The end goal is to enable the learners to access quality education and motivate them to pursue the institute of their choice. From being an alternative financing lender, Eduvanz aims to become the go-to financing solution for learners across all the sectors starting from K-12 to up- skilling/skilling, UG/PG, and Test preparation. How is the microfinance business faring in this ongoing pandemic? As one of the prominent microfinance enablers, what steps have you taken towards tackling this challenge all the while safeguarding your employees and taking care of your clientele’s needs? Digital finance has witnessed an expansion in the sector despite the devastating impact of the Covid-19 pandemic on the country’s economy. While the pandemic has accelerated the acceptance and adoption of digital financing as compared to pre-pandemic but the fine line between fintech and banks is slowly blurring. With the technological advancements and with digitization there has been a significant demand towards upskilling and skilling courses which is where we too have witnessed the rise in demand. www.insightssuccess.in 20| FEB 2021

- 24. How is the FINANCING Sector in India Helping Young ENTREPRENEURS MICR ? www.insightssuccess.in 22| FEB 2021

- 25. icrofinance, also known as microcredit, is a way Mof providing small businesses and entrepreneurs credit to pursue with their ventures. Small businesses and young entrepreneurs often do not have access to financial resources from major institutions. Accordingly, they have a tough time accessing loans, insurance, and investments, which will help them prosper in their business. This is where microfinancing institutions come into play. They provide loans, credit, money transfer, and so on to young business owners and entrepreneurs. The Structure of Microfinancing Microfinancing helps young entrepreneurs to start their own business and to march towards financial independence. A borrower can avail of this type of loan if they do not have any collateral. However, owing to high interest rates, these loans come with the risk of default. Microfinancing encompasses microloans, micro-savings, and microinsurance. This helps young businessowners to start their business effectively. Individuals residing in underdeveloped countries or who could not otherwise avail a traditional loan can opt for microfinance. Microfinancing also provides the option of micro-savings accounts. Accordingly, entrepreneurs can open a savings account without any minimum balance. They can also avail of insurance at a lower rate, and with lesser premiums. The Importance of Financial Literacy Individuals interested in opting for microloans need to have basic information regarding aspects such as book-keeping, cash flow management, and so on. Access to cell phones and wireless internet has also provided further advantage. Now, potential borrowers can gather information through cell phones and use them to carry out financial transactions. Microfinancing is Essential Microfinance provides entrepreneurs with the resources and capital to proceed with their business. Without microfinance, they may have to go for loans or payday advances with very high interest rates. Alternately, they may have to bother their friends and family for financial assistance. With the aid of microfinancing tools, they can easily invest in their business, or spend to make their own lives better. Who Benefits from Microfinancing? Entrepreneurs from low-income background, self-employed and household-based entrepreneurs can reap the benefits of the microfinancing services provided by financial institutions. In rural areas, small farmers and people involved in small income-generating activities can apply for microfinance. In urban areas, microfinance activities surround shopkeepers, service providers, street vendors, and so on. Poor and non-poor people with relatively stable source of income can apply for loans. How Efficiency is Microfinancing Many experts have lauded microfinance as the key towards ending the cycle of poverty, decreasing unemployment, increasing earning power, and aiding the financially disadvantaged. However, there are many others, who believe that it has lost its mission and may not work as well as it should. Some people argue that many borrowers sometimes use microloans to pay for their necessities, or sometimes even their business fails. This, in turn, puts them into further debt. For example, as per data, 94% of all microfinance loans in South Africa are used by people to pay for their necessities. This proves that the borrowers are using the loan not to invest in any new business, but to pay off a previous loan. This eventually leads to more debt. However, there are many experts who believe that if microfinance tools are used properly, they can work wonders for the financially underserved entrepreneurs, who want to achieve tremendous success in their venture. The industry’s high repayment rates act as a proof of the effectiveness of these loans. Hence, microfinance is a very important topic in the field of finance. If it is implemented properly, microfinance can be very beneficial for young entrepreneurs to excel in their dream business. - Ananda Kamal Das FINANCING ENTREPRENEURSHIP www.insightssuccess.in FEB 2021 | 23

- 26. ith the vision to touch the lives of millions Wthrough impact financing, Inditrade Capital commenced its micro finance operations in April 2017 in Maharashtra, through its wholly-owned subsidiary, Inditrade Microfinance Ltd. In the following interview, Mr Sudip Bandyopadhyay, the Group Chairman, shares valuable insights into the company’s continuous success in the microfinancing space, and also how Inditrade Capital Group of Companies is poised for better market opportunities in 2021. Below are the highlights of the interview: What is the vision and mission of your company? When we offer credit to our customers, who represent the bottom of India’s enterprise pyramid, we not only seek to augment financial inclusion of those who have been hitherto bypassed or underserved by the formal financial sector but hope to spark progress all along the ecosystem that they form a part of. As our borrowers and their families experience economic and social progress, their advancement has a multiplier effect on backward and forward linked enterprises, as well as the communities they live in. Our aspirations for our borrowers go beyond mere financial stability. We envision supporting them as they expand from micro to small and then scale-up to medium and eventually large enterprises that create immense value for our nation. Kindly talk about the exclusive products and services offered by your company. Our micro-finance lending offers five unique products – Ujwal, our income generation loan to new customer; Sulabh – a consumption loan for home and business appliances; Vikas – a top up loan available to the existing customers; Shiksha – an education loan for family upbringing and Pragati – a 2nd cycle income generation loan for existing customers with good track record. What kind of challenges has the company and its team faced being in the micro finance business? Being a segment that requires the right blend of people skills and conversancy with technology, our largest challenge has been to attract right talent, train and retain them. On account of the ongoing crisis, currently, ensuring liquidity has been posing a challenge too. As one of the prominent micro finance enablers, what steps have you taken towards tackling the COVID-19 pandemic, all the while safeguarding your employees and taking care of your clientele’s needs? As directed by the Government, initially (March to May) we offered moratorium to all customers who approached us with requests for the same. However, effective June 2020 onwards, we began to give the moratorium facility on the basis of merit/performance of the customer. This approach was followed so that we could use our funds to meet non- moratorium demand as well. After poor collections in April and May 2020, finally we saw an overall recovery rate of 53% in June-2020. More importantly, we were glad to see a very positive response from customers, who showed intentions to repay although they were saving money for uncertainties that arose during the lockdowns. We now look forward to supporting our clients by disbursing top-up loans that can help them expand and sustain their businesses, which will, in turn, generate cash flows, which could drive repayments. We have ensured that all our lenders are paid their June EMI 100%. The repayment has been based on mutually agreed moratorium given in writing by all lenders. Today Empowering Lives through Impeccable Finance Solutions Inditrade Capital Ltd. 24| FEB 2021 www.insightssuccess.in

- 27. Sudip Bandyopadhyay Group Chairman Inditrade Capital strives to touch the lives of millions through impact financing” “ ABOUT THE LEADER Recognized by the International Who’s Who, Sudip Bandyopadhyay, the Group Chairman, is a Chartered Accountant and Cost Accountant with more than three decades of experience in various areas of finance and financial services. He has been part of various large conglomerates such as Hindustan Unilever, ITC, and Reliance amongst others. It is Sudip’s long term vision to ensure Inditrade is an active participant in nation building. He firmly believes that Inditrade is today at a stage where it can take a quantum leap by pioneering change in the Agri lending and micro lending space, while building on its strength in the personal finance domain, in a substantial and sustained manner. Sudip sits on the Boards of a number of listed and unlisted domestic companies and is also an investor in many Fintech and other Technology related ventures. Sudip also has regular presence in electronic and print media. India's Best Micro Finance Companies to Rely On www.insightssuccess.in FEB 2021 | 25

- 28. we are self-sufficient to the extent of paying all our dues both on book and off book, meet salaries and other administrative expenses out of collections. All our offices were generally closed during April and May and employees were enabled to work from home. To facilitate them, we • provided laptops for critical operating staff so that they could carry out critical tasks. • provided VPN connectivity to employees as required. • managed the attendance sign in and sign out through iBoss across all teams. • Hand-held employees for video-calls on Skype/zoom for regular monitoring and reporting. • Conducted board meetings over video conferencing. We opened all our branches (171) and were happy to witness more than 85% attendance from end May 2020. Our corporate offices in Mumbai opened on June 8. Before opening the offices, we ensured that all of them were sanitized thoroughly. We provided sanitizers/masks for all the staff who attended. We also made arrangements for Cogun for all our employees, to enable them to open doors and use elevators without contact. We put in place stringent SOP for all our offices: • Temperature check before entering office. • Rotational schedules • Staggered sitting • Restricted numbers in offices, meeting rooms, pantry • Sanitizing couriers received • Restriction on printing, travel, etc. • Placement of sanitizers as required. • Masks mandatory while at workplace Some additional ongoing measures that we adopted were: • Bus facility has been started in Mumbai on all three lines – Western, Central and Harbour to facilitate employee transport. • Pick-up and drop every day. The past few months have been a difficult time for all and Inditrade has tried to respond, in real time, with compassion and practicality. We have successfully worked around the challenges that we faced and look forward to carrying forward our mission with as much determination in the new normal. We also set up a COVID-19 Benefit Insurance plan, which was in addition to the regular health plan. All employees were covered under the special COVID-19 benefit plan up to an amount of INR 1 lakh. The benefit would be provided to the employee on the unfortunate condition when he tests positive for COVID-19 and required to undergo hospitalization for a period of 24 hrs. What does the future look like for your company in terms of growth and expansion? Our main focus is on impact financing. We have been very clear from day one that we would not be chasing numbers. Operational excellence with a human touch has always been our goal. We see this as the game-changer for a long-term standing in the MFI space. It’s also about how we can uplift our clients socially and economically, while finally satisfying our investors, of course. www.insightssuccess.in 26| FEB 2021

- 30. Major Factors of Financial Planning for Business and Personal Growth You cannot over-emphasize the importance of financial planning. When it is done right, it can give a boost to your personal and professional life and make everything simple and convenient. However, whether or not financial planning pays off depends a lot upon several factors. Except for a few factors that overlap, the factors affecting financial planning are different for business and personal life. Let us take a look at them separately. Factors affecting business financial planning Sales forecasting As a business owner, you should estimate your sales revenue for every month, quarter, and year. By doing so, you will have a blueprint of your progress and you will be able to develop better marketing strategies to achieve your sales targets. Knowing your expenses Your business expenses can be divided into three categories: Ÿ Regular Expenses Ÿ Expected Expenses Ÿ Associated Expenses Regular expenses include current ongoing costs such as the costs of rent, utilities, and employee salaries. They may also include the cost incurred to conduct conferences and office parties etc. Expected expenses include future costs like tax hikes, increase in the minimum wage, cost incurred during maintenance and repairs, etc. Associated expenses are the estimated costs of various initiatives that a business undertakes to fuel its growth. For instance, costs incurred while training and hiring recruits come under associated expenses. Knowing your assets and liabilities Knowing your assets and liabilities is vital for understanding the financial position of your business. By tracking them, you can maximize the potential value of your business. Startups and SMEs often tend to underestimate the importance of their assets and fail to properly account for outstanding bills. Finding the break-even point Break-even point refers to the point where the total sales have matched the total incurred by the business in the manufacturing of a certain product. By knowing where your break-even point is, you can effectively determine the best price for your product as well. Devising an operation plan If you want your business to run smoothly, you need to create an operational plan with as many details as possible. Try to imagine the core areas of your business that will be engaged the most and accurately estimate the expenses that will need to be made to achieve your targets. By having an operations plan, you will be in a better position to determine whether your business can be optimized with the introduction of new technology or whether the cost of implementing that technology will be too much to bear at your current level. Factors affecting personal financial planning Financial potential How fast can you achieve your financial targets depends on how much you have been able to save and how much you are willing to save. Your current financial potential plays a www.insightssuccess.in 28| FEB 2021

- 32. key role in setting up targets. Investments It is very important to choose the right investment options; otherwise, you might get into serious financial trouble. Research thoroughly before making any decision to ensure that your hard- earned money does not go to waste. Plan for emergencies A financial plan is incomplete unless you incorporate an emergency clause. As a rule of thumb, always create your financial plan by considering the worst-case scenario. The best way to deal with emergencies is to have insurance cover. Make sure you have good insurance policies to cover your liabilities. Accounting for dependents If you have people who depend on you financially, let’s say parents, spouse, children, or other family members, you need to account for them in your financial plan. Goals The first step is to identify your financial goals, and the second step is to prioritize them. Also make sure that you set time-bound, achievable targets. Setting up targets that are way too unrealistic will only work against you. Age Your age plays a major role in financial planning. When you are young (in your 20s) you can take bigger financial risks, but as you mature and become older, your capacity to take risks decreases, and your financial plan should reflect that. These are the factors that you should take into account for creating a solid financial plan that will save you from unnecessary stress and hassle. Ajay Kapur is the Chairman of the highly respected and valued organisa on, Shubham Group which comprises five companies, viz., Shubham Chemicals & Solvents Ltd., Divine Autotech Pvt. Ltd., Ansh Impex Pvt. Ltd., Sai Kripa Buildtech Pvt. Ltd., and Sainoor Automobiles Pvt. Ltd. Under the ardent leadership of Mr. Kapur, SCSL provides techno-commercial services to industries such as plywood and laminate, synthe c resins, footwear, FMCG, tex le, packaging, pharmaceu cal and many more. Mr. Kapur believes, “Des ny changes one future, but determina on may change one’s des ny, too.” In the last 28 years, SCSL is went through many challenges, but Mr. Kapur’s undaunted behaviour and courage helped SCSL to surpass every obstacle. Today, the organisa on is growing by leaps and bounds. His go-ge er a tude and trust in the team enabled SCSL as one of the best customer-centric organisa on in the country; an organisa on whose core philosophy lies on ethical business prac ces and transparency of opera ons. In the year 2006, Ajay Kapur joined Modern Public School as Chairman & Managing Director which was established in the year 1971 by his mother, Late Mrs. Malka Kapur. He is an alumnus of Delhi School of Economics and contributes a lot to educa onal ins tu ons in Delhi-NCR. He believes that there’s nothing more rewarding than giving back to society and making a difference in the lives of people. Due to his vision and commitment, the School has been listed in the Forbes magazine as one of the “Great Indian Schools of 2018”. Mr. Kapur wants to see posi ve changes in society, and that’s why he always helps young businesses and entrepreneurs. He is one of the directors and chief mentors at Risers Accelerator, a Delhi-based accelerator group to leverage start-ups. Being the pilot steward and key mentor, he is taking charge to educate and empower young entrepreneurs and their promising startups. Mr. Ajay Kapur is the recipient of the pres gious "Innova ve Business Leader of Asia" award for Excellence in Business Development at the th 16 South Asian Excellence Awards – 2018. Also, under his leadership, Shubham Group has won many awards for outstanding performance in different segments, including “Excellence Award for Achieving Highest Sales” in an award ceremony held at Kuala Lumpur. About the Author – Ajay Kapur, Founder and Managing Director of SCSL www.insightssuccess.in 30| FEB 2021

- 35. Overview of the INDIAN MICRO FINANCE Sector After pandemic, lockdown, and financial tussle, the year 2021 brought hope of starting new. While people moving forward with the new normal Indian economyisseeingasurgeofgrowth initswake. Microfinance sector is among the first to recover the post- COVID-19 pandemic. Be it the AP crisis, demonetization, or any other crisis, the microfinance sector has seen a common aftereffect – poor loan repayment. So how has the Microfinance Institutions (MFIs) survived all these crises? The answer is the bottom line of the pyramid – women customers and rural consumers who form a strong backbone of themicrofinancesectorinIndia. As the COVID-19 pandemic, just like any other sector, hit the microfinance sector hard, everything came to standstill when the whole country went into lockdown on March 25, 2020. Most borrowers lost their jobs. The country saw a painful trend of reverse migration of workers and labours right after the lockdown was imposed. The Coronavirus pandemic not only stopped the repayment activity completely, but the RBI’s regulation about providing a moratorium put the repayment process on pausetillAugust 2020. The Indian economy indeed went on the back foot due to the pandemic. But talking about the MFI sector, it has not only survived but bounced back with more strength after every crisis.And the same fate is to be followed with the COVID-19 crisis with the collective efforts of the customers, money lenders,andthegovernment. The MFI sector is already experiencing the changing dynamicspost-pandemiccrisis.Here’s how: RBI has announced a new regulatory framework for MFIs. This is the first time when the microfinance sector will be seeing any regulatory norms to harmonize the operations. To boost theIndianeconomyandestablishharmonyinthe www.insightssuccess.in FEB 2021 | 33

- 36. microfinance sector, the Reserve Bank of India (RBI) recently took major steps. RBI is now intervening with a framework that will apply to all the lenders in the microfinance sector. This includes commercial banks, small finance banks, and otherentities. Clear guidelines regarding the interest rate, lending norms, andotheroperationsareimposed. Digitizationistheway ahead. After the demonetization, the MFI sector saw another slowdown in repayment from its customers. Previously, the loan disbursement had been majorly taken in cash. After the dust of demonetization settled, people got more accustomed to digital payment.As a result, now most of the loan disburse- ment process happens through a cashless model. Post- COVID, digitization will be the reality of the microfinance sector. Not only the digital mode makes the repayment easy but providing more credit to the customers will be hassle-free throughtheonlineprocess. Highlevelofconnectionwith the customers. Strong connection with its customers has always been the USP of the microfinance sector. It’s the ground connect that helped MFI survive throughout the pandemic. While the customers were anxious amid financial struggles about missing the repayment deadline, the majority of lenders showed patienceandempathytowards customers. The companies asked their staff to connect with the customers over virtual meetings and phone calls. Not only the companies offered moratorium and digital mode of repayment, but they also counselled the borrowers about their safety and hygiene. This further strengthened the customer relationship and helpedlessenthepanicamongtheborrowers. Pent-up plans willberevived. The customers on the bottom line of the MFI sector are people who constantly juggle to bridge the gap between their financial needs and savings. Most of these customers borrow a loan to grow their small businesses to support their families. Most of them had plans to expand their businesses, maybe starting a new branch, expanding the space, relocating the business, buy machines and instruments, or invest in manage- ment and marketing. But due to lockdown, every plan came to anabrupthaltwaitingtoberevived. Post-lockdown, now that people are moving strongly to bring back the normalcy in their work and life, all the plans put on hold for about a year will be brought into action. People will need more credit to boost their business post-pandemic, in turn,boostingthemicrofinancesectorinIndia. Theruraleconomywillbe themajorboost. While the pandemic first hit urban India badly affecting the metro cities, towns, and suburbs, rural India was seemingly unaffected at the start with minimum to zero COVID cases in some areas. Even after the lockdown was imposed and the cities came to a halt, the rural economy was running with vegetables, grains, and dairy products allowed to be brought tothemarketas essentials. The rural economy, however, has been disproportionately affected by the pandemic. But the digital lending process has been a major help for the lenders to reach potential borrowers. Strong customer relations and information through local credit bureaus will be the game-changers to get more potential borrowers onruralgrounds. What nextinthe futureof themicrofinance sector? With a population of 1.3 billion and one-third population relying on agriculture and related jobs, the microfinance sector spans a wide space of the Indian economy. While there is a greater need for credit from the borrowers’side, the huge gapbetweendemandandsupplyremains. MFIs are facing the major challenges post-pandemic – higher non-performing assets and a major hurdle in providing hand- to-hand liquidity to the lending institutes and borrowers on theground. RBI has responded to these two problems by offering three months moratoria to the borrowers and providing liquidity to thelendinginstitutestohelpsurvivethepandemic. But to survive is not enough. For the MFIs to thrive post- COVID-crisis, the lending banks will have to provide liquidity to the intermediate MFIs for them and the end customers to get back to normalcy and repay the borrowed amount. In other words, it works both ways. Lenders must be easy and provide credit to the borrowers to help them bring back normalcy. And the borrowers must repay the credit once the dust of the COVID-19 pandemic settles.And together we will pull the Indian economy out of the dark if we focus on a ray of lightattheendofthetunnel. WrittenbyVrushaliRakhunde www.insightssuccess.in 34| FEB 2021

- 38. Amidst so much development happening around the world there are still some sections of society that are under-privileged. To be financially empowered is the most fundamental progress in any area of life. Satin Creditcare offers a diversified suite of products to serve the under-privileged segments of the society. It constantly strives to empower and promote its customers through its diverse range of financial products and services. Mr. HP Singh is the Chairman and Managing Director of Satin Creditcare Network Limited. Mr. Singh started Satin Creditcare Network Limited (SCNL) in 1990. Thirty years later, SCNL has become one of the leading microfinance companies in the country with operations spanning 23 states and union territories across India. Today, SCNL stands tall as a differentiated market leader. This differential approach has also manifested in the company's faster-than-industry growth in the last five years. The company has been able to sustain the growth momentum despite the setback says a lot about the inherent strengths leveraged through the years to overcome myriad- challenges. Under Mr. Singh's esteemed leadership, SCNL has now crossed the $1 billion AUM mark to join the Ivy League of Companies in the billion-dollar club. Over the years, Mr. Singh's visionary approach has always helped in keeping the business abreast of the latest developments and trends as well as adapt to suit the changing dynamics of the ever-evolving industry. Mr. Singh has been an inspiration for young aspiring entrepreneur since the inception of SCNL. In an interview with Insights Success Mr. HP Singh shares the Journey of SCNL and about its contribution to the financial inclusion. Below are the highlights of the interview between Mr. HP Singh and Insights Success: Kindly talk about the exclusive products and services offered by your company. While microfinance being the company's core area where it gives collateral-free loan to women through the Joint Liability Group (JLG) model, the company keeps expanding its offerings to make them more encompassing and suited to the diverse needs of the growing customer base. Given the dynamically evolving nature of today's credit culture, keeping pace with customers' unique aspirations and needs can be quite challenging. The company is continuously expanding the vistas of the business to deliver customized products and services to the customers. The companies' clients are economically active women in rural, semi-urban and urban areas, who otherwise have limited access to mainstream financial service providers. In continuity to evolving the product offerings, Mr. Singh incorporated Satin Housing Finance Limited in 2017 and Satin FinServ in 2018. Satin Housing Finance Limited (SHFL) a professionally managed housing finance company registered with the National Housing Bank (NHB), is a wholly-owned subsidiary of SCNL. It is engaged in providing long-term finance for purchase, construction, extension, and repair of houses for the retail segment, along with loans against residential property to customers belonging to the Middle- and Low-Income Groups in peripherals of urban India, semiurban and rural India. Satin FinServ Limited (SFL) on the other hand is aimed to "serve the small business owners (MSMEs) in a manner that is mutually beneficial" by providing them loans for their business needs. SFL has a specific focus on small business owners in manufacturing, trading and services posting an annual turnover of less than Rs. 200 lakhs. SFL's product Driving Financial Inclusion www.insightssuccess.in 36| FEB 2021

- 39. Mr. HP Singh Chairman and Managing Director Satin Creditcare remain focused on driving financial inclusion, underlined by its strong commitment to achieving socio- economic progress of low-income communities “ “ India's Best Micro Finance Companies to Rely On www.insightssuccess.in FEB 2021 | 37

- 40. offerings include MSME – LAP. Loans in the range of Rs. 2 lakhs to Rs. 15 lakhs are offered to customers falling under the category defined and against an immovable property. Mr. Singh acquired Taraashna Financial Services Limited as SCNL subsidiary, pursuant to a special resolution passed by its shareholders on July 30, 2016. TFSL acts as a business correspondent for banks and NBFCs. What is the vision and mission of your company? Mission: Ÿ To be a leading micro-financial institution by providing a comprehensive range of products and services for the financially under-served community. Ÿ To lead in gender empowerment by leveraging on technology and innovation that forge sustainable strategic partnerships. Vision: Making Micro-finance Inclusive and Purpose Driven Mr. HP Singh has played a pivotal role in the success of the organization and his efforts are a measure of how effectively an organization's mission statement translates into actual practice. How the technological advancements and innovation in the microfinance space has impacted/enhanced the business of your company? Digital transformation technology has been a game-changer for the company. It has not only made the operations quick and easy, but also enabled the company to turn around customer acquisition to disbursement journey by bringing it down from the earlier 15-20 days to a few minutes. This digital transformation put the company ahead of the curve to better respond to the ever-changing business scenarios. The technology was built inhouse in a record time of seven months, which helped in live tracking of day-to-day business operations and KPI's through real-time dashboards updated every 2 minutes which helps the company in real- time decision making, faster book closing, improved data quality and better brand image. The company successfully geotagged the borrowers' houses as well as branches which helped in improving employee productivity via route mapping, while reducing dependability on loan officers (as attrition rates are high in the segment). The digital platform is completely online with real-time systems, which provide support to the end-to-end lending process. The platform is equipped with comprehensive reporting capabilities, audit trails and logs, detailed information about loan histories, transaction reports, required decision-making reports and numerous management analysis and real-time dashboards. The solution provides instant customer identification and bank account verification, real-time CB checks, and SMS notifications with various real-time integration of APIs. Today, 100% of the SCNL branches can do cashless disbursements. SCNL also became the first Micro Finance Institutions (MFI) to launch its Customer Service App for client servicing and cashless collections, and also offer payment options via its website for repayment. What does the future look like for your company in terms of growth and expansion? With operations spanning 23 states and union territories across India, SCNL maintains a focus on rural and semi- urban areas, ensuring that the services reach deep within those numerous regions that usually face low or at best, moderate rates of penetration by other microfinance institutions. SCNL plays an eminent role in rural growth clearly exhibited in ~77% of its operations focused on rural India with a presence in more than 84,000 villages. This deep-rooted approach puts Satin Creditcare Network Limited in a sweet spot to leverage the growing capabilities of India's hinterland to avail financial loans, and thereby, embark on the journey of rising economic growth and development. SCNL endeavours on achieving steady growth without dampening the portfolio quality and expect to regain growth trajectory with the coming quarters to be much better and robust both on financial and operational aspects. www.insightssuccess.in 38| FEB 2021

- 42. UPMA Uplifting Rural and Semi-urban Localities by Enabling Microfinance FEATURED PERSON www.insightssuccess.in 40| FEB 2021

- 43. Microfinance Association of Uttar Pradesh (UPMA) is the State association of Microfinance Institutions operating in the State. Microfinance institutions are engaged in extending small ticket size loans to rural and semi urban poor on sift terms collateral free loans. These institutions are registered with RBI as NBFC-MFI. Total exposure of industry in the state is around 15,000 crores with 4.7 million clients. The main objective of UPMA is partnering with the State Govt, other Governmental agencies and various stakeholders. The question is when there is association of Microfinance Institutions at National level i.e., MFIN and Sa Dhan then what is the necessity of State assn. National Association work at the national level. They engage with BI, or Central Govt and other agencies at National level towards policy intervention. Both these National Associations are also Self-Regulatory Organizations and SRO. As SRO their main object is ensuring compliance of Govt guidelines, observance of Code of Conduct etc. Whereas as a State association we are working with the field level staff on ground level. We are conducting meetings of our members organization at field level in the Distt. These meetings are called Distt Meetings. We are holding various workshops for Microfinance clients on digital literacy, financial literacy, customers rights as client to microfinance etc. Sudhir Sinha, Project Manager Sudhir is a science graduate from Lucknow University started his Banking Career since 1972. During a span of 41 years worked in various capacities besides heading branches from Rural, Semi Urban to Metro, Small Medium Large and ELBs. A good administrative experience by working as Dy Regional Head, Regional Head, Dy Zonal Head etc. Worked in two different states of Gujarat and Andhra. He retired from Bank in February,2013 and joined UPMA in December,2013. He has been heading the same since March 2017. Our other initiatives are capacity building of member bodies, instilling the principles of Good Governance. In this direction we have organized a workshop on Corporate Governance for Independent Directors Company Secretary. These workshops are organized in association with Institute of Directors (IOD); Institute of Corporate Governance GOI. We have also organized workshops for HR Heads, Credit Verticals, Front line officers or for that matter entire spectrum of Microfinance delivery channels. As a part of our partnering with Govt officers during demonetization reports in regard to customer reaching Distt Administration for waiver of loan. We have toured almost the entire state from East to west and North to South and convinced the Distt administration about the fall out of such instigated representation. Distt Administration could be convinced and great loss to the sector could be averted. During the election period we work with the State Election Commission for creating awareness under the SVEEP initiative of the Election Commission. This gives our partner a sense of responsiveness towards our Constitutional duties. During Covid period it was noticed that those of our clients whose livelihood depends on roadside food selling viz tea shops, chaat thela or fast food etc. Sensing their trouble, we have disbursed Rs.2,000/- to around 400 such badly hit female clients. We have also disbursed masks, sanitizer during peak Covid period through Distt Administration. All our initiatives carry financial support from SIDBI. We are also arranging various advanced level training programs for our Microfinance staff through Bankers Institute of Rural Development (BIRD). We are also associating with IIM Lucknow in technology advancement. We have organized workshops with IIM Lucknow. Recently the State Govt has organized an Investor Summit, where investors, Govt Officers, and delegation from foreign countries did participate. We have put our stall in the panorama and attracted a good number of visitors. This gave the sector a wide understanding about the sector. Microfinance Exclusive www.insightssuccess.in FEB 2021 | 41

- 44. We are organizing annual conferences also where the speakers of eminence from various fields of finance are invited to share their concern expectations and the way forward. Various research papers and thought processes are also put forth during such annual conferences. So, far we have hosted Regional Director RBI, Ex Dy Governor RBI, Ex Chief Secretary Govt of UP besides people from Media and heads of Microfinance Institutions from across the country. Thus, during a period of around 7 years we have tried to engage with each and every tool available in the state towards capacity building, instilling best practices, good and Corporate Governance besides instilling a sense of responsiveness in the sector. Presently we are working on two projects. One being developing a job seeker to become a Job provider. Under the project we will identify 50 young entrepreneurs who are unemployed may be migrant workers. These migrant workers, mainly female, will be provided one week job orientation training on ODOP (One Distt One Product). Subsequently will be provided a loan from Microfinance partners. A hand holding for six months will be provided to them so that they are able to employ at least 4 to 5 more job seekers with them. This pilot project is being launched in two districts of the state namely Kannauj and Firozabad. Our next project is supporting startup in the field of Women Empowerment, Rural Livelihood or Fintech in linking and associating with IIM. The project is already launched. We will be extending financial support from our resources to IIM for this initiative. www.insightssuccess.in 42| FEB 2021