Achieving High Growth | Guidance for Middle Market Executives

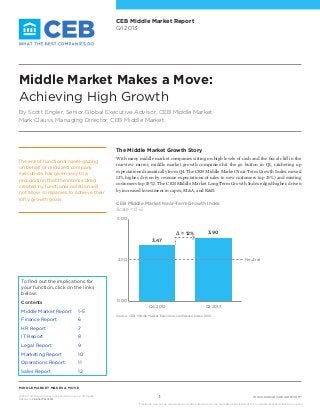

- 1. www.executiveboard.com MIDDLE MARKET MAKES A MOVE © 2013 The Corporate Executive Board Company. All Rights Reserved. CEB5477313SYN 1 This study may not be reproduced or redistributed without the expressed permission of The Corporate Executive Board Company. CEB Middle Market Report Q1 2013 The Middle Market Growth Story With many middle market companies sitting on high levels of cash and the fiscal cliff in the rearview mirror, middle market growth companies hit the go button in Q1, ratcheting up expectations dramatically from Q4. The CEB Middle Market Near-Term Growth Index moved 12% higher, driven by revenue expectations of sales to new customers (up 21%) and existing customers (up 15%). The CEB Middle Market Long-Term Growth Index edged higher, driven by increased investment in capex, M&A, and R&D. The era of functional navel-gazing on behalf of midsized company executives has given way to a recognition that the intense drag created by functional isolation will not allow companies to achieve their lofty growth goals. Q4 Q1 0.00 2.50 5.00 3.47 3.90∆ = 12% Neutral Q4 2012 Q1 2013 CEB Middle Market Near-Term Growth Index Scale = 0–5 Middle Market Makes a Move: Achieving High Growth By Scott Engler, Senior Global Executive Advisor, CEB Middle Market Mark Clauss, Managing Director, CEB Middle Market Source: CEB, Middle Market Executive Confidence Index, 2012. To find out the implications for your function, click on the links below: Contents Middle Market Report 1–5 Finance Report 6 HR Report 7 IT Report 8 Legal Report 9 Marketing Report 10 Operations Report 11 Sales Report 12

- 2. www.executiveboard.com MIDDLE MARKET MAKES A MOVE © 2013 The Corporate Executive Board Company. All Rights Reserved. CEB5477313SYN 2 This study may not be reproduced or redistributed without the expressed permission of The Corporate Executive Board Company. CEB Growth Indicators Percentage of Middle Market Executives Predicting Growth CEB Production Indicators Percentage of Middle Market Executives Predicting Growth Revving up the Sales Engine... Expectations for growth jumped sharply in Q1. Seventy-two percent of executives are now expecting higher revenue over the next 12 months, an increase of 9% from Q4. Ninety- one percent of middle market companies are expecting higher sales to new customers, and 85% of middle market companies are expecting higher sales to existing customers. 0% 50% 100% 66% 82% 55% 79% 49% 79% 45% 67% 0% 50% 100% 61% 72% 76% 91% 64% 85% Revenue Introduction of New Products Sales to New Customers New Orders Sales to Existing Customers Production Capacity Higher Q4, 2012 Higher Q1, 2013 Higher Q4, 2012 Higher Q1, 2013 …and the Product Pipeline Eight out of 10 midsized companies expect more new orders and are looking to ramp up product introduction and production to meet that demand. Thirty percent more companies now expect to increase production (79% versus 49%) and 22% more companies are looking to increase capacity. Source: CEB, Middle Market Executive Confidence Index, 2012. Source: CEB, Middle Market Executive Confidence Index, 2012. CEB Growth Indicators Differences Revenue: +9% Sales to New Customers: +15% Sales to Existing Customers: +21% CEB Production Indicators Differences Introduction of New Products: +16% New Orders: +24% Production: +30% Capacity: +22%

- 3. www.executiveboard.com MIDDLE MARKET MAKES A MOVE © 2013 The Corporate Executive Board Company. All Rights Reserved. CEB5477313SYN 3 This study may not be reproduced or redistributed without the expressed permission of The Corporate Executive Board Company. Q4 Q1 0.00 2.50 5.00 3.32 CEB Middle Market Long-Term Growth Index Scale = 0-5 CEB Long-Term Growth Indicators Percent Change in Companies Looking to Increase Expenditures Over Q4, 2012 The Capex Iceberg Thaws Although near-term growth expectations have jumped markedly, the long-term growth outlook is slowly turning positive after trending sideways in 2012. Companies are still cautious but finally loosening the purse strings on long-term growth drivers. The overall CEB Middle Market Long-Term Growth Index was up just slightly, but underneath, the trend is more optimistic. Source: CEB, Middle Market Executive Confidence Index, 2012. Source: CEB, Middle Market Executive Confidence Index, 2012. R&D Expenditures Number of M&A Deals Capital Expenditures 0% 5% 10% 0% 5% 10% 5% 7% 5% 3.28 Neutral More midsized executives are expecting an increase in capex, R&D expenditure, and M&A. Just as significant is a drop in the number of companies expecting to decrease capex in 2013. In Q4, 36% of midsized companies expected to reduce capex spending, and the number improved significantly in Q1. Only 24% of midsized companies now plan on reducing capex. Q4 2012 Q1 2013

- 4. www.executiveboard.com MIDDLE MARKET MAKES A MOVE © 2013 The Corporate Executive Board Company. All Rights Reserved. CEB5477313SYN 4 This study may not be reproduced or redistributed without the expressed permission of The Corporate Executive Board Company. Disparity Between Expectations for Revenue and Head Count Growth and Cognitive Dissonance Although large enterprise is reducing head count, Middle Market continues to add staff. Twenty-one percent more midsized companies than large enterprise companies plan to add head count, and 77% of midsized companies are increasing or holding the line on overall head count. Middle Market is far more optimistic than large enterprise when it comes to head count, but revenue expectations continue to outstrip hiring expectations. Although 72% of midsized company executives expect revenue to increase, only 50% of executives expect to add head count to support that growth. Reengineering the Human Capital Equation, 1 + 1 = ? The disparity between revenue expectations and head count reflects a deeper change in approach to human capital. Rather than add massive head count along with expectation (as has been done in the past), middle market companies are focused on reengineering the human equation to ensure the whole is worth many times more than the sum of the parts. Specifically, middle market companies are breaking through functional silos to enable trend sensing, intelligence sharing, and strategic collaboration. 0% 40% 80% 72% 50% Revenue Head Count ∆ = 22% Source: CEB, CEB CIO Leadership Council Business Productivity Database, 2012. 1 Validation of value leakage estimates: Model assumes a typical project portfolio of $100 M annually with a 15% expected return. Estimate of realized business benefits is validated by surveying the business sponsors of 51 systems implementations. Sources of value leakage are sized based on regression analysis of 163 drivers of project business impact. In two pronounced examples, two separate CEB middle market companies approached the problem by physically reorganizing their companies around areas of practice and strategic groups. They moved people out of their functional groups and into groups where they now sit next to their functional peers in Marketing, IT, HR, etc., who are working on the same initiatives—in effect, forcing functional collaboration via physical proximity. Many companies are looking to achieve collaboration benefits through IT investments. Twenty-five percent more middle market executives surveyed in Q1 are planning to increase IT capex than in Q4. CEB research found that companies tread with caution as satisfaction rates are still low, and typically, companies realize 74% of their IT investments and capture an even lower percentage of expected return.1 This view is supported by the latest research on enterprise performance.

- 5. www.executiveboard.com MIDDLE MARKET MAKES A MOVE © 2013 The Corporate Executive Board Company. All Rights Reserved. CEB5477313SYN 5 This study may not be reproduced or redistributed without the expressed permission of The Corporate Executive Board Company. Relative Importance of Employee Performance Component to Business Unit Profitability1 The bottom line is that improving performance in the new work environment requires enterprise contribution—which means employees must be effective at individual tasks and network performance. Business units with high enterprise contribution increased profits by 12.6% and revenues by 12.4%.1 Middle market companies have a distinct advantage in connectivity due to having fewer locations, less complexity, and shallower organizational grids. They are focused on driving new competencies, breaking down functional silos to create functional convergence on strategy, and creating new roles to enable horizontal workflows. This new focus on cross-functional efficiency and innovation can be seen very clearly in the imperatives of midsized company functional heads on p. 6. From Legal to Finance to Marketing, every list of functional imperatives includes initiatives to maximize the return on human interaction across the company versus just a return on investment in functional expertise. Now, let’s take a look at how your function can increase performance. Individual Task Performance Network Performance 2002 2012 RelativeImportanceto BusinessUnitProfitability 1 Relative importance in business unit profitability is determined by conducting a MANOVA analysis. n (2002) = 13,047; n (2012) = 23,339. Source: CEB, CEB Corporate Leadership Council, 2012. Reengineering the Human Capital Equation, 1 + 1 = ? (Continued) The importance of network performance—activating the ability of people to work together—has risen by 200% over the past 10 years. The result of this tectonic change in organizations is that the bulk of efficiency gains over the next five years will not result from improving individual effectiveness in role but corporate connectedness, whereby each function works in concert across the enterprise to drive exponential performance. 0% 50% 100% 22% 78% 49% 51%

- 6. www.executiveboard.com MIDDLE MARKET MAKES A MOVE © 2013 The Corporate Executive Board Company. All Rights Reserved. CEB5477313SYN 6 This study may not be reproduced or redistributed without the expressed permission of The Corporate Executive Board Company. Middle Market by Function FINANCE Finance has evolved into the key strategic compass of the midsized organization, with CFOs now playing a co-CEO role in strategic development, risk sensing, and execution. This expanded role is the result of the current economic climate, in which companies must balance growth and profitability and reduce the risk of big growth bets. To meet these higher-level demands, middle market finance departments are focusing on strengthening strategy development, improving business performance management to drive execution, and building processes and capabilities to increase the impact that Finance has on business partner decisions. The Top Four Areas CEB Is Helping Finance Executives ■■ Five out of the top 10 risks facing midsized companies are strategic risks. ■■ Fewer than 1 out of 3 companies believe their teams consistently derive business insight from data. ■■ Only 5% of the data Finance provides is viewed as helpful by the organization. Developing and Executing Growth Strategy CEB Insights and Tactics ■■ Reorient yourself as a strategic advisor, create a process that forces choice, embrace risk as a core element of business performance management, and manage the strategy, not the business. Improving Business Performance Management CEB Insights and Tactics ■■ Build an integrated business performance management approach to drive outcomes and action. ■■ Select metrics and build dashboards that link to value drivers. Building Effective Business Partnering and Analytics CEB Insights and Tactics ■■ Focus FP&A activities on providing insight that challenges outdated business assumptions. Streamlining Budgeting and Forecasting CEB Insights and Tactics ■■ Increase process efficiency in budgeting and forecasting activities. ■■ Focus on improving management reporting, operating reviews, and other business insight–focused processes. To find out the implications for your function, click on the links below: Contents Middle Market Report 1–5 Finance Report 6 HR Report 7 IT Report 8 Legal Report 9 Marketing Report 10 Operations Report 11 Sales Report 12

- 7. www.executiveboard.com MIDDLE MARKET MAKES A MOVE © 2013 The Corporate Executive Board Company. All Rights Reserved. CEB5477313SYN 7 This study may not be reproduced or redistributed without the expressed permission of The Corporate Executive Board Company. Improving Manager Capabilities CEB Insights and Tactics ■■ The most effective managers set clear and measurable goals for their direct reports that link to organizational goals. Sourcing New Talent CEB Insights and Tactics ■■ Prioritize requests based on the potential sourcing value to the organization, and engage hiring managers in sourcing activities. Building Bench Strength CEB Insights and Tactics ■■ Executives must identify future-focused competencies and enable leaders who are both achieving current results and capable of leading the future of the organization. Driving Functional Efficiency CEB Insights and Tactics ■■ Identify the critical connections across talent management activities to improve collaboration, efficiency, and effectiveness of key talent management processes. Enabling Innovation and Adaptability CEB Insights and Tactics ■■ Create a clear mandate for innovation, encourage risk taking, and work with leadership to support development of new ideas. ■■ Employees reporting to managers who are effective at manager-led development have 25% higher performance levels, 40% higher retention levels, and 29% higher commitment levels than employees reporting to managers who are ineffective at development. ■■ Great Global Leaders are almost three times more likely to hit their three-year performance goals and lead teams that have both 12% higher levels of discretionary effort and a 13% lower risk of attrition than average. ■■ Business leaders believe that just 35% of organizations are effective at talent management. ■■ “Building a Culture of Innovation” is a priority for 54% of senior R&D executives. Middle Market by Function (Continued) HUMAN RESOURCES An increase in talent acquisition efforts and 25% strategic growth targets for 2013 pushed HR budgets up 7%. To meet those targets, HR needs to think beyond individual role performance and consider how to enable efficient workflows across functions to manage talent effectively. The enterprise’s need to align the workforce to strategy and manage a growing employee base is fueling a need to upgrade HRIS systems. The Top Five Areas CEB Is Helping HR Executives To find out the implications for your function, click on the links below: Contents Middle Market Report 1–5 Finance Report 6 HR Report 7 IT Report 8 Legal Report 9 Marketing Report 10 Operations Report 11 Sales Report 12

- 8. www.executiveboard.com MIDDLE MARKET MAKES A MOVE © 2013 The Corporate Executive Board Company. All Rights Reserved. CEB5477313SYN 8 This study may not be reproduced or redistributed without the expressed permission of The Corporate Executive Board Company. Middle Market by Function (Continued) INFORMATION TECHNOLOGY Across the board, midsized company IT spending is up, but IT’s role is rapidly changing. IT executives are prioritizing business outcomes over assets, enabling the organization to make IT decisions, and focusing on end-user output. Ultimately, IT is moving into a more consultative role to the business to influence decisions and help the organization understand how the pieces fit together. The Top Five Areas CEB Is Helping IT Executives ■■ Seventy-six percent of employees report a significant increase in time spent working with data and information. ■■ Sixty percent report exchanging information with 10 or more people on a day-to-day basis. ■■ Sixty-one percent of employees do not believe the support they receive from IT enables them to be fully productive. ■■ Only one in five global IT leaders are effective at delivering value to the organization. Instituting End-to-End IT Services CEB Insights and Tactics ■■ Package the technologies, processes, and resources across IT needed to deliver a specific business outcome. Creating Strategic Roadmaps CEB Insights and Tactics ■■ Drive consensus, bridge gaps between strategic plans and operating plans, and coordinate IT planning across multiple organizational units and technologies. Enabling Business Partner Responsibility and Coaching CEB Insights and Tactics ■■ Equip business partners to make better IT investment decisions and more effectively manage IT projects. Supporting Knowledge Work CEB Insights and Tactics ■■ Equip teams within and beyond the IT organization to collaborate, work globally, and generate insight from data. Focusing IT Investment on Critical Business Capabilities CEB Insights and Tactics ■■ Define services through business capabilities, and manage and measure services based on business outcome. To find out the implications for your function, click on the links below: Contents Middle Market Report 1–5 Finance Report 6 HR Report 7 IT Report 8 Legal Report 9 Marketing Report 10 Operations Report 11 Sales Report 12

- 9. www.executiveboard.com MIDDLE MARKET MAKES A MOVE © 2013 The Corporate Executive Board Company. All Rights Reserved. CEB5477313SYN 9 This study may not be reproduced or redistributed without the expressed permission of The Corporate Executive Board Company. Middle Market by Function (Continued) LEGAL Growth and international expansion are putting pressure on middle market general counsel to become more proactively involved in business decisions earlier in the process. This change will speed execution and support growth by understanding business and technology risks, educating business clients about risk-informed decision making, and ensuring a culture of compliance and ethics. Middle market companies are bringing more legal activities in house to both reduce outside legal spend and bring more expertise close to the business. The Top Five Areas CEB Is Helping Legal Executives ■■ Eighty-five percent of legal executives tell us that managing information risk is a top priority. ■■ Less than 50% of survey respondents train employees on the company’s records management policy, and one- third do not train employees on appropriate e-mail use. ■■ CEB research indicates that legal executives worry most about: ■■ Growth of unstructured data, ■■ Cloud computing, ■■ Remote access to information, ■■ Employee negligence and misconduct, and ■■ Personal devices in the workplace. Improving the Consistency and Speed of Commercial Contracting CEB Insights and Tactics ■■ Improve consistency and speed by selectively involving Legal where it can most impact risk and by simplifying agreements and processes for faster deal making. Building or Improving Corporate Compliance and Ethics CEB Insights and Tactics ■■ Capture key risks across the enterprise, develop an employee-friendly code of conduct, and create effective monitoring and reporting capabilities. Developing Business Partnership Skills CEB Insights and Tactics ■■ Understand business partner needs and expectations, build credibility, develop influence, and align to business goals. Managing Information Risk CEB Insights and Tactics ■■ Gather realistic input by incorporating power users, design practical employee programs, and enable risk-informed decision making. Educating Business Clients and Employees on Legal and Compliance Risks CEB Insights and Tactics ■■ Design end-user-focused compliance training and communication by engaging stakeholders and enlisting their support to drive accountability. To find out the implications for your function, click on the links below: Contents Middle Market Report 1–5 Finance Report 6 HR Report 7 IT Report 8 Legal Report 9 Marketing Report 10 Operations Report 11 Sales Report 12

- 10. www.executiveboard.com MIDDLE MARKET MAKES A MOVE © 2013 The Corporate Executive Board Company. All Rights Reserved. CEB5477313SYN 10 This study may not be reproduced or redistributed without the expressed permission of The Corporate Executive Board Company. Middle Market by Function (Continued) MARKETING Consumers don’t want relationships with brands. Marketers can get more brand “stickiness” (brand intent, follow through, recommendation, and repurchase) by investing in strategies that simplify consumers’ purchase decision paths as opposed to investing in strategies intended to drive engagement with the brand. (So brands can stop trying to get more likes on Facebook in the name of “engagement.”) On average, customers progress nearly 60% of the way through the purchase decision-making process before engaging a sales rep, which means Marketing is now playing a key sales role by informing the customer earlier in the process. Marketing analytic skills are at a premium as well. The Top Five Areas CEB Is Helping Marketing Executives ■■ Sixty-two percent of shoppers search for deals online for at least half their shopping trips. ■■ Analysis of customer data shows there are only two significant drivers of changing a customer’s direction: teaching customers about their own business and providing them with compelling reasons to act. ■■ Information volume is rising 60% per year, and 71% of CMOs feel unprepared for this data explosion. ■■ Forty-three percent of marketing spend is wasted.1 1 This estimate is based on Rex Briggs’s analysis of more than $1 billion worth of advertising by 30 Fortune 200 companies. Understanding Customer Buying Behavior CEB Insights and Tactics ■■ In the consumer space, decision simplicity is the most important element of the purchase path, and it drives stickiness more than long-term brand affinity or engagement. ■■ Most B2B companies struggle with delayed sales engagement and stalled deals. To push customers through the purchase funnel, Marketing must tailor to distinct customer purchase needs and use key channels to build deal momentum. Reshaping Customer Buying Criteria CEB Insights and Tactics ■■ For content marketing to “win,” suppliers must do more than produce thought leadership. They must teach customers something new about their own business and motivate them to take immediate action. Fusing Multiple and Emerging Communication Channels CEB Insights and Tactics ■■ Build a clear, consumer-centric, strategy-led planning approach. Building the Marketing Team of the Future CEB Insights and Tactics ■■ Too many marketers are looking for agile marketers who are analytically savvy, can make quick decisions, and have digital prowess. These individuals are rare, and even if you can find them, they often underperform. Hire “focusers”—marketers who can filter out noise, resist distraction, and never lose sight of long-term goals. Harnessing Data for Focus and Decision Making CEB Insights and Tactics ■■ Building data streams and gaining insight from them doesn’t need to be an all-or- nothing exercise. Chances are the data your company already collects could be used to improve marketing strategy and execution. To find out the implications for your function, click on the links below: Contents Middle Market Report 1–5 Finance Report 6 HR Report 7 IT Report 8 Legal Report 9 Marketing Report 10 Operations Report 11 Sales Report 12

- 11. www.executiveboard.com MIDDLE MARKET MAKES A MOVE © 2013 The Corporate Executive Board Company. All Rights Reserved. CEB5477313SYN 11 This study may not be reproduced or redistributed without the expressed permission of The Corporate Executive Board Company. Middle Market by Function (Continued) OPERATIONS Midsized companies are introducing new products, ramping up capacity and production at faster rates than larger companies, and putting new demands on Operations to find efficiencies and strategically align to support growth. Sixty-six percent of companies are introducing more new products, and 55% are expecting increased order volume. Midsized companies, more than larger companies, have a greater opportunity to fine-tune processes for efficiency, rethink design, and work closely with Sales to manage inventory to drive expansion. The Top Five Areas CEB Is Helping Operations Executives ■■ Only 35% of executives believe their S&OP process is even somewhat effective. ■■ The average company spends 25% of the value of its inventory just to hold it each year. ■■ Only 37% feel that Operations’ KPIs align with overall corporate objectives. ■■ Functions that have a higher proficiency with metrics drive performance by 24%. Optimizing Sales and Operations Planning CEB Insights and Tactics ■■ Communicate the value of a standard, global planning approach. ■■ Clearly align stakeholder roles and responsibilities back to measurable planning activities, and implement a repeatable framework that balances enterprise standardization with local flexibility. Ensuring Strategic Alignment CEB Insights and Tactics ■■ Evaluate business assumptions, assess customer strategies, and communicate desired strategic position internally and externally. Revamping Inventory Management CEB Insights and Tactics ■■ Understand the true drivers of inventory costs, and plan strategically around them to create sustainable lower costs. Increasing Metric Focus CEB Insights and Tactics ■■ Clearly link Operations’ metrics back to corporate and customer objectives, evaluate and filter metrics’ key performance drivers, and build living scorecards and dashboards tailored to day-to-day decision making. Transforming the Procurement Function CEB Insights and Tactics ■■ Balanced, mature project portfolios that include initiatives to drive both cost structure transformation and product and brand enhancement deliver higher value and are driven by three core functional capabilities: idea quality, execution ability, and selling ability. To find out the implications for your function, click on the links below: Contents Middle Market Report 1–5 Finance Report 6 HR Report 7 IT Report 8 Legal Report 9 Marketing Report 10 Operations Report 11 Sales Report 12

- 12. www.executiveboard.com MIDDLE MARKET MAKES A MOVE © 2013 The Corporate Executive Board Company. All Rights Reserved. CEB5477313SYN 12 This study may not be reproduced or redistributed without the expressed permission of The Corporate Executive Board Company. Middle Market by Function (Continued) SALES To fuel growth, midsized companies are investing in more “sales feet on the street.” Seventy-three percent of middle market companies are increasing their sales forces, with the majority of that increase bolstering field sales (62% of the sales budget) and to a lesser extent sales operations, inside sales, and field sales management. Midsized companies are reporting less reliance on discounts and a shorter average sales cycle compared to large companies. The Top Five Areas CEB Is Helping Sales Executives ■■ The best organizations are building a culture that allows for higher performance and retention levels, not to mention a better ability to attract top talent. ■■ Although customers are spending again, the way they are buying has changed. They are more informed and do not contact suppliers until they complete 57% of their purchase process. Driving Sales Transformation CEB Insights and Tactics ■■ Empower reps to sell to an empowered customer who is capable of learning what to do on their own. Getting in Early and Shaping Demand CEB Insights and Tactics ■■ Shape demand by teaching customers where they learn by executing four critical pre-funnel selling activities. Creating More Precise Sales Force Segmentation Models CEB Insights and Tactics ■■ Ensure your teams and resources are aligned appropriately to hit growth goals. Building an Insight-Selling Organization CEB Insights and Tactics ■■ Enable your teams to replicate Challenger® behavior through different-in-kind messaging, talent development, and sales process. Partnering with Marketing to Move up the Decision Chain CEB Insights and Tactics ■■ Help reps reduce cold-calling time by generating leads using social media. To find out the implications for your function, click on the links below: Contents Middle Market Report 1–5 Finance Report 6 HR Report 7 IT Report 8 Legal Report 9 Marketing Report 10 Operations Report 11 Sales Report 12

- 13. www.executiveboard.com MIDDLE MARKET MAKES A MOVE © 2013 The Corporate Executive Board Company. All Rights Reserved. CEB5477313SYN 13 This study may not be reproduced or redistributed without the expressed permission of The Corporate Executive Board Company. About CEB CEB is the leading member-based advisory company. By combining the best practices of thousands of member companies with our advanced research methodologies and human capital analytics, we equip senior leaders and their teams with insight and actionable solutions to transform operations. This distinctive approach, pioneered by CEB, enables executives to harness peer perspectives and tap into breakthrough innovation without costly consulting or reinvention. The CEB member network includes more than 16,000 executives and the majority of top companies globally. Visit Us to Learn More www.executiveboard.com www.research.executiveboard.com About CEB Middle Market CEB middle market programs operate on the principle that the collective experience and resources of a member network can more swiftly and effectively resolve challenges than any one of its individual participants. Through shared funding of a central research team and the contribution of proven ideas, our members receive immediate and unlimited access to ongoing best practice research and business intelligence, essential tools for productivity and effectiveness, and an unparalleled peer network. Key Facts ■■ Serves seniormost executives and their teams at midsized organizations ■■ Designed for organizations with annual revenue less than $1 billion ■■ Supports career growth and development, management challenges, strategy development, and execution of operating plans ■■ Each program has more than 1,200 best practice studies, benchmarking reports, and tools. CEB Middle Market Functional Programs ■■ CEB Corporate Legal Exchange® ■■ CEB Finance Leadership Exchange® ■■ CEB HR Leadership Council® ■■ CEB IT Leadership Exchange ■■ CEB Marketing Leadership Roundtable ■■ CEB Operations Leadership Exchange ■■ CEB Sales Leadership Roundtable®