3 Pillars of Performance in Finance Shared Services

•

1 gefällt mir•287 views

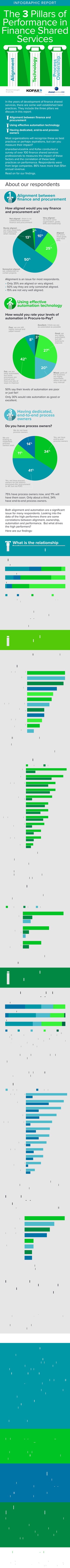

As finance shared services mature, there are some well-established best practices that have developed. There three pillars that build the basis of any high performing organization: 1. Alignment between finance and procurement 2. Using effective automation technology 3. Having dedicated, end-to-end process owners Most organizations will recognize these as best practices or perhaps aspirations, but can you measure their impact? sharedserviceslink and Kofax conducted a survey of over 100 finance shared services professionals to measures the impact of these factors and the correlation of these best practices on performance.

Melden

Teilen

Melden

Teilen

Downloaden Sie, um offline zu lesen

Empfohlen

Watch the recording of this session and learn how to effectively leverage benchmarks to build a roadmap of efficiency opportunities in your Finance & SSC organization through real-world examples.10TH ANNUAL CFO LEADERSHIP CONFERENCE: F&A Benchmarks: Prophecy or Pretense?

10TH ANNUAL CFO LEADERSHIP CONFERENCE: F&A Benchmarks: Prophecy or Pretense?Auxis Consulting & Outsourcing

Empfohlen

Watch the recording of this session and learn how to effectively leverage benchmarks to build a roadmap of efficiency opportunities in your Finance & SSC organization through real-world examples.10TH ANNUAL CFO LEADERSHIP CONFERENCE: F&A Benchmarks: Prophecy or Pretense?

10TH ANNUAL CFO LEADERSHIP CONFERENCE: F&A Benchmarks: Prophecy or Pretense?Auxis Consulting & Outsourcing

Weitere ähnliche Inhalte

Was ist angesagt?

Was ist angesagt? (20)

The State of Infrastructure: Remote Management Gains Traction

The State of Infrastructure: Remote Management Gains Traction

Acounts Payable Trends 2017: The Process and Technology of AP Invoice (ACAP)

Acounts Payable Trends 2017: The Process and Technology of AP Invoice (ACAP)

What Does it Take To Scale Your Automation Program?

What Does it Take To Scale Your Automation Program?

Business Process Automation: Are You Ready for It?

Business Process Automation: Are You Ready for It?

Ibm bis 2014 m. rolfe cfo insights from ibm global c suite study

Ibm bis 2014 m. rolfe cfo insights from ibm global c suite study

Expense management professionalservices_imagetag(1)

Expense management professionalservices_imagetag(1)

C-Suite Snacks Webinar Series: A Year Like No Other - Manufacturing and Distr...

C-Suite Snacks Webinar Series: A Year Like No Other - Manufacturing and Distr...

Solving Your Toughest T&E Expense Management Challenges

Solving Your Toughest T&E Expense Management Challenges

2018 National Compliance Pulse Survey: Small Businesses Weigh In on Top Emplo...

2018 National Compliance Pulse Survey: Small Businesses Weigh In on Top Emplo...

Delivering Growth and Profitability in 2017: Insights from over 500 CFOs

Delivering Growth and Profitability in 2017: Insights from over 500 CFOs

Reinventing AP: How employing automation leads to scalable growth

Reinventing AP: How employing automation leads to scalable growth

Why should mid-market companies invest in eprocurement

Why should mid-market companies invest in eprocurement

Andere mochten auch

Andere mochten auch (20)

SIVG Was der VR wissen muss: Unternehmenskunst und Social Media

SIVG Was der VR wissen muss: Unternehmenskunst und Social Media

Ähnlich wie 3 Pillars of Performance in Finance Shared Services

Watch the recording of this session and learn how to structure a winning AP automation strategy from beginning to end. We will show demos of Intelligent Data Capture and RPA in action for invoice processing.10TH ANNUAL CFO LEADERSHIP CONFERENCE: Achieving “Touchless” AP Automation

10TH ANNUAL CFO LEADERSHIP CONFERENCE: Achieving “Touchless” AP AutomationAuxis Consulting & Outsourcing

Driving efficiency with invoice processing in complex business environments

Here’s your chance to learn how AP automation provides so much more than just automating one single process. This session will walk through some of the other tangible benefits AP automation provides around process excellence in complex business environments. Hear how automation delivers a foundation to support and deliver results against wider strategic objectives in your organization despite a complicated process and systems landscape. Learn how automation can then be applied and is relevant for the Procurement landscape even in complex business environments.Driving efficiency with invoice processing in complex business environments -...

Driving efficiency with invoice processing in complex business environments -...Global Business Intelligence

Ähnlich wie 3 Pillars of Performance in Finance Shared Services (20)

“Touchless AP Automation”: [Auxis Webinar - February 26th, 2020]![“Touchless AP Automation”: [Auxis Webinar - February 26th, 2020]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![“Touchless AP Automation”: [Auxis Webinar - February 26th, 2020]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

“Touchless AP Automation”: [Auxis Webinar - February 26th, 2020]

How to Get Proactive about your Vendor Master Data: 4 tips for success

How to Get Proactive about your Vendor Master Data: 4 tips for success

10TH ANNUAL CFO LEADERSHIP CONFERENCE: Achieving “Touchless” AP Automation

10TH ANNUAL CFO LEADERSHIP CONFERENCE: Achieving “Touchless” AP Automation

How to achieve process excellence with multiple ERPs - 3 Keys to success

How to achieve process excellence with multiple ERPs - 3 Keys to success

Automation Anywhere - Imagine New York 2019 - Conagra Brands

Automation Anywhere - Imagine New York 2019 - Conagra Brands

OnBase AP Whitepaper: Four Ways Shared Services Organizations Can Extend The ...

OnBase AP Whitepaper: Four Ways Shared Services Organizations Can Extend The ...

"Making Accounts Receivable Automation Work for You" Webinar Slide Deck

"Making Accounts Receivable Automation Work for You" Webinar Slide Deck

Driving efficiency with invoice processing in complex business environments -...

Driving efficiency with invoice processing in complex business environments -...

Beyond Spreadsheets: How to Take Your Budgeting and Planning to the Next Level

Beyond Spreadsheets: How to Take Your Budgeting and Planning to the Next Level

Mehr von Sarah Fane

Mehr von Sarah Fane (10)

3 Ways Covid-19 Changed Shared Services and how to Prepare for What's Next

3 Ways Covid-19 Changed Shared Services and how to Prepare for What's Next

Measure and improve the strength of your shared services' foundation

Measure and improve the strength of your shared services' foundation

Global Business Services - what are they and how do they differ from shared s...

Global Business Services - what are they and how do they differ from shared s...

Deliver savings in increase profit: Top working capital management strategies

Deliver savings in increase profit: Top working capital management strategies

3 Procure to Pay zones that are overlooked and 3 sSolutions to get you in the...

3 Procure to Pay zones that are overlooked and 3 sSolutions to get you in the...

Kürzlich hochgeladen

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...Falcon Invoice Discounting

Kürzlich hochgeladen (20)

Paradip CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Paradip CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Al Mizhar Dubai Escorts +971561403006 Escorts Service In Al Mizhar

Al Mizhar Dubai Escorts +971561403006 Escorts Service In Al Mizhar

Berhampur CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Berhampur CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Chennai Call Gril 80022//12248 Only For Sex And High Profile Best Gril Sex Av...

Chennai Call Gril 80022//12248 Only For Sex And High Profile Best Gril Sex Av...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Pre Engineered Building Manufacturers Hyderabad.pptx

Pre Engineered Building Manufacturers Hyderabad.pptx

New 2024 Cannabis Edibles Investor Pitch Deck Template

New 2024 Cannabis Edibles Investor Pitch Deck Template

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

How to Get Started in Social Media for Art League City

How to Get Started in Social Media for Art League City

Falcon Invoice Discounting: Empowering Your Business Growth

Falcon Invoice Discounting: Empowering Your Business Growth

Marel Q1 2024 Investor Presentation from May 8, 2024

Marel Q1 2024 Investor Presentation from May 8, 2024

Lucknow Housewife Escorts by Sexy Bhabhi Service 8250092165

Lucknow Housewife Escorts by Sexy Bhabhi Service 8250092165

GUWAHATI 💋 Call Girl 9827461493 Call Girls in Escort service book now

GUWAHATI 💋 Call Girl 9827461493 Call Girls in Escort service book now

Uneak White's Personal Brand Exploration Presentation

Uneak White's Personal Brand Exploration Presentation

Durg CALL GIRL ❤ 82729*64427❤ CALL GIRLS IN durg ESCORTS

Durg CALL GIRL ❤ 82729*64427❤ CALL GIRLS IN durg ESCORTS

HomeRoots Pitch Deck | Investor Insights | April 2024

HomeRoots Pitch Deck | Investor Insights | April 2024

UAE Bur Dubai Call Girls ☏ 0564401582 Call Girl in Bur Dubai

UAE Bur Dubai Call Girls ☏ 0564401582 Call Girl in Bur Dubai

3 Pillars of Performance in Finance Shared Services

- 1. The 3 Pillars of Performance in Finance Shared Services INFOGRAPHIC REPORT About our respondents In the years of development of finance shared services, there are some well established best practices. They include the three pillars we discuss in this report: • Alignment between finance and procurement • Using effective automation technology • Having dedicated, end-to-end process owners Most organizations will recognize these as best practices or perhaps aspirations, but can you measure their impact? sharedserviceslink and Kofax conducted a survey of over 100 finance shared services professionals to measures the impact of these factors and the correlation of these best practices on performance. Respondents were from large companies. 86% have more than $1bn annual revenue. Read on for our findings. Alignment is an issue for most respondents. • Only 35% are aligned or very aligned. • 50% say they are only somewhat aligned. • 15% are not very well aligned. Alignment between finance and procurement How aligned would you say finance and procurement are? © sharedserviceslink.com Ltd and Kofax from Lexmark 2016. No copy or visual can be used in part, as a phrase or in whole without the written permission of sharedserviceslink.com Ltd. The concept of this product belongs to sharedserviceslink.com Ltd and cannot be re-created by a third party for the purpose of an event, article, report or any other written product, without written consent made available by sharedserviceslink.com Ltd. About Lexmark Alignment Technology Process Ownership Research brought to you by: 25% 50% 2% 10% 13% Aligned - we share most goals and most KPIs Not aligned - there is no collaboration between finance and procurement Somewhat aligned - we collaborate on certain projects Rarely aligned - we work separately, but collaborate when needed Very aligned - we share same organization, goals, KPIs and leadership 50% say their levels of automation are poor or just fair! Only 30% would rate automation as good or excellent. Using effective automation technology How would you rate your levels of automation in Procure-to-Pay? 20% 42% 3% 27% 8% Good, we are highly automated, but still looking to improve Mixed, parts of the business are highly automated, others are still very manual Poor, we are still highly manual and paper-based Fair, we are fairly automated, but some processes are manual and there are lots of ways to improve Excellent, I think we are as automated as possible 75% have process owners now, and 11% will have them soon. Only about a third, 34% have end-to-end process owners. There is a strong correlation between those that say finance and procurement are aligned and those that have end-to-end process owners. * 89% of companies who say finance and procurement are aligned have process owners. For all respondents, manual invoice processing, high rates of invoice exceptions and PO problems are the top pain points. Now focusing on pain points and how aligned organizations are: What pain points do all respondents currently face in P2P? Organizations with poor alignment suffer more pain points in every category than those with good alignment. The areas where alignment makes the biggest difference are: • Visibility into spend • Visibility into working capital • Length of financial close process With the combination of good alignment and process owners, the situation improves dramatically. Here is a snapshot of where alignment coupled with process ownership makes the biggest difference. There is a also correlation between levels of automation and alignment. Companies that have aligned P2P have much better rates of automation. No company in which finance and procurement were said to be truly aligned still had a paper-based manual process. High rates of automation make a huge difference to invoice processing, ability to capture early payment discounts and visibility into working capital. The free-text responses to this question fell into these main categories: Having the right technology was the number 1 wish for improving P2P. Improved automation was rated third. For those companies that have implemented technology, savings have been in the double digits. Having dedicated, end-to-end process owners Do you have process owners? Alignment and process ownership 41% 11% 34% 14% Yes, we have end-to-end process owners We are looking to implement process owners soon Yes, we have process owners for the distinct processes (for procurement or AP, but not P2P) We do not have process owners High levels of manual invoice processing Purchase order problems (No PO, Wrong PO) High rates of invoice exceptions Poor visibility into spend Vendor master data is out of date Maverick spending, off contract spend Inability to capture early payment discounts Poor visibility into working capital Late payments Inability to make three way matches Long financial close process Duplicate payments Poor visibility into spend Purchase order problems (No PO, Wrong PO) High levels of manual invoice processing High rates of invoice exceptions Poor visibility into working capital Maverick spending, off contract spend Vendor master data is out of date Inability to capture early payment discounts Long financial close process Late payments Inability to make three way matches Duplicate payments Poor visibility into spend Poor visibility into working capital Long financial close process We are looking to implement process owners soon Yes, we have process owners for the distinct processes (for procurement or AP, but not P2P) Yes, we have end-to-end process owners Not aligned Somewhat aligned Aligned We do not have process owners Both alignment and automation are a significant issue for many respondents. Looking into the data of the high performers there are some correlations between alignment, ownership, automation and performance. But what drives the high performers? Here are our findings: What is the relationship between alignment and common P2P pain points? What pain points do you currently face? What is the relationship between P2P automation and alignment of finance and procurement? Pain points and alignment Pain points, alignment and process ownership 40% 20% 33% 7% 14% 12% 50% 24% 2% 9% 29% 60% How would you rate your levels of automation in Procure-to-Pay? Poor, we are still highly manual and paper- based Fair, we are fairly automated, but some processes are manual and there are lots of ways to improve Mixed, parts of the business are highly automated, others are still very manual Good, we are highly automated, but still looking to improve Not aligned Somewhat aligned Aligned 33% 27% 20% 20% 44% 24% 24% 46% 6% 2% 14% 34% 6% Excellent, I think we are as automated as possible 51% 51% 49% 40% 35% 33% 30% 23% 23% 20% 17% 9% Having the right technology Process improvement Improved automation Improved alignment between finance and procurement More resource, more FTEs Improved data and governance Training Process standardisation and enforcement (ownership) 73% 17% 67% 46% 53% 40% 53% 43% 47% 11% 40% 34% 40% 26% 40% 31% 33% 11% 27% 14% 27% 14% 13% 9% Not aligned Aligned Levels of automation and pain points If you could do one thing to improve your Procure-to-Pay processes, what would it be? If you have implemented a process improvement technology or enabling technology, what savings have you achieved, as a % of the original cost of running these functions? Low levels of automation High levels of automation Not aligned Aligned Aligned with process owners 73% 14% 47% 11% 5% 33% 11% 0% 17% High levels of manual invoice processing Purchase order problems (No Po, Wrong PO) High rates of invoice exceptions Poor visibility into spend Inability to capture early payment discounts Vendor master data is out of date Maverick spending, off contract spend Poor visibility into working capital Inability to make three way matches Late payments Long financial close process Duplicate payments 74% 12% 68% 41% 63% 23% 55% 24% 47% 8% 43% 18% 42% 23% 37% 8% 31% 14% 31% 13% 27% 4% 16% 8% 27% 20% 17% 15% 6% 6% 5% 5% Accounts Payable Procurement Procure- to-Pay Record to Report Accounts Receivable 32% 32% 28% 27% 21% Summary Own your processes Process Owners drive alignment. 89% of companies who say finance and procurement are aligned have process owners. Organizations with poor alignment suffer more pain points, particularly in visibility into spend, visibility into working capital and the length of financial close process. Alignment is also correlated to automation. No company in which finance and procurement were said to be truly aligned still had a paper-based manual process. High rates of automation make a huge difference to invoice processing, ability to capture early payment discounts and visibility into working capital. Automating technology is driving savings in the double digits. Having the right technology was the No 1 way to drive improvements for 27% of respondents. Based upon our findings, here are three ways to deliver measurable improvements in your P2P department today. Implement end-to-end process owners – if not in name, then in practice – to drive improvements throughout the finance processes. Process ownership has a significant impact on your ability to effectively align finance and procurement as well as reduce the commonly felt pain points in finance. Look at the P2P process as a whole Examine if you are using your technology most effectively across finance and procurement. Are you using different tools? Are they best-of-breed for both finance and procurement? Automation can still drive savings in the double digits, when implemented effectively. Build a business case that looks at the whole picture It’s not just savings from efficiency that can build the business case for investing in finance automation technology. This data shows that not only does better automation and alignment improve efficiency, it helps improve visibility into spend and working capital, and can help improve the financial close process. Ensure your business case goes beyond FTE reduction savings. What is the relationship between process ownership and alignment? ©sharedserviceslink and Lexmark 2016 1 2 3 www.lexmark.com/software-solutions Research sponsored by 89%* * * 1 2 3 4