Weitere ähnliche Inhalte

Ähnlich wie Work sample (20)

Kürzlich hochgeladen (20)

Work sample

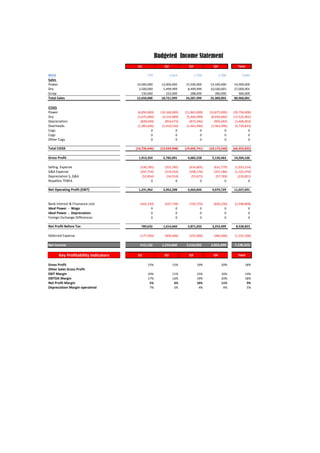

- 1. Q1 Q2 Q3 Q4 Total

MVA 770 1,414 1,756 1,706 5,645

Sales

Power 10,000,000 13,000,000 15,500,000 14,500,000 53,000,000

Dry 2,500,000 5,499,999 8,499,999 10,500,003 27,000,001

Scrap 150,000 222,000 288,000 300,000 960,000

Total

Sales 12,650,000 18,721,999 24,287,999 25,300,003 80,960,001

COGS

Power (6,850,000) (10,160,000) (11,865,000) (10,875,000) (39,750,000)

Dry (1,675,000) (3,514,999) (5,404,999) (6,930,002) (17,525,001)

Depreciation

(828,040) (854,673) (872,246) (905,042) (3,460,002)

Overheads (1,383,606) (1,410,236) (1,463,496) (1,463,496) (5,720,833)

Cogs 0 0 0 0 0

Cogs 0 0 0 0 0

Other

Cogs 0 0 0 0 0

Total

COGS (10,736,646) (15,939,908) (19,605,741) (20,173,540) (66,455,835)

Gross

Profit 1,913,354 2,782,091 4,682,258 5,126,463 14,504,166

Selling

Expense (330,785) (355,785) (614,805) (631,779) (1,933,154)

G&A

Expense (297,754) (319,354) (348,176) (357,186) (1,322,470)

Depreciation

S,

G&A

(52,854) (54,554) (55,675) (57,769) (220,851)

Royalites

TEBEA 0 0 0 0 0

Net

Operating

Profit

(EBIT) 1,231,962 2,052,398 3,663,602 4,079,729 11,027,691

Bank

Interest

&

Finanance

cost

(442,330) (437,738) (792,570) (826,230) (2,498,868)

Ideal

Power

-‐

Wage 0 0 0 0 0

Ideal

Power

-‐

Depreciation 0 0 0 0 0

Foreign

Exchange

Differences 0 0 0 0 0

Net

Profit

Before

Tax 789,632 1,614,660 2,871,032 3,253,499 8,528,823

Deferred

Expense (177,500) (400,000) (355,000) (400,000) (1,332,500)

Net

Income

612,132 1,214,660 2,516,032 2,853,499 7,196,323

Key

Profitability

Indicators Q1 Q2 Q3 Q4 Total

Gross

Profit 15% 15% 19% 20% 18%

Other

Sales

Gross

Profit

EBIT

Margin 10% 11% 15% 16% 14%

EBITDA

Margin 17% 16% 19% 20% 18%

Net

Profit

Margin 5% 6% 10% 11% 9%

Depreciation

Margin

operatinal 7% 5% 4% 4% 5%

Budgeted Income Statement

- 2. USD Q1 Q2 Q3 Q4

Assets

Cash

-‐

6,098,740

-‐

5,952,764 129,592 3,038,623

Receivables

15,617,390 16,450,723 17,117,389 17,450,726

Finished

Goods

Inventory 0 0 0 0

Work

In

Progress

Inventory 0 0 0 0

Raw

Materials

Inventory 17,891,812 20,866,479 22,611,312 24,391,813

Goods

in

Transit

&

Others 0 0 0 0

Total

Inventory 17,891,812 20,866,479 22,611,312 24,391,813

Dues

from

Related

Parties

8,671,420 8,671,420 8,671,420 8,671,420

Other

Debit

Balances 0 0 0 0

Other

Current

Assets 0 0 0 0

Total

Current

Assets 36,081,882 40,035,858 48,529,714 53,552,582

Net

Plant

Property

&

Equipment 42,040,199 41,130,972 40,303,051 39,340,240

Total

Long-‐Term

Assets 42,040,199 41,130,972 40,303,051 39,340,240

Total

Assets 78,122,081 81,166,830 88,832,764 92,892,822

Liabilities

Bank

Overdrafts 0 0 0 0

Importation

Finance

(L/Cs) 0 0 0 0

Secured

Borrowings

(with

Recourse) 0 0 0 0

Total

Short-‐term

Facilities 0 0 0 0

Current

Portion

of

Long-‐Term

Debt 0 0 0 0

Accounts

&

Notes

Payable

-‐

5,620,879

-‐

3,547,642 5,847,261 6,653,820

Dues

to

Related

Parties

(Specific) 0 0 0 0

0 0 0 0 0

Dues

to

Related

Parties

74,574,155 74,574,155 74,574,155 74,574,155

Other

Current

Liabilities 643,149 0 0 0

Total

Current

Liabilities 69,596,425 71,026,513 80,421,416 81,227,975

Medium-‐term

Loans

Long-‐Term

Payables 4,600,000 4,600,000 0 0

Total

Long-‐Term

Liabilities 4,600,000 4,600,000 0 0

Total

Liabilities 74,196,425 75,626,513 80,421,416 81,227,975

Equity

Common

Stock

Retained

Earning

"Opening" 3,522,860 4,579,283 6,653,684 9,380,889

Add:

Net

Profit 225,297 383,533 825,164 951,459

Less:

Dividends 0 0 0 0

Retained

Earning

"Ending" 3,748,157 4,962,817 7,478,848 10,332,348

Shareholders'

loan 0 0 0 0

Total

Equity 3,748,157 4,962,817 7,478,848 10,332,348

0 0 0 0 0

Balance Sheet

- 3. USD Q1 Q2 Q3 Q4

Cash

Flows

from

Operating

Activities

Net

Income 225,297 383,533 825,164 951,459

Tax

Expense 59,167 133,333 118,333 133,333

Depreciation 0 0 0 0

Forex

Differences 0 0 0 0

Adjusted

Net

income 284,464 516,867 943,497 1,084,792

Decrease

(Increase)

in

Inventory

Balances 1,548,333

-‐

1,151,333

-‐

593,500

-‐

593,500

Increase

(Decrease)

in

Receivables

and

Other

Debit

Balances 5,533,332

-‐

0 0

-‐

3

Increase

(Decrease)

in

Payables

and

Other

Credit

Balances

-‐

6,437,380 1,530,197 2,108,213 3,986

Net

Cash

Flows

from

Operating

Activities 928,750 895,731 2,458,211 495,275

Cash

Flows

from

Investing

activities

Capital

Expenditures

-‐

1,396,924 303,076 320,937 320,937

Capitalized

Interest 0 0 0 0

Net

Cash

Flows

from

Investing

Activities

-‐

1,396,924 303,076 320,937 320,937

Cash

Flows

from

Financing

activities

Proceeds

from

Capital

Increase 0 0 0 0

Increase

(Decrease)

in

Long-‐Term

Liabilities

-‐

4,600,000 0 0 0

Dividends

Paid 0 0 0 0

Increase

(Decrease)

in

Shareholders'

loan 0 0 0 0

Increase

(Decrease)

in

Bank

Overdrafts 0 0 0 0

Increase

(Decrease)

in

Financed

L/Cs 0 0 0 0

Increase

(Decrease)

in

Secured

Borrowings 0 0 0 0

0 0 0 0

Net

Cash

Flows

from

Financing

Activities

-‐

4,600,000 0 0 0

Net

Increase

(Decrease)

In

Cash

Balance

-‐

5,068,174 1,198,806 2,779,148 816,212

Opening

cash

Balance

-‐

1,089,733

-‐

7,284,903

-‐

2,767,889 2,089,078

Ending

Cash

Balance (6,157,907)

(6,086,097)

11,259

2,905,290

USD Q1 Q2 Q3 Q4

Cash

Flows

from

Operating

Activities 928,750 895,731 2,458,211 495,275

Cash

Flows

from

Investing

activities

-‐

1,396,924 303,076 320,937 320,937

Cash

Flows

from

Financing

activities

-‐

4,600,000 0 0 0

Net

Increase

(Decrease)

In

Cash

Balance

-‐

5,068,174 1,198,806 2,779,148 816,212

Ending

Cash

Balance (6,157,907)

(6,086,097)

11,259

2,905,290

0 0 0 0

Projected Cash Flow

Summarized Cash Flow Statement (Indirect Method)

- 4. USD Q1 Q2 Q3 Q4

Short-‐Term

Bank

Facilities 0 0 0 0

Spontaneous

Financing 69,596,425 71,026,513 80,421,416 81,227,975

0

Long-‐Term

Bank

Debt

&

Equivelants 4,600,000 4,600,000 0 0

0

Equity

&

Shareholders'

loan 3,748,157 4,962,817 7,478,848 10,332,348

Total 77,944,581 80,589,330 87,900,264 91,560,322

-‐

177,500.00

-‐

577,500.00

-‐

932,500.00

-‐

1,332,500.00

USD Q1 Q2 Q3 Q4

Long-‐Term

Assets 42,040,199 41,130,972 40,303,051 39,340,240

Net

Operating

Working

Capital

-‐

33,514,542

-‐

30,990,655

-‐

31,891,702

-‐

27,675,393

Total

Bank

Debt 4,600,000 4,600,000 0 0

Equity

&

Shareholders'

loan 3,748,157 4,962,817 7,478,848 10,332,348

Net

Investment 33,600,459 27,511,220 19,945,105 28,142,667

Item

Dupoint Formula Q1 Q2 Q3 Q4

RETURN

ON

SALES 4.84% 6.49% 10.36% 11.28%

TOTAL

ASSET

TURNOVER 0.49 0.69 0.82 0.82

RETURN

ON

ASSETS 2.35% 4.49% 8.50% 9.22%

ASSET

LEVERAGE 20.84 16.35 11.88 8.99

RETURN

ON

EQUITY 49% 73% 101% 83%

Item Q1 Q2 Q3 Q4

Profitability

Sales

Growth N/A 48.0% 29.7% 4.2%

COGS

/

Sales 84.9% 85.1% 80.7% 79.7%

Gross

Profit

Margin 15.1% 14.9% 19.3% 20.3%

S

G&A

/

Sales 2.6% 1.9% 2.5% 2.5%

Interest

/

Sales 3.5% 2.3% 3.3% 3.3%

FX

Loss

/

Sales 0.0% 0.0% 0.0% 0.0%

EBITDA

Margin 9.7% 11.0% 15.1% 16.1%

Net

Operating

Profit

Margin 9.7% 11.0% 15.1% 16.1%

NPBT

/

Sales 6.2% 8.6% 11.8% 12.9%

Profit

margin 4.8% 6.5% 10.4% 11.3%

Net

Profit

Growth N/A 98% 107% 13%

Item Q1 Q2 Q3 Q4

Asset Efficiency & Turnover

Net

Investment

USD 33,600,459

27,511,220

19,945,105

28,142,667

Fixed

Assets

Turnover 0.90

1.37

1.81

1.93

Working

Capital

Turnover 1.05

1.40

1.50

1.42

Financial Highlights'

Financial Structure

Financial Structure

- 5. Item Q1 Q2 Q3 Q4

Business Cycles

Net

Cash

to

Cash

Cycle N/A N/A N/A N/A

Total

Receivables

Days

on

Hands 86 119 94 369

Third

Party

Receivables

Days

on

Hand 111 77 62 246

Affiliates

Receivables

Days

On

Hand 31 42 96 123

Inventory

Days

On

Hand 150 109 299 419

RM

Days

On

Hand 150 109 299 419

WIP

Days

On

Hand N/A N/A N/A N/A

FG

Days

On

Hand N/A N/A N/A N/A

GIT

&

Others

Days

On

Hand N/A N/A N/A N/A

Other

Current

Assets

Days

On

Hand N/A N/A N/A N/A

Total

Payables

Days

on

Hands 289 395 1,043 1,442

Third

Party

payables

Days

on

Hand -‐47

-‐26

16 112

Affiliates

payables

Days

On

Hand 313 421 1,027 1,331

Other

Current

Liabilities

Days

On

Hand 5 2 N/A N/A

Item Q1 Q2 Q3 Q4

LIQUIDITY

Cash

Ratio 0.088-‐

0.08-‐

0.00

0.04

Current

Ratio 0.5

0.6

0.6

0.7

Quick

Ratio 0.3

0.3

0.3

0.4

EBITDA

USD 14,783,541 24,628,775 43,963,221 48,956,749

Net

Working

Capital

USD -‐33,514,542

-‐30,990,655

-‐31,891,702

-‐27,675,393

Item Q1 Q2 Q3 Q4

LEVERAGE & CAPITAL STRUCTURE

Financial

Leverage

20.8

16.4

11.9

9.0

Gearing

(Bank

Debt/Equity)

1.2

0.9

0.0

0.0

Current

Lab.

/

Total

Assets 89% 88% 91% 87%

Total

Bank

Debt

/

EBITDA

0.3

0.2

0.0

0.0

Operating

Cash

Flows

/

Interest

2.1

2.0

3.1

0.6

Operating

Cash

Flows

/

Bank

Debt

2.4

2.3

N/A N/A

Times

Interest

Covered

(Per

EBIT)

2.8

4.7

4.6

4.9

Fixed

Charge

Coverage

(Per

EBIT)

2.8

4.7

4.6

4.9

USD Q1 Q2 Q3 Q4 Total

Cash

Flows

from

Operating

Activities

Net

Cash

Collections

from

Sales

-‐

24,288,810

-‐

833,332

-‐

666,667

-‐

333,337

Suppliers

Payments 40,324,818

-‐

16,841,338

-‐

11,955,672

-‐

21,147,481

Other

Operating

Cash

Receipts

(Payments) 312,364

-‐

998,934

-‐

614,805

-‐

631,779

Income

Taxes

Paid

-‐

177,500

-‐

400,000

-‐

355,000

-‐

400,000

Interest

Payments

-‐

442,330

-‐

437,738

-‐

792,570

-‐

826,230

Net

Cash

Flows

from

Operating

Activities 15,728,542

-‐

19,511,342

-‐

14,384,714

-‐

23,338,827

Cash

Flows

from

Investing

activities

Capital

Expenditures

-‐

1,396,924 303,076 320,937 320,937

Net

Cash

Flows

from

Investing

Activities

-‐

1,396,924 303,076 320,937 320,937

Cash

Flows

from

Financing

activities

Proceeds

from

Capital

Increase 0 0 0 0

Increase

(Decrease)

in

Long-‐Term

Liabilities

-‐

4,600,000 0 0 0

Dividends

Paid 0 0 0 0

Increase

(Decrease)

in

Shareholders'

loan 0 0 0 0

Increase

(Decrease)

in

Bank

Overdrafts 0 0 0 0

Increase

(Decrease)

in

Financed

L/Cs 0 0 0 0

Increase

(Decrease)

in

Secured

Borrowings 0 0 0 0

Net

Cash

Flows

from

Financing

Activities

-‐

4,600,000 0 0 0

Net

Increase

(Decrease)

In

Cash

Balance 9,731,617

-‐

19,208,266

-‐

14,063,777

-‐

23,017,891

Opening

cash

Balance

-‐

1,089,733

-‐

7,284,903

-‐

2,767,889 2,089,078

Ending

Cash

Balance 8,641,885

-‐

26,493,170

-‐

16,831,666

-‐

20,928,812

Cash Flow Statement (Direct Method)