White paper payment banks - changing landscape of retail banking

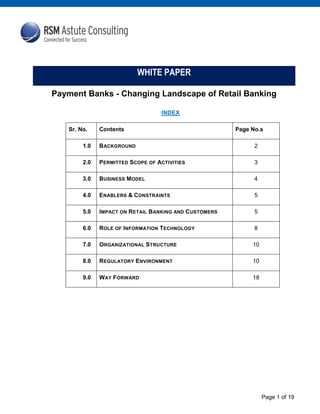

- 1. Page 1 of 19 INDEX Sr. No. Contents Page No.s 1.0 BACKGROUND 2 2.0 PERMITTED SCOPE OF ACTIVITIES 3 3.0 BUSINESS MODEL 4 4.0 ENABLERS & CONSTRAINTS 5 5.0 IMPACT ON RETAIL BANKING AND CUSTOMERS 5 6.0 ROLE OF INFORMATION TECHNOLOGY 8 7.0 ORGANIZATIONAL STRUCTURE 10 8.0 REGULATORY ENVIRONMENT 10 9.0 WAY FORWARD 18 WHITE PAPER Payment Banks - Changing Landscape of Retail Banking

- 2. Page 2 of 19 1.0 Background and Scope: The Reserve Bank of India has on 19 August 2015 decided to grant ‘in-principle’ approval to 11 applicants. The Payment Banks are intended to be an ubiquitous payment network and universal access to savings with differential licensing to offer financial services to the hitherto excluded segments of the population. The objective of setting up of payments banks will be to further financial inclusion by providing small savings accounts and payments/ remittance services to migrant labor workforce, low income households, small businesses, other unorganized sector entities and other users. This will be possible through heavy technological focus, as cost to serve unbanked population will be lower due to technology adoption right from inception. In this White Paper, we have endeavored to discuss the following aspects: What is the Business Model of the Payment Banks and what are the Permissible Activities vis-a vis a bank? How will the Payment Banks impact the landscape of the Retail Banking in India? How will it impact the customers? What is the Regulatory Framework of the Payment Banks? What is the Technology Architecture of the Payment Banks?

- 3. Page 3 of 19 2.0 Permitted Scope of Activities

- 4. Page 4 of 19 3.0 Business Model

- 5. Page 5 of 19 4.0 Enablers and Constraints Enablers Constraints Sharing of infrastructure with promoter is Permitted Heavy focus on technology Cost efficient technology platform to reduce overall cost of transaction for servicing unbanked population Existing customer base to start Existing Infrastructure of promoters, PPI, telecom co.'s can be leveraged by Payment Banks No threshold for amount to be transacted, enabling transactions above Rs. 1 Lakh by business units provided the account balance at the end of the day should not breach the regulatory limit of Rs. 1 Lakh. Interest can be paid to deposit holders Funds can be invested for generating returns Deposits mobilized by the Payments Bank would be covered under DICGC Can function as BC of other banks for credit and other services which it cannot offer Basic banking activities like FD / RD account opening & Lending services not permitted Despite of mandatorily being technology driven, RBI does not envisage payments banks to be “virtual” banks or branchless banks. (25% physical access points, Own control Offices) The payments bank will have to undertake its own KYC/ AML/ CFT exercise as any other bank. (documentation obtained by Telecom / earlier companies for KYC are not acceptable) 5.0 Impact on Retail Banking and Customers The preliminary assessment of likely impact on various stakeholders of the economy is given below: Stakeholders Likely Impact Customers High deposit rates to lure customers. Low cost with innovative & convenient services. As Payment banks will be heavily using technology the cost will be lower, also since their core business will not be lending but other service products, they will bring in innovation to services to be more competitive. Localized touch points, expect to see local kirana and prepaid mobile recharge outlets to become payments banks touch points Structured Products like seamless transfers & customized remittance. Payment banks might use of data analytics to enhance product offerings

- 6. Page 6 of 19 and for target-based advertising and marketing. Expect freebies to woo customers due to competition. We have seen offers and discounts in the universal banking space and in other sectors such as e-commerce and taxi-hailing services. The same can be expected here as well. Even if some do not offer discounts, at least expect cheaper or even free services. Universal Banks The payments banks could wean away low-cost savings bank deposits from the established full-service players, denting their ability to price loans at a competitive level. The threat of impending competition has awakened incumbent banks to look at liabilities and payments as a separate business and not just as a source of liquidity and facilitating transactions. The impact on private sector banks will be minimal because they have already made strong investments in technology. However the Banks with low technological adoptions will tend to lose more. Private sector banks like Kotak Mahindra Bank Ltd, Yes Bank Ltd and ICICI Bank Ltd and the largest public sector Bank State Bank of India have tied up with some of the companies that have got approval for setting up payment banks and hence may not be affected much. That means, in the longer term, some of the smaller public sector banks may remain under pressure, particularly those that are strapped for cash. Loss of cost of infrastructure spend on rural branches (RBI mandated all universal banks to have 25% branches in rural areas). Payment Banks could act like feeder banks and make the larger banks more competitive. Payment Banks can increase the reach of the universal banks for large pool of unbanked population for FD, RD & Lending services. According to an SBI Research report, on the asset side, an incremental amount of at least Rs.14 Lac Crores per annum is expected to be freed up for credit needs of the infrastructure sector. Reaching out to untapped segments in rural areas and small towns, by using new business models is now considered the next big opportunity for the financial sector and is actively engaging in it. The above may result into reduction in staff strength by universal banks by technology adoption as there is tremendous pressure to manage cost. So also there will be a need for recalibrating the staff strength (training

- 7. Page 7 of 19 for handling lending activities & complex products is the need of hour). The universal banks need to significantly change in marketing & positioning which make will enable better utilization of its staff by focusing on core activities like lending. Insurers Payment Banks can increase the reach of Insurers to large pool of uncovered population. Considering the current insurance penetration rate of 3.9% in India this is big opportunity for Insurers to tap new markets. Mutual Funds and other financial products Similarly the Asset Management Companies might get some share by accessing new untapped markets.

- 8. Page 8 of 19 6.0 Role of Information Technology Payment banks are required to adapt technological solutions from the start of their business operations to lower costs and extend their network. 6.1 IT Architecture for Business Flow Users CBS (CASA) CustomerCASA Hosted Infra Investment Customers Business Correspondents’ Fund Transfer Big Data& Data Analytics InternetBrowser Utility Payment CRM Mobile Apps MF Sourcing DMS Branches Insurance Products Sourcing Business Correspondents ATM PPI - mWallets NEFT, RTGS, NECS, etc. POS Investments of funds UIDAI Vendors Registered agents BCs to Other PaymentGateways Promotional schemes KRA /RTA - CAMs, Karvy, etc. Insurers Connectivity to External Parties & Applications Banking ProcessDelivery Channels ITInfrastructure Applications

- 9. Page 9 of 19 6.2 IT Business Model These players would have to explore business models which are: Cost efficient technology platform to reduce overall cost of transaction and Sharing of resources with vendors / other players Act as BCs and share their infrastructure. Tie-ups for cross-sell of products and promotional schemes 6.3 Business Solutions / Technologies that may be deployed Hosted Banking solutions eKYC technologies using connectivity to UIDAI Mobile banking and Internet Banking solutions A mix of Customer Access points such as Own branch network Business Correspondents ATMs & POS Merchants’ locations such as Kirana shops, mobile recharge vendors, etc. Use of shared infrastructures such as networks, card vendors, ISPs and Datacentres Data analytics technologies for driving business strategy, operations & monitoring and frauds management Document Management Solutions Connectivity to : Remittance enabling networks such as NEFT, IMPS, RTGS, NECS Payment gateways & utility bills payment vendors such as TPSL, Billdesk, etc. KRAs, RTAs & Insurers for sale of MF & Insurance products. Switches such as VISA, MASTER & RUPAY 6.4 Use of Third Party Vendors: Outsourcing of various non-core business activities would be required. The following functions could be considered: Managed services : IT Infrastructure ATMs (CRAs & CITs) POS Portal / app development and maintenance and content management Multiple ISPs

- 10. Page 10 of 19 7.0 Organisational Structure The broad organizational structure with access point mix is given below: 8.0 Regulatory Framework Some of the conditions laid down in Draft guidelines & other press releases are summarized below: 8.1 Promoters: Eligible Promoters Entities / groups in the private sector, entities in public sector and Non-Banking Financial Companies (NBFCs) shall be eligible to set up a bank through a wholly- owned Non-Operative Financial Holding Company (NOFHC). Corporate The NOFHC shall be wholly owned by the Promoter / Promoter Group. The NOFHC

- 11. Page 11 of 19 structure of the NOFHC shall hold the bank as well as all the other financial services entities of the group. Corporate governance of NOFHC At least 50% of the Directors of the NOFHC should be independent directors. The corporate structure should not impede effective supervision of the bank and the NOFHC on a consolidated basis by RBI. Prudential norms for the NOFHC The prudential norms will be applied to NOFHC both on stand-alone as well as on a consolidated basis and the norms would be on similar lines as that of the bank. Exposure norms The NOFHC and the bank shall not have any exposure to the Promoter Group. The bank shall not invest in the equity / debt capital instruments of any financial entities held by the NOFHC. Other Business of Promoters The other financial services of promoter (if any) should be ring fenced & interference with Payment Bank. Banks as Promoters Even banks can take equity stake in a Payments Bank to the extent permitted under Section 19 (2) of the Banking Regulation Act, 1949. Prior approval for acquisition As per Section 12B of the Act, any acquisition of 5 per cent or more of voting equity shares in a private sector bank will require prior approval of RBI. This will also apply to the Payments Banks. 8.2 Capital Requirements: Minimum Capital Minimum paid up voting equity capital set at INR 100 Crores, & are required to maintain a positive network of INR 100 Crores. Leverage Ratio The payments bank should have a leverage ratio of not less than 3 per cent, i.e., its outside liabilities should not exceed 33.33 times its net worth (paid-up capital and reserves). Capital Adequacy The Payments Bank shall be required to maintain a minimum capital adequacy ratio of 15 per cent of its risk weighted assets (RWA) on a continuous basis, subject to any higher percentage as may be prescribed by RBI from time to time, As Payments Banks are not expected to deal with sophisticated products, the capital adequacy ratio will be computed under simplified Basel I standards. FDI Foreign shareholding is allowed as per FDI rules in Private Banks. 8.3 Promoter Equity Minimum Equity Promoter stake should be minimum 40% & be held by Promoter for minimum lock in period of 5 years. Diversified Holding Since a Payments Bank cannot undertake lending activities, it is not mandatory for it to have a diversified ownership structure. However, when the Payments Bank reaches the net worth of Rs. 500 crore, and therefore becomes systemically important, diversified ownership and listing will be mandatory within three years of reaching that net worth; for others listing is voluntary subject to fulfillment of the requirements of the capital market regulator. Ceiling & Reduction Shareholding in excess of 40% should be brought down to 40% within period of 3 years, to 30% in 10 years and to 26% within 12 years. Non Promoter Holding Entities other than the promoters will not be permitted to have shareholding in excess of 10 per cent of the voting equity capital of the bank.

- 12. Page 12 of 19 8.4 Corporate Governance Directors Majority of Bank Directors should be independent directors Common Directors The Bank can have common Directors as that of Promoter Company. However independent Directors of Promoter company will not be considered as Independent for Payment Banks Fit & Proper The payment banks should comply with the corporate governance guidelines including ‘fit and proper’ criteria for Directors as issued by the RBI from time to time. Voting Rights As per Section 12 (2) of the Banking Regulation Act, 1949, the voting rights in private sector banks are capped at 10 per cent per shareholder. 8.5 Business Plan Framework The applicants were required to furnish their business plans and project reports with their applications. Therefore the banks already have a road map defined for steps to be taken. The business plan contain Minimum of Following: Way in which the bank proposes to achieve the objectives behind setting up of Payments Bank. Aspects relating to business model proposed to be used; bank’s access points in rural and semi-urban areas; control over its BCs and customer grievance redressal; JV partnership with a scheduled commercial bank, if any; etc. Deviation In case of deviation from the stated business plan (filed by applicants while applying for license) after issue of license, RBI may consider restricting the bank’s expansion, effecting change in management and imposing other penal measures as may be necessary. 8.6 Other conditions Channel/ Geographical Coverage The Payments Bank should ensure widespread network of access points particularly to remote areas, either through their own branch network, ATMs or BCs or through networks provided by others. The Payments Bank is expected to adapt technological solutions to lower costs and extend its network. Minimum No. of Branches No such minimum No. of Branches/ access points prescribed by RBI. The Banks have to be guided by the five year business plan submitted to RBI. Mandatory Presence 25% of the Physical access points must be in the “Unbanked” areas (The Payments Bank shall operate in remote areas mostly through BCs and other networks). Therefore, the requirement of opening at least 25 per cent of branches in unbanked rural centers (population up to 9,999 as per the latest census), is not stipulated for them. Technology The operations of the bank should be fully networked and technology driven from the beginning, conforming to generally accepted standards and norms. Grievance Redressal The bank should have a high powered Customer Grievances Cell to handle customer complaints.

- 13. Page 13 of 19 8.7 Corporate & Banking Regulations Some of the conditions laid down in Draft guidelines & other press releases are summarized below: a. Corporate Regulations Companies Act The Payments Bank will be registered as a public limited company under the Companies Act, 2013. Public Issue SEBI (Issue of Capital & Disclosure Requirements) Regulations, 2009 and SEBI dilution norm for promoters. Differential Voting Rights Cap of 10% voting rights of as per Banking Regulation Act, 1949 to be aligned to differential voting rights as permitted under Companies Act 2013. b. Banking Regulations: License The Payment Banks will be licensed under Section 22 of the Banking Regulation Act, 1949, with specific licensing conditions restricting its activities to acceptance of demand deposits and provision of payments and remittance services. Prudential Norms As the Payments Bank will not have loans and advances in its portfolio, it will not be exposed to credit risk and, the prudential norms and regulations of RBI as applicable to loans and advances, will therefore, not apply to it. However, the Payments Bank will be exposed to operational risk and should establish a robust operational risk management system. Further, it may face liquidity risk, and therefore is required to follow RBI’s guidelines on liquidity risk management, to the extent applicable. Banking Activities RBI is yet to come up with detailed regulations for governing Payment Banks. However some of the existing acts which will affect the Payment Banks are as follows: Reserve Bank of India Act, 1934 Banking Regulation Act, 1949 Foreign Exchange Management Act, 1999 Payment and Settlement Systems Act, 2007 Other relevant Statutes and Directives, Prudential Regulations and other Guidelines/Instructions issued by RBI for universal Bank to the extent it relates to activities of Payment Banks The eligible deposits mobilized by the Payments Bank would be covered under the deposit insurance scheme of the Deposit Insurance and Credit Guarantee Corporation of India (DICGC).

- 14. Page 14 of 19 c. Permitted Investment Activities: RBI is yet to come up with detailed regulations for governing Payment Banks; however the broad scope of Investment activities as defined in draft regulations being indicative in nature, are listed below: 8.8 Service Tax Service Tax implications on major activities to be undertaken by Payment Banks as permitted by Reserve Bank of India are listed below: Deposits No Service Tax implications as the whole transactions of accepting deposits are mere transaction in money Issuance of ATM/ Debit Cards Transaction / Issue Charges liable to Service Tax

- 15. Page 15 of 19 Remittance Services Acceptance of funds at one end and payments of funds at other end through various channels. Business Correspondent services (“BC”) Issuance of Pre- Paid Payment Instrument (“PPI”) Internet Banking/ Utility Bill Payment Any charges recovered by Payment Banks for providing internet banking services liable to Service Tax. Cross Border Impact on CENVAT Credit

- 16. Page 16 of 19 Non-Risk Financial services Cenvat Credit Banking Cos. engaged in providing services by way of extending deposits, loan or advances are eligible for only 50% of CENVAT Credit. Payment Banks cannot undertake lending activities. However, Payment Banks will be required to invest minimum 75% of its deposits in Government Securities and hold maximum 25% in current and time/ fixed deposits with other banks. Considering the above interpretation, payment Banks are eligible only for 50% of CENVAT Credit on common Inputs and Input services Registration

- 17. Page 17 of 19 8.9 Other Regulations: SEBI & IRDA As regards commission etc. banks are required to follow the guidelines issued by respective sectoral regulators in the matter e.g. IRDA, SEBI, AMFI etc. for sourcing of MF and Insurance products Money laundering Prevention of Money Laundering Act, 2002 for Customer Acceptance Policy & Monitoring of suspicious transactions Tax framework Income Tax 1961 Service Tax Rules 1994 Information Technology Information Technology Act 2002 : Adopt reasonable Security Practices Adhere to Customer Data Privacy & Secrecy norms PCI DSS Standards FATCA The Foreign Account Tax Compliance Act (FATCA) was enacted by the Government of the United States in March 2010, to combat offshore tax evasion by US individuals and US owned entities. It imposes obligations on foreign financial institutions to collect prescribed information relating to US persons, and to withhold tax on any 'withholdable payment' received by any US person who does not consent to their details being disclosed to the US Internal Revenue Service (IRS). As a consequence to inter-Governmental Agreement between India with the US, Indian banks, mutual funds, insurance companies and other financial institutions will have to collect additional details from US persons and/or withhold tax on qualifying payments. Though the Payment Banks are not allowed to hold NRI deposits, however exposure FDI & availing any other form of services from US individuals / US owned entities will make them liable for FATCA compliance.

- 18. Page 18 of 19 9.0 Way Forward Detailed regulations for governing Payment Banks to be issued by RBI. Compliance to all conditions laid down in ‘in-principle” approval to be met within the deadline of 18 months. Strategize the stages to become fully operational. Competition from here on is only going to get tougher, as RBI is going to announce small finance banks soon and is currently evaluating around 70 applications.

- 19. Page 19 of 19 Scope & Limitations: For further information please contact: RSM Astute Consulting Group 13th Floor, Bakhtawar, 229, Nariman Point, Mumbai - 400 021. T: (91-22) 6108 5555 / 6121 4444 F: (91-22) 6108 5556 / 2287 5771 E: emails@astuteconsulting.com www.astuteconsulting.com Offices: Mumbai, New Delhi - NCR, Chennai, Kolkata, Bengaluru (Bangalore), Surat, Hyderabad, Ahmedabad, Pune, Gandhidham, Indore and Jaipur. RSM Astute Consulting Private Limited is a member of RSM network. Each member of the RSM network is an independent accounting and advisory firm which practices in its own right. The RSM network is not itself a separate legal entity in any jurisdiction. 7 September 2015 © RSM Astute Consulting, 2015 The purpose of this White Paper (‘Paper’) is to provide a brief overview of the term ‘Payment Banks’ as per the report of Dr. Nachiket Mor and the in-principle approval granted by RBI for differentiated linencing. No part of this Paper shall be reproduced without our prior written consent. The Paper is prepared for general use and our views as stated above would be required to be revalidated vis-à-vis the facts of each case. The Reserve Bank of India or Government authorities may or may not subscribe to the views expressed herein. Under no circumstances, our liability in respect of matters discussed in this Paper shall exceed the fees received or the damages actually suffered for this matter, whichever is less.