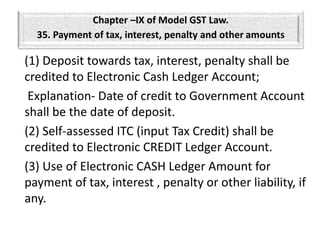

Payment of tax

- 1. (1) Deposit towards tax, interest, penalty shall be credited to Electronic Cash Ledger Account; Explanation- Date of credit to Government Account shall be the date of deposit. (2) Self-assessed ITC (input Tax Credit) shall be credited to Electronic CREDIT Ledger Account. (3) Use of Electronic CASH Ledger Amount for payment of tax, interest , penalty or other liability, if any. Chapter –IX of Model GST Law. 35. Payment of tax, interest, penalty and other amounts

- 2. (4) Use of Electronic CREDIT Ledger Amount for payment of tax, interest , penalty or other liability, if any (5)(a) UTILIZATION OF IGST Credit: can be used for payment of IGST/CGST/SGST Tax liability but subject to priority order hereunder : • 1st Priority: against IGST Tax liability • 2nd Priority: Balance if any against of CGST liability, if any. • 3rd Priority: Balance if any, may be utilized for payment of SGST liability 35. Payment of tax, interest, penalty and other amounts

- 3. (b) UTILIZATION OF CGST Credit: can be utilized against payment of CGST and IGST but subject to priority order hereunder : 1st Priority: against CGST Tax liability 2nd Priority: Balance if any against of IGST liability, if any. © * CGST Credit can not be utilized for payment of SGST tax liability. **As per provision to be incorporated in CGST Act (b) UTILIZATION OF SGST Credit: can be utilized against payment of SGST and IGST but subject to priority order hereunder : 1st Priority: against SGST Tax liability 2nd Priority: Balance if any against of IGST liability, if any. © * SGST Credit can not be utilized for payment of CGST tax liability. **As per provision to be incorporated in SGST Act 35. Payment of tax, interest, penalty and other amounts

- 4. (6) Refund of un-utilized CASH / CREDIT Amount paid against tax, interest, penalty, fee or other amount in accordance with provisions of Sec.38(This Section is for Refund) and the amount collected as CGST / SGST Refund shall stand reduced to the extent of refund amount. • * Importing provision under IGST Act is Sec.27: Application of certain provisions of the CGST Act, 2016, therefore , Pls. go through Sec. supra. 35. Payment of tax, interest, penalty and other amounts

- 5. (7) Recording and maintenance of ALL liabilities of taxable person in ELECTRONIC REGISTER. (8) Taxable person shall pay the tax or other dues in following order: (a) Self-assessed Tax / other Dues to return of previous period; (b) Self-assessed Tax / other Dues to return of current period; © any other amount including demand u/s 51 of the Act. 35. Payment of tax, interest, penalty and other amounts

- 6. (9) Every person who has paid the tax on goods and/or services under this Act shall, unless the contrary is proved by him, be deemed to have passed on the full incidence of such tax to the recipient of such goods and/or services. Explanation.— For the purposes of this section(i.e, Section 35) , the expression “tax dues” means the tax payable under this Act and does not include interest, fee and penalty. • ** Comment: Principles of unjust enrichment will invoke while claiming the refund of excess tax paid amount, therefore, correct assessment and correct payment should be put on priority list of job assignment. 35. Payment of tax, interest, penalty and other amounts

- 7. • There is separate provision for payment of interest on: – Tax dues – undue or excess claim of input tax credit under sub-section (10) of Section 29 36. Interest on delayed payment of tax

- 8. • Who can deduct the TDS? • The following person can deduct TDS: – Central /State Govt. Department; – Local Authorities; – Govt. agencies – Such other person notified by Central/State Govt. – one percent from the payment made or credited to the supplier • Time of Payment of Tax deducted Amount: to be deposited within 10th day after end of the month in which deduction made; • TDS Certificate(containing relevant details as specified in Sec.37(3)) by dedcutor to dedutee within 5 days of crediting the amount to Government, if fails to pay , late fee @Rs.100/= per day subject to maxmimum of Rs.5000/= • Deductee will claim credit of the TDS amount in Electronic Cash Ledger Section 37 : Tax deduction at source

- 9. • If deductor fails to pay the amount to Government within stipulated period (i.e, 10th Day after end of the month) , shall be liable for payment of INTEREST . • Refund to Deductor / deductee in case of excess/ erroneous deduction. • No refund of excess / erroneous refund if amount deducted has been • credited to the electronic cash ledger of the deductee. Views expressed are strictly personal. Ram Sunder Singh Bhilai, Durg (C.G.) Section 37 : Tax deduction at source

- 10. • TDS to be deducted when total value of supply under a contract exceeds (>) Rs.10 Lacs; • TDS Amount: one percent from the payment made or credited to the supplier . • Value of supply excludes tax amount indicated in invoice