QNBFS Daily Market Report September 4, 2018

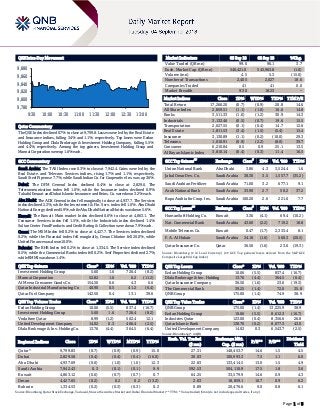

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.7% to close at 9,799.8. Losses were led by the Real Estate and Insurance indices, falling 3.4% and 1.1%, respectively. Top losers were Ezdan Holding Group and Dlala Brokerage & Investment Holding Company, falling 5.5% and 4.4%, respectively. Among the top gainers, Investment Holding Group and Mannai Corporation were up 1.6% each. GCC Commentary Saudi Arabia: The TASI Index rose 0.3% to close at 7,942.4. Gains were led by the Real Estate. and Telecom. Services indices, rising 1.7% and 1.1%, respectively. Saudi Steel Pipe rose 7.7%, while Saudi Indian Co. for Cooperative Ins. was up 3.6%. Dubai: The DFM General Index declined 0.4% to close at 2,829.6. The Telecommunication index fell 1.0%, while the Insurance index declined 0.9%. Takaful Emarat and Dubai Islamic Insurance and Reins. Co. were down 3.2% each. Abu Dhabi: The ADX General index fell marginally to close at 4,937.7. The Services index declined 2.3%, while the Investment & Fin. Serv. index fell 1.0%. Abu Dhabi National Energy declined 5.9%, while Abu Dhabi National Hotels was down 5.6%. Kuwait: The Kuwait Main market Index declined 0.6% to close at 4,863.1. The Consumer Services index fell 1.5%, while the Industrials index declined 1.4%. Sultan Center Food Products and Credit Rating & Collection were down 7.9% each. Oman: The MSM Index fell 0.2% to close at 4,427.7. The Services index declined 0.2%, while the Financial index fell marginally. Oman Chlorine fell 20.0%, while United Finance was down 10.0%. Bahrain: The BHB Index fell 0.2% to close at 1,334.5. The Service index declined 0.5%, while the Commercial Banks index fell 0.2%. Seef Properties declined 2.7%, while BMMI was down 1.4%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Investment Holding Group 5.60 1.6 726.4 (8.2) Mannai Corporation 52.82 1.6 6.2 (11.2) Al Meera Consumer Goods Co. 154.50 0.6 4.3 6.6 Qatar Industrial Manufacturing Co 40.90 0.5 41.2 (6.4) Qatar Fuel Company 142.50 0.4 13.1 39.6 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 10.06 (5.5) 837.4 (16.7) Investment Holding Group 5.60 1.6 726.4 (8.2) Vodafone Qatar 8.99 (1.2) 502.4 12.1 United Development Company 14.02 0.3 466.4 (2.5) Dlala Brokerage & Inv. Holding Co. 13.76 (4.4) 364.5 (6.4) Market Indicators 03 Sep 18 02 Sep 18 %Chg. Value Traded (QR mn) 99.6 96.1 3.7 Exch. Market Cap. (QR mn) 540,421.0 545,963.8 (1.0) Volume (mn) 4.5 5.3 (15.0) Number of Transactions 2,405 2,027 18.6 Companies Traded 41 41 0.0 Market Breadth 9:30 18:23 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,266.20 (0.7) (0.9) 20.8 14.6 All Share Index 2,859.51 (1.1) (1.0) 16.6 14.8 Banks 3,511.33 (1.0) (1.2) 30.9 14.3 Industrials 3,132.46 (0.5) (0.7) 19.6 15.5 Transportation 2,027.55 (0.1) (0.4) 14.7 12.6 Real Estate 1,811.53 (3.4) (1.5) (5.4) 15.4 Insurance 3,130.89 (1.1) (0.2) (10.0) 29.3 Telecoms 1,010.91 (0.9) (2.2) (8.0) 39.7 Consumer 6,210.84 0.5 0.9 25.1 13.5 Al Rayan Islamic Index 3,810.14 (0.4) (0.3) 11.4 16.5 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Union National Bank Abu Dhabi 3.86 4.3 3,524.4 1.6 Jabal Omar Dev. Co. Saudi Arabia 38.30 3.5 1,557.7 (35.2) Saudi Arabian Fertilizer Saudi Arabia 71.00 3.2 677.1 9.1 Arab National Bank Saudi Arabia 33.90 2.7 50.2 37.2 Bupa Arabia for Coop. Ins. Saudi Arabia 100.20 2.6 221.6 7.7 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% HumanSoft Holding Co. Kuwait 3.36 (4.1) 69.4 (10.2) Nat. Commercial Bank Saudi Arabia 43.60 (2.2) 719.2 18.8 Mobile Telecom. Co. Kuwait 0.47 (1.7) 2,333.4 8.1 F. A. Al Hokair Saudi Arabia 24.18 (1.6) 560.3 (20.5) Qatar Insurance Co. Qatar 36.50 (1.6) 23.6 (19.3) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 10.06 (5.5) 837.4 (16.7) Dlala Brokerage & Inv. Holding 13.76 (4.4) 364.5 (6.4) Qatar Insurance Company 36.50 (1.6) 23.6 (19.3) The Commercial Bank 39.25 (1.4) 72.0 35.8 QNB Group 175.00 (1.4) 74.9 38.9 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 175.00 (1.4) 13,225.9 38.9 Ezdan Holding Group 10.06 (5.5) 8,612.3 (16.7) Industries Qatar 123.00 (0.4) 8,356.6 26.8 Qatar Islamic Bank 138.70 (0.2) 8,077.3 43.0 United Development Company 14.02 0.3 6,543.7 (2.5) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,799.83 (0.7) (0.9) (0.9) 15.0 27.31 148,453.7 14.6 1.5 4.5 Dubai 2,829.58 (0.4) (0.4) (0.4) (16.0) 30.03 100,993.3 7.5 1.1 6.0 Abu Dhabi 4,937.69 (0.0) (1.0) (1.0) 12.3 22.83 133,414.5 13.0 1.5 4.9 Saudi Arabia 7,942.43 0.3 (0.1) (0.1) 9.9 592.53 504,110.9 17.5 1.8 3.6 Kuwait 4,863.12 (0.6) (0.7) (0.7) 0.7 64.25 33,579.9 14.6 0.9 4.3 Oman 4,427.65 (0.2) 0.2 0.2 (13.2) 2.03 18,859.1 10.7 0.9 6.2 Bahrain 1,334.53 (0.2) (0.3) (0.3) 0.2 0.89 20,476.6 9.0 0.8 6.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,780 9,800 9,820 9,840 9,860 9,880 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QSE Index declined 0.7% to close at 9,799.8. The Real Estate and Insurance indices led the losses. The index fell on the back of selling pressure from Qatari and GCC shareholders despite buying support from non-Qatari shareholders. Ezdan Holding Group and Dlala Brokerage & Investment Holding Company were the top losers, falling 5.5% and 4.4%, respectively. Among the top gainers, Investment Holding Group and Mannai Corporation were up 1.6% each. Volume of shares traded on Monday fell by 15.0% to 4.5mn from 5.3mn on Sunday. Further, as compared to the 30-day moving average of 6.5mn, volume for the day was 29.8% lower. Ezdan Holding Group and Investment Holding Group were the most active stocks, contributing 18.4% and 16.0% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 09/03 UK Markit Markit UK PMI Manufacturing SA August 52.8 53.9 53.8 09/03 EU Markit Markit Eurozone Manufacturing PMI August F 54.6 54.6 54.6 09/03 Germany Markit Markit Greece Manufacturing PMI August 53.9 – 53.5 09/03 France Markit Markit France Manufacturing PMI August F 53.5 53.7 53.7 09/03 China Markit Caixin China PMI Mfg August 50.6 50.7 50.8 09/03 Japan Markit Nikkei Japan PMI Mfg August F 52.5 – 52.5 09/03 India Markit Nikkei India PMI Mfg August 51.7 – 52.3 09/03 France Markit Markit France Manufacturing PMI August F 53.5 53.7 53.7 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar QIBK confirms that there is no material information or news that has affected the trading volume of its shares – Based on the disclosure and transparency principle, Qatar Stock Exchange’s management addressed Qatar Islamic Bank (QIBK) regarding the recent increase in trading volume on the bank's shares. The bank reported that it has no news or information that has not been disclosed in accordance with Qatar Stock Exchange regulations. The bank affirmed its commitment to the principle of disclosure and transparency on any matters that may affect investors' decisions. (QSE) Ministry of Finance starts budget discussions – As a part of its efforts to prepare budget for 2019, which starts from January 1 and ends on December 31, the Ministry of Finance has issued directives to different Ministries and government institutions to prepare the budget. The instructions, a copy of which is with Lusail newspaper, issued by Minister of Finance HE Ali Shareef Al Emadi, include rules and guidelines for its implementation. The Ministry’s discussion with different Ministries and institutions started from September 2 and will continue until September 25. (Peninsula Qatar) Qatar’s central bank sells QR7.85bn of bonds, Sukuk – Qatar's central bank stated it sold QR7.85bn of conventional bonds and Sukuk. The central bank sold QR2.45bn of three-year conventional bonds and QR1.0bn of three-year Sukuk at a yield of 3.75%. It also sold QR3.2bn of five-year conventional bonds and QR1.2bn of five-year Sukuk at 4.25%. (Zawya) EIU: Diversification projects in Qatar to sustain robust growth until 2030 – Qatar’s economic diversification investment projects will sustain robust growth until 2030, the Economist Intelligence Unit (EIU) has noted and said the country’s real GDP growth will average 3.6% during the next 12 years. EIU said, “There remains potential for bursts of high growth,” if further gas export projects, beyond those planned for the mid- 2020s are approved by the government. “Diversification and the expansion of the services sector, funded by the state’s hydrocarbons wealth, will also provide opportunities for growth,” the EIU said. The population will continue to increase, largely through immigration, to 3.8mn in 2050. As a result, growth in real GDP per head will be much slower than growth in real GDP. Assessing Qatar’s overall business environment, EIU said the country’s overall business environment score has improved slightly, rising from 6.76 for the historical period (2013-17) to 6.86 for the forecast period (2018-22). (Gulf- Times.com) Transport sector urged to use global customs transit system – Qatar Chamber has called on companies in the transport sector wishing to join the global customs transit system for moving goods across international borders to submit their documents in order to be included in the list of companies authorized to use this system for export and import operations. Qatar Chamber’s Chairman, Sheikh Khalifa bin Jassim Al-Thani pointed out that the International Road Transports (TIR) system is an international system of transport and customs guarantee that Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 31.26% 43.52% (12,202,984.43) Qatari Institutions 19.78% 16.61% 3,152,571.99 Qatari 51.04% 60.13% (9,050,412.44) GCC Individuals 2.38% 0.79% 1,584,714.16 GCC Institutions 1.14% 3.08% (1,929,975.96) GCC 3.52% 3.87% (345,261.80) Non-Qatari Individuals 10.46% 11.56% (1,096,198.25) Non-Qatari Institutions 34.98% 24.45% 10,491,872.49 Non-Qatari 45.44% 36.01% 9,395,674.24

- 3. Page 3 of 5 is globally applicable. It allows the transportation of goods from the country of origin through transit countries to the country of destination in sealed containers subject to customs control through a mutually recognized multilateral system. It is also considered the easiest, safest and most reliable means of transporting goods across multiple international borders, thus saving time and money for transport operators and customs authorities. (Gulf-Times.com) UNWTO: Qatar among 10 most open countries in the world – Qatar has become the most open country in the Middle East and the 8 th most open in the world in terms of visa facilitation, according to the World Tourism Organization’s (UNWTO) recently updated visa openness rankings. The high ranking reflects a string of visa facilitation measures introduced by Qatar, including allowing nationals of 88 countries to enter Qatar visa-free and free-of-charge. As a result, Qatar’s openness score has leapt by 71.3 points since 2014, when it ranked 177 th . Already, Qatar’s increased openness is showing in the growing number of visitors from markets, which can now access the country visa-free. Notable increases in arrival volumes in the first half of 2018 compared to the first half of 2017 came from India (18%), China (43%) and Russia, which grew most significantly with a 366% increase. (Peninsula Qatar) International UK factories feel pinch from global economy as export orders fall – British manufacturers had their weakest month in over two years and export orders suffered a rare decline in August, a warning that a world economic slowdown, as well as the approach of Brexit, is weighing on the country’s factories, a survey showed. The IHS Markit/CIPS UK Manufacturing Purchasing Managers’ Index (PMI) fell to 52.8, its lowest level since July 2016, immediately after the Brexit vote and a lot weaker than a median forecast of 53.8 in a Reuters poll of economists. Sterling weakened against the Dollar and the Euro after the data, and economists said that the prospect of leaving the European Union in March next year without any trade agreement appeared to be weighing on sentiment. New orders were the weakest in more than two years, weighed down by the first drop in export orders since April 2016, and hiring by manufacturers almost stagnated. (Reuters) Eurozone’s manufacturing growth eases on trade war worries – Eurozone’s manufacturing growth slowed to a near two-year low in August, as optimism dwindled amid growing fears of an escalating global trade war, a survey showed. However, this edition of the survey should be treated with some caution. It only represents about 70% of the usual sample size as swathes of European factories take a break over the summer months. IHS Markit’s August final manufacturing Purchasing Managers Index dropped to a 21-month low of 54.6 from July’s 55.1, unchanged from an initial reading, yet comfortably above the 50 level that separates growth from contraction. An output index, which feeds into a composite PMI due on September 5, and is regarded as a good gauge of economic health, nudged up to 54.7 from 54.4. (Reuters) Nikkei newspaper: Japan’s PM Abe to raise sales tax 'by all means' – Japanese Prime Minister Shinzo Abe vowed to proceed with next year’s scheduled sales tax hike ‘by all means’ and take steps to ease an expected hit to consumption from the higher levy, the Nikkei newspaper reported. Abe said his ruling Liberal Democratic Party (LDP) won last year’s lower house election with a pledge to use proceeds from the sales tax increase to make Japan’s social welfare system more sustainable. Abe twice postponed the tax hike after an increase to 8% from 5% in 2014 tipped Japan into recession. Abe said the impact of the tax hike to 10% will be smaller than that of the increase to 8%. He also said the government will take measures to moderate an expected downturn in consumption after the hike. (Reuters) China discusses ways to stabilize market expectations – China’s financial oversight body has discussed with experts the ways to improve communications with market participants and stabilize market expectations, the central bank said. The office of the cabinet’s Financial Stability and Development Committee (FSDC), which is based at the central bank, held a meeting with experts, including former central bank Chief, Zhou Xiaochuan, the central bank said. (Reuters) Regional MENA countries spearheading $2.6tn smart cities market – Countries in the Middle East and North Africa (MENA) region, especially with initiatives from across the GCC, are spearheading the global smart cities market, which is set to reach $2.6tn by 2025, stated a report by Schneider Electric, a leader in digital transformation of energy management and automation. As mega-trends such as connectivity, mobility, social media, and new digital business models transform the world, city governments across the region are harnessing the power of the Internet of Things (IoT) to drive innovation, meet citizen needs, and enhance energy and infrastructure development. (GulfBase.com) Saudi Arabia may maintain October light crude prices for Asia cargoes – Saudi Arabia is expected to keep prices for the light crude grades it sells to Asia largely unchanged in October from the previous month to keep its oil competitive against other suppliers, according to sources. Saudi Arabia has cut the prices for Arab Light and Arab Extra Light to Asia over the past two months as it fends off competition from other Middle East oil suppliers, Europe and the US. (Reuters) SAUDIA expands codeshare accord with Garuda Indonesia – Saudi Arabian Airlines (SAUDIA), the national flag carrier of Saudi Arabia, and Garuda Indonesia airlines have expanded their existing bilateral codeshare agreement, which will see SAUDIA’s code-SV, added to GA flights between Indonesia, Saudi Arabia and beyond. This follows from the existing partnership on flights between Saudi Arabia and Indonesia operated by SV. The expanded agreement will now include flights sold and operated by both airlines to points within both countries, as well as three destinations in Australia. (GulfBase.com) Saudi Cable Company approves capital reduction – Saudi Cable Company announced that its shareholders approved cutting its capital by 72.63% during the Extraordinary General Meeting (EGM). The company's capital reduced to SR110.61mn from SR404.11mn and number of share also decreased from 40,411,400 to 29,349,994. (Tadawul)

- 4. Page 4 of 5 APICORP mandates banks before possible five-year Dollar bond sale – Arab Petroleum Investments Corporation (APICORP) mandated banks to arrange a series of investor meetings in Britain and the US ahead of a potential international bond issue, according to a document issued by one of the banks. The meetings will start on September 5, 2018, and a fixed-rate, five- year benchmark US Dollar senior unsecured Rule 144A/Regulation S bond deal will follow, subject to market conditions. (Reuters) Abu Dhabi Commercial Bank in merger talks with two rivals – Abu Dhabi Commercial Bank stated that it is in early merger talks with Union National Bank and Al Hilal Bank, which could potentially form a lender with $113bn in assets. Abu Dhabi has been revamping its economy and pressing ahead with consolidating state-owned entities after two years of low oil prices weighed heavily on its revenues. Two of Abu Dhabi’s top banks were merged last year to create First Abu Dhabi Bank with total assets of $175bn, while two of its big sovereign wealth funds were also combined. (Reuters) RAK Properties sets new heights in destination tourism – RAK Properties is collaborating with leading international British architectural design firm RMJM to create a unique take on outdoor entertainment on Hayat Island at Mina Al Arab, Ras Al Khaimah (RAK) that will create a destination in which to visit and live. The project is expected to draw a large number of tourists to Ras Al Khaimah. The Ras Al Khaimah Tourism Development Authority stated that there is promising YoY increase and its latest reporting showed 14% increase in the number of international visitors to Ras Al Khaimah in 1H2018. The Authority stated that the Emirate is likely to have received more than 1mn visitors by the end of 2018, with an aim of 3mn visitors annually by 2025. (GulfBase.com) Burgan Bank gets approval for bond sale – Burgan Bank received the central bank’s initial approval to offer up to KD150mn in bonds. The sale of senior unsecured bonds is subject to approval from the Capital Markets Authority, the Kuwaiti lender stated in a statement. (Bloomberg) Oman expects oil prices to stay between $70-80 per barrel this year – Oman’s Oil Minister, Mohammed Bin Hamad Al Rumhi said that he expects oil prices to remain between $70 to $80 a barrel this year, Omani news website WAF reported. Saudi Arabia, Kuwait and the UAE are the only three countries that have the capacity to increase oil production, he said at an oil conference in Oman. OPEC and its allies pledged on June 22-23 to return to 100% compliance with their agreement to reduce their combined output by 1.8mn bpd. (Reuters) Port of Duqm’s project set for end-2020 completion – Construction work on the Port of Duqm’s Commercial Terminal and Operational Zone project is well under way and is slated for completion before the end of 2020, according to a summary note prepared by one of the project’s key lenders. The Asian Infrastructure Investment Bank, a multilateral development bank headquartered in China, has committed $265mn in funding support for the project, representing 75% of the total project cost of $353.33mn. The balance 25% (amounting to $88.33mn) is being contributed by the Special Economic Zone Authority of Duqm. (GulfBase.com)

- 5. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg ( # Market closed on September 3, 2018) Source: Bloomberg (*$ adjusted returns, # Market closed on September 3, 2018) 50.0 75.0 100.0 125.0 Aug-14 Aug-15 Aug-16 Aug-17 Aug-18 QSE Index S&P Pan Arab S&P GCC 0.3% (0.7%) (0.6%) (0.2%) (0.2%) (0.0%) (0.4%) (0.8%) (0.4%) 0.0% 0.4% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,200.99 (0.0) (0.0) (7.8) MSCI World Index 2,173.42 (0.1) (0.1) 3.3 Silver/Ounce 14.51 (0.2) (0.2) (14.4) DJ Industrial# 25,964.82 0.0 0.0 5.0 Crude Oil (Brent)/Barrel (FM Future)# 78.15 0.9 0.9 16.9 S&P 500# 2,901.52 0.0 0.0 8.5 Crude Oil (WTI)/Barrel (FM Future)# 69.80 0.0 0.0 15.5 NASDAQ 100# 8,109.54 0.0 0.0 17.5 Natural Gas (Henry Hub)/MMBtu# 2.96 0.0 0.0 (16.4) STOXX 600 382.51 0.3 0.3 (5.0) LPG Propane (Arab Gulf)/Ton# 104.00 0.0 0.0 6.4 DAX 12,346.41 0.0 0.0 (7.6) LPG Butane (Arab Gulf)/Ton# 110.38 0.0 0.0 4.5 FTSE 100 7,504.60 0.4 0.4 (7.0) Euro 1.16 0.1 0.1 (3.2) CAC 40 5,413.80 0.3 0.3 (1.5) Yen 111.07 0.0 0.0 (1.4) Nikkei 22,707.38 (0.7) (0.7) 1.1 GBP 1.29 (0.7) (0.7) (4.8) MSCI EM 1,047.13 (0.8) (0.8) (9.6) CHF 1.03 (0.0) (0.0) 0.6 SHANGHAI SE Composite 2,720.73 0.0 0.0 (21.7) AUD 0.72 0.3 0.3 (7.6) HANG SENG 27,712.54 (0.6) (0.6) (7.8) USD Index# 95.14 0.0 0.0 3.3 BSE SENSEX 38,312.52 (1.3) (1.3) 0.9 RUB 68.12 0.9 0.9 18.2 Bovespa 76,192.73 (1.6) (1.6) (20.2) BRL 0.24 (2.5) (2.5) (20.3) RTS 1,085.19 (0.7) (0.7) (6.0) 80.8 78.8 76.1