Juhayna Food Industries - Initiation of Coverage - 22 February 2016

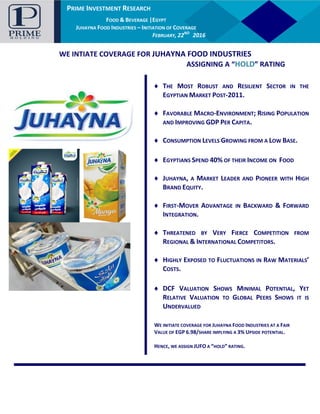

- 1. PRIME INVESTMENT RESEARCH AUTOMOTIVE |EGYPT GB AUTO – INITIATION OF COVERAGE JANUARY, 14TH 2016 PRIME INVESTMENT RESEARCH FOOD & BEVERAGE |EGYPT JUHAYNA FOOD INDUSTRIES – INITIATION OF COVERAGE FEBRUARY, 22ND 2016 WE INTIATE COVERAGE FOR JUHAYNA FOOD INDUSTRIES ASSIGNING A “HOLD” RATING WE INITIATE COVERAGE FOR JUHAYNA FOOD INDUSTRIES AT A FAIR VALUE OF EGP 6.98/SHARE IMPLYING A 3% UPSIDE POTENTIAL. HENCE, WE ASSIGN JUFO A “HOLD” RATING. ♦ THE MOST ROBUST AND RESILIENT SECTOR IN THE EGYPTIAN MARKET POST-2011. ♦ FAVORABLE MACRO-ENVIRONMENT; RISING POPULATION AND IMPROVING GDP PER CAPITA. ♦ CONSUMPTION LEVELS GROWING FROM A LOW BASE. ♦ EGYPTIANS SPEND 40% OF THEIR INCOME ON FOOD ♦ JUHAYNA, A MARKET LEADER AND PIONEER WITH HIGH BRAND EQUITY. ♦ FIRST-MOVER ADVANTAGE IN BACKWARD & FORWARD INTEGRATION. ♦ THREATENED BY VERY FIERCE COMPETITION FROM REGIONAL & INTERNATIONAL COMPETITORS. ♦ HIGHLY EXPOSED TO FLUCTUATIONS IN RAW MATERIALS’ COSTS. ♦ DCF VALUATION SHOWS MINIMAL POTENTIAL, YET RELATIVE VALUATION TO GLOBAL PEERS SHOWS IT IS UNDERVALUED

- 2. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 Valuation: We initiate our coverage for Juhayna Food Industries with a “Hold” rating driven from an upside potential of 3%; driven from our estimated Fair Value of EGP 6.98. Using the DCF valuation methodology for Juhayna, we utilized an average WACC over our forecasted horizon of 14.73%, a risk free rate of 9.70%, and a market risk premium of 8%. We used the average F&B Sector Beta which is equivalent to 0.68. We applied a perpetual growth rate of 5%, driven by the sector’s ability to outperform the GDP; supported by the population growth coupled with increasing disposable income and spending power over the medium-term. JUHAYNA FOOD INDUSTRIES … WHEN THERE’S ROOM FOR EVERYONE ….. Stock Data Outstanding Shares [mn] 941.4 Mkt. Cap [Bn] 6.38 Bloomberg – Reuters JUFO EY / JUFO.CA 52-WEEKS LOW/HIGH 6.60 – 10.90 DAILY AVERAGE TURNOVER (‘000S) 4,041 Ownership Pharon Investments 52.22% BoD 0.85% Free Float 46.93% Financial Highlights EGP mn 2015 2016E 2017E 2018E Revenues 4,231 4,845 5,587 6,388 GPM (%) 40% 40% 39% 38% EBITDA 863 960 1053 1169 N.Income 280 418 487 581 NPM (%) 7% 9% 9% 9% EPS 0.30 0.44 0.52 0.62 P/E 22.81x 15.28x 13.12x 11.00x DPS 0.15 0.16 0.18 0.22 BV/S 2.57 2.82 3.14 3.52 Source: Juhayna, Prime Estimates Prices are as 21 February 2016 5 6 7 8 9 10 11 12 -02-2015 -03-2015 -04-2015 -05-2015 -06-2015 -07-2015 -08-2015 -09-2015 -10-2015 -11-2015 -12-2015 -01-2016 JUFO EGX Rebased “HOLD” MARKET PRICE EGP 6.78 FAIR VALUE EGP 6.98 POTENTIAL 3% UPSIDE INVESTMENT GRADE “VALUE” Report Content Valuation 2 Financial Statements 4 Preface 5 Macro Overview on Egypt 6 Egypt’s F&B Sector 18 The Food & Beverage on the EGX 19 Juhayna Food Industries Co.: 25 I. MANUFACTURING 29 II. AGRICULTURE & FARMING 37 III. Distribution, Sales and Marketing 38 Main Events in 2015 for Juhayna 38 Financial Overview 40 Disclosure 48 Source: Bloomberg • The F&B sector is among the most stable sectors in Egypt. Despite the political and economic turmoil that has been in Egypt specifically and the MENA in general since 2011, the F&B sector has proven to be quiet robust and resilient. Egypt’s demographics (population of 90 mn and more than 60% is under the age of 30) show a very good prospect for the sector. • Bullish outlook on the Egyptian economy and the Consumer Goods markets in the medium- term. Continued political stability and economic reforms are expected to persist in the medium- term. A boom is expected in the consumer goods market / F&B sector, on the back of the rising population, rising GDP Per Capita and the tendency of Egyptians to spend around 40% of their income on food. • Regional and International players have shown interest in the Egyptian F&B sector throughout the last several years. Such producers usually have extensive experience and the know-how of penetrating emerging markets. • The Egyptian Dairy market witnessed lots of changes in the last decade. The dairy market in Egypt grew at a CAGR rate of 10% in 2010-2015 The conversion rates from Loose Milk to Packaged Milk accelerated, where in 2015 the share of loose milk stood at 60% against the 40% for packaged milk. • Juhayna Food Industries is a leading producer and distributor of milk, juice and yoghurt products. Production began in 1987 with a total production capacity of 35 tons per day and annual sales of EGP 2.4mn. Since 1983 and for more than 3 decades Juhayna has embarked a journey full of developments and expansions that distinguished it as a leading Egyptian producer of juice and dairy products. Each year, Juhyana introduces 10-15 new products to its diverse consumer base. • Currently, its holds the largest market share in all of its products – plain milk (63%) – flavored milk (64%) – juice (20%) – drinkable yoghurt (35%) – spoonable yoghurt (33%) . Throughout the years, Juhayna invested heavily in backward and forward integration, where it was able to build a business-model that is very hard to replicate by competitors. • In the last decade, Juhyana has suffered from the deterioration of its market shares. International companies, such as Al Marai and Danone were able to grab market shares that used to belong to Juhayna. • Juhayna’s main risk lies within the fluctuating prices of raw materials; namely powder milk. Powder milk represents 30% of the total raw materials. 30% of the raw materials is imported and subject to FX risks. 2

- 3. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 DCF Valuation shows that Juhayna has a minimal upside potential of 3%. However, Valuation based on Multiples would imply that Juhayna is considered relatively undervalued and justify trading at a premium. Juhayna has a lower Leading P/E ratio (11.65x) than its global (16.56x) and regional (13.6x) peers. Using the leading P/E multiple for global peers, Juhayna’ FV would stand at EGP 7.31, implying a 7% upside potential. From the below table, we can see that the F&B sector is traded at a high P/E ratio, regionally and globally. This can be attributed to the defensive nature of the sector that should be represented in the investors’ portfolios, especially in a country like Egypt which is featured with strong domestic demand. Consequently, investors opt to allocate a portion of their portfolios towards the F&B sector regardless of the upside potential driven from DCF method. Value (EGP / Share) Upside Potential 100% DCF 6.95 3% 100% P/E Multiple 7.29 7% 50% DCF / 50% P/E Multiple 7.13 5% In EGP mn 2016E 2017E 2018E 2019E 2020E FCF 145,276 719,765 762,886 869,424 979,443 PV - FCF 129,303 557,889 513,882 509,660 502,594 Terminal Value 8,329,505 Average WACC 14.73% Perpetual Growth 5% Entity Value 8,507,149 Equity Value 6,573,916 No. of Shares (mn.) 941.41 DCF Value/share 6.98 GLOBAL P/E – Trailing P/E – Leading (NY) P/B Median 18.13x 16.56x 1.29x JUFO.CA 22.82x 11.65x 2.64x REGIONAL P/E – Trailing P/E – Leading (NY) P/B Median 13.27x 13.6x 1.27x JUFO.CA 22.82x 11.65x 2.64x Upside Risks: 1) Further backward integration to secure a higher portion of raw milk. 2) Major success and solid performance of Arju. 3) Ability to pass higher percentage of increase in COGS to end-consumers than our estimation 4) Faster conversion from loose to packaged milk. 5) Further increase in consumption per capita levels. 6) Faster recovery in export markets. Downside Risks: 1) Higher than estimated costs of raw materials 2) Higher / faster rate of devaluation. 3) Worsening FX shortage and Juhayna’s inability to secure its required FX needs. 4) Faster deterioration of market shares. 3

- 4. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: JUHAYNA, PRIME ESTIMATES Financial Statements … Historical & Forecasts Income Statement Brief Historical Forecasts In EGP `000 2014 2015 2016E 2017E 2018E Revenues 3,684,060 4,231,162 4,845,014 5,586,978 6,388,174 COGS 2,520,314 2,558,806 2,914,728 3,418,673 3,935,939 Depreciation & Amortization 186,988 204,275 235,575 272,450 304,507 Gross Profit 1,163,746 1,672,356 1,930,285 2,168,305 2,452,235 GPM 32% 40% 40% 39% 38% EBITDA 571,047 863,384 959,900 1,052,526 1,169,274 EBITDA Margin 16% 20% 20% 19% 18% Net Income After MI 169,964 279,829 417,647 486,392 580,390 Net Attributable Income 169,964 279,829 376,440 438,402 523,126 NPM 5% 7% 8% 8% 8% Balance Sheet Brief Historical Forecast In EGP `000 2014 2015 2016E 2017E 2018E Assets Total Current Assets 1,178,264 1,589,805 1,112,284 1,297,291 1,629,170 Total Non-Current Assets 3,336,738 3,405,458 3,770,877 3,642,307 3,496,312 Total Assets 4,515,002 4,995,263 4,883,160 4,939,598 5,125,482 Liabilities & Equity Total Current Liabilities 1,352,962 1,307,020 1,381,895 1,382,883 1,431,693 Total Non-Current Liabilities 877,584 1,265,298 845,742 602,183 377,095 Total Liabilities 2,230,547 2,572,317 2,227,637 1,985,066 1,808,787 Total Equity 2,284,455 2,422,945 2,655,523 2,954,532 3,316,695 4

- 5. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: MASLOW’S HIERARCHY OF NEEDS SOURCE: CAPMAS & CBE & MINISTRY OF INVESTMENT SOURCE: CAPMAS MASLOW’S HIERARCHY OF NEEDS EGYPT’S POPULATION BREAKDOWN BY GENDER REAL GDP GROWTH RATES Preface: Food is considered the most basic need for life. A very traditional list of basic needs would include food (including water), shelter and clothing. All governments around the work have been very attentive to the importance of providing food to their people. No matter the downturn in any country/ region or even on a global level, the food and beverage sector has always been among the most stable and resilient sectors. The Egyptian economy is one of the most developed and diversified economies in Africa and the Middle East. It has a population of around 90 mn (87.96 mn on 1/1/2015), where approximately 60% is under the age of 30 and only 5% above the age of 60. This extremely young and dynamic population is a powerful catalyst for social and economic development. On the political front, Egypt is progressing steadily towards building its democratic institutions and political system. The political roadmap that was initiated by the Egyptian president Abdel Fattah El Sisi on July 2013 was completed in January 2016 where the House of Representatives convened for the first time. The political stability and the recent economic reforms implemented by the Egyptian government drove the real GDP growth in the last several years. Egypt achieved real GDP growth rates of 2.10%, 2.20% and 4.20% for FY2012/13, FY2013/14 and FY2014/15 respectively. 51%49% Males Females 7% 32% 30% 20% 11% 60+ 30 - 59 15 -29 5 -- 14 0 --4 1,207 1,372 1,576 1,844 2,102 2,430 5.10% 1.80% 2.20% 2.10% 2.20% 4.20% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 5.50% 0 500 1,000 1,500 2,000 2,500 3,000 FY10a FY11a FY12a FY13a FY14a FY15a GDP at market prices Real GDP Growth (%) EGP Bn 5

- 6. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: POPULATION REFERENCE BUREAU - 2015 SOURCE: CBE & PRIME ESTIMATES EGYPT’S POPULATION FERTILITY RATES – BIRTHS PER 1,000 POPULATION Macro Overview on Egypt: Various factors determine the attractiveness of the F&B sector in any given country. Egypt has many favorable factors that make it a perfect destination for existing companies to expand and for new entrants to penetrate. On the other hand, Egypt has many pitfalls from the economic, social and regulatory perspectives that may impede the development of any sector, including the F&B. The following factors show why Egypt has one of the most attractive and promising F&B sectors on a regional and international scale. 1) Large, Young and Dynamic Population: Egypt is the most populous country in the MENA region and the third in Africa, after Nigeria (179 mn) and Ethiopia (101 mn). Egypt had approximately 87.96 million citizens living in Egypt in January 2015 with a historical average growth rate of 2.3% since 2005. 70.00 71.35 72.94 74.44 76.10 77.84 79.62 81.57 83.67 85.78 87.96 2.0% 1.9% 2.2% 2.1% 2.2% 2.3% 2.3% 2.4% 2.6% 2.5% 2.5% 1.0% 1.2% 1.4% 1.6% 1.8% 2.0% 2.2% 2.4% 2.6% 2.8% 65 70 75 80 85 90 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015* Population (mn) Growth Rate Year 2010 2011 2012 2013 2014 2015* 2016 f 2017 f 2018 f 2018 f 2019 f 2020 f Population (mn) 77.840 79.618 81.567 83.667 85.783 87.963 90.127 92.373 94.692 97.052 99.469 101.945 Growth Rate (Prime Estimates) 2.30% 2.30% 2.40% 2.60% 2.50% 2.50% 2.46% 2.49% 2.51% 2.49% 2.49% 2.49% Egypt has one of the highest fertility rates when compared to many other developing or developed countries, with an average of 31.3 births per 1,000 of the population. (Source: CAPMAS). Moreover, Egypt has a rising rate of natural increase - the difference between Births and Deaths. It is expected that Egypt’s population will reach 100 mn by 2019/2020. 11 20 22 31 34 0 10 20 30 40 More Devloped World Less Developed EGYPT * Least Developed 11 12 18 18 18 31 36 0 10 20 30 40 Europe North America Latin America Asia Oceana EGYPT * Africa Mn 6

- 7. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: CAPMAS EGYPT’S POPULATION BREAKDOWN – BY AGE NATURAL INCREASE IN EGYPT’S POPULATION URBANIZATION RATE IN EGYPT 15 17 19 21 23 25 27 1,000 1,200 1,400 1,600 1,800 2,000 2,200 2,400 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Number Rate Egypt is witnessing an increase in the urbanization rate as a result of the rising income levels and most of the job opportunities being located mainly in the greater Cairo and Alexandria. 33 35 37 39 41 43 45 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 35 38 41 42 43 44 44 43 43 43 43 43 Egypt has one of the world’s most youthful populations, where approximately 60% is under the age of 30 and only 5% is above the age of 60. This extremely young and dynamic population gives the country’s future prospects an undeniable strength. 1% 1% 2% 3% 4% 4% 5% 5% 6% 8% 10% 10% 10% 9% 11% 11% 75 ++ 70 -- 74 65 --69 60 -- 64 55 --59 50 --54 45 --49 40 --44 35 --39 30 --34 25 --29 20 -- 24 15 -- 19 10 --14 5 -- 9 0 -- 47% 32% 30% 20% 11% 60+ 30 - 59 15 -29 5 -- 14 0 --4 Per 1,000 of Pop. Per 1,000 of Pop. % 7

- 8. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: REUTERS & PRIME ESTIMATES REAL GDP GROWTH RATES Political Events in Egypt Jan-11 * Egypt erupted in large-scale anti-regime demonstrations. * The resignation of President Hosni Mubarak * The collapse of the regime that had been in power for 30 years Jun-12 * Dr. Mohamed Morsi, the candidate of the Freedom & Justice Party was elected as Egypt’s 5th president and the 1st from outside the military. Jul-13 *President Morsi was removed. *Interim President Adly Mansour was sworn in. Jun-14 *Presidential elections were held and Abdel Fattah El-Sisi was elected with almost 97% of the votes. * El-Sisi was sworn into office as president on June 8, 2014. 2) Slightly Improving Economy: The Egyptian economy has struggled severely in the last several years. This has been the result of the political turmoil that has started in 2011. Since mid-2014, the economic and political scene started to witness some improvement. This has been reflected in all aspects of the economy. Real GDP growth rates started to improve, where it recorded 2.20% and 4.20% for FY2013/14 and FY 2014/15 respectively. S&P Long-term Issuer Rating (Foreign) S&P Long-term Issuer Rating (Domestic) Moody's Long-term Issuer Rating (Foreign) Moody's Long-term Issuer Rating (Domestic) Fitch Long-term Issuer Default Rating (Foreign) Fitch Long-term Issuer Default Rating (Domestic) B- 15-Nov-2013 B- 15-Nov-2013 B3 07-Apr-2015 B3 07-Apr-2015 B 19-Dec-2014 B 19-Dec-2014 CCC+ 09-May-2013 CCC + 09-May-2013 Caa1 21-Mar-2013 Caa1 21-Mar-2013 B- 05-Jul-2013 B- 05-Jul-2013 B- 24-Dec-2012 B- 24-Dec-2012 B3 12-Feb-2013 B3 12-Feb-2013 B 30-Jan-2013 B 30-Jan-2013 B 10-Feb-2012 B 10-Feb-2012 B2 21-Dec-2011 B2 21-Dec-2011 B+ 15-Jun-2012 B+ 15-Jun-2012 B+ 24-Nov-2011 B+ 24-Nov-2011 B1 27-Oct-2011 B1 27-Oct-2011 BB- 30-Dec-2011 BB 30-Dec-2011 BB- 18-Oct-2011 BB- 18-Oct-2011 Ba3 16-Mar-2011 Ba3 16-Mar-2011 BB 03-Feb-2011 BB+ 03-Feb-2011 BB 01-Feb-2011 BB+ 01-Feb-2011 Ba2 31-Jan-2011 Ba2 31-Jan-2011 BB+ 14-Dec-2005 BBB- 18-Aug-2008 BB+ 22-May-2002 BBB - 22-Aug-2003 Ba1 28-Jul-1999 Ba1 23-Jun-2008 BBB 14-Dec-2005 BBB- 15-Jan-1997 BBB 22-May-2002 Baa1 28-Nov-2001 BBB + 22-Jun-2001 A- 15-Jan-1997 Furthermore, the international credit ratings agencies started to upgrade the ratings for Egypt and its long-term sovereign debt. The government started to announce many initiatives (1 mn houses), reforms and mega-projects (EEIC - The New Suez Canal – The New Tax System – The Investment Law –SMEs Initiative, New Monetary & Fiscal Policies) that enhanced the sentiment locally and globally. 1206.6 2429.80 5.10% 4.20% 1.50% 3.00% 4.50% 6.00% 0 500 1000 1500 2000 2500 3000 FY10a FY11a FY12a FY13a FY14a FY15a GDP at market prices Real GDP Growth (%) EGP Bn. % 8

- 9. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: CAPMAS, CBE, REUTERS, BLOOMBERG, PRIME ESTIMATES SUEZ CANAL REVENUES It is worthy to note that 2015 was not a very pleasant year for Egypt; decreasing Suez Canal revenues, declining Tourism revenues, FX shortage, Energy Crisis. On the bright side, FDIs increased in 2015, on the back of the EEIC and the huge support by the GCC countries; namely Saudi Arabia, Kuwait and the UAE. The FX shortage and the Energy crisis were the main two dilemmas that had a huge impact on the economy. Many factories were shut down as they were not supplied by natural gas and many producers could not purchase any of their imported raw materials, whether from the official market or the parallel market. The top sectors that were affected by the Energy crisis were Cement, Steel and Fertilizers. Pharmaceuticals and F&B were mainly affected by the FX Shortage. Some sectors, such as Automotive were unfortunately affected by both, the energy crisis and FX shortage. The CBE tried to manage the FX shortage by giving priorities to some sectors. The CBE gave the top priorities to: 1) Pharmaceuticals 2) Food & Beverage and 3) Raw Materials. Large food producers were able to obtain the required FX to a large extent, however according to some officials it took them almost double the time to get it. For Example, Juhayna and Edita have very good connections with banks and they were able to get the required FX in 2015, however it took them 4 weeks instead of 2 to get the required amounts. Suez Canal Revenues: Tourism Revenues: Foreign Direct Investments - FDI: 434.8 382 420.1 422.1 449.6 431.6 437.7 462.1 448.8 449.2 408.4 429 350 370 390 410 430 450 470 Jan. 2015 Feb. 2015 Mar. 2015 Apr. 2015 May. 2015 Jun. 2015 Jul. 2015 Aug. 2015 Sep. 2015 Oct. 2015 Nov. 2015 Dec. 2015 Suez Canal Revenues (USD Mn.) USD Mn. 5175 5465 5,000 5,100 5,200 5,300 5,400 5,500 2015 2014 Revenues (USD Bn.) 17483 17148 16,000 16,500 17,000 17,500 18,000 2015 2014 No. of Passing Ships No. 678 640 835 924 895 820 912 915 802 909 559 642 617 755 860 768 786 886 998 884 1003 898 782 400 500 600 700 800 900 1000 1100 Jan. Feb Mar Apr May Jun Jul Aug Sep Oct Nov* Dec* 2015 2014 Number of Tourists Arrivals ('000s) '000s 1,656 509 428 701 407 3,902 6,111 11,053 13,237 8,113 6,758 2,189 3,982 3,005 4,119 6,371 - 2,000 4,000 6,000 8,000 10,000 12,000 14,000 Direct Investment in Egypt (Net FDIs - USD Mn) USD Bn. USD Mn. 9

- 10. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: PRIME ESTIMATES SOURCE: IMF Growth of real GDP should be around 4% per year in the medium-term as political stability improves, economic reform progresses and investment rises. As for the long-term, Egypt is expected to have quiet solid real growth rates such as that of pre-2011 (6-8% per annum) in the 2020-2025 period. GDP Breakdown by Expenditures EGP billion FY10a FY11a FY12a FY13a FY14a FY15a FY16f FY17f FY18f GDP at market prices 1206.6 1371.8 1576 1843.80 2101.90 2429.80 2805.45 3237.16 3744.07 Real GDP Growth (%) 5.10% 1.80% 2.20% 2.10% 2.20% 4.20% 3.70% 3.89% 4.55% Private Consumption 899.8 1035.9 1271.0 1486.1 1738.5 1998.3 2298.0 2619.8 3012.7 Real Growth (%) 4.10% 4.50% 6.50% 7.83% 4.06% 2.77% 3.56% 3.15% 3.18% Government Consumption 134.7 155 179.0 211.2 252.4 287.4 330.5 373.5 418.3 Real Growth (%) 4.50% 3.80% 3.10% 8.66% 6.63% 7.04% 6.85% 6.35% 5.08% Investment 235.3 234.5 258.0 264.4 290.6 349.2 408.6 478.0 559.3 Real Growth (%) 8.00% -4.40% 5.80% -4.77% 1.71% 8.60% 7.40% 10.26% 9.92% Net Exports (63.2) (53.6) (132.0) (117.9) (179.6) (205.1) (231.7) (234.1) (246.2) Real Growth (%) -10.03% 29.42% 1.88% 13.17% 11.25% 3.16% Exports 257.6 282.0 275.0 316.6 303.4 320.9 304.9 329.2 362.2 Real Growth (%) -3.00% 4.60% -2.30% 5.61% -11.86% -0.35% -22.05% -3.01% 5.00% Imports 320.8 335.6 407.0 434.5 483.0 526.0 536.5 563.3 608.4 Real Growth (%) -3.20% 7.50% 10.80% 0.52% 0.17% 0.49% -8.60% 3.73% 4.07% Figures are nominal and in billion of Egyptian pounds, growth rates are real 3) Growing GDP Per Capita:GDP per Capita has always been a more reliable indicator than GDP, as it reveals the true picture of the country’s economic health and is far better when comparing the country’s economic health over time. The GDP per capita in Egypt is considered very low, compared to other countries in the MENA region and Africa. From a “real” GDP per capita perspective, Egyptians have suffered from a drop during the 2011-2014 period. On a positive note, the IMF predicts a clear improvement in the GDP per capita for the period 2015-2020. Qatar Kuwait United Arab Emirates Bahrain Saudi Arabia Oman Lebanon Libya Iraq AlgeriaJordanTunisiaMorocco Egypt Sudan Yemen 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 0 2 4 6 8 10 12 14 16 GDP Per Capita - USD - 2014 - MENA Angola Botswana Cabo Verde Cameroon Chad Republic of Congo Gabon Kenya Nigeria Seychelles Swaziland Zimbabwe Egypt 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 0 2 4 6 8 10 12 14 GDP Per Capita - USD- 2014 - Africa USD USD 10

- 11. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: IMF SOURCE: IMF SOURCE: IMF & WORLD BANK & CAPMAS 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 GDP per Capita, Constant Prices - EGP 19,237 19,170 19,121 18,992 18,955 19,363 19,792 20,272 20,806 21,409 22,045 y-o-y Change -0.35% -0.26% -0.67% -0.19% 2.15% 2.22% 2.43% 2.63% 2.90% 2.97% GDP per Capita, Current Prices - EGP 15,326 17,053 19,120 20,700 23,040 26,126 29,097 32,893 36,825 40,748 44,889 y-o-y Change 11.27% 12.12% 8.26% 11.31% 13.39% 11.37% 13.05% 11.95% 10.65% 10.16% 4) Slightly Improving Disposable Income … Yet Still Weak Social Justice: Egypt is considered a middle-income country. More than 22% of the total population live in poverty. Poverty is more dominant in certain regions of the country; almost 50% of the people residing in Upper Egypt cannot provide the basic needs of food. Egypt suffers from income inequality as they highest 20% of the population earns more than 40% of the country’s total income. The disposable income has slightly improved in the last several years, however sometimes the effect of rising inflation surpasses the rise in income. Egyptians place a high priority on food, as they spend around 38% of their income on food, which represents the highest threshold. 224,196 250,082 271,270 284,593 293,030 200,000 210,000 220,000 230,000 240,000 250,000 260,000 270,000 280,000 290,000 300,000 2012 2013 2014 2015 2016 Annual Disposable Income (USD million)USD Mn. 40.33% 13.01% 16.37% 21.04% 9.25% Income Distribtuion by Quintiles - Egypt 2008 1st 20% 2nd 20% 3rd 20% 4th 20% 5th 20% Annual Average of Household Expenditure by Expenditure Groups % Food & Non-Alcoholic Beverages 38% Alcholic Beverages & Tobacco 4% Clothing & Footwear 5% Housing, Electricity, Water, Gas & Other Fuels 18% Furniture & Equipment 4% Health 9% Transport 5% Communication 2% Recreation & Culture 2% Education 4% Restaurants & Hotels 4% Others 3% 13,458 20,254 25,353 30,492 0 10,000 20,000 30,000 40,000 Total Urban Rural Total Urban Rural Total Urban Rural Total Urban Rural 2004/2005 2008/2009 2010/2011 2012/2013 Annual Average of Household IncomeEGP/Annum 11

- 12. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: CBE 5) High Consumption & Expenditure on Food: Food consumption is rising rapidly from a quiet low base. Demand for food is expected to rise as income rises. Most of the sub- sectors offer very strong potential, as the per capita consumption in Egypt is relatively low compared to other countries. Food consumption is expected to grow rapidly (at a double-digit rate) in the medium-term. The rapid increase is mainly driven by high inflation. The increase will also be fueled by favorable demographic trends and investments by local, regional and international investors. On the other hand, one of the main threats that food producers face is that the consumer base is very price-sensitive and is quiet inelastic. Producers are sometimes not able to transfer any increase in costs to the consumers, leading to the shrinkage of their margins. Food Consumption Indicators - Historical Data & Forecasts, 2011-2018 2011 2012 2013e 2014f 2015f 2016f 2017f 2018f Food Consumption EGP Bn 256 299 335 378 431 491 555 621 Food Consumption,Food consumption, EGP, % chg y-o-y 14 17 12 13 14 14 13 12 Food Consumption,EGP per capita 3,220 3,705 4,082 4,532 5,084 5,709 6,362 7,016 Food Consumption,EGP per capita, % chg y-o-y 12 15 10 11 12 12 11 10 SOURCE: BMI 6) Globalization of Food Tastes: The consumption and lifestyle trends have changed dramatically in Egypt in the last decade. This change is more obvious in the youth, as they are more aware of the international trends through the internet and social media. This is referred to as “The Westernization of Lifestyles”. Also the concept of “Dining Out” has been more common than before, given that income has been on the rise, more women have entered the workforce and people have much busier lifestyles. High income segments are becoming increasingly brand conscious and thus some brands are starting to benefit from “Brand Loyalty” This gives food producers and food chain a great opportunity to grab new and larger shares of this growing sector. 7) Slow Recovery of Tourism: Tourism is of great importance to the Egyptian economy. In FY2014/15, tourism contributed around 2% to the GDP. Tourism is one of the main sources of FX, besides the Suez Canal and Oil Exports. Also tourism employs a large share of the population. Egypt attracts tourists from around the world; however Europeans and Arabs are on top of the list. Tourism has been hit severely after the 2011 revolution, on the back of the political instability and the lack of security, Tourism started to pick up mid-2013 due to the political stability and the government carrying out several international campaigns with international agencies, urging tourists from all over the world to come visit Egypt. 11% 13% 17% 2% Tourism , 2% 56% GDP FY2014/2015 - By Sector - % Agriculture, Forests & Fishing Extractions (Oil & Gas) Manufacturing Industries Electricity Tourism Others 12

- 13. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: CBE SOURCE: REUTERS In general, the F&B sector is not directly affected by Tourism, as the majority is consumed domestically. Even the political turmoil has not affected the consumption patterns of Egyptians; as Hypermarkets and retail outlets reported higher sales during the peak of the political instability – 2011- 2013. It is worthy to note that there are a few sub-sectors that are strongly-correlated with tourism, such as Alcoholic Beverages. 76% 13% 5% 3% 3% 0.2% Natioanlity of Tourists - 2013/2014 - % European Countries Middle East Countries African Countries Americas Asia & the Pacific Egypt started 2015 with positive growth in y-o-y arrival numbers from January to July; however the tourism sector was slightly affected by the decline in the purchasing power of Russian tourists (main users of Egypt’s RED Sea resorts and hotels). Arrivals started to weaken in August. Since September, 3 main incidents occurred – 2 domestic and 1 international – that had an extremely negative outcome on tourism. These incidents led to a drop in the annual revenues from tourism to reach USD 6.1bn in 2015, as compared to USD 7.4bn in 2014; a 15% drop. Also the number of tourists’ arrivals dropped in 2015 by 6% reaching 9.3mn, against 9.9mn in 2014. The December official figures are not yet announced, however the estimates show that revenues dropped by almost 50% and December could be considered the third weakest month with respect to tourism revenues since January 2011. Egypt has lost around EGP 2.2bn per month as a result of the Russian and British airline bans. We believe that tourism will start to pick up gradually in the coming years, however at a slow rate and that it would take several years till it gets back to the pre-2011 levels. Incidents that Affected Tourism in Egypt Sep. 15 The Egyptian military accidentally attacked a convoy of Mexican tourists in the Western Desert, killing 12 people. Nov. 15 A Russian passenger plane crashed in the Sinai peninsula, killing all 224 people on board. The attack was claimed by the Islamic State, and Russia and several other countries concluded the crash was due to terrorism, although Egypt has denied the airplane was brought down by foul play. Nov. 15 A series of coordinated terrorist attacks occurred in Paris. Three suicide bombers struck near the Stade de France in Saint-Denis, followed by suicide bombings and mass shootings at cafés, restaurants and a music venue in central Paris. The attackers killed 130 people. 200 400 600 800 1000 1200 No. of Tourist Arrivals - 2011-2015 - '000s ‘000s 13

- 14. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: REUTERS, CBE, PRIME ESTIMATES SOURCE: CAPMAS 9,751.8 5,073.3 7,370 5,900 7,800 4,000.0 5,000.0 6,000.0 7,000.0 8,000.0 9,000.0 10,000.0 11,000.0 FY12/13a FY13/14a FY 14/15a FY 15/16f FY16/17f Tourism Revenues - USD Million 678 640 835 924 895 820 912 915 802 909 559 642 617 755 860 768 786 886 998 884 1003 898 782 400 500 600 700 800 900 1000 1100 Jan. Feb Mar Apr May Jun Jul Aug Sep Oct Nov* Dec* 2015 2014 Number of Tourists Arrivals ('000s)'000s 8) Geographic Location & Trade Agreements: Egypt benefits from an outstanding geographic location that helps it act as a major player in carrying out regional and international agreements. Egypt has favorable free-trade agreements with neighboring countries from the MENA region, Africa and most of the EU countries. Egypt is a major exporter of fruits, vegetables, juices, herbs and processed foods. Egypt has a balance of trade deficit in general and in the F&B sector in specific. Other than the outstanding location, Egypt has a relative low cost of labor which makes many multinational companies consider Egypt as a key hub for regional exports. Exports to the Euro-countries – EU – have been on the rise, as a result of the very flexible trade agreements between the 2 groups. According to the terms of the free trade agreements, the EU has free access to the Egyptian market for around 90% of their agricultural and fisheries exports, while around 70% of Egyptian agricultural products have free entry to the EU. The political turmoil in many of the neighboring countries has had an effect on Egypt export markets, such as Libya, Iraq and Sudan. -400,000 -300,000 -200,000 -100,000 0 100,000 200,000 300,000 400,000 500,000 600,000 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Exports Imports Trade Balance Exports, Imports & Trade Balance - EGP mn - 2004 - 2014 -15,000 -10,000 -5,000 0 5,000 10,000 15,000 20,000 25,000 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Exports Imports Trade Balance Exports, Imports & Trade Balance - Food & Beverage & Tobacco - EGP mn - 2004 - 2014 USD Mn. EGP Mn. EGP Mn. 14

- 15. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: BLOOMBERG, CBE & PRIME ESTIMATES SOURCE: CAPMAS Despite the opportunities prevailing in the Egyptian market, there are some risks that may impose some obstacles in the F&B Sector: 1) High Inflation: Egypt suffers from high inflation. The average CPI rate in 2014 and 2015 was a double-digit figure, 10.2% which is relatively high. Food and Beverages represent around 40% of the CPI rate. Food & Beverages prices are known for being very volatile as they are affected by seasonality and climatic conditions (fruits & vegetables). Even though the CBE and the government prioritize curbing inflation, we expect that the Egypt will pertain to suffer from double digit inflation rates till FY2017. 2 4 6 8 10 12 14 8/1/2010 12/1/2010 4/1/2011 8/1/2011 12/1/2011 4/1/2012 8/1/2012 12/1/2012 4/1/2013 8/1/2013 12/1/2013 4/1/2014 8/1/2014 12/1/2014 4/1/2015 8/1/2015 Annual Consumer Inflation % % 40% Headline CPI Constituents - % Food and Beverages Housing, Water, Electricity, Gas and other Fuels Medical Care Transportation Clothing and Footwear Education Cafes and Restaurants Hotels Furnishings, Household Equipment Miscellaneous Goods and Services Communications Recreation and Culture Tobacco and Related Products 11.0% 8.7% 6.9% 10.1% 11.0% 9.9% 10.5% 9.8% 10.5% 9.0% 9.5% 10.1% 10.4% 10.5% 9.9% 9.7% 6.50% 7.50% 8.50% 9.50% 10.50% 2011a 2012a 2013a 2014a 2015a 2016f 2017f 2018f CPI Inflation Anuual Average (Fiscal Years) CPI Inflation Anuual Average (Calendar Years) % 2) High Unemployment: High unemployment remains a threat to the local market development. Unemployment hiked after the 2011 revolution, as many companies had to downsize and terminate some workers/employees, or even close their operations and file for bankruptcy. Egypt’s unemployment reached a double-digit figure in 2011 and remained in the same category since then. 0 5000 10000 15000 20000 25000 30000 Labor Force Employed Unemployed 27686 24122 3564 ‘000s 15

- 16. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: BLOOMBERG, CBE & PRIME ESTIMATES Employed Males Females Unemployed Males Females 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% Q1FY08 Q2FY08 Q3FY08 Q4FY08 Q1FY09 Q2FY09 Q3FY09 Q4FY09 Q1FY10 Q2FY10 Q3FY10 Q4FY10 Q1FY11 Q2FY11 Q3FY11 Q4FY11 Q1FY12 Q2FY12 Q3FY12 Q4FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 8.90% 11.90% 12.77% Unemployment Rate %% In January, 2016, Al- Sisi pledged to reduce unemployment to 10 % over the next five years, while announcing the SME initiative. Furthermore, the participation ratio in Egypt is very low compared to other countries due to the fact that most of the population is below the age of 30. In the medium-term the participation rate will gradually rise as new generations will join the workforce, in addition to a large share of women joining the workforce as well. 3) Ambiguity in the Monetary Policy, Exchange Rates & FX Unavailability: The FX shortage and the Energy crisis were the main risks that hindered the Egyptian economy in 2015. Egypt relies heavily on imports as in raw materials and finished goods. Reserves stood at about USD 36bn before the 2011 revolt that ousted Hosni Mubarak. Foreign international reserves reached USD 16.44bn in Dec. 2015. This had a negative impact on the economy, as investors feared to penetrate the market and businesses could not import any of the imported raw materials which halted their operations. Another impediment that affected the Egyptian economy is the “lack a clear monetary policy” in general and the devaluation of the Egyptian Pound in specific. Many emerging markets have devaluated their currencies against the USD in 2015, such as China and Vietnam. The CBE devaluated the EGP against the USD several times in 2015. In the medium-term, we expect that the CBE will have to further devaluate the EGP in order to attract investors, curb imports and flourish exports. 5.96 6.01 6.6 7.15 7.63 8.53 9.04 9.4 5 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 FY11a FY12a FY13a FY14a FY15a FY16f FY17f FY18f EGP/USD Rate 7.00 7.20 7.40 7.60 7.80 8.00 8.20 EGP / USD Rate 2015 16

- 17. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: BLOOMBERG 4) Reliance on Imported Raw Materials in the Production Process: Egypt relies heavily on importing raw materials. Many commodity prices have declined severely in 2015 such as crude oil, sugar, copper, steel and powder milk. The rise of commodity prices represents a huge risk for producers. Sometimes the severe drop in international prices can lead to unfair competition between local and international producers, where local producers are not able to compete with the extremely new prices – e.g. Sugar. 160 170 180 190 200 210 220 230 240 CRB Index - 2015 5) VAT Tax & Higher Cost of Living: Egypt's government has announced on several occasions since 2007 that it is going to implement the VAT in order to increase fiscal revenues, but the decision has been repeatedly postponed. Egypt’s government is expected to finalize a bill on a value added tax (VAT) by the end of 1Q 2016 and present it to the House of Representatives. The VAT will be fixed at a unified rate between 10 - 12 % and will be imposed on all goods and services with a few exceptions such as subsidized food stuffs like oil , dairy and wheat. The application of the VAT is expected to lead to inflation as the price level of most goods will increase. Consequently, this will lead to lower disposable income and people would have less money to spend on goods and services. Egypt’s F&B Sector: The F&B sector has witnessed lots of changes in 2015, as 2015 has been referred to as “The year of M&As”. Another important event was the very successful IPO of Edita Food Industries. In the coming years, the food & beverage industry will change even further. We expect it to become more concentrated and many regional and international players will penetrate the market, benefiting from their large capital and extensive know-how. Date Transaction Jan-15 Kellogg acquired Bisco Misr for USD 87mn. Feb-15 Qalaa announced that it is willing to sell Dina Farms and it put it on the auction block for an estimated value of EGP 700mn. Abraaj, Savola, Al Marai have shown interest. Mar-15 Pioneers acquired Arab Dairy for EGP 257 mn. The company is best known for its “Panda Cheese”. Apr-15 Edita Food Industries held its IPO on the EGX and the London Stock Exchange. The share rose 16.2% in the 1st month. The institutional offering was covered 13.4x and the retail offering was covered 4.5x. May-15 Juhayna Food Industries annoucned it will form a VC with Denmark's Arla Foods that will be 51% owned by Juhayna and managed by Arla. The VC, ArJu Food Industries, will add cheese, butter and infant formula to Juhayna's existing product lines. Jun-15 Arabian Food Industry Co. - best known for owning Domty - announced that it is planning to list 40% of its shares on the EGX in 1Q 2016. 17

- 18. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 Date Transaction (Cont’d) Sep-15 Kellogg acquired Mass Food for USD 50mn. Mass Food is the sole producer of Temmy's Cereal and Nutrifit Brands. Nov-15 Olayan Financing Co. acquired Rashidi El Mizan for EGP 518mn, which was owned by Qalaa Agrifoods Business Unit Gozour Dec-15 Kamal Hagag acquired Misr October for Food Industries (El Misrieen) for EGP 50mn. El Misrieen was owned by Qalaa Agrifoods Business Unit Gozour Qalaa announced that it is willing to sell Enjoy. It hired Pharos as the advisor for the transaction and it started the due diligence process. Danone acquired Halayeb Company for Dairy Products for EGP 120mn. The company owns the Kateelo Milk Brand. Beyti announced its plans to invest EGP 4bn to build a new juice plant and two dairy farms. Lulu hypermarkets, which owns 118 hypermarkets in the region, opened a new 170,000 square feet branch in New Cairo. The retailer announced that it will open another 10 branches in Egypt at a total investment cost of EGP 3bn investment in the coming 5 years. - SWOT Analysis for the F&B Sector in Egypt: STRENGTHS WEAKNESSES * Egypt is the largest and most-dynamic country in the region, with a population of around 90mn. * Low absolute figures of consumption per capita for food. * Food consumption is increasing from a very low base. * Majority of the population are considered poor. * Very good location with respect to Europe, Asia and Africa. * Tourism is at one of its lowest periods, where a slow recovery is expected and it could last several years. * Favorable trade agreements with the EU, GCC and African countries. * Competition is very high between companies, it could lead to fierce price wars and consequently companies would have to shrink their margins. * Low labor costs * F&B on top of income expenditure *Low self-sufficiency in majority of sub-sectors. This may lead to an unfair competition with international markets that may offer their products at prices lower than the domestically produced, eg. Sugar * Rising GDP per capita and disposable income. * Development of new niche markets, where higher margins can be attained. *Reliance on imported raw materials. * Youth are increasingly becoming brand consciousness and they are aware of international trends. * Low barriers to entry make it difficult to attain long-term profits. 18

- 19. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: EGX – PRICES AS OF FEB 18TH 2016 OPPORTUNITIES THREATS * Increasing consumption per capita for most food items. * Prices of commodities / raw materials may rise and consequently shrink the producers' margins. * Income is expected to rise as well as demand for food. * Persistence of high inflation * High income segments tend to associate food, cafes, dining places with class and public image. * Political turmoil in the neighboring countries which represent a large share of the export base. * Rising health awareness will have an effect on consumer choices * Devaluation would make the imported raw materials more expensive for the producers. * Application of the VAT Tax may lead to inflation, which will consequently decrease the disposable income. * High unemployment. The Food & Beverage on the EGX: The F&B Sector on the EGX is a quiet small sector, compromising around 9% of the total value, 2% of the total volume and 8% of total market cap. The sector has a P/E ratio of 17.15x and a Dividend Yield of 11.51%. The sector is considered non-cyclic and will further expand in the coming years. The F&B sector has a low beta (0.69) as it is less volatile than the market, thus we believe investors should be exposed to it. Sector Name % of Total Value % of Total Volume % of Total Market Cap Banks 9.08 0.89 26.80 Real Estate 25.69 24.57 15.49 Telecommunications 17.34 33.00 11.51 Financial Services excluding Banks 17.16 22.57 9.17 Food and Beverage 8.77 2.14 8.15 Industrial Goods and Services and Automobiles 6.50 5.44 7.79 Construction and Materials 3.54 3.42 6.55 Personal and Household Products 2.56 2.56 4.29 Basic Resources 4.27 1.71 3.14 Travel & Leisure 3.36 2.55 2.73 Chemicals 0.71 0.39 2.62 Oil and Gas 0.24 0.15 0.70 Technology 0.42 0.23 0.55 Media 0.02 0.02 0.16 Healthcare and Pharmaceuticals 0.16 0.34 0.12 Utilities 0.07 0.01 0.12 Retail 0.12 0.02 0.10 19

- 20. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 Since 2010, the F&B Sector has had 2 of the most successful IPOs; Juhayna Food Industries & Edita Food Industries (EFID.CA). In 2H 2015, Arabian Food Industry Co., best known for Domty announced that it is planning to list 40% of its shares on the EGX by 1Q 2016. Major IPOs – 2010 – 2015: - Orascom Construction – (ORAS.CA) - IPO - March 2015: Stock Return - 6M After IPO (%) -1% Stock Return - Since Inception (%) -50% EGX 30 Return - 6M After IPO (%) -17.% EGX 30 Return - Since Stock Inception (%) -38% 80 90 100 110 120 130 140 ORAS.CA EGX 30 Rebased - Emaar Misr for Development - (EMFD.CA) - IPO - July 2015: Stock Return - 6M After IPO (%) -27.16% Stock Return - Since Inception (%) -45% EGX 30 Return - 6M After IPO (%) -16.80% EGX 30 Return – Since Stock Inception (%) -27% 2 2.5 3 3.5 4 4.5 EMFD.CA EGX 30 Rebased EGP EGP 20

- 21. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 - Juhayna Food Industries – (JUFO.CA) - IPO - June 2010: Stock Return - 6M After IPO (%) 28.75% Stock Return - Since Inception (%) 107% EGX 30 Return - 6M After IPO (%) 7.04% EGX 30 Return – Since Stock Inception (%) -5% 2.5 2.7 2.9 3.1 3.3 3.5 3.7 3.9 4.1 4.3 JUFO.CA EGX 30 Rebased - Qalaa Holding - (CCAP.CA) - IPO - December 2009: Stock Return - 6M After IPO (%) -43.95% Stock Return - Since Inception (%) -91% EGX 30 Return - 6M After IPO (%) 11.56% EGX 30 Return - Since Stock Inception (%) -6% 6 8 10 12 14 16 18 CCAP.CA EGX 30 Rebased EGP EGP 21

- 22. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 - Palm Hills Development Company – (PHDC.CA) – April 2008: Stock Return - 6M After IPO (%) -42.99% Stock Return - Since Inception (%) -73% EGX 30 Return - 6M After IPO (%) -52.55% EGX 30 Return – Since Stock Inception (%) -48% 4 5 6 7 8 9 10 PHDC.CA EGX 30 - Rebased - Arabian Cement (ARCC.CA) – May 2014: Stock Return - 6M After IPO (%) 67.69% Stock Return - Since Inception (%) -12% EGX 30 Return - 6M After IPO (%) 3.98% EGX 30 Return - Since Stock Inception (%) -30% 6 7 8 9 10 11 12 13 14 15 16 ARCC.CA EGX 30 - Rebased EGP EGP 22

- 23. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 - Talaat Mostafa Group (TMGH.CA) – IPO – November 2007: Stock Return - 6M After IPO (%) -18.02% Stock Return - Since Inception (%) -64% EGX 30 Return - 6M After IPO (%) 22.24% EGX 30 Return - Since Stock Inception (%) -38% 9 10 11 12 13 14 15 16 TMGH.CA EGX 30 - Rebased - Amer Group (AMER.CA) – IPO – November 2010: Stock Return - 6M After IPO (%) -58.57% Stock Return - Since Inception (%) -50% EGX 30 Return - 6M After IPO (%) -26.59% EGX 30 Return – Since Stock Inception (%) -12% 0.2 0.3 0.4 0.5 0.6 0.7 0.8 AMER.CA EGX 30 - Rebased EGP EGP 23

- 24. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: BLOOMBERG, PRICES AS OF 21/2/2016 SOURCE: BLOOMBERG, PRICES AS OF 21/2/2016 - Edita Food Industries (EFID.CA) – IPO –April 2015: Stock Return - 6M After IPO (%) 44.63% Stock Return - Since Inception (%) 32% EGX 30 Return - 6M After IPO (%) -19.58% EGX 30 Return - Since Stock Inception (%) -32% 15 20 25 30 35 40 EFID.CA EGX 30 - Rebased - Relative Valuation of Egypt’s F&B: As mentioned earlier, DCF Valuation for F&B stocks would usually show minimal potential, however comparing the stocks with its Regional and Global Peers would yield different results. Using the Trailing P/E and P/B multiples, Juhayna is considered an over-priced stock. Median global and regional P/E stands at 18.13x and 13.27x, significantly lower than Juhayna’s 22.82x. Also Juhayna is relatively over-priced from the P/B perspective; Median global and regional P/B stands at 1.29x and 1.27x, significantly lower than Juhayna’s 2.64x. Leading multiples are used more often than trailing multiples, as they more indicative for the future prospect of the company. Using the Leading P/E multiple, Juhayna is found to be an under-valued stock as its 11.65x P/E multiple is lower than that of the global (16.56x) and regional peers (13.6x) EGP GLOBAL P/E – Trailing P/E – Leading (NY) P/B Median 18.13x 16.56x 1.29x JUFO.CA 22.82x 11.65x 2.64x REGIONAL P/E – Trailing P/E – Leading (NY) P/B Median 13.27x 13.6x 1.27x JUFO.CA 22.82x 11.65x 2.64x 24

- 25. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 Juhayna Food Industries Co.: Juhayna Food Industries is a leading producer and distributor of milk, juice and yoghurt products. The company was established in 1983 by Safwan Thabet along with a number of other founders, with a paid-in-capital of EGP 1.3mn. Production commenced in 1987 with a total production capacity of 35 tons per day and annual sales of EGP 2.4mn. Since 1983, and for more than 3 decades Juhayna has embarked a journey full of developments and expansions that distinguished it as a leading Egyptian producer of juice and dairy products. According to a study by Nielsen released early 2014, Juhayna holds Egypt’s highest brand-equity-index score, higher than the other leading multinational household and FMCG Brands in Egypt. Currently, its holds the largest market share in all of its products – plain milk (63%) – flavored milk (64%) – juice (20%) – drinkable yoghurt (35%) – spoonable yoghurt (33%) . Dairy is the largest contributor to Sales Revenue, followed by yoghurt, where they represented 52% and 25% respectively in 2015. The juice segment showed the highest y-o-y growth in sales (24%), due to the launching of the new juice brand – Premium-. Juhayna’s competitive edge is its strong brand equity, solid backward and forward integration and diverse set of products. Its main risks are the increasing competition from other companies (local, regional and international) and the rise in raw materials cost, namely powder milk. - Ownership Structure: Juhayna Food Industries started trading on the EGX in June 2010. On the IPO, the offering was up to 164,778,105 ordinary shares, each with a nominal value of EGP 1. The combined offering included a domestic offering to the public in Egypt, up to 41,194,527. These shares were offered through public (20%) and private placements (80%) and both were fully covered. 52.22% 46.93% 0.85% JUFO Ownership Structure Pharon Investments Free Float BoD Currently the company has a paid-up-capital of EGP 941,405,082 distributed over 941,405,082 shares. As for the ownership structure, Pharon Investments holds 52.22%, the BoD holds 0.85% and the Free Float represents the remaining 46.93% - BoD Structure & Management: Safwan Thabet - Chairman & CEO - Yasser El Mallawany Ziad Bahaa El Din Ahmed El Abin Seif El Din Thabet Mohamed El Dogheim ( Pharon Investments Ltd) Akil Beshir (Pharon Investments Ltd) Heba Thabet ( Pharon Investments Ltd) Mariam Thabet ( Pharon Investments Ltd) 25

- 26. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 - Timeline for Juhayna: Timeline 1983 * Juhayna began operations in 1983 with a state-of-the-art manufacturing facility in the 6th of October City. * Juhayna was the first Egyptian company to partner with the global packaging giant, Tetra Pak (called Alfa-Laval at the time) and thus became a market pioneer in the market in producing packed milk, yoghurt and juice. 1987 * Juhayna introduced its first dairy and juice products in the Egyptian market, produced with global quality standards. 1988 * Juhayna began exporting its products and established a wide customer base in Europe and the Middle East. 1990 * Juhayna started the leadership and innovation journey by launching digestive drinkable yoghurt under the brand name “Rayeb”. 1991 * Juhayna became the exclusive supplier of dairy products to McDonald’s Egypt and entered into supply agreements with a number of leading global fast-food chains including Burger King, KFC and Pizza Hut. Juhayna is also the supplier of choice for hotels and airlines, such as Lufthansa & Egypt-Air. 2000 * Juhayna introduced the new Whipping Cream product, as one of its new innovations, for the first time in the Egyptian market. 2001 * Juhayna introduced the first fruit-flavored drinkable yoghurt product in the Egyptian market, under the name of “Zabado” 2005 * Juhayna started its vertical integration expansion plans & developing its manufacturing facilities in addition to establishing new facilities. The Group acquired El Masreya Company for Dairy and Juice Products, a factory that Juhayna enhanced to become solely devoted to producing its dairy products. 2010 * Juhayna’s shares were first traded on the Egyptian Exchange Market (EGX). The IPO was named the “Best African IPO” in 2010 by a leading international investment and communications group “Africa Investor”; in a joint summit with the New York Stock Exchange to promote investment on the continent. 2015 * Juhayna signed a strategic partnership agreement with “Arla Foods” – a Danish leader in dairy products –to form a VC under the name of “ArJu for Food Industries”. The new venture aims at improving the domestic distribution and production capacity of cheese, butter, infant milk and other high-quality products. 26

- 27. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 - Group Structure & Subsidiaries: The group operates a highly integrated business model through Juhayna Food Industries SAE and its 8 subsidiaries. The business is divided into 3 main arms. It operates through 5 segments: Dairy, Yoghurt, Juice, Concentrates and Agriculture. Juhayna Food Industries S.A.E Manufacturing Commercial & Distribution Agriculture & Farming Juhayna Food Industries SAE Product Divisions Dairy Juhayna Food Industries Masreya Dairy & Juice Company (El Masreya) Yoghurt The Egyptian Company for Food Industries (Egyfood) Juice International Company for Modern Food Industries (El Dawleya) Concnetrates El Marwa Food Industries (El Marwa) The Modern Concentrates Company Centralized Business Divisions Agriculture & Farming Enmaa for Livestock Company Enmaa for Reclamation and Agriculture Milky's for Milk Production Distribution, Sales & Marketing Tiba for Trade & Distribution 27

- 28. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 Subsidiaries 1) Masreya Dairy and Juice Company – El Masreya - (Dairy): - Authorized Capital: EGP 500mn. - Paid-Up Capital: EGP 100mn. - Juhayna Ownership: 99.9%. 2) International Company for Modern Food Industries – El Dawleya - (Juice): - Authorized Capital: EGP 1bn. - Paid-Up Capital: EGP 500mn. - Juhayna Ownership: 99.9% - Exempted from the Corporate Tax till 31/12/2018.* 3) The Egyptian Company for Food Industries (Egyfood) - (Yoghurt): - Authorized Capital: EGP 1bn. - Paid-Up Capital: EGP 250mn - Juhayna Ownership: 99.9% - Exempted from the Corporate Tax till 31/12/2018.* 4) El-Marwa Food Industries (El-Marwa) - (Concentrates): - Authorized Capital: EGP 250mn. - Paid-Up Capital: EGP 100mn. - Juhayna Ownership: 99.9% 5) The Modern Concentrate Company - (Concentrates) - Authorized Capital: EGP 100mn. - Paid-Up Capital: EGP 100mn. - Juhayna Ownership: 99.8% - Exempted from the Corporate Tax till 31/12/2018. 6) Tiba for Trade & Distribution (Sales, Marketing & Distribution Activities): - Authorized Capital: EGP 500mn. - Paid-Up Capital: EGP 150mn. - Juhayna Ownership: 99.9% 7) Al-Enmaa for Agriculture Development and Live Stock Company: (Reclamation / Cultivation of Agricultural Land & Establishment of Dairy Farms): - Authorized Capital: EGP 1bn. -Paid-Up Capital: EGP 350mn. - Juhayna Ownership: 99.9% - Exempted from the Corporate Tax till 31/12/2018.* - 3 Main Subsidiaries: i. Enmaa for Livestock Company – (Dairy Farm): 1. Authorized Capital: EGP 500mn. 2. Paid-Up Capital: EGP 100mn 3. Al-Enmaa for Agriculture Development and Live Stock Company Ownership: 99.9% ii. Enmaa for Reclamation and Agriculture (Reclaims land for the cultivation of fruits / cattle feed and other agri. crops. 1. Authorized Capital: EGP 500mn. 2. Paid-Up Capital: EGP 100mn 3. Al-Enmaa for Agriculture Development and Live Stock Company Ownership: 99.9% iii. Milky’s for Milk Production: (Breeding cows for milk production) 1. Authorized Capital: EGP 500mn. 2. Paid-Up Capital: EGP 90mn 3. Al-Enmaa for Agriculture Development and Live Stock Company Ownership: 40 % 4. Juhayna Ownership: 39.9% 28

- 29. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: CAPMAS & IMF - Some of the group’s subsidiaries (El Dawleya, EgyFood, and Modern Concentrates) benefit from a 10-year tax holiday that was offered to some companies conducting business in designated Industrial Zones and New Urban Communities in Egypt. Enmaa is subject to a tax exemption for the following activities, as per the Income Tax Law: Land Reclamation and cultivation, livestock breeding, chicken production. It is also a 10-year tax holiday. Production Plants Date of Establishment Main Products Capacity Juhayna 1987 Dairy and other intermediate products. 1,000 tons per day. El Masreya 2005 Dairy. 1,000 tons per day. El Dawleya 2009 Juice. 750 tons per day El Marwa 1998 Concentrates – (mango, guava, peach and apricot) 300 tons per day Modern Concentrates 2007 Concentrates – (citrus: lemon and orange) 720 tons per day Egy Food I 2013 Yoghurt - (Spoonable & Drinkable) 80 tons per day Egy Food II 2014 Yoghurt - (Spoonable & Drinkable) 700 tons per day I. MANUFACTURING: The manufacturing segment is considered Juhayna’s main segment, where it is divided into 4 main sub-sectors: Dairy, Yoghurt, Juice and Concentrates. 1) Dairy Sector: - Overview of the Egyptian Milk Market: • The Egyptian dairy industry has witnessed a strong consumption growth rate since 2007. (CAGR 2007 – 2015: 14%). It is estimated that Egypt’s Dairy sales reached 432,123 tons in 2015. • The Egyptian dairy market is underpenetrated as Egyptians spend little of their income on dairy products – 13% on Milk, Cheese and Eggs. • Egyptians tend to have very unhealthy diets, as they tend to have high levels of consumption per capita of unhealthy food items such as sugar, while on the other hand they tend to have relatively low levels of consumption per capita of healthy food items such as milk and yoghurt. 13% 29% 7% Milk, Cheese & Eggs , 13% 7% 7% 15% 4% 2% 4% Annual Average of Household Expenditure on F&B - % Bread & Cereals Meat Fish & Sea Food Milk, Cheese & Eggs Oils & Fats Fruits Vegetables Sugar, Jam, Honey , Choc. & Conf. Others Sugar Consumption Per Capita (KG / Annum) Milk Consumption Per Capita (KG/Annum) Egypt 4 24 World 25 108 29

- 30. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: FAPRI SOURCE: JUHAYNA • Consumption per capita of milk is quiet low compared to other countries. 91 88 68 64 44 32 25 13 0 20 40 60 80 100 United States Russia European Union Brazil India Japan Egypt China Fluid Milk Consumption Per Capita - 2015 - kg/annum • Egyptian consumers are relatively more elastic to dairy than other countries. This imposes a huge risk for dairy producers. -0.2 -0.2 -0.15 -0.12 -0.08 -0.06 -0.05 -0.04 -0.25 -0.2 -0.15 -0.1 -0.05 0 Brazil Egypt Russia Argentina China European Union Japan India Fluid Milk - Elasticity - Own Price Egypt Fluid Milk Demand Income 0.4 Own-price -0.2 - The Egyptian milk market is highly fragmented, and till recently was mainly dominated by non-packaged (loose) products. Loose milk is transported to consumers via a milk peddler, who obtains milk directly from one of the small scale farms in rural areas and delivers it by a bicycle or a small van to the consumer. Before 2009, loose milk accounted for around 88% of the total supply of Egyptian milk. Research associated the consumption of loose milk with several health and hygiene issues. The government (Ministry of Health) has carried out several awareness campaigns to educate people of the health risks of consuming loose milk and encouraging healthier packaged milk. These campaigns have been quiet successful as by 2015, the consumption of packaged milk represented around 40% of the total milk consumption. Between 2010 and 2015, packaged milk consumption in Egypt grew by a CAGR rate of 15% The acceleration of the conversion to packaged products will mainly depend on low to middle income families. Factors that will affect the conversion include GDP Per Capita, disposable income and family formation rates. Moreover, the availability of low-priced packaged milk is crucial. 0% 20% 40% 60% 80% 100% 2008/2009 (Before Campaigns) 2010 2015 2020 88% 80% 60% 50% 12% 20% 40% 50% Loose Milk Packaged Milk 30

- 31. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: FAPRI - Raw Milk vs. Powder Milk: Both raw milk and powder milk are used by dairy producers in Egypt. This is mainly due to the low rates of milk production by local herds. Local herds in Egypt are known to have low fertility rates, poor breeding and low yields. The rate of growth in the cow herds is far less than the growth in population and in the dairy consumption patterns. This implies that Egypt will remain a net importer of dairy and the self-sufficiency rates will keep declining. 91 820 1,699 7,188 8,938 16,610 22,980 24,090 40,053 0 10,000 20,000 30,000 40,000 Saudi Arabia Japan Egypt Russia U.S. China European Union Brazil India Milk Cow Numbers (Thousand Head) - 2015 Egyptian Dairy Supply and Utilization 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 *Milk Cow Numbers - Thousand Heads 1,647 1,650 1,665 1,669 1,679 1,699 1,717 1,741 1,760 1,782 1,802 *Milk Production per Cow – Kilograms 1,004 1,043 1,095 1,147 1,207 1,270 1,340 1,405 1,471 1,537 1,603 *Cow Milk Production - Thousand Metric Tons 1,654 1,721 1,824 1,914 2,026 2,157 2,301 2,446 2,590 2,739 2,889 *Fluid Milk Consumption - Thousand Metric Tons 1,763 1,869 1,985 2,059 2,125 2,183 2,235 2,293 2,350 2,408 2,469 *Per Capita Milk Consumption (Kg/Annum) 21.9 22.8 23.7 24.1 24.5 24.7 24.8 25.0 25.2 25.4 25.6 1,270 1,405 1,458 2,243 3,924 6,000 9,589 10,236 22,501 0 5,000 10,000 15,000 20,000 25,000 Egypt India Brazil China Russia European Union Japan U.S. Saudi Arabia Milk Production per Cow - (Kilograms) - 2015 Despite the increasing modernization of the dairy industry and entrance of new products and farms focused on the production of packaged products, the majority of dairy production is still of loose products. 31

- 32. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: JUHAYNA Juhayna Dairy Products Plain Milk Juhayna Bekhero Flavoured Milk Mix Jino - Juhayna Dairy Products: The group produces packaged milk in two categories: plain milk and flavored milk. Juhayna has the largest market share in both. 63% 19% 5% 5% 8% 0% 20% 40% 60% 80% Juhyana Al Marai Lamar Sabaho (Faragello) Others Plain Milk 64% 17% 13% 4% 2% 0% 10% 20% 30% 40% 50% 60% 70% Juhayna Dango Al Marai Faragello Others Flavored Milk -Plain Milk: The group has been the long-standing market leader in the Egyptian plain packaged milk market. It has a 63% market share. It was among the first products that were produced by the company back in 1987 and it has been the leading product group in terms of sales. It is worthy to note that Juhayna was the first company to introduce packaged milk to Egyptians and it used to dominate the market of packaged milk (market share of 95%+). Increasing competition from local, regional and international producers have had a strong effect on the market share of Juhayna, shrinking its share to 63%. The group has 2 plain milk brands: Juhayna Milk and Bekhero Milk. Juhayna Milk: it is available in many varieties: full cream, half cream, skimmed milk (0.04% fat), no fat milk (0.00%) and foam milk. It is considered a premium brand. It targets consumers that are concerned with health aspects of milk and are willing to pay for a premium. Bekhero Milk: The group launched Bekhero Milk in 1999 in pouch packing as an affordable quality product, targeting mainly rural and urban females that are typically mothers in the low and middle income segments. This consumer is more cost conscious than the typical Juhayna milk consumer. There are 2 varieties of Bekhero Milk: full fat and skimmed. 32

- 33. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 It is worthy to note that both packaging products were developed by the same global packaging company, Tetrapack. The main difference between the two packaging methods is that the regular Juhayna Milk pack has a 6-month expiration date, whereas the Bekhero pouch has a 3-month expiration date, this is due to the difference in the number of layers in the packaging. The price differential between the Juhayna brand and the Bekhero brand is around 15%; Juhayna Milk is EGP1 more expensive than Bekhero in the 1ltr package (Juhayna EGP8-8.5 / Bekhero EGP7-7.5). - Flavored Milk: The group began producing flavored milk in 1997.Juhyna is a market leader with having 2 brands; Mix and Jino. It targets children aged eight and above whose parents belong to the upper and middle income segments. -As for the Dairy raw materials, Juhayna uses 2 main raw materials for dairy: Raw milk and Powder Milk. Both compromise around 65-70% of the raw materials. Raw Materials: % Powder Milk 30% Raw Milk 35-40% Packaging 18-22% Concentrates 6- 15% Others 2% - The average rate of using raw and powder milk differ significantly throughout the year. The average rate is 70% raw milk and 30% powder milk. The milk yield per cow declines in the summer due to the hot weather leading to rise in the costs of raw milk. Juhayna uses the 70-30% rate, however it can reach up to 50-50% during the summer. Raw Milk: Throughout the years, Juhayna has invested heavily in its backward integration. 10-15% of its raw milk needs is provided by 2 of its subsidiaries (Enmaa & Milky’s). More than 80% of the raw milk is supplied by 117 dairy farms. Raw milk prices are set by a committee formed of dairy farmers, manufactures and officials from The Ministry of Agriculture. The committee meets 4 times throughout the year to set the prices of raw milk. Several factors affect the pricing of raw milk, including competition between dairy producers, feed prices, milk-to-feed ratio, comparable market prices and international powder milk prices. The government does not subsidize any dairy farms. Juhayna has an outstanding relation with many farmers and thus may obtain more favorable prices. In order to secure the company’s need of raw milk, Juhyana initiated a project in 2014, named “The Farms Upgrade Program” where it distributed 1,120 German Holstein Heifers across 70 local farms. Moreover, Juhayna developed a 500 feddan dairy farm where it targets to have a cow herd of 4,000 cows by 2017. Powder Milk: Juhayna uses powder milk as one of its main raw materials. It represents 30% of the group’s raw materials. Powder milk is imported and it is not locally produced, thus it makes the company subject to FX fluctuations. Juhayna was not severely harmed in 2015 by the FX shortage, as the F&B is considered one of the top sectors with respect to FX demand fulfillment. (F&B, Pharmaceuticals and Raw Materials get the highest priority). In addition to that, Juhayna has solid relations with banks and financial institutions and they are constantly supplied with the required FX. Juhayna purchases its powder milk through auctions, where prices are determined based on demand and supply. Previously, auctions were held every year during the period of April-September. Currently auctions are held throughout the year on online platforms such as “Frontera”, which covers around 40% of the global transactions. Juhayna usually secures its needs of powder milk for 6- months ahead. The rise in powder milk prices and devaluation of the EGP imposes a huge threat to Juhayna and both would affect the dairy margins.Raw Milk Supply % Enmaa for Livestock Company 5% Milky’s for Milk Production: 8% 117 Small / Medium Farms 87% 33

- 34. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: JUHAYNA 2) Yoghurt Sector: The Egyptian yoghurt market is currently very competitive. International and local players have shown interest in the underpenetrated yoghurt market in Egypt, such as Danone, Lactel, Nestle and Dina Farms. 280 220.8 122.4 105.6 88 65.6 61.6 19.2 0 50 100 150 200 250 300 France Saudi Arabia Russia Japan Canada Mexico U.S. Egypt Yoghurt Cups / Year/ Capita Egyptians consume very little amounts of yoghurt compared to other countries. Egyptians are very elastic with respect to yoghurt as they consider it non-essential in their diets. Till the early 2000s, the “baladi” yoghurt was dominant in the yoghurt market, however in 2009, yoghurt consumption was divided equally between packaged yoghut and baladi yoghurt. Consumers were encouraged to convert to packaged products mainly due to the minimal price differential between the two types. Currently most of the yoghurt market is packaged and branded. The baladi yoghurt is rarely available and can be found at even higher prices than the branded yoghurt. Per capita yoghurt consumption was around 2.6 kg/annum in 2009 in Egypt, which is considered low compared to other countries ; at that time Saudi Arabia, Tunisia and Oman had consumption per capita of 4.9kg/annum, 6.6kg/annum and 7.2kg/annum respectively. Consumption of yoghurt is expected to increase in the near term; however Egypt will remain to have a low-consumption per capita compared to other countries. Egypt's Yogurt Market 2010 2011 2012 2013 2014 2015f 2016f 2017f 2018f 2019 2020 Per Capita Yoghurt Consumption (Kg / Annum) 2.7 2.8 3.0 2.8 2.6 2.7 2.9 3.0 3.0 3.1 3.1 y-o-y Change - 3.6% 6.9% -7.3% -6.3% 5.7% 4.4% 3.3% 1.9% 1.5% 1.6% Total Yogurt Market 206,600 222,727 244,000 232,000 222,950 241,752 258,695 273,994 286,203 297,922 310,227 y-o-y Change - 7.8% 9.6% -4.9% -3.9% 8.4% 7.0% 5.9% 4.5% 4.1% 4.1% Packaged Yogurt 116,200 147,000 169,000 171,000 165,000 186,120 204,732 221,111 234,377 246,096 258,401 y-o-y Change - 26.5% 15.0% 1.2% -3.5% 12.8% 10.0% 8.0% 6.0% 5.0% 5.0% Loose Yogurt 90,400 75,727 75,000 61,000 57,950 55,632 53,963 52,884 51,826 51,826 51,826 y-o-y Change - -16% -1% -19% -5% -4% -3% -2% -2% 0% 0% 0% 20% 40% 60% 80% 100% 2007 2008 2009 2010 2015 40% 40% 50% 59% 90% 60% 59% 50% 41% 10% Packaged Yoghurt Baladi Yoghurt It is worthy to note that the Yoghurt market was severely harmed in 2013 and 2014, as the producers increased the prices of their products. Consumers were very inelastic as they reduced their yoghurt consumption to a large extent. Since 2015, the yoghurt market started to grow on the back of the producers’ fast response to lowering the prices. Demand for yoghurt is quiet cyclical and is subject to seasonal fluctuations. It typically increases during the summer months and almost doubles during Ramadan where there can be a shortage of supply of yoghurt products. 34

- 35. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: JUHAYNA Juhayna Yoghurt Products Spoonable Plain Yoghurt Mix Yoghurt Acti-Life Drinkable Rayeb Zabado Judo 35% 22% 19% 15% 9% 0% 10% 20% 30% 40% Juhayna Lactalis Nestle Danone Others 33% 33% 12% 12% 10% 0% 10% 20% 30% 40% Juhayna Danone Nestle Lactalis Al Marai Spoonable YoghurtDrinkable Yoghurt Juhayna introduced packaged yoghurt to the Egyptian market in 1987. Two main types of yoghurt are produced; spoonable and drinkable. Juhayna is a market leader in both. Juhayna is expected to have a boost in the yoghurt segment. Currently Egyfood I & II are both operational with production capacities of 80 and 700 tons per day respectively. Juhayna is threatened in the yoghurt sector to a large extent, taking into account Danone’s successful penetration of the Egyptian yoghurt market. In 2015, Juhayna , in conjunction with Danone held a successful campaign named “Eat a cup of yoghurt a day” to urge people to consume more of yoghurt. Also Juhayna held other awareness campaigns, TV ads and billboards as it aims to benefit from any increase in market base. 35

- 36. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: JUHAYNA 3) Juice Sector: The juice market in Egypt is fragmented with more than 300 producers. The juice industry has very low barriers to entry, where some brands are produced in small houses in rural areas. Egyptians are considered highly elastic for juice as it is considered non-essential and luxurious. Juhayna started producing juice since 1987. Juice can be divided into 3 main types according to the fruit concentration levels. 20% 20% 20% 11% 3% 26% 0% 5% 10% 15% 20% 25% 30% Juhayna Beyti Faragello Rani Cappi Others Juhayna Juice Products 100% Pure Nectar Drinks “100% Pure”: 100% pure fruit concentrate with no added sugar. “Nectar”: 20-50% fruit concentrate. “Drinks”: 10% fruit concentrate. Egyptians tend to consume very little amounts of juice. In 2009, the consumption per capita Egypt was quiet low – 2.8 litres/annum, compared to the consumption per capita in the MENA region - 13 litres/annum this low consumption can be justified by the Egyptians preferences of tea, coffee and other soft drinks. Over the last several years, international players such as Coca-Cola and Pepsi (through Al Marai) have shown huge interest in the juice market and both have been quiet successful in penetration the market. The Egyptian juice market is well-positioned for future growth, yet the very fierce competition awaits Juhayna. Juice Segment 2010 2011 2012 2013 2014 2015f 2016f 2017f 2018f 2019 2020 Per Capita Juice Cons. (ltr) 3.5 4.41 5.82 5.82 5.82 5.90 5.99 6.08 6.20 6.36 6.55 y-o-y Change - 26% 32% 0% 0% 1% 1% 1% 2% 2% 3% Total Juice Market 272,440 351,000 475,000 487,000 517,000 519,251 540,083 561,965 587,688 617,545 652,070 y-o-y Change - 29% 35% 3% 6% 0% 4% 4% 5% 5% 6% Juice 36

- 37. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 VAT Tax on Dairy, Yoghurt and Juice: The VAT taxation system is expected to be applied during 2016. Essential food items will be exempted and they will be exposed to the current sales tax of 10%. According to the Juhayna’s management, the Dairy and Yoghurt products will be exempted from the VAT, however it is not yet decided whether juice will be exempted or not, as it not considered an essential food item. The rate differential between the VAT (10-12%) and the current sales tax (10%) is quiet minimal. A minute effect will occur if the applied rate exceeds 10% and it will be applied on all juice products, consequently Juhayna will not be adversely affected by the VAT. 4) Concentrates Sector – (Backward Integration): The concentrates segment is specialized in processing seasonal fruits into concentrates including mango, guava, peach, apricot and citrus. The 2 factories (Marwa & Modern) supply Juhayna with around 70% of its need for juice production. These factories assist in ensuring the constant supply of high-quality concentrates for the group’s juice production process. The group also sells concentrates to third-party business customers. II. AGRICULTURE & FARMING – (Backward Integration): The agricultural arm of Juhayna operates through 3 subsidiaries: 1) Enmaa for Livestock Company – (Dairy Farm) 2) Enmaa for Reclamation and Agriculture (Reclaims land for the cultivation of fruits / cattle feed and other agricultural crops). 3) Milky’s for Milk Production - Enmaa provides Juhyana with 5% of its raw milk requirements, where Milky’s provide it with another 8%. The rest is satisfied by 117 small and medium farms. *Cow Herds in Juhayna’s Dairy Farms: Juhayna seeks to have a cow herd of 4,000 Holstein Heifers (German breed) cows by 2017. It received 2 shipments throughout 2015, where it received 650 and 950 respectively. It is worthy to note that Juhayna constantly supplies third-party farms with cows through its “Farms Upgrade Program”, where it had a cow herd of 1,120 Holstein heifers distributed among 70 farms in 2015. *Land Cultivation and Reclamation: Up till now, Juhayna has cultivated and reclaimed 6,000 feddans. The company still has a large land bank that it can reclaim / cultivate in the future. 37

- 38. PRIME INVESTMENT RESEARCH JUHAYNA FOOD INDUSTRIES - INITIATION OF COVERAGE FEBRUARY, 2016 SOURCE: BLOOMBERG 2015 Distribution Centers 30 Retail Outlets 50,000 Trucks & Vans 1,000 SKUs 200+ III. Distribution, Sales and Marketing – (Forward Integration): The distribution, sales and marketing is carried out by Juhayna’s subsidiary, Tiba for Trade and Distribution that was established in 2007. The distribution network plays a major part in the product penetration in the Egyptian market and is very difficult for competitors to replicate. Juhayna is considered to have a first-mover advantage and it represents a barrier to entry for potential new competitors. Large competitors such as Al Marai and Lamar have started to build-up distribution networks; however it will take them several years to build a vast network as that of Juhayna. In 2015, Tiba owned 30 distribution centers located throughout Egypt. It announced its plans to build up 2 new centers and renovate another 2 in 2016, reaching a total number of 32 distribution centers. By end of 2015, Tiba operated a fleet of more than 1,000 trucks, which delivers the group’s products across a wide distribution network and it is able to reach remote areas in a timely manner. Currently, the products reach more than 50,000 retail outlets. 7.2 7.4 7.6 7.8 8 8.2 8.4 8.6 8.8 JUFO.CA - Price - August 2015 Main Events in 2015 for Juhayna and their effect on the Company’s Value & Stock Valuation: 1) Safwan Thabet, Juhayna’s Chairman and CEO Assets Freeze on Alleged MB Ties: In August, 2015, the committee tasked with accounting for Muslim Brotherhood (MB)-related assets has frozen the assets of Juhayna’s Chairman and CEO, Safwan Thabet. This decision covered his personal assets only and did not include Juhayna as it is a publicly-owned company. A week later, the EGX barred him for trading and all his trading codes were suspended. During this week, Juhayna’s stock (JUFO.CA) dropped by around 8%. At that time, Aberdeen Asset Management increased its stake in the company from 4.8% to reach 5.1% through buying 1.4 mn shares at the price of EGP 8.1/share. On the other hand, this decision has no effect on the operations of Juhayna as Thabet’s managerial role is still effective and there is no final ruling yet regarding his affiliation with the MB. The case has no tangible effect on Juhayna’s fundamentals and hence it is not taken into account with the company’s valuation. 38