Si portfolio perspectives_retirement_portfolios_0212

- 1. Structured Investing Portfolio Perspectives February 2012 Retirement Portfolios For the Next Generation of Retirees By Joni Clark, CFA, CFP®, Chief Investment Officer, Loring Ward Effective retirement distribution strategies require significantly thumb was to plan for about 70% of pre-retirement expenses. more than just periodically withdrawing funds. Investors It was generally assumed that retirees would plan for more need a more comprehensive approach to portfolio manage- sedentary lifestyles, staying home and gardening or playing ment, with more time and resources dedicated to retirement bridge. Today’s retirees are much more likely to travel, take up planning and cash flow management. expensive hobbies or look to materially affect those around Investors need to understand the unique risks and chal- them. All of this may require growth from a portfolio over lenges facing retirees today, and why the traditional income the long term. approaches used with past generations may not work for the Adequately funding retirement may also be a greater chal- next generation. Simply generating retirement income may lenge for the next generation of retirees because personal sav- be an incomplete, even counterproductive, strategy. Instead, ings and retirement portfolios are expected to play a much investors may need to focus on generating total return vs. larger role than for previous generations. income to build long-term wealth and financial security. These unique risks and challenges point to one key distinc- Investing in retirement has always been an intricate process tion in the requirement for retirement portfolios for the next involving complex risk considerations such as longevity risk, generation of retirees: Portfolio growth may be essential to inflation risk and uncertainty of investment returns. But indi- meet these challenges and increase the probability of sustain- viduals approaching retirement today face some additional ing income needs over a 30+ year retirement period. challenges. Traditionally, retirement portfolios were designed to provide With today’s advances in medicine, diet, and technology, retir- income through a laddered bond portfolio or some other ees are not only living longer but are staying healthier than type of fixed income, stable value or other guaranteed income previous generations. Those who remain healthy may main- vehicle. With the current low interest rate environment, and tain more active lifestyles, which in turn may lead to higher the potential for increased inflation in the years ahead, it may income replacement needs during their retirement years.1 be very difficult for average retirees to sustain their income Retirement planning for previous generations assumed that needs over their lifetime without a significant allocation to the need for money declined with age. The previous rule of equities to support long-term growth.

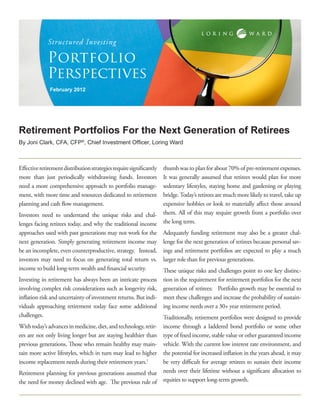

- 2. Structured Investing Portfolio Perspectives The primary concern with the traditional approach is that In the end, financial security is about total wealth — the fixed income, especially long-term fixed income, is gener- present value of net worth, not marginal income generated ally not a good hedge against inflation. We all feel the effects from the portfolio. of inflation on our day-to-day expenses through increasing We believe a better approach to meeting retirement income prices, but inflation also takes a significant bite out of invest- objectives is an efficiently diversified portfolio constructed to ment returns. provide maximum total return for any given level of acceptable risk. The portfolio should Inflation Risk: Will Returns Keep Pace with Inflation? Inflation Risk: Will Returns Keep Pace with Inflation? be designed to meet a retiree’s current income 12% needs while also targeting long-term growth Annualized Returns 10% 1926 to 2010 objectives. This may be accomplished by bal- 9.9% ancing the account with 50% or more in equi- 8% ties in an effort to improve the probability of 6% 6.6% sustaining retirement income through the 4% 5.5% retiree’s life expectancy. 3.6% “Regardless of age or desired consumption a balanced 2% 2.4% portfolio provides the best odds of success… For most 0 0.6% STOCKS BONDS CASH reasonable spending patterns, an overly conservative Before Inflation After Inflation Before Inflation After Inflation Before Inflation After Inflation asset allocation, as well as an overly aggressive asset Past performance is no guarantee of future results. Assumes reinvestment of income and no transaction costs allocation, will only serve to increase the risk of or taxes. This is for illustrative purposes only and not indicative of any investment. Stocks are represented by the Standard & Poor’s (S&P) 500 Index; Bonds are represented by the Ibbotson/SBBI Long-Term Government Bonds running out of money too soon.” Index; Cash is represented by one-month Treasury Bills. An investment cannot be made directly in an index. ©2010 Morningstar, Inc. All rights reserved. 3/1/2011 — Moshe A. Milevsky, The first bars for each asset class on the graph above represent Applied Risk Management During Retirement the nominal, or unadjusted, returns of each asset class. The (June 2005) second bars illustrate the real, or inflation-adjusted, returns Using this approach, the primary role of fixed income is of each asset class which reflect the real purchasing power to dampen overall portfolio volatility associated with that the investor is left with after inflation. Notice that with equities — not to provide income. Instead, income is pro- cash and bonds, after adjusting for inflation, you are left with vided through a synthetic dividend2, which is simply a very meager returns to support long-term growth. Cash real combination of dividend and interest income and the returns were 0.6% and bond real returns were 2.4%, both less harvesting of capital growth. than half of equities. From a pure investment theory perspective, we should not While bonds pay steady income, using them expressly for care whether we draw income from dividends or capital income can create unintended inflation and longevity risks growth. Money is money, whether it comes from a stock divi- for retirees. dend, bond income payment or from capital growth. There’s And for what? no reason to prefer one above the other for spending needs. In fact, drawing from capital growth may be more tax efficient

- 3. Structured Investing Portfolio Perspectives than receiving a stock dividend or bond income. If you A total return retirement income portfolio should provide redeem any instrument you’ve held for longer than a year, better management of inflation risk, reduced volatility risk the cash receipts are currently taxed at the capital gains rates through effective diversification and improved sustainability of 15%, instead of at higher income tax rates. With this in of withdrawals through a long-term growth strategy. mind, the best way to meet monthly cash needs might just be to redeem appreciated assets. Note: Past performance does not guarantee future results and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Diversification neither assures a profit nor guarantees against loss in a declining market. Implementing a total return income portfolio cannot guarantee a gain or protect against a loss. References: 1 Retirement Income Redesigned, Harold Evensky & Deena Katz 2 “Synthetic Dividend” is a term coined by Eugene Fama Jr., Dimensional Fund Advisors “Factors in Practice” (2007) © 2012 LWI Financial Inc. All rights reserved. LWI Financial Inc. (“Loring Ward”) is an investment adviser registered with the Securities and Exchange Commission. Securities transactions offered through Loring Ward Securities Inc., an affiliate, member FINRA/SIPC. R 12-051 (02/12)