Webcast

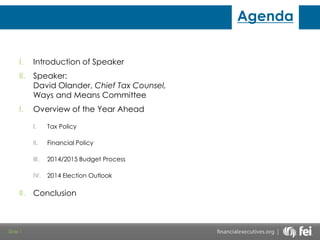

- 1. Agenda I. Introduction of Speaker II. Speaker: David Olander, Chief Tax Counsel, Ways and Means Committee I. Overview of the Year Ahead I. II. 2014/2015 Budget Process IV. Slide 1 Financial Policy III. II. Tax Policy 2014 Election Outlook Conclusion

- 2. Tax Policy February 28, 2014 Slide 2

- 3. Tax Reform Highlights House Ways and Means Committee Chairman Dave Camp (R-Mich.) unveils comprehensive tax reform discussion draft Sen. Ron Wyden (D-Ore.) assumes Chairmanship of Senate Finance Committee Obama Administration to release FY 2015 budget request to Congress Slide 3

- 4. Tax Reform House Camp comprehensive tax reform discussion draft: ―Tax Reform Act of 2014‖ – “Make the tax code simpler and fairer for families and employers.” 979-page draft reduces the size of the federal income tax code by 25% Lowers the corporate and individual tax rates Reforms international tax rules – “Strengthen the economy so there are more jobs and bigger paychecks for American families.” $3.4 trillion in additional economic growth 1.8 million new jobs $1,300 per year more for the average American family Slide 4

- 5. Tax Reform House Tax Reform Act of 2014 – Individual – Reduces today’s seven brackets to two: 10% and 25% New 10% surtax on certain income above $450,000/$400,000 Manufacturing income exempt – Increases standard deduction – Caps mortgage interest deduction at $500,000 for new debt – Repeals Alternative Minimum Tax (AMT) – Taxes investment income as ordinary income with 40% exclusion – Simplifies the rules governing S corporations – Taxes part of carried interest as ordinary income – Maintains current law on the estate tax Slide 5

- 6. Tax Reform House Tax Reform Act of 2014 – Corporate – Reduces corporate rate to 25% over five years (by 2% points/year) – Provides an improved, permanent R&D tax credit (repeals most other business credits) – Repeals the corporate AMT – Modifies depreciation rules (property placed in service starting in 2017) – Repeals LIFO with transition rules – Modernizes international tax rules 95% dividends received deduction (DRD) Includes safeguards against base erosion (revised Option C) Ends “lock-out” effect on foreign earnings Slide 6 Read more at tax.house.gov

- 7. Tax Reform Senate Wyden tax reform credentials – Wyden/Coats “Bipartisan Tax Fairness and Simplification Act of 2011” Reduces individual tax brackets to three: 15%, 25%, and 35% Creates new 35% exclusion for dividend and long-term capital gains Triples standard deduction Retains mortgage interest deduction, charitable, child credits Expands tax-free savings opportunities Reduces corporate tax rate to 24% Allows one-time, low-tax repatriation of foreign earnings Ends deferral on foreign income Limits value of corporate interest deduction Slide 7

- 8. Tax Reform Administration Obama Administration State of the Union and FY 2015 Budget – State of the Union broke no new ground on tax policy – Economic agenda focused on job creation and reducing income inequality – Reiterated proposal for “business” tax reform that uses one-time revenue to fund infrastructure spending – FY 2015 budget expected on March 4; tax proposals in “Green Book” – May include new revenue raising tax proposals to address perceived international tax avoidance Slide 8

- 9. Tax Reform Outlook Highly unlikely to pass this year Reform proposals may be recycled for future reform efforts or as offsets Slide 9

- 10. Other Tax Legislation Tax Extenders Senate Majority Leader Harry Reid (D-Nev.): failed effort in late 2013 Wyden: tax extenders ―bridge‖ to tax reform Camp: tax extenders to be addressed in context of tax reform Legislative action probable in late 2014 Slide 10

- 11. Other Tax Legislation 2014 No year-end must pass tax legislation Extenders State tax bills Highway Trust Fund Affordable Care Act Pension and retirement offsets Slide 11

- 12. Financial Policy February 28, 2014 Slide 12

- 13. Financial Policy Legislative Issues Regulatory Issues New Financial Considerations in Tax Reform Proposal Slide 13

- 14. Legislative Issues S. 888/H.R. 634 – the Business Risk Mitigation and Price Stabilization Act The bills (S.888/H.R. 634) provide a clear exemption from margin requirements for derivatives end-users. Current status in the legislative process – passed the House, awaiting Senate action. Slide 14

- 15. Legislative Issues H.R. 677 – the Inter-affiliate Swap Clarification Act The bill would exempt internal swaps between two affiliates from clearing and margin requirements, as well as ensure that endusers will not be penalized for using CTUs. The bill is awaiting action on the House floor, has passed through the committee process. Negotiations with House Financial Services Committee Ranking Member Waters. Slide 15

- 16. Regulatory Issues Update on Money Market Mutual Fund (MMMF) Reform Federal regulators are considering additional reforms to MMMFs, beyond those enacted after the financial crisis. Since MMMFs are critical tools for American businesses for shortterm financing and investing, it is vital that these reforms do not compromise their usefulness. Expectations on when we may see a final rule remain up in the air. Slide 16

- 17. Regulatory Issues Update on the Volcker Rule The Dodd-Frank Act directed five federal regulatory agencies — the Federal Reserve, the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, the Securities and Exchange Commission, and the Commodity Futures Trading Commission— to implement the Volcker Rule A final rule (over 900 pages long) was released by the agencies on December 10, 2013 Many concerns remain – within both the government and business community Slide 17

- 18. Tax Reform Proposal Financial Provisions in Tax Reform Proposal ―Lending tax‖ already upsetting the financial services industry Tax reform proposal would modify the treatment of certain derivatives Slide 18

- 19. The FY2014-2015 Budget ―Process‖ Are we there yet? Slide 19

- 20. Budget Process Government Shutdown – October 1- 17, 2013 Agreement to Reopen Government Continuing Resolution until Jan. 15, 2013 (Budget deadline by Dec. 13, 2013) Debt Ceiling extension until February 7, 2014 2 Year Budget Agreement H.J. Res. 59 Reached – Dec.10, 2013 Omnibus Appropriations Act – January 13, 2014 Debt Ceiling bill – February12, 2014 Slide 20 Clean, no policy quid pro quo’s Suspended Debt Ceiling until March 15, 2015

- 23. FY2014 Budget Agreement • According to the CBO’s latest projection: the budget deficit will fall to 3.0% of GDP in 2014 (the average rate since the 1970s) and 2.6% in 2015. • However, deficits return to 4% of GDP by 2024, at which time the publicly held federal debt will reach 79% of GDP, up from the current 74%. • While the CBO projections average a 3% GDP growth rate through 2017, continued low labor force participation rates will ratchet back growth to an average 2.2% from 2018 to 2024, causing a drag on revenue growth, which coupled with the expected increase in entitlement spending and interest expense results in the rise in deficits. • “Most of the increase in projected deficits results from lower projections for the growth of real GDP and for inflation, which have reduced projected revenues between 2014 and 2023 by $1.4 trillion. Legislation enacted since May has lowered projected deficits during that period by a total of $0.4 trillion (including debt-service costs).” CBO, THE BUDGET AND ECONOMIC OUTLOOK: 2014 TO 2024, FEBRUARY 2014 • Slide 23 Therefore, the current CBO projections show a net increase in their 10 year federal deficit forecast of $1 trillion over previous forecasts.

- 24. FY2014 Budget Agreement FY2014 Budget Agreement Slide 24

- 25. FY2014 Omnibus Appropriations Bill • $1.1T Omnibus Appropriations bill for FY 2014 ( an increase of $45B had the original sequester cuts remained). Includes a defense supplemental beyond the budgeted $1.04T. • • More for Head Start • $21 B more for DoD ($30B less than President’s request – OCO funds up $6 B, to be used for general budget as US leaves Afghanistan • EPA can still regulate Carbon Emissions • No abortion funding • Significant cuts in IRS funding • Cuts in CFTC and SEC funding ($100 M and $324 M respectively from Admin) • Slide 25 ACA largely intact (except for $1 B cut in Public Health Fund) Medicare provider cuts extended 2 years (@ $24 B)

- 26. FY2014 Omnibus Appropriations Bill Figures are in millions of dollars of new budget authority. Slide 26

- 27. FY2015 Appropriations Process • With the Budget Agreement covering 2 years, Congress can revert to regular order for FY2015. • • House and Senate Budget cap of $1.014T, worked out in the budget deal • • Requires that Congress pass 12 Agency Appropriations bills based on the: Deadline September 30, 2014, just before the election President’s Budget expected March 4, 2014 • • Drops last year proposal for “chained CPI” • Focuses new expenditures on job training and early education • Slide 27 Abandons attempt for Grand Bargain with Republicans in favor of safe election year budget to shore up Democrat base Probably DOA, but sets the framework for Senate Democrats negotiating position

- 28. 2014 Election Outlook A look at how elections can impact your business. Slide 28

- 29. Election Overview The 2014 election cycle is already well underway. Both Texas and Illinois will hold primaries in early March. While it is unlikely that the House of Representatives will switch from Republican to Democrat control, the Senate is very much in play. The outcome of federal and state elections will have a direct impact on senior financial executives and their companies. Slide 29

- 30. House of Representatives It is almost certain that the GOP will not lose seats in the House of Representatives. Historical data shows that the party that controls the White House typically loses seats in the House of Representatives, especially during the 6th year of an 8 year presidency. In keeping the House, the GOP will likely keep the focus in the next congress on: – Affordable Care Act – Tax reform – Overreaching regulatory bodies such as the EPA Slide 30

- 32. Senate • • The GOP has had opportunities over the last two election cycles to win the Senate, but were unable to do so based on flawed candidates. • Slide 32 The GOP has a real shot at taking the Senate from the Democrats in 2014. That being said, there are a number of factors in play that will either make or break the GOP. As the polling shows now, the GOP is ahead in 4 states currently held be Dems (MT, SD, AR, and WV). There are three ―toss up‖ seats: AK, LA, and NC. The GOP would need to win 2 of the 3.

- 33. Senate • • If the GOP does win in 2014, there are two directions the party could go. It could work with President Obama on his last two years to achieve a grand bargain on many key issues that remain outstanding. • Slide 33 Victory could be short lived, however, as the GOP has many seats to defend in 2016 (including many that were part of the wave election of 2010.) It could also oppose any Obama initiatives, thus assuring his last two years as a lame duck.

- 35. Governorships • • Many up for reelection include a number from the class of 2010. Democrats will paint them as part of the ―wave‖ while the GOP will portray them as being far removed from Washington and actually accomplishing something. • Slide 35 There are 22 Republican governorships up in 2014, compared to just 14 for Democrats. President Obama desperately needs to win governorships as a sign of progress on his agenda – including raising the minimum wage and an increase in education spending.

- 37. What This Means for Executives • • If the GOP is able to take back the Senate, there will be movement in the legislative branch that hasn’t existed since 2010 when Democrats last controlled both chambers. • Slide 37 Many of the key issues that were mentioned on the call today need to move through the legislative process in order to avoid continued uncertainty for senior financial executives. That being said, President Obama is in office until 2016. Both sides are going to need to work together in order to get anything accomplished.

- 38. Government Affairs Team Who We Are Robert Kramer Vice President Government Affairs rkramer@financialexecutives.org Karen Bachman Lapsevic Director Government Affairs klapsevic@financialexecutives.org Learn More: Committee on Government Business Learn More: Committee on Taxation Committee on Benefits Finance Kelli McMorrow Sr. Manager Government Affairs kmcmorrow@financialexecutives.org Tyler Roberts Manager Government Affairs troberts@financialexecutives.org Learn More: Committee on Corporate Treasury Learn More: Private Company Roundtable Private Company Policy Slide 38

- 39. Questions? Headquarters Office 877.359.1070 | 973.765.1070 membership@financialexecutives.org Government Affairs Office 202.626.7801 Visit Our Advocacy Homepage Slide 39