dmr resume 2016

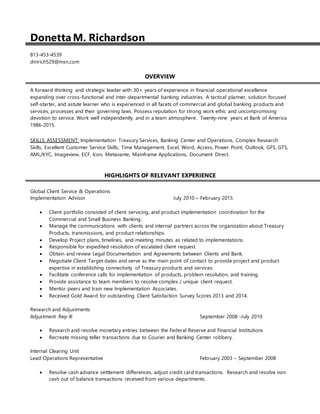

- 1. Donetta M. Richardson 813-453-4539 dmrich529@msn.com OVERVIEW A forward-thinking and strategic leader with 30+ years of experience in financial operational excellence expanding over cross-functional and inter-departmental banking industries. A tactical planner, solution focused self-starter, and astute learner who is experienced in all facets of commercial and global banking products and services, processes and their governing laws. Possess reputation for strong work ethic and uncompromising devotion to service. Work well independently and in a team atmosphere. Twenty-nine years at Bank of America 1986-2015. SKILLS ASSESSMENT: Implementation Treasury Services, Banking Center and Operations, Complex Research Skills, Excellent Customer Service Skills, Time Management, Excel, Word, Access, Power Point, Outlook, GFS, GTS, AML/KYC, Imageview, ECF, Icon, Metavante, Mainframe Applications, Document Direct. HIGHLIGHTS OF RELEVANT EXPERIENCE Global Client Service & Operations Implementation Advisor July 2010 – February 2015 Client portfolio consisted of client servicing, and product implementation coordination for the Commercial and Small Business Banking. Manage the communications with clients and internal partners across the organization about Treasury Products, transmissions, and product relationships. Develop Project plans, timelines, and meeting minutes as related to implementations. Responsible for expedited resolution of escalated client request. Obtain and review Legal Documentation and Agreements between Clients and Bank. Negotiate Client Target dates and serve as the main point of contact to provide project and product expertise in establishing connectivity of Treasury products and services. Facilitate conference calls for implementation of products, problem resolution, and training. Provide assistance to team members to resolve complex / unique client request. Mentor peers and train new Implementation Associates. Received Gold Award for outstanding Client Satisfaction Survey Scores 2013 and 2014. Research and Adjustments Adjustment Rep III September 2008 -July 2010 Research and resolve monetary entries between the Federal Reserve and Financial Institutions Recreate missing teller transactions due to Courier and Banking Center robbery. Internal Clearing Unit Lead Operations Representative February 2003 – September 2008 Resolve cash advance settlement differences, adjust credit card transactions. Research and resolve non cash out of balance transactions received from various departments.

- 2. Support banking centers and missing proof work telephone calls. Recreate missing teller transactions due to Courier and Banking Center robbery. Train staff on new procedures and system enhancements. Award of Excellence 2008 . Return Items Group Lead June1999 - January 2003 Ensure checks received from the Federal Reserve Banks and Clearinghouse Banks are processed timely and accurately. Research items for offset, coach associates on error resolution and system applications. Facilitate team meetings, schedule adherence, performance appraisals, conference reports. Participate in system enhancements, deliver new procedures and revisions. Customer Service Team Manager October 1998 -May 1999 Supervised twenty telephone associates. Responsible for daily statistics, schedule adherence and performance appraisals. Coach associates to ensure quality product knowledge and customer service are delivered. Resolve complex customer calls and research Helpdesk Specialist May 1994 – September 1998 Provide banking centers, banking operations and associates assistance with operation systems, legal and bank policy procedures. Resolve complex research. Additional Experience January 1986 – April 1994 Exceptions Clerk ATM Group Lead Banking Center Operations Manager Teller Education Woodruff High School