Weitere ähnliche Inhalte Ähnlich wie E marketer retail mobile commerce Ähnlich wie E marketer retail mobile commerce (20) 1. Copyright ©2013 eMarketer, Inc. All rights reserved.

The Big Picture: Retail Mcommerce Forecast 2

Smartphone Shopping and Spending Trends 4

Commerce of Convenience (Almost) 7

Conclusions 11

eMarketer Interviews 12

Related eMarketer Reports 12

Related Links 12

January 2013

Executive Summary: Consumers are creatures of convenience. With digital storefronts just an arm’s length away,

millions are reaching first for their smartphone when the urge to shop strikes. Whether at home or on the go, these

consumers use their phones to browse and research products, hunt for deals and make purchases.

149663

eMarketer’s mobile commerce forecast reflects a confluence of

three trends: the expanding number of smartphone shoppers,

whose behavior affects commerce in all channels; the growing

number of smartphone buyers who enjoy the immediacy of

purchasing through their phone and are expected to generate

roughly a third of mcommerce sales this year; and the rapid rise

in tablet shopping, which will produce the bulk of mcommerce

sales over the next four years.

This report presents eMarketer’s latest mobile commerce

estimates and discusses smartphone shopping and sales trends,

including the dual role smartphones play as a sales channel and as

an influencer on purchases made through other means.

US consumers will spend $13.4 billion on retail purchases made

via smartphones in 2013, up from $9.8 billion last year. Despite

these gains, buying products (other than digital content) with

a smartphone can often be cumbersome. So even though

shopping sessions frequently start on a smartphone, they often

still end on a computer or in a physical store.

Key Questions

■■ What is the outlook for mcommerce sales?

■■ What level of sales do smartphones generate?

■■ How,when and where do consumers use smartphones to shop?

■■ Where are retailers falling short in meeting smartphone

shoppers’ expectations?

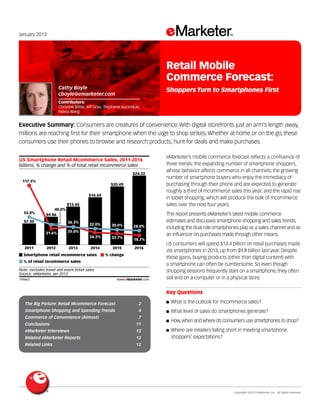

billions, % change and % of total retail mcommerce sales

US Smartphone Retail Mcommerce Sales, 2011-2016

2011

117.5%

55.0%

2012

31.6%

40.0%

2013

35.0%

2014

24.2%

32.0%

2015

22.7%

30.0%

2016

$7.50

$9.86

$13.44

$16.69

$20.49

$24.32

18.7%

28.0%

Smartphone retail mcommerce sales % change

% of retail mcommerce sales

Note: excludes travel and event ticket sales

Source: eMarketer, Jan 2013

149663 www.eMarketer.com

36.3%

Cathy Boyle

cboyle@emarketer.com

Contributors:

Christine Bittar, Jeff Grau, Stephanie Kucinskas,

Haixia Wang

Retail Mobile

Commerce Forecast:

Shoppers Turn to Smartphones First

2. Retail Mobile Commerce Forecast: Shoppers Turn to Smartphones First Copyright ©2013 eMarketer, Inc. All rights reserved. 2

The Big Picture: Retail Mcommerce

Forecast

Today’s mobile shoppers are bewitched by the

immediacy of smart devices—the ability they provide

to access product information, deals and sales now

and the power to purchase now, all with a tap of a

fingertip. eMarketer projects double-digit increases in

the number of mobile shoppers and buyers over the

next two years and expects mobile retail sales to rise

from $38.4 billion this year to $86.8 billion in 2016.

Tablets are expected to play a pivotal role in the growth of mobile

commerce as consumers adopt these larger but still easily

portable devices even faster than they did smartphones. Retail

purchases made through tablets are expected to comprise 70%

of mcommerce sales in 2016, up from 62% this year.

Likewise, sales made through smartphones are expected

to grow at double-digit rates and comprise roughly 30% of

mobile commerce sales each year through 2016. Purchases

made through other mobile devices, such as ereaders or

handheld gaming systems, will represent less than 3% of total

mcommerce sales during the period.

billions and % of total

US Retail Mcommerce Sales, by Device, 2011-2016

Tablet

—% of total

Smartphone

—% of total

Other mobile devices

—% of total

Total

2011

$5.45

40.0%

$7.50

55.0%

$0.68

5.0%

$13.63

2012

$13.86

56.2%

$9.86

40.0%

$0.94

3.8%

$24.66

2013

$24.00

62.5%

$13.44

35.0%

$0.96

2.5%

$38.40

2014

$34.33

65.8%

$16.69

32.0%

$1.15

2.2%

$52.17

2015

68.0%

30.0%

2.0%

$46.44

$20.49

$1.37

$68.29

2016

70.3%

28.0%

1.7%

$61.06

$24.32

$1.48

$86.86

Note: excludes travel and event ticket sales

Source: eMarketer, Jan 2013

149662 www.eMarketer.com

149662

An Expanded View of Mobile Commerce

Due to the rapid adoption of tablet devices in the US and

the robust growth of the mobile app economy, eMarketer

has expanded the scope of its retail mobile commerce

forecast. The forecast now includes shopping for or buying

physical or digital goods using a browser or app on a

mobile phone, tablet, ereader or other handheld device,

such as a gaming system or an MP3 player.

Mirroring the retail ecommerce categories established by

the US Department of Commerce, sales of mobile apps

and in-app purchases are also included in eMarketer’s

mcommerce forecast, but travel and event ticket sales

are excluded. Point-of-sale payments made using a mobile

device at a physical store are also excluded as the mobile

device is serving only as a digital wallet for cash or credit.

eMarketer’s retail mcommerce sales forecast and its

mobile shopper and buyer forecasts are derived by

comparing estimates from other research organizations

and weighing overall mcommerce trends.

Mobile Shoppers vs. Buyers: Some consumers use a mobile

device to browse, research or compare products but stop

short of the mobile checkout counter. eMarketer classifies

these “just browsing” consumers as mobile shoppers. Those

who buy are referred to by eMarketer as mobile buyers.

Both groups have a base age of 14 and have shopped or

made a purchase with a mobile device within the past year.

Mobile Registers Are Ringing

Ecommerce sales may ring the loudest but mcommerce sales are

chiming in with greater volume each year.Retail sales generated

via mobile devices in 2013 are projected to total $38.4 billion and

represent 15% of ecommerce sales.eMarketer projects mobile’s

annual sales tally will increase by double-digit rates through 2016,

at which point roughly a quarter of ecommerce sales will come

through mobile devices.

billions, % change and % of retail ecommerce

US Retail Mcommerce Sales, 2011-2016

2011

$13.63

168.9%

7.0%

2012

$24.66

81.0%

11.0%

2013

$38.40

55.7%

15.0%

2014

$52.17

35.8%

18.0%

2015

$68.29

30.9%

21.0%

2016

$86.86

27.2%

24.0%

Retail mcommerce sales % change % of retail ecommerce

Note: excludes travel and event ticket sales; includes sales on tablets

Source: eMarketer, Jan 2013

149657 www.eMarketer.com

149657

eMarketer’s retail mcommerce projections have been raised

compared to the forecast published in January 2012 to reflect

the inclusion of digital content sales and sales made through

all mobile devices. The optimistic outlook for growth is based

in part on data reported in Q4 2012, including:

■■ comScore’s estimate that US retail mcommerce sales in

2011 represented 7.7% of total ecommerce sales.

■■ Internet Retailer’s estimate that mobile commerce sales

from the 400 biggest retail, ticket and travel companies in

the US totaled $10.85 billion and represented 52% of total

US mcommerce sales in 2012.

■■ Findings from Javelin Strategy and Research that valued the

US retail mcommerce market at $20.7 billion for 2012.

3. Retail Mobile Commerce Forecast: Shoppers Turn to Smartphones First Copyright ©2013 eMarketer, Inc. All rights reserved. 3

eMarketer believes the estimates made by these companies

are conservative given the rapid adoption of tablets and the

steady growth of smartphone ownership. Together, these

devices are extending traditional shopping hours well into the

evening and the average order values made via tablets and

smartphones are exceeding desktop averages as consumers

grow more comfortable buying through portable devices.

Majority of Online Shoppers are Mobile Shoppers, Too

eMarketer’s mobile shopper forecast reflects a cultural shift

toward a mobile-centric lifestyle in the US, one in which all

things digital are increasingly accessed through mobile devices.

Smartphone and tablet usage is expected to increase rapidly in

2013 and grow at double-digit rates for the next two years.

The mobile shopper and buyer audiences are expected to

expand in a similar fashion. eMarketer forecasts the number

of mobile shoppers in the US will increase by 24% in 2013 to

118 million consumers and represent 62% of digital shoppers.

Over the next four years, the overlap between mobile and

digital shoppers will steadily increase as the number of mobile

shoppers grows to 174 million in 2016. At that point, roughly

eight out of 10 digital shoppers will also be mobile shoppers.

millions and % of digital shoppers

US Mobile Shoppers and Penetration, 2011-2016

2011

68.4

38.4%

2012

94.8

51.5%

2013

118.0

62.2%

2014

139.7

71.5%

2015

159.1

79.1%

2016

174.9

84.6%

Mobile shoppers % of digital shoppers

Note: ages 14; mobile device users who have used their mobile device to

browse, research or compare products via web browser or mobile app

within the past year, but have not necessarily made a purchase via mobile

device

Source: eMarketer, Jan 2013

149799 www.eMarketer.com

149799

The rising tide of mobile traffic to retail destinations is a clear sign

of the consumer shift toward mobile shopping.A year-long analysis

of the traffic patterns of 150 US ecommerce sites conducted by

marketing technology provider Monetate showed mobile device

activity more than doubled in a year.In Q3 2011,smartphones and

tablets combined accounted for less than 8% of traffic for sites

using the Monetate platform.Twelve months later,smartphone

traffic alone comprised 8% and tablets held a 10% share.A similar

growth trend was noted by research firm comScore:one in eight

page views,or 13.3% of all internet visits,inAugust 2012 (including

those outside the retail sector) stemmed from mobile devices,

double the share from a year earlier.Unlike the Monetate findings,

comScore’s analysis showed mobile phone users outpaced tablet

users in site visits by roughly 2-to-1.

“Thirty percent of our site traffic comes from mobile devices

and between 70% and 75% of our customers are using

iPhones,” said Bridget Dolan, vice president of interactive

media at beauty products retailer Sephora. Like Sephora’s

customers, the largest share of mobile shoppers on Black

Friday and Cyber Monday 2012 used a smartphone to access

retail sites, but tablet traffic grew the most year over year,

according to findings from IBM Digital Benchmarks. So, while

smartphones lead the way now, that is likely to change quickly.

As the number of mobile shoppers goes up, so does the

number of buyers. “We’ve definitely seen a progression of our

shoppers completing the full purchase on the device. They’re

not only browsing and price-comparing, they’re placing full

orders,” said Aki Iida, head of mobile for shoe and apparel

retailer Zappos.com.

Retail trends and the latest research leads eMarketer to believe

that 72 million people in the US will make a purchase through a

mobile device in 2013, a figure that will increase nearly 65%, to

119 million, in 2016.The growth of the mobile buyer community

will be fueled in greatest measure by the expanding number

of tablet users who, as noted in eMarketer’s June 2012 report,

“Tablet Shopping Fuels ‘Couch and Pillow’ Commerce,”

are more prone to buying. Still, the number of consumers making

purchases on a smartphone is expected to increase by double-

digit levels for the next three years and contribute significantly to

the overall expansion of the mobile buyer population.

The Big Picture: Retail Mcommerce Forecast

4. Retail Mobile Commerce Forecast: Shoppers Turn to Smartphones First Copyright ©2013 eMarketer, Inc. All rights reserved. 4

millions and % change

US Mobile Buyers, 2011-2016

2011

33.2

117.0%

2012

52.5

57.9%

2013

72.6

38.3%

2014

89.1

22.7%

2015

105.1

18.0%

2016

119.6

13.9%

Mobile buyers % change

Note: aages 14+; mobile device users who have used their mobile device

to make at least one purchase via web browser or mobile app within the

past year

Source: eMarketer, Jan 2013

149863 www.eMarketer.com

149863

“Just four years ago mobile commerce barely existed. Today,

mobile touches nearly one in every three purchases on eBay,”

said Steve Yankovich, vice president of mobile for eBay, in a

company blog post on December 11, 2012. Prescription drug

retailer Walgreens has also seen the number of customers

using a smartphone to order and buy prescription refills

steadily increase. “The latest numbers show 40% of our online

prescription business now comes from mobile,” said Tim

McCauley, Walgreens’ senior director of mcommerce.

Smartphone Shopping and

Spending Trends

eMarketer’s adjusted mobile commerce forecast

sheds light on several key trends related to

smartphone-driven commerce:

■■ Roughly six out of seven mobile shoppers, or 100 million US

consumers, will use a smartphone to shop in 2013. Over the

next three years, the US smartphone shopper population

will expand by 55% to comprise 155 million people in 2016,

or nearly half of the US population.

■■ The number of smartphone buyers will increase by a larger

degree (60%) over the next three years as retailers continue

to invest in mobile storefronts and gain experience in

converting mobile shoppers to buyers. Buyers will represent

just over half (53%) of the smartphone shopper population

in 2016, leaving significant headroom for growth.

■■ Average annual sales per smartphone buyer will rise

incrementally through 2016.Indeed,current buyers are expected

to spend more as they gain confidence in the channel,but

growth in the average annual spend per buyer will be tempered

by a larger,more economically diverse smartphone user base.

This year,the average smartphone buyer is expected to spend

$262 on purchases made with their phone,and that figure will

rise 12% over the next three years to reach $295.

Key eMarketer Numbers—US Smartphone Retail

Mcommerce

99.9

155.3

51.3

82.3

$13.44

$24.32

$262.19

$295.65

Note: *ages 14+; **excludes travel and event ticket sales

Source: eMarketer, Jan 2013

149864 www.eMarketer.com

Smartphone shoppers*

(millions)

Smartphone buyers* (millions)

Smartphone retail mcommerce

sales** (billions)

Average spend per smartphone

buyer

2013 2016 2013 2016

2013 2016 2013 2016

149864

Spending Preferences and Patterns Emerge

The comfort zone on spending levels is shifting as

smartphones become a more commonly accepted shopping

channel. Forty-five percent of smartphone owners surveyed

by Mojiva said they were comfortable spending $50 or more

The Big Picture: Retail Mcommerce Forecast

5. Retail Mobile Commerce Forecast: Shoppers Turn to Smartphones First Copyright ©2013 eMarketer, Inc. All rights reserved. 5

on holiday gifts purchased with their phone, up 5 percentage

points from a similar survey conducted a year earlier. On

the other end of the spectrum, the number who said they

wouldn’t spend a penny through their phone was less than

half the size it was in 2011, shrinking from 21% to 9%. The

“less than $20” and “more than $100” categories grew the

fastest year over year as the nonspenders dwindled. The

comfort zone for the largest single group of respondents was

the $20–$50 price range, as it was the previous year.

% of total

Maximum Amount that US Smartphone Owners

Would Be Comfortable Spending on a Holiday Gift

Purchase via Smartphone, 2011 & 2012

Note: 2011 n=205; 2012 n=1,000

Source: Mojiva, "Mobile Audience Guide (MAG)," Nov 13, 2012

147435 www.eMarketer.com

2011 2012

$0

21%

$50-$100

20%

$100+

20%

<$20

8%

$20-$50

31%

$0

9%

$50-$100

21%

$100+

24%

<$20

12%

$20-$50

34%

147435

An August 2012 survey conducted by Research Now for mobile

marketing firm Vibes showed a similar breakdown in spending

patterns for “connected shoppers,” a subset of the 1,000

smartphone owners polled and defined as those who use a

smartphone to perform shopping-related tasks before, during

and after making a purchase. Nearly two-thirds of “connected

shoppers” said they had made a purchase with their phone, and

the largest group of buyers (44%) spent between $20 and $49.

Looking beyond spending preferences to average order values

shows basket sizes from smartphones defy the device’s

small screen.

For the first three quarters of 2012, average order values from

smartphones consistently outpaced desktop averages, according

to marketing technology firm Monetate.“The smartphone

audience is a smaller data set [compared to the desktop

audience] and it has a higher affluent element, so that’s why their

numbers are generally higher than traditional [desktop],” said Kurt

Heinemann, Monetate’s chief marketing officer.

Q3 2012 data from Monetate showed the average order value

for smartphone buyers was $97, which was roughly $6 higher

than the desktop average for the same period. However, it

was also $6 lower than the smartphone average from the

prior year. The decline in the smartphone average order value

over the 12 month period was likely due to the smartphone

audience growing larger and more economically diverse.

US Average Ecommerce Order Value, by Device,

Q3 2011-Q3 2012

Smartphone

Traditional

Tablet

Q3 2011

$104.11

$105.66

$100.76

Q4 2011

$119.74

$104.21

$106.05

Q1 2012

$104.28

$94.57

$96.29

Q2 2012

$96.90

$91.80

$96.37

Q3 2012

$97.82

$91.76

$69.84

Source: Monetate, "Ecommerce Quarterly EQ3 2012," Nov 16, 2012

149865 www.eMarketer.com

149865

Top Retailers and Product Categories

A handful of companies and products tend to dominate the

mobile commerce landscape. According to Internet Retailer’s

“Mobile 400” report, mcommerce sales for the largest retail,

ticket and travel companies in the US totaled $10.8 billion

in 2012, up from $5.5 billion in 2011. Of that total, 39% was

accrued by 10 companies. Amazon topped the list with an

estimated $4 billion in mobile receipts; Apple followed with

$1.7 billion in sales of mobile apps, music, video and ebooks.

QVC and Wal-Mart were ranked fifth and sixth, respectively.

The remaining six companies were from the travel sector.

Meanwhile, eBay estimates its mobile transactions totaled

$10 billion in 2012, a number equal to the combined

mcommerce sales of the Mobile 400 companies, according to

Internet Retailer. It’s important to note, however, that eBay’s

estimate is for mobile transactions worldwide.

Wal-Mart and Apple appeared again in an October 2012

survey conducted by Equation Research for mobile solutions

provider Mobiquity. When the research firm asked 1,000

smartphone and tablet owners which retailers they purchased

from most using a smartphone within the past six months, the

largest group (23%) said they spent their money at Wal-Mart.

Equal shares of the smartphone spenders surveyed (14%) said

Target, Best Buy or Apple were their mobile stores of choice.

Brick Meets Click, which consults with clients on how technology

is influencing shopping, has found that retailers who succeed

with smartphone shoppers are the ones that use the device

to solve shoppers’ problems.“Successful retailers are more

shopper-centric and they tend to compete by moving more

quickly to serve shoppers vs. responding to competition. Some

are using mobile to help customers quickly find products in large

stores and others are saving shoppers time by letting them use

mobile devices to make purchases.They’re solving problems

rather than focusing on simply selling more products,” said Bill

Bishop, Bricks Meets Click’s chief architect.

Smartphone Shopping and Spending Trends

6. Retail Mobile Commerce Forecast: Shoppers Turn to Smartphones First Copyright ©2013 eMarketer, Inc. All rights reserved. 6

% of respondents

Retailers that US Smartphone Owners Browse and

Buy from Most on Their Smartphones, Nov 2012

Browse Buy

Wal-Mart 28% 23%

Target 22% 14%

Best Buy 21% 14%

Apple 15% 14%

Macy's 12% 10%

The Home Depot 15% 9%

Lowe's 12% 8%

Walgreens 11% 8%

Kohl's 11% 7%

Costco - 7%

CVS 9% -

Source: Mobiquity, "The Mobile Shopping Satisfaction Report" conducted

by Equation Research, Dec 12, 2012

149023 www.eMarketer.com

149023

Drilling down to the product level shows smartphone sales

in 2012 stemmed mostly from digital products. In an August

15, 2012, blog post, Forrester reported that media products

dominated the mcommerce landscape and would continue to

lead the way in mobile sales over the next four years. Survey

results from online research firm uSamp support Forrester’s

assertion: Of 1,100 adult mobile device users polled in September,

the largest group of respondents (50%) said they had purchased

digital content with their mobile device. Beyond digital products,

roughly a third of those polled by uSamp reported buying

consumer electronics from a mobile storefront.

A pre-holiday survey conducted by mobile ad network

Mojiva showed smartphone owners were getting more

comfortable with the idea of buying physical goods with

their phones. Of the 1,000 smartphone owners surveyed by

Mojiva in September 2012, larger groups said they would

consider buying toys and games (56% vs. 52%) and clothing

(45% vs. 40%) with their phones compared to a similar

survey conducted in 2011. Indeed, the greatest number of

respondents said they were willing to buy “electronics” such

as movies and music, but growth in the other holiday gift

categories indicates smartphone owners were opening their

minds to a wider variety of mobile purchases.

% of respondents

Types of Holiday Items that US Smartphone Owners

Would Consider Purchasing on Their Smartphones,

2011 & 2012

Electronics (e.g., movies, music)

51%

60%

Toys & games

52%

56%

Clothing

40%

45%

Flights/hotels

27%

28%

Decorations

23%

24%

Food items

19%

20%

Charitable donations

17%

17%

None of the above

23%

17%

2011 2012

Note: 2011 n=205; 2012 n=1,000

Source: Mojiva, "Mobile Audience Guide (MAG)," Nov 13, 2012

147434 www.eMarketer.com

147434

Is Smartphone Commerce a Man’s Game?

Research studies conducted among mobile users suggest

men are more avid mobile shoppers and buyers than women.

These findings are noteworthy given recent data from the

Pew Internet & American Life Project and from Arbitron and

Edison Research that showed smartphone ownership rates

among the two genders were nearly the same and that the

smartphone population as a whole was equally split between

men and women.

Still, results from a collection of surveys conducted in the lead-

up to the 2012 holiday season showed men were more inclined

to perform a wider variety of shopping-related tasks with a

smartphone than were their female counterparts.And they were

more likely to buy. uSamp’s September 2012 survey showed men

were more likely to scan a barcode, make a mobile payment,

make a purchase with the device and conduct post-purchase

activities such as commenting on and reviewing a purchase.

The only place where women outpaced men was in the hunt for

deals: 44% of female respondents to the uSamp survey said they

used a mobile coupon, vs. 35% of the men polled.

Smartphone Shopping and Spending Trends

7. Retail Mobile Commerce Forecast: Shoppers Turn to Smartphones First Copyright ©2013 eMarketer, Inc. All rights reserved. 7

% of respondents in each group

Mobile Shopping Activities of US Mobile Device Users,

by Gender, Sep 2012

Scanned a barcode

91%

85%

Used mobile for payment

46%

32%

Made a mobile purchase

45%

34%

Used a mobile coupon

35%

44%

Commented on a purchase

35%

28%

Wrote a review of a purchase

26%

16%

Male Female

Source: uSamp as cited in company blog, Sep 12, 2012

145482 www.eMarketer.com

145482

“The NRF 2012 Holiday Consumer Spending Survey” conducted

in October 2012 by research firm BIGinsight for The National

Retail Federation showed similar results. Of the 8,900 consumers

surveyed, more men than women said they intended to use

their smartphone to research products or compare prices and

to make purchases over the holidays. Men planned to use their

phone less than women for just two activities: to find store

information such as location or hours and to redeem coupons.

While men may not use mobile coupons as frequently as

women, they are more likely to use their smartphone to check

product information and compare prices in a store to get the

best deal. When interactive marketing agency Moosylvania

asked 1,800 smartphone users if they used their smartphone

in-store to compare prices, 80% of men said “yes” compared

to 67% of the female respondents.

Certainly, the gender mix will vary by retail category and

merchant, but in general, mobile shopping and buying activities

are more popular among men than women.“Our [desktop]

website is female-dominant, but on mobile we see more men

accessing our store,” said Zappos’ Iiada.This has implications for

marketers—not only those who target male consumers, but any

marketer interested in attracting more smartphone users to a

mobile storefront and more women to a physical store.

Commerce of Convenience (Almost)

For smartphone users, shopping trips are morphing

into shopping minutes. They occur at random times

throughout the day—from home and afar—and are

driven by impulse as often as intent. Curiosity piqued

by a television commercial can be instantly satisfied

with a smartphone search. And items from shopping

lists can be purchased while waiting in a doctor’s

office. By comparison, logging on to a computer at

home or at work feels like a time-consuming “trip”.

Yet many smartphone users still end up in front of

a PC or at a physical store because they encounter

roadblocks in the mobile checkout process.

Once a consumer owns a smartphone and they get a taste

of the type of information, deals and storefronts that are at

their fingertips, their reliance on the device ramps up rapidly.

Eighty-two percent of smartphone owners surveyed by mobile

marketing firm Vibes said their phone was “always or often”

within arm’s reach when shopping.And smartphone shoppers

surveyed by Deloitte in March 2012 reported using their phone

at least 50% of the time, either on the way to a store or in the

store itself.The frequency of usage was even higher, closer to

60%, for consumers who shopped in the following categories:

appliance/electronics, furniture/home furnishing, food/beverage

or health/personal care/drug.These high usage rates suggest

that smartphones are highly influential in the purchase process.

An Unbiased Shopping Resource

With internet access in hand and friends just a phone call, text

or tweet away, smartphone shoppers have a trusted source of

information at their disposal at all times.“People use their phone

instead of talking to a salesperson.A salesperson is trying to sell

them something, but their phone doesn’t have an agenda. It’s

unbiased, so they go to their phone to search for information,”

said Jack Philbin,Vibes’ co-founder, president and CEO.

And they frequently tap a variety of sources for research

purposes. Of the US smartphone and tablet owners

polled by Prosper Mobile Insights in August 2012, 88% of

respondents labeled themselves occasional or regular mobile

researchers. Another August survey, this one conducted by

email marketing provider Yesmail, showed that 64% of US

smartphone owners searched for product information on a

company’s website using their phone.

Finding product information is just one of a growing number

of research activities consumers do with their smartphones.

A survey conducted by MarketLive in the build-up to the 2012

holidays shed light on 10 shopping activities online shoppers

Smartphone Shopping and Spending Trends

8. Retail Mobile Commerce Forecast: Shoppers Turn to Smartphones First Copyright ©2013 eMarketer, Inc. All rights reserved. 8

expected to do on their phone before visiting a store. The

two largest groups of respondents said they would use their

phones to check for sales and specials (42%) and to look for

competitive pricing on Amazon.com (41%). A slightly smaller

group (37%) said they would use their phone to browse an

online store for the product they were interested in.

Across the board, more consumers planned to use their

smartphone before entering the store during the 2012 holiday

season compared to the prior year. Interestingly, two new

activities garnered a significant number of responses: 30% of

respondents said they would look up prices on the retailer’s

own mobile site prior to visiting and 22% said they planned to

reserve products for pickup when they arrived at the store.

% of respondents

Mobile Activities US Online Shoppers Will Conduct on

Their Smartphones Before Visiting a Store This

Holiday Season, 2011 & 2012

Check for sales and specials

38%

42%

Look for competitive pricing on Amazon

35%

41%

Browse an online store for product of interest

33%

37%

Look up store information

30%

37%

Look for competitive prices on products at retailers online other

than Amazon

30%

35%

Check for product ratings and reviews

30%

33%

Look for competitive prices on comparison shopping engines

26%

30%

Check inventory of a product of interest prior to making a visit

to the store

25%

28%

Look up prices on the retailer's mobile site where I was

intending to buy

30%

Reserve products for subsequent pickup at retail store

22%

2011 2012

Note: "frequently" or "often"

Source: MarketLive, "Fa, La, Fa...30 Last Minute Tricks to Maximize Holiday

Selling," Oct 10, 2012

146620 www.eMarketer.com

146620

Once in the aisle,the urge to comparison shop and find product

reviews kicked in.Forty-nine percent of US mobileWi-Fi users

polled by location-based platform provider JiWire used their

device to comparison shop in Q3 2012,up 10% from the prior year.

“Forty-eight percent of the connected shoppers we surveyed said

they felt better about their purchase when they used their phones

as a resource.So the more retailers can do to engage customers

with mobile touchpoints in the store,the better shot they have at

retaining their business,”saidVibes’ Philbin.

The habit of turning to the smartphone to gather information

during the discovery phase of the purchase process offers

marketers unique opportunities to influence buying decisions.

Nearly 30% of smartphone users polled in the first quarter

of 2012 for the “Our Mobile Planet: United States” study

commissioned by Google said research done on their

smartphone changed their decision to buy a product online, and

a slightly greater number said it changed their mind about buying

a product in a store. Marketers who embrace mobile researching

behavior as a sign of consumer malleability and deliver relevant

content—and offers of value—through mobile channels have a

better chance of converting a smartphone shopper into a buyer.

% of respondents

Influence of Smartphones on Purchase Decisions

According to US Smartphone Owners, Q1 2012

I intentionally have my smartphone with me to compare prices

and inform myself about products

35%

I have changed my mind about purchasing a product or service in

store as a result of information I gathered using my smartphone

32%

I have changed my mind about purchasing a product or service

online as a result of information I gathered using my smartphone

29%

Note: n=1,000

Source: Google, "Our Mobile Planet: United States" in partnership with

Ipsos MediaCT, May 1, 2012

149880 www.eMarketer.com

149880

Empowered to Roam, but Still Shopping from Home

Indeed, consumers with smartphones can shop from anywhere

at anytime. However, the largest group of smartphone users (60%)

surveyed by Moosylvania said they were most likely to make a

purchase on their phone while at home.“The New Multi-Screen

World: Understanding Cross-Platform Consumer Behavior”

report published by Google in cooperation with research firm

Ipsos and Sterling Brands noted a similar preference for in-home

shopping.When 1,600 smartphone, PC and TV users were asked

to log their media interactions in a mobile diary over a 24-hour

period and were later surveyed about the behaviors noted in

the diaries, 60% reported shopping at home with a smartphone

while the remainder used the device to browse and buy products

outside the home. Compared to the number of respondents

who reported shopping out-of-home with a PC or laptop (16%),

smartphone users are wonderfully mobile. Still, home is the hub

of smartphone shopping.

Commerce of Convenience (Almost)

9. Retail Mobile Commerce Forecast: Shoppers Turn to Smartphones First Copyright ©2013 eMarketer, Inc. All rights reserved. 9

% of total interactions

At-Home vs. Out-of-Home Shopping via Smartphone

and PC/Laptop According to US Connected Device

Users*, Q2 2012

Note: figures are based on 323 PC/laptop shopping interactions and 152

smartphone shopping interactions reported by users; out-of-home

represents on the go, in-store, at work or elsewhere; *use smartphone, PC

and TV

Source: Google and Sterling Brands, "The New Multi-Screen World:

Understanding Cross-Platform Consumer Behavior" conducted by Ipsos,

Aug 29, 2012

144876 www.eMarketer.com

PC/laptop Smartphone

In-home

84%

Out-of-

home

16%

In-home

59%

Out-of-

home

41%

144876

Although smartphones are used steadily throughout the day,

usage spikes as the workday ends and consumers settle in

at home.With a smartphone,“You can shop in every waking

moment of the day, but we see a big burst in mobile shopping in

the evening hours,” said eBay’s Yankovich in an interview with

Fox Business News on November 20, 2012.A month prior to that,

an analysis conducted by mobile ad network Jumptap showed

iPhone usage spiked twice in the evening hours: between 4pm

and 8pm usage was 16% above the daily average and was 52%

above the daily average between 8pm and 12pm.

It’s no surprise the sweet spot for mobile shopping falls within

these time periods. USA Touchpoints, a syndicated consumer

insights and cross-platform research tool deployed by The

Media Behavioral Institute, showed the highest percentage

of mobile shopping occurred from 4pm to 8pm. During these

hours the average reach among mobile shoppers never

dropped below 8% and was as high as 13%.

Confident that consumers would turn to their smartphones

after dinner on Thanksgiving Day 2012, eBay started promoting

exclusive mobile deals at precisely 5:23pm—the time they

anticipated most US consumers would finish eating. “On a

holiday, when everyone is together, people talk about gift

ideas, so we wanted to provide a convenient way for them to

shop,” Yankovich said.

Mobile shopping is situational; there are times when shopping

with a smartphone just makes more sense than a laptop or

desktop, Yankovich added. “It’s not socially acceptable to

bring a computer to the Thanksgiving table, but people are

comfortable pulling out their phone.”

The comfort of the couch and the sound of theTV present another

situation that motivates smartphone users to shop.Sixty-five

percent of US smartphone users surveyed byVibes said they

had their smartphone within easy reach when watchingTV.And

roughly half that number (29%) shopped via their phone with the

TV on,according toABI Research.Interestingly,the smartphone

users polled by Moosylvania were more inclined to research

products with their smartphone while sitting in front of theTV (19%)

than when shopping in a store (12%).

shopkick, a mobile app that offers shoppers rewards for

walking into stores, noticed that its 4.5 million shoppers

were using the shopkick app from home at least six days a

month. To better serve these at-home shoppers, the company

redesigned the app so those who shopped at home could

earn additional “kicks” (reward currency) when they later

walked into the store. “The couch is now connected to the

store through the reward currency, and we see 51% of all

people who walk into a store have previously used the

shopkick app at home to prepare for that visit,” said Cyriac

Roeding, shopkick’s CEO and co-founder. “And engagement

on the couch is also leading to increased engagement in the

store. Walk-ins went up by 40% after we redesigned the app.”

Taken together with the data above, this example highlights the

opportunity for retailers to increase sales by using smartphones

as the link between home and the digital or physical storefront.

First Stop for Shopping, but Not Always the Last

Roughly two thirds of consumers who used multiple digital

devices in a day turned to their smartphone first to shop,

according to the Google/Ipsos “Multi-Screen World” report.

The smartphone won out again with other online activities

as well: Sixty-five percent of those polled in August 2012 said

they started online searches using their smartphone and 63%

reached for their smartphone first to browse the web. The

number who started these same activities using a laptop or

PC was significantly lower, between 25% and 30%.

% of respondents

Select Activities that Are Started on a Smartphone

and Continued on Other Devices According to US

Connected Device Users*, Q2 2012

Social networking

Searching for info

Shopping online

Browsing the internet

Managing finances

Watching an online video

Planning a trip

Started on

a smartphone

66%

65%

65%

63%

59%

56%

47%

Continued

on a PC

58%

60%

61%

58%

56%

48%

45%

Continued

on a tablet

8%

4%

4%

5%

3%

8%

3%

Note: read chart as 66% of connected device users have started social

networking on a smartphone before moving to another device, with 58%

using a PC and 8% using a tablet; numbers may not add up to total due to

rounding; *use smartphone, PC and TV and have started an activity on one

device then continued on another

Source: Google and Sterling Brands, "The New Multi-Screen World:

Understanding Cross-Platform Consumer Behavior" conducted by Ipsos,

Aug 29, 2012

144871 www.eMarketer.com

144871

Commerce of Convenience (Almost)

10. Retail Mobile Commerce Forecast: Shoppers Turn to Smartphones First Copyright ©2013 eMarketer, Inc. All rights reserved. 10

Still, most mobile retail apps and websites fall short of meeting

shoppers’ expectations and needs. Of the 65% of shoppers who

began shopping on their smartphone, nearly all of them moved to

their desktop or laptop to finish the task, according to the Google

and Sterling Brands study. Research conducted by comScore for

PayPal unearthed a similar behavior pattern, but the trend was

less amplified. Forty-four percent of consumers who started the

purchase process with their smartphone moved to a traditional

computer to complete the task, according to comScore’s survey

of smartphone and tablet owners.

Certainly, a higher degree of familiarity and comfort with

buying products in the more mature (and some believe more

secure) desktop environment plays a role in why smartphone

shoppers move to the larger screen in the end. However,

the lack of storefronts built for touch navigation is also a

contributing factor.

In worldwide survey of 889 in-house marketers, agencies,

vendors and consultants conducted by Econsultancy between

July and August 2012, only a third of respondents said that

they had designed a website specifically for mobile phones.

Granted, this number was up 40% compared to the research

firm’s 2011 survey, indicating that progress is being made.

However, the number is still out of proportion to the rapid

increase in smartphone usage for shopping-related activities.

Usability testing was also limited, according to respondents;

more than half (55%) of respondents said they had not yet

conducted usability tests to see how their content rendered

on mobile devices. While this was likely due to limited

resources dedicated to mobile, it means the majority of the

group was unaware of how their site rendered on a smaller

screen and how a potential shopper would navigate their

content with a fingertip instead of a mouse.

% of respondents

Companies Worldwide that Have Designed Their

Website Specifically for Mobile Phones or Tablets,

2011 & 2012

Mobile phones

25%

35%

Tablets

13%

23%

Neither

70%

61%

2011 2012

Note: 2011 n=307; 2012 n=337 client-side marketers

Source: Econsultancy, "Conversion Rate Optimization Report 2012"

sponsored by RedEye, Oct 31, 2012

147313 www.eMarketer.com

147313

According to an annual mcommerce audit conducted by

The Acquity Group, US retailers are better prepared for

smartphone shoppers. The brand commerce and digital

marketing firm analyzed the mobile presence of the 300 top

retailers named by Internet Retailer and found that 95% had

a mobile-optimized website, an improvement of 157% over

the previous year’s survey. While this demonstrates significant

progress, the analysis also showed just half of the sites

rendered properly across the four leading mobile operating

systems—iOS, Android, RIM and Windows Mobile.

In addition, the time it takes mobile websites to load far exceeds

consumer expectations.According to a smartphone user study

conducted by Keynote Competitive Research in the first half

of 2012, 64% of smartphone users expected a mobile website

page to download in less than four seconds.Yet, the average

load times for mobile retail websites in the US hovered between

eight and nine seconds, according to Keynote’s mcommerce

performance index, which monitors the download speeds of the

homepages of 30 well-known retailers.

Indeed,businesses can’t control wireless data speeds,but by

building simple (and light) mobile websites they can shave seconds

off download times and increase user satisfaction levels.And if

smartphone shoppers are presented with finger-friendly navigation

and ordering methods,shopping carts are more likely to fill up.

The challenge then becomes understanding and managing

mobile shopping cart abandonment. In a survey conducted

in April 2012 by research firm Harris Interactive on behalf of

MasterCard, 63% of the 2,200 consumers polled said they had

abandoned a shopping cart when shopping online through

a computer or mobile device. Roughly a quarter said they

did so monthly. Looking specifically at mobile, shopping cart

recovery firm SeeWhy contends shopping cart abandonment

rates on mobile devices are substantially higher. “While the

average shopping cart abandonment rate across all devices

[tracked by SeeWhy] averaged 72 percent, on mobile devices

the rate has been 97% for the past year,” said Charles Nicholls,

SeeWhy’s founder and chief strategy officer.

Given smartphone owners’ tendency to use their smartphones

to fill downtime moments, their shopping behavior is

characterized by multiple starts and stops, which inherently

leads to cart abandonment. Pair that behavior with the

growing sophistication of consumers—the ease with which

they search for product/price information on their phone and

their knowledge that items in a cart will often be held there

in perpetuity—and it’s easy to see how cart abandonment is

becoming part of the shopping process.“Customers are getting

used to permanent shopping carts where the contents are

stored.They put items into carts simply because it makes it

easy to find them again later on,” Nicholls said.

The challenge for retailers is getting those customers to

return. Zappos noticed shoppers frequently used the mobile

shopping cart as a holding area for items they liked and hoped

to purchase. To remind customers of their previous shopping

Commerce of Convenience (Almost)

11. Retail Mobile Commerce Forecast: Shoppers Turn to Smartphones First Copyright ©2013 eMarketer, Inc. All rights reserved. 11

sessions and to encourage them to return, Zappos added

badge functionality to its app. “It’s like the badge on the text

app that tells you the number of unread messages you have.

If a shopper adds three items to the shopping cart and closes

the app, the badge on the app will remind them they have

three items to take action on,” said Iida.

Indeed, behavior alone is not the cause of high abandonment

rates. Security concerns and the form factor of the mobile

storefront also play a part. “When it comes to making a

purchase, people feel most comfortable on a traditional

desktop/laptop, where they feel their information is safe. And

they may have auto-fill turned on [which facilitates ordering

through the desktop], so you’re going to end up with a

multidevice path to purchase, which is challenging,” Nicholls

said. With a nonlinear path to purchase that is navigated by

multiple devices, marketers need to take shopping sessions

on all devices into account when calculating conversion rates.

As creatures of convenience, consumers will inevitably turn to

the shopping channel that best fits their mood, the moment

and their environment. Multichannel shopping is a reality, and

as Walgreens has found, shoppers who engage with brands in

multiple channels are more valuable than those who use only

one channel. “We see the more channels we use to engage

with consumers and make it easier for them to shop, the

better the overall value. That’s demonstrated by our data that

shows customers who buy from us through multiple channels

are six times as valuable as those who came through just one

channel,” said Walgreens’ McCauley.

The key takeaway for marketers is to make shopping on a

smartphone as frictionless an experience as it is online and

in-store. Being the method many consumers turn to first to

shop, a satisfying smartphone experience not only has the

power to deliver a positive first impression, it could be a

lasting one as well—one that leaves a business poised to build

long-term, potentially lucrative, relationships with consumers.

Conclusions

Retail sales from mobile devices are beginning to

represent a significant portion of ecommerce sales.

eMarketer forecasts sales from mobile devices will reach

$38.4 billion in 2013 and represent 15% of ecommerce

sales. That share will increase to 24% in 2016, at which point

mcommerce sales will total $86.9 billion.

Smartphone commerce sales will grow by 81% between

2013 and 2016 as smartphone ownership escalates

and retail investments in mobile storefronts pay off.

The number of smartphone buyers is expected to increase at a

faster rate than smartphone shoppers. However, given the larger

base of smartphone users, the ratio of these two groups will

remain relatively unchanged through 2016. Smartphone buyers

will comprise 53% of the smartphone audience in 2016, up from

51% this year. In the long term, that “other half” represents a

significant opportunity for growth if marketers can improve site

performance and conversion methods.

The vast majority of mobile shoppers have a

smartphone within arms reach at all times, and for

many it will be the first device they’ll turn to for

shopping. A shopping spree could occur at any time and

in any place, but the majority of smartphone consumers

gravitate toward shopping at home between 4pm and 8pm.

Retailers like eBay are targeting promotions to arrive within

these prime shopping hours. And companies such as shopkick

are building a bridge between the couch and the physical

store by rewarding customers for using their smartphone at

home prior to visiting a shop in person.

Smartphone shoppers may start shopping on their

phone, but they often finish the task on a computer

or in a physical store. To some degree, this is a sign that

retailers have not yet met the expectations of smartphone

shoppers. These consumers habitually turn to their phone in

downtime moments and as a result, shopping sessions are not

continuous experiences. They are characterized by frequent

starts and stops. Retailers like Zappos that remind smartphone

shoppers of items left in the mobile shopping cart and that

make the phone the most convenient way to buy are winning

the favor of these consumers. Yet there will inevitably be times

when the most convenient way for smartphone shoppers to

seal the deal is via a computer or a visit to a store. The key

takeaway for retailers is to ensure the smartphone shopping

experience leaves a positive impression on consumers, as that

impression (good or bad) will be carried over to whichever

channel the consumer chooses to shop through next.

Commerce of Convenience (Almost)

12. Retail Mobile Commerce Forecast: Shoppers Turn to Smartphones First Copyright ©2013 eMarketer, Inc. All rights reserved. 12

eMarketer Interviews

Zappos Describes Consumers’ Mcommerce

Shopping Patterns

Aki Iida

Head of Mobile

Zappos.com

Interview conducted on December 5, 2012

Walgreens Mobile App Satisfies Customers’ Need for Speed

Tim McCauley

Senior Director of Mcommerce

Walgreens

Interview conducted on December 7, 2012

Redesigned Rewards App Shopkick Drives 40% More

Consumers into Stores

Cyriac Roeding

CEO and Co-Founder

shopkick

Interview conducted on December 6, 2012

Bill Bishop

Chief Architect

Brick Meets Click

Interview conducted on November 29, 2012

Bridget Dolan

Vice President of Interactive Media

Sephora

Interview conducted December 18, 2012

Kurt Heinemann

Chief Marketing Officer

Monetate

Interview conducted on December 11, 2012

Charles Nicholls

Founder and Chief Strategy Officer

SeeWhy

Interview conducted on December 7, 2012

Jack Philbin

Co-Founder, President and CEO

Vibes

Interview conducted on December 3, 2012

Related eMarketer Reports

Tablet Shopping Fuels ‘Couch and Pillow’ Commerce

Multichannel Customer Service: Best Practices for

Building Retail Loyalty

Related Links

ABI Research

Arbitron

The Acquity Group

BIGinsight

comScore

Deloitte

Econsultancy

Edison Research

Equation Research

Forrester

Google

Harris Interactive

Internet Retailer

IBM

Ipsos

Javelin Strategy and Research

JiWire

Jumptap

Keynote

MarketLive

Media Behavioral Institute

Mobiquity

Mojiva

Monetate

Moosylvania

Nielsen

National Retail Federation

Pew Internet and American Life Project

Prosper Mobile Insights

Research Now

SeeWhy

Sterling Brands

Telmetrics

TNS Infratest

uSamp

Vibes

Yesmail

xAd

Editorial and

Production Contributors

Nicole Perrin Associate Editorial Director

Cliff Annicelli Senior Copy Editor

Emily Adler Copy Editor

Dana Hill Director of Production

Joanne DiCamillo Senior Production Artist

Stephanie Gehrsitz Senior Production Artist

Allie Smith Director of Charts

13. The world’s go-to source for information on

digital marketing, media and commerce.

In the fast-paced digital world, it is neither prudent nor professional to

make business decisions based solely on a single source. eMarketer helps

companies minimize risk and maximize opportunity by providing…

COLLECTIVE WISDOM

COVERAGE

See all aspects of what is happening today in digital marketing, media

and commerce.

COLLECTION

Information is gathered from thousands of research sources around the globe

and hundreds of interviews with industry professionals a month.

CURATION

eMarketer sifts through the clutter, vets data for accuracy and distills information

to its essential intelligence – to save you time.

COMPARISON

Side-by-side source comparison charts display all relevant information on a

topic in one place.

CONTEXT

Focused, clear and concise, eMarketer reports provide a quick, complete picture

of fast-changing digital trends to make sense of complex issues.

CONVENIENCE

The information you need is accessible 24/7 from your PC, laptop, tablet or

smartphone—and downloadable in PDF, Excel, JPEG or PowerPoint formats.

CONFIDENCE

For 15 years, eMarketer has been recognized as the standard for media coverage

of the digital world—cited more than 4,000 times in the New York Times and

Wall Street Journal alone—and relied on by major brands and advertising

agencies around the globe.

COMPETITIVENESS

No one in business wants to be surprised, so see the trends coming and make

certain your organization always has the latest, most accurate and comprehensive

digital information available—with an eMarketer Corporate Subscription.

To schedule a conversation or customized

demonstration, go to eMarketer.com or call 212-763-6010