SRBS lecture 2

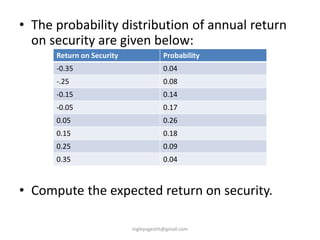

- 1. • The probability distribution of annual return on security are given below: • Compute the expected return on security. Return on Security Probability -0.35 0.04 -.25 0.08 -0.15 0.14 -0.05 0.17 0.05 0.26 0.15 0.18 0.25 0.09 0.35 0.04 ingleyogeshh@gmail.com

- 2. • Expected return= 0.013 = 1.3% Return on Security Probability Expected return -0.35 0.04 -0.014 -.25 0.08 -0.020 -0.15 0.14 -0.021 -0.05 0.17 -0.009 0.05 0.26 0.013 0.15 0.18 0.027 0.25 0.09 0.023 0.35 0.04 0.014 Expected Value 0.013 ingleyogeshh@gmail.com

- 3. • Mr. Rajan wants to invest in company A or company B. The return on stock A and B and probabilities are given below: Advice Mr. Rajan, whether he should invest in company A or B Company A Company B Return % Probability Return % Probability 6 0.10 4 0.1 7 0.25 6 0.2 8 0.30 8 0.4 9 0.25 10 0.2 10 0.10 12 0.1 ingleyogeshh@gmail.com

- 4. • Calculation of Expected Return Company A Company B R (i) P ER R (i) P ER 6 0.10 0.60 4 0.1 0.40 7 0.25 1.75 6 0.2 1.20 8 0.30 2.40 8 0.4 3.20 9 0.25 2.25 10 0.2 2.00 10 0.10 1.00 12 0.1 1.20 ∑ 8 ∑ 8 ingleyogeshh@gmail.com

- 5. • Calculation of Standard Deviation of stock A • Mean R (i) = 40/5=8 • Standard Deviation: 1.14 R (i) R (i) – Mean R (i) [R (i) – Mean R (i)] 2 P P * [R (i) – Mean R (i)] 2 6 -2 4.00 0.10 0.40 7 -1 1.00 0.25 0.25 8 0 0.00 0.30 0.00 9 1 1.00 0.25 0.25 10 2 4.00 0.10 0.40 40 1.30 ingleyogeshh@gmail.com

- 6. • Calculation of Standard Deviation of stock B • Mean R (i) = 40/5=8 • Standard Deviation: 2.19 R (i) R (i) – Mean R (i) [R (i) – Mean R (i)] 2 P P * [R (i) – Mean R (i)] 2 4 -4 16 0.10 1.60 6 -2 4 0.20 0.80 8 0 0 0.40 0.00 10 2 4 0.20 0.80 12 4 16 0.10 1.60 40 4.80 ingleyogeshh@gmail.com

- 7. Analysis Stock A (%) Stock B(%) Average Return 8 8 Risk 1.14 2.19 ingleyogeshh@gmail.com

- 8. • Following is the data relating to five securities. • Which of the securities should be selected for investment? • Assuming prefect correlation, analyse whether it is preferable to invest 75% in security A and 25% in security C Security A B C D E Returns (%) 8 8 12 4 9 Risk S.D (%) 4 5 12 4 5 ingleyogeshh@gmail.com

- 9. Analysis • Which of the securities should be selected for investment? 1. A 2. C 3. E ingleyogeshh@gmail.com

- 10. Assuming prefect correlation, analyse whether it is preferable to invest 75% in security A and 25% in security C In case of positive correlation exists between two securities, their risk and return can be averaged with the proportion. Hence proportion of 3:1 for risk and return will be as follows: Risk = [(3*4) + (1*12)]/ 4 = 6% Return = [(3*8) + (1*12)]/ 4 = 9% ingleyogeshh@gmail.com

- 11. • Comparing the above average risk and return with security E, it is better to invest in E as it has less risk for the same return of 6% Stock A & C (%) Stock E (%) Average Return 9 9 Risk 6 6 ingleyogeshh@gmail.com