Why microfinance failed to take off in India?

•

0 gefällt mir•334 views

Melden

Teilen

Melden

Teilen

Downloaden Sie, um offline zu lesen

Empfohlen

Empfohlen

Weitere ähnliche Inhalte

Was ist angesagt?

Was ist angesagt? (20)

Micro finance in India: legal and regulatory framework

Micro finance in India: legal and regulatory framework

IMPACT OF MICROFINANCE ON THE RURAL DEVELOPMENT IN ASSAM ABSTRACT

IMPACT OF MICROFINANCE ON THE RURAL DEVELOPMENT IN ASSAM ABSTRACT

Microfinance & its impact on women entrepreneurship develop

Microfinance & its impact on women entrepreneurship develop

The role of microfinance institutions in the development of small and medium ...

The role of microfinance institutions in the development of small and medium ...

Jims ecell : Microfinance - A Holistic Perspective

Jims ecell : Microfinance - A Holistic Perspective

Alternative Sources of Funding for Micro Enterprises

Alternative Sources of Funding for Micro Enterprises

A research proposal on the Impacts of Microfinance in Kenya

A research proposal on the Impacts of Microfinance in Kenya

The impact of microfinance on living standards, empowerment and poverty allev...

The impact of microfinance on living standards, empowerment and poverty allev...

Ähnlich wie Why microfinance failed to take off in India?

Ähnlich wie Why microfinance failed to take off in India? (20)

role of financial instituttion in providing microfinance

role of financial instituttion in providing microfinance

Summer Training Report of Role & Implications of Micro-Finance

Summer Training Report of Role & Implications of Micro-Finance

Kürzlich hochgeladen

Kürzlich hochgeladen (20)

Enabling Business Users to Interpret Data Through Self-Service Analytics (2).pdf

Enabling Business Users to Interpret Data Through Self-Service Analytics (2).pdf

Shareholders Agreement Template for Compulsorily Convertible Debt Funding- St...

Shareholders Agreement Template for Compulsorily Convertible Debt Funding- St...

Karol Bagh, Delhi Call girls :8448380779 Model Escorts | 100% verified

Karol Bagh, Delhi Call girls :8448380779 Model Escorts | 100% verified

Connaught Place, Delhi Call girls :8448380779 Model Escorts | 100% verified

Connaught Place, Delhi Call girls :8448380779 Model Escorts | 100% verified

Lucknow Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

Lucknow Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

Sangareddy Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

Sangareddy Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

Sohna Call Girls Service ☎ ️93326-06886 ❤️🔥 Enjoy 24/7 Escort Service

Sohna Call Girls Service ☎ ️93326-06886 ❤️🔥 Enjoy 24/7 Escort Service

JAIPUR CALL GIRLS SERVICE REAL HOT SEXY 👯 CALL GIRLS IN JAIPUR BOOK YOUR DREA...

JAIPUR CALL GIRLS SERVICE REAL HOT SEXY 👯 CALL GIRLS IN JAIPUR BOOK YOUR DREA...

EV Electric Vehicle Startup Pitch Deck- StartupSprouts.in

EV Electric Vehicle Startup Pitch Deck- StartupSprouts.in

Sector 18, Noida Call girls :8448380779 Model Escorts | 100% verified

Sector 18, Noida Call girls :8448380779 Model Escorts | 100% verified

Hyderabad Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

Hyderabad Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

Tirupati Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

Tirupati Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

+971565801893>>Safe and original mtp kit for sale in Dubai>>+971565801893

+971565801893>>Safe and original mtp kit for sale in Dubai>>+971565801893

Dehradun Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

Dehradun Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

Bangalore Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

Bangalore Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

call Now 9811711561 Cash Payment乂 Call Girls in Dwarka

call Now 9811711561 Cash Payment乂 Call Girls in Dwarka

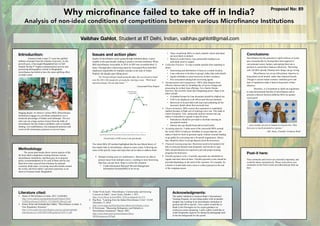

Why microfinance failed to take off in India?

- 1. Introduction: Grameen bank in past 37 years has uplifted millions of people from the clutches of poverty. As the proverb goes, it has taught Bangladesh how to fish! Despite having 2nd highest entrepreneurial activity and possessing demographics similar to Bangladesh, microfinance has failed to have the same uplifting effect on India’s poor. Digging deeper, we observe various MFIs (Microfinance Institutions) engage in a cut-throat competition over a miniscule percentage of Indian rural landscape. This not only cuts out a large section of poor from the folds of microfinance but also leads to problems such as multiple lending, over-indebtedness, less transparent practices and worst-of-all extortionary practices to recover loans. Methodology: The action plan breaks down various aspects of the far-from-ideal competition existing between various microfinance institutions, and then goes on to propose policy recommendations to fix each of them one-by-one. Ideas have been sourced from literature by national economic think-tanks, reviewing succesful models around the world, and from author’s personal experience as an intern at Grameen bank, Bangladesh. Acknowledgments: The author indebted to Grameen Bank’s International Training Program, for providing author with invaluable insights into working of an microfinance institution in general and GB in specific. Next, author would like to thank Colin Purrington for his expert guidance on conference poster designing. Lastly, author would like to credit Deepanshu Agarwal for taking the photograph used as the the background for this poster. Issues and action plan: Inspite of microfinance sector going through turbulent phase, it grew steadily in the past decade, leading to positive investor sentiment. When SKS microfinance went public in 2010, its IPO was oversubscribed 13 times. Through after a harrowing report by Associated Press held SKS employees responsible for multiple suicides in the state of Andra Pradesh, the façade came falling down. “An 18-year-old girl drank pesticide after she was forced to hand over Rs.150 (~$3) meant for an exam fee, leaving a note, “Work hard and earn money. Do not take loans.”” - Associated Press Report Growth index of MFI sector in the past decade The whole SKS-AP incident highlighted that the neo-liberal theory of free market fails in microfinance, atleast to some extent. Following are some of the specific issues and steps that can be taken to address them: § Multiple lending and over-indebtedness: Borrowers are able to procure loans from multiple sources, resulting in more borrowing than they can pay back. Steps to tackle this situation: • Credit Information Bureau(CIB) and Management Information Systems(MIS) to be set up. • These would help MFIs to clearly identify which individual are most likely to default. • Based on credit history, max permissible lending to an individual must be capped. § Collection Practices: To stop a similar episode from repeating in future • Sanctioning and distribution of loans at a central location. • Loan collection to be done in groups, rather than individually • Agents forbidden to meet borrowers at there residence. • Peer assessment among loan recovering agents. § Documentation and transparency: MFIs often disguise there effective interest rates by including like of service charge and processing fee in their loan offerings. For a barely literate borrower, this severely limits their bargaining power. Steps to be taken include: • A standard format for loan document should be chalked out. • EAR to be displayed in all offices and relevant literature. • Borrowers to be provided with loan card containing all the necessary details about their personal loan. § Cluster formation: MFIs restrict their operation to established markets because of high cost of entering a new one. This leads to cluster formation. Also, nationwide uniform interest rate cap makes it unfeasible to operate in specific areas: • Subsidiaries should be provided to facilitate entering an unexplored market. • Interest rate cap should fixed and revised locally § Accepting deposits: Unlike most of the successful MFIs around the world, MFIs in India are forbidden to accept deposits, can makes it hard for them to generate equity without external funding or go public by converting into a for-profit organization. Hence, they should be allow to accept deposits from the borrowers. § Financial training programs: Borrowers need to be trained to be able to read and interpret loan proposals, and not just to sign. MFIs should therefore be required to provide proper training programs for borrowers. § Flexible payment cycles: Currently, payments are scheduled on regular and short interval basis. Flexible payment cycles should be provided depending on the need of the customer. For example, for a farmer it would make more sense to collect payment at the end of the cropping season. Conclusions: Microfinance has the potential to uplift millions of world poor economically by freeing them from oppressive conventional money lenders, and putting them into a position to control their finances effectively. That being said, AP-SKS episode illustrate how things can go wrong. Microfinance are set up with primary objective to bring about social benefit, rather than financial benefit. Though in current Indian scenario, turbulent grow and lack of regulations make it hard to keep track of their objective. Therefore, it is incumbent to chalk out regulations to reap full potential benefits of microfinance and to promote cohesion between different MFIs for greater social good. " " " " " “...poor people are just as human as anyone else. They have just as much potential as anyone.” - Md. Yunus, Founder, Grameen Bank Vaibhav Gahlot, Student at IIT Delhi, Indian, vaibhav.gahlot@gmail.com Literature cited: 1. Status of Microfinance in India, 2012, NABARD, http://www.nabard.org/departments/pdf/Status%20of %20Microfinance%202011-12%20full%20book2.pdf. 2. Kenny Kline and Santadarshan Sadhu, “Microfinance in India: A New Regulatory Structure”, http://www.centre-for-microfinance.org/wp-content/uploads/ attachments/csy/1602/IIM%20Regulation%20V11.pdf. 3. Vishal Vivek Jacob, “Microfinance: Current status and Growing Concerns in India”, Avant Garde, October 1, 2011, http://www.iitk.ac.in/ime/MBA_IITK/avantgarde/?p=475. 4. Peg Ross, “Learning from the Indian Microfinance Crisis” CGAP, December 15, 2010, http://www.cgap.org/blog/learning-indian-microfinance-crisis. 5. R Srinivasan, “Measuring Delinquency and Defaults in Microfinance Institutions” March, 2007, http://www.iimb.ernet.in/microfinance/Docs/ MFIDelinquencyWP.pdf . Post-it here: Your comments and review are extremely important, and would be taken constructively. Please write down your comments on the Post-it notes provided and put them up here: Proposal No: 89