Forward guidance by central banks is no Panacea

•

1 gefällt mir•1,854 views

Central banks in recent months have experimented with ‘forward guidance’ – sending signals about the future path of monetary policy particularly in relation to interest rates – as a way of stabilising medium to longer run expectations in the markets and among businesses and consumers.

Melden

Teilen

Melden

Teilen

Empfohlen

Empfohlen

Weitere ähnliche Inhalte

Was ist angesagt?

Was ist angesagt? (20)

AS Macro Revision: Monetary Policy and Exchange Rates

AS Macro Revision: Monetary Policy and Exchange Rates

2010: Coping with the Crisis and Future Challenges

2010: Coping with the Crisis and Future Challenges

Andere mochten auch

Andere mochten auch (6)

Forward Guidance & Heterogenous Beliefs, Andrade, Gaballo, Mengus & Mojon

Forward Guidance & Heterogenous Beliefs, Andrade, Gaballo, Mengus & Mojon

Ähnlich wie Forward guidance by central banks is no Panacea

February 2013 World Economic Situation and ProspectsFebruary 2013 World Economic Situation and Prospects

February 2013 World Economic Situation and ProspectsDepartment of Economic and Social Affairs (UN DESA)

Ähnlich wie Forward guidance by central banks is no Panacea (20)

Draghinomics Introduces Quantitative Easing to the Eurozone

Draghinomics Introduces Quantitative Easing to the Eurozone

Ben Bernanke's Opening Press Conference Statement.

Ben Bernanke's Opening Press Conference Statement.

Global Central Banks Monetary Policy Review highlights 2013

Global Central Banks Monetary Policy Review highlights 2013

No UK rate hikes this year and room for further Euro upside

No UK rate hikes this year and room for further Euro upside

QNB group tapering of quantitative easing may hurt global growth

QNB group tapering of quantitative easing may hurt global growth

February 2013 World Economic Situation and Prospects

February 2013 World Economic Situation and Prospects

Mehr von tutor2u

Mehr von tutor2u (20)

Poverty Reduction Policies in Low Income Countries

Poverty Reduction Policies in Low Income Countries

Forward guidance by central banks is no Panacea

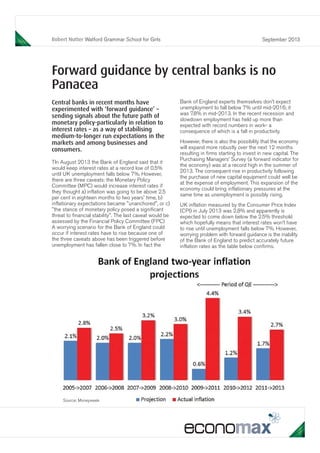

- 1. Robert Nutter Watford Grammar School for Girls September 2013 Forward guidance by central banks is no Panacea Central banks in recent months have experimented with ‘forward guidance’ – sending signals about the future path of monetary policy-particularly in relation to interest rates – as a way of stabilising medium-to-longer run expectations in the markets and among businesses and consumers. TIn August 2013 the Bank of England said that it would keep interest rates at a record low of 0.5% until UK unemployment falls below 7%. However, there are three caveats: the Monetary Policy Committee (MPC) would increase interest rates if they thought a) inflation was going to be above 2.5 per cent in eighteen months to two years' time, b) inflationary expectations became "unanchored", or c) "the stance of monetary policy posed a significant threat to financial stability". The last caveat would be assessed by the Financial Policy Committee (FPC) A worrying scenario for the Bank of England could occur if interest rates have to rise because one of the three caveats above has been triggered before unemployment has fallen close to 7%. In fact the Bank of England experts themselves don’t expect unemployment to fall below 7% until mid-2016; it was 7.8% in mid-2013. In the recent recession and slowdown employment has held up more than expected with record numbers in work- a consequence of which is a fall in productivity. However, there is also the possibility that the economy will expand more robustly over the next 12 months resulting in firms starting to invest in new capital. The Purchasing Managers’ Survey (a forward indicator for the economy) was at a record high in the summer of 2013. The consequent rise in productivity following the purchase of new capital equipment could well be at the expense of employment. This expansion of the economy could bring inflationary pressures at the same time as unemployment is possibly rising. UK inflation measured by the Consumer Price Index (CPI) in July 2013 was 2.8% and apparently is expected to come down below the 2.5% threshold which hopefully means that interest rates won’t have to rise until unemployment falls below 7%. However, worrying problem with forward guidance is the inability of the Bank of England to predict accurately future inflation rates as the table below confirms. Source: Moneyweek

- 2. Forward guidance has also been a feature of US monetary policy. Following their December 2012 meeting, the Federal Reserve (the US Central Bank) indicated that they anticipated that a target range for the federal funds rate (short term interest rate) of 0 to 0.25% percent will be appropriate at least as long as (a) the US unemployment rate remains above 6.5% (b) inflation between one and two years ahead is projected to be no more than 0.5% above the 2% target and (c) longer-term inflationary expectations continue to be ‘well anchored’. Unemployment in the US is at 7.4% and inflation at 1.3%. The Federal Reserve has also indicated that over time it will gradually bring to an end its quantitative easing (QE) programme in a policy measure known as ‘tapering’. The third phase of QE known as QE3 programme involved the Federal Reserve buying $85bn worth of long term bonds to provide more liquidity in the banking sector. However, when Ben Bernanke the Federal Reserve Chairman made these comments in May 2013 suggesting that the bank might end its purchase of bonds this led to wild fluctuations on the markets. By July 2013 Mr Bernanke sought to reassure markets once and for all that winding up - or tapering - the QE programme would not happen until the US economy was on a solid footing. Forward guidance is designed to give stability in markets and the business sector but as seen in the US it is very easy for markets to become irrational and lack stability with this new development in monetary policy. Robert Nutter Watford Grammar School for Girls In the US (and the UK and euro zone) the buying of bonds (quantitative easing), especially government debt, has reduced yields and made it cheaper for governments to borrow. If central banks indicate in their forward guidance that the buying of government bonds is to cease, long term interest rates (yields) will rise meaning that governments with high fiscal deficits will see a rise in their borrowing costs - a real problem for high deficit countries such as the UK. Forward guidance has also become part of European Central Bank (ECB)’s monetary policy, although not quite as explicit as the Federal Reserve or the Bank of England. The ECB has said "the Governing Council confirms that it expects the key ECB rates to remain at present or lower levels for an extended period of time providing support for a gradual recovery in economic activity in the remaining part of 2013 and in to 2014.” By the second quarter of 2013 the euro zone had emerged from recession with a growth rate of 0.3% although this was a mixed picture across the euro zone countries. Germany grew by 0.7% and France by 0.5% but Italy and Holland saw their GDP fall by 0.2%. Forward guidance will not solve a fundamental problem across the euro zone that a ‘one-size fits all’ monetary policy cannot work among countries which are not an optimal currency area. Forward guidance by the Bank of England will not in itself deal with low economic growth, supply side failures, nor the debt mountain. It might help, but it is no panacea.