Net lease-qsr-research-report

•

1 gefällt mir•231 views

The Boulder Group’s Research Department has released a new research report providing comprehensive numbers and analysis of the activity in the National Net Lease Quick Service Restaurant (QSR) Market.

Melden

Teilen

Melden

Teilen

Downloaden Sie, um offline zu lesen

Empfohlen

Empfohlen

Weitere ähnliche Inhalte

Mehr von The Boulder Group

Mehr von The Boulder Group (20)

Net Lease Tenant Profile Report 2019 | The Boulder Group

Net Lease Tenant Profile Report 2019 | The Boulder Group

Net Lease Casual Dining Report 2018 | The Boulder Group

Net Lease Casual Dining Report 2018 | The Boulder Group

net lease research report q1 2018 | The Boulder Group

net lease research report q1 2018 | The Boulder Group

Net Lease Big Box Research Report | The Boulder Group

Net Lease Big Box Research Report | The Boulder Group

Kürzlich hochgeladen

Kürzlich hochgeladen (20)

~Call Girls In Roop Nagar {8447779280}(Low Price) Escort Service In Delhi

~Call Girls In Roop Nagar {8447779280}(Low Price) Escort Service In Delhi

Call Girls in Maurice Nagar (Delhi) ꧁8447779280꧂ Female Escorts Service in De...

Call Girls in Maurice Nagar (Delhi) ꧁8447779280꧂ Female Escorts Service in De...

BPTP THE AMAARIO For The Royals Of Tomorrow in Sector 37D Gurgaon Dwarka Expr...

BPTP THE AMAARIO For The Royals Of Tomorrow in Sector 37D Gurgaon Dwarka Expr...

Retail Space for Lease - 1221 W. Main St., Sun Prairie, WI

Retail Space for Lease - 1221 W. Main St., Sun Prairie, WI

Low rate ↬Call girls in Sabzi Mandi Delhi | 8447779280}Escort Service In All ...

Low rate ↬Call girls in Sabzi Mandi Delhi | 8447779280}Escort Service In All ...

Call Girls In Sarai Rohilla ☎️8447779280{Sarai Rohilla Escort Service In Delh...

Call Girls In Sarai Rohilla ☎️8447779280{Sarai Rohilla Escort Service In Delh...

Kohinoor Courtyard One Wakad Pune | Elegant Living Spaces

Kohinoor Courtyard One Wakad Pune | Elegant Living Spaces

Housing Price Regulation Thesis Defense by Slidesgo.pptx

Housing Price Regulation Thesis Defense by Slidesgo.pptx

MEQ Mainstreet Equity Corp Q2 2024 Investor Presentation

MEQ Mainstreet Equity Corp Q2 2024 Investor Presentation

Bptp The Amaario Launch Luxury Project Sector 37D Gurgaon Dwarka Expressway...

Bptp The Amaario Launch Luxury Project Sector 37D Gurgaon Dwarka Expressway...

Call girls in Shakti Nagar Delhi~8447779280°/=@/ Short 1500 Night 6000}ESCORT...

Call girls in Shakti Nagar Delhi~8447779280°/=@/ Short 1500 Night 6000}ESCORT...

Escort—>Call GiRls In Mori Gate Delhi —>8447779280—Service Escorts In South D...

Escort—>Call GiRls In Mori Gate Delhi —>8447779280—Service Escorts In South D...

Kohinoor Teiko Hinjewadi Phase 2 Pune E-Brochure.pdf

Kohinoor Teiko Hinjewadi Phase 2 Pune E-Brochure.pdf

Jaipur Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

Jaipur Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

Net lease-qsr-research-report

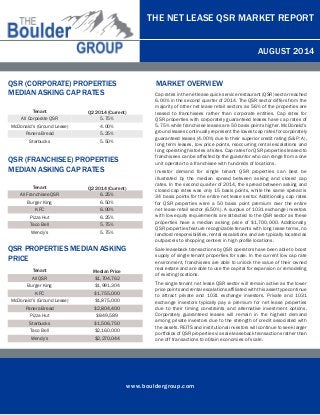

- 1. www.bouldergroup.com THE NET LEASE QSR MARKET REPORT AUGUST 2014 Tenant Q2 2014 (Current) All Corporate QSR 5.75% McDonald’s (Ground Lease) 4.00% Panera Bread 5.25% Starbucks 5.50% MARKET OVERVIEW Cap rates in the net lease quick service restaurant (QSR) sector reached 6.00% in the second quarter of 2014. The QSR sector differs from the majority of other net lease retail sectors as 56% of the properties are leased to franchisees rather than corporate entities. Cap rates for QSR properties with corporately guaranteed leases have cap rates of 5.75% while franchisee leases are 50 basis points higher. McDonald’s ground leases continually represent the lowest cap rates for corporately guaranteed leases (4.00%) due to their superior credit rating (S&P: A), long term leases, low price points, reoccurring rental escalations and long operating histories at sites. Cap rates for QSR properties leased to franchisees can be affected by the guarantor who can range from a one unit operator to a franchisee with hundreds of locations. Investor demand for single tenant QSR properties can best be illustrated by the median spread between asking and closed cap rates. In the second quarter of 2014, the spread between asking and closed cap rates was only 15 basis points, while the same spread is 34 basis points for the entire net lease sector. Additionally, cap rates for QSR properties were a 50 basis point premium over the entire net lease retail sector (6.50%). A surplus of 1031 exchange investors with low equity requirements are attracted to the QSR sector as these properties have a median asking price of $1,700,000. Additionally, QSR properties feature recognizable tenants with long lease terms, no landlord responsibilities, rental escalations and are typically located as outparcels to shopping centers in high profile locations. Sale leaseback transactions by QSR operators have been able to boost supply of single tenant properties for sale. In the current low cap rate environment, franchisees are able to unlock the value of their owned real estate and are able to use the capital for expansion or remodeling of existing locations. The single tenant net lease QSR sector will remain active as the lower pricepointsandrentalescalationsaffiliatedwiththisassettypecontinue to attract private and 1031 exchange investors. Private and 1031 exchange investors typically pay a premium for net lease properties due to their timing constraints and alternative investment options. Corporately guaranteed leases will remain in the highest demand among private investors due to the strength of credit associated with the assets. REITS and institutional investors will continue to seek larger portfolios of QSR properties via sale leaseback transactions rather than one off transactions to obtain economies of scale. QSR (CORPORATE) PROPERTIES MEDIAN ASKING CAP RATES QSR PROPERTIES MEDIAN ASKING PRICE Tenant Q2 2014 (Current) All Franchisee QSR 6.25% Burger King 6.50% KFC 6.00% Pizza Hut 6.25% Taco Bell 5.75% Wendy’s 5.75% QSR (FRANCHISEE) PROPERTIES MEDIAN ASKING CAP RATES Tenant Median Price All QSR $1,704,762 Burger King $1,991,304 KFC $1,755,000 McDonald’s (Ground Lease) $1,875,000 Panera Bread $2,804,400 Pizza Hut $849,589 Starbucks $1,506,750 Taco Bell $2,160,000 Wendy’s $2,270,044

- 2. www.bouldergroup.com THE NET LEASE QSR MARKET REPORT AUGUST 2014 SELECTED COMPANY COMPARISON Tenant Total Number of Locations Ticker Symbol Market Cap Arby's 3,400 Private Private Burger King 13,000+ BKW $9 B Carl's Jr. 1,369 Private Private Chick Fil A 1,800 Private Private Chipotle 1,637 CMG $18 B Dairy Queen 5,700 Private Private Dunkin' Donuts 11,000 DNKN $4 B Hardee's 1,944 Private Private Jack in the Box 2,200 JACK $2 B KFC 18,875 YUM $34 B McDonald's 35,000+ MCD $97 B Panda Express 1,653 Private Private Panera Bread 1,800 PNRA $4 B Pizza Hut 14,967 YUM $34 B Popeyes 1,800+ PKLI $959 M Sonic Drive-In 3,510 SONC $1 B Starbucks 23,187 SBUX $59 B Taco Bell 6,500 YUM $34 B Wendy's 5,900 WEN $3 B Whataburger 700+ Private Private Leases can be guaranteed by franchisees or corporations. QSR MEDIAN ASKING CAP RATE BY REGION WEST MOUNTAIN MIDWEST SOUTH NORTHEAST NORTHEAST SOUTH MIDWEST MOUNTAIN WEST 6.00% 6.00% 6.50%6.38% 4.85%

- 3. www.bouldergroup.com THE NET LEASE QSR MARKET REPORT AUGUST 2014 FOR MORE INFORMATION AUTHOR John Feeney | Vice President john@bouldergroup.com CONTRIBUTORS Randy Blankstein | President randy@bouldergroup.com Jimmy Goodman | Partner jimmy@bouldergroup.com Zach Wright | Research Analyst zach@bouldergroup.com © 2014. The Boulder Group. Information herein has been obtained from databases owned and maintained by The Boulder Group as well as third party sources. We have not verified the information and we make no guarantee, warranty or representation about it. This information is provided for general illustrative purposes and not for any specific recommendation or purpose nor under any circumstances shall any of the above information be deemed legal advice or counsel. Reliance on this information is at the risk of the reader and The Boulder Group expressly disclaims any liability arising from the use of such information. This information is designed exclusively for use by The Boulder Group clients and cannot be reproduced, retransmitted or distributed without the express written consent of The Boulder Group. Sector Q2 2013 (Previous) Q2 2014 (Current) QSR Sector 6.55% 6.00% Retail Net Lease Market 7.00% 6.50% QSR Premium (bps) 45 50 QSR SECTOR VS NET LEASE SECTOR CAP RATES Corporate Cap Rate Franchisee Cap Rate Spread (bps) 5.75% 6.25% +50 QSR ASKING CAP RATE BY GUARANTOR MEDIAN NATIONAL CLOSED CAP RATE SPREAD Sector Closed Asking Spread (bps) QSR Sector 6.33% 6.17% 16 Lease Term Remaining Cap Rate 20+ 5.80% 15-19 6.10% 10-14 6.35% Under 10 6.80% ASKING CAP RATE BY LEASE TERM REMAINING