Tax reforms by US Presidents

•Als PPTX, PDF herunterladen•

1 gefällt mir•367 views

Tax reforms by 3 US Presidents

Melden

Teilen

Melden

Teilen

Empfohlen

Presentation by Dr. Nyah Zebong Asaah at the Urban Age “Developing Urban Futures” conference in Addis Ababa on November 30th, 2018.

Watch his presentation on YouTube: https://youtu.be/e3eJjouc4mc

Local Government Revenues: Sources, Challenges and Reforms

Local Government Revenues: Sources, Challenges and ReformsInternational Centre for Tax and Development - ICTD

Weitere ähnliche Inhalte

Was ist angesagt?

Presentation by Dr. Nyah Zebong Asaah at the Urban Age “Developing Urban Futures” conference in Addis Ababa on November 30th, 2018.

Watch his presentation on YouTube: https://youtu.be/e3eJjouc4mc

Local Government Revenues: Sources, Challenges and Reforms

Local Government Revenues: Sources, Challenges and ReformsInternational Centre for Tax and Development - ICTD

Was ist angesagt? (20)

Post Election Special Edition Whitepaper: Eye on Washington

Post Election Special Edition Whitepaper: Eye on Washington

Business Whitepaper 1: Fiscal Cliff & Tax Issues/ Assessing and Mitigating th...

Business Whitepaper 1: Fiscal Cliff & Tax Issues/ Assessing and Mitigating th...

Post-Election Estate Planning and Tax Mitigation Strategies

Post-Election Estate Planning and Tax Mitigation Strategies

Local Government Revenues: Sources, Challenges and Reforms

Local Government Revenues: Sources, Challenges and Reforms

Andere mochten auch

Andere mochten auch (7)

Managing the Evolution of Aspect-Oriented Software with Model-based Pointcuts

Managing the Evolution of Aspect-Oriented Software with Model-based Pointcuts

A Summary of a Theological and Pastoral Exploration of the Role of Sports Cha...

A Summary of a Theological and Pastoral Exploration of the Role of Sports Cha...

Ähnlich wie Tax reforms by US Presidents

Ähnlich wie Tax reforms by US Presidents (20)

Corporate tax reform and labor market implications

Corporate tax reform and labor market implications

Post-Election: What You Need to Know for Tax Planning

Post-Election: What You Need to Know for Tax Planning

34 Things You Need to Know About the New Tax Law (AARP)

34 Things You Need to Know About the New Tax Law (AARP)

Fund Our Future Tax The Rich Invest In Our New York

Fund Our Future Tax The Rich Invest In Our New York

Chapter1Introduction to Federal Taxation and Understanding the

Chapter1Introduction to Federal Taxation and Understanding the

Where's the Money? State and Local Government Finance Forecast - Outlook 2015

Where's the Money? State and Local Government Finance Forecast - Outlook 2015

Cbizmhm special report_fiscal-year-2016-budget-proposals

Cbizmhm special report_fiscal-year-2016-budget-proposals

Mehr von Tirthankar Sutradhar

Mehr von Tirthankar Sutradhar (20)

Huff Model for selected retail stores in Bangalore

Huff Model for selected retail stores in Bangalore

Generic building blocks of sustainable competitive advantage

Generic building blocks of sustainable competitive advantage

From distribution to growing distribution channels: HBR case study

From distribution to growing distribution channels: HBR case study

7 r's of logistics & 7 r's of Samsung Mobile in India

7 r's of logistics & 7 r's of Samsung Mobile in India

An analysis of the distribution channel of vodafone

An analysis of the distribution channel of vodafone

Promoting sustainable development a case study on Proctor & Gamble

Promoting sustainable development a case study on Proctor & Gamble

Kürzlich hochgeladen

VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-992072VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai ...

VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai ...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S030524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...dipikadinghjn ( Why You Choose Us? ) Escorts

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Satisfaction and Quality Time

Booking Contact Details

WhatsApp Chat: +91-7001035870

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

29-april-2024(v.n)

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Sa...

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Sa...Call Girls in Nagpur High Profile

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine S...

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine S...Call Girls in Nagpur High Profile

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...dipikadinghjn ( Why You Choose Us? ) Escorts

Model Call Girl Services in Delhi reach out to us at 🔝 9953056974 🔝✔️✔️

Our agency presents a selection of young, charming call girls available for bookings at Oyo Hotels. Experience high-class escort services at pocket-friendly rates, with our female escorts exuding both beauty and a delightful personality, ready to meet your desires. Whether it's Housewives, College girls, Russian girls, Muslim girls, or any other preference, we offer a diverse range of options to cater to your tastes.

We provide both in-call and out-call services for your convenience. Our in-call location in Delhi ensures cleanliness, hygiene, and 100% safety, while our out-call services offer doorstep delivery for added ease.

We value your time and money, hence we kindly request pic collectors, time-passers, and bargain hunters to refrain from contacting us.

Our services feature various packages at competitive rates:

One shot: ₹2000/in-call, ₹5000/out-call

Two shots with one girl: ₹3500/in-call, ₹6000/out-call

Body to body massage with sex: ₹3000/in-call

Full night for one person: ₹7000/in-call, ₹10000/out-call

Full night for more than 1 person: Contact us at 🔝 9953056974 🔝. for details

Operating 24/7, we serve various locations in Delhi, including Green Park, Lajpat Nagar, Saket, and Hauz Khas near metro stations.

For premium call girl services in Delhi 🔝 9953056974 🔝. Thank you for considering us!Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X79953056974 Low Rate Call Girls In Saket, Delhi NCR

Kürzlich hochgeladen (20)

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

Mira Road Memorable Call Grls Number-9833754194-Bhayandar Speciallty Call Gir...

Mira Road Memorable Call Grls Number-9833754194-Bhayandar Speciallty Call Gir...

VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai ...

VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai ...

Solution Manual for Financial Accounting, 11th Edition by Robert Libby, Patri...

Solution Manual for Financial Accounting, 11th Edition by Robert Libby, Patri...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Sa...

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Sa...

WhatsApp 📞 Call : 9892124323 ✅Call Girls In Chembur ( Mumbai ) secure service

WhatsApp 📞 Call : 9892124323 ✅Call Girls In Chembur ( Mumbai ) secure service

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine S...

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine S...

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

Kharghar Blowjob Housewife Call Girls NUmber-9833754194-CBD Belapur Internati...

Kharghar Blowjob Housewife Call Girls NUmber-9833754194-CBD Belapur Internati...

20240429 Calibre April 2024 Investor Presentation.pdf

20240429 Calibre April 2024 Investor Presentation.pdf

Vasai-Virar Fantastic Call Girls-9833754194-Call Girls MUmbai

Vasai-Virar Fantastic Call Girls-9833754194-Call Girls MUmbai

06_Joeri Van Speybroek_Dell_MeetupDora&Cybersecurity.pdf

06_Joeri Van Speybroek_Dell_MeetupDora&Cybersecurity.pdf

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7

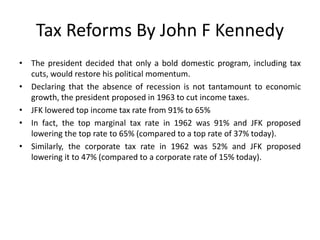

Tax reforms by US Presidents

- 1. Tax Reforms By John F Kennedy • The president decided that only a bold domestic program, including tax cuts, would restore his political momentum. • Declaring that the absence of recession is not tantamount to economic growth, the president proposed in 1963 to cut income taxes. • JFK lowered top income tax rate from 91% to 65% • In fact, the top marginal tax rate in 1962 was 91% and JFK proposed lowering the top rate to 65% (compared to a top rate of 37% today). • Similarly, the corporate tax rate in 1962 was 52% and JFK proposed lowering it to 47% (compared to a corporate rate of 15% today).

- 2. • He also proposed a cut in the corporate tax rate from 52% to 47% • Kennedy argued that “a rising tide lifts all boats” and that strong economic growth would not continue without lower taxes. • The House Ways and Means Committee voted a tax bill out of committee in August and the grateful president reiterated that lowering taxes was the surest path to full employment and lower deficits. Polls showed that over 60% of Americans favoured the tax cuts.

- 3. The Mellon Tax Cuts • When the federal income tax was enacted in 1913, the top rate was just 7 percent. By the end of World War I, rates had been greatly increased at all income levels, with the top rate jacked up to 77 percent (for income over $1 million). • After five years of very high tax rates, rates were cut sharply under the Revenue Acts of 1921, 1924, and 1926. • The combined top marginal normal and surtax rate fell from 73 percent to 58 percent in 1922, and then to 50 percent in 1923 (income over $200,000). In 1924, the top tax rate fell to 46 percent (income over $500,000). The top rate was just 25 percent (income over $100,000) from 1925 to 1928, and then fell to 24 percent in 1929.

- 4. • In 1924, Mellon noted: “The history of taxation shows that taxes which are inherently excessive are not paid. The high rates inevitably put pressure upon the taxpayer to withdraw his capital from productive business.” • Detailed Internal Revenue Service data show that the across-the-board rate cuts of the early 1920s-including large cuts at the top end-resulted in greater tax payments and a larger tax share paid by those with high incomes.

- 6. Conclusion • The tax cuts of the 1920s were the first federal experiment with supply-side income tax rate cuts. Data for the period show an initial decline in federal revenues as tax rates were cut, but revenues grew strongly during the subsequent economic expansion. After the cuts, total tax payments and the share of total taxes paid by the top income earners soared.

- 7. • President John F. Kennedy brought up the issue of tax reduction in his 1963 State of the Union address. • His initial plan called for a $13.5 billion tax cut through a reduction of the top income tax rate from 91% to 65%, reduction of the bottom rate from 20% to 14%, and a reduction in the corporate tax rate from 52% to 47%. The first attempt at passing the tax cuts was rejected by Congress in 1963. • Kennedy was assassinated in November 1963, and was succeeded by Lyndon Johnson. Johnson was able to achieve Kennedy's goal of a tax cut in exchange for promising a budget not to exceed $100 billion in 1965. The Revenue Act of 1964 emerged from Congress and was signed by Johnson on February 26, 1964. • Implications on economy: • The stated goal of the tax cuts were to raise personal incomes, increase consumption, and increase capital investments. • Evidence shows that these goals were met to some degree by the tax cut. • Unemployment fell from 5.2% in 1964 to 4.5% in 1965, and fell to 3.8% in 1966. • Initial estimates predicted a loss of revenue as a result of the tax cuts, however, tax revenue increased in 1964 and 1965.

- 8. TAX REFORMS BY OBAMA

- 9. Tax Relief for Middle-Class Families President Obama has cut taxes for middle class families every year he has been in office, and federal taxes for middle class families are currently at nearly their lowest levels in decades. A typical middle class family has gotten a tax cut of $3,600 over the last four years – more if they were putting a child through college. • President Obama's Making Work Pay credit provided 95 percent of working families a tax cut of $400 per person or $800 per couple in 2009 and 2010. • The President's payroll tax cut provided 160 million workers a 2 percent reduction in payroll taxes

- 10. • Cutting taxes for a typical family earning $50,000 a year by $1,000 . • Federal income taxes on middle‐income families are now lowest level. 15 million working families with children benefit from the President’s improvements to the Child Tax Credit and Earned Income Tax Credit. Starting in 2014, about 18 million individuals and families will get tax credits for health insurance coverage averaging about $4,000 apiece, as a result of the Affordable Care Act. Over the next ten years, the Affordable Care Act will provide middle class individuals and families with almost $700 billion in tax credits to help pay for health insurance coverage.

- 11. Tax Relief for Small Businesses • Administration have focused on strengthening small businesses by signing into law 18 tax cuts for small businesses, ranging from 100% expensing to the small business health tax credit. • The temporary tax exclusion of capital gains from key small business investments.