Weitere ähnliche Inhalte

Ähnlich wie FLASH NEWS - FDI

Ähnlich wie FLASH NEWS - FDI (20)

Mehr von CA. Vivek Agarwal

Mehr von CA. Vivek Agarwal (6)

FLASH NEWS - FDI

- 1. HABIBULLAH & CO. CHARTERED ACCOUNTANTS

© Habibullah & Co. Chartered Accountants, India

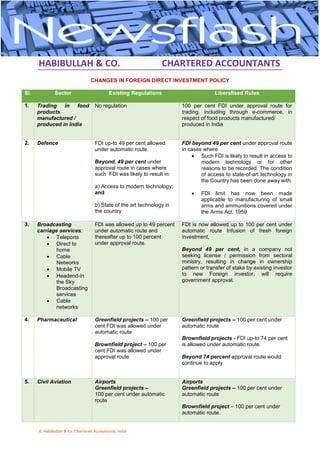

CHANGES IN FOREIGN DIRECT INVESTMENT POLICY

Sl. Sector Existing Regulations Liberalised Rules

1. Trading in food

products

manufactured /

produced in India

No regulation 100 per cent FDI under approval route for

trading, including through e-commerce, in

respect of food products manufactured/

produced in India

2. Defence FDI up-to 49 per cent allowed

under automatic route.

Beyond, 49 per cent under

approval route in cases where

such FDI was likely to result in:

a) Access to modern technology;

and

b) State of the art technology in

the country

FDI beyond 49 per cent under approval route

in cases where

Such FDI is likely to result in access to

modern technology or for other

reasons to be recorded. The condition

of access to state-of-art technology in

the Country has been done away with.

FDI limit has now been made

applicable to manufacturing of small

arms and ammunitions covered under

the Arms Act, 1959

3. Broadcasting

carriage services:

Teleports

Direct to

home

Cable

Networks

Mobile TV

Headend-in

the Sky

Broadcasting

services

Cable

networks

FDI was allowed up to 49 percent

under automatic route and

thereafter up to 100 percent

under approval route.

FDI is now allowed up to 100 per cent under

automatic route Infusion of fresh foreign

investment,

Beyond 49 per cent, in a company not

seeking license / permission from sectoral

ministry, resulting in change in ownership

pattern or transfer of stake by existing investor

to new Foreign investor, will require

government approval.

4. Pharmaceutical Greenfield projects – 100 per

cent FDI was allowed under

automatic route

Brownfield project – 100 per

cent FDI was allowed under

approval route

Greenfield projects – 100 per cent under

automatic route

Brownfield projects - FDI up-to 74 per cent

is allowed under automatic route.

Beyond 74 percent approval route would

continue to apply

5. Civil Aviation Airports

Greenfield projects –

100 per cent under automatic

route

Airports

Greenfield projects – 100 per cent under

automatic route

Brownfield project – 100 per cent under

automatic route.

- 2. HABIBULLAH & CO. CHARTERED ACCOUNTANTS

© Habibullah & Co. Chartered Accountants, India

Brownfield project –

74 per cent under automatic route

and thereafter, up to 100 per cent

under approval route.

Airport Transport Services

FDI up to 49 per cent under

automatic route

Airport Transport Services

FDI up-to 100 percent is allowed, up-to 49

percent under automatic route.

Beyond 49 percent through approval route

(other than in case of investment by foreign

airline, where FDI up to 49 per cent is allowed)

6. Private Security

Agencies

49 percent FDI was allowed

under approval route

FDI up-to 49 per cent under automatic route

and

Beyond 49 per cent and up-to 74 per cent

under approval route

7. Establishment of

branch office (BO),

liaison office (LO) or

project office (PO)

Separate clearance from Reserve

Bank of India / security clearance

was required for establishment of

BO/ LO/ PO in Defence, Telecom,

Private Security and Information

and Broadcasting sectors

This is most important amendment and

henceforth no such approval shall be required

in cases where approval is granted by Foreign

Investment Promotion Board (FIPB) or

concerned ministry / Regulator.

8. Animal Husbandry 100 percent FDI was allowed

under automatic route subject to

compliance with controlled

conditions

The controlled conditions prescribed have

been done away with.

9. Single Brand Retail

Trading

In cases involving FDI beyond 51

percent, 30 percent of value of

Goods purchased were to be

sourced from India.

The sourcing requirements have been

relaxed up to three years

For entities having ‘state-of-art’ and cutting

edge’ technology the sourcing norms have

been relaxed for another 5 years

Our Comments

As part of a second wave of big bang reforms, the government on 20th June approved 74% FDI in

brownfield pharma and 100% FDI in Greenfield projects, both under the automatic route

With the government giving the green signal to 100 per cent foreign direct investment (FDI) in trading

of food products manufactured or produced in India, including through e-commerce, we feel that the

measure will reduce wastage, curb inflation and will be beneficial for the farmers. India is the second

largest producer of fruits and vegetables in the world. However, it has very limited integrated cold chain

infrastructure and storage facilities, causing heavy losses to farmers in terms of wastage in quality and

quantity of the fruits and vegetables. This change is likely to benefit farmers paving way for creating

robust backend infrastructure and giving end consumers access to good quality food products.

The government announced sweeping changes in India's foreign direct investment policy, opening up

the airline business to 100 per cent ownership, relaxing rules for single brand retail and defence and

- 3. HABIBULLAH & CO. CHARTERED ACCOUNTANTS

© Habibullah & Co. Chartered Accountants, India

putting most sectors on the automatic approval route. The other changes on Defence, Single brand

retail trading are also likely to facilitate further foreign investment as some of the conditions acting as

impediment have been relaxed.

The above changes clearly exhibit the consistent approach of GoI in opening various sectors for foreign

Investment in India along with the measures taken improve ease of doing business in India. India is

now the most open economy in the world for foreign direct investment, Prime Minister Narendra Modi

said, hailing the new rules.

The above radical changes have opened the door for larger foreign investment in the country.

In a major amendment government has decided to do away with the requirement of separate security

clearance or Reserve Bank approval for setting up branches or liaison offices by foreign companies

dealing in defence, telecom, private security or information and broadcasting if the requisite approval

of the FIPB or the ministry or regulator concerned is in place.

Now most of the sectors would be under automatic approval route, except a small negative list and this

decision of Indian Government to further liberalise the FDI regime shall help to attain the objective of

providing major impetus to employment and job creation in India.

- 4. HABIBULLAH & CO. CHARTERED ACCOUNTANTS

© Habibullah & Co. Chartered Accountants, India

About Us

Habibullah & Co. (HCO) is a professional

services firm providing audit, assurance, tax,

financial advisory and consulting services to a

wide range of publicly traded and privately held

companies, guided by core values including

competence, honesty and integrity,

professionalism, dedication, responsibility and

accountability.

At HCO, the interests of our clients are

paramount. Our focus on the mid-market

means we have a real understanding of the

environment in which our clients operate and

are ideally placed to help them grow and

prosper.

Who we are and what we stand for

Established 1962

10 Partners

100 + staff

6 offices across India

International Representation through

“Antea- Alliance of Independent Firms”

Member Firm of The Institute of

Chartered Accountants of India since

1962

Registered with all major Government

Regulators in India

Our Services

Accounting and Auditing

Business Setups in India

Tax Compliance, Planning and

Management

Transfer Pricing Advisory

Business Advisory

Contact Us

For any assistance contact our Managing

Partner for International relations:

CA. Vivek Agarwal

E: vivek@hcoca.com

T: +91-98391-19370

Office in India

New Delhi

Lucknow

Gorakhpur

Patna

Ranchi

Varanasi

Mau

Associates at

Kolkata

Mumbai

Allahabad

Agra

Email

info@hcoca.com

Website

www.hcoca.com

Follow Us

Unsubscribe

Reply to this mail with subject “unsubscribe”

Disclaimer

This presentation is exclusively designed and prepared by

Habibullah & Co. and no part of this can be reproduced

without consent. While due care has been taken to draft this

please obtain professional advice before taking any

decision.