Target's and Walmart's and what's happening to the retail

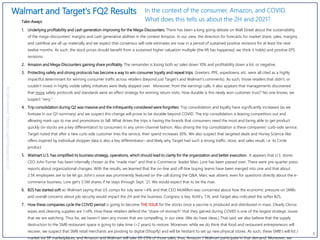

- 1. 1 Walmart and Target's FQ2 Results Allrightsreserved,InflectionCapitalManagement,LLC Take-Aways: 1. Underlying profitability and cash generation improving for the Mega-Discounters. There has been a long going debate on Wall Street about the sustainability of the mega-discounters' margins and cash generative abilities in the context Amazon. In our view, the direction for forecasts for market share, sales, margins, and cashflow are all up materially and we expect that consensus sell-side estimates are now in a period of sustained positive revisions for at least the next twelve months. As such, the stock prices should benefit from a sustained higher valuation multiple (the lift has happened, we think it holds) and positive EPS revisions. 2. Amazon and Mega-Discounters gaining share profitably. The remainder is losing both w/ sales down 10% and profitability down a lot, or negative. 3. Protecting safety and strong protocols has become a way to win consumer loyalty and repeat trips. Greeters, PPE, wipedowns, etc. were all cited as a highly impactful determinant for winning consumer traffic across retailers (beyond just Target's and Walmart's comments). As such, those retailers that didn't, or couldn't invest in highly visible safety initiatives were likely skipped over. Moreover, from the earnings calls, it also appears that managements discovered that more safety protocols and standards were an effect strategy for winning return visits. How durable is this newly won customer trust? No one knows; we suspect "very." 4. Trip consolidation during Q2 was massive and the infrequently considered were forgotten. Trip consolidation and loyalty have significantly increased (as we foresaw in our Q1-summary) and we suspect this change will prove to be durable beyond COVID. The trip consolidation is leaving competitors out and allowing mark-ups to rise and promotions to fall. What drives the trips is having the brands that consumers need the most and being able to get product quickly (in-stocks are a key differentiator) to consumers in any omni-channel fashion. Also driving the trip consolidation is these companies' curb-side service. Target noted that after a new curb-side customer tries the service, their spend increases 30%. We also suspect that targeted deals and Honey Science-like offers inspired by individual shopper data is also a key differentiator--and likely why Target had such a strong traffic, store, and sales result, i.e. its Circle product. 5. Walmart U.S. has simplified its business strategy, operations, which should lead to clarity for the organization and better execution. It appears that U.S. stores CEO John Furner has been internally chosen as the "made man" and that e-Commerce leader Marc Lore has been passed over. There were pre-quarter press reports about organizational changes. With the results, we learned that the on-line and off-line buying teams have been merged into one and that about 2.5K employees are to be let go. John's voice was prominently featured on the call during the Q&A. Marc was absent, even for questions directly about the e- commerce business. Lore get's 3.5M shares if he stays through Sept. '21. We would expect that to be the max. 6. B2S has started soft w/ Walmart saying that US comps for July were >4% and that CEO McMillon was concerned about how the economic pressure on SMBs and overall concerns about job security would impact the 2H and the business. Congress is key. Kohl's, TJX, and Target also indicated the softer B2S. 7. How these companies cycle the COVID period is going to become THE ISSUE for the stocks once a vaccine is produced and distributed in mass. Clearly Clorox wipes and cleaning supplies are 1-offs. How these retailers defend the "share-of-stomach" that they gained during COVID is one of the largest strategic issues that we are watching. Thus far, we haven't seen any moves that are compelling, in our view. (We do have ideas.) That said, we also believe that the supply destruction to the SMB restaurant space is going to take time (>2 years) to restore. Moreover, while we do think that food and restaurant entrepreneurs will recover, we suspect that SMB retail merchants are pivoting to digital (Shopify) and will be hesitant to set up new physical stores. As such, these SMB's will list / market via 3P marketplaces, and Amazon and Walmart will take 20-25% of those sales; thus, Amazon / Walmart participate in that demand. Moreover, we In the context of the consumer, Amazon, and COVID. What does this tells us about the 2H and 2021?

- 2. 2 WMT: Sales Outlook All rights reserved, Inflection Capital Management, LLC We feel that Walmart's business is two related segment but with independent drivers, the traditional store visit and the online + curbside + delivery segment. Consequently, when we forecast sales, we think about them individually. We expect store sales to have a weak Q3 due to a soft B2S and weaker SMB and HH confidence. We then expect store sales to strengthen in Q4 due to building consumer confidence reflecting optimism about COVID vaccines/treatments and against an easy comparative. In contrast, we forecast the digital-traffic to be driven by Walmart's internal actions resulting in continued very robust growth rates. Walmart lost share both in essentials and non-essentials. Walmart's grocery was +MSD% in a +DD category due to it holding price in an inflationary environment, missing mid-week in-fill shopping trips, reduced trade hours, and out-of-stock execution issues. They also likely preferred curb-side inventory over shelf-inventory leading to lower in-store customer satisfaction. Additionally, lower in-stocks also adversely impacted their ability to fulfill surging demand in hardlines. One would expect the in stock position to improve going into Q4, given Q2's learnings. Terrific e-Commerce results, but not unexpected given Walmart's investment in curbside and Amazon's already reported results. Walmart's QoQ eCommerce revenue lift of $3B, or 40%, compares well to Amazon's QoQ GMV lift $11B and 25%. Walmart did not disclose GMV, thus, this is an apples-&-oranges comparison. Forecasting a weaker store- focused consumer and a slightly softer digital consumer Forecasting a rebound in the store-focused consumer. 2.9X 4.6X Walmart U.S. First Quarter Second Quarter Third Quarter Forth Quarter 2018 2019 2020 2018 2019 2020 2018 2019 2020 2018 2019 2020 Catagory Comps Groc ery Inflation neglible (=) neg neg NC NC Groc ery +LSD +mSD +LDD 5% +mSD +MSD 2% 5% 5% +LSD Apparel neg Down 5% weather +MSD 5% neg NC +MSD Health & Wellness +LSD +mSD +HSD 2% +mSD +LSD 5% 5% 3% +LSD General M erc handise +0-0.5% +LSD +MSD 5% +LSD Mid-teens 2% LSD 5% neg Hardlines neg +HSD 7% Strong toys neg Entertainment +HSD 9% strong neg Home pos pos +HSD 5% Strong strong Comparable-store sales 2.1% 3.4% 10.0% 4.5% 2.8% 9.3% 3.4% 3.2% 5.4% 4.2% 1.9% 7.6% 3-yr CAGR 4.6% 7.0% 16.1% 8.1% 9.4% 17.4% 7.5% 8.0% 12.5% 8.8% 14.2% Ticket 0.7% 2.3% 16.5% 2.3% 2.2% 27.1% 1.2% 1.9% 3.3% 0.9% Traffic 1.4% 1.1% (5.6%) 2.2% 0.6% (14.0%) 2.2% 1.3% 0.9% 1.0% 2-yr stac k in traffic 2.9% 2.5% (4.5%) 3.5% 2.8% 3.7% 3.5% 2.5% 1.9% e-Commerc e Lift 1.0% 1.4% 390 bps ? 1.0% 1.4% 600 bps 1.4% 1.7% 439 bps 1.8% 210 bps 455 bps e-Commerc e Grow th % 74% 40% 37% 97% 44% 41% 75% 43% 35% 75% Comp e-Commerc e Grow th $ $754 $1,088 $3,133 $787 $1,159 $5,112 $1,088 $1,321 $3,648 $1,558 $1,901 $4,200 Grow th Fac tor 1.3 X 1.4 X 2.9 X 1.5 X 2.9 X 1.8 X 1.2 X 2.9 X 3.1 X 2.9 X 2.9 X WM TStore Comp Grow th 1.1% 2.0% 6.6% 3.5% 1.4% 3.3% 2.0% 1.5% 1.0% 2.4% -0.2% 3.0% WM TStore Comp $ Grow th $830 $1,555 $5,266 $2,756 $1,159 $2,812 $1,554 $1,209 $832 $2,078 -$181 $2,768 Grow th Fac tor 1.9 X 1.9 X 3.4 X 3.3 X 0.4 X 2.4 X 1.1 X 0.8 X 0.7 X 1.2 X 1.3 X Base Period Sales $75,436 $77,748 $80,344 $78,738 $82,815 $85,200 $77,724 $80,583 $83,189 $86,579 $90,520 $92,271 Sq Footage Contribution $728 -$47 $534 $66 $158 $216 $76 $150 $305 $31 $150 Comp e-Commerc e Grow th $ $754 $1,088 $3,133 $787 $1,159 $5,112 $1,088 $1,321 $3,648 $1,558 $1,901 $4,200 Ac quisitions WM TStore Comp $ Grow th $830 $1,555 $5,266 $2,756 $1,159 $2,812 $1,554 $1,209 $832 $2,078 -$181 $2,768 Current Period Sales $77,748 $80,344 $88,743 $82,815 $85,200 $93,282 $80,583 $83,189 $87,819 $90,520 $92,271 $99,389 Note the larger ticket size driven by UPTs

- 3. 3 WMT's P&L & 2H All rights reserved, Inflection Capital Management, LLC 1. GM inflection, expense leverage, and lower .com losses drives underlying OM / EBIT up by +164 bps and 40% profit growth in the U.S. division. Assuming limited COVID and no 1-off expenses in the 2H, profits could rise 60%. Driving this is the consumer's desire to limit cross shopping and bundle trips into one destination (see Walmart's Q2 ticket up an incredible +27%). As such, the margin mix is higher, promotional levels are down a lot, and there is little consumer cherry-picking. This is happing both online and offline; Amazon, Kroger, Target, etc. are all benefiting. As long as there is COVID concerns and consumers are unwilling to mingle, the boost to margins should continue. 2. Given declining inventory and robust profit growth, cash flows and cash are rising substantially. 3. Q3 and Q4 earnings, excluding COVID charges and other 1-offs, pro-forma EPS should be well above Street expectations. Wal-Mart Stores—Quarterly Earnings Model ~$40m per Penny First Qtr Second Qtr Third Qtr Fourth Qtr $ m illions 2018 % Chg. 2019 % Chg. 2020 % Chg. 2018 % Chg. 2019 % Chg. 2020 % Chg. 2018 %Chg. 2019 % Chg. 2020 % Chg. 2018 %Chg. 2019 % Chg. 2020 % Chg. Division Model Walmart USSales $77,748 3.1% $80,344 3.3% $88,743 10.5% $82,815 5% $85,200 2.9% $93,282 9.5% $80,583 3.7% $83,189 3.2% $87,819 5.6% $90,520 4.6% $92,271 1.9% $99,389 7.7% Est ttl COGS 56,585 3.4% 58,424 3.3% 65,535 12.2% 59,792 61,702 3.2% 67,150 8.8% 55,939 59,904 7.1% 63,039 5.2% 65,419 4.9% 66,984 2.4% 71,732 7.1% Est ttl GP-$ 21,163 2.2% 21,920 3.6% 23,208 5.9% 23,023 4% 23,498 2.1% 26,132 11.2% 21,785 (1%) 23,285 6.9% 24,781 6.4% 25,101 3.5% 25,287 0.7% 27,657 9.4% GM Rate 27.2% (23) bp 27.28% 6 bp 26.2% (113) bp 27.8% (35) bp 27.6% (22) bp 28.0% 43 bp 28.0% (28) bp 28.0% (4) bp 28.2% 23 bp 27.7% (27) bp 27.4% (33) bp 27.8% 42 bp Est Total SG&A 17,236 4.8% 17,778 3.1% 18,236 2.6% 18,250 4.0% 18,839 3.2% 20,702 9.9% 17,848 (1.0%) 19,109 7.1% 19,682 3.0% 20,058 0.0% 20,359 1.5% 21,275 4.5% Rate 22.0% (25) bp 22.1% 7 bp 22.2% 8 bp 22.1% 23.0% 22.4% (56) bp 22.2% 22.1% (9) bp 21.4% (66) bp Walmart USEBIT 3,927 (8.0%) 4,142 5.5% 4,972 20.0% 4,479 1% 4,659 4.0% 5,430 42.3% 3,937 2.9% 4,176 6.1% 5,099 59.8% 5,043 (0.3%) 4,928 28.9% 6,383 61.4% 5.1% (23) bp 5.2% 10 bp 5.6% 45 bp 5.4% (10) bp 5.5% 6 bp 5.8% 164 bp 4.9% 5.0% 13 bp 5.8% 79 bp 5.6% 5.6% 5 bp 6.4% 80 bp Sam'sClub Sales $13,622 (2.7%) $13,830 1.5% $15,163 9.6% $14,790 (0.6%) $15,049 1.8% $16,375 8.8% $14,521 $14,625 0.7% $16,375 12.0% $14,978 (0.2%) $15,288 3.0% $15,427 0.9% Sam's Club EBIT 375 451 494 402 (3%) 480 592 23.3% 379 327 491 50.2% 414 $6 384 463 20.5% 3.2% 3.6% 43 bp 2.2% 3.0% 76 bp 2.8% 2.5% 3.0% 49 bp International $30,260 11.7% $28,775 (4.9%) $29,766 3.4% $31,731 12% $29,139 (8.2%) $27,167 (6.8%) $29,548 0.0% $29,167 0.1% $29,139 (0.1%) $31,025 (3.7%) $33,049 6.5% $31,896 (3.5%) International EBIT 1,265 $102 738 ($527) 806 $68 1,269 (19%) 893 ($376) 889 ($4) 1,179 ($270) 931 ($248) 889 ($42) 1,170 ($685) 1,105 $80 1,200 $95 Central (413) $196 (386) $23 (378) $8 (400) $7 (449) ($49) (402) $47 (509) $183 (419) $90 (369) $50 (560) $294 (570) $60 (520) $50 EBITConsolidated 5,154 (2%) 4,945 (4%) 5,894 19% 5,750 ($257) 5,583 (3%) 6,509 16.6% 4,986 5,015 1% 6,110 21.8% 6,067 (6%) 5,847 7% 7,525 28.7% Debt expense (487) (625) (549) (503) (585) (635) (534) (589) (620) (605) (611) (620) Pretax inc ome 4,610 (1.4%) 4,320 (6.3%) 5,288 22.4% 5,247 4,998 (6.4%) 5,874 17.5% 4,413 4,426 (1.1%) 5,490 24.0% 5,415 5,236 (3.3%) 6,905 31.9% Inc ome taxes 1,106 24.0% 1,000 23.1% 1,296 1,300 24.8% 1,275 1,350 1,130 950 1,290 1,180 1,257 1,623 Rate 25.5% 23.0% 25.6% 21.5% 23.5% 21.8% 24.0% 23.5% Net inc ome before M I & subs.3,504 3,320 3,992 3,947 13.5% 3,723 4,524 21.5% 3,283 3,476 4,200 20.8% 4,235 3,979 5,283 32.8% M inority interest & equity in subs.(142) (64) (84) (134) (70) (85) (107) (33) (85) (126) (153) (160) Net income—Continuing 3,362 3,256 3,908 3,813 3,653 4,439 3,176 3,443 4,115 4,109 3,826 5,123 EPScontinuing operations $1.13 13.6% $1.13 (0.4%) $1.37 21.6% $1.29 19.0% $1.27 (2.3%) $1.56 22.4% $1.08 $1.20 7.2% $1.44 20.0% $1.41 6.3% $1.34 (5.0%) $1.80 34.2% Guidance $1.03 NA .90-.98 $1.24-1.34 Diluted shares outs. (M il.) 2,967 (2.6%) 2,886 (2.7%) 2,849 (1.3%) 2,960 (2.0%) 2,869 (3.1%) 2,848 (0.7%) 2,941 2,861 (2.7%) 2,848 (0.5%) 2,914 (5.3%) 2,855 (2.5%) 2,848 (0.2%) Buybac k M odel (shares) 20 6 14 23 OCF 3,563 7,017 7,622 11,939 3,563 % of Rev 2.90% 5.25% 5.85% 8.67% Cap Ex -2,205 -1,752 -2,666 -1,817 Cash Flow Inv esting -1,135 -1,696 -2,689 -1,938 Cash Flow Financ ing -846 565 -4,685 -8,379 Cash 9,292 14,985 9,320 16,954

- 4. 4 Walmart's Improving Margins in e-Commerce All rights reserved, Inflection Capital Management, LLC 1. Compounding losses in Walmart's e-Commerce business have been a sore point for investors and management. It's why Marc Lore's two predecessors were let go earlier than when one would have imagined. FIXING Walmart.com was why Marc Lore was hired and perhaps the changes discussed on page-1 suggest that management and the board now see Walmart.com as now FIXED and on a sustainable path to profitability. We estimate that the business lost $3.4B in '19. Driving that $3.4B to profitability would add 15% to the company's bottom line. 2. Walmart does not provide any detail for its e-Commerce business and so the model below is our estimates based upon our knowledge from other companies that do provide detail. Based upon Walmart's Q2 comments and those of others, we suspect that losses will be materially lower this year due to volume leverage on its fixed costs, flat marketing spend, and the collapse of its buying group into the store's buying group. Additionally, a substantial portion of incremental growth is for curbside fulfillment which doesn't have shipping. e-Com m erce Model 2018 2019 2020E Sales $16,050 $22,015 $36,634 %Change 66.4% Merchandise Costs $12,038 $16,511 $28,208 %of Rev enue 75.0% 75.0% 77.0% Shipping $1,605 $1,981 $2,564 %of Rev enue 10.0% 9.0% 7.0% %Change 23.4% 29.4% FC Costs $1,124 $1,761 $3,663 %of Rev enue 7.0% 8.0% 10.0% Contribution Margin $1,284 $1,761 $2,198 %of Rev enue 8.0% 8.0% 6.0% Marketing $1,605 $2,201 $2,201 %of Rev enue 10.0% 10.0% 6.0% Other Expense $2,523 $2,960 $2,690 %of Rev enue 15.7% 13.4% 7.3% Total Expense $18,894 $25,415 $39,327 Est. Annual e-Com m erce Losses ($2,844) ($3,400) ($2,693)

- 5. Target Corp. M ay-19 Jul-19 Oct-19 Jan-20 2019 M ay-20 Jul-20 Oct-20 Jan-21 2020 U.S. Retail Comp 4.8% 3.4% 4.5% 1.5% 3.4% 10.8% 24.3% 15.0% 16.0% 16.8% Ttl Comp Growth $795 $597 $792 $341 $1,879 $4,418 $2,768 $3,709 B&M Contribution $315 $263 $366 ($159) $157 $1,982 $368 $694 TGT.com Contribution $480 $333 $426 $500 $1,723 $2,437 $2,400 $3,015 New Store Contribution $50 $34 $73 $429 -$24 -$45 $50 $50 B&M Sales pf $16,274 $16,856 $17,033 $20,132 $16,407 $18,792 $17,451 $20,876 YoY Ch $287 $498 ($397) $133 $1,937 $418 $744 TGT.com Sales (drive-up & Shipt) $1,127 $1,327 $1,381 $2,845 $2,964 $3,904 $3,781 $5,860 YoY Ch $247 $344 $326 $397 $1,837 $2,576 $2,400 $3,015 % Change 28% 35% 31% 16% 163% 194% 174% 106% Target.c om penetration 7.1% 7.3% 7.5% 12.3% 15.3% 17.2% Same Day Serv ic e $313 $400 $1,183 $1,491 YoY Ch $870 $1,091 278% 273% Non-Same Day Serv ic e $814 $928 $1,781 $2,413 YoY Ch $967 $1,485 119% 160% Same-Store-Sales 4.8% 3.4% 4.5% 1.5% 3.4% 10.8% 24.3% 15.0% 16.0% 16.8% Number of Transactions 3.7% 2.4% 3.1% 1.3% -1.5% 4.6% Avg. Transaction Amt -0.6% 0.9% 1.4% 0.2% 12.5% 18.8% B&M Comps 1.9% 1.5% 3.2% -0.8% 0.9% 10.9% 2.0% 3.0% Est B&M Transactions 2.5% 0.6% 1.8% -1.0% -11.6% -7.9% 5 Target's Superior Market Share Gains Allrightsreserved,InflectionCapitalManagement,LLC 1. Target is experiencing massive growth in its digitally-ordered business vs. the base period's growth due to traction with Drive-Up, Shipt, and the expanding eligibility of what can be digitally fulfilled; additionally, Target benefits from a more economically secure consumer cohort vs. Walmart's "everyone" with a touch more fragility. Undoubtedly, Target's discretionary brands are also being selected as part of a Target "visit" relative to other limited-category retailers. Walmart's discretionary brands are less well considered by the more affluent consumer. Target may also have done better with in-stocks than Walmart. Target's YoY inventory was down only 2.7% vs. Walmart's -10% (in- store). 2. Similar to Walmart, the growth in Target's basket size was tremendous and that in combination to the increase in total transactions speaks to it gaining loyalty. We also strongly suspect that Circle (75M members and up from 50M at the end of February) and other personalized marketing initiatives by Target are having significant impact on driving frequency and consideration. Target's apparel business was up +DD, in contrast to Kohl's which declined 23%. Target's home +30%. Target's house brand grocery business is up 30% for the year. All of these drive margin rate higher. 3. Given that Target is still significantly enhancing its digital selection and capabilities, we foresee a very strong 2H of digital growth. For example, Drive-Up for fresh & frozen grocery to be expanded to 1500 stores this fall vs. just the Twin Cities. Moreover, given the trip consolidation and loyalty trends, a more economically durable consumer, and an easy Q4 comp, we also expect growth in the 2H for its B&M business. Target's Customer Demo Target's Sales Mix Beauty & Essentials 27% Food & Beverage 19% Home Furn & Decor 19% Apparel & Accs 19% Hardlines 16%

- 6. Target Corp. 2019 M ay-20 Jul-20 Oct-20 Jan-21 2020 Retail Sales 77,131 19,371 22,696 21,232 26,736 90,035 % Change 3.6% 11.3% 24.8% 15.3% 15.6% 16.7% COGS 54,864 14,510 15,673 14,840 19,563 64,585 YoYCh $2,262 $3,048 $1,905 $2,507 Retail Gross Profit 22,267 4,861 7,023 6,393 7,174 25,450 % Change 5.4% -5.7% 26.4% 16.7% 18.0% 14.3% % of Retail Sales 28.9% 25.1% 30.9% 30.1% 26.8% 28.3% 48 bps -452 bps 38 bps 35 bps 38 bps -60 bps U.S. Retail SG&A 16,232 4,060 4,435 4,478 4,854 17,827 YoYCh $397 $523 $325 $350 BAU Costs YoY $95 $123 $125 $150 C19 Costs $620 $400 $200 $200 Disc retionary Cuts -$318 % of Retail Sales 21.0% 21.0% 19.5% 21.1% 18.2% 19.8% % of sales 21.0% -9 bps -197 bps -146 bps -145 bps 19.8% Retail Depreciation 2,357 577 542 542 542 2,203 EBIT 3,678 224 2,046 1,373 1,778 5,420 % Change 15.4% -75.4% 88.6% 82.8% 90.5% 47.4% % of Retail Sales 4.8% 1.2% 9.0% 6.5% 6.6% 6.0% Inc remental M argin 21.3% 22.1% 23.4% Credit & Adv ertising Segment 981 244 279 289 299 1,111 Interest Expense, Net 470 139 120 120 120 499 Pretax Income 4,189 329 2,205 1,542 1,957 6,032 Provision for Income Taxes 921 45 503 351 446 1,345 Inc ome tax rate 22.0% 14% 22.8% 22.8% 22.8% 22.3% Net Income 3,268 284 1,702 1,190 1,510 4,687 Adjusted Diluted EPS $6.34 $0.56 $3.37 $2.36 $2.99 $9.29 6 TGT's P&L & 2H All rights reserved, Inflection Capital Management, LLC 1. One very critical consideration for both Target's and Walmart's digital profitability is that 65-75% of the orders are fulfilled by the stores (a good portion of these for Target due have the driving Shipt cost). Thus, for these sales they avoide the typical 10% of sales in shipping costs. Yes, there is the burden of the store rent, but that's sunk cost and at 50 bps-to-sales is a fraction of what shipping would be. Thus, one needs to compare the pick-cost vs. the shipping and FC costs which typically total around 18%. In total, Target's digital sales still have ~1000 bps of higher costs (variable) than customer-picked baskets. However, the unit economics massively improve as the basket size increases which is what we are witnessing. Target stated that the YoY variable cost for digital orders declined 30% YoY. 2. For Q3 and Q4 , excluding COVID charges and other 1-offs, pro-forma EPS should be well above Street expectations. As noted earlier, the efficiencies that come with a bundled trip and the higher net pricing that comes with that digitally purchased bundle is leading to higher industry-wide gross margin rates. That should continue for the 2H and 2021. Should that occur, Wall Street will assign a higher valuation multiple onto the group. Like all large companies, COVID inspired Target's management to remove costs from the business, fewer BP -transactions, less T&E, less advertising, etc.; that also should continue in the 2H.

- 7. 7 Select Prior Work All rights reserved, Inflection Capital Management, LLC Amazon's Q2 '20 and what it means for its business, retail, and our economy Observations from Q1 '20 Retailer Earnings Recommendations to Walmart for Increasing Loyalty, Gaining Share, and Improving Rate