ftb.ca.gov forms 09_588

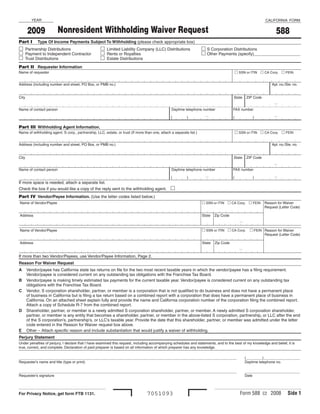

- 1. YEAR CALIFORNIA FORM Nonresident Withholding Waiver Request 2009 588 Part I Type Of Income Payments Subject To Withholding (please check appropriate box) Partnership Distributions Limited Liability Company (LLC) Distributions S Corporation Distributions Payment to Independent Contractor Rents or Royalties Other Payments (specify)____________________ Trust Distributions Estate Distributions Part II Requester Information SSN or ITIN CA Corp. FEIN Name of requester Address (including number and street, PO Box, or PMB no.) Apt. no./Ste. no. City State ZIP Code – Name of contact person Daytime telephone number FAX number – – ( ) ( ) Part III Withholding Agent Information. SSN or ITIN CA Corp. FEIN Name of withholding agent, S corp., partnership, LLC, estate, or trust (If more than one, attach a separate list.) Address (including number and street, PO Box, or PMB no.) Apt. no./Ste. no. City State ZIP Code – Name of contact person Daytime telephone number FAX number – – ( ) ( ) If more space is needed, attach a separate list. Check the box if you would like a copy of the reply sent to the withholding agent. Part IV Vendor/Payee Information. (Use the letter codes listed below.) SSN or ITIN CA Corp. FEIN Name of Vendor/Payee Reason for Waiver Request (Letter Code) Address State Zip Code – SSN or ITIN CA Corp. FEIN Reason for Waiver Name of Vendor/Payee Request (Letter Code) Address State Zip Code – If more than two Vendor/Payees, use Vendor/Payee Information, Page 2. Reason For Waiver Request A Vendor/payee has California state tax returns on file for the two most recent taxable years in which the vendor/payee has a filing requirement. Vendor/payee is considered current on any outstanding tax obligations with the Franchise Tax Board. B Vendor/payee is making timely estimated tax payments for the current taxable year. Vendor/payee is considered current on any outstanding tax obligations with the Franchise Tax Board. C Vendor, S corporation shareholder, partner, or member is a corporation that is not qualified to do business and does not have a permanent place of business in California but is filing a tax return based on a combined report with a corporation that does have a permanent place of business in California. On an attached sheet explain fully and provide the name and California corporation number of the corporation filing the combined report. Attach a copy of Schedule R-7 from the combined report. D Shareholder, partner, or member is a newly admitted S corporation shareholder, partner, or member. A newly admitted S corporation shareholder, partner, or member is any entity that becomes a shareholder, partner, or member in the above-listed S corporation, partnership, or LLC after the end of the S corporation’s, partnership’s, or LLC’s taxable year. Provide the date that this shareholder, partner, or member was admitted under the letter code entered in the Reason for Waiver request box above. E Other – Attach specific reason and include substantiation that would justify a waiver of withholding. Perjury Statement Under penalties of perjury, I declare that I have examined this request, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of paid preparer is based on all information of which preparer has any knowledge. ___________________________________________________________________________________________________________ (________)__________________ Requester’s name and title (type or print) Daytime telephone no. ___________________________________________________________________________________________________________ ___________________________ Requester’s signature Date Form 588 C2 2008 Side 7051093 For Privacy Notice, get form FTB 1131.

- 2. SSN or ITIN CA Corp. FEIN Name of Requestor SSN or ITIN CA Corp. FEIN Name of Vendor/Payee Reason for Waiver Request (Letter Code) Address State Zip Code SSN or ITIN CA Corp. FEIN Name of Vendor/Payee Reason for Waiver Request (Letter Code) Address State Zip Code SSN or ITIN CA Corp. FEIN Name of Vendor/Payee Reason for Waiver Request (Letter Code) Address State Zip Code SSN or ITIN CA Corp. FEIN Name of Vendor/Payee Reason for Waiver Request (Letter Code) Address State Zip Code SSN or ITIN CA Corp. FEIN Name of Vendor/Payee Reason for Waiver Request (Letter Code) Address State Zip Code SSN or ITIN CA Corp. FEIN Name of Vendor/Payee Reason for Waiver Request (Letter Code) Address State Zip Code SSN or ITIN CA Corp. FEIN Name of Vendor/Payee Reason for Waiver Request (Letter Code) Address State Zip Code SSN or ITIN CA Corp. FEIN Name of Vendor/Payee Reason for Waiver Request (Letter Code) Address State Zip Code SSN or ITIN CA Corp. FEIN Name of Vendor/Payee Reason for Waiver Request (Letter Code) Address State Zip Code SSN or ITIN CA Corp. FEIN Name of Vendor/Payee Reason for Waiver Request (Letter Code) Address State Zip Code SSN or ITIN CA Corp. FEIN Name of Vendor/Payee Reason for Waiver Request (Letter Code) Address State Zip Code Side Form 588 C2 2008 7052093

- 3. Instructions for Form 588 Nonresident Withholding Waiver Request General Information California. Withholding agents should • Distributions of California source keep the signed form containing taxable income to a domestic A Purpose this certification and provide it to (nonforeign) nonresident S corporation the FTB upon request. Withholding shareholder, partner, or member. For Use Form 588, Nonresident Withholding agents are relieved of the withholding more information, get FTB Pub. 1017. Waiver Request, to request a waiver on requirements if they rely in good faith • Allocations of California source withholding payments of California source on a signed certification (Form 590) income or gain to foreign (non-U.S.) income to nonresident vendors/payees. that the vendor/payee is a resident of nonresident partners or members. For Do not use Form 588 to request a waiver California or has a permanent place of more information, get FTB Pub. 1017. if you are a: business in California. This exception There are no provisions in the • Foreign (non-U.S.) partner or does not apply, if the resident, California RTC to waive withholding member. There are no provisions in S corporation, partnership, or LLC that for foreign (non-U.S.) S corporation the California Revenue and Taxation has a permanent place of business in shareholders, partners, or members. Code (RTC) to waive withholding for California is acting as an agent for the • Other California source income paid to foreign partners or members. actual vendor/payee. nonresidents. • Seller of California real estate. Sellers • The withholding agent’s total payments Compensation for services includes of California real estate should use of California source income to the payments for personal services rendered Form 593-C, Real Estate Withholding vendor/payee are $1,500 or less for the in California, commissions paid to Certificate. calendar year. salespersons or agents for orders • The payments are for income from Form 588 does not apply to payments for received or sales made in California, fees intangible personal property, such as wages to employees. Wage withholding for professional services rendered in interest and dividends, unless derived is administered by the California California, and payments to entertainers, in a trade or business or the property Employment Development Department wrestlers, boxers, etc., for performances has acquired a business situs in (EDD). For more information, go to their in California. California. website at www.edd.ca.gov or contact When compensation is paid for services • The payments are for services EDD customer service at 888.745.3886. performed both within and outside of performed outside of California or for B Requirement California, the portion paid for services rents, royalties, and leases on property rendered in California and subject to located outside of California. RTC Section 18662 requires withholding withholding should be determined by an • The payment is to a nonresident of income or franchise tax on certain allocation. Refer to Form 587, Nonresident corporate director for director payments made to nonresidents for Withholding Allocation Worksheet. services, including attendance at board income received from California sources. Use Form 592, Quarterly Resident and meetings. The withholding rate is seven percent Nonresident Withholding Statement, • The vendor/payee is a tax-exempt unless a waiver is granted by the Form 592-A, Foreign Partner or Member organization under either California Franchise Tax Board (FTB). Quarterly Withholding Remittance or federal law (provide a completed C Income Subject to Statement, and Form 592-F, Foreign Form 590 to the withholding agent Partner or Member Annual Return, to Withholding to certify). report and remit withholding to the FTB. • The vendor/payee receives a written The items of income subject to authorization from the FTB waiving the Domestic nonresidents may use withholding include, but are not limited to: withholding. Form 589, Nonresident Reduced • Compensation for services performed • The domestic (nonforeign) nonresident Withholding Request, to request the in California by nonresidents (including S corporation shareholder, partner, or reduction in the standard seven percent payment of expenses). For more member provides the S corporation, withholding amount that is applicable information, get FTB Pub. 1017, partnership, or LLC with a properly to California source payments made to Resident and Nonresident Withholding completed and signed Form 590-P, nonresidents. Guidelines. Nonresident Withholding Exemption D Exceptions to Withholding • Rent paid to nonresidents on Certificate for Previously Reported commercial real or personal property Income. Withholding is not required when: located in California if the rent is paid • The income of nonresident • The payment is for goods. in the course of the withholding agent’s S corporation shareholders, partners, • The payment is being made to a business. or members, including a bank or resident of California, an S corporation, • Royalties paid to nonresidents for the corporation, is derived from qualified a partnership, or an LLC that has right to use natural resources located investment securities of an investment a permanent place of business in in California. partnership. California. Form 590, Withholding • Distributions of California source Exemption Certificate, can be used taxable income to nonresident by vendors/payees to certify that they beneficiaries from an estate or trust. are residents of California or have • Prizes and winnings received by a permanent place of business in nonresidents for contests in California. Form 588 Instructions 2008 Page

- 4. Withholding Waivers Where to get Publications, Part IV – List the name, address and social security number (SSN), individual Forms, and Information The FTB issues a determination letter. A taxpayer identification number (ITIN), Unrelated to Nonresident withholding agent must have received California corporation number, or federal the determination letter authorizing a Withholding employer identification number (FEIN) waiver of withholding before eliminating of the nonresident vendor/payee. If there By Automated Phone Service: Use this withholding on payments made to are more than two Vendor/Payees enter service to check the status of your refund, nonresidents. The withholding agent than information on Side 2. Use additional order California forms, obtain payment retains the waiver for a minimum of five pages as needed. and balance due information, and hear years. recorded answers to general questions. Under “Reason for Waiver Request,” enter Withholding waivers issued by the FTB This service is available 24 hours a day, the letter code that corresponds to your apply only for the limited purpose of 7 days a week, in English and Spanish. reason for requesting a waiver. determining the withholding obligation From within the If you choose Reason D, provide the date under RTC Section 18662. They do United States. . . . . . . . . . 800.338.0505 that the shareholder, partner, or member not apply to the taxability of income. was admitted below the letter code (D) in A withholding waiver is effective for a From outside the the Reason for Waiver Request box. maximum of two years from the date United States. . . . . . . . . . 916.845.6600 the waiver is granted. If you previously (not toll-free) If you choose Reason E, provide all of the received a withholding waiver and wish to required additional information. Follow the recorded instructions. Have have it extended, submit a new request on paper and pencil handy to take notes. If vendor/payee chooses Reason B, but Form 588 and attach a copy of the original does not have California taxable returns By Mail: Allow two weeks to receive your authorization letter. The acceptance of on file for the two most recent taxable order. If you live outside of California, evidence submitted with the application years (as described in Reason A), then the allow three weeks to receive your order. is not binding on the FTB for any purpose resulting waiver will be effective for one Write to: other than for issuing a withholding year. TAX FORMS REQUEST UNIT MS F284 waiver. Part V – Sign and date the request. FRANCHISE TAX BOARD Specific Instructions PO BOX 307 When and Where to File RANCHO CORDOVA CA 95741-0307 The withholding agent, S corporation, Submit your request for a waiver at partnership, LLC, vendor/payee, estate, or In Person: Many libraries now have least 21 business days before making a trust may complete and sign this form. internet access. A nominal fee may apply payment to allow the FTB time to process to download, view, and print California Complete the entire form and attach the your request. forms and publications. Employees at information supporting your request. Mail Form 588 to: libraries cannot provide tax information or Failure to include necessary information assistance. WITHHOLDING SERVICES AND and documents may delay issuance or COMPLIANCE MS F182 denial of the waiver. Assistance for persons with disabilities FRANCHISE TAX BOARD We comply with the Americans with Private Mail Box PO BOX 942867 Disabilities Act. Persons with hearing or Include the Private Mail Box (PMB) in the SACRAMENTO CA 94267-0651 speech impairments call: address field. Write “PMB” first, then the Or box number. Example: 111 Main Street TTY/TDD: 800.822.6268 PMB 123. Fax to: 916.845.9512 Asistencia para personas Part I – Check the box indicating the type discapacitadas. Nosotros estamos en Where to get Publications, of payment for which a waiver is being conformidad con el Acta de Americanos Forms, and Information requested. Discapacitados. Personas con problemas auditivos o dificultad con el habla pueden Part II – Enter the name, address By Internet: You can download, view, and llamar al TTY/TDD 800.822.6268. (including PMB, if applicable), and to print California tax forms and publications whose attention the withholding certificate from our website at ftb.ca.gov. is to be mailed. Include a daytime By Phone: To have publications or telephone number, with area code, so we forms mailed to you, or to get additional can call if we need additional information. nonresident withholding information, Part III – Enter the information related contact Withholding Services and to the withholding agent, S corporation, Compliance at the address or automated partnership, LLC, estate, or trust making number below: the payments. Use a separate form or WITHHOLDING SERVICES AND attach a list if there is more than one COMPLIANCE MS F182 withholding agent. FRANCHISE TAX BOARD PO BOX 942867 SACRAMENTO CA 94267-0651 Telephone: 888.792.4900 916.845.4900 (not toll-free) Fax: 916.845.9512 Page Form 588 Instructions 2008