The Great Fall in China August 2015 - Special market bulletin St. James's Place

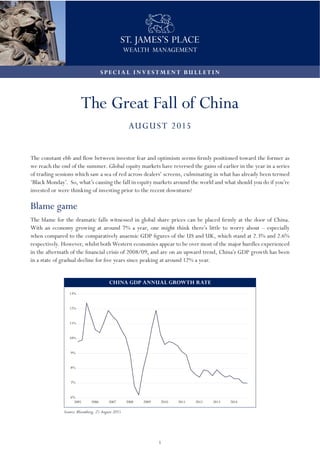

- 1. SPE CI A L I N V E STM E N T BU L L E T I N CHINA GDP ANNUAL GROWTH RATE 6% 7% 8% 9% 10% 11% 12% 13% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Source: Bloomberg, 25 August 2015 SPE CI A L I N V E STM E N T BU L L E T I N The Great Fall of China AUGUST 2015 The constant ebb and flow between investor fear and optimism seems firmly positioned toward the former as we reach the end of the summer. Global equity markets have reversed the gains of earlier in the year in a series of trading sessions which saw a sea of red across dealers’ screens, culminating in what has already been termed ‘Black Monday’. So, what’s causing the fall in equity markets around the world and what should you do if you’re invested or were thinking of investing prior to the recent downturn? Blame game The blame for the dramatic falls witnessed in global share prices can be placed firmly at the door of China. With an economy growing at around 7% a year, one might think there’s little to worry about – especially when compared to the comparatively anaemic GDP figures of the US and UK, which stand at 2.3% and 2.6% respectively. However, whilst both Western economies appear to be over most of the major hurdles experienced in the aftermath of the financial crisis of 2008/09, and are on an upward trend, China’s GDP growth has been in a state of gradual decline for five years since peaking at around 12% a year. 1

- 2. SPE CI A L I N V E STM E N T BU L L E T I N This slowdown in the pace of Chinese expansion has been well understood for a number of years. However, a combination of disappointing economic data, recent excessive share price rises, and thin trading volumes at the height of summer, proved a potent combination to put first the Chinese stock market, and then global markets, into reverse. China’s trade figures released in mid-August provided evidence to suggest that world trade may be contracting, as the value of China’s exports and imports fell by over 8% year-on-year in July. What’s more, this weakness was broad-based, with exports to the US, the EU, and to other emerging economies, all declining in July. This data was followed by the preliminary Caixin China Manufacturing Purchasing Managers’ Index (a gauge of Chinese manufacturing activity), which fell to a 77-month low in August and sparked further concerns about China’s failed attempts to reinvigorate slowing growth. What goes up… Whilst investors have enjoyed a gradual upward move in international equity markets over the last 12 months or so, the Shanghai Stock Exchange Composite Index had surged by more than 155% since May 2014. This has been fuelled by a government-sponsored market access programme that encouraged many local, first-time investors into the market, creating a boom to rival that of tech stocks at the start of the millennium. Whilst experienced investors may reflect on the adage that what goes up must come down, many local investors panicked and dumped recently-acquired shares when it became obvious that the government’s attempts to prop up an overheated market were unsuccessful. The People’s Bank of China has responded to the continued fall in share prices by further cutting interest rates in an attempt to stimulate economic growth. Wasatch Advisors, managers of the St. James’s Place Emerging Market Equity fund, provide a professional investor’s perspective: “We’ve never invested in Chinese A-shares due to our concerns regarding growth, valuations and transparency. When we do decide to pursue additional opportunities in China, it’s likely that our investments will be through the H-shares traded in Hong Kong, where corporate governance is better and speculation tends to be less extreme.” 2 SHANGHAI COMPOSITE INDEX IN YUAN Source: Bloomberg, 25 August 2015 Please be aware that past performance is not indicative of future performance. -20% 0% 20% 40% 60% 80% 100% 120% 140% 160% Aug 12 Nov 12 Feb 13 May 13 Aug 13 Nov 13 Feb 14 May 14 Aug 14 Nov 14 Feb 15 May 15 Aug 15 SHANGHAI COMPOSITE INDEX Just 20 years ago such developments would barely have caused a ripple in international markets, but with China now accounting for around 15% of global GDP, a slowdown in the largest engine of global growth was bound to have some knock-on effects.

- 3. SPE CI A L I N V E STM E N T BU L L E T I N “It is no surprise that growth concerns in China would whack the markets,” commented Richard Rooney of Burgundy Asset Management. “China is the foundation of the global growth story for many multinationals.” As China’s consumption of resources has slowed, commodity prices have also been falling, with the obvious impact on the share prices of mining and commodity stocks around the globe and those emerging markets heavily reliant on these industries. In fact, most commodity prices are near 52-week lows, as evidenced by Brent Crude oil which stands at just over $42 per barrel at the time of writing. In stark contrast to China, one further factor that has been playing on investors’ minds is the fear of potential interest rate rises in the US and the UK. Forecasters had predicted a September rate rise by the US Federal Reserve, followed by the Bank of England perhaps in the first quarter of 2016, reflecting the return to better health of these economies. Whilst the recent volatility may not be sufficient to delay these moves, it will certainly cause the authorities to be wary about raising rates too far too fast. Food for thought Accurately predicting short-term market movements remains highly speculative and prone to failure, and it would be foolish to suggest that further falls in markets are unlikely to follow in the days or weeks ahead. That said, it will have come as little surprise to experienced investors that the UK and other equity markets have almost completely reversed the sharp falls seen on Monday. As we have stated in the past, so often the best days to invest follow the steepest falls. However, unlike previous market slides, we believe that things today are in broadly positive shape and that there are reasons to think opportunistically or, for those currently invested, to remain confident that they can ride out the storm. Major economies such as the US, UK, eurozone and Japan are generally improving, with data suggesting that there is little to support the case for a significant global economic downturn. The gradual decline in China’s growth rate is nothing new and whilst economic data remains ‘sluggish’, it seems insufficient to support the case for the ‘hard landing’ that many had initially feared. Whilst a fall in commodity prices will impact on the profitability of certain commodity-linked companies, the net effect will be beneficial for global consumers. The fundamentals of companies haven’t changed overnight. Whilst the FTSE 100 Index is down by 9.9% since the start of the year, the FTSE 250 is marginally up. This reflects the significant weighting of commodity- linked companies within the blue-chip index compared with its mid-cap peer. Likewise, the recent fall in prices will, no doubt, present selective buying opportunities. The situation surrounding Greece seems to be resolved for the time being, as ‘Grexit’ appears more unlikely following an €86 billion international bailout from which it can start to service debt liabilities. Such a market event once again provides a demonstration of the value of maintaining a balanced and appropriately-diversified investment portfolio. Short-term volatility is an inherent feature of equity markets. However, with the support of very accommodative monetary policy worldwide, markets have marched higher for four years without much volatility, which perhaps makes recent events more unsettling. The advice to investors remains the same; to maintain a well-diversified portfolioandkeepfocusonthelonger-termobjectivesthatinvestmentinrealassetshasprovencapableofachieving. Wasatch Advisors and Burgundy Asset Management are fund managers for St. James’s Place. 3

- 4. SPE CI A L I N V E STM E N T BU L L E T I N The ‘St. James’s Place Partnership’ and the titles ‘Partner’ and ‘Partner Practice’ are marketing terms used to describe St. James’s Place representatives. The St. James’s Place Partnership, as part of St. James’s Place Wealth Management plc, is authorised and regulated by the Financial Conduct Authority. St. James’s Place Wealth Management plc, St. James’s Place UK plc, St. James’s Place Unit Trust Group Ltd and St. James’s Place International plc are members of the St. James’s Place Wealth Management Group. St. James’s Place UK plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. St. James’s Place Unit Trust Group Ltd is authorised and regulated by the Financial Conduct Authority. St. James’s Place International plc is authorised and regulated by the Central Bank of Ireland. St. James’s Place Wealth Management Group plc Registered Office: St. James’s Place House, 1 Tetbury Road, Cirencester, Gloucestershire, GL7 1FP, United Kingdom. Registered in England Number 2627518. SJP4524-VR1 (08/15) PD The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place. FTSE International Limited (“FTSE”) © FTSE 2015. “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited under licence. All rights in the FTSE indices and/or FTSE ratings vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and/or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent.