Costing assignment.docx

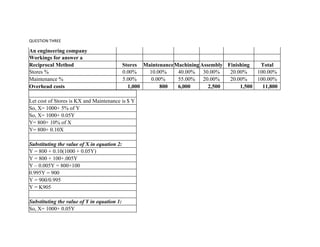

- 1. QUESTION THREE An engineering company Workings for answer a Reciprocal Method Stores MaintenanceMachining Assembly Finishing Total Stores % 0.00% 10.00% 40.00% 30.00% 20.00% 100.00% Maintenance % 5.00% 0.00% 55.00% 20.00% 20.00% 100.00% Overhead costs 1,000 800 6,000 2,500 1,500 11,800 Let cost of Stores is KX and Maintenance is $ Y So, X= 1000+ 5% of Y So, X= 1000+ 0.05Y Y= 800+ 10% of X Y= 800+ 0.10X Substituting the value of X in equation 2: Y = 800 + 0.10(1000 + 0.05Y) Y = 800 + 100+.005Y Y – 0.005Y = 800+100 0.995Y = 900 Y = 900/0.995 Y = K905 Substituting the value of Y in equation 1: So, X= 1000+ 0.05Y

- 2. So, X= 1000+ 0.05*905 So, X= 1000+ 45 X= K1,045 Allocation Summary Stores Maintenance Machining Assembly Finishing Total Stores % 0.00% 10.00% 40.00% 30.00% 20.00% 100.00% Maintenance % 5.00% 0.00% 55.00% 20.00% 20.00% 100.00% Department cost 1,000 800 6,000 2,500 1,500 11,800 Total costs Stores (1,045) 105 418 313.5 209 0.50 Maintenance 45 (905) 497.75 181 181 (0.25) Cost after allocation - - 6,915 2,995 1,890 11,800 Answer a Machining Note Machine Hours 50,000 A Overhead cost 6,915 B Overhead absorption rates 0.14 C=B/A Answer a Assembly Finishing Note Labor Hours 30,000 20,000 D Overhead cost 2,995 1,890 E Overhead absorption rates 0.10 0.09 F=E/D Bid for Job K Answer b Machining Assembly Finishing Total Note Machine/ Labor hour used 45.00 15.00 12.00 G

- 3. Departmental predetermined OH Rate 0.14 0.10 0.09 H= See C, F Overhead applied to Job K ('000) 6.22 1.50 1.13 8,855 I=G*H Direct materials 24,000 Direct Labor 15,000 Total cost of Job K 47,855 J Profit 11,963.75 K=J/80%*20% Sell price 59,818.75 L=J+K QUESTION FOUR (a) Percentage of direct labour cost method = (K600 000 / K200 000) x 100 = 300% of direct labour cost Direct labour hour method = (K600 000/40 000 direct labour hours) = K15 per direct labour hour Machine hour method = (K600 000/50 000 machine hour) = K12 per machine hour (B) The question states that the company has become machine-intensive and implies that in the long term there is a closer association between overhead expenditure and machine hours than the other two methods. Therefore the best measure of overhead resources consumed by jobs or products is machine hours.

- 4. (C) Job Ax (K) Direct material 3788 Direct labour 1100 Direct expenses 422 Prime cost 5310 Production overhead (120 machine hours K12) 1440 Factory cost 6750 Administrative overheads (20% K6750) 1350 Total cost 8100 Profit (K8100/0.90 K8100) 900 Selling price 9000 Workings Administration overhead absorption rate = Total admin. Overheads/total factory cost = K328 000 / K1 640 000 = 20% of factory cost

- 5. QUESTION FIVE Step 1 Process costing is a method of costing whereby products go through various manufacturing levels and individual costs need to be calculated. Here, it is assumed that every process is an independent unit, and the output of one is considered as input for another. Step 2 Primary process A/c Particulars Units Cost Particulars Unit Cost Direct material 65,000 39,000 Normal loss 6,500 Labour 5,730 Abnormal loss 3,500 2,870 Overheads 3,240 Secondary process 55,000 45,100 47,970 47,970 Cost per unit of Primary process = Total cost/ Normal Units = 47,970/(65,000-6,500) =47,970/58,500 =K0.82 Secondary process A/c Particulars Units Cost Particulars Unit Cost Primary Process A/c 55,000 45,100 Normal loss 2,750 Direct material 6,300 Labour 7,200 Overheads 4,100 Secondary process 53,000 63,600 Abnormal Gain 750 900 55,750 63,600 55,750 63,600 Cost per unit of Secondary process = Total cost/ Normal Units = 62,700/(55,000-2,750) =62,700/52,250 =K1.2

- 6. Finishing process A/c Particulars Units Cost Particulars Unit Cost Secondary Process A/c 53,000 63,600 Normal loss 2,650 3312 Labour 8,280 Abnormal loss 2,350 3,432 Overheads 5,160 Secondary process 48,000 70,296 53,000 77,040 53,000 77,040 Cost per unit of Finishing process = Total cost/ Normal Units = (77,040-3312.5)/(55,750-2,650) =73,727/50,350 =1.46 K Part Abnormal loss A/c Particulars Units Cost Particulars Unit Cost Primary process 3,500 2,870 By Costing P&L costing 5,850 6,302 Finishing process 2,350 3,432 6,302 6,302 Abnormal gain A/c Particulars Units Cost Particulars Unit Cost To normal loss 750 900 By Secondary process 750 900 900 900 QUESTION SIX

- 9. QUESTION NINE a) Gross Wages to direct workers in the month Basic wages - Total Attendeance - 2640 Hrs Rate Per Hour K5,000 (Per Hour) Basic Wages - K 13,200,000 Group Bonuses - K 2,840,000 Emplyer's Pension Contribution - K 1,460,000 Overtime Wages (Extra 40% for 180 Hrs) - K 360,000 ( K5000 * 40% * 180 Hrs) (Extra) Gross Wages (Total) - K 17,860,000 b) Cost Accounting Entry in Comapny Cost records Entry No. 1 Basic Wages - Direct Workers K 13,200,000 Dr. Group Bonuses - Direct Workers - K 2,840,000 Dr. Emplyer's Pension Contribution - Direct workers K 1,460,000 Dr.

- 10. Overtime Wages - Direct Workers - K 360,000 Dr. Basic Wages - Indirect Workers - K 3,760,000 Dr Group Bonuses - Indirect Workers - K 710,000 Dr Emplyer's Pension Contribution - Indirect Workers K 405,000 Dr Overtime Wages - Indirect Workers - - K 120,000 Dr To Direct Workers wages Payable Account K 17,860,000 Cr. Indirect Workers Wages Payable Account K 4,995,000 Cr. (Being Amount Payable to Direct & Indirect Workers for the Month of Sept, 2020) Entry No. 2 Machine Break-down Cost Overheads K 563,447 Dr. Waiting Time Unproductive Cost Overheads K 267,151 Dr To Basic Wages - Direct Workers K 625,000 Cr. (K 425,000 + K 200,000) Group Bonuses - Direct Workers - K 136,469 Cr. (K 91439 + K 45,030)

- 11. Emplyer's Pension Contribution - Direct workers K 69.129 Cr. (K 47,008 + K 22,121) (Being Cost of Unproductive Factory Overheads transferred for Allocations) Entry No. 3 Overhead - For Overtime wages - for Customer A K 192,000 Dr. To Overtime Wages - Direct Workers K 144,000 Cr. Overtime Wages - Indirect Workers - K 48,000 Cr. (Being Cost of Extra Overtime Charges paid for specific Customer is transferred so that proper contribution is derived from particular custmer.) Note: Direct wages for Overtime hrs are assumed to be allocated to particular Customer as part of Regular Cost) Working Sheet for above Entries Gross Wages to indirect workers in the month Basic wages - Total Attendeance - 940 Hrs Rate Per Hour K4000 (Per Hour)

- 12. Basic Wages - K 3,760,000 Group Bonuses - K 710,000 Emplyer's Pension Contribution - K 405,000 Overtime Wages (Extra 40% for 75 Hrs) - K 120,000 ( K4000 * 40% * 75 Hrs) (Extra) Gross Wages (Total) - K 4,995,000 Extra Overtime Cost of Specific request of particular Customer i. 40% of 180 Hrs of Direct Workers - 72 Hrs. Overtime Cost of Each Direct Worker - K5000*40% = K 2,000 Total Overtime Cost of 72 Hrs of Direct Workers = K2,000 * 72 = K 144,000 ii. 40% of 75 Hrs of Indirect Workers - 30 Hrs. Overtime Cost of Each Indirect Worker - K4000*40% = K 1,600 Total Overtime Cost of 30 Hrs of Indirect Workers = K1,600 * 30 = K 48,000 Total Cost of Overtime wages of Particular Cutstomer for Direct and Indirect Worker - Direct Worker - K 144,000

- 13. Indirect Worker - K 48,000 Total - K 192,000 iii. Cost of Non-productive time machine Breakdown 85 hours - Total Cost working Basic Wages Cost - K 5000 * 85 = K 425,000 Group Bonuses - K 2,840,000/2640*85 = K 91,439 (Allocation) Emplyer's Pension Contribution - K 1,460,000/2640 *85 = K 47,008 (Allocaton) Total Cost K 563,447 iv. Waiting for work 40 hours - Total Cost Working Basic Wages Cost - K 5000 * 40 = K 200,000 Group Bonuses - K 2,840,000/2640*40 = K 45,030 (Allocation) Emplyer's Pension Contribution - K 1,460,000/2640 *40 = K 22,121 (Allocaton) Total Cost K 267,151 QUESTION TEN

- 14. QUESTION ELEVEN A) Production report for march 2013: ON WEIGHTED AVERAGE COST METHOD (WACM): Input units Phy. Units Mat. In Mat. Cost Conver. Cost Total 12000 Op WIP (on WACM) 12000 12000 12000 12000 95000 Introduced & Completed 83000 83000 83000 83000 Transfer out 95000 Normal loss 2000 0 0 0 Cl WIP 10000 10000 8000 6000 107000 (i)Equivalent units 105000 103000 101000 Total costs to account for: Op WIP 14000 5000 3000 22000 Incurred during march 200000 44000 52000 29600 0 Total Costs 214000 49000 55000 31800 0 (ii)cost per Eq. unit 2.04 0.48 0.54 (iii)Cost of Transf. out 193619.0476 45194 51733 29054 6 (iii)Cost of Cl WIP 20381 3806 3267 27454 Total cost accountted for: 31800 0 (iv) Process 2 Account:

- 15. DEBIT AMOUNT K CREDIT AMOUNT K Op WIP 22000 Normal Loss 0 Transf. from Pro 1 200000 Transf. out to FG 290546 Mat. Added 44000 Cl WIP 27454 Conv. Costs 52000 Total 318000 Total 318000 B) The business has to determine the cost of its products because 1: To determine the selling price of the products. 2: To know the value scrapped out of inputs during the process. QUESTION TWELVE Step 1 Working Notes 1 Particular Working Normal loss in units 5000 kg x 10% 500 units Normal loss in Amount 500 units x K2 per unit 1000 K

- 16. Abnormal loss in units 5000 units - 500 units - 4400 units 100 Units Abnormal loss in Amount (110000 x 100 / 4500) units 2422 K 2 Particular Working Normal loss in units 4400 kg x 5% 220 units Normal loss in Amount 220 units x K6 per unit 1320 K Abnormal Gain in units 4200 Units + 220 Units - 4400 Units 20 units Abnormal Gain in Amount (204258 x 20 / 4180) units 977 K 3 Particular Working Normal loss in units 4200 kg x 10% 420 units Normal loss in Amount 420 units x K10 per unit 1320 K Abnormal loss in units 4200 Units - 220 Units - 3500 280 Units

- 17. Units Abnormal loss in Amount (358475 x 280 / 3780) units 26554 K Step 2 Process 1 A/c (Working Note 1) Particular Qty in Kgs Amount (in K) Particular Qty in Kgs Amount (in K) To Raw material 5000 40000 By Normal Loss 500 1000 To direct material 12000 To Direct Labour 10000 By Output transfer to Process 2 A/c 4400 106578 To Direct Expenses 8000 To Departmental Overhead 40000 5000 110000 5000 110000 Process 2 A/c (Working Note 2) Particular Qty in Kgs Amount (in K) Particular Qty in Amount (in

- 18. Kgs K) To Raw material 4400 106578 By Normal Loss 220 1000 To direct material 25280 To Direct Labour 12000 By Output transfer to Process 3 A/c 4200 203915 To Direct Expenses 12400 To Departmental Overhead 48000 To Abnormal Gain 20 977 4420 205235 4420 205235 Process 3 A/c (Working Note 3) Particular Qty in Kgs Amount (in K) Particular Qty in Kgs Amount (in K) To Raw material 4200 203915 By Normal Loss 420 4200 To direct material 46400 By Abnormal Loss. 280 26554 To Direct Labour 20000 By Finished Goods A/c 3500 327721

- 19. To Direct Expenses 8160 To Departmental Overhead 80000 4200 358475 4200 358475 Step 3 Normal loss A/c Particular Qty in Kgs Amount (in K) Particular Qty in Kgs Amount (in K) To Process 1 A/c 500 106578 By Abnormal Gain A/c 20 120 To Process 2 A/c 220 25280 To Process 3 A/c 420 12000 By Cash 1120 6400 1140 6520 Abnormal loss A/c Particular Qty in Kgs Amount (in K) Particular Qty in Kgs Amount (in K) To Process 1 A/c 100 2422 By Cash Process 1 A/c 100 200

- 20. Process 3 A/c 280 2800 To Process 3 A/c 280 26554 By Costing PandL A/c 25976 380 28976 380 28976 QUESTION THIRTEEN Katwa Mutale : Gross Profit Working for November 2019 : 1. FIFO Method : Particulars Calculation No. of Cars Rate Amount in K Opening Inventory 3 11400 (34200) Purchases ( 4 x 11875 ) + 12 (157700)

- 21. ( 4 x 13300 ) + ( 4 x 14250 ) Sales ( 5 x 19000) + ( 5 x 19000 ) + ( 1 x 19000 ) 11 171000 Closing Inventory 4 x 14250 ( remaining 4 cars which are purchased on 25th Nov.) 4 57000 Gross Profit (Total ) 29100 2. LIFO METHOD : Particulars Calculation No. of Rate Amount in

- 22. Cars K Opening Inventory 3 11400 (34200) Purchases ( 4 x 11875 ) + ( 4 x 13300 ) + ( 4 x 14250 ) 12 (157700) Sales ( 5 x 19000) + ( 5 x 19000 ) + ( 1 x 19000 ) 11 164000 Closing Inventory ( 3 x 11400 ) + ( 1 x 11875) ( sold 4 cars which are purchased on 4 46075

- 23. 25th Nov , 4 cars which are purchased on 20th Nov and 3 Cars which are purchased on 10th Nov ) Gross Profit (Total ) 18175 3. Weighted Average Method : Particulars Calculation No. of Cars Rate Amount in K Opening Inventory 3 11400 (34200) Purchases ( 4 x 11875 ) + ( 4 x 13300 ) + ( 4 x 14250 ) 12 (157700)

- 24. Sales ( 5 x 19000) + ( 5 x 10000 ) + ( 1 x 19000 ) 11 164000 Closing Inventory Average Rate : = (3x11400)+(4x11875)+(4x13300)+(4x14250) / 15 Cars 4 12793.333 per car 51173 Gross Profit (Total ) 23273 QUESTION FOURTEEN Mutina total hour 60

- 25. basic hrs ovetime 40 20 pay scale: 720 360 basic pay 180 premium in this question, units/hour is not mentioned and with that I'm assuming it as 8 units/ hour so in 60 hours, the totoal output will be: 480 extra output 50

- 26. time saved 6.25 bonus 70.3125 gross pay= 1330.313 Munida total hour 45 basic hrs ovetime 40 5 pay scale: 720 90 basic pay 45 premium in this question, units/hour is not mentioned and with that I'm assuming it as 8 units/ hour so in 60 hours, the totoal output will be: 360 extra output 240 time saved 30 bonus 337.5 gross pay= 1192.5

- 27. Mumba total hour 48 basic hrs ovetime 40 8 pay scale: 720 144 basic pay 72 premium in this question, units/hour is not mentioned and with that I'm assuming it as 8 units/ hour so in 60 hours, the totoal output will be: 384 extra output 106 time saved 13.25 bonus 149.0625 gross pay= 1085.063