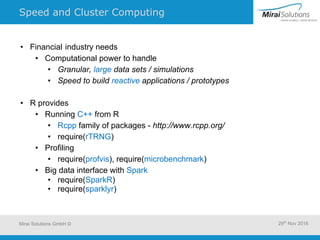

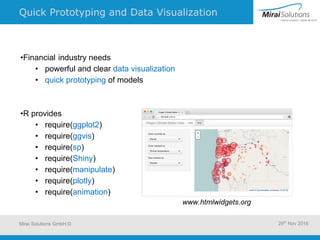

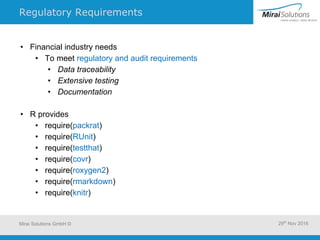

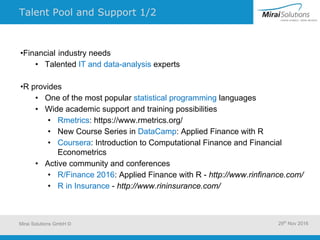

R is a popular statistical programming language that is well-suited for use in the financial industry. It has a large talent pool of users, strong academic and community support, and packages for tasks like data manipulation, domain-specific analysis, and integration with other systems. R can help financial organizations handle large and complex data, build models and prototypes quickly, and meet regulatory requirements through features like documentation, testing, and traceability of work.

![Integration Capabilities 1/2

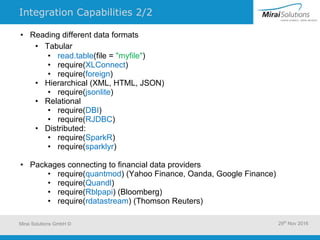

•Financial industry needs

• Flexible and extensive integration capabilities to existing

IT-environments

“The original concept for R

was to create an interface

language. […] So the idea

was to create a language

that was really good at

providing interfaces to

other computing systems.”

John Chambers

Keynote speech

UseR 2014

http://datascience.la/john-chambers-user-2014-keynote/

Mirai Solutions GmbH © 29th

Nov 2016](https://image.slidesharecdn.com/userininsurancegabrielfoix-161201080756/85/How-to-use-R-in-different-professions-R-In-Finance-Speaker-Gabriel-Foix-Mirai-Solutions-6-320.jpg)