INCOME TAXATION- CHAPTER 13-A ADDITIONAL CLAIMABLE COMPENSATION EXPENSE

•Als PPTX, PDF herunterladen•

0 gefällt mir•16 views

Income Taxation

Melden

Teilen

Melden

Teilen

Empfohlen

Empfohlen

Presentation by Isabela Atanasiu (Case Handler, European Commission DG COMP.E.3) on the occasion of the EESC LMO conference on 'Excluded or included' in Brussels on 6 November 2012. State Aid as a Possible Tool for Promoting Recruitment and Employment of Part...

State Aid as a Possible Tool for Promoting Recruitment and Employment of Part...European Economic and Social Committee - SOC Section

Obat Aborsi Cepat Tuntas hub. 085175415434, jual obat aborsi Di Bandung, Jual obat aborsi cytotec di Bandung, Jual cytotec Bandung, jual obat aborsi Gasdrun Bandung, jual obat aborsi di Bandung, Penjual obat aborsi Di Kota Bandung, Penjual obat aborsi Cytotec Bandung, obat gugur kandungan Bandung, Cara Pakai Obat Cytotec Di Bandung, Kegunaan Obat Cytotec Di Bandung, harga obat cytotec di Bandung, harga obat Aborsi di Bandung, harga obat Aborsi Cytotec di Bandung, obat aborsi Bandung, obat aborsi Bandung, obat aborsi Bandung, obat cytotec asli Bandung, obat gugur kandungan Bandung, tempat jual obat aborsi di Bandung, cytotec asli di Bandung, jual cytotec Bandung, jual obat aborsi di Bandung, harga obat cytotec Asli Di Bandung, apotik yang jual cytotec di Bandung, obat cytotec Bandung, cytotec asli di Bandung, harga resmi cytotec Bandung, obat cytotec asli Bandung, jual obat aborsi di Bandung, beli obat cytotec di Bandung, apotik yang jual cytotec di Bandung, jual cytotec Bandung, harga obat cytotec, obat cytotec asli Bandung, cytotec asli di Bandung, toko obat yang menjual cytotec di Bandung, jual cytotec Resmi Di Bandung, apotik yang jual cytotec di Bandung, jual Obat Aborsi Resmi Di Bandung, harga cytotec di apotik k24 Jam Di Bandung, cytotec asli di Bandung, jual obat cytotec di Daerah Bandung, jual obat cytotec murah Di Bandung, jual obat cytotec Original di Bandung, Nama nama Obat Aborsi, obat aborsi di daerah khusus Bandung, obat aborsi cepat Bandung, obat aborsi Asli daerah Bandung, jual obat aborsi di kab Bandung, jual cytotec ORIGINAL Bandung, jual obat aborsi ampuh bergaransi kota Bandung, obat telat datang bulan terbaik di apotik kota Bandung, obat penggugur kandungan Bandung, apotik yang jual cytotec di Bandung, obat penggugur kandungan Bandung, Cara Pakai Obat Cytotec Yg Benar, harga cytotec di apotik k24 Bandung, obat aborsi Manjur Di Bandung, jual Obat Kuret Di Bandung, jual obat Penggugur Di Bandung, jual obat cytotec Paten Di Bandung, cytotec asli di Bandung, obat cytotec Bandung, apotik yang jual cytotec di Bandung, jual cytotec Bandung, jual obat cytotec Bandung, cytotec asli di Bandung, bidan aborsi di resmi di Bandung, Dukun Aborsi resmi Di Bandung, harga cytotec di apotik k24 Bandung, jual cytotec Bandung cod, obat aborsi Bandung, Apotik obat aborsi Bandung, obat aborsi Bandung pusat, obat penggugur kandungan di apotik, jual Obat Telat datang Bulan Di Bandung, obat aborsi asli kota Bandung, jual obat aborsi Gas di Bandung, obat aborsi Resmi Bandung, obat aborsi Paling Ampuh Di Bandung, jual obat aborsi Cepat Bandung, beli obat cytotec di Bandung, jual cytotec Ori Di Bandung, jual obat aborsi di Bandung, apotik yang jual cytotec di Bandung, obat cytotec Bandung, cytotec asli di Bandung, harga resmi cytotec Di Bandung, obat cytotec asli Di Bandung, klinik jual obat aborsi Kuret Di Bandung, tempat jual obat aborsi di Bandung, tempat jual obat aborsi ilegal Kota Bandung, klinik jual obat aborsi di Bandung,Klinik Jual Obat Aborsi Di Bandung wa 0851/7541/5434 Misoprostol 200mcg Pfize...

Klinik Jual Obat Aborsi Di Bandung wa 0851/7541/5434 Misoprostol 200mcg Pfize...Spesialis Kandungan Resmi BPOM

Weitere ähnliche Inhalte

Ähnlich wie INCOME TAXATION- CHAPTER 13-A ADDITIONAL CLAIMABLE COMPENSATION EXPENSE

Presentation by Isabela Atanasiu (Case Handler, European Commission DG COMP.E.3) on the occasion of the EESC LMO conference on 'Excluded or included' in Brussels on 6 November 2012. State Aid as a Possible Tool for Promoting Recruitment and Employment of Part...

State Aid as a Possible Tool for Promoting Recruitment and Employment of Part...European Economic and Social Committee - SOC Section

Ähnlich wie INCOME TAXATION- CHAPTER 13-A ADDITIONAL CLAIMABLE COMPENSATION EXPENSE (20)

SMAC_Salient-Features-of-the-New-Income-Tax-Act-2023.pdf

SMAC_Salient-Features-of-the-New-Income-Tax-Act-2023.pdf

State Aid as a Possible Tool for Promoting Recruitment and Employment of Part...

State Aid as a Possible Tool for Promoting Recruitment and Employment of Part...

HAPTER 9 - Other Income, Other Deductions and Other IssuesIntroduc.pdf

HAPTER 9 - Other Income, Other Deductions and Other IssuesIntroduc.pdf

Revenue regulations no. 11 2018,(train law) relative to withholding of incom...

Revenue regulations no. 11 2018,(train law) relative to withholding of incom...

Kürzlich hochgeladen

Obat Aborsi Cepat Tuntas hub. 085175415434, jual obat aborsi Di Bandung, Jual obat aborsi cytotec di Bandung, Jual cytotec Bandung, jual obat aborsi Gasdrun Bandung, jual obat aborsi di Bandung, Penjual obat aborsi Di Kota Bandung, Penjual obat aborsi Cytotec Bandung, obat gugur kandungan Bandung, Cara Pakai Obat Cytotec Di Bandung, Kegunaan Obat Cytotec Di Bandung, harga obat cytotec di Bandung, harga obat Aborsi di Bandung, harga obat Aborsi Cytotec di Bandung, obat aborsi Bandung, obat aborsi Bandung, obat aborsi Bandung, obat cytotec asli Bandung, obat gugur kandungan Bandung, tempat jual obat aborsi di Bandung, cytotec asli di Bandung, jual cytotec Bandung, jual obat aborsi di Bandung, harga obat cytotec Asli Di Bandung, apotik yang jual cytotec di Bandung, obat cytotec Bandung, cytotec asli di Bandung, harga resmi cytotec Bandung, obat cytotec asli Bandung, jual obat aborsi di Bandung, beli obat cytotec di Bandung, apotik yang jual cytotec di Bandung, jual cytotec Bandung, harga obat cytotec, obat cytotec asli Bandung, cytotec asli di Bandung, toko obat yang menjual cytotec di Bandung, jual cytotec Resmi Di Bandung, apotik yang jual cytotec di Bandung, jual Obat Aborsi Resmi Di Bandung, harga cytotec di apotik k24 Jam Di Bandung, cytotec asli di Bandung, jual obat cytotec di Daerah Bandung, jual obat cytotec murah Di Bandung, jual obat cytotec Original di Bandung, Nama nama Obat Aborsi, obat aborsi di daerah khusus Bandung, obat aborsi cepat Bandung, obat aborsi Asli daerah Bandung, jual obat aborsi di kab Bandung, jual cytotec ORIGINAL Bandung, jual obat aborsi ampuh bergaransi kota Bandung, obat telat datang bulan terbaik di apotik kota Bandung, obat penggugur kandungan Bandung, apotik yang jual cytotec di Bandung, obat penggugur kandungan Bandung, Cara Pakai Obat Cytotec Yg Benar, harga cytotec di apotik k24 Bandung, obat aborsi Manjur Di Bandung, jual Obat Kuret Di Bandung, jual obat Penggugur Di Bandung, jual obat cytotec Paten Di Bandung, cytotec asli di Bandung, obat cytotec Bandung, apotik yang jual cytotec di Bandung, jual cytotec Bandung, jual obat cytotec Bandung, cytotec asli di Bandung, bidan aborsi di resmi di Bandung, Dukun Aborsi resmi Di Bandung, harga cytotec di apotik k24 Bandung, jual cytotec Bandung cod, obat aborsi Bandung, Apotik obat aborsi Bandung, obat aborsi Bandung pusat, obat penggugur kandungan di apotik, jual Obat Telat datang Bulan Di Bandung, obat aborsi asli kota Bandung, jual obat aborsi Gas di Bandung, obat aborsi Resmi Bandung, obat aborsi Paling Ampuh Di Bandung, jual obat aborsi Cepat Bandung, beli obat cytotec di Bandung, jual cytotec Ori Di Bandung, jual obat aborsi di Bandung, apotik yang jual cytotec di Bandung, obat cytotec Bandung, cytotec asli di Bandung, harga resmi cytotec Di Bandung, obat cytotec asli Di Bandung, klinik jual obat aborsi Kuret Di Bandung, tempat jual obat aborsi di Bandung, tempat jual obat aborsi ilegal Kota Bandung, klinik jual obat aborsi di Bandung,Klinik Jual Obat Aborsi Di Bandung wa 0851/7541/5434 Misoprostol 200mcg Pfize...

Klinik Jual Obat Aborsi Di Bandung wa 0851/7541/5434 Misoprostol 200mcg Pfize...Spesialis Kandungan Resmi BPOM

Kürzlich hochgeladen (20)

Klinik Jual Obat Aborsi Di Bandung wa 0851/7541/5434 Misoprostol 200mcg Pfize...

Klinik Jual Obat Aborsi Di Bandung wa 0851/7541/5434 Misoprostol 200mcg Pfize...

The Indian Ocean Tsunami of 2004 Remembering a Catastrophe.pptx

The Indian Ocean Tsunami of 2004 Remembering a Catastrophe.pptx

Global Trends in Market Reserch & Insights - Ray Poynter - May 2023.pdf

Global Trends in Market Reserch & Insights - Ray Poynter - May 2023.pdf

Generating Leads with Analyst Content Webinar Slides_SJN Final.pdf

Generating Leads with Analyst Content Webinar Slides_SJN Final.pdf

Niche Analysis for Client Outreach Outside Marketplace.pptx

Niche Analysis for Client Outreach Outside Marketplace.pptx

The Vital Role of Keyword Density in Crafting SEO-Optimized Content

The Vital Role of Keyword Density in Crafting SEO-Optimized Content

Why Digital Marketing Important for our Business.pdf

Why Digital Marketing Important for our Business.pdf

How To Structure Your Web3 Website For Max Visibility In The Bull Market🚀

How To Structure Your Web3 Website For Max Visibility In The Bull Market🚀

Tea Gobec, Kako pluti po morju tehnoloških sprememb, Innovatif.pdf

Tea Gobec, Kako pluti po morju tehnoloških sprememb, Innovatif.pdf

Mastering Email Marketing - A Comprehensive Guide.pdf

Mastering Email Marketing - A Comprehensive Guide.pdf

Fantasy Cricket Apps: A New Viewpoint for Online Cricket Betting Apps

Fantasy Cricket Apps: A New Viewpoint for Online Cricket Betting Apps

Rhys Cater, Precis, The future of media buying with Generative AI.pdf

Rhys Cater, Precis, The future of media buying with Generative AI.pdf

Klaus Schweighofer, Zakaj je digitalizacija odlična priložnost za medije, Sty...

Klaus Schweighofer, Zakaj je digitalizacija odlična priložnost za medije, Sty...

The Future Normal - DIGGIT - Henry Coutinho-Mason.pdf

The Future Normal - DIGGIT - Henry Coutinho-Mason.pdf

Licença Lotter Pro - Conheça o Certificado Oficial da Licença Lotter Pro.pdf

Licença Lotter Pro - Conheça o Certificado Oficial da Licença Lotter Pro.pdf

INCOME TAXATION- CHAPTER 13-A ADDITIONAL CLAIMABLE COMPENSATION EXPENSE

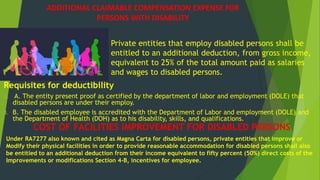

- 1. ADDITIONAL CLAIMABLE COMPENSATION EXPENSE FOR PERSONS WITH DISABILITY Requisites for deductibility A. A. The entity present proof as certified by the department of labor and employment (DOLE) that disabled persons are under their employ. B. B. The disabled employee is accredited with the Department of Labor and employment (DOLE) and the Department of Health (DOH) as to his disability, skills, and qualifications. Private entities that employ disabled persons shall be entitled to an additional deduction, from gross income, equivalent to 25% of the total amount paid as salaries and wages to disabled persons. COST OF FACILITIES IMPROVEMENT FOR DISABLED PERSONS Under RA7277 also known and cited as Magna Carta for disabled persons, private entities that improve or Modify their physical facilities in order to provide reasonable accommodation for disabled persons shall also be entitled to an additional deduction from their income equivalent to fifty percent (50%) direct costs of the Improvements or modifications Section 4-B, incentives for employee.

- 2. ADDITIONAL TRAINING EXPENSE UNDER THE JEWERLY INDUSTRY DEVELOPMENT ACT OF 1998 Under RA 8502 and its implementing rules and regulations, a qualified jewelry enterprise duly registered, and accredited with the Board of Investment (BOI) is entitled to an additional deduction from taxable Income of 50% of the expenses incurred in training schemes approved by technical Education and Skills Authority (TESDA) . The same shall be deductible the year the expenses were incurred. Conditions for deductibility 1 . A qualified jewelry enterprise must submit to the BIR a certified true copy of its certificate of Accreditation Issued by BOI. 2. The training schemes must be approved and certified by TESDA. ADDITIONAL LABOR TRAINING EXPENSE UNDER THE CREATE LAW Under RA 11534, 50% of the value of labor training expenses incurred for skills development of enterprise Based trainees enrolled in publics senior high schools, public higher educations institutions, or public higher education institutions, or public technical and vocational institutions shall be claimed as additional deductions against gross income.

- 3. Conditions of deductibility: ILLUSTRATION Texas instrument (TI) established an apprenticeship program in training private and public school senior high students. The program was duly accredited by TESDA .During the year TI incurred a total of 1 ,800,000 apprentice training expenses on top of following payroll expenses. Factory Personnel pay roll P 8,000,000 Support department personal payroll 500,000 Administrative personal payroll 1,500,000 Total P 10,000,000 The additional deduction shall be computed as follows: Apprenticeship training expense P 1,800,000 Multiply by: Incentive percentage 50% Possible deduction P 900,000 Deduction limit (8M direct labor × 10% ) P 800,000 The deductible amount shall be the lower 800,000. The same shall be classified under special allowable deduction. The 1 ,800,000 training expenses shall be claimable under regular allowable deduction. 1.Apprenticeship agreement between the enterprise (taxpayer) and the trainees pursuant to the labor code of the Philippines. 2. Certification from DepEd, TESDA, or CHED secured by the enterprise.