Financial Analysis - LinkedIn Corporation operates a social networking website used for professional networking. The Company's website allows members to post a profile of their professional expertise and accomplishments

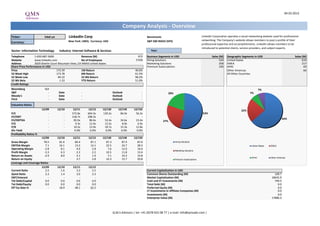

- 1. 04.03.2013 Company Analysis - Overview Ticker: lnkd un LinkedIn Corp Benchmark: LinkedIn Corporation operates a social networking website used for professional New York: LNKD, Currency: USD S&P 500 INDEX (SPX) networking. The Company's website allows members to post a profile of their Currency: professional expertise and accomplishments. LinkedIn allows members to be introduced to potential clients, service providers, and subject experts. Sector: Information Technology Industry: Internet Software & Services Year: Telephone 1-650-687-3600 Revenue (M) 972 Business Segments in USD Sales (M) Geographic Segments in USD Sales (M) Website www.linkedin.com No of Employees 3'458 Hiring Solutions 524 United States 619 Address 2029 Stierlin Court Mountain View, CA 94043 United States Marketing Solutions 258 EMEA 217 Share Price Performance in USD Premium Subscriptions 190 APAC 69 Price 173.39 1M Return 40.6% Other Americas 66 52 Week High 173.78 6M Return 61.5% All Other Countries 52 Week Low 84.10 52 Wk Return 98.2% 52 Wk Beta 1.33 YTD Return 51.0% Credit Ratings Bloomberg IG4 7% S&P - Date - Outlook - 20% 7% Moody's - Date - Outlook - Fitch - Date - Outlook - Valuation Ratios 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E 22% P/E - - 572.8x 604.3x 130.2x 84.0x 56.2x 53% EV/EBIT - - 218.7x 208.3x - - - EV/EBITDA - - 82.0x 86.6x 53.4x 34.6x 23.4x 64% 27% P/S - - 9.3x 12.4x 12.5x 8.9x 6.9x P/B - - 10.2x 13.9x 18.7x 15.3x 12.8x Div Yield - - 0.0% 0.0% 0.0% 0.0% 0.0% Profitability Ratios % 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Gross Margin 78.5 81.6 84.4 87.1 87.3 87.4 87.6 Hiring Solutions EBITDA Margin 7.1 16.1 13.2 14.1 22.5 24.7 28.3 United States EMEA Operating Margin -2.8 8.1 4.9 5.8 7.6 12.0 16.0 Marketing Solutions Profit Margin -3.3 6.3 2.3 2.2 10.5 11.8 13.4 Return on Assets -2.9 8.0 2.1 1.9 7.1 10.3 14.8 APAC Other Americas Return on Equity - - 3.7 2.8 10.3 15.7 20.8 Premium Subscriptions Leverage and Coverage Ratios 12/09 12/10 12/11 12/12 Current Ratio 2.5 1.6 3.2 2.5 Current Capitalization in USD Quick Ratio 2.3 1.4 3.0 2.3 Common Shares Outstanding (M) 109.7 EBIT/Interest - - - - Market Capitalization (M) 18635.9 Tot Debt/Capital 0.0 0.0 0.0 0.0 Cash and ST Investments (M) 749.5 Tot Debt/Equity 0.0 0.0 0.0 0.0 Total Debt (M) 0.0 Eff Tax Rate % - 18.9 48.1 62.2 Preferred Equity (M) 0.0 LT Investments in Affiliate Companies (M) 0.0 Investments (M) 0.0 Enterprise Value (M) 17886.3 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 2. Company Analysis - Analysts Ratings LinkedIn Corp Target price in USD Broker Recommendation Buy and Sell Recommendations vs Price and Target Price Price Brokers' Target Price 200 250 100% 5% 4% 4% 0% 0% 0% 0% 0% 0% 0% 0% 0% 180 35% 160 200 80% 42% 39% 39% 40% 39% 39% 41% 38% 44% 40% 48% 140 150 60% 120 100 100 40% 80 61% 61% 60% 65% 61% 61% 59% 60 50 57% 56% 58% 52% 52% 20% 40 0 20 Telsey Advisory Morgan Stanley Genuity Corp Barclays Fitzgerald Lazard Capital BMO Capital Piper Jaffray Daiwa Securities Raymond James Securities (USA) Evercore Macquarie Sterne, Agee & Partners LLC Securities Inc JPMorgan Cowen and Securities Financial Group Needham & Co EVA Dimensions IPOfinancial.com Robinson Argus Research Goldman Sachs Jefferies William Blair & Wedge Partners Wunderlich Wedbush SunTrust Montrose Partners Securities Company Credit Agricole Susquehanna Canaccord Cantor Northland Avondale Markets Markets 0% 0 Co. Ltd. Leach Group Corp Co mars.12 avr.12 mai.12 juin.12 juil.12 août.12 sept.12 oct.12 nov.12 déc.12 janv.13 févr.13 Buy Hold Sell Price Target Price Date Buy Hold Sell Date Price Target Price Broker Analyst Recommendation Target Date 28-Feb-13 52% 48% 0% 4-Mar-13 173.39 158.42 Cantor Fitzgerald YOUSSEF H SQUALI hold 143.00 1-Mar-13 31-Jan-13 59% 41% 0% 1-Mar-13 170.46 158.42 Wunderlich Securities BLAKE T HARPER buy 195.00 27-Feb-13 31-Dec-12 61% 39% 0% 28-Feb-13 168.18 158.42 Evercore Partners KEN SENA overweight 200.00 27-Feb-13 30-Nov-12 61% 39% 0% 27-Feb-13 168.55 158.42 Morgan Stanley SCOTT W DEVITT Overwt/Attractive 180.00 26-Feb-13 31-Oct-12 65% 35% 0% 26-Feb-13 157.77 156.32 SunTrust Robinson Humphrey SO YOUNG LEE buy 150.00 21-Feb-13 28-Sep-12 60% 40% 0% 25-Feb-13 156.05 156.32 Daiwa Securities Co. Ltd. KAZUYA NISHIMURA neutral 165.00 19-Feb-13 31-Aug-12 61% 39% 0% 22-Feb-13 160.44 156.32 Canaccord Genuity Corp MICHAEL GRAHAM buy 150.00 18-Feb-13 31-Jul-12 61% 39% 0% 21-Feb-13 157.36 156.32 Argus Research Corp JOSEPH F BONNER hold 11-Feb-13 29-Jun-12 58% 42% 0% 20-Feb-13 158.09 156.32 Avondale Partners LLC RANDLE G REECE market outperform 180.00 11-Feb-13 31-May-12 56% 40% 4% 19-Feb-13 160.76 155.53 Northland Securities Inc BILL SUTHERLAND market perform 145.00 11-Feb-13 30-Apr-12 52% 44% 4% 18-Feb-13 162.66 153.00 Telsey Advisory Group THOMAS FORTE no rating system 165.00 10-Feb-13 30-Mar-12 57% 38% 5% 15-Feb-13 162.66 153.00 BMO Capital Markets DANIEL SALMON market perform 130.00 8-Feb-13 14-Feb-13 161.34 153.00 JPMorgan DOUGLAS ANMUTH overweight 163.00 8-Feb-13 13-Feb-13 157.71 153.00 Jefferies BRIAN J PITZ buy 175.00 8-Feb-13 12-Feb-13 155.00 153.00 Needham & Co KERRY RICE hold 8-Feb-13 11-Feb-13 155.41 153.00 Wedbush MICHAEL PACHTER neutral 140.00 8-Feb-13 8-Feb-13 150.48 151.42 Raymond James AARON M KESSLER market perform 8-Feb-13 7-Feb-13 124.09 134.72 Macquarie THOMAS WHITE outperform 160.00 8-Feb-13 6-Feb-13 125.77 133.71 Sterne, Agee & Leach ARVIND BHATIA neutral 8-Feb-13 5-Feb-13 124.45 133.31 Cowen and Company JOHN BLACKLEDGE neutral 8-Feb-13 4-Feb-13 123.30 133.31 Lazard Capital Markets WILLIAM BIRD neutral 8-Feb-13 1-Feb-13 123.82 135.00 Susquehanna Financial Group DEEPAK MATHIVANAN Positive 155.00 8-Feb-13 31-Jan-13 123.79 135.00 Piper Jaffray EUGENE E MUNSTER overweight 176.00 8-Feb-13 30-Jan-13 123.46 135.00 Credit Agricole Securities (USA) JAMES LEE buy 161.00 8-Feb-13 29-Jan-13 124.53 135.00 Barclays MARK MAY equalweight 135.00 8-Feb-13 28-Jan-13 127.20 135.00 Wedge Partners MARTIN PYYKKONEN no rating system 8-Feb-13 25-Jan-13 123.78 135.00 William Blair & Co TIMOTHY J MCHUGH market perform 7-Feb-13 24-Jan-13 121.22 135.00 EVA Dimensions ANDREW S ZAMFOTIS hold 15-Jan-13 23-Jan-13 120.26 135.00 Goldman Sachs HEATH P TERRY buy/attractive 157.00 3-Aug-12 22-Jan-13 119.29 135.00 IPOfinancial.com TEAM COVERAGE buy 17-Feb-12 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 3. 04.03.2013 LinkedIn Corp Company Analysis - Ownership Ownership Type Ownership Statistics Geographic Ownership Distribution Geographic Ownership 1% 2% Shares Outstanding (M) 109.7 United States 93.97% 1% 1%0% 0% Float 98.5% Britain 1.34% 1% 1% Short Interest (M) 4.5 Canada 0.99% 1% Short Interest as % of Float 4.17% Japan 0.86% Days to Cover Shorts 1.13 Unknown Country 0.75% Institutional Ownership 101.52% Switzerland 0.44% Retail Ownership -2.28% Luxembourg 0.44% Insider Ownership 0.76% Others 1.20% Institutional Ownership Distribution 97% 95% Investment Advisor 87.38% Hedge Fund Manager 8.60% Pension Fund (Erisa) 0.97% United States Britain Canada Institutional Ownership Retail Ownership Insider Ownership Individual 0.75% Japan Unknown Country Switzerland Pricing data is in USD Others 2.32% Luxembourg Others Top 20 Owners: TOP 20 ALL Institutional Ownership Holder Name Position Position Change Market Value % of Ownership Report Date Source Country T ROWE PRICE ASSOCIA 7'833'170 1'466'654 1'358'193'346 8.75% 31.12.2012 13F UNITED STATES 1% 2% 1% JENNISON ASSOCIATES 7'705'593 82'273 1'336'072'770 8.61% 31.12.2012 13F UNITED STATES FMR LLC 5'083'134 2'948'557 881'364'604 5.68% 31.12.2012 ULT-AGG UNITED STATES 9% MORGAN STANLEY 4'016'541 -434'658 696'428'044 4.49% 31.12.2012 ULT-AGG UNITED STATES AMERIPRISE FINANCIAL 3'998'973 175'610 693'381'928 4.47% 31.12.2012 13F UNITED STATES JP MORGAN 3'703'400 981'364 642'132'526 4.14% 31.12.2012 ULT-AGG VANGUARD GROUP INC 3'578'026 720'002 620'393'928 4.00% 31.12.2012 13F UNITED STATES WELLINGTON MANAGEMEN 3'413'977 727'331 591'949'472 3.81% 31.12.2012 13F UNITED STATES CAPITAL GROUP COMPAN 2'544'120 20'000 441'124'967 2.84% 31.12.2012 ULT-AGG UNITED STATES BLACKROCK 2'427'438 132'541 420'893'475 2.71% 28.02.2013 ULT-AGG UNITED STATES 87% HARBOR CAPITAL ADVIS 2'381'116 10'273 412'861'703 2.66% 31.12.2012 MF-AGG UNITED STATES ALLIANCE BERNSTEIN 1'721'263 965'169 298'449'792 1.92% 31.12.2012 ULT-AGG UNITED STATES ARTISAN PARTNERS HOL 1'598'200 259'900 277'111'898 1.79% 31.12.2012 13F UNITED STATES AMERICAN CENTURY COM 1'444'680 291'230 250'493'065 1.61% 31.12.2012 13F UNITED STATES Investment Advisor Hedge Fund Manager Pension Fund (Erisa) Individual Others MANAGED ACCOUNT ADVI 1'407'827 -237'663 244'103'124 1.57% 31.12.2012 13F UNITED STATES WELLS FARGO 1'312'350 640'126 227'548'367 1.47% 31.12.2012 ULT-AGG FRANKLIN RESOURCES 1'277'750 581'660 221'549'073 1.43% 31.12.2012 ULT-AGG UNITED STATES STATE STREET 1'072'678 68'511 185'991'638 1.20% 01.03.2013 ULT-AGG UNITED STATES GILDER GAGNON HOWE 1'047'375 -133'817 181'604'351 1.17% 31.12.2012 13F UNITED STATES NEUBERGER BERMAN LLC 1'014'523 -983'863 175'908'143 1.13% 31.12.2012 13F UNITED STATES Top 5 Insiders: Holder Name Position Position Change Market Value % of Ownership Report Date Source SZE DAVID 409'557 -15'937 71'013'088 0.46% 19.02.2013 Form 4 WEINER JEFFREY 85'770 -3'303 14'871'660 0.10% 19.02.2013 Form 4 SORDELLO STEVEN J 41'268 -1'211 7'155'459 0.05% 19.02.2013 Form 4 NISHAR DIPCHAND 37'620 -12'500 6'522'932 0.04% 20.02.2013 Form 4 HENKE DAVID 35'758 6'200'080 0.04% 05.02.2013 Form 4 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 4. Company Analysis - Financials I/IV LinkedIn Corp Financial information is in USD (M) Equivalent Estimates Periodicity: Fiscal Year 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Income Statement Revenue 32 79 120 243 522 972 1'491 2'088 2'702 - Cost of Goods Sold 7 19 26 45 81 126 Gross Income 25 60 94 198 441 847 1'302 1'826 2'367 - Selling, General & Admin Expenses 26 66 98 179 415 790 (Research & Dev Costs) 12 29 39 65 132 257 Operating Income -0 -6 -3 20 26 57 114 250 433 - Interest Expense 0 0 0 0 0 0 - Foreign Exchange Losses (Gains) 0 0 0 0 0 0 - Net Non-Operating Losses (Gains) -1 -1 -0 1 3 -0 Pretax Income 0 -4 -3 19 23 57 176 324 521 - Income Tax Expense 0 0 1 4 11 36 Income Before XO Items 0 -5 -4 15 12 22 - Extraordinary Loss Net of Tax 0 0 0 0 0 0 - Minority Interests 0 0 0 0 0 0 Diluted EPS Before XO Items 0.00 (0.11) (0.10) 0.07 0.11 0.19 Net Income Adjusted* 7 28 156 247 361 EPS Adjusted 0.06 0.25 1.33 2.06 3.08 Dividends Per Share 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Payout Ratio % 0.0 0.0 0.0 0.00 0.00 0.00 Total Shares Outstanding 42 42 43 101 110 Diluted Shares Outstanding 39 42 41 46 104 113 EBITDA 2 1 8 39 69 137 335 517 765 *Net income excludes extraordinary gains and losses and one-time charges. Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 5. Company Analysis - Financials II/IV Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Balance Sheet Total Current Assets 99.211 121.158 172.206 725.927 1018.797 + Cash & Near Cash Items 80 90 93 339 270 + Short Term Investments 0 0 0 238 479 + Accounts & Notes Receivable 15 24 58 111 204 + Inventories 0 0 0 0 0 + Other Current Assets 4 7 21 37 66 Total Long-Term Assets 23 27 66 148 364 + Long Term Investments 0 0 0 Gross Fixed Assets 31 47 95 192 328 Accumulated Depreciation 9 21 38 77 142 + Net Fixed Assets 22 26 57 115 187 + Other Long Term Assets 1 2 9 33 177 Total Current Liabilities 28 49 105 227 415 + Accounts Payable 3 5 2 28 54 + Short Term Borrowings 0 0 0 0 0 + Other Short Term Liabilities 25 44 103 198 362 Total Long Term Liabilities 1 2 8 22 59 + Long Term Borrowings 0 1 2 0 0 + Other Long Term Borrowings 1 2 7 22 59 Total Liabilities 29 51 114 249 474 + Long Preferred Equity 103 103 104 0 + Minority Interest 0 0 0 0 + Share Capital & APIC 6 14 25 618 879 + Retained Earnings & Other Equity -16 -20 -5 7 29 Total Shareholders Equity 93 97 124 625 908 Total Liabilities & Equity 122 149 238 874 1'382 Book Value Per Share -0.24 -0.15 0.47 6.16 8.28 9.28 11.31 13.50 Tangible Book Value Per Share -0.26 -0.16 0.35 5.96 6.93 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 6. Company Analysis - Financials III/IV Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Cash Flows Net Income 0 -5 -4 15 12 22 38 108 250 + Depreciation & Amortization 2 6 12 20 43 80 + Other Non-Cash Adjustments 2 5 7 11 31 51 + Changes in Non-Cash Capital 3 2 7 9 47 114 Cash From Operating Activities 8 9 21 54 133 267 + Disposal of Fixed Assets 0 0 + Capital Expenditures -8 -20 -13 -50 -89 -125 -183 -216 -256 + Increase in Investments -251 -444 + Decrease in Investments 12 199 + Other Investing Activities -1 0 -6 -10 -62 Cash From Investing Activities -8 -20 -13 -56 -338 -433 + Dividends Paid 0 0 + Change in Short Term Borrowings 0 0 + Increase in Long Term Borrowings 0 0 + Decrease in Long Term Borrowings 0 0 + Increase in Capital Stocks 15 78 2 5 269 97 + Decrease in Capital Stocks -0 -4 -1 -0 -0 -0 + Other Financing Activities -0 -0 0 -0 183 0 Cash From Financing Activities 14 74 1 4 451 97 Net Changes in Cash 14 63 9 3 246 -69 Free Cash Flow (CFO-CAPEX) -0 -10 8 4 44 142 164 241 326 Free Cash Flow To Firm -0 4 44 142 Free Cash Flow To Equity Free Cash Flow per Share -0.01 -0.25 0.20 0.10 0.58 1.35 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 7. Company Analysis - Financials IV/IV Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Ratio Analysis Valuation Ratios Price Earnings 572.8x 604.3x 130.2x 84.0x 56.2x EV to EBIT 218.7x 208.3x EV to EBITDA 82.0x 86.6x 53.4x 34.6x 23.4x Price to Sales 9.3x 12.4x 12.5x 8.9x 6.9x Price to Book 10.2x 13.9x 18.7x 15.3x 12.8x Dividend Yield 0.0% 0.0% 0.0% 0.0% 0.0% Profitability Ratios Gross Margin 77.3% 76.4% 78.5% 81.6% 84.4% 87.1% 87.3% 87.4% 87.6% EBITDA Margin 5.2% 1.1% 7.1% 16.1% 13.2% 14.1% 22.5% 24.7% 28.3% Operating Margin -1.3% -7.0% -2.8% 8.1% 4.9% 5.8% 7.6% 12.0% 16.0% Profit Margin 1.0% -5.7% -3.3% 6.3% 2.3% 2.2% 10.5% 11.8% 13.4% Return on Assets -2.9% 8.0% 2.1% 1.9% 7.1% 10.3% 14.8% Return on Equity 3.7% 2.8% 10.3% 15.7% 20.8% Leverage & Coverage Ratios Current Ratio 3.58 2.46 1.63 3.20 2.45 Quick Ratio 3.44 2.32 1.43 3.04 2.29 Interest Coverage Ratio (EBIT/I) -36.00 Tot Debt/Capital 0.00 0.01 0.01 0.00 0.00 Tot Debt/Equity 0.00 0.01 0.01 0.00 0.00 Others Asset Turnover 0.89 1.26 0.94 0.86 Accounts Receivable Turnover 6.11 5.89 6.16 6.17 Accounts Payable Turnover 6.96 12.84 5.38 3.07 Inventory Turnover Effective Tax Rate 3.8% 18.9% 48.1% 62.2% Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 8. Company Analysis - Peers Comparision MONSTER LINKEDIN CORP-A FACEBOOK INC-A GOOGLE INC-CL A YAHOO! INC EBAY INC AMAZON.COM INC YELP INC GROUPON INC ZYNGA INC- CL A WORLDWID Latest Fiscal Year: 12/2012 12/2012 12/2012 12/2012 12/2012 12/2012 12/2012 12/2012 12/2012 12/2012 52-Week High 173.78 45.00 10.40 814.47 22.62 57.27 284.72 31.96 19.21 14.48 52-Week High Date 04.03.2013 18.05.2012 26.03.2012 04.03.2013 04.03.2013 01.02.2013 25.01.2013 28.03.2012 05.03.2012 21.03.2012 52-Week Low 84.10 17.55 4.94 556.52 14.35 34.83 178.04 14.10 2.60 2.09 52-Week Low Date 06.03.2012 04.09.2012 04.03.2013 14.06.2012 06.03.2012 06.03.2012 06.03.2012 04.06.2012 12.11.2012 09.11.2012 Daily Volume 166'440 12'825'634 442'852 887'636 10'465'454 2'539'774 732'834 201'086 11'541'690 15'699'751 Current Price (3/dd/yy) 173.39 27.55 4.96 813.54 22.36 54.59 268.84 22.68 5.24 3.55 52-Week High % Change -0.2% -38.8% -52.3% -0.1% -1.2% -4.7% -5.6% -29.0% -72.7% -75.5% 52-Week Low % Change 106.2% 57.0% 0.4% 46.2% 55.8% 56.7% 51.0% 60.9% 101.5% 69.9% Total Common Shares (M) 109.7 2'372.0 111.1 330.0 1'182.7 1'294.0 454.0 63.5 656.9 779.3 Market Capitalization 18'637.7 65'627.8 579.5 269'393.6 26'439.6 70'776.6 122'201.5 1'435.6 3'436.0 2'788.5 Total Debt - 2'356.0 164.2 5'537.0 - 4'519.0 4'218.0 - - 100.0 Preferred Stock - - - - - - - - - - Minority Interest - - - - 45.4 - - - (1.9) - Cash and Equivalents 749.5 9'626.0 148.2 49'557.0 6'022.4 9'408.0 11'448.0 95.1 1'209.3 1'652.3 Enterprise Value 17'888.1 58'357.8 595.6 225'373.5 20'462.6 65'887.6 114'971.5 1'340.5 2'224.7 1'236.2 Valuation Total Revenue LFY 972.3 5'089.0 890.4 50'175.0 4'986.6 14'072.0 61'093.0 137.6 2'334.5 1'281.3 LTM 972.3 5'089.0 916.0 51'379.0 4'986.6 14'071.0 61'093.0 137.6 2'334.5 1'281.3 CY+1 1'490.8 6'677.7 831.8 49'451.2 4'674.1 16'345.5 75'751.6 211.4 2'561.5 1'057.4 CY+2 2'088.2 8'434.7 849.6 57'163.0 4'845.7 18'730.9 93'067.6 294.9 2'833.0 1'101.9 EV/Total Revenue LFY 12.2x 11.0x 0.7x 3.8x 3.5x 4.3x 1.7x 8.0x 0.8x 0.2x LTM 12.2x 11.0x 0.7x 3.7x 3.5x 4.3x 1.7x 8.0x 0.8x 0.2x CY+1 11.9x 8.5x 0.6x 4.4x 4.6x 3.9x 1.5x 6.3x 0.8x 1.4x CY+2 8.4x 6.6x 0.5x 3.6x 4.2x 3.2x 1.2x 4.4x 0.6x 1.3x EBITDA LFY 136.7 1'187.0 142.5 15'722.0 1'457.1 4'088.0 2'835.0 (10.3) 155.4 54.0 LTM 136.7 1'187.0 118.0 15'684.0 1'457.1 4'090.0 2'834.0 (10.3) 143.7 54.0 CY+1 335.2 3'400.1 152.4 22'087.3 1'664.4 5'383.4 4'646.4 21.1 254.9 58.9 CY+2 516.7 4'479.8 161.4 25'944.5 1'740.8 6'241.8 6'384.0 46.6 319.3 122.6 EV/EBITDA LFY 86.6x 47.1x 4.5x 12.0x 12.0x 14.9x 37.6x -107.2x 12.8x 5.3x LTM 86.6x 47.1x 5.4x 12.1x 12.0x 14.9x 37.6x - 13.8x 5.3x CY+1 53.1x 16.7x 3.3x 10.0x 12.9x 11.9x 24.6x 62.7x 7.8x 25.8x CY+2 33.9x 12.3x 2.4x 7.9x 11.7x 9.6x 17.1x 27.8x 5.2x 11.5x EPS LFY 0.19 0.01 0.71 34.02 1.17 1.95 0.05 -0.33 -0.03 -0.20 LTM 0.19 0.02 0.21 33.74 1.17 1.94 0.36 -0.44 -0.08 -0.23 CY+1 1.33 0.57 0.36 45.71 1.16 2.75 3.13 0.09 0.20 (0.04) CY+2 2.06 0.78 0.42 53.86 1.27 3.21 5.54 0.37 0.29 0.00 P/E LFY 912.6x 1377.5x 23.6x 24.1x 19.1x 28.1x 746.8x - - - LTM 912.6x 1377.5x 23.6x 24.1x 19.1x 28.1x 746.8x - - - CY+1 130.2x 48.2x 13.9x 17.8x 19.4x 19.8x 85.9x 257.7x 26.3x - CY+2 84.0x 35.2x 11.8x 15.1x 17.6x 17.0x 48.6x 61.6x 18.1x 3550.0x Revenue Growth 1 Year 86.2% 37.1% (10.4%) 32.4% 0.0% 20.8% 27.1% 65.2% 45.0% 12.4% 5 Year - - (8.6%) 24.7% (5.8%) 13.7% 30.6% - - - EBITDA Growth 1 Year 98.3% (42.9%) (17.7%) 15.7% (1.1%) 23.4% 45.8% 13.9% - - 5 Year 141.2% - (12.8%) 21.0% 1.5% 9.4% 25.8% - - - EBITDA Margin LTM 14.1% 23.3% 12.9% 30.5% 29.2% 29.1% 4.6% (7.5%) 6.2% 4.2% CY+1 22.5% 50.9% 18.3% 44.7% 35.6% 32.9% 6.1% 10.0% 10.0% 5.6% CY+2 24.7% 53.1% 19.0% 45.4% 35.9% 33.3% 6.9% 15.8% 11.3% 11.1% Leverage/Coverage Ratios Total Debt / Equity % 0.0% 20.0% 18.7% 7.7% 0.0% 21.7% 51.5% 0.0% 0.0% 5.5% FALSE FALSE FALSE FALSE FALSE Total Debt / Capital % 0.0% 16.7% 15.7% 7.2% 0.0% 17.8% 34.0% 0.0% 0.0% 5.2% FALSE FALSE FALSE FALSE FALSE Total Debt / EBITDA 0.000x 1.985x 1.392x 0.353x 0.000x 1.105x 1.488x - 0.000x 1.852x FALSE FALSE FALSE FALSE FALSE Net Debt / EBITDA -5.483x -6.125x 0.136x -2.807x -4.133x -1.195x -2.551x - -8.416x -28.746x FALSE FALSE FALSE FALSE FALSE EBITDA / Int. Expense - 23.275x - 187.167x - 64.889x 30.815x - - - FALSE FALSE FALSE FALSE FALSE Credit Ratings S&P LT Credit Rating - - - AA NR A AA- - - - FALSE FALSE FALSE FALSE FALSE S&P LT Credit Rating Date - - - 19.11.2012 18.04.2008 02.03.2010 26.11.2012 - - - FALSE FALSE FALSE FALSE FALSE Moody's LT Credit Rating - - - Aa2 - A2 Baa1 - - - FALSE FALSE FALSE FALSE FALSE Moody's LT Credit Rating Date - - - 16.05.2011 - 21.10.2010 26.11.2012 - - - FALSE FALSE FALSE FALSE FALSE Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |