mutual funds

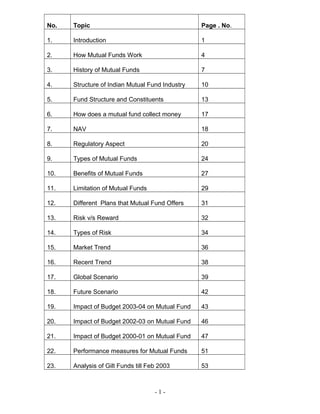

- 1. No. Topic Page . No. 1. Introduction 1 2. How Mutual Funds Work 4 3. History of Mutual Funds 7 4. Structure of Indian Mutual Fund Industry 10 5. Fund Structure and Constituents 13 6. How does a mutual fund collect money 17 7. NAV 18 8. Regulatory Aspect 20 9. Types of Mutual Funds 24 10. Benefits of Mutual Funds 27 11. Limitation of Mutual Funds 29 12. Different Plans that Mutual Fund Offers 31 13. Risk v/s Reward 32 14. Types of Risk 34 15. Market Trend 36 16. Recent Trend 38 17. Global Scenario 39 18. Future Scenario 42 19. Impact of Budget 2003-04 on Mutual Fund 43 20. Impact of Budget 2002-03 on Mutual Fund 46 21. Impact of Budget 2000-01 on Mutual Fund 47 22. Performance measures for Mutual Funds 51 23. Analysis of Gilt Funds till Feb 2003 53 - 1 -

- 2. 24. Bibliography 56 Project Report on MUTUAL FUNDS Submitted by NAMITA WALVEKAR - - -40 Project Co-ordinator PROF.SUBRAMANIAN Date of Submission SEPTEMBER 25, 2003 - 2 -

- 3. N.E.S RATNAM COLLEGE OF SCIENCE , ARTS AND COMMERCE BHANDUP (WEST ). CERTIFICATE I _______________ hereby certify that Namita Walvekar ;40 of NES Ratnam college ,Bhandup of Third Year Student Bachelor of Management Studies(T.Y.BMS),(Semester V) has completed a project on “Mutual Funds” in the year 2003-2004 (Signature) - 3 -

- 4. DECLARATION I Mr/Miss NAMITA .WALVEKAR of N.E.S RATNAM COLLEGE of T.Y.BMS(Semester V)hereby declare that I have completed this project on “MUTUAL FUNDS” in the Academic year 2003-2004. The information collected and submitted is true and original to the best of my knowledge. ( SIGNATURE STUDENT ) - 4 -

- 5. MethodologyMethodology The data collected for compiling the project are secondary data. The sources are: Data from various Internet sites. Data from newspapers. Data from current affairs magazines. - 5 -

- 6. Objective of the project.Objective of the project. The objective of the project is to understand mutual funds, its different schemes, benefits offered to its investors and its overall functioning in India . - 6 -

- 7. AcknowledgementAcknowledgement Foremost, I would like to express my heartfelt thanks and acknowledge the guidance and support given by my project guide Prof. Subramanian I would also like to convey my thanks to Prof.Miss .Julie Joseph . A vote of appreciation also goes to Mr. Pankaj Sinha ,Mr.Rishu Miglani for helping me compile my project - 7 -

- 8. Mutual Funds: An overview Introduction A Mutual Fund is a trust that collects the savings of a number of investors who share a common financial goal. Mutual fund offers a simple and effective way to put money in a number of financial investments that no one investor could afford. The money thus collected is invested by the fund manager in different types of securities depending upon the objective of the scheme. These could range from shares to debentures to money market instruments. The income earned through these investments and the capital appreciation realized by the scheme are shared by its unit holders in proportion to the number of units owned by them (pro rata). There are some things in LIFE that GROW faster than your savings. Your EXPENSES, for instance. In today’s world of inflation and spiraling costs, you need to invest your savings wisely so that you get good returns consistently .your end objective is to maximize returns while minimizing risk . a judicious mix of mutual funds give you a short at growth in any market condition while reducing portfolio risk through diversification . Thus a Mutual Fund is the most suitable investment for the common man as it offers an opportunity to invest in a diversified, professionally managed portfolio at a relatively low cost. Anybody with an investible surplus of as little as a few thousand rupees can invest in Mutual Funds. Each Mutual Fund scheme has a defined investment objective and strategy. - 8 -

- 9. TYPES / CLASSIFICATION OF FUNDS: Mutual fund On the basis of on the basis of yield execution and operation and investment pattern Close-ended open-ended Income Growth Balance Specialized Money Taxation Fund Fund Fund Fund Market Fund For example, a mutual fund could invest in investors favorite stocks , which if you went to buy on your own would cost lakhs. But since several other like-minded investors invest with other investors in the mutual fund , you get to own many of investors favourite stocks without having to invest huge amounts. A mutual fund provides diversification,professional management and liquidity.Diversification reduces the risk that negative performance of one type of - 9 -

- 10. investment will result in a significant loss to the mutual fund and erosion of investor own money in the fund . Say an investor buy 100shares of ITC Rs.1,00,000 . ITC reports negative news and the share price 20%. You loose Rs.20,000 Had you invested in a mutual fund which had ITC among other stocks , ITC’s fall could have been managed by another share’s risk or atleast the loss would not have been as large .The flip side of course is that had the shares done well ,the investor would have gained handsomely whereas the gain would have been smaller for the mutual fund . Mutual funds are managed by professional portfolio managers , who have the education and experience(atleast that’s what the investor expects )to research and put investments with the best potential and those that meet the mutual funds investment objectives. And for a busy person like many investors are , that means less time researching individual shares and bonds or spending big bucks on an investment advisor . Unlike fixed deposits with banks or company deposits , mutual funds shares /units can be sold back to the mutual fund and the investor can withdraw funds in some cases by just making a phone-call. A note of caution though-a funds unit price and return will vary and the investor may have a gain or loss on selling his mutual fund units. The biggest advantage of mutual funds is that the investor doesn’t need huge amounts to be invested in all his favourite stocks and bonds . most mutual funds have a minimum investment of rupees 5000. A mutual fund is the ideal investment vehicle for today’s complex and modern financial scenario. Markets for equity shares, bonds and other fixed income instruments, real estate, derivatives and other assets have become mature and information driven. Price changes in these assets are driven by global events occurring in faraway places. A typical individual is unlikely to have the knowledge, skills, inclination and time to keep track of events, understand their implications and act speedily. An individual also finds it difficult to keep track of ownership of his assets, investments, brokerage dues and bank transactions etc. A mutual fund is the answer to all these situations. It appoints professionally qualified and experienced staff that manages each of these functions on a full time basis. The large pool of money collected in the fund allows it to hire - 10 -

- 11. such staff at a very low cost to each investor. In effect, the mutual fund vehicle exploits economies of scale in all three areas - research, investments and transaction processing. While the concept of individuals coming together to invest money collectively is not new, the mutual fund in its present form is a 20th century phenomenon. In fact, mutual funds gained popularity only after the Second World War. Globally, there are thousands of firms offering tens of thousands of mutual funds with different investment objectives. Today, mutual funds collectively manage almost as much as or more money as compared to banks. The flow chart below describes broadly the working of a mutual fund: pool their passed back to money with returns investors fund manager invests in capital market securities for a specified or in period A draft offer document is to be prepared at the time of launching the fund. Typically, it pre specifies the investment objectives of the fund, the risk associated, the costs involved in the process and the broad rules for entry into and exit from the fund and other areas of operation. In India, as in most countries, these sponsors need approval from a regulator, SEBI (Securities exchange Board of India) in our case. SEBI looks at track records of the sponsor and its financial strength in granting approval to the fund for commencing operations. - 11 -

- 12. A sponsor then hires an asset management company to invest the funds according to the investment objective. It also hires another entity to be the custodian of the assets of the fund and perhaps a third one to handle registry work for the unit holders (subscribers) of the fund. In the Indian context, the sponsors promote the Asset Management Company also, in which it holds a majority stake. In many cases a sponsor can hold a 100% stake in the Asset Management Company (AMC). E.g. Birla Global Finance is the sponsor of the Birla Sun Life Asset Management Company Ltd., which has floated different mutual funds schemes and also acts as an asset manager for the funds collected under the schemes. FIVE STEPS TO SELECTING THE RIGHT FUND. Take into consideration the present needs and future financial goals and what are the money requirements . the fund category for investors will depend on two prime factors: : 1) investment objective and time horizon 2) personal risk taking ability Most of the time the investor gets swayed with market trends and invest their money in investments , which don’t match with either of the above parameters . what may be suitable to one investor may not be suitable for another. Investments must reflect investors risk personality and collectively perform to help them achieve their financial objective . today there are varied choices of schemes available to choose from. they offer investors different risk levels , investment styles and objectives. Based on the investors needs investor must select what suits him the best . for example ,if investors goal is near term , like his sons college fees to be paid in the next semester , then the investor should look at debt based mutual fund (in this case avoid equity based funds which have higher risks associated to them ). However if investor plans to buy a house 5 years later , then investor can have a decent in equity based mutual funds depending on the investors risk personality . thus based on different goals - 12 -

- 13. and time horizon you can create a personalized portfolio of different mutual fund schemes . once the investor knows the category of funds that suits him , the next step is to start deciding specific schemes . this is a very crucial step because there are so many schemes on offer . the points to be considered before deciding the scheme : - a. Period of existence - - it is advisable to invest in schemes which has been in existence long enough to have built a track record. b. Past track record - - past is no guarantee for future but analyzing the past thus gives an investor enough information to make a wise decision . based on this an investor can take a call on how the fund has performed over various periods of market fluctuation , and compare that with similar funds in the category . it will also give you an idea of the volatility of the returns . select funds , which are steady performers and don’t show too much fluctuations in returns . c. Fund house - - to look at the credit worthiness of the fund house . the quality of the service offered is also important . incase of a foreign fund house , assess how its schemes have performed overseas. d. Portfolio Quality - - the most important thing to analyze in any fund is its underlying investments . these investments and their quality will determine the returns of the scheme . this information is fairly available on the internet and funds also come out with regular news letters , which disclose their portfolios. Incase of debt funds investor needs to look at the credit quality of the portfolio .A scheme with large proportion of low graded paper indicates higher risks and is avoidable.incase of equity – based funds you should look at how well the portfolio is diversified across sectors and companies . at times the portfolios are very skewed to certain well performing sectors that may perform for a small proportion of time only. These schemes are avoidable . - 13 -

- 14. e. Corpus size - - select a scheme with a decent corpus size . small corpus sizes are a problem when faced with redemption pressure in times of panic as this results in distress sales where existing investors lose out . incase of debt funds ,subscription to good corporate issues start at very high lot sizes ,which again may be missed by small funds due to liquidity problem. f. Adherence to its objectives - - while analyzing the scheme past performance look into how often it has moved away from its objective .it is very important for a scheme to stick to its objectives . like a debt fund can’t invest in equities when equities start performing well .this is important to do because based on this objectives the investor has to choose the goals. g. Incentives - - some intermediaries offer incentive on investments.the investor for that may upfront money get stucked with a bad performing fund or a fund which does not match an investors objective. h. Fund managers objectives - - look into the past track record of the fund managers with whom an investor is trusting his hard earned money. Once the investor has selected the scheme the next step is to decide whether to invest in dividend option or growth .If an investor needs regular inflow of income then he can opt for dividend option and if he is seeking wealth build up for the future then select growth option . When the investor invests it does mean his goals are achieved . it is very important to continuously monitor them and see if they are performing as per his expectation . in case of under performance an investor can look at a shift to another fund. - 14 -

- 15. HOW MUTUAL FUNDS WORK A large number of people with money to invest buy shares/units in a Mutual Fund Their pooled money has more buying power The Fund Manager invests the money in a collection of stocks, bonds or other securities - 15 -

- 16. Successful investment adds value to the fund Investors receive distributions Most investment professionals agree that it's smarter to own a variety of stocks and bonds than to gamble on the success of a few. But diversifying can be tough because buying a portfolio of individual stocks and bonds can be expensive. And knowing what to buy — and when — takes time and concentration. Mutual funds offer one solution: When you put money into a fund, it's pooled with money from other investors to create much greater buying power than you would have investing on your own. Since a fund can own hundreds of different securities, its success isn't dependent on how one or two holdings do. And the fund's professional managers keep constant tabs on the markets, working to adjust the portfolio for the strongest possible performance. - 16 -

- 17. PAYING OUT THE PROFITS : A mutual fund makes money in two ways: by earning dividends or interest on its investments and by selling investments that have increased in price. The fund distributes, or pays out, its profits (minus fees and expenses) to its investors. Income distributions are from the money the fund earns on its investments. Capital gain distributions are the profits from selling investments. Different funds pay their distributions on different schedules — from once a day to once a year. Many funds offer investors the option of reinvesting all or part of their distributions to buy more shares in the fund. You pay taxes on the distributions you receive from the fund, whether the money is reinvested or paid out in cash. But if a fund loses more than it makes in any year, it can use the loss to offset future gains. Until profits equal the accumulated losses, distributions aren't taxable, although the share price may increase to reflect the profits. CREATING A FUND Mutual funds are created by investment companies (called mutual fund companies), brokerage houses and banks. Each new fund has a professional manager, an investment objective, and a plan, or investment program, it follows in building its portfolio. The funds are marketed to potential investors with ads in the financial press, through direct mailings and press announcements, and in some cases with the support of registered representatives who make commissions selling History Of Mutual Funds - 17 -

- 18. Mutual Funds in India (1964-2000) The end of millennium marks 36 years of existence of mutual funds in this country. The ride through these 36 years is not been smooth. Investor opinion is still divided. While some are for mutual funds others are against it. UTI commenced its operations from July 1964 .The impetus for establishing a formal institution came from the desire to increase the propensity of the middle and lower groups to save and to invest. UTI came into existence during a period marked by great political and economic uncertainty in India. With war on the borders and economic turmoil that depressed the financial market, entrepreneurs were hesitant to enter capital market.The already existing companies found it difficult to raise fresh capital, as investors did not respond adequately to new issues. Earnest efforts were required to canalize savings of the community into productive uses in order to speed up the process of industrial growth.The then Finance Minister, T.T. Krishnamachari set up the idea of a unit trust that would be “open to any person or institution to purchase the units offered by the trust. However, this institution as we see it, is intended to cater to the needs of individual investors, and even among them as far as possible, to those whose means are small.” His ideas took the form of the Unit Trust of India, an intermediary that would help fulfill the twin objectives of mobilizing retail savings and investing those savings in the capital market and passing on the benefits so accrued to the small investors. UTI commenced its operations from July 1964 “with a view to encouraging savings and investment and participation in the income, profits and gains accruing to the Corporation from the acquisition, holding, management and disposal of securities.” Different provisions of the UTI Act laid down the structure of management, scope of business, powers and functions of the Trust as well as accounting, disclosures and regulatory requirements for the Trust. One thing is certain – the fund industry is here to stay. The industry was one-entity show till 1986 when the UTI monopoly was broken when SBI and Canbank mutual fund entered the arena. This was followed by the entry of others like BOI, LIC, GIC, - 18 -

- 19. etc. sponsored by public sector banks. Starting with an asset base of Rs0.25bn in 1964 the industry has grown at a compounded average growth rate of 26.34% to its current size of Rs1130bn. The period 1986-1993 can be termed as the period of public sector mutual funds (PMFs). From one player in 1985 the number increased to 8 in 1993. The party did not last long. When the private sector made its debut in 1993- 94, the stock market was booming. The opening up of the asset management business to private sector in 1993 saw international players like Morgan Stanley, Jardine Fleming, JP Morgan, George Soros and Capital International along with the host of domestic players join the party. But for the equity funds, the period of 1994-96 was one of the worst in the history of Indian Mutual Funds. 1999-2000 Year of the funds Mutual funds have been around for a long period of time to be precise for 36 yrs but the year 1999 saw immense future potential and developments in this sector. This year signaled the year of resurgence of mutual funds and the regaining of investor confidence in these MF’s. This time around all the participants are involved in the revival of the funds ----- the AMC’s, the unit holders, the other related parties. However the sole factor that gave life to the revival of the funds was the Union Budget. The budget brought about a large number of changes in one stroke. It provided center stage to the mutual funds, made them more attractive and provides acceptability among the investors. The Union Budget exempted mutual fund dividend given out by equity-oriented schemes from tax, both at the hands of the investor as well as the mutual fund. No longer were the mutual funds interested in selling the concept of mutual funds they wanted to talk business which would mean to increase asset base, and to get asset base and investor base they had to be fully armed with a whole lot of schemes for every investor .So new schemes for new IPO’s were inevitable. The quest to attract investors extended beyond just new schemes. The funds started to regulate themselves and were all - 19 -

- 20. out on winning the trust and confidence of the investors under the aegis of the Association of Mutual Funds of India (AMFI) One can say that the industry is moving from infancy to adolescence, the industry is maturing and the investors and funds are frankly and openly discussing difficulties opportunities and compulsions. - 20 -

- 21. Structure of the Indian mutual fund industry The mutual fund industry in India was started by the Unit Trust of India (UTI)in 1963 with the intriduction of the unit scheme US-64.this scheme was a big success , which encourage UTI to introduce special schemes like the unit linked insurance plan(ULIP)in 1971 , Childern’s Gilt Growth Funds(CGGF)in 1986 , master share in 1987 ,etc. 1987 saw the entry of public sector mutual funds into the market .m these were mainly public sector banks and financial institution,which established their own mutual funds. SBI mutual fund , Can Bank,LIC mutual fund and Indian bank mutual fund were among the first to be launched .1993 saw the entry of private sector mutual funds . These were mainly foreign fund management companies entering India through joint venture with Indian companies .Mutual funds have been successful in garnering funds from individual investors under various schemes .With the introduction of the SEBI in 1996 , the regulatory authority for mutual funds ,investor protection measures have been put in place giving individual investors added confidence while putting there money with mutual funds . by October 1999 , mutual funds had garnered rupees 86.949 crores of which rupees 64,276 crores was under the management of UTI . The Indian mutual fund industry was dominated by the Unit Trust of India, which has a total corpus of Rs700bn collected from more than 20 million investors. The UTI has many funds/schemes in all categories i.e. equity, balanced, income etc with some being open-ended and some being closed-ended. The Unit Scheme 1964 commonly referred to as US 64, which is a balanced fund, is the biggest scheme with a corpus of about Rs200bn. UTI was floated by financial institutions and is governed by a special act of Parliament. Most of its investors believe that the UTI is government owned and controlled, which, while legally incorrect, is true for all practical purposes. - 21 -

- 22. The second largest category of mutual funds are the ones floated by nationalized banks. Canbank Asset Management floated by Canara Bank and SBI Funds Management floated by the State Bank of India are the largest of these. GIC AMC floated by General Insurance Corporation and Jeevan Bima Sahayog AMC floated by the LIC are some of the other prominent ones. The aggregate corpus of funds managed by this category of AMCs is about Rs150bn. The third largest category of mutual funds are the ones floated by the private sector and by foreign asset management companies. Several private sectors Mutual Funds were launched in 1993 and 1994. Kothari Pioneer Mutual fund was the first fund to be established by the private sector in association with a foreign fund. The largest of these are Prudential ICICI AMC and Birla Sun Life AMC. This signaled a growth phase in the industry and at the end of financial year 2000, 32 funds were functioning with Rs. 1,13,005 crores as total assets under management. As on August end 2000, there were 33 funds with 391 schemes and assets under management with Rs. 1,02,849 crores. The Securities and Exchange Board of India (SEBI) came out with comprehensive regulation in 1993 which defined the structure of Mutual Fund and Asset Management Companies for the first time. The diagram below shows the three segments and a few of the players in each segment. UTI SBI M F LIC M F GIC M F PUBLIC SECTOR SUN F&C BIRLA SUN LIFE ALLIANCE CAPITAL PRUDENTIAL ICICI PRIVATE SECTOR Indian M UTUAL FUNDS INDUSTRY - 22 -

- 23. Some of the AMCs operating currently are: Name of the AMC Nature of ownership Alliance Capital Asset Management (I) Private Limited Private foreign Birla Sun Life Asset Management Company Limited Private Indian Bank of Baroda Asset Management Company Limited Bank Bank of India Asset Management Company Limited Bank Canbank Investment Management Services Limited Bank Cholamandalam Cazenove Asset Management Company Limited Private foreign Dundee Asset Management Company Limited Private foreign DSP Merrill Lynch Asset Management Company Limited Private foreign Escorts Asset Management Limited Private Indian First India Asset Management Limited Private Indian GIC Asset Management Company Limited Institution IDBI Investment Management Company Limited Institution Indfund Management Limited Bank ING Investment Asset Management Company Private Limited Private foreign J M Capital Management Limited Private Indian Jardine Fleming (I) Asset Management Limited Private foreign Kotak Mahindra Asset Management Company Limited Private Indian - 23 -

- 24. Kothari Pioneer Asset Management Company Limited Private Indian Jeevan Bima Sahayog Asset Management Company Limited Institution Morgan Stanley Asset Management Company Private Limited Private foreign Punjab National Bank Asset Management Company Limited Bank Reliance Capital Asset Management Company Limited Private Indian State Bank of India Funds Management Limited Bank Shriram Asset Management Company Limited Private Indian Sun F and C Asset Management (I) Private Limited Private foreign Sundaram Newton Asset Management Company Limited Private foreign Tata Asset Management Company Limited Private Indian Credit Capital Asset Management Company Limited Private Indian Templeton Asset Management (India) Private Limited Private foreign Unit Trust of India Institution Zurich Asset Management Company (I) Limited Private foreign Fund Structure and Constituents Special legal structure of mutual funds Mutual funds have a unique structure not shared with other entities such as companies or firms. It is important for employees and agents to b aware of the special nature of this structure, because it determines the rights and responsibilities of the fund’s constituents viz sponsors trustees, custodians, transfer agent, the fund and the asset management company. - 24 -

- 25. Structure of mutual funds in India Like other countries, India has a legal framework within which mutual funds must be constituted. Unlike in the UK, where two distinct ‘ trust’ and ‘corporate’ structures are followed with separate regulations, in India, open and close end funds operate under the same regulatory structure, and are constituted along one unique structure as unit trusts. A mutual fund in India is allowed to issue open end and closed end schemes under a common legal structure. The structure which is required to be followed by mutual funds in India is laid down under SEBI ( Mutual fund) regulations, 199A mutual fund is normally formed as a Trust and is governed by a Board of Trustees - see diagram below. The Trustees in turn appoint an investment advisor to manage the various schemes launched by the mutual fund. This investment advisor is called an Asset Management Company (AMC). The AMC is responsible for marketing and selling the schemes, investing the funds collected by it and servicing the investors. The AMC is responsible to the Trustees and has to take their approval for all major actions taken in connection with the mutual fund. To help the AMC in its daily activities, it appoints specialists in different areas - a Registrar & Transfer (R&T) Agent , a Custodian and one or more Banks The Fund Sponsor “Sponsor “ is defined under SEBI regulations as any person who, acting alone or in combination with another body corporate, establishes a mutual - 25 -

- 26. fund. The sponsor of a fund is akin to the promoter of a company as he gets the funds registered with SEBI. The sponsor will form a trust and appoint board of trustees. The sponsor will also generally appoint an asset management company as fund managers. The sponsor either directly or acting through the trustees, will also appoint a custodian to hold the fund assets. All these appointments are made in accordance with SEBI regulations. As per the existing SEBI regulations, for a person to qualify as a sponsor, he must contribute at least 40% of the net worth of the AMC and posses a sound financial track record over five years prior to registration. Mutual Fund as Trusts It should be understood that a mutual fund is just “ a pass through” vehicle. Under the Indian Trust Act, the Trust or the Fund has no independent legal capacity itself, rather it is the trustee or the trustees who have the legal capacity and therefore all acts in relation to the trust are taken on its behalf by the trustees. The trustees hold the unitholders money in fiduciary capacity i.e. the money belongs to the unit holders and is entrusted to the fund for the purpose of investment. In legal parlance, the investors or the unit holders are the “ beneficial owners “ of the investment held by the trust, even as these investments are held in the name of the trustees on a day – to –day basis. Being a public trusts, mutual funds can invite any number of investors as beneficial owners in their investment schemes. Trustees The trust – the mutual fund- may be managed by a board of trustees- a body of individuals, or a Trust company- a corporate body. Most of the funds in India are managed by Board of Trustees. While the Board of Trustees is governed by the provisions of the Indian Trusts Act, where the Trustee is a corporate - 26 -

- 27. body, it would also be required to comply with the provisions of the Companies Act, 1956. The trust is created through a document called the Trust Deed that is executed by the Fund Sponsor in favour of the trustees. Clauses in the trust deed, inter alia, deal with the establishment of the trust, the appointment of the trustees, their powers and duties, and the obligations of the trustees towards unit holders and the AMC. The trustees must ensure that the investor’s interest is safeguarded and that the AMC’s operations are along professional lines. They must also ensure that the management of the fund is in accordance with SEBI Regulations. The Asset Management Company The role of an AMC is to act as the Investment Manager of the Trust. The sponsors or the trustees, if so authorized by the trust deed appoint the AMC. The AMC so appointed is required to be approved by SEBI. The AMC would, in the name of the trust, float and then manage the different investment “schemes” as per the SEBI regulations and as per the Investment Management Agreement it signs with the trustees. The AMC of the mutual fund must have a net worth of at least Rs. 10 crores at all times. The AMC cannot act as trustee of any other mutual fund. The AMC must always act in the interest of the unit holders and report to the trustees with respect to its activities. Other fund constituents Custodian and depositories Mutual funds are in the business of buying and selling of securities in large volumes. Handling these securities in terms of physical delivery and eventual safekeeping is therefore a specialized activity. The custodian is appointed by the board of trustees for safeguarding of physical securities or - 27 -

- 28. participating in any vlaering system through approved depository companies on behalf of the mutual fund in case of dematerialized securities. The custodian should be an entity independent of the sponsors and is required to be registered with the SEBI. Transfer agents Transfer agents are responsible for issuing and redeeming units of the mutual fund and provide other related services such as preparation of transfer documents and updating investor records. Bankers Funds activities involve dealing with money on a continuous basis primarily with respect to buying and selling units, paying for investment made, receiving the proceeds on the sale of investments and discharging its obligations towards operating expenses. A funds banker therefore plays a crucial role with respect to its financial dealings by holdings its bank accounts and providing it with remittance services. How does a mutual fund collect funds? Mutual funds offer units or shares to the public by issuing an offer document or prospectus. When an Asset management company or a Fund Sponsor wishes to launch a new scheme of a mutual fund, they are required to formulate the details of the scheme and register it with SEBI before announcing the scheme and inviting the investors to subscribe to the fund. The document containing the details of the new scheme that the AMC or the sponsor prepares for and circulates to the prospective investor is called the Prospectus or the Offer Document. This document contains: 1. The face value of each unit in terms of rupees 2. Objective of the scheme - 28 -

- 29. 3. How the funds collected will be invested and what securities or in what money market instruments 4. Minimum amount of subscription per application 5. Duration of the scheme 6. Who can apply for units 7. Date of launching the scheme and the date upto which applications will be received 8. Repurchase facility (if available) or arrangements proposed to be made for listing the units on Stock Exchanges. Each scheme of the mutual funds should be registered with the Securities and Exchange Board of India (SEBI). The funds give wide publicity through newspapers about their schemes and make arrangements for collecting the application money in important centers in one or more banks. After the last date for receiving the application is over, mutual funds collect all the applications, scrutinize them and allot units to the applicants and issue them unit certificates, which are evidence for owning the units. Mutual funds invest the funds collected from the public according to the investment objectives stated in the offer documents/ prospectus. Mutual funds are allowed to invest in a wide range of securities in different industries with a view to spreading the investment risk. - 29 -

- 30. Net Asset Value (NAV) The net asset value of the fund is the cumulative market value of the assets fund net of its liabilities. In other words, if the fund is dissolved or liquidated, by selling off all the assets in the fund, this is the amount that the shareholders would collectively own. This gives rise to the concept of net asset value per unit, which is the value, represented by the ownership of one unit in the - 30 -

- 31. fund. It is calculated simply by dividing the net asset value of the fund by the number of units. However, most people refer loosely to the NAV per unit as NAV, ignoring the “per unit”. We also abide by the same convention. The following are the regulatory requirements and accounting definitions laid down by SEBI ▪ NAV = Net Assets of the Scheme / Number of units outstanding Market value of investments + Receivables + Other Accrued Income + Other Assets – Accured expenses – Other Payables – Other Liabilities Number of units outstanding as at the NAV date THE SIMPLE FORMULA THAT A NEW INVESTOR CAN USE TO FIND OUT HIS EARNINGS IS : NAV = Principle + Profit – Cost(companies expenses) Calculation of NAV The most important part of the calculation is the valuation of the assets owned by the fund. Once it is calculated, the NAV is simply the net value of assets divided by the number of units outstanding. The detailed methodology for the calculation of the asset value is given below. Asset value is equal to Sum of market value of shares/debentures • Liquid assets/cash held, if any • Dividends/interest accrued Amount due on unpaid assets Expenses accrued but not paid - 31 -

- 32. Details on the above items For liquid shares/debentures, valuation is done on the basis of the last or closing market price on the principal exchange where the security is traded For illiquid and unlisted and/or thinly traded shares/debentures, the value has to be estimated. For shares, this could be the book value per share or an estimated market price if suitable benchmarks are available. For debentures and bonds, value is estimated on the basis of yields of comparable liquid securities after adjusting for illiquidity. The value of fixed interest bearing securities moves in a direction opposite to interest rate changes Valuation of debentures and bonds is a big problem since most of them are unlisted and thinly traded. This gives considerable leeway to the AMCs on valuation and some of the AMCs are believed to take advantage of this and adopt flexible valuation policies depending on the situation. Interest is payable on debentures/bonds on a periodic basis say every 6 months. But, with every passing day, interest is said to be accrued, at the daily interest rate, which is calculated by dividing the periodic interest payment with the number of days in each period. Thus, accrued interest on a particular day is equal to the daily interest rate multiplied by the number of days since the last interest payment date. Usually, dividends are proposed at the time of the Annual General meeting and become due on the record date. There is a gap between the dates on which it becomes due and the actual payment date. In the intermediate period, it is deemed to be “accrued”. Expenses including management fees, custody charges etc. are calculated on a daily basis. A funds NAV is affected by four factors: ▪ Purchase and sale of investment securities ▪ Valuation of all securities held - 32 -

- 33. ▪ Other assets and liabilities ▪ Units sold or redeemed Regulatory Aspects Schemes of a Mutual Fund The asset management company shall launch no scheme unless the trustees approve such scheme and a copy of the offer document has been filed with the Board. Every mutual fund shall along with the offer document of each scheme pay filing fees. The offer document shall contain disclosures which are adequate in order to enable the investors to make informed investment decision including the disclosure on maximum investments proposed to be made by the scheme in the listed securities of the group companies of the sponsor A close-ended scheme shall be fully redeemed at the end of the maturity period. “Unless a majority of the unit holders otherwise decide for its rollover by passing a resolution”. The mutual fund and asset management company shall be liable to refund the application money to the applicants,- (i) If the mutual fund fails to receive the minimum subscription amount referred to in clause (a) of sub- regulation (1); (ii) If the moneys received from the applicants for units are in excess of subscription as referred to in clause (b) of sub-regulation (1). The asset management company shall issue to the applicant whose application has been accepted, unit certificates or a statement of accounts specifying the number of units allotted to the applicant as soon as possible but not later than six weeks - 33 -

- 34. from the date of closure of the initial subscription list and or from the date of receipt of the request from the unit holders in any open ended scheme. Rules Regarding Advertisement: The offer document and advertisement materials shall not be misleading or contain any statement or opinion, which are incorrect or false. Investment Objectives And Valuation Policies: The price at which the units may be subscribed or sold and the price at which such units may at any time be repurchased by the mutual fund shall be made available to the investors. General Obligations: Every asset management company for each scheme shall keep and maintain proper books of accounts, records and documents, for each scheme so as to explain its transactions and to disclose at any point of time the financial position of each scheme and in particular give a true and fair view of the state of affairs of the fund and intimate to the Board the place where such books of accounts, records and documents are maintained. The financial year for all the schemes shall end as of March 31 of each year. Every mutual fund or the asset management company shall prepare in respect of each financial year an annual report and annual statement of accounts of the schemes and the fund as specified in Eleventh Schedule. Every mutual fund shall have the annual statement of accounts audited by an auditor who is not in any way associated with the auditor of the asset management company. - 34 -

- 35. Procedure For Action In Case Of Default: On and from the date of the suspension of the certificate or the approval, as the case may be, the mutual fund, trustees or asset management company, shall cease to carry on any activity as a mutual fund, trustee or asset management company, during the period of suspension, and shall be subject to the directions of the Board with regard to any records, documents, or securities that may be in its custody or control, relating to its activities as mutual fund, trustees or asset management company. Restrictions On Investments: A mutual fund scheme shall not invest more than 15% of its NAV in debt instruments issued by a single issuer, which are rated not below investment grade by a credit rating agency authorized to carry out such activity under the Act. Such investment limit may be extended to 20% of the NAV of the scheme with the prior approval of the Board of Trustees and the Board of asset management company. A mutual fund scheme shall not invest more than 10% of its NAV in unrated debt instruments issued by a single issuer and the total investment in such instruments shall not exceed 25% of the NAV of the scheme. All such - 35 -

- 36. investments shall be made with the prior approval of the Board of Trustees and the Board of asset management company. No mutual fund under all its schemes should own more than ten per cent of any company’s paid up capital carrying voting rights. Such transfers are done at the prevailing market price for quoted instruments on spot basis. The securities so transferred shall be in conformity with the investment objective of the scheme to which such transfer has been made. A scheme may invest in another scheme under the same asset management company or any other mutual fund without charging any fees, provided that aggregate interscheme investment made by all schemes under the same management or in schemes under the management of any other asset management company shall not exceed 5% of the net asset value of the mutual fund. The initial issue expenses in respect of any scheme may not exceed six per cent of the funds raised under that scheme. Every mutual fund shall buy and sell securities on the basis of deliveries and shall in all cases of purchases, take delivery of relative securities and in all cases of sale, deliver the securities and shall in no case put itself in a position whereby it has to make short sale or carry forward transaction or engage in badla finance. Every mutual fund shall, get the securities purchased or transferred in the name of the mutual fund on account of the concerned scheme, wherever investments are intended to be of long-term nature. Pending deployment of funds of a scheme in securities in terms of investment objectives of the scheme a mutual fund can invest the funds of the scheme in short term deposits of scheduled commercial banks. No mutual fund scheme shall make any investment in; i. Any unlisted security of an associate or group company of the sponsor; or ii. Any security issued by way of private placement by an associate or group company of the sponsor; or - 36 -

- 37. iii. The listed securities of group companies of the sponsor which is in excess of 30% of the net assets [of all the schemes of a mutual fund] No mutual fund scheme shall invest more than 10 per cent of its NAV in the equity shares or equity related instruments of any company. Provided that, the limit of 10 per cent shall not be applicable for investments in index fund or sector or industry specific scheme. A mutual fund scheme shall not invest more than 5% of its NAV in the equity shares or equity related investments in case of open-ended scheme and 10% of its NAV in case of close-ended scheme. Types of Mutual Funds Mutual fund schemes may be classified on the basis of its structure and its investment objective. By Structure: Open-ended Funds - 37 -

- 38. An open-end fund is one that is available for subscription all through the year. These do not have a fixed maturity. Investors can conveniently buy and sell units at Net Asset Value (“NAV”) related prices. The key feature of open-end schemes is liquidity. Closed-ended Funds A closed-end fund has a stipulated maturity period which generally ranging from 3 to 15 years. The fund is open for subscription only during a specified period. Investors can invest in the scheme at the time of the initial public issue and thereafter they can buy or sell the units of the scheme on the stock exchanges where they are listed. In order to provide an exit route to the investors, some close-ended funds give an option of selling back the units to the Mutual Fund through periodic repurchase at NAV related prices. SEBI Regulations stipulate that at least one of the two exit routes is provided to the investor. Interval Funds Interval funds combine the features of open-ended and close-ended schemes. They are open for sale or redemption during pre-determined intervals at NAV related prices. By Investment Objective: Growth Funds The aim of growth funds is to provide capital appreciation over the medium to long- term. Such schemes normally invest a majority of their corpus in equities. It has been proven that returns from stocks, have outperformed most other kind of investments held over the long term. Growth schemes are ideal for investors having a long-term outlook seeking growth over a period of time. Income Funds The aim of income funds is to provide regular and steady income to investors. Such schemes generally invest in fixed income securities such as bonds, corporate - 38 -

- 39. debentures and Government securities. Income Funds are ideal for capital stability and regular income. Balanced Funds The aim of balanced funds is to provide both growth and regular income. Such schemes periodically distribute a part of their earning and invest both in equities and fixed income securities in the proportion indicated in their offer documents. In a rising stock market, the NAV of these schemes may not normally keep pace, or fall equally when the market falls. These are ideal for investors looking for a combination of income and moderate growth. Money Market Funds The aim of money market funds is to provide easy liquidity, preservation of capital and moderate income. These schemes generally invest in safer short-term instruments such as treasury bills, certificates of deposit, commercial paper and inter-bank call money. Returns on these schemes may fluctuate depending upon the interest rates prevailing in the market. These are ideal for Corporate and individual investors as a means to park their surplus funds for short periods. Load Funds A Load Fund is one that charges a commission for entry or exit. That is, each time you buy or sell units in the fund, a commission will be payable. Typically entry and exit loads range from 1% to 2%. It could be worth paying the load, if the fund has a good performance history. No-Load Funds A No-Load Fund is one that does not charge a commission for entry or exit. That is, no commission is payable on purchase or sale of units in the fund. The advantage of a no load fund is that the entire corpus is put to work. Other Schemes: - 39 -

- 40. Tax Saving Schemes These schemes offer tax rebates to the investors under specific provisions of the Indian Income Tax laws as the Government offers tax incentives for investment in specified avenues. Investments made in Equity Linked Savings Schemes (ELSS) and Pension Schemes are allowed as deduction u/s 88 of the Income Tax Act, 1961. The Act also provides opportunities to investors to save capital gains u/s 54EA and 54EB by investing in Mutual Funds, provided the capital asset has been sold prior to April 1, 2000 and the amount is invested before September 30, 2000. Special Schemes Industry Specific Schemes Industry Specific Schemes invest only in the industries specified in the offer document. The investment of these funds is limited to specific industries like InfoTech, FMCG, and Pharmaceuticals etc. Index Schemes Index Funds attempt to replicate the performance of a particular index such as the BSE Sensex or the NSE 50 Sectoral Schemes Sectoral Funds are those, which invest exclusively in a specified industry or a group of industries or various segments such as ‘A’ Group shares or initial public offerings. Benefits of Mutual Fund investment Professional Management Mutual Funds provide the services of experienced and skilled professionals, backed by a dedicated investment research team that analyses the performance and - 40 -

- 41. prospects of companies and selects suitable investments to achieve the objectives of the scheme. Diversification Mutual Funds invest in a number of companies across a broad cross-section of industries and sectors. This diversification reduces the risk because seldom do all stocks decline at the same time and in the same proportion. You achieve this diversification through a Mutual Fund with far less money than you can do on your own. Convenient Administration Investing in a Mutual Fund reduces paperwork and helps you avoid many problems such as bad deliveries, delayed payments and follow up with brokers and companies. Mutual Funds save your time and make investing easy and convenient. Return Potential Over a medium to long-term, Mutual Funds have the potential to provide a higher return as they invest in a diversified basket of selected securities. Low Costs Mutual Funds are a relatively less expensive way to invest compared to directly investing in the capital markets because the benefits of scale in brokerage, custodial and other fees translate into lower costs for investors. Liquidity In open-end schemes, the investor gets the money back promptly at net asset value related prices from the Mutual Fund. In closed-end schemes, the units can be sold - 41 -

- 42. on a stock exchange at the prevailing market price or the investor can avail of the facility of direct repurchase at NAV related prices by the Mutual Fund. Transparency You get regular information on the value of your investment in addition to disclosure on the specific investments made by your scheme, the proportion invested in each class of assets and the fund manager’s investment strategy and outlook. Flexibility Through features such as regular investment plans, regular withdrawal plans and dividend reinvestment plans, you can systematically invest or withdraw funds according to your needs and convenience. Affordability Investors individually may lack sufficient funds to invest in high-grade stocks. A mutual fund because of its large corpus allows even a small investor to take the benefit of its investment strategy. Choice of Scheme Mutual Funds offer a family of schemes to suit your varying needs over a lifetime. Well Regulated All Mutual Funds are registered with SEBI and they function within the provisions of strict regulations designed to protect the interests of investors. The operations of Mutual Funds are regularly monitored by SEBI Limitations of mutual funds - 42 -

- 43. It is 100% true that globally, most mutual fund managers underperform the asset class that they are investing in .This under performance is largely the result of limitations inherent in the concept of mutual funds. These limitations are as follows: Entry and exit costs: Mutual funds are a victim of their own success. When a large body like a fund invests in shares, the concentrated buying or selling often results in adverse price movements i.e. at the time of buying, the fund ends up paying a higher price and while selling it realizes a lower price. This problem is especially severe in emerging markets like India, where, excluding a few stocks, even the stocks in the Sensex are not liquid, let alone stocks in the NSE 50 or the CRISIL 500. Wait time before investment: It takes time for a mutual fund to invest money. Unfortunately, most mutual funds receive money when markets are in a boom phase and investors are willing to try out mutual funds. Since it is difficult to invest all funds in one day, there is some money waiting to be invested. Further, there may be a time lag before investment opportunities are identified. This ensures that the fund underperforms the index. Fund management costs: The costs of the fund management process are deducted from the fund. This includes marketing and initial costs deducted at the time of entry itself, called “load”. Then there is the annual asset management fee and expenses, together called the expense ratio. Usually, the former is not counted while measuring performance, while the latter is. A standard 2% expense ratio means that, everything else being equal, the fund manager underperforms the benchmark index by an equal amount. Cost of churn: The portfolio of a fund does not remain constant. The extent to which the portfolio changes is a function of the style of the individual fund manager i.e. whether he is a - 43 -

- 44. buy and hold type of manager or one who aggressively churns the fund. It is also dependent on the volatility of the fund size i.e. whether the fund constantly receives fresh subscriptions and redemptions. Such portfolio changes have associated costs of brokerage, custody fees, registration fees etc. which lowers the portfolio return commensurately. Change of index composition: World over, the indices keep changing to reflect changing market conditions. There is an inherent survivorship bias in this process, with the bad stocks weeded out and replaced by emerging blue chips. This is a severe problem in India with the Sensex having been changed twice in the last 5 years, with each change being quite substantial. Another reason for change index composition is Mergers & Acquisitions. Tendency to take conformist decisions: From the above points, it is quite clear that the only way a fund can beat the index is through investment of some part of its portfolio in some shares where it gets excellent returns, much more than the index. This will pull up the overall average return. In order to obtain such exceptional returns, the fund manager has to take a strong view and invest in some uncommon or unfancied investment options. They follow the principle “No fund manager ever got fired for investing in Hindustan Lever” ie if something goes wrong with an unusual investment, the fund manager will be questioned but if anything goes wrong with the blue chip, then you can always blame it on the “environment” or “uncontrollable factors” knowing fully well that there are many other fund managers who have made the same decision. Unfortunately, if the fund manager does the same thing as several others of his class, chances are that he will produce average results. This does not mean that if a fund manager takes “active” views and invests in heavily researched “uncommon” ideas, the fund will necessarily outperform the index. Different plans that Mutual Funds offer Growth Plan and Dividend Plan - 44 -

- 45. A growth plan is a plan under a scheme wherein the returns from investments are reinvested and very few income distributions, if any, are made. The investor thus only realises capital appreciation on the investment. This plan appeals to investors in the high income bracket. Under the dividend plan, income is distributed from time to time. This plan is ideal to those investors requiring regular income. Dividend Reinvestment Plan Dividend plans of schemes carry an additional option for reinvestment of income distribution. This is referred to as the dividend reinvestment plan. Under this plan, dividends declared by a fund are reinvested on behalf of the investor, thus increasing the number of units held by the investors. Automatic Investment Plan Under the Automatic Investment Plan (AIP) also called Systematic Investment Plan (SIP), the investor is given the option for investing in a specified frequency of months in a specified scheme of the Mutual Fund for a constant sum of investment. AIP allows the investors to plan their savings through a structured regular monthly savings program. Automatic Withdrawal Plan Under the Automatic Withdrawal Plan (AWP) also called Systematic Withdrawal Plan (SWP), a facility is provided to the investor to withdraw a pre-determined amount from his fund at a pre-determined interval Risk vs Reward The first thing that has to be kept in mind before investing is that when you invest in mutual funds, there is no guarantee that the investor will end up with more money when you withdraw your investment than what you started out with. That is the potential of loss is always there. The loss of value in your investment is what is considered risk in investing. Even so, the opportunity for investment growth that is possible through investments in mutual funds far exceeds that concern for most investors. - 45 -

- 46. At the cornerstone of investing is the basic principal that the greater the risk you take, the greater the potential reward. Or stated in another way, you get what you pay for and you get paid a higher return only when you’re willing to accept more volatility. Risk then, refers to the volatility—the up and down activity in the markets and individual issues that occurs constantly over time. This volatility can be caused by a number of factors—interest rate changes, inflation or general economic conditions. It is this variability, uncertainty and potential for loss, that causes investors to worry. We all fear the possibility that a stock we invest in will fall substantially. But it is this very volatility that is the exact reason that you can expect to earn a higher long-term return from these investments than from a savings account. Different types of mutual funds have different levels of volatility or potential price change, and those with the greater chance of losing value are also the funds that can produce the greater returns for you over time. So risk has two sides: it causes the value of your investments to fluctuate, but it is precisely the reason you can expect to earn higher returns. - 46 -

- 47. Risk Tolerance/Return Expected Focus Suitable Products Benefits offered by MFs Low Debt Bank/ Company FD, Debt based Funds Liquidity, Better Post- Tax returns Medium Partially Debt, Partially Equity Balanced Funds, Some Diversified Equity Funds and some debt Funds, Mix of shares and Fixed Deposits Liquidity, Better Post- Tax returns, Better Management, Diversification High Equity Capital Market, Equity Funds (Diversified as well as Sector) Diversification, Expertise in stock picking, Liquidity, Tax free dividends Types of risks All investments involve some form of risk. These common types of risk need to be considered and evaluated against potential rewards when an investor selects an investment. Market Risk - 47 -

- 48. At times the prices or yields of all the securities in a particular market rise or fall due to broad outside influences. When this happens, the stock prices of both an outstanding, highly profitable company and a fledgling corporation may be affected. This change in price is due to “market risk”. Also known as systematic risk. Inflation Risk Sometimes referred to as “loss of purchasing power.” Whenever inflation rises forward faster than the earnings on investment, there is the risk that investor actually be able to buy less, not more. Inflation risk also occurs when prices rise faster than your returns. Credit Risk In short, how stable is the company or entity to which an investor lends his money when he invests? How certain are investors that they will be able to pay the interest they promised, or repay their principal when the investment matures? Interest Rate Risk Changing interest rates affect both equities and bonds in many ways. Investors are reminded that “predicting” which way rates will go is rarely successful. A diversified portfolio can help in offsetting these changes. Exchange risk A number of companies generate revenues in foreign currencies and may have investments or expenses also denominated in foreign currencies. Changes in exchange rates may, therefore, have a positive or negative impact on companies which in turn would have an effect on the investment of the fund. Investment Risks - 48 -

- 49. The sectoral fund schemes, investments will be predominantly in equities of select companies in the particular sectors. Accordingly, the NAV of the schemes are linked to the equity performance of such companies and may be more volatile than a more diversified portfolio of equities. Changes in the Government Policy Changes in Government policy especially in regard to the tax benefits may impact the business prospects of the companies leading to an impact on the investments made by the fund.Effect of loss of key professionals and inability to adapt business to the rapid technological change. An industries’ key asset is often the personnel who run the business i.e. intellectual properties of the key employees of the respective companies. Given the ever-changing complexion of few industries and the high obsolescence levels, availability of qualified, trained and motivated personnel is very critical for the success of industries in few sectors. It is, therefore, necessary to attract key personnel and also to retain them to meet the changing environment and challenges the sector offers. Failure or inability to attract/retain such qualified key personnel may impact the prospects of the companies in the particular sector in which the fund invests. Market Trends Alone UTI with just one scheme in 1964, now competes with as many as 400 odd products and 34 players in the market. In spite of the stiff competition and losing market share, UTI still remains a formidable force to reckon with.Last six years have been the most turbulent as well as exiting ones for the industry. New - 49 -

- 50. players have come in, while others have decided to close shop by either selling off or merging with others. Product innovation is now passé with the game shifting to performance delivery in fund management as well as service. Those directly associated with the fund management industry like distributors, registrars and transfer agents, and even the regulators have become more mature and responsible. The industry is also having a profound impact on financial markets. While UTI has always been a dominant player on the bourses as well as the debt markets, the new generation of private funds which have gained substantial mass are now seen flexing their muscles. Fund managers, by their selection criteria for stocks have forced corporate governance on the industry. By rewarding honest and transparent management with higher valuations, a system of risk-reward has been created where the corporate sector is more transparent then before. Funds have shifted their focus to the recession free sectors like pharmaceuticals, FMCG and technology sector. Funds performances are improving. Funds collection, which averaged at less than Rs100bn per annum over five-year period spanning 1993-98 doubled to Rs210bn in 1998-99. In the current year mobilization till now have exceeded Rs300bn. Total collection for the current financial year ending March 2000 is expected to reach Rs450bn. What is particularly noteworthy is that bulk of the mobilization has been by the private sector mutual funds rather than public sector mutual funds. Indeed private MFs saw a net inflow of Rs. 7819.34 crore during the first nine months of the year as against a net inflow of Rs.604.40 crore in the case of public sector funds. Mutual funds are now also competing with commercial banks in the race for retail investor’s savings and corporate float money. The power shift towards mutual funds has become obvious. The coming few years will show that the traditional saving avenues are losing out in the current scenario. Many investors are realizing that investments in savings accounts are as good as locking up their deposits in a closet. The fund mobilization trend by mutual funds in the current year - 50 -

- 51. indicates that money is going to mutual funds in a big way. The collection in the first half of the financial year 1999-2000 matches the whole of 1998-99. India is at the first stage of a revolution that has already peaked in the U.S. The U.S. boasts of an Asset base that is much higher than its bank deposits. In India, mutual fund assets are not even 10% of the bank deposits, but this trend is beginning to change. Recent figures indicate that in the first quarter of the current fiscal year mutual fund assets went up by 115% whereas bank deposits rose by only 17%. This is forcing a large number of banks to adopt the concept of narrow banking wherein the deposits are kept in Gilts and some other assets, which improves liquidity and reduces risk. The basic fact lies that banks cannot be ignored and they will not close down completely. Their role as intermediaries cannot be ignored. It is just that Mutual Funds are going to change the way banks do business in the future. - 51 -

- 52. Banks v/s Mutual Funds BANKS MUTUAL FUNDS Returns Low Better Administrative exp. High Low Risk Low Moderate Investment optionsLess More Network High penetration Low but improving Liquidity At a cost Better Quality of assets Not transparent Transparent Interest calculationMinimum balance between 10th . & 30th . Of every month Everyday Guarantee Maximum Rs.1 lakh on deposits None Recent trends in mutual fund industry The most important trend in the mutual fund industry is the aggressive expansion of the foreign owned mutual fund companies and the decline of the companies floated by nationalized banks and smaller private sector players. Many nationalized banks got into the mutual fund business in the early nineties and got off to a good start due to the stock market boom prevailing then. These banks did not really understand the mutual fund business and they just viewed it as another kind of banking activity. Few hired specialized staff and generally chose to transfer staff from the parent organizations. The performance of most of the schemes floated by these funds was not good. Some schemes had offered guaranteed returns and their parent organizations had to bail out these AMCs by paying large amounts of money as the difference between the guaranteed - 52 -

- 53. and actual returns. The service levels were also very bad. Most of these AMCs have not been able to retain staff, float new schemes etc. and it is doubtful whether, barring a few exceptions, they have serious plans of continuing the activity in a major way. The experience of some of the AMCs floated by private sector Indian companies was also very similar. They quickly realized that the AMC business is a business, which makes money in the long term and requires deep- pocketed support in the intermediate years. Some have sold out to foreign owned companies, some have merged with others and there is general restructuring going on. The foreign owned companies have deep pockets and have come in here with the expectation of a long haul. They can be credited with introducing many new practices such as new product innovation, sharp improvement in service standards and disclosure, usage of technology, broker education and support etc. In fact, they have forced the industry to upgrade itself and service levels of organizations like UTI have improved dramatically in the last few years in response to the competition provided by these. - 53 -

- 54. Global Scenario Some basic facts- The money market mutual fund segment has a total corpus of $ 1.48 trillion in the U.S. against a corpus of $ 100 million in India. Out of the top 10 mutual funds worldwide, eight are bank- sponsored. Only Fidelity and Capital are non-bank mutual funds in this group. In the U.S. the total number of schemes is higher than that of the listed companies while in India we have just 277 schemes Internationally, mutual funds are allowed to go short. In India fund managers do not have such leeway. In the U.S. about 9.7 million households will manage their assets on- line by the year 2003, such a facility is not yet of avail in India. On- line trading is a great idea to reduce management expenses from the current 2 % of total assets to about 0.75 % of the total assets. 72% of the core customer base of mutual funds in the top 50-broking firms in the U.S. are expected to trade on-line by 2003. Internationally, on- line investing continues its meteoric rise. Many have debated about the success of e- commerce and its breakthroughs, but it is true that this - 54 -

- 55. aspect of technology could and will change the way financial sectors function. However, mutual funds cannot be left far behind. They have realized the potential of the Internet and are equipping themselves to perform better. In fact in advanced countries like the U.S.A, mutual funds buy- sell transactions have already begun on the Net, while in India the Net is used as a source of Information. Such changes could facilitate easy access, lower intermediation costs and better services for all. A research agency that specializes in internet technology estimates that over the next four years Mutual Fund Assets traded on- line will grow ten folds from $ 128 billion to $ 1,227 billion; whereas equity assets traded on-line will increase during the period from $ 246 billion to $ 1,561 billion. This will increase the share of mutual funds from 34% to 40% during the period. Such increases in volumes are expected to bring about large changes in the way Mutual Funds conduct their business. Here are some of the basic changes that have taken place since the advent of the Net. Lower Costs: Distribution of funds will fall in the online trading regime by 2003 . Mutual funds could bring down their administrative costs to 0.75% if trading is done on- line. As per SEBI regulations , bond funds can charge a maximum of 2.25% and equity funds can charge 2.5% as administrative fees. Therefore if the administrative costs are low , the benefits are passed down and hence Mutual Funds are able to attract mire investors and increase their asset base. Better advice: Mutual funds could provide better advice to their investors through the Net rather than through the traditional investment routes where there is an additional channel to deal with the Brokers. Direct dealing with the fund could help the investor with their financial planning. In India , brokers could get more Net savvy than investors and could help the investors with the knowledge through get from the Net. - 55 -

- 56. New investors would prefer online : Mutual funds can target investors who are young individuals and who are Net savvy, since servicing them would be easier on the Net. • India has around 1.6 million net users who are prime target for these funds and this could just be the beginning. The Internet users are going to increase dramatically and mutual funds are going to be the best beneficiary. With smaller administrative costs more funds would be mobilized .A fund manager must be ready to tackle the volatility and will have to maintain sufficient amount of investments which are high liquidity and low yielding investments to honor redemption. Net based advertisements: There will be more sites involved in ads and promotion of mutual funds. In the U.S. sites like AOL offer detailed research and financial details about the functioning of different funds and their performance statistics. It is witnessing a genesis in this area. There are many sites such as indiainfoline.com and indiafn.com that are doing something similar and providing advice to investors regarding their investments. In the U.S. most mutual funds concentrate only on financial funds like equity and debt. Some like real estate funds and commodity funds also take an exposure to physical assets. The latter type of funds are preferred by corporate’s who want to hedge their exposure to the commodities they deal with. For instance, a cable manufacturer who needs 100 tons of Copper in the month of January could buy an equivalent amount of copper by investing in a copper fund. For Example, Permanent Portfolio Fund, a conservative U.S. based fund invests a fixed percentage of it’s corpus in Gold, Silver, Swiss francs, specific stocks on various bourses around the world, short –term and long-term U.S. treasuries etc. In U.S.A. apart from bullion funds there are copper funds, precious metal funds and real estate funds (investing in real estate and other related assets as well.).In India, the Canada based Dundee mutual fund is planning to launch a gold and a real estate fund before the year-end. - 56 -

- 57. In developed countries like the U.S.A there are funds to satisfy everybody’s requirement, but in India only the tip of the iceberg has been explored. In the near future India too will concentrate on financial as well as physical functions. Future Scenario The asset base will continue to grow at an annual rate of about 30 to 35 % over the next few years as investor’s shift their assets from banks and other traditional avenues. Some of the older public and private sector players will either close shop or be taken over. Out of ten public sector players five will sell out, close down or merge with stronger players in three to four years. In the private sector this trend has already started with two mergers and one takeover. Here too some of them will down their shutters in the near future to come. But this does not mean there is no room for other players. The market will witness a flurry of new players entering the arena. There will be a large number of offers from various asset management companies in the time to come. Some big names like Fidelity, Principal, Old Mutual etc. are looking at Indian market seriously. One - 57 -

- 58. important reason for it is that most major players already have presence here and hence these big names would hardly like to get left behind. A perceptible change is sweeping across the mutual fund landscape in India. Factors such as changing investors' needs and their appetite for risk, emergence of Internet as a powerful service platform, and above all the growing commoditization of mutual fund products are acting as major catalysts putting pressure on industry players to formulate strategies to stay the course. Increased deregulation of the financial markets in the country coupled with the introduction of derivative products offers tremendous scope for the industry to design and sell innovative schemes to suit individual customer needs. As it is being increasingly felt, with the commoditization of products looking imminent, service to investor and performance would be major differentiators. Union Budget 2003 - 04 - Impact on MF Industry MF Industry The Budget 2003-04 has brought some cheers to the mutual fund industry. The budget has following proposals for the MF investors: Investors, once again, will get the tax-free dividends from MF units. Dividends from Equity Funds will be tax free While Debt Mutual Funds have to pay distribution tax amounting to 12.5 percent of the dividends declared. Long-term capital gains tax on equity funds remains at 20 per cent with indexation, or 10 per cent, whichever is lower. Investments made in listed equity shares, for one year from April 2003, will be exempted from long-term capital gains tax. - 58 -

- 59. Administered interest rates on PPF and small-savings have been reduced by 1 per cent. Interest on Relief and Savings bonds will also be reset accordingly. This is likely to give a boost to the debt market. Personal Taxation On the taxation front Budget 2003-04 has the following proposals – Standard deduction for income tax raised to 40 % or Rs 30,000 whichever is lower, on income up to Rs 5 Lakh p.a. Standard deduction for income exceeding Rs 5 Lakhs will be Rs 20,000. Exemption under Section 80L of the Income Tax Act increased to Rs 15,000, which includes Rs 3000 exclusively for interest from Government securities. Surcharge on corporate tax halved to 2.5 % from 5 %. 10 % surcharge for income above Rs 8.5 Lakh p.a. Tax rebate u/s 88 to include expenditure on children’s education up to Rs 12000 per child for a maximum of 2 children. Tax rebate for senior citizens u/s 88 hiked from Rs 15,000 to Rs 20,000. Tax exemption on the interest payments on housing loans remains unaltered to Rs 1.5 Lakh. - 59 -

- 60. Dividend tax abolished in the hand of the taxpayer. Long Term Capital Gains on shares removed. VRS payments up to Rs 5 Lakh exempt from tax. Budget meets MF industry expectation In his maiden Budget today, the finance minister Jaswant Singh did not disappoint the mutual fund (MF) industry as the announcements were in-line with the industry`s expectations. Jaswant Singh said in his Budget speech, `We need to promote investment in the industrial sector and improve the debt and equity markets. We are also committed to bringing small investors back to the equity markets by restoring their confidence.` To ensure this, the Budget has proposed that dividends will be tax-free in the hands of shareholders from April 1, 2003. Domestic companies will pay a 12.50 per cent dividend distribution tax. While mutual funds, including UTI-II, renamed UTI Mutual Fund, will also pay dividend distribution tax, equity-oriented schemes are proposed to be exempted from the purview of tax for one year. UTI-I, however, will be exempt from dividend distribution tax. To give a further fillip to capital markets, the Budget also proposes to exempt all listed equities acquired on or after March 1, 2003, and sold after the - 60 -