Natural gas 2018

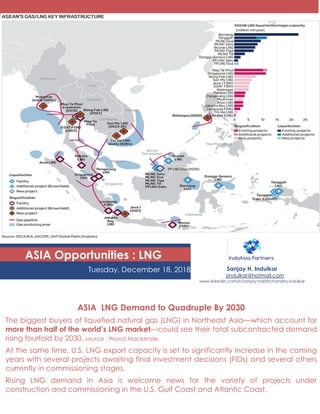

- 1. Asian LNG Demand To Quadruple By 2030 Sanjay H. Indulkar sindulkar@hotmail.com www.linkedin.com/in/sanjay-harishchandra-indulkar ASIA Opportunities : LNG Tuesday, December 18, 2018 ASIA LNG Demand to Quadruple By 2030 The biggest buyers of liquefied natural gas (LNG) in Northeast Asia—which account for more than half of the world’s LNG market—could see their total subcontracted demand rising fourfold by 2030, source : Wood Mackenzie. At the same time, U.S. LNG export capacity is set to significantly increase in the coming years with several projects awaiting final investment decisions (FIDs) and several others currently in commissioning stages. Rising LNG demand in Asia is welcome news for the variety of projects under construction and commissioning in the U.S. Gulf Coast and Atlantic Coast.

- 2. Source : International Energy Agency WORLD OUTLOOK Natural Gas LNG appears as the main driver of inter- regional natural gas trade growth, sustained by strong export capacity expansion.

- 3. The People’s Republic of China becomes the world’s leading importer of natural gas. Driven by continuous economic growth and strong policy support to curb air pollution, China accounts for 37% of the global increase in natural gas consumption between 2017 and 2023, more than any other country. As domestic production cannot keep pace, China becomes the world’s largest natural gas importer by 2019 and with 171 billion cubic meters (BCM) of imports by 2023, is mostly supplied by liquefied natural gas (LNG). Compared with the previous decade, the industrial sector takes the lead from power generation as the main driver of global growth in demand for natural gas. Emerging markets, primarily in Asia, account for the bulk of this increase with uses as a fuel for industrial processes as well as for feedstock for chemicals and fertilizers. Industrial gas demand also grows in major producing regions, such as North America and the Middle East, to support expansion of their petrochemicals sectors. The United States is the source of much of the growth in natural gas production and most of the additional LNG exports. The United States, already the world’s top producer, accounts for almost 45% of the growth in global production and nearly three-quarters of LNG export growth. Development of destination-free and gas-indexed US LNG exports provides additional flexibility to the expanding market. Three major transformations are set to shape the evolution of Global Natural Gas Markets In The Next Five Years.

- 4. Asian LNG Demand To Quadruple By 2030 China and emerging Asian markets drive growth in global natural gas consumption growth 2017 was a year of strong growth for natural gas, mainly driven by China. Global natural gas demand grew by 3%, the highest increase since 2010. China, where demand grew 15%, accounted for nearly a third of the global increase, driven by a determined policy effort to improve air quality through coal to gas boiler conversions in the residential and industrial sectors. This led to an unprecedented surge in LNG of 1.6% throughout the forecast period. Emerging Asian markets, led by China, account for more than half of the growth in global natural gas consumption to 2023. imports, placing China as the world’s second largest LNG importer after Japan. The global natural gas market passes the 4 trillion cubic meters (TCM) mark by 2022, China becomes the largest natural gas importing country in the world by 201 leading emerging Asian gas market growth. An increasing role for natural gas – defined as a clean energy source – in every sector of China’s economy is backed by strong policy support from the 13th Five-Year Plan. China’s demand grows at an average of 8% per year throughout the forecast period, accounting for over a third of global demand increase. The share of imports in China’s supply rises from 39% to 45% over the forecast period. Other emerging Asian economies increase their natural gas consumption for industry (including fertilizers and petrochemicals) and power generation, and develop their domestic markets and infrastructure to import more LN figure ES1

- 5. Natural gas supplies 22% of the energy used worldwide, and makes up nearly a quarter of electricity generation, as well as playing a crucial role as a feedstock for industry. Natural gas is a versatile fuel and its growth is linked in part to its environmental benefits relative to other fossil fuels, particularly for air quality as well as greenhouse gas emissions Houston-based LNG player Tellurian Inc. is trying to change the way the LNG business evolves. Instead of pricing its LNG on the Henry Hub bench-mark, it will price LNG on the Japan-Korea-Marker (JKM), a benchmark price assessment developed by commodities data provider S&P Global Platts, which includes spot physical cargoes delivered ex-ship into Japan, South Korea, China and Taiwan. Small-scale Asian LNG projects facing big challenges southeast Asia, the world's third most populous region and its fastest growing LNG demand center, with consumption due to nearly quadruple from 10.8 million MT in 2017 to 40 million MT/year by 2025, The disperse nature of Southeast Asia's geography and energy demand, scattered over thousands of islands, means smaller LNG ships, small-scale regasification terminals and break bulk LNG hubs would be required to deliver the gas molecules to some of its future customers. • A Fraction of Demand • Diseconomies of Scale • Domestic Price Challenge • Clustering Demand

- 6. With an annual growth of 10% in 2017 to 290 million tons (Mt) and 8.3% in the first half of 2018Liquified Natural Gas (LNG) demand is rising faster than expected. Accounting for 44% of global demand growth in 2017, China is the main driver of the growth as the government has made natural gas a key policy choice to reduce air pollution and restructure its high-carbon energy mix. Demand from emerging economies has also boomed in past years. LNG prices have soared since the fourth quarter of 2017 with spot deliveries above $10/million British thermal units (MBTU) in summer 2018 and above $12/MBTU for forthcoming winter delivery This is changing as investment in new LNG export capacity is coming. A final investment decision (FID) on a huge project (LNG Canada) was taken at the beginning of October and several projects are close to FID. Qatar in pole position Second wave of US LNG projects under way. Russia on the starting block Mozambique finally coming Papua New Guinea’s expansion close to FID Canada: tax exemptions help Nigeria’s LNG partners working hard on LNG expansion The Next Wave of Global LNG Investment Conclusion: The new wave of global LNG projects is taking shape Investment in new LNG projects is coming back worldwide, with projects advancing in Qatar, Russia, Mozambique, Papua New Guinea, the USA and Canada. some 185 MTPA of capacity (excluding expansions from the first wave of US LNG projects) that promoters expect to sanction before the end of 2019 and that will be commissioned by 2022-2024. That may ease a rapid tightening of the LNG market in the early 2020s, although delays in FID and construction, and cancellations, cannot be ruled out

- 7. Traditionally, LNG has been used largely for power generation. However, this is changing as market conditions in traditional LNG-importing countries change and new importers with different dynamics join the market. The growth in demand for LNG used for base load power generation will be limited as gas in many major economies can’t compete with renewables. Rising renewable penetration will expand LNG’s role in providing flexible power generation to balance the electricity grid in many major economies. The use of LNG in the industrial and transport sectors will push up gas demand, particularly in Asia where environmental concerns are on the rise. The opportunity for LNG in base load power will be mostly in floating storage and regasification-based emerging markets that are plagued by power shortages. Diverse drivers to LNG demand

- 8. PAGE 4 How big is the demand growth? The world consumed 285MMt of LNG in 2017. The substantial expansion of global LNG trade in 2017 is unlikely to repeat in 2018 and further slowdown is expected in 2019-22. Global LNG demand is expected to reach 330MMtpa by 2022. Southeast Asia and Europe will drive a rebound in global LNG ―Lowering LNG prices during the early 2020s and accelerating infrastructure build-out in South Asia are the key to unlocking LNG demand in the region,‖ Evolving LNG purchase models Traditionally, LNG importers buy LNG via long-term, take-or-pay, and delivery location-fixed contracts. Japan, China, and India have all seen some progress in setting up the required trading platforms. . A supply shortage risk and price spike ahead? 30-33MMtpa of new capacity will be added from 2018-20. Australia has the last batch of projects to come on-stream before the end of 2018 but full ramp-up will take a couple of years. The boom in U.S. LNG supply will end in 2020. Global capacity will peak at 396MMtpa in 2021 and will begin to fall behind demand post 2025. To support further demand growth, final investment decisions (FID) on new supply projects will need to be made in the next few years to provide sufficient supply post 2025. Global LNG Demand/Supply-Capacity Balance