Filing of income tax return for financial year 2017

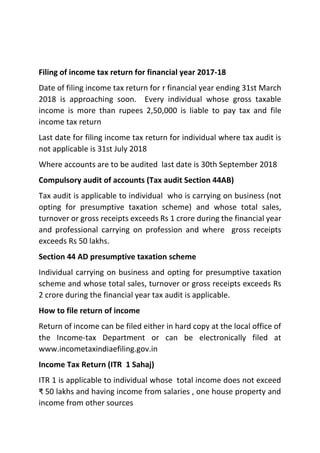

- 1. Filing of income tax return for financial year 2017-18 Date of filing income tax return for r financial year ending 31st March 2018 is approaching soon. Every individual whose gross taxable income is more than rupees 2,50,000 is liable to pay tax and file income tax return Last date for filing income tax return for individual where tax audit is not applicable is 31st July 2018 Where accounts are to be audited last date is 30th September 2018 Compulsory audit of accounts (Tax audit Section 44AB) Tax audit is applicable to individual who is carrying on business (not opting for presumptive taxation scheme) and whose total sales, turnover or gross receipts exceeds Rs 1 crore during the financial year and professional carrying on profession and where gross receipts exceeds Rs 50 lakhs. Section 44 AD presumptive taxation scheme Individual carrying on business and opting for presumptive taxation scheme and whose total sales, turnover or gross receipts exceeds Rs 2 crore during the financial year tax audit is applicable. How to file return of income Return of income can be filed either in hard copy at the local office of the Income-tax Department or can be electronically filed at www.incometaxindiaefiling.gov.in Income Tax Return (ITR 1 Sahaj) ITR 1 is applicable to individual whose total income does not exceed ₹ 50 lakhs and having income from salaries , one house property and income from other sources

- 2. ITR Form 2 is for Individuals having income exceed rupees 50,00,000 and having income from salaries, house property, capital gains and other sources ITR 3 It is applicable to an individual who is carrying on a proprietary business or profession. ITR 4 Also known as SUGAM is applicable to individuals who have opted for the presumptive taxation scheme Who is supposed to pay Advance Tax Tax payer having estimated tax liability of Rs. 10,000 or more is liable to pay advance tax. However, for senior citizen, an individual of the age of 60 years and above not having any income from business or profession is not liable to pay advance tax. An individual who is liable to pay advance tax is required to estimate his current income and pay advance tax accordingly Instalments of advance tax and due dates (Sec 211) For financial year 2017-18 1st instalment of 15 percent of advance tax is to be paid on or before the 15th June 2017 2nd Instalment of up to 45 percent of tax liability to be paid on or before the 15th September 2017. 3rd Instalment of up to 75 percent of the tax lability to be paid by 15th December 2017 4th instalment of 100 percent of tax liability to be paid on or before the 15th March 2018 For non payment of advance tax, tax payer has to pay interest on late payment Income tax rates for financial year 2017-18 (Slab rates) An individual having income up to Rupees 2,50,000 is exempted for payment of income tax.

- 3. Income between rupees 2,50,000 to Rupees 5 lakhs, tax payable is at 5 percent Income above rupees 5, lakhs and up to rupees 10 lakhs tax to be paid at the rat of 20 percent And income above Rupees 10,Lakhs tax rate applicable is of 30 percent For senior citizen For senior citizen above age of 60 years but below 80 years of age, income up to rupees 3,00,000 is exempted from tax and rest of the slab rates are same For individual above 80 years of age income up to rupees 5,00,000 is exempted from tax and rest of the slab rates are same Surcharge: The amount of income-tax shall be increased by a surcharge at the rate of 10% of such tax, where total income exceeds fifty lakh rupees but does not exceed one crore rupees Where total income exceeds one crore rupees the amount of income- tax shall be increased by a surcharge at the rate of 15% of such tax. Education and secondary and higher education cess Education cess of 2 percent and 1 percent higher education cess to be paid on income tax and surcharge calculated Every tax payer has to file income tax return by due date that is by 30th July or 30th September to avoid tax inquiry from tax authorities