Realty411 Magazine - Your FREE Resource for Real Estate Wealth!!

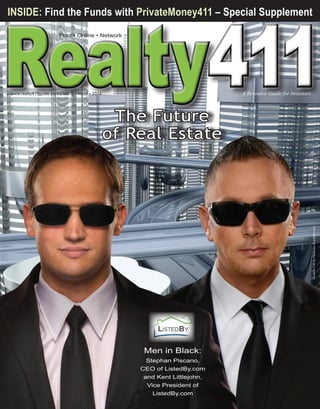

- 1. 411 INSIDE: Find the Funds with PrivateMoney411 – Special Supplement Print • Online • Network www.realty411guide.com | Vol. 5 • No. 1 • 2014 A Resource Guide for Investors Modern City by Vladislav Kochelaevskiy The Future of Real Estate Men in Black: Stephan Piscano, CEO of ListedBy.com and Kent Littlejohn, Vice President of ListedBy.com

- 2. er pp U g in tin tar S BLACK BE ’s $30 Education • Coaching • Pri p Ca w Lo he in t g rtin Sta tin tar S he % Real Estate Education for Investo - 23 te Ra • KickStart 101 – How to Create Cash and Wealth Throug • Wholesaling – Flipping Houses for Quick Cash • Master’s Program In the Field Wholesale Training • Rehabbing – Making Huge Profits • Purchase Options – The Best Creative Financing Strate • Joint Venture – Developing Strategic Alliances • Business Training – Quick Start Entrepreneurs • Real Estate Investor Club – Monthly Meetings to Stay E 0’s $10 Ap t g in 5% s1 c pre iat ion Nationwide Turn-key Real s 60’ L $ ow Cash Flow + Appreciation + Tax B • Cleveland, OH • Kansas City, MO Starting in the Low Cap Rate 9% Strategy: Cash Flo • Indianapolis, IN Starting in the Low $60’s Cap Rate 9% Strategy: Cash Flow & Appreciation • Phoenix, AZ Starting in the Low Cap Rate 3% - 5% Strategy: Appreci C Flo ash A w& re pp cia tio n Starting in the Upper $30’s Cap Rate 15% - 23% Strategy: Heavy Cash Flow & Appreciation (9 51 ) 280 BlackBeltInve

- 3. ELT INVESTORS ivate Money Lending • Nationwide Investments ors Coaching gh Real Estate • One-on-one Coaching in Building, Setting and Achieving Your Goals egies Hard Money Lending • Lending for CA & AZ Residential & Commercial Rehabs Engaged eal Estate Investments Benefits = Wealth Builder w $60’s ow & Appreciation w $100’s % iation • Las Vegas, NV Starting in the Low $100’s Cap Rate 3% - 5% Strategy: Appreciation • Southern CA Starting in the Mid $100’s Cap Rate 3% - 5% Strategy: Appreciation 0-1900 stors.com

- 4. “ This book is a must read for anyone getting started in real estate.... You will enjoy this book! Frank Paras, Home Depot Director The book that will REVOLUTIONIZE The real estate market order today at andrewcordle.com

- 6. Grayson Financial Services The World’s Leading Credit Expert Are opportunities sli bad credit scores? W without bankruptcy? be reversed or a garn needs to be stopped If you are trying to buy apartment, get a loan, your debt and you are h you need a better soluti 2000 this country switch Scoring System”. We off “Rapid Restructure”. No POPULAR CREDIT RESTORATION & DEBT RESO Option Cost Result 1. Consumer Credit Counseling $600-$3000 per month for 3-7 years Broke With Bad Credit! completion You Still Ne In Credit Restoration 2. Debt Consolidation $400-$1500 per month for 3-7 years Limited Debts. Broke, S Some Debt, With Bad C completion You Need T Credit Restoration 3. Bankruptcy 13 $600-$3000 per month for 3-7 years 4. Credit Repair Company $99 per month for 3-7 years GFS Rapid Restructure $250 down $200 per month for 3-6 months Broke With Bad Credit! completion You Need T Credit Restoration No FICO or Debt Solutio completion You Need T Debt Program and Fix Y True Debt Elimination 700-990 Credit Score Guaranteed. THE ONL FICO BASED CREDIT & SOLUTION!!! www.MyDebtFilter.c

- 7. Home of the Grayson Dream America Project, where you can get pre-approved for any loan, financing or line of credit – regardless of your score. Call us for the lowest rates. No hassle or excessive inquiries. ipping away from you because you have Would you like to eliminate your debt ? Do you have a judgment that needs to nishment, foreclosure or bank lien that d? Now! Call y a home, get a job, get a promotion, buy a car, rent an , apply for some business capital, get a new credit card, or lower having problems then look no further. Your only problem is that ion. Stop making inquires and get the money you need. In the year hed from “the Old Credit & Debt System” to the “New FICO Credit ffer the only FICO based credit & debt solution in the country, ow you can improve your score while eliminating your debt. OLUTION OPTIONS VS RAPID RESTRUCTURE Time Frame Total Cost Upon eed To Enroll 3 -7 Years $50,000 on avg. Plus Cost of Credit Restoration + Cost of Credit Score Enhancement Still Have Credit! Upon To Enroll In 3 -7 Years $30,000 on avg. Plus Cost of Credit Restoration + Cost of Credit Score Enhancement 3 -7 Years $50,000 on avg. Plus Cost of Credit Restoration + Cost of Credit Score Enhancement 3 -7 Years Up To $8400 Plus Cost of Debt Upon To Enroll In on! Upon To Enroll In Your Score + Credit Restoration Time + Credit Restoration Time + Credit Restoration Time + Debt Elimination Time + Credit Score Enhancement Time n Plus LY & DEBT 3-6 months Elimination + Cost of Credit Score Enhancement Starting at ONLY $1250 ( financing available) com • 718-322-7220

- 8. Real estate + IRa = smaRt way to Invest Yes! you can use your IRa to invest in real estate. Surprised that you can invest in real estate in your tax-advantaged Individual Retirement Account (IRA)? You’re not alone. At PENSCO Trust Company, we’ve focused on this specialized area of investing for over two decades. And after completing alternative asset transactions for thousands of clients — who currently trust us with custody of more than $10 billion of their assets — we know exactly what it takes to buy, hold and sell real property and notes secured by real estate in tax-advantaged retirement accounts. Discover how to use your IRA to invest in real estate. Download your free copy of our investment primer “The Ins and Outs of Buying Real Estate Using a Retirement Account” by visiting www.pensco.com/Realty411. Call 1-866-381-7371 to get staRted. © 2013 PENSCO Trust Company

- 9. JasonHartman.com Realty411 Wealth Real Estate FOUNDER/CEO Linda Pliagas DRE #01355569 PRESIDENT Nikolaos K. Pliagas EDITORIAL STAFF Hannah Ash Robb Magley Tim Houghten Stephanie Mojica COPY EDITOR Lori Peebles PHOTOGRAPHER John DeCindis COLUMNISTS Tom Wilson Kathy Fettke Lori Greymont Randy Hughes Jason Hartman BROKER/ADVISOR Steve Kendis, GRI, MLO DRE #00815859 PRODUCTION Jeff Cohen Augusto Meneses WEB MASTER Victoria Landis ADVERTISING Teri Burke Kelly Global Marketing EVENTS & EXPOS Jason Kennedy Lawrence Ruano DISTRIBUTION To receive complimentary copies, please call our hotline 310.499.9545 ADVERTISING: 805.693.1497 Realty411Guide.com | reWEALTHmag.com Questions? 310.994.1962 or 310.499.9545 The Complete Solution for Real Estate Investors TM Yes, it is possible to: Earn 10-18% in Your IRA! Earn 18-35% with Income Property! Platinum Properties Investor Network, Inc. helps people achieve The American Dream of financial freedom by purchasing income property in prudent markets nationwide. Jason’s Complete Solution for Real Estate Investors™ is a comprehensive system providing real estate investors with education, research, resources and technology to deal with all areas of their income property investment needs. Featured Properties Join Our VIP Social Network: http://realty411guide.ning.com Realty411 / reWealth magazine is published quarterly from Santa Barbara County, Calif. ©Copyright 2014. All Rights Reserved. Reproduction without permission is strictly prohibited. The opinions expressed by writers/columnists are not endorsed by the publishers. IMPORTANT DISCLOSURE: Publishers and staff are not responsible for performing due diligence on the opportunities offered by this magazine’s advertisers and sponsors. Before investing in real estate seek the advisement of a trusted financial advisor, attorney or tax consultant. Beware: Real estate investing can be risky and may result in loss of capital. ATLANTA Projected ROI 33% Cash Flow $2,456 PRINTED IN THE USA — GOD BLESS AMERICA Connect to our virtual network online: DALLAS Projected ROI 35% Cash Flow $5,294 MEMPHIS Projected ROI 29% Cash Flow $3,101 IRCA-LA Changed It’s Name! We Create Wealth One Property at a Time See terms of service at: www.JasonHartman.com/terms First Time Admission is FREE Call 818-217-4630 for more information www.JasonHartman.com We Serve Southern California www.prosperitythroughrealestate.com Realty411Guide.com Podcast PAGE 9 • 2014 reWEALTHmag.com

- 10. America’s Buy to Rent Lender Financing Single-Family Rental Properties B2R Finance, America’s Buy to Rent Lender, is a leading provider of single-family buy to rent mortgages for professional property investors. We offer cost effective and innovative lending solutions dedicated to investors buying single-family rental properties. “Whether you own 5 properties or 500, B2R can assist you with a variety of lending programs to enhance your investment.” Learn More About B2R Lending Programs: www.b2rfinance.com info@b2rfinance.com 855-710-0227

- 11. T by Linda Pliagas publisher, agent, investor hank you for spending some time with us, I hope you enjoy our new issue. We are excited to show off our largest print edition to date. When we started the publication in 2007, it was a modest 16 pages and printed on newsprint; now we own multiple publications, numerous real estate websites, and we are producing expos around the country. We’ve really grown tremendously, and I’d like to thank our loyal readers and our advertisers for their support. Now it’s our time to give back, which is why we are devoting the entire 2014 to traveling across the country to host complimentary expos and mixers to connect with as many investors and industry professionals as possible. From New York City to San Francisco and Indianapolis to McAllen, Texas, we want to learn the nuances about a variety of markets so we can better educate our readers. Over the years, investors from around the nation have relied on our magazine to make informed decisions on where to invest, what type of properties to focus on, or whom to train with to further their real estate education. I take my position as publisher very seriously, and I’m proud that I have been in the industry over 11 years as a licensed real estate agent in California. Besides assisting many with their real estate transactions by referring them to brokers around the country, I have also personally purchased, managed, and sold millions of dollars worth of real estate in five states. Real estate is such an exciting industry and, to me, finding solid rental properties is exhilarating. I truly enjoy the art of real estate. In fact, my husband and I recently closed escrow last month on two phenomenal rental properties in Santa Barbara County. Both were purchased for half of what the market was just a few years ago and appreciation, in this particular area, is already starting to set in! Folks, if we can locate two value-priced properties in one of the most expensive areas of California, I know you can find some solid deals in your market too. If being a landlord is not your style, then perhaps you’re better suited being a private money lender or a note buyer. How about purchasing tax liens or maybe even a hotel? The beauty of real estate is that opportunities for investing are diverse, a lot of avenues for prosperity exist. It’s up to each of us to learn what type of real estate best suits our personality, needs and goals. I hope this publication can give you some ideas and resources to help you in your journey. Until next time, linda’s note I truly enjoy the art of Real Estate. Linda Pliagas PS: Be sure to keep up to date with our travel schedule by visiting www.Realty411guide.com/events for our calendar. YOUR DIGITAL GUIDE TO REAL ESTATE WEALTH Learn Real Estate Investing Strategies & Tips From the Experts Stay Up to Date on the Latest in the Real Estate Market Providing Quality Real Estate Content to As Many Investors Around the World as Possible Pleasurable Viewing of Images and Videos on the iPads Retina Display For the iPad, iPad Mini & iPhone/iPod (Coming Soon) REI Wealth is co-published by Realty411 *All at the convenience of automatic delivery when you subscribe! • Only $3.99 per month - Less than the cost of a Latte! • Subscribe Now & Get the First 7 Days FREE www.reiwealthmag.com OR http://budurl.com/q769 Realty411Guide.com PAGE 11 • 2014 reWEALTHmag.com

- 12. contents 11 Publisher’s Note: The Art of Real Estate 13 Memphis Invest Expands to Texas 18 Safety in Numbers with Tax Liens 21 Analyze Marck de Lautour’s Deal 22 Finance Goes Back to Basics 24 Due Diligence with Kathy Fettke 27 Learn About ListedBy.com 30 Perfect Credit with Dr. Grayson 34 Mobile Home Park Investing with Mike Conlon 37 Discover B2R Finance 38 Secrets from Sensei Gilliland 40 Flipping Houses with Duncan Wierman & Anthony Patrick BIRMINGHAM, AL Pg. 82 42 Jason Hartman Talks Real Estate 44 A Bus Tour with Lori Greymont CEO of Summit Assets Group 45 Manifest Real Estate Miracles 46 Profile of Hanover Equity Group 47 Zero in on Vacant Homes 49 Special Private Money 411 51 FirstKey Lending Unleashes Big Capital for Smaller Investors 52 Discover MOR Financial 54 Five Steps to Raising Capital 55 No Fluff with Leonard Rosen Pg. 81 56 Financial Market Intelligence 60 A Successful Private Lending Practice 65 The Launch of LA South REIA 66 Multifamily vs. Single Family 68 Retire Wealthy with an IRA 69 Turn-Key and Renter Ready 71 Land Trusts vs. LLCs 73 Crowdfunding Investing 75 Flip or Flop with Tarek & Christina El Moussa 78 Williams & Williams Update 80 10 Rules for RE Success 81 Taking Title Properly 82 Larry Goins Discusses Deals 84 Let’s Analyze a Hotel 88 Learn Probate Investing 90 Legal Aide for Investors 93 News from Lady Landlords 94 Relationship-Building Tips Realty411Guide.com PAGE 12 • 2014 Pg. 75 reWEALTHmag.com

- 13. TexasMemphisInvest.com Expansion with S uccessful investors realize how important diversification is to risk management in their portfolios. MemphisInvest.com, the largest turnkey investment company in Tennessee, is responding to the needs of their nearly 900 clients by expanding their operation to what they believe is another top market: Dallas. Although it’s over 400 miles away from their Cordova-based company, the Clothier family, principals of Memphis Invest, are quite at home in the Texas market as they had lived in Dallas for many years as proprietors of a grocery business. So comfortable in fact that they quickly expanded into the market by purchasing hundreds of homes, which were rehabbed and sold as turnkey investments to their loyal clients, many of them already own multiple properties in Memphis. All the properties were sold without any direct advertising or marketing. Now that a secondary office has been set up to handle their growing list of properties under management, they are well on target to expand to nearly 800 doors. Recently, we had the pleasure of interviewing Chris Clothier, co-owner of Memphis Invest to discuss their explosive expansion into the Texas market. Question: Why did Memphis Invest choose Dallas as their next rental market? Answer: There were a couple of reasons, but mostly our familiarity with the market. We still have family and business ties in the Dallas/Ft. Worth area and luckily the market was a fantastic investing opportunity. We had been looking for which market to expand into and Dallas kept presenting the best opportunity for our success and, more importantly, for our clients’ success. Realty411Guide.com Q: I’m sure your team and clients had wonderful reactions to the expansion, but were there any concerns about adding a second city? A: The biggest concern was consistency. We had developed a very stable and reliable model in Memphis with a fantastic team and that is very difficult to duplicate. We were very methodical about who we hired and how we trained them. Our culture of putting customer service first and being transparent in our communication, both good and bad, was very important to us. So our biggest concern was how do we keep the high quality of work, communication, service and the reliable model while moving into another city. Q: When did Memphis Invest decide to expand to Dallas and how long did it take from the initial idea to actually selling properties and overseeing rentals in that market? A: We decided in the 4th quarter of 2011 that we were going to open an office in Dallas. We were actually buying our first properties there in February of 2012, but we were not advertising the new city at that time. We were having private conversations with individual investors about the opportunities there and taking orders for properties. At first, we outsourced the property management, but learned very quickly that no one was going to show the same attention to detail and care like we were, so we opened our property management division in October of 2012. We held our first sneek peek event in the Fall of 2012 and hosted 140 investors to the city. Today we are managing just under 250 properties in the DFW metroplex and on average completing between 17 and 20 deals a month over the last couple of months. Our goal for 2014 is to complete PAGE 13 • 2014 Interview by Linda Pliagas between 250 and 300 transactions in the Dallas market. Q: How did you put your team together in a far away city and what tips do you have for other companies and investors trying to manage a long-distance portfolio or staff? Chris Clothier A: Without the ability to have a Clothier or a high-level team member in the city each day, I am not sure we would have undertaken a remote location. Our reputation, our commitment to excellence and our integrity are too important to us. So without the easy commute to Dallas, I am not sure we would have chosen the city. We could leave early morning and be in our offices by noon. There are also daily flights back and forth for the hour-long flight. So we chose a city with three attributes for us: a. We were very familiar with the layout of the city. b. We had great connections in the city and were able to locate high quality personnel quickly. c. It was close enough for a Clothier or one of our top leaders to be in the city almost daily. > reWEALTHmag.com

- 14. Without these benefits, I think it would have been much more difficult. We kept great notes, had meetings on the progress and issues with the second city constantly and have essentially developed a roadmap for going into additional cities. Question: How many clients now own in Dallas? How many homes are currently under your management? A: We have just under 250 properties under management in Dallas and there are right at 80 clients who own properties in the metroplex. and would be lucky to get 1-year leases in Dallas. We scoffed at that belief and brought the exact same property management and renovation style to Dallas from Memphis. We believed that a home that has been renovated to a higher standard and a management company with great communication and service could easily command a 2-year lease. Today, we rent 80% of our properties in the DFW market on 2-year leases. Q: Are you still hosting property bus tours in both cities? Where can we find out more information about them? A: We do not do bus tours of the cities anymore. We have investors visiting our offices weekly to see properties and the operation. The events that we host now, one in each city each year, are geared toward showcasing our team and our operation as we all the attributes of the cities neur in Memphis for 25 plus years. My older brother Kent Clothier, Jr. more than doubled the size of a private company in Florida at the age of 28 growing sales for that company to over $2 billion a year. Kent may not be a part of the day-to-day business operations for our companies, but he is a great example of our family being driven to excel. Our families’ success is due to the fact that we have failed and been able to grow and learn from those failures. What you see today is a company where the culture is so important. We have 44 employees and they all strive to excel and be the best. That is very similar to the culture we have developed in every company we have built. Q: Can you give us a sneak peak to what the future holds for the Clothier team and family? A: We are already in a third city, Houston, Question: Are you inclined to stay within certain areas of the city? How were those areas chosen? A: Just like in Mem“Just like in Memphis, we are trying to buy in areas that we are phis, we are trying to buy in areas that we are very familiar with. We have an understanding of the dynamics very familiar with. We have an understanding in the area and the economic factors that make it a good rentof the dynamics in the area and the economic al part of town. Our biggest concerns are always going to be factors that make it a good rental part of access to jobs, access to transportation and schools.” town. Our biggest concerns are always going to be access to jobs, access to themselves. We try to include charities TX, exploring and looking for office locatransportation and schools. So right and big companies in the cities as well as tion as well as properties. There is a lot of now we are buying in spot areas of town inviting political leaders to address the good opportunity coming for our existing and are only managing in maybe 10% groups. Our events now are much less and future clients and three cities will of the entire metroplex. There is plenty about selling properties and more about certainly help us to fill all of the demand. of room to grow and expand into other helping investors get a good feel for the It has been a process of development over areas of the city, but right now we are market and the company and then make a the last 10 years and these next few years concentrating on doing it right, not so decision if the market and the partner are certainly look to be very promising for our much doing it quickly. the right fit for them. Of course, there is company and for our clients. With three always time on our weekends for investors cities we believe we will be able to fill the Q: How does the Dallas rental market to get out and see properties and we endemand from smart real estate investors as compare with Memphis, as far as ROI, courage it, but we wanted to take the focus they look to develop portfolios of consisvacancies and taxes? off of the “bus tour” or “buying tour” tent and stable returns on solid assets. A: The two markets are remarkably mentality and put it back on the long-term similar as far as returns are concerned, relationship aspect of investing in buy and Q: Is there anything you would like to but Dallas certainly presents more hold real estate. add about the Dallas market and your challenges with insurance and tax rates. involvement in that city? They are a little more fluid than they Q: Your company has accomplished so A: We are really excited about the Dallas/ are in Memphis and are more prone to much in such a small amount of time, Ft. Worth market and even about the change. So we keep a very close eye on what do you attribute your success to? possibilities in the near future for Housthose two costs, which are major factors A: This is not new to my family. My ton. This is going to be a fun year and in an investors ROI. As far as vacanfather has been an entrepreneur for over we are focused on positive growth and cies are concerned, we were told early 30 years and he followed in the footsteps building some great friendships with our on that we would have high turnover of my grandfather who was an entreprenew clients. Realty411Guide.com PAGE 14 • 2014 reWEALTHmag.com

- 18. Safety in Numbers Discover how Chris Gleason and MMG Capital lower the risk on what’s already one of the most secure investments in the industry. By Robb Magley | Photograph by Sam Green Every day, all across the country, real estate taxes go unpaid. It’s no secret that real estate taxes generally represent the majority of a county’s revenue; and they need that revenue to provide services like firefighters, police officers, roads and bridges. In more than half of the U.S., counties are required by law to collect unpaid taxes through the sale of tax liens to investors — counties sell a certificate that grants the right to collect those taxes, plus interest and penalties, to investors for the amount of the outstanding tax alone. This allows the county to balance their budget and operate without a revenue deficit — it’s great for the county, and investors like the opportunity, too. But while the sale of real estate tax liens to investors is a process that dates back to the early 1900s, it’s not the unexplored territory it used to be, according to Chris Gleason, managing director at MMG Capital. “The tax lien industry isn’t a secret any more,” said Gleason. “Anyone can register, walk into an auction, and bid. There are thousands and thousands of tax lien investors across the country, and that makes the market competitive.” It’s become so popular because it’s Realty411Guide.com an exceptionally low-risk investment in general, according to Gleason, who noted the overwhelming majority of tax liens investments eventually get paid back to the investor — plus interest and fees. “That’s because no one’s interested in losing their house over a tax lien that represents 1-3% of the property’s value,” said Gleason. “Over 95% of property owners redeem their unpaid taxes within their state’s statutory period. For the ones that don’t, the certificate holder has the opportunity to do what’s called ‘filing for deed’ — the equivalent of foreclosing for a tax lien.” Filing for deed starts the process, and the property owner is forced to “redeem” (e.g., pay up), or the property will go up for sale. “At that point, if you’ve done your due diligence and you have a piece of property that has value, someone’s going to come along at that foreclosure sale and pay for the property,” said Gleason. “And that essentially gets you redeemed, too. Over 99% of the time you get your money back, plus interest and fees.” And that’s the goal. Gleason points out the biggest misunderstanding about the tax lien industry is that people think everyone’s in it to acquire real property. “No one PAGE 18 • 2014 should be going into it because they want to buy property for $500,” said Gleason. “Realistically, you’re not going to acquire property this way — unless you’re buying tax liens on worthless property nobody wants. Then you might end up with it — and you’re going to be mad that you did.” While the concept of investing in tax liens is very attractive, and in many ways very simple, the reality of doing it in a competitive market is complicated once you’re on the ground, according to Gleason; between the ins-and-outs of varying state laws, timing, and bid structures, to say nothing of traveling to auctions and servicing the liens once you buy them, the real rate of return for a small investor shrinks quickly. Gleason and MMG Capital structure the purchase of tax liens as a pooled fund opportunity — at once spreading out an investor’s risk and increasing yield. “The rates that you can achieve by yourself, with not a lot of money, are not very high,” said Gleason. “First of all, you’re competing with people like us; we come into these auctions with millions of dollars. Second, if there’s a larger parcel out there, say an apartment building, that’s Continued on pg. 86 reWEALTHmag.com

- 19. Safety. Security. Double-Digit Returns. WeÊmakeÊrealÊestateÊ taxÊlienÊinvestmentsÊ simple and attainable. Find out why these ultra-safe assets should be a part of your portfolio. Call or visit us on the web for free information. (310)Ê295.1121ÊÊÊÊÊinfo@mmgcap.comÊÊÊÊÊwww.mmginvestors.com

- 21. SBD Housing Expands to Florida F or the past 10 years, Marck de Lautour, owner of SBD Housing Solutions has been focusing on the metro Kansas City area for investment properties. His Rolodex of investors includes clients in Australia, New Zealand, Canada and California. Now with the success of hundreds of deals in the Mid West, SBD Housing Solutions is now expanding operations to Florida, specifically Tampa. Recently we interviewed de Lautour to get an inside glimpse of how this savvy investor is able to scoop up quality deals with built-in equity before anyone else does. By Lori Peebles of time so it certainly helped in getting the property turned quickly and efficiently. The SBD Housing Solutions Team (SBD) started researching in the Tampa Bay area back in Jan 2012 and didn’t get our first buy until June 2013! Not fast, but we had to learn the market and we went through 3-4 different cities before settling in on the Bradenton / Sarasota area. Acquisition Phase Research Phase Question: How did you land your latest re- Q: What were the terms of the sale? A: hab deal? Cash, closing fast. Got them down from A: It was an MLS opportunity, the owner list price of $295, down to $264K. Then got it SOLD for $369,900 in under 70 days. occupant needed to sell. But it was undervalued even at that price. Q: What are some tips you have to research Q: How did this deal compare to other deals you’ve done? a property or area? A: You have to have someone local on the A: We typically buy on the courthouse steps ground that is firmly entrenched in the mar- so having to wait 30 days to close on the ket, able to jump on deals when they come purchase was a bit different! But we could up. We were very patient. Our company get our contractors inside the home ahead Realty411Guide.com PAGE 21 • 2014 Rehab/Maintenance Q: Was the property rehabbed or was it a light cosmetic fixer? A: It was a cosmetic fixer upper, but there was an upstairs loft that converted easily with one wall built, into a 4th bedroom. Probably increasing the value by $10K-$15K with that addition alone. The rest was dolling up the bathrooms and kitchen with granite and travertine, and the whole house with some phenomenal dark hardwoods floors! Q: How does this rehab compare versus the properties in the past? A: Of all the homes we have completed in Florida this was the easiest. Extensive cosmetic makeover would describe it, approximately $25,000 of capital invested in the remodel. Management Q: How long was the property held? What tips do you have for managing an asset? A: Just 68 days prior to contract acceptance, then 25 days to close. Work with people you trust — simple as that. Have fun — laugh and learn from mistakes, and Continued on pg. 86 reWEALTHmag.com

- 22. But With A Few New Tricks S By Robb Magley teve Bighaus has been in the mortgage industry long enough to see a lot that looks familiar about today’s market. “I tell people, as far as qualifying, we’re back to lending as it was 20 years ago,” said Bighaus, senior loan officer for SecurityNational Mortgage Company. “I mean obviously we have a few tools we didn’t have back then — credit reports are instantaneous, we’ve got the automated underwriting system, and so on. But as far as documentation type, we’re back to that full-doc loan.” After last July’s bump in interest rates, things are settling back into a more comfortable area that Bighaus says a lot of his investors still find attractive. “I still see a lot of people who want to get into investment properties obtaining financing, because it’s a great time right now to do it,” said Bighaus. “Terms are still great, you know — 30year money, getting high 4’s and low 5’s, that’s still pretty cheap money when you’re looking at investment properties.” As more people enter the market, Bighaus said he’s seeing investors follow the lenders’ lead as far as trending toward more traditional investment models — 20-25% down payments, for example, and buy-and-hold investments outnumbering fix-and-flip plans. “I’ve only seen a handful of people in the last couple of years who have bought their properties and turned around and sold them right away,” said Bighaus. “Everything I see with my clients right now is portfolio building, because they’re all thinking about retirement.” One of the results of that is the increased popularity among investors of 15-year mortgages, especially for loan amounts associated with smaller properties; Bighaus said savvy borrowers are looking at the small difference in payments and seeing big advantages to Realty411Guide.com Image: maxxyustas / 123RF.com strategy Mortgage Industry Goes Back To Basics– shorter terms. “Where I really see it is in those loan amounts below $50,000,” said Bighaus. “When you look at the difference between 30-year and 15-year terms on a loan of that size, for $50 or $100 difference in the payment every month, you’ve got a better rate, you’ve got more money being applied to principal every month, and you’ve cut your term in half. They’re thinking long term; if they can get it paid off in 15 years, then they’re that much farther ahead of the game.” And the game is growing; Bighaus’ company continues to expand its footprint, operating today in a dozen states with more being added by the end of this year and still more planned for 2015. That can mean a lot of traveling, but Bighaus sees it as part of what differentiates his service from the competition. “Wherever investors are buying property, that’s where we’re focusing our business,” he said. “I like to visit the markets that I loan in, because I like to actually see the inventory and meet the people.” Bighaus is seeing a lot of his customers come back with PAGE 22 • 2014 Continued on pg. 85 reWEALTHmag.com

- 23. It’s about time we show you A REAL HERO Close your loan in as little as 30 days! Steve Bighaus has over 24 years experience in the mortgage industry. He maintains a focus on servicing the real-estate investor by offering aggressive financing options and resources for buyers interested in purchasing or refinancing their investment property. By concentrating on investment properties and the financing that comes with them, Steve is recognized nationally as an industry expert. The knowledge that he has enables him to find financing for people even when they have had difficulty elsewhere. Contact Steve Bighaus Senior Loan Officer 206.930.1801 Attention Investors: Pre-Qualify Today! steve.bighaus@snmc.com NMLS#: 112825 This is not a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant. Security National Mortgage Co. is an Equal Opportunity Lender. NMLS# 3116

- 24. due diligence Kathy Fettke gives insight on a recent fraud investigation - They wanted to offer the best deal in town. Testimonials on their website raved about what a great deal it was. “No worrying about property management! No vacancies! No repairs!” Who wouldn’t want that? In reality, that type of situation can exist, but usually only in a triple net lease situation where the tenant agrees to pay all expenses and repairs. It cannot work in a situation where the seller takes on such enormous responsibility for thousands of clients . Here’s what our member thinks happened next: Half-way In: How to Vet Out Turn-Key Property Providers (and Avoid Getting Scammed) R eal estate, like any investment, can attract lots of scammers. How do you really know who you’re dealing with? You see ads everywhere for “turnkey” rental properties, but what does this really mean, and how do you know who to trust? The owners of the Bay Area Equity Group, a turn-key property provider located in Campbell, California, were recently arrested on suspicion of fraud. I saw these guys at a real estate expo I attended last year and they seemed like nice enough people. What happened? Real Wealth Network has over 14,000 members now, so it’s pretty easy for us to get information. It turns out that one of our members purchased property through the Bay Area Equity Group. I asked him about it and here’s what he told me he thinks happened: In the Beginning... - They started to get behind on making owner distributions. - They realized they couldn’t meet the guarantees. - They didn’t want to let their investors down. How Ponzi Schemes Begin... Often times operators need to rely on new money to feed the old promises. In this case, our member suspects this is what happened: - Allegedly the owners started to buy distressed property, perform a minimal rehab, and then resell far above market prices. - Proceeds from the sales allegedly went to pay for the former guarantees. - It still wasn’t enough. - They started out with good intentions. - They made guarantees of 15% returns on rental properties in Detroit, MI. - Desperation kicked in. Allegedly they started to sell the same property twice to different people, but only record one sale. Continued on pg. 83 - They offered to cover repair costs in many cases. Realty411Guide.com - Operating costs ended up being higher than expected. PAGE 24 • 2014 reWEALTHmag.com

- 25. Secret CASH FLOW The Best Kept in real estate INVESTMENT PROPERTIES Learn How to Buy Your First Hotel & Make Thousands of Dollars in CASH FLOW Every Month! • Beginners and Experienced real estate investors alike • National Training Events • Free Education and Webinars • Extensive and Hands-on Coaching Register to attend the next Rich in Five Hotel training event Successful Real Estate Investing Begins with the Right Investment Property! Come Learn From the only hotel expert who can teach you how to buy your first hotel VISIT www.richinfive.com or email info@richinfive.com Same Time + Same Energy + Same Strategies = Your First Hotel = Thousands in CASH RICH in Five P.O. Box 2007 Round Rock, TX 78680 (512) 788-1710 FLOW Every Month! Realty411Guide.com WWW.NORADAREALESTATE.COM PAGE 25 • 2014 reWEALTHmag.com

- 26. Join us on www.ListedBy.com Today! LISTEDBy The FUTURE of The Real Estate Industry Real Buyers • Real Sellers • Real Estate FREE EXPOSURE FOR YOURSELF AND YOUR LISTINGS • Global Online Real Estate Marketplace • Live Bidding Auctions • Listing Style Property Offerings • Fully Functional Social Network Designed to Get Exposure for Real Estate Professionals • FREE to post listings • FREE to bid on assets • FREE to become a listed service provider and market yourself to potential clients! • We make our money off of advertising so our users pay nothing ever! BEST of ALL IT’S 100% FREE!

- 27. Learn about ListedBy.com Stephan Piscano The real estate market continues its aggressive ascend back from the ashes of 2008 and is showing no signs or desire to slow down any time soon. With interest rates at all time lows, the landscape for investors seems just right even for the less aggressive types. ListedBy founder and chief executive officer, and real estate investment veteran Stephan Piscano has been one of the most successful – and daring – investors to take advantage of the recent market drop. While he spends time building online auction site ListedBy.com, his investor acumen continues to spot opportunities along the way. If you heard or read Stephan’s predictions for the real estate market a year ago, and you followed his advice, you would know he was spot on. Today we’re happy to join Stephan to get insight into some of his investing strategies and plans for the future, and how real estate investors and real estate professionals can benefit from using ListedBy.com. Q: Stephan, you created the website ListedBy.com to meet the needs that you personally had experienced and observed in the online sector as a real estate investor. Can you give us a brief rundown of what ListedBy.com is and how it helps investors meet their needs? A: Thanks Roger, I am excited and thankful to discuss this here on Realty411. As many who follow ListedBy know, I created the site after liquidating several real estate assets online through sites such as eBay and others. At the time it became clear to me after searching literally for years that there was no website out there that allowed me to have the marketplace functionality I needed to properly market my listings, and do it in a setting that promoted trust and openness. With that in mind we went live with ListedBy.com to harness the marketplace functionality of a site such as eBay, but tailor it to real estate, and we added the key piece of the social network which we modeled after LinkedIn to give the buyers the ability to not only research the property that they were buying, but also research the person they are buying it from. This creates more direct communication between the parties and since we never play middleman as our competition does, we create a setting where transactions are much more likely to take place. This functionality allows an investor to not only research real estate online, but actually make a BUYING ACTION through the site and be in DIRECT contact with a person that can actually accept that action all online and all at no cost. Q. That seems comprehensive. So it sounds like the key aspect of the site is transparency? A: Yes you could say that. It is really all about cutting out the Realty411Guide.com middle man and allowing the buyer to be in direct contact with either the property owner, or the actual list agent. Many websites try to either limit the communication between the parties so they don’t get cut out, or they route traffic to their own buyers’ agents so the buyer ends up dealing with an agent that knows nothing about them, and nothing about the property itself. That can be beneficial to first time buyers who need their hand held a bit more, but to an investor it simply slows everything down and wastes time. ListedBy.com dramatically speeds up the process for the buyer and creates targeted exceptional exposure for the owner/agent. Q: Well that sounds great but I’m assuming that Brokers and Agents are not too happy about being cut out of the loop. A: Oh No I’m happy you asked about that because that is actually one of the biggest misconceptions that people have about the site when they hear about the model. While it is true that of course an owner could use our site directly with a buyer, the reality of it is that the majority of transactions happening on our site take place with agents, and we have actually found that, believe it or not, the agent benefits from our site more than anyone else. By removing the middle man and routing the DIRECT buyer traffic straight to the list agent, it gives the listing agent the opportunity to double-end the transaction and effectively put twice as much revenue in their pocket. In addition to that we have actually heard from several agents that by building out their social network profile on the site with photos, bio, and client recommendations, they have actually gotten new PAGE 27 • 2014 > reWEALTHmag.com

- 28. Q: So in essence, in addition to buying and selling, an agent can use the social networking part of the site to grow their brand? A: Yes, we built out the functionality with everything that a real estate professional needs to connect with investors and partners from around the world, and it is ALWAYS FREE. Agents can see stats on who came to their profile page and who viewed their listings. It is some unreal technology that can put REAL CASH in their pocket. A: Yes actually we added MLS syndication in October 2012 so currently you can search about 600,000 MLS listings in a separate section of the site. We also recently partnered with Foreclosure.com to feed nearly two million foreclosure listings to the site. This combination gives our users the opportunity to search auction listings, MLS listings, and foreclosure listings all in one spot. If that was not enough, we also have a service providers directory where users can search property managers, contractors, escrow compa- “By removing the middle man and routing the DIRECT buyer traffic straight to the list agent, it gives the listing agent the opportunity to double-end the transaction and effectively put twice as much revenue in their pocket.” Q: So what type of advertising opportunities are available on ListedBy.com ? Q: Do users on ListedBy have other listing options or just auction? A: Good question. The site is set up to allow users to list as a live bidding reserve, or no reserve auctions. However, most of our listings are actually what we call an “Own-It-Now” Best Offer Listing. This is where the listing is set at a fixed “Own-It-Now” price, but users can actually submit offers through the site which can be countered, accepted or rejected all through the site. It is actually that rapidly paced direct offer submission functionality that really seems to excite our users the most. Q: So are there any other features besides the marketplace and the social network? Realty411Guide.com recently we have been debating if we should start charging a small fee because people simply don’t believe that it REALLY IS FREE. But right now there is no fee to list, no fee to buy, no commission, no percentage, no membership fee — NOTHING. ListedBy really is free. Our main revenue model currently is from corporate advertisers. We have been fortunate to have three separate fortune 500 companies enter long-term advertising partnerships with us since we went live. When we designed the site model I looked at all the most successful sites such as Facebook, Google and others and we realized that these sites really don’t charge their userbase anything. We want to give our users something that they want and need, and give them a reason to come to the site everyday which creates targeted traffic that is extremely valuable for our advertisers putting their brand in front of consumers that they KNOW need the service, at the moment that they need it the most. nies and more all on the site. I would get sleepy thinking about it if it wasn’t so darn exciting! Basically we are like five websites in one. And we are designed to give the investor, the agent, and the real estate service provider, everything that they need all in one spot! Q: So I’m hearing a lot of use of the word “FREE”. How can that be? A: Many users may be wondering what is the catch and how ListedBy generates its revenue. Yes, we get that a lot. In fact, PAGE 28 • 2014 A: We have several ways that we can drive traffic to our advertising partners. From our massive reach on social media with our LinkedIn groups, to our more than 200,000 opt-in users. We find that all of our top advertisers extend their campaigns and dramatically lower their cost per lead working with us. I always say that when we went live with the site and tried to figure out how to drive traffic ourselves, I made all the mistakes already with my own money so you don’t have to. We know as a group that we have developed what we believe to be the most effective and powerful marketing platform in the real estate sector, and we are thankful that excelling in reWEALTHmag.com Image: Gina Sanders / 123RF.com business and new clients from being on the site! A lot of times a user might come to the site looking to buy, but they don’t see a property that particular day they like, but if perhaps they see an agent profile that catches their eye and excitement now that agent has a new and hot lead directly to their site! Given that we designed the social network to drive traffic back to the agent’s own site, it becomes an exceptional benefit in itself.

- 29. this way allows us to help drive profits for our advertisers, and more importantly keep the website free to our loyal and active users. Q: You actually were on the cover of Realty411’s alternate cover, Real Estate Wealth, when the site went live back in 2012. How has the site grown since then and what are you looking forward to in the coming year? A: Yes, it actually is a bit sentimental to me being in this issue because the very first piece of media/advertising we did when we went live was with Linda’s alternate cover, Real Estate Wealth. Since then while we have had some ups and downs I am so thankful to say we have grown at one of the fastest paces in the real estate sector, had literally thousands of transactions take place as a result of the site, and I am really thankful to have gotten to meet some of my heros and icons in real estate and tech. Also I am really thankful to great members that have joined the team in the last year and provided such amazing talent and have been such a huge part of our success. In the coming year I am excited about where we are going because I feel like the first year we built our brand, built our base, and learned what we are and how to execute. I feel that we are now ready to put it all in place. In 2014 we are going live with the 2.0 main version of the site, which is going to have some simply UNREAL features that the world has never seen before. This will help us as we also transition more to focusing on having a major presence in the auction and the real estate sector and focusing on high level transactions and allowing users to truly buy real estate in a better and more effective set up. Q: Any other thoughts you’d like to share with a fellow property investor? A: I think that this is an exciting time to be a real estate investor, and perhaps even more so to be an agent. The lack of inventory, combined with low interest rates and the basic sense that this is an exceptional hot market has created a consistent rise in the market as we had projected. I think the market should continue to rise the next 2-3 years, however I do believe that at some point when interest rates start to go up that we could see another small crash in the market. To me it is simply a race between rapid inflation and the interest rates, to see which of the two catalysts stands to impact the market the hardest. You could see the prices continue to rise not because homes are worth more but because the dollar is worth less. That would mean the more leverage that you buy with, the better you can capitalize by paying off your loan balance with cheap dollars in the long term. Either way, whatever you do you better do it on ListedBy.com, and we hope to see you there soon.

- 30. Give Him Some Credit One Man’s Quest for Perfection. by Hannah Ash L now the perfect credit score (not 850), and that’s what he wants; he wants to get you thinking differently about credit. The ambitious CEO of Grayson Financial Services and The 990 Club believes that a credit score of 990 is a goal well worth setting (and achieving). Dr. Grayson is a man on a mission and his mission is to empower Americans to acquire financial literacy and excellent credit. In this economy, his message of hope is both a rarity and a beacon of light. “Do you know what FICO stands for?” Dr. Grayson asks. That most people can’t answer this question, he says, is indicative of a problem. Dr. Grayson believes that as a country, we need to acquire a richer understanding of how the current credit scoring system works and what we can do to improve or perfect our scores. He is eager to point out that in the year 2000, a new credit regime quietly took over and rewrote the age-old model….too quietly, he implies. In previous years, he begins, “As long as you paid your bills on time, you could expect to have good credit...but in 2000, that changed.” ong after everyone else has taken off for the weekend, Dr. Michael C. Grayson enthusiastically discusses the ins and outs of credit from his empty New York office. Dr. Grayson’s finance and credit service, The 990 Club, was inspired by a rather lofty goal; to help his clients achieve the perfect 990 credit score. 990? He knows it may surprise you to learn that 990 is A mericans, and their credit scores, now fall under the FICO-based system; FICO, or the Fair Isaac Corporation, scores are calculated based upon the length of credit history, amount of money owed, types of credit and newly opened credit while the payment history is a mere 35% of the score. What this means, Dr. Grayson concludes, is that a millionaire many times over who always pays her bills Realty411Guide.com PAGE 30 • 2014 reWEALTHmag.com

- 31. Image: Alma Gami / 123RF.com; Dr. Grayson photographed by Mike Morgan on time may end up with a less than desirable score. He has seen how credit scores can make or break a real estate deal. He recounts a cautionary tale of how he once worked with a real estate developer and millionaire whose funding for a project got held up due to her score. The developer, who always paid her bills on time, had assumed her credit was excellent. Her FICO score, which landed somewhere in the 500’s, was a rude awakening. If a multi-millionaire isn’t credit-worthy, then who is? According to Dr. Grayson, everyone can be. The 990 Club and GFS were founded as a response to the financing problems Dr. Grayson, while working as a financial advisor, saw investors encounter as a result of lackluster credit. The teams at GFS and The 990 Club function like something of a credit and financing think tank; through offering intellectual capital to those seeking capital and credit, Dr. Grayson’s company provides an innovative, and popular, service in a downturned economy. Grayson offers unique FICO-compliant strategies that elevate investors, home buyers, corporations, small businesses and nonprofits to the credit level at which they want to be. Dr. Grayson has cracked FICO’s algorithms and, he says, he has a formula that gets his clients results. Does his formula work? For Dr. Grayson, the proof is in the pudding. One of his clients was able to achieve the highest credit score in the world, a perfect 990. He is eager to spread the message that long-term financial growth and excellent credit go hand in hand. Simply stated; Dr. Grayson wants to change the world, one credit score at a time. Though many companies offer credit repair services, Dr. Grayson isn’t flustered by the competition. The one-size-fitsall approach that most credit repair companies use doesn’t really repair anything: “The problem with the other leading companies,” he says, “is that they only address the negative items on a consumer’s payment history”. As payment history accounts for a just portion of the total score, the switch to the more comprehensive FICO system in 2000 actually made payment-history focused credit repair somewhat obsolete and the result, Grayson says, is that his competitors’ take far longer to do far less. C redit repair companies today must address all aspects of credit scores, Dr. Grayson puts forth, and GFS does just that. Most credit repair companies are equipped with dispute form letters; GFS is armed with the “Grayson Formula” (the result of Dr. Grayson’s reverse engineering of FICO algorithms). Rapid Restructuring is Grayson’s secret ingredient; the Formula, he says with confidence, can give anyone good credit in approximately 30-45 days using his strategic credit restoration and development approach. Anyone? “Anyone,” Grayson reiterates; further, his formula can take good credit scores and make them great. Great credit scores can become perfect (or close to) and Grayson is proud of his success, “The 990 Club has more members whose credit scores are in the 900’s range than any other service club.” Dr. Grayson is a Man on a Mission.. Realty411Guide.com PAGE 31 • 2014 > reWEALTHmag.com

- 32. Dr. Grayson wants to bring his message of financial literacy and good credit beyond his work with investors and individuals. He believes good credit is the key to obtaining loans, closing contracts, obtaining grants and even getting a job these days; GFS is committed to community outreach and empowering the disenfranchised. Dr. Grayson regularly works with government organizations, politicians, churches and nonprofits to discuss opportunities for financing, credit and financial growth; in 2012, Grayson presented before New York Governor Cuomo’s forum on small business. Currently, he is undergoing a series of meetings with New York City’s high school principals to develop a pilot program: The 700 Club. Grayson’s goal for the project is to give every graduating senior the gift of good credit (a 700 score) and the skills to maintain it; a large task, no doubt, but one in which Dr. Grayson believes fully. For individuals looking to improve their credit scores, Dr. Grayson advises they learn what FICO stands for and what, exactly, is scored. Though a perfect credit score may seem impossible for most of us to achieve in the current economic climate, he disagrees. Where we see 500’s and 600’s, this determined CEO sees 800’s and 900’s. Is he a magician? No; Dr. Michael Grayson is a scientist who believes in the transformational power of great credit. For more information about Dr. Grayson, visit www.mydebtfilter.com Dr. Grayson photographed by Mike Morgan BoeschLawGroup.com Personal Injury Business & Commercial Entertainment Estate & Trusts Building Business Real Estate THE RESPECT AND REPUTATION OF A CLOSER. Realty411Guide.com PAGE 32 • 2014 reWEALTHmag.com

- 33. Learn the Money-Making Art of Flipping Houses... DS ON! HAN In 3 Intensive Days Attendees will Discover: aHow to find great investment properties aHow to manage contractors aHow to estimate repair and building upgrades aHow to never overpay for repairs aWhich upgrades will provide the best return aHow to determine if a property will qualify for FHA financing aHow to inspect properties with confidence aHow to develop a real estate investment team aHow to analyze a rehab project to prevent over-spending aHow to avoid pitfalls & more... www.FlippingHousesBusTour.com

- 34. The New Main $treet Millionaires In this book, Mike Conlon will show you an unconventional path to prosperity in this very difficult economy by providing quality, ethical, and affordable services to America’s largest and fastest growing consumer group. In order to prosper on this path, you don’t need a college degree, only the willingness to work hard and learn. UNCONVENTIONAL WEALTH: UNCONVENTIONAL WEALTH: bad shape (a goal in any purchase is to save as many homes as possible). The first move we made was to “zonedown” the properties to create immediate higher occupancy. We zoned the larger park down to 132 spaces by creating one lot from two spaces. We did the same with the smaller park going form 84 spaces to 60. Existing residents loved the larger lots, but our goal was to get it prepared for financing, which means we need a minimum of 65% physical occupancy (actual homes on lots) at both parks. The “zoning-down” process took us approximately 4 months to accomplish with a total cost less than $20,000. Less density is almost always well received by local municipalities. Many investors ask me why I would “zone-down” a park instead of simply filling it up with a repo home. Although we added 5 repo homes to each park, this process is time consuming and expensive. A typical repo home will cost you $15,000 — $20,000 to purchase, move, set-up, and rehab. “Zoning-down” parks is a much cheaper way to get occupancy up immediately. Once we zoned the park down, we executed our “rehab playbook” to perfection with the following steps: Mike’s basic investing premise has brought him success over the last decade and he foresees even more opportunities over the next 10 years. Unconventional Wealth gives readers insight into the skillz they need to become Main $treet Millionaires. Realty411Guide.com MIKE CONLON M He has bought, rehabbed, and sold over $50 million worth of commercial multi-family (affordable apartment complexes and mobile home parks) involving 15 projects over the last ten years. He was a leader in the financial planning business in the 1990’s and early 2000’s as he grew a financial planning broker-dealer from $1.2 million in gross revenues to $40 million in six years and then sold it to a large national insurance company; he also managed over $100 million of client money in his own financial planning practice before becoming completely disillusioned with Wall Street money machine. He is a 1990 graduate of the University of Minnesota Law School. The New Main $treet Millionaires 2012. Both parks were REO (bank owned) parks that we bought via a broker. This was y company, an off-market deal Affordable that was not listed The New Main Communities on any public $treet Millionaires Group, LLC (ACG), websites. In my based in Cary, NC, business, knowing specializes in purchasing the brokers and MIKE CONLON distressed mobile home establishing a track communities at distressed record with them sales prices, rehabbing is very important. the properties over 9-15 months and We like the greater Cincinnati – Dayton then either obtaining a refinance from market because of its large population a financial institution or flipping the (over 3 million combined) and strong property for significant gain. We have base of employment. The multi-family done 16 full cycle deals (buy, sell, rebusiness, whether apartments or mobile hab) for sales proceeds exceeding $65 home parks, is all about having strong million over the last 9 years. We also employment near the property. Lot rents currently own over 3,000 mobile home are solid in this market as well , ranging spaces amongst 12 parks throughout from $325 - $375. the Southeast and Midwestern U.S. for We purchased the two parks for cash flow purposes. $1,150,00 all cash. One park had 306 We have just recently finished a spaces with 55 resident-occupied homes 12-month rehab project amongst two and 120 empty homes. The other park parks in the northern Cincinnati market had 84 spaces with 34 resident-occupied that we run as one combined park, homes and 3 empty homes. Both parks (they are 10 minutes apart). We use had been in steady decline for 5 years. In one manager to cover both parks. We fact, we had to tear down 101 homes at the purchased the deal on October 26th of large property because they were in such Mike has the unique ability to provide Americans with a realistic, no B.S. view of the financial world today – one that comes from his years of street-wise investment success in three different businesses – financial planning, mid-sized apartment complexes, and mobile home communities that have made him a true Main $treet Millionaire. PAGE 34 • 2014 1. Repaved the roads – cost $79,000 2. Trimmed many trees – cost $21,000 3. Rehabbed 22 existing homes and sold them to residents – net cost $88,500 4. Added 5 repo homes at each park – cost $180,500 The additional cost in this project was the tear-down of 101 homes, which cost $111,625. A little bonus at the larger park is that 8 owners of nice RVs are leasing lots form us in the back of the park. Total rehab costs for this deal were right under $500,000. I was fortunate to use a bank line of credit for half of the rehab. Our total cost into the two parks is > reWEALTHmag.com Photo: Jacqueline Moore | Dreamstime.com miche Invest in Mobile Homes Investor & author mike conlon teaches how to

- 35. Why Should You Invest In A Mobile Home Community? 3 The demand for affordable housing is skyrocketing 3 Very little, if any, affordable housing has been built in the U.S. since the mid-1990’s 3 Much higher cash flows than apartment complexes as they are less maintenance intensive, have much less resident turnover, and much lower ongoing capital expenses 3 Higher barriers to entry as the costs to build a new park are high and available land near larger metro areas is scarce and expensive 3 Much easier to manage when the majority of residents are just “leasing the dirt” Why affordable communities group? Learn how I made over $500,000 in profit in two years by buying one distressed community Mike Conlon, President/CEO MIke Conlon, aka Main Street Millionaire, has the unique ability to provide a realistic, no b.s. view of the investment world today as he is highly educated but also has 15 years+ of streetwise investment success that has made him a multi-millionaire. Mike tailors his business strategy around providing outstanding customer service and quality, affordable products to the fastest growing consumer segment in the U.S., to the working poor. AFFORDABLE COMMUNITIES GROUP 3 10+ years experience in buying, rehabbing and selling over 3,000 units 3 Have completed 15 full cycle deals (buy, rehab, sell) resulting in over $50 million proceeds 3 Experts in the property management business as we self-manage all our properties - very “hands-on” 3 Keep a tight geographic focus - diversified, but not too spread out 3 We put our own capital into every deal Log on to any websites below to get more information on investing in Mobile Home Communities and to score a free copy of Mike’s new book: Unconventional Wealth Creating the New Mainstreet Millionaires mainstreetmillionaire.com affordablecommunitiesgroup.com carolinaturnkeyproperties.com This advertisement is an offer for an educational product is in no way an offer to solicit or sell any investment or security. All investments contain risk, including potential loss of principal. Please consult your financial advisors before making any financial decisions.

- 36. G IN AT S! BR AR LE YE CE 10 The Best Education in the Real Estate Industry! in Person or Online Monthly educational club meetings with networking Workshops taught by seasoned experts $1,650,000. We now have 126 residents combined from both parks (up from 89 a year ago when we took over). We will add 6-10 more repo’s in the Spring to get to 70% occupancy. We just had the parks appraised and the valuation was $3,225,500. We will get all of our original capital and rehab funds back upon a refinance this Spring. More important, the parks have been positive cash flow from day one (I can’t stress the fact enough that you never buy a negative cash flow property) and the monthly net cash flow (after all expenses and mortgage payments) now exceeds $15,000 a month. You can see a positive article about our project written by the local newspaper on our website, just go to: www.acgmhc.com Affordable mentoring and training classes Hands on investment opportunities Exclusive insider’s member resources VIP membership with 24/7 access to MLS and Deal Analyzer Success and self improvement training sessions Online real estate hangouts and video libraries Mike Conlon is the founder and majority owner of Affordable Communities Group, LLC based in Cary, NC. He is also the author of Unconventional Wealth: The New Mainstreet Millionaires, which is available through Amazon. INVEST IN TEXAS 11.3% Be the Bank: Earn Passive Returns - High Annual Yields on First Liens on Texas Real Estate. a Real Estate is Stable and Appreciating a Rents are increasing a Leading the nation in job growth* a 4 of the top 6 fastest growing cities* a Experienced company, solid track record *forbes.com 512.219.5558 Annual Yield Email: info@stallioncap.com Based on 4th Quarter 2013 Accredited Investors Only. Call us today to see if you qualify. www.stallioncap.com 13740 Research Blvd. • Building J, Suite 7 • Austin TX, 78750 © 2013 Stallion Capital Management All Rights reserved Realty411Guide.com PAGE 36 • 2014 reWEALTHmag.com

- 37. Blackstone Unleashes Financing Options R eal estate investors looking for funding in 2014 could find this new lending source and its President one of their best allies… On November 15th, 2013 investment giant Blackstone made a major announcement that changes the game for rental property investors, and is likely to create ripples which have the potential to provide a huge boost to the U.S. economy at every level. Former joint head of single family rental finance at Deutsche Bank AG, John Beacham, recently joined Blackstone Tactical Opportunities’ new B2R Finance lending arm as President. “B2R” has now unleashed several stunning new mortgage finance programs specifically designed to aid small to mid-sized buy and hold real estate investors with loans of $500k to $50M. The Major Pivot Real Estate Entrepreneurs Have Been Begging For In recent years some rental property investors have felt significant pressure from mega funds like Blackstone, which according to Bloomberg, has spent over $7B in acquiring tens of thousands of U.S. residential rental homes. At the same time, access to credit for those desiring to capitalize on appetizing investment opportunities in the market has been incredibly restrictive, even for well-qualified borrowers. The B2R Finance pivot completely changes these dynamics. The new buy to rent financing source puts all of the best of Blackstone behind the smaller real estate entrepreneur to fuel their goals for the new year, and long term passive income generation and wealth building. With access to considerable deal flow, the capital to execute on it and a lending partner that really understands their needs the next 12 months promise to be an exciting time for expanding portfolios. In an interview with B2R President, John Beacham, Realty411 got the inside scoop on the firm’s new loan programs… Making Buy to Rent Finance a Breeze So what’s so notable about this new collection of loan products, and lender, and how easy is it to get funded? Realty411Guide.com By Tim Houghten al nightmare scenarios in which they have In our exclusive run out of funds have proven them to not January 2014 interview always be the most attractive option for John was quick to point buy and hold investors. out that while B2R Blackstone’s B2R flips this all on its Finance is a completely head, and specifically provides critically separate entity to Invineeded liquidity for those with 5 or more tation Homes, it puts rental homes, who are seeking loans from all of that experience, John Beacham $500k and up. billions in liquidity, and This enables investors to re-capitalize, understanding of the challenges investors achieve leverage for expanding portfolios face in this arena into backing the smaller and is providing a massive cash injection rental property landlord. with wide reaching benefits which should In fact, B2R is one of the only players make life a little better for everyone. in this segment of the market. Specifically 3 Steps to Success… it is unique in offering tailor made loan When asked about the advantages of products for financing single family rental working with B2R Finance, John Beaproperty portfolios with loan amounts cham explained, the B2R management between $500,000 to $50,000,000. team has funded significantly Mr. Beacham more rental homes loans than points out that Loan Program other institutions, pointing out not only are Highlights: the benefits of the expertise and approximately • Easy 3 Step Loan Process focus as “This is all we do.” 98% of the na• 30 Year Amortization Of course what everyone tion’s estimated • 5 & 10 Year Terms wants to know is how easy it is 14 million sin• Non-Recourse Options to get one of these loans… gle family rental • Min. DSCR 1.25 John told Realty411 that homes actually • Low Cost owned by small- • Loans from $500K to $50MB decision making on these loans is primarily based upon the asset er investors (not and cash flow, the company offers non-relarge institutional players), but “75% of course options; providing fast funding and those properties have been purchased with no debt.” John goes on to highlight: “that’s a straightforward process. Beacham was clearly very bullish on over 10 million properties in the U.S. with the outlook for rising asset values, which no financing on them, much of which has been picked up by entrepreneurs buying for investors should take as a great sign, and indicator of an aggressive lending partner their own personal portfolios”. which really wants to make loans, and B2R’s President comments that this pool which represents around 1 in 10 of all a lot of them. According to the head of the unit the borrowing process is really a homes in America doesn’t remain unlevsimple 3 step process: eraged due to a choice, but rather a gap in 1. Call toll free on 800-227-8107 or apply the market which has left investors sorely online at http://www.b2rfinance.com/ underserved. apply-now Besides the strict credit requirements 2. Return the signed term sheet and banks have set, investors in this segment ‘expense deposit’ for due diligence of the market have been buffeted by 3. Close your loan quirks in underwriting requiring extensive paperwork and limits put on the number of Investors who are serious about improving properties able to be financed. Hard money and growing their portfolios for 2014 need to learn more about B2R Finance and the lenders have tried to move back in, but high fees, double-digit rates, and occasion- opportunities they offer. PAGE 37 • 2014 reWEALTHmag.com

- 38. The Sensei Speaks On What, Where & How To Invest In 2014

- 39. S ensei Gilliland, of the extremely successful 12 ROUNDS real estate investors club and Black Belt Investors, just gave us the scoop on Remote RehabsSM, and where to find big spreads like it was 2010 again… The U.S. housing market may be even hotter than the club house fireplace at this time of year, but many new and veteran real estate investors alike are finding themselves battling heavy competition, rapidly rising prices and the logistical challenges of out of area investing. Sensei Gilliland’s simple “Find it. Fix it. Profit” mantra hasn’t just helped him come through some of the toughest years the U.S. housing market has ever experienced unscathed. It has evolved into the formidable weapon many rapidly growing investors, portfolios and investment businesses are crediting with using to get the edge – Black Belt Investors. In the past four years Black Belt Investors has been responsible for an incredible number of transactions. A big part of this certainly has to do with the focus on investing in the individual success of other investors. Rather than simply trying to pitch investors or consumers on a product, or overpriced inventory which needs to be shed, Black Belt Investors offers a full suite of assistance from education to investment opportunities to coaching and hard money lending in order to help all investors grow from the ground up to achieving their personal goals. Sensei explains this unique approach has helped many with their own breakthroughs, and just making what they were already doing better. This variety of strategies has helped others to reduce risk and hone in on what they really want more of. To date Sensei Gilliland’s students have used these strategies to generate cash via flipping houses, lease options and owner financing. Still, when asked which was his favorite real estate investment strategy for 2014, Sensei says he is still bullish on Remote RehabsSM. Remote RehabsSM enable global investors to benefit from accessing discounted properties, adding value and either flipping them for sizable, fast profits or holding them for ongoing cash flow and passive wealth building. Satisfying the demand for strong returns and below average acquisition costs, with the perk of having multiple exit strategies to choose from, Remote RehabsSM enable investors to engage in the most profitable markets, at the right times and leverage expert teams to maximize their returns. Obviously the biggest question most have today is where to engage in remote rehabbing? Black Belt Investors continues to see primary markets such as Las Vegas, Phoenix, and Southern California as the territory of wealth builders with an extremely long outlook, or who are okay with modest yields in exchange for enhanced safety. These markets continue to attract plenty of domestic and foreign interest, yet to a certain extent have suffered due to this popularity. Rental property investments in these areas can be great for long term hold and wealth preservation, but lack the advantage of rapid price appreciation today. Secondary is the new primary according to real estate experts and analysts across all industry sectors. Sensei Gilliland points Realty411Guide.com to secondary markets such as Kansas City, MO and Indianapolis, IN as offering a superior solution for those seeking a blend of appreciation and cash flow. However, for those looking for rapid wealth building Sensei’s top pick for Q1 2014 is Cleveland, OH. As he puts it “Cleveland, OH is now like Southern California in 2010,” It’s ripe with pent up equity, offering tremendous benefit to cash flow and value seeking investors.” Put simply Sensei sums up the current opportunities as being able to “pick up a beautiful home, in a good suburban neighborhood, with a strong cap rate,” but warns “the window of opportunity is short.” Right now Sensei paints a good example of this opportunity as being able to scoop up one of these homes which previous sold for around $100K, for just $45K. He also points out some of the benefits of this market right now include: 1. Getting ahead of hedge funds (and profiting from the rise they will provide later). 2. Affordable homes. 3. Cleveland is pumping millions into revitalization. 4. A city committed to avoiding developing a reputation like Detroit, and determined to maintain and lift local property values. 5. A county invested in the success and protection of real estate investors through ‘point of sale’ check, home inspection reports, monitoring contractors and ensuring investors are not overcharged on rehabs. This is backed up even further in recent news headlines: • Q3 2013 figures from Ohio banks show $2B in REOs and $35B in non-performing residential loans on their books. • On Oct. 17th, 2013 it was revealed Starwood Hotels & Resorts Le Meridien brand was joining the Cleveland rebirth with a new luxury hotel. • Nov. 4th, 2013, Crain’s declared “Cleveland is in the vanguard of urban revitalization strategies.” • Forbes says more than $3.5B is currently being invested in redeveloping the Cleveland area. Most real estate investors are probably familiar with the concept of turnkey and remote investing. So what really separates Black Belt Investors from the rest and has fueled the firm’s success? Sensei says the real differentiating factor in working with BBI is that unlike other investment firms and the endless line up of gurus out there which all appear to be punting their own inventory, much of which is being sold at, or even above market rates is “built in value, and being able to make acquisitions at wholesale rates.” Rather than picking from an old menu of stale listings which have been turned down by other investors, those investing through the Remote RehabsSM program are helped to find hot and fresh opportunities, which meet their individual criteria and investment objectives. Find out more about Sensei Gilliland, Remote RehabsSM, and request your free copy of Black Belt Investors’ Cash and Wealth Report online at: www.BlackBeltInvestors.com PAGE 39 • 2014 reWEALTHmag.com