REALTY411 - A COMPLIMENTARY MAGAZINE FOR INVESTORS

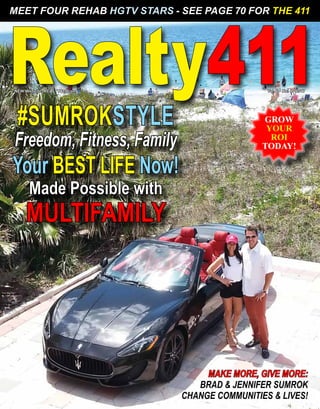

- 1. Realty411GROW YOUR ROI TODAY! MEET FOUR REHAB HGTV STARS - SEE PAGE 70 FOR THE 411 MAKE MORE, GIVE MORE: BRAD & JENNIFER SUMROK CHANGE COMMUNITIES & LIVES! #SUMROKSTYLE Freedom, Fitness, Family Your BEST LIFE Now! Made Possible with MULTIFAMILY NEW Website: REALTY411.com Vol. 6 • No. 4 • 2017

- 2. To learn more visit FOAcommercial.com/r41105 or call (855) 809-6115 © 2017 Finance of America Commercial LLC I I NMLS ID # 1133465 | AZ Mortgage Banker License BK #0926974. CA Finance Lenders License #60DBO 060757. MN: This is not an offer to enter into an agreement. Any such offer may only be made in accordance with the requirements of Minn. Stat. §47.206(3), (4). 500 North Rainbow Blvd., Suite 300, Las Vegas, NV 702-448-2030 NV Mortgage Broker License No. 4136. OR Mortgage Lender #ML-5283. Finance of America Commercial LLC only makes loans for business purposes. Finance of America Commercial LLC is not currently licensed in Utah and is not licensed for certain loans in Idaho. Finance of America Commercial LLC is licensed or exempt from licensing requirements in all other states. Your specific facts and circumstances will determine whether Finance of America Commercial LLC has the authority to approve loans in your specific jurisdiction. Finance of America Commercial LLC operates out of several locations, but not all locations conduct business in all jurisdictions. *Loans are subject to investor and business credit approval, appraisal and geographic location of the property and other underwriting criteria. Loan amounts and rates may vary depending upon loan type, LTV, verification of application information and other risk-based factors. Application fees, closing costs and other fees may apply. 1. For new construction loans, land must be already improved/developed for use (ie., ready for utilities and plumbing.) All applicable building permits must be submitted. Compare our Rates and Points to the Competition! Fix & Flip Lines of Credit* with rates starting at 6.99% Financing for ground-up new Construction*,1 Approved Borrowers >2000 Single and Portfolio Rental Loans* with No W-2 THE FUTURE OF LENDING IS HERE

- 3. Realty411Guide.com PAGE 3 • 2017 reWEALTHmag.com PUBLISHER Linda Pliagas LEGAL COUNSEL Boesch Law Group CONSULTANTS Steven Kendis, GRI Hector Padilla, GRI ADVERTISING Ryan Gay Jason Burke Kasey Barrett EDITORIAL STAFF Tim Houghten Stephanie Mojica COPY EDITOR Lori Peebles Stephanie Mojica PHOTOGRAPHER John DeCindis Realty411 Wealth Real Estate 805.693.1497 | Visit www.REALTY411.com PUBLISHED BY Pliagas Enterprises VICE PRESIDENT Nikolaos K. Pliagas COLUMNISTS Tom Wilson Kathy Fettke Randy Hughes Sensei Gilliland Leon McKenzie WEB MASTER Maria Landicho MARKETING Holly Lynn Rosa Houghten EVENTS & EXPOS Kasey Barrett Lawrence Ruano Michael Ringwald To receive complimentary copies for your club, real estate office or business, please call 805.693.1497 ADVERTISING 310.994.1962 Realty411.com | reWEALTHmag.com Realty411 / reWealth magazine is proudly published from Santa Barbara County, Calif. ©Copyright 2017. All Rights Reserved. Reproduction without permission is strictly prohib- ited. The opinions expressed by writers/columnists are not endorsed by the publishers. IMPORTANT DISCLOSURE: Publishers and staff are not responsible for performing due diligence on the opportunities offered by magazine advertisers and expo sponsors. Be- fore investing in real estate seek the advice of your trusted financial advisor, attorney or tax consultant. BEWARE: Real estate investing is risky and may result in loss of capital. PRINTED IN THE USA — GOD BLESS AMERICA Connect to Our Virtual Network Online: OurMissionisEducate&InspireOtherstoInvest. Learn How to Turn One Single Family House into a Monthly $5,000 - $15,000... Learn How to Turn One Single Family House into a Monthly $5,000 - $15,000... Cash Flow Tsunami!Cash Flow Tsunami! “Senior Housing is America’s Best Financial Opportunity for the Next 20 Years!” “Senior Housing is America’s Best Financial Opportunity for the Next 20 Years!” -Gene Guarino, President and founder-Gene Guarino, President and founder RALAcademy.comRALAcademy.com 480-704-3065480-704-3065

- 5. contents 10 Publisher’s Letter: It’s Time for a Mid-Year Review 12 Approaches to Negotiation: Tips & Techniques 16 Atlanta: Rich With Renters by Kathy Fettke 21 Three Offbeat Investments to Consider 22 20/20 REI Prepares for Big Business in Texas 27 The Trump Economy: An Emphasis on America 28 #SumrokStyle: Live Free & Fun with Apartment Investing. Learn with Brad & Jennifer Sumrok 31 Double-Digit Returns is Possible with Leverage 34 Discover the All New BREIA / MD-REIA 37 The Truth About Income & Real Estate Investing 40 Marco Santarelli Pinpoints Top National Markets 51 - 88 Private Money411 Featuring Texas Pride Lending, plus Meet the Leaders of Finance 89 Be a Maverick, Do It Different by Paul Finck 92 What Investors Should Be Demanding Now from Property Management by Pam Blanco 95 #TheConnector - A New Investor Emerges 99 Laura Alemery: An Educator on a Mission 105 Protect Your Assets Now with Fortune DNA 109 Your Worth is Beyond Compare with Sam Sadat 110 Money Mindset and Your Bank Account Balance 115 Armando Montelongo Reclaims His Throne 118 Randy Hughes Explains Why a Trust Works pg. 77 pg. 35 pg. 47 pg. 47 pg. 35 INSIDE: Learn strat- egies to help your bottom line from renowned industry ex- perts, such as (right, clock- wise): Kaaren Hall, Marco Santarelli, Todd Dotson and Brad and Jennifer Sumrok

- 6. • New Lower Costs. • Higher LTV’s. • 2nds for more leverage (case by case). • No upfront appraisal- Immediate pre-approval. • Will Allow No $$$ Down! • No bank statements, financials or verifications. • Faster service without the red tape! • No prepayment penalties or reserves required. • short form stated income loan application. • Flexibility to work within your business model. ATTENTION! FIX & FLIP INVESTORS WE’LL HELP YOU GET THERE!! YOU DESERVE MORE FROM YOUR LENDER!! Our Brand NEW Loan Program may lend you up to 100% of your purchase price, plus 100% of repairs Direct Lender Specializing in Fix & Flip Loans since 1987 GET A QUOTE NOW!!! Joel Hoffman 2624 Magnolia Blvd. Burbank, CA 91505 ACHIEVE REAL WEALTH TODAY! 818-848-8960: www.aztecfinancial.net

- 7. 800.248.8447 info@IRAServices.com www.IRAServicesTrust.com IRA SERVICES AND IRA SERVICES TRUST COMPANY AND THEIR REPRESENTATIVES DO NOT OFFER TAX OR LEGAL ADVICE. DO NOT PROVIDE INVESTMENT ADVICE, DO NOT SELL INVESTMENTS, DO NOT EVALUATE, RECOMMEND, OR ENDORSE ANY ADVISORY FIRM OR INVESTMENTS. INVESTMENTS ARE NOT FDIC INSURED AND ARE SUB- JECT TO RISK, INCLUDING THE LOSS OF PRINCIPAL. CLIENTS ARE ADVISED TO PERFORM OR FACILITATE THEIR OWN DUE DILIGENCE WHEN INVESTING. THE INFORMA- TION CONTAINED HEREIN DOES NOT CONSTITUTE LEGAL OR TAX ADVICE AND SHOULD NOT BE CONSTRUED TO APPLY TO ANY INDIVIDUAL PERSON OR SITUATION. EACH PERSON SHOULD CONSULT WITH HIS OR HER OWN PERSONAL TAX ADVISOR, FINANCIAL PLANNER, ATTORNEY OR ACCOUNTANT WITH RESPECT TO SUCH INDIVIDUAL’S SPECIFIC SITUATION AND SHOULD NOT RELY UPON THIS INFORMATION WITHOUT SUCH CONSULTATION. IRA SERVICES TRUST COMPANY Build Opportunities With a Real Estate IRA Have ‘Checkbook Control’ Over Your IRA Assets OUR CLIENTS ENTRUST US WITH MORE THAN $7 BILLION IN ASSETS. • Ability to act immediately on investment opportunities • Make payments or deposits without a third-party delay • Asset protection when doing business within the IRA/LLC Advantages of an IRA/LLC: If you have questions, please contact us. It is best to seek advice from your legal or tax advisor before proceeding with any type of investment strategy.

- 10. RemoteRehabs.com “The 100% Hands-Free, High Return Way to Effortlessly & Confidently Generate Great Cash Flow in the Hottest Real Estate Markets in America...” Cleveland Cash Flow Starting in the upper $40K’s 13% ROI Arizona Rentals Starting in the $80K’s #1 for job growth - Forbes Sensei Gilliland We Find It, We Fix It, We Rent It... YOU PROFIT!

- 11. “Put Jabber Mouth Marketing in your corner to launch affordable, attractive, and effective real estate websites, land- ing pages, blogs, branding, and email campaigns.” Discover the Dojo The All NEW Online On-Demand Real Estate Training Center www.BlackBeltInvestors.com Disciplined Investing Real Estate Education, Coaching and Investments Celebrating 22 Years in Real Estate www.BlackBeltInvestors.com www.JabberMouthMarketing.com Call for a FREE Consultation: (888) 379-0515 DISCIPLINED INVESTING Real Estate Education, Coaching and Investments The ALL NEW Online On-Demand Real Estate Training Center DISCOVER THE DOJO NO-HOLDS BARRED REAL ESTATE TRAINING

- 12. Goals Will Be Reached Review the Past, Learn, Let Go LINDA’S LETTER Linda Pliagas, Publisher Realty411Guide.com PAGE 12 • 2017 reWEALTHmag.com T hank you for joining us for another exciting issue! If you’ve been following us for a few years, you will notice this is our largest magazine yet. At 124 pages, it is a remarkable increase from our premiere publication 10 years ago. This magazine has grown steadily around the country and globally, with a force fueled by my dual life-long passions: media and real estate. My mission is simply to share in- formation, which can expand knowl- edge, increase motivation, and create a positive impact in our industry. Positive energy attracts the like, and now, even more exciting things are in motion, such as our collaboration with top celebrity rehab stars from HGTV (Home & Garden Television), the country’s leading cable network for real estate entertainment. Last year, we featured Clint Harp, from Fixer Upper at our expo in Texas. (Client now has his own show, Wood Work, on the DIY (Do It Yourself) Network. This fall, we are proud to host four HGTV celebrity rehabbers: The mother/ daughter duo from Good Bones, as well as the identical twins from Listed Sisters. In addition, recently a producer reached out to me to assist him with a new project, Property Pitch. Now, we have a creative treatment, which he wrote and registered with the Writer’s Guild of America. Life is exciting! I’m reaching my goals, and I hope you are as well. It is important to note that on our quest for success, we will encounter obstacles... mainly our own Self. As we move forward, we tend to review the past and wish we could erase mistakes. We all have things we would like to redo. It’s important to give yourself per- mission to review the past, learn from it, then... let it go. Move forward to accept the new opportunities in store. Thanks again for your support, and if I can help you in any way, please let me know. Follow on Facebook, Twitter, and Instagram PhotobyJohnDeCindis SATURDAY, AUG. 19, 2017 LAGUNA CLIFFS MARRIOTT RESORT AND SPA 25135 Park Lantern Dana Point, CA 92629 9:00 AM TO 5 PM - FREE EVENT NETWORKING COFFEE MIXER RSVP: 805.693.1497 or REALTY411expo.com/OC Hosted by Realty411 and Learn from Kent Clothier! REALESTATEINVESTOREXPO + Networking Breakfast Mixer! Orange County’s

- 13. NORADA REAL ESTATE INVESTMENTS 30251 Golden Lantern, Suite E-261 Laguna Niguel, CA 92677 ARE YOU ON TRACK TO ACHIEVE YOUR FINANCIAL GOALS? Income-producing real estate is the most historically proven way to accumulate wealth, and has created more financial freedom than any other means. Norada Real Estate Investments provides everything you need to invest in the best turnkey cash-flow rental properties. Our simple proven system will help you Create Real Wealth and Passive Monthly Income. Get your FREE Strategy Session with our knowledgeable Investment Counselors today! www.NoradaRealEstate.com (800) 611-3060

- 14. START OUT EARLY Negotiations begin at the first encounter (e.g., phone inquiry). Many people think the initial pleasantries are just that, and the formal negotiations will begin later. Not so. The superior negotiator will have already begun gathering information and setting expec- tations. Start early so you don’t have to catch up. THE THREE ELEMENT There are three elements to any negotiation: 1) Information, 2) STRATEGY Approaches to REAL ESTATE NEGOTIATION ARTICLE BY BRUCE KELLOGG INTRODUCTION Negotiation, unfortunately, is not taught much to real estate profes- sionals, or to investors. International, corporate, and purchasing courses exist, even to the extent of Master’s degrees, but real estate has not received the same coverage. This article aims to help that. Continued on pg. 16 Realty411Guide.com PAGE 14 • 2017 reWEALTHmag.com

- 15. How to Own Real Estate In this class you will learn to dominate the banks, own multiple properties,eliminate your mortgages in ten years and start with very little cash flow. Without Mortgages Realty411Guide.com PAGE 16 • 2016 reWEALTHmag.com How to Own Real Estate In this class you will learn to dominate the banks, own multiple properties,eliminate your mortgages in ten years and start with very little cash flow. Without Mortgages OUR EXPERT SPEAKER Over the past 15 years, national consultant, speaker and educator, Matthew Pillmore has presented financial education national- ly for and in front of countless real estate organizations. He speaks nationally on the topics of credit scoring, debt elimination, fiscal responsibility and strategic cash flow maximization. Mr. Pillmore has studied under the found- ers of the FICO credit scoring system. We have countless testimonials and references from previous REIA owners, managers and attendees that can attest to the value of the education provided by VIP Financial Education. All educational content is provided free of charge. There is no “selling from the stage” or solicita- tion by the speaker. The class will last approximately 50 minutes plus time for questions. VIP is not a financial advisor, nor do they sell any financial products. VIP has been providing free financial education for over 15 years and has an A+ rating with the Better Business Bureau. Learn to DOMINATE the Bank, OWN Multiple Properties, and ELIMINATE Your Mortgages in 10 Years and Start with Very Little Cashflow. “If you’re serious about your business, then this is a must-see class!” www.FreeCashFlowEd.com/VIP

- 16. Time, and 3) Power. These will be described below. GATHER INFORMATION The negotiator who gathers the most information usually has an advantage. Interview people, obtain reports, do inspections, use the MLS (Multiple-Listing Service) and other online resources. Hire a private investigator on the seller if the deal is large enough, looking for vulnerabilities (e.g., bitter divorce). You can’t know too much. THE FACTOR OF TIME It helps to know if the other party has any time constraints, along with your own, of course. Pending foreclosure, divorce, condemnation proceedings are some examples. If the property is “a steal”, scoop it up fast. If it’s priced at or above “market”, then “grind real slow”. Use time to your advantage. THE FACTOR OF POWER In some negotiations the power levels are uneven. One party has more leverage over the other. Seasoned ne- gotiators assess power levels and devise strategies to take these into account. Then, even the weaker party can optimize its outcome. BE GENEROUS WHEN SELLING Some sellers believe in “Win-Lose” negotiating. They want “top dollah”. This apparent greed and intransi- gence grates on everyone involved, sometimes to the extent of legal action or retaliation. Be generous when selling. Paint that bedroom. Purchase a Home Protec- tion Plan for those first-time buyers. You’re on your way to wealth. DON’T BE CHEAP! Keep your word. Perform everything you’ve agreed to do. And smile as you do it, even if the deal is going against you and you are taking a loss. Don’t whine. Smile. Builds character….and your reputation. THE “CONCESSION PATTERN” In the back-and-forth of negotiations, your “con- cession pattern” is very important because it sets up expectations in the other party. Always negotiate fairly tightly. Don’t concede too much because the other par- ty will see that as an opening to seek more. Go back- and-forth more times if need be. Try to set things up so you take the other party’s counteroffer rather than force them to take yours. This way they will feel they won, and you will have less trouble with them the rest of the way. And, please, don’t arbitrarily “split the difference”. Amateur negotiators do that. “SHARP PRACTICES” The day will come, if it hasn’t already, when the oth- er party will bring “sharp practices” to the table. If these are illegal (e.g., undisclosed money back after the close), call them on it, and refuse to participate. If these are not exactly illegal, then counter them as best you can, or walk away. Life is too short, and your reputation is too important. Always “take the high road” in negotiations. RE-NEGOTIATING AFTER INSPECTIONS Y’all know to re-negotiate after property inspec- tions, right? ‘Thought so. READING LIST Included on the next page is a list of “Recommended Reading.” Buy all of them, used. Read and highlight them. Then, once a year, re-read the highlights. You owe it to your clients, and yourself, to be in tip-top shape a as a negotiator. v Bruce Kellogg has been a REALTOR® and investor for 35 years. He has trans- acted about 500 properties for cli- ents, and about 300 properties for him- self in 12 California counties. These include 14 units, 5+ apartments, offic- es, mixeduse buildings, land, lots, mo- bile homes, cabins, and church- es. He is available for listing, sell- ing, consulting, mentoring, and partner- ing. Reach him at brucekellogg10@gmail. com, or (408) 489-0131. Gather Information: The negotiator who gathers the most information usually has an advantage. Realty411Guide.com PAGE 16 • 2017 reWEALTHmag.com

- 17. APPROACHESTOREINEGOTIATION Recommended Reading by Bruce Kellogg • Negotiate This, Herb Cohen, 2003 • Everything Negotiable, Eric Wm. Skopec and Laree S. Kiely, 1994 • Guerrilla Negotiating, Jay Conrad Levinson, Mark S. A. Smith, and Orvel Ray Wilson, 1999 • The Negotiating Game, Chester Karrass, 1992 • The Only Negotiating Guide You’ll Ever Need, Peter J. Stark and Jane Flaherty, 2003 • Seal the Deal, Leonard Koren and Peter Good- man, 1991 • You Can Negotiate Anything, Herb Cohen, 1980 • How to Win Friends and Influence People, Dale Carnegie, 1936 REAL ESTATE CLUB SAM’S Founded 2003 Real Estate Education In Person & Online Workshops & Bootcamps Mentoring Programs Investment Opportunities Private Lending Founded in 2003, Sam’s Real Estate Club has helped thousands of investors learn, network and prosper Watch our real estate investing meetings LIVE online! Sam Sadat President & Founder CELEBRATING 14YEARS (800) 998-9930 www.SamsREclub.com KATHY Realty411Guide.com PAGE 17 • 2017 reWEALTHmag.com

- 18. Atlanta Suburbs: RICH with RENTERS MARKETS W e’ve heard a lot about millennials pouring into to city centers as they chase after jobs, social connections, luxury apartments and condos, and the benefits of the sharing economy. But a new report shows that the biggest U.S. metros are experiencing a renter “boom” in the suburbs -- and Rent- Cafe says suburban Atlanta is at the top of that list. That’s creating new opportunities for investors looking for single-fam- ily rentals with low prices and high returns, and Atlanta is a great place to find them. Atlanta was a superhot market for the single-family investor just a few years ago, but popular neighborhoods got a little too popu- lar and prices rose. Other neighbor- hoods hadn’t recovered enough to draw interest. As the wheel turns for real estate hot spots, neighborhoods that were shunned before, are look- ing better now and many of those great locations are in the suburbs. What’s Happening in the Suburbs? The RentCafe report says it looks at Census data for a 5-year period, from 2011 through 2015. And, it found that urban centers have not gained as many renters as we’ve come to be- lieve. It says the numbers show that suburban areas gained substantially more renter households than their urban counterparts in 19 out of the 20 metros it reviewed. In Atlanta, the data shows a net gain of 52,300 suburban renter households during that time frame. That’s a 26% increase in those households. That’s a huge number of additional renters in just a 5-year-period. Atlanta’s urban area only gained 15,100 renters which reflects a 10% increase. Suburban rent growth was so strong in Atlanta, St. Louis, Riverside County California, and Boston, it was “three” times that of their more urban counterparts. RentCafe says of the 20 metros areas it studied, suburban areas gained about 700,000 new renter households in that 5-year period. City centers in those same areas gained about 600,000. In Riverside County the percentage of suburban renter growth was lower than Atlanta but the overall number of new renter house- holds was much higher, at 60,500. Just 18,500 renter households were added in urban areas. Chicago also saw sub- stantial suburban renter growth, along with Miami, and Dallas. RentCafe says the main reason for the shift is “cheaper rents”. Renters are also getting more family-friend- ly neighborhoods with garden-style apartment communities. They are also finding that schools are usually better in the suburbs, neighborhoods are quieter, and their living expenses take a smaller bite out of their paycheck. RentCafe says that an analysis of the Yardi Matrix database shows that renters save about 11% or a month’s worth of rent if they move to the sub- urbs, based on average rents in the 20 areas studied. Kathy Fettke is Co-CEO of Real Wealth Network and best selling author of Retire Rich with Rentals. She is an active real estate inves- tor, licensed real estate agent, and former mortgage broker, specializing in helping people build multi-million dollar real estate portfolios that generate passive monthly cash flow for life. With a passion for research- ing real estate market cycles, Kathy is a frequent guest expert on CNN, CNBC, Fox, Bloomberg, NPR, CBS MarketWatch and the Wall Street Journal. She was also named among the “Top 100 Most Intriguing Entrepreneurs” by Goldman Sachs two years in a row. Kathy hosts two podcasts, The Real Wealth Show and Real Estate News for Investors — both top ten podcasts on iTunes with listeners in 27 different countries. Her company, Real Wealth Network, offers free resources and cutting edge education for beginning and experienced real estate investors. Kathy is passionate about teaching others how to create “real wealth,” which she defines as having both the time and the money to live life on your terms. Realty411Guide.com PAGE 18 • 2017 reWEALTHmag.com

- 19. What’s Going on in “Hotlanta”? It’s bustling with life, people are finding jobs, and the city is making some big quality-of-life improve- ments. Atlanta is undergoing a big redevelopment plan. That’s contrib- uting to those jobs and making the city a more attractive place to be. Just to give you an idea of the kinds of things Atlanta is doing, there’s a huge project underway called the “Atlanta Beltline”. It’s a project that will connect 45 city neighborhoods with a 22-mile loop of multi-use trails, streetcars, and parks. The Beltline website says it has received several awards as for its visionary approach to making the city more walkable, bikeable, and oriented toward public transit. The project is making use of long forgot- ten rail lines that circled the city. There’s also the former Bell- wood Quarry that is being turned into a huge park and reservoir. You may have seen the stunning granite quarry walls and bright blue tint of the water in scenes for “The Hunger Games”, “The Walking Dead”, and “Stranger Things”. The city is in- vesting at least $300 million dollars to turn the water-filled quarry into a 2.4 billion gallon reservoir. When it’s done, it’s expected to hold a 30- day supply of drinking water for 1.2 million people. Once the reservoir is finished, the city will develop the surrounding 300 acres as the city’s largest park. The new Westside Res- ervoir Park will also be connected to the city via the Beltline. There’s also the conversion of the former Fort McPherson Army base into a huge movie studio complex. African American filmmaker Tyler Perry bought the historic 330-acre piece of real estate in 2015 and is turning it into the latest version of his Tyler Perry Studio. The L.A. Times reports that when it’s done later this year, it will be one of the largest studios in the country. The paper also says that Tyler hopes to create 3 to 4,000 news jobs at the studio, and recruit people from low-income parts of Atlanta. Major upgrades are also coming to one of Martin Luther King Junior Drive which runs right through the city center -- past the state capi- tal, the historic Atlanta University Center, and the Georgia Dome. It’s a 12-mile stretch that has become an eyesore with old or abandoned buildings in need of repair. The city plans to convert the 4-lane road into two traffic lanes, and two for bicycles. There will also be new roundabouts, plant-filled medians, small parks, and new pedestrian crosswalks. And then there are two new sports stadiums in the making. Both the Falcons and the Braves are building new stadiums. That’s expected to bring tens of thousands of new jobs to the city. And the city is already experiencing job growth that’s high- er than the nation’s average. The latest report from the U.S. Department of Labor shows that Atlanta experienced a 3.6% growth rate for non-farm jobs in the last year. Jobs for the professional and business services industry grew the most at 4.6%. That’s well above the 3% growth rate for that sector nationally. Percentage of Suburban Renter Growth These are just a few things go- ing on in “Hotlanta”. As for the percentage of suburban rent growth for the other areas, Phoenix and Riverside County came in with a 23% increase. Tampa, Dallas, and Minneapolis range from 18% down to 15% growth in suburban renters. Detroit, Miami, and Denver expe- rienced a 14% renter growth rate in the suburbs. Houston, Washington, D.C., and Seattle were all at 13%. Chicago was at 12%. San Francisco at 10%. San Diego and St. Louis were at 9%. Los Angeles, Boston, New York, and Philadelphia were at the bottom of the list with a 7% to 3% suburban rental growth. The Real Wealth Network offers opportunities for investors to own single-family rentals in several of those suburban markets. We will be talking about opportunities in suburban Atlanta at some of our upcoming live events. For infor- mation about our calander, visit Realwealthnetwork.com and just click on the “learn” tab and then the “live events” tab. v Realty411Guide.com PAGE 19 • 2017 reWEALTHmag.com

- 20. G ene Guarino has found a real es- tate investment niche, which can more than double the cash flow potential of a property. How does he do it? Could it work for you too? Gene started investing in real estate at 18 years old. He has done everything from fix and flip, buy and hold, wholesaling, com- mercial and everything in between. Fifteen years ago, he stumbled on a way to super-size rents and net investment income as he was problem-solving a challenge for his own family. Now, he’s teaching his solution to investors all around the world. > SUPPLY & DEMAND > There are around 77 million boomers turning 65. With 10,000 people a day turning 65 and 4,000 turning 85 years old each day. In fact, this “Super senior” group is the fastest-growing demographic in America. As we continue to live longer, the over 85 population is expected to surge by 300% in the next few years; 70% of these retirees and seniors are going to need help with their activities of daily living or ADLs. They will need a place to live and many will also need assis- tance with their ADLs. The demand and need is huge now, and it is an unstoppable wave of opportunity. > CREATIVE PROBLEM SOLVING > Gene Guarino experienced this for himself, firsthand. When his mother needed this type of assisted living help. She didn’t like the ‘big box’ offerings out there. Neither did Gene. He wanted to ensure his mom was taken care of in a “home-like” atmo- sphere. It isn’t always practical or logis- tically possible for us to give them ~ While Helping Others~ HowToSUPER-SIZEYourRents, Continued on pg. 24 article by: Tim Houghten what they want and take care of the rest of our families. Gene’s mom wanted to keep living in a regular home. Liv- ing alone just wasn’t viable, and didn’t make sense, as will be the case for millions of others. As with all other great innovations, Gene stumbled on his life’s calling, and an innovative solution for in- vestors, by solving this need he felt firsthand: “Significant residual income and helping other people” Today, Gene trains thou- sands of real estate investors to secure their own great retirement, while helping others live well during theirs. For some that may include their own parents. What he discovered was the ability to acquire, convert and operate a residential assisted living home in a single-family home. It gives residents not only the aid they need, but also a far more comfort- able and friendly space to live, with good company. Those things can be priceless at that age, and for the peace of mind for family members, and may not only help extend life, but keep it enjoyable as well. The average resident at an RAL home in the US pays $3,600 per month to stay there. It will have 6, 8, 10, 12 or even 16 or more National Speaker, Educator and Founder of the Residential Assisted Living Academy

- 21. W hen most people think of investing in real estate, homes, mini-malls, or apartment buildings may come to mind first. However, that's only the tip of the real estate investment iceberg. Consider the following offbeat real estate investing opportu- nities. These investments can provide a significant return in the long run and may very well alter your financial future. 1. RECREATIONAL VEHICLES (RV) Believe it or not, RV rentals and sales is a very big market. With baby boomers leaning into retirement and young families seeking a way to lessen their vacation costs, many people are willing to buy or rent an RV. • If you're hoping to purchase an RV to save money on your family vacations, keep the RV until it makes sense to sell it. Make routine cosmetic updates to the RV throughout the years to match the expectations of buyers. • Consider renting out the RV for a profit. The RV rental market is hungry with renters, but is much undeserved. You can easily rent out a class C motor home for 7-nights for a minimum of $125 per night! If you're fully booked every week out of the year, you can earn $46,000 in just one year! • For a class A RV you can charge in upwards of $200 per night, or $1,400 for a seven-day week, which equates to $73,000 over the course of a fully booked year. Pop-up campers can be rented for as much as $75 per night - or just over $27,000 for a fully-booked year. > STRATEGY 3 OFFBEAT Investments to Considerby Dr. Teresa Martin, Esq. Realty411Guide.com PAGE 21 • 2017 reWEALTHmag. com

- 22. MEETYOUR REIANYC LEADER Teresa R Martin, Esq - Founder/Counsel D r. Teresa R. Martin, Esq. is a sought-after attorney, real estate broker, real estate and financial health coach, keynote speaker, author, consultant, and a Dave Ramsey Master Coach. As principal of her own practice, she has honed her skills in the areas of residential & commercial real estate transactions, foreclosure defense litigation and credit restoration services. In addition to being an attorney, Teresa wears the hat of a seasoned real estate investor with a focus on creative acquisition strategies. Strate- gies that she developed, implemented and taught to others through her role as Counsel/Founder of Real Estate Investors Association NYC (“REIA NYC”) and as Director and past President of the New York Chapter of Better Investing, the na- tion’s largest non-profit organization dedicated to investment education. Her legal experience, coupled with her pas- sion for financial ministry and consumer edu- cation, led her to join and complete her Group Leader training with Fellowship of Companies for Christ International (“FCCI”) in 2005. She con- tinues to use her God-given gifts to encourage, equip and help others understand sound financial biblical principles through Generational Wealth Zone, a conduit for the everyday person to achieve financial freedom through tutelage in the areas of financial literacy, business ownership, real estate and stock market investing. Teresa has appeared as a legal and real estate expert on Voice of Ameri- ca, Real Estate Straight Talk and numerous radio programs. She has been featured in such publications as Money magazine and Diva Zone magazine and more. Email: tmartin@reianyc. org • Even if you're only able to rent out your RV for two weeks out of the month for $125 per night, you're able to earn $23,000 per year! 2. SELF-STORAGE Self-storage is a big industry. The shaky state of the economy may be partially to blame, as the number of multi-generation homes and families downsizing their living quarters are increasing. • The Self Storage Association reports that one in ten families rent out-of-home storage space. Typically, units rent between $50 per month for a small unit to over $200 for a sizeable storage unit. • The cost of purchasing a self-storage facility varies widely. It can cost as little as $200,000 or as much as $3,000,000 depending on the size, location and demand for the service in the area. • Keep in mind, aside from the mortgage, there is still overhead. Utilities must be operating in order to keep the storage facility at an acceptable temperature; this is to avoid ruined personal property. Also, employees might be necessary, as well as a security system. But as a whole, the investment generates fairly passive income. 3. ONLINE REAL ESTATE Online real estate, otherwise known as websites, requires very little investment and can typically gen- erate a good ROI over time. Traditionally real estate is thought of as tangible, but don't disregard the earn- ing power of online property. When you consider that Candy.com sold for over $5 million dollars, online real estate has the potential for astronomical returns. Continued on pg. 24 Realty411Guide.com PAGE 22 • 2017 reWEALTHmag.com

- 23. TAKE CONTROL ... UNLOCK UNLIMITED BUYING POWER. 6100 Indian School Rd NE Suite 215 Albuquerque NM 87110 1-800-529-3951 Option 1 specializediraservices.com CALL: 1-800-529-3951 OPTION 1 VISIT: SPECIALIZEDIRASERVICES.COM Feeling lost in the stock market conundrum? Unlock your IRA to fund your next deal. Or unlock your best friend’s 401k for that property on Main St. We provide you the “self-directed” keys to access the $7 Trillion dollars locked away in IRAs and 401ks across the nation. Only you can self-directed it off of Wall Street and back onto main street. By combining the power of Specialized IRA Services’ concierge level service and real estate deals in your own backyard, you can take control of your financial future like many others have. Make your next deal a self-directed one. Unlock unlimited tax-free earning potential today. Your Money, Your Future, Your Way. HSA SEP 401k CESA IRA ROTH

- 24. • Approximate startup costs are as follows: $10 for a domain name, $0-75 for a standard website template to over $750 for a unique website design, and content creation starting at around $15 for a quality article. • The key to making money online is having high quality and a high quantity of content, in addition to moneymaking streams like marketing other compa- ny's products, on-site advertising, or product sales. There you have it — three markets where the compe- tition isn't very fierce and the bar of entry is relatively low. By investing in any one of the three offbeat investments mentioned, you'll have the opportunity to maximize your investment dollar. And over time, you may be able to transform your investment into a fully expanded business. v Three Offbeat Investments to Consider, pg. 22 Realty411Guide.com PAGE 24 • 2017 reWEALTHmag.com residents. After all expenses including the cost of the real estate, the net monthly profit can be $5,000 to $15,000. Some of that may be funded from long-term care insurance, government assistance, insurance poli- cies, savings and investments or even the sale of a family home. When you focus on just the private pay residents and not the Medicare or government assisted residents, you can be netting $10,000 to $25,000 per month. If you just want to own the real estate and lease that to the operator of the RAL home, you can typically charge up to twice the normal or fair market rent. The lease will typically be a long-term lease of 3 - 5 years with renew- als of 3 - 5 years. That makes for a significant cash flow. That easily has the potential to generate multiple times the average market rent of a given property that may oth- erwise be leased annually to another individual. With just one of these tenants, investors could be doubling their gross income. This also happens to be extremely import- ant to investors who are now finding they are facing high property prices, peaking rents, and rising interest rates. > FIND THE RIGHT FIT > According to Gene Guarino there are several ways to implement this strategy, including: 1. ACQUIRING EXISTING ASSETS Although rarely available due to being such strong cash-flow generating investments, there may be some of these existing facilities available for purchase as turnkey operations. That means plugging right into an existing stream of income, and immediate returns. 2. ACQUIRING & REPOSITIONING HOMES Most investors will probably find that they can create the most value by acquiring and repositioning homes with this strategy themselves. There may be licenses and regulations to follow, depending on where the property is located, but the upside can be hugely profitable. 3. NEW BUILDS, NEW OPPORTUNITIES With property prices rising, but interest rates reasonable for now, some investors may apply this strategy by custom-building their own facilities from the ground up. This can provide a new and attractive product, with little maintenance requirements, and perhaps even greater equity. > LEARN MORE, EARN MORE > Gene has been training thousands of individuals on how they can apply these strategies themselves. We caught up with him after a recent trip to Central Amer- ica where he had been training and educating expats in Belize, Panama, and Mexico about how they can do it in their own communities. His US-based students now have residential investments like this in at least 13 states. This training and education is provided through the Residential Assisted Living Academy, which delivers both live and online training. Online training teaches the RAL Formula through modules like How To Turn A Single Family Home Into A Cash Flow Machine, Find It, Fund It, Fill It, and Running Your Business. The 3-Day FAST TRACK is a live training experi- ence that includes touring his RAL certified homes and learning the business from the inside out. Find out more at http://RALAcademy.com/ or call 480.704.3065 How to Super-Size Your Rents, pg. 20

- 25. MOVING TO TEXAS Big Business Discover Why Companies are Exiting the West Coast and Staking Ground in the Lone Star State, Giving 2020 REI a Hometown Advantage. >>

- 26. C ompanies are moving to Texas in droves. Toyota is relocating hun- dreds of their employees to their new headquarters in Plano, Texas by May 15th. The biggest online retailer in the world, Amazon, recently moved a major portion of their distribution center to North Texas. That is just the tip of the iceberg. If you think moving to the Lone Star State is just a passing fad, just ask State Farm, Liberty Mutual, Fed EX, and Jamba Juice. The business gold rush has begun and they are all coming to Texas. Why? Let’s break it down. First and foremost, doing business has never been easier. It’s more about business growth than anything else. “Businesses are sick and tired of being over-taxed and over-regulated and are making the economically sensible choice to move to Texas,” said John Wittman, deputy press secretary for Texas Gov. Greg Abbott’s Office. The timing is simply perfect in Texas as both corpo- rate relocation and real estate demand rises at the same time. “When so many large corporations are lining up to move to Texas, there is going to be a shortage of actual real estate available,” said Marcus Reynolds, VP of Investor Relations for 2020 REI. “Texas is a very business-friendly state for compa- nies to move to. Among the essential benefits for this migration to Texas include no state income tax, a strong economy, steady job market, and affordable housing.” California is losing out to Texas as corporations flee higher tax rates and stringent regulations. “I was raised in California and couldn’t imagine a better place to be but in 2011, I realized that the cost of living was so out of reach my family and I decided to make the move to Texas,” said Abe Romero, VP of Marketing for 2020 REI. “If I would have known what I know now, I would have bought as much Texas real estate as humanly possible.” Texas has always been bigger and better but that statement has never been truer for real estate investors. “Texas is an out-of-state investor’s dream,” said Tim Herriage, CEO of 2020 REI. “Real estate investors can come in and fix and flip or purchase and rent for much greater returns than nearly anywhere in the country. Our state is in such high demand that it is not un- common for my company to buy a property and then find a buyer who will pay 20% more than we paid for it within the same day.” Real estate has for the most part paid higher returns than the stock market. It’s a way for those who want to invest to take advantage of an asset that has historical- ly outperformed Wall Street. “At the end of the day, we feel great about the service we provide,” said Tim. “We are an investors one-stop shop for Texas. We offer comprehensive in house services for investors of all sizes and scopes. 2020 and its companies have helped investors sell one home, or sell two dozen; and then flipped roles to help an out-of-state fund acquire hundreds of homes using our licensed real estate agents. We have the unique ability of being able to leverage our in-house finance team, full-service real estate agency, and experienced direct investment teams to provide a complete ecosystem for those wanting to invest in Texas.” 2020 REI was founded to live up to its mission; to provide world-class customer support with the highest level of integrity. “Our team is transacting more than $10MM per month in Texas investment proper- ty,” said Herriage. “Investable Realty is expanding beyond Dallas to service more of the state, and it is always exciting when we are able to help investors meet their goals, while achieving our own. I encour- age investors of all levels to contact our team, and let us show you why we are the premier one-stop shop for real estate investing in Texas.” v To learn more about 2020 REI and how they can help you grow your real estate investment business, please call or text at 972-382-7866 or email us at sales@2020rei.com Texas is a very favorable state for companies to move to along with hard work- ing Americans. ‘ ’ Realty411Guide.com PAGE 26 • 2017 reWEALTHmag.com

- 27. The �ming is simply perfect in Texas as both corporate reloca�on and real estate demand rises at the same �me. “When so many large corpora�ons are lining up to move to Texas, there is going to be a shortage of actual real estate available,” said estor Rela�ons for 2020 ss friendly state for mong the essen�al benefits nclude no state income dy job market, and exas as corpora�ons flee ent regula�ons. “I was ldn’t imagine a be�er ealized that the cost of my family and I decided to aid Abe Romero, VP of I would have known what I ught as much Texas real .” er and be�er but that truer for real estate of-state investors dream,” 2020 REI. “Real estate fix and flip or purchase and rent for nearly anywhere in the country. Our d that it is not uncommon for my stop shop for Texas. We offer comprehensive in house services for investors of all sizes and scopes. 2020 and its companies have helped investors sell one home, or sell two dozen; and then flipped roles to help an out of state fund acquire hundreds of homes using our licensed real estate agents. We have the unique ability of being able to leverage our in-house finance team, full service real estate agency, and experienced direct investment teams to provide a complete ecosystem for those wan�ng to invest in Texas.” 2020 REI was founded to live up to its mission; to provide world class customer support with the highest level of integrity. “Our team is transac�ng more than $10MM per month in Texas investment property” said Herriage. “Investable Realty is expanding beyond Dallas to service more of the state, and it is always exci�ng when we are able to help investors meet their goals, while achieving our own. I encourage investors of all level to contact our team, and let us show you why we are the premier one-stop shop for real estate inves�ng in Texas.” Texas real estate as humanly possible. ry te es ard Real estate investors can come in and fix and flip or purchase and rent for much greater returns than nearly anywhere in the country. 2000 homes. He is passionate about helping other real estate investors achieve success” Marcus Reynolds is VP of Investor Relations at 2020 REI. He is an expert at finding stabilized turnkey properties for investors who want to grow their portfolio through passive real estate investments. Abe Romero is VP of Marketing for 2020 REI and brings 20 years of marketing experience to the organization. He is passionate about working in the real estate industry and helping investors better understand the market. o Texas or’s Dream ‘Real estate investors can come in and fix and flip or purchase and rent for much greater returns than nearly anywhere in the country.’ ‘Real estate investors can come in and fix and flip or purchase and rent for much greater returns than nearly anywhere in the country.’ MARCUS REYNOLDS is VP of Investor Rela- tions at 2020 REI. He is an expert at sourcing 'stabilized turnkey investment proper- ties' for investors who plan to strategically grow their investment portfolio. ABE ROMERO is VP of Marketing for 2020 REI and brings 20 years of marketing experi- ence to the organiza- tion. He is passionate about working in the real estate industry and helping investors better understand the market. ted and are making the ce to move to Texas,” said s secretary for Texas Gov. The �ming is simply perfect in Texas as both corporate reloca�on and real estate demand rises at the same �me. “When so many large corpora�ons are lining up to move to Texas, there is going to be a shortage of actual real estate available,” said estor Rela�ons for 2020 ss friendly state for mong the essen�al benefits nclude no state income dy job market, and exas as corpora�ons flee nt regula�ons. “I was ldn’t imagine a be�er ealized that the cost of my family and I decided to aid Abe Romero, VP of I would have known what I ught as much Texas real .” er and be�er but that truer for real estate of-state investors dream,” 020 REI. “Real estate fix and flip or purchase and rent for nearly anywhere in the country. Our d that it is not uncommon for my provide,” said Tim. “We are an investors one stop shop for Texas. We offer comprehensive in house services for investors of all sizes and scopes. 2020 and its companies have helped investors sell one home, or sell two dozen; and then flipped roles to help an out of state fund acquire hundreds of homes using our licensed real estate agents. We have the unique ability of being able to leverage our in-house finance team, full service real estate agency, and experienced direct investment teams to provide a complete ecosystem for those wan�ng to invest in Texas.” 2020 REI was founded to live up to its mission; to provide world class customer support with the highest level of integrity. “Our team is transac�ng more than $10MM per month in Texas investment property” said Herriage. “Investable Realty is expanding beyond Dallas to service more of the state, and it is always exci�ng when we are able to help investors meet their goals, while achieving our own. I encourage investors of all level to contact our team, and let us show you why we are the premier one-stop shop for real estate inves�ng in Texas.” bought as much Texas real estate as humanly possible. ry te es ard Real estate investors can come in and fix and flip or purchase and rent for much greater returns than nearly anywhere in the country. Tim Herriage has 12 years experience in the single family real estate industry and has purchased over 2000 homes. He is passionate about helping other real estate investors achieve success” Marcus Reynolds is VP of Investor Relations at 2020 REI. He is an expert at finding stabilized turnkey properties for investors who want to grow their portfolio through passive real estate investments. Abe Romero is VP of Marketing for 2020 REI and brings 20 years of marketing experience to the organization. He is passionate about working in the real estate industry and helping investors better understand the market. TIM HERRIAGE has 15 years’ experience in the single family real estate industry and has purchased nearly 2000 homes. He is passionate about helping other real estate investors achieve success.

- 28. W e’re wading into the Trump Economy. How do we survive and thrive in these new times? It no longer matters whether we loved or hated the idea of Trump winning the election. He’s in the White House. Instead of allowing our emotions to hang on the puppet strings of big media, what we all need to focus on is what is really happening off-screen, and how we can get out in front of it, and make smart investment decisions. THE BIG SHAKE UP Some big shake ups have happened: The firing of many government officials and What’s next for America, the real estate market and global investors? THE#TRUMPECONOMY Continued on pg. 30 Realty411Guide.com PAGE 28 • 2017 reWEALTHmag.com An economic analysis by Tim Houghten

- 29. Realty411Guide.com PAGE 21 • 2017 reWEALTHmag.com

- 30. the reversal of numerous Obama-era policies. Brace yourself: More change seems imminent. Focusing on the facts; what we do know is that there has been a big shift in both the energy sector and jobs. It appears that there is now far more support for old energy. That includes support for the Keystone XL pipeline and entrenched automakers. Several major auto manufacturers have already pledged to reverse direction, and expand plants and jobs in the US, to the tune of billions of dollars in investment, and tens of thousands of jobs. That’s on top of the almost 300,000 jobs added in February 2017, which beat estimates by almost 30%. Infrastructure investment, a stronger job market, and hopefully rising wages, could all lay a great foundation, and become a launch pad for a far more robust American economy in the years ahead. THE REAL ESTATE PRESIDENT If there is one thing that virtually everyone can agree on, it is that Trump should be great for real estate. One must assume he ought to act in the interest of his main passion and investment of choice. The real estate market is going strong with foreclo- sures down, inven- tory tightening and interest rates still being historically low. Funding crite- ria is also loosening up with stated loans and other creative funding products returning. Despite all the tales of bank- ruptcies, the con- spiracy theories and fake news, Trump remains a real estate legend. That belief has already shown up in the market This fresh confidence in the market has set off a new surge. The idling market, which had appeared set for a dip, got wings in January, setting a 10-year record for home sales, according to NAR (National Association of REALTORS®). Wells Fargo and the National Association of Home Builders simultane- ously reported a bump in sentiment, and new highs in home buyer activity, with a bright outlook for President Trump has been very vocal about easing the ability to lend and borrow, specifically for home buyers and small businesses. Realty411Guide.com PAGE 30 • 2017 reWEALTHmag.com

- 31. Realty411Guide.com PAGE 31 • 2017 reWEALTHmag.com 2017. Buyers are shopping, investors are hunting for deals, sellers are listing high, and real estate and mortgage professionals and businesses are injecting masses of capital into new marketing campaigns to claim a share of the action. The general consensus is that this flurry of confi- dence and activity will carry the market through the majority of the next four to eight years and beyond. LENDING CAPS The rise of property values and transaction activity may only be hindered by access to credit and affordabil- ity. President Trump has been very vocal about easing the ability to lend and borrow, specifically for home buyers and small businesses. A return to the ‘good old days’ of easy sub-prime lending might be welcomed by many. Yet, banks and big funds have already established new channels for putting capital to work, and avoiding the risk of direct consumer lending. They are currently far happier loaning to real estate investors than retail home buyers, and that’s showing up in underwriting and mortgage approvals. Some investment property lenders are again offer- ing 100% financing and stated income loans. That’s a combo most home buyers may have to wait a little longer for. Meanwhile Fan- nie Mae and Freddie Mac have public- ly announced that they intend to loan billions this year, as they blow through lending caps, thanks to exemptions for ‘affordable’ housing projects. Hopefully the powers that be will be able to gracefully maintain balance Continued on pg. 122

- 32. T he art of transacting real estate investments for generating income, and why investing in rental property may not be the move for you, yet… Real estate is absolutely the corner- stone of wealth. It is highly reliable, and an essential element for building and preserving finances. However, some find getting started, and getting the results they hoped for, is a challenge. Over the last 22 years of coaching and training investors, I’ve found that comes down to three main things. 1. Getting lost in the different invest- ment options 2. Making it more complicated than it needs to be 3. Failing to have a solid action plan MYTHS & MISCONCEPTIONS ABOUT REAL ESTATE INVESTING * MYTH 1: There is One Superior Way to Invest One of the biggest hurdles today is not only the increasing number of real estate websites and gu- rus out there, but that so many are more focused on sales, rather than true education. Too many try to promise that their strategy is ‘the superior’ solution. The truth is that wholesaling, fixing and flipping houses, private lending, and investing in rental properties can all work. I’ve personal- ly done all of these. I still do today. The best strategy really comes down to your personal preferences, your time- line, capacity to invest, and goals. Some people love rehabbing houses and would do it regardless of the money. Others just want a completely hands-free way to invest and would never dream of taking on a DIY project for any amount of money. For many it is a matter of the right strategy at the right moment, and diversifying and moving up over time. * MYTH 2: You’ve Got to Do a Lot of Deals How many houses does someone need to own or flip per month to live a comfortable life? See most people I encounter think they must do five to 10 houses per month. Then they just get daunted by the size of that, or they set unrealistic goals, which diffuses their motivation, and they never get started. It’s true that there are investors and business owners out there hustling, doing 10, 20 or more deals a month. Big goals The Truth About Income & Real Estate Investing > Realty411Guide.com PAGE 45 • 2017 reWEALTHmag.com BY SENSEI GILLILAND

- 33. Realty411Guide.com PAGE 46 • 2017 reWEALTHmag.com are great. Yet, most don’t need to do anywhere near that. Every deal is different. But if you could make $5,000 wholesaling a property, or $50,000 flipping a house, or $500 a month on a rental, how many would you really need to live well? Two wholesale deals a month would make you over $100,000 per year. Rehabbing and flipping a house every 2 months could pocket you $300,000 per year. Ten modest rentals could give you $50,000 in passive income per year. Or you could loan your capital to some good house flippers as a private lender and make 10% returns, and beat the pants off the performance most are getting in the stock market. * MYTH 3: You Should Focus on Building the Biggest Stash of Cash Having big figures on your bank statements, a six-figure 401(k) balance, and a home safe stuffed with cash might make you feel great. There are definitely benefits of having liquidity and some serious reserves. Yet, no matter how much you’ve got, you can burn through it fast. Check out the stats and you’ll find the average retirement account balances dives around 50% within the first five years of retirement. Today we’ve got to be prepared to live 30 plus years after retirement age. We also need to be pre- pared to survive and provide, even if we can’t get up and go to work tomorrow. Ongoing passive income streams are far more valuable than cash in the bank. I’d rather have just $100,000 in the bank and $100,000 in perpetual annual income from rentals, than having $1M in the bank, and no passive income sources. * CREATING A BATTLE PLAN Whether you need $70,000 or $700,000 a year to life comfortably and afford the lifestyle you want and to sustain it, you need a plan. If you are starting out with nothing, then you may need to start with wholesaling, and then move up to fixing and flipping, and then invest that capital through private lending and acquiring in- come producing rentals. Or maybe if you already have some capital or properties, you just need to restructure your portfolio to optimize your cash flow and wealth- building potential. It doesn’t have to be that complicated or confus- ing. It can take work and hustle, but if you are pas- sionate about your goals, you can achieve them through real estate. It’s all about having a plan that’s right and that works for you. That’s what I do. I help inves- tors, from brand new beginners to those with established portfo- lios, to create a straightforward step-by-step battle plan to get where they really want to go, in a way they can stick to. If you are not sure exactly what the right way to start is, or if you are getting the most out of your investments, then visit www.BlackBeltInvestors.com and setup a free strategy session, with me, and I’d be glad to show you how I’ve helped thou- sands of others get on the financial path they always dreamed of. v

- 34. • REHAB PROPERTIES • NEW CONSTRUCTION • HARD MONEY LOANS Any type of RESIDENTIAL or COMMERCIAL Property! • REHAB PROPERTIES • NEW CONSTRUCTION • HARD MONEY LOANS Any type of RESIDENTIAL or COMMERCIAL Property! California Bureau of Real Estate License Number 01963387 Call Mr. Antonio Castillo Your Aggressive Loan Specialist Now! Antonio@cacommercialcapital.com 323-369-1442 No Red Tape Rush Funding Spec Homes Land Appartment Buildings Commercial Properties WE MAY LEND YOU 100% OF PURCHASE PRICE PLUS 100% REPAIRS SUBJECT APPRAISAL Almost No Qualifying No Financials or Verification REHAB PROPERTIES NEW CONSTRUCTION HARD MONEY LOANS for $85 Million Private Funds!! Attention! AGENTS!! INVESTORS!! DEVELOPERS!! YES!! WE MAY LEND YOU 100% OF THE PURCHASE PRICE PLUS 100% REPAIRS SUBJECT APPRAISAL We Are Anxious to Lend You Money Right Now!! Call Mr. Antonio Castillo YOUR AGGRESSIVE LOAN SPECIALIST NOW! 323.369.1442 California Bureau of Real Estate License umber 01963387 antonio@cacommercapital.com Almost No Qualifying No Financials or Verification REHAB PROPERTIES NEW CONSTRUCTION HARD MONEY LOANS for $85 Million Private Funds!! Attention! AGENTS!! INVESTORS!! DEVELOPERS!! DIRECT LENDERS WILL ALSO LOAN FOR: • Spec Homes • Land • Apartment Buildings • Commercial Properties • Up to $3,000,000 + Per Property • HANDSOME REFERRAL FEES PAID $$$ $85 Million Private Funds!!! No Financials or Verification - Rush Funding! No Red Tape - Almost No Qualifying

- 35. Realty411Guide.com PAGE 35 • 2017 reWEALTHmag.com TheAmazingStoryBehind Brad&JenniferSumrok’s REALESTATESUCCESS What’sitliketoachieve FINANCIAL FREEDOM throughrealestateinvestment? Live FREE Have FUN with MULTIFAMILY INCOME

- 36. THE WORLD IS YOUR OYSTER Brad and Jennifer Sumrok are always on the go: From traveling around the world, to teaching students nation- ally and having homes in two states. We caught up with Brad one recent afternoon as his wife prepared some healthy shakes in the background. The financially independent couple were getting ready to take off to Hong Kong and Thailand for a 24- day birthday getaway. The Sumroks have a second home in the sunny Gulf Coast of Florida, but say they get away internationally at least two times each year. Re- cently that includes destinations like Italy, Costa Rica, and Machu Picchu in Peru. Though Brad says one of his most memorable excursions was taking his dad on his dream vacation — a 13-day cruise and land exploration of Alaska, for his 80th birthday. On another occasion Brad took off to live in Mexico for six weeks to immerse himself in the culture and learn Spanish. THE KEYS TO FREEDOM For the Sumroks, financial freedom came from investing in Multifamily real estate. Brad says that in 2003 he found a mentor who taught him about real estate and financial inde- pendence. In under three years, Brad replaced his six-figure corporate income and put $1M in his pocket from his investments and quit his job. He was just 38 years old. What do you do when you don’t have to work to survive anymore, especially starting at such a young age? While you’ll find Brad Sumrok’s popular Facebook profile rich in travel pics, workout vid- eos, and his investment properties, Brad says that he really found his gift in teaching others how to master investing in apartment buildings for passive income. Although he had rarely spoken on stage prior to getting into real estate he says “when you are led to something, when you are living in your passion, and area of mastery, you are not really working.” Add- ing that what he does now is simply “sharing life experience and transfer- ring that mastery,” to his students. APARTMENT INVESTOR MASTERY Brad Sumrok currently hosts three weekend training events in Texas each year. These March, July, and November events attract hundreds of attendees from all over the United States, and beyond. Over 400 guests visited the March 2017 weekend, which combines live training and loading up in buses to get out and look at active multifamily property deals. As of early 2017, Mr. Sumrok per- sonally owned property in five states, and six different property markets. In the last year his students acquired 29 multifamily complexes, in 11 markets, totaling 2,885 units, worth Brad Sumrok quit his corporate job in 2005, thanks to investing in multifamily real estate. He’ll never go back to the rat race, because he and his wife live life on their own terms and have more freedom and income than when he had a job. Realty411Guide.com PAGE 36 • 2017 reWEALTHmag.com

- 37. STUDENTS’STORIES <<< “In less than 10 months after attending Brad’s train- ing, we led the purchase of 214 units in Oklahoma for $7,350,000. Brad’s Mento- ring Program made every- thing so easy for us.” - Tariq Sattar and Iven Vien >>> “We joined Brad’s Program and were surprised at how quickly things happened for us. We followed Brad’s process and closed on two buildings total- ing 128 units in New Mexico. Following Brad’s system made it so easy!” - Monick and Peter Halm (with partner Chris Rush) (Above): Brad and Jennifer Sumrok produce and host multifamily property tours, which have grown to become one of the most popular tours in the industry. SUMROK’SSUCCESSSUMROK’SSUCCESS (Above): Brad’s Weekend Apartment Investor Training in Dallas with over 400 attendees from all over North America and the world. Realty411Guide.com PAGE 37• 2017 reWEALTHmag.com >>> “Brad helped us buy a 32-unit property that initially cash- flowed over $3,000 per month. After 3 years, we refinanced and pulled out $450,000 tax-free! We still own it, have over $600,000 equity, and cash flow over $3,000 per month. This one deal changed our lives.” - Phyllis and Ken Salverson >>> Brad, aka:“The Apartment King,” is surrounded by fun-loving ladies who are also successful apart- ment investing students. <<< “I was an absolute beginner who purchased a 32-unit property with seven other investors I met in Brad’s Program. Two years later we sold the property and the investors more than doubled their money.” - Tom Lafferty

- 38. $133M. Brad says there are three main types of attendees at his events. This includes: active single-family home investors who are feeling the pain of daily management and trying to scale, and passive investors who have capital to work with and want hands-free, cash-flowing opportu- nities. Or like him in 2002 — the educated corporate workers who may have some savings, but have never been taught about being an investor or business owner, and who may want to skip over single-family investing and start immediately as a multifamily investor, either buying large deals as a Syndicator or small- er deals with their own money. While his weekend training events are held in Texas, the strat- egies taught there can be applied anywhere in the US, as demonstrat- ed by many of Brad’s students and Brad himself who buy in different US markets. Brad says that while he enjoys world travel he believes success comes when you “invest in what you know, and where you know,” and that area of mastery for this edu- cator is in US apartment buildings. While this may sound complicat- ed or a big move to make, attendees love Brad’s ability to break it down and make it simple. For those who can commit a few hours per week, achieving their own financial free- dom can be a realistic and attainable goal as well. ENRICHING PEOPLE CHANGING MANY LIVES Those interested in finding out more about Brad and his events can do so online at ApartmentInvestorMastery. com or BradSumrok.com. Then it’s up to each individual and family to decide how they will flex their freedom. For the Sumroks, it isn’t just travel and education, but also increasingly enriching others’ lives. What will you do with your freedom? Realty411Guide.com PAGE 38 • 2017 reWEALTHmag.com

- 39. #SUMROKSTYLE SEE THE WORLD Recently that has included help- ing family members realize their dreams, charitable contributions for back to school drives, and organiz- ing and matching charitable dona- tions and GoFundMe campaigns for local people such as those who need critical surgeries, but lack the funds. What will you do with your freedom? v The Sumroks: Live Free, Have Fun, pg. 38 Above: Brad and Jennifer infront of the largest Buddhastatue in the world at LantauIsland, Hong Kong. Above: Brad and Jennifer feeding an elephant in Thailand. Below: In Stone- henge. Right: The loving couple renew their vows before family and friends. Above: Brad and Jennifer visiting and celebrating with Robert Kiyosaki, founder of the Rich Dad Company, at his birthday party held on a cruise. Above right: Extreme adventures on a glacier in Alaska. Left: Fun times with family is the foundation of the Sum- rok lifestyle. Peace out from Alaska while rafting with Brad’s father and Jennifer’s mother. ADVENTURES FROM MULTIFAMILY INVESTORS

- 40. What’s it like to run a multi-million dollar multifamily empire with proper- ties around the country? The Sumrok’s take you behind the scenes into their busy, healthy, and fun-filled lives! 7 am - The Sumrok’s awake (to no alarm) after getting a good night’s sleep. The active duo do not set alarms unless they are catching a flight or have some other scheduled voluntary activity. After awaking, they immediately start drinking water. 7:15 am - Brad drinks coffee (yes, that is still one of his vices) and Jen has tea while they discuss the upcoming day. 7:30 am - Drink up! Time for a vegan protein shake. 8 am - 9:30 am - The fit couple hit the gym religiously four to five days per week! Workouts consist mostly of weight training (about an hour) followed by abs, then 20 min of high intensity cardio. A yoga day is added for flexibility. When in their Florida home, they also enjoy running or walking on the beach in the morning. While traveling, the Sumrok’s do their best to maintain working out and choose hotels with decent fitness centers and full-service restau- rants. Their favorite U.S. chains are Fairmont, W, Four Seasons and JW Marriott. 10 am - Breakfast (either made at their home or in a local restaurant that specializes in paleo/organic foods). Brad and Jen’s favorite is the “hash bowl” (diced sweet potatoes, onions with scrambled egg whites and grilled chicken). Jen doesn’t eat meat so she has hers with eggs, avocado, quinoa and kale. 11 am - 5 pm - This time is usually spent supporting stu- dents with coaching calls and reviewing deals, working on their business (planning events, prepping for speaking engage- ments, growing the business, and meeting and supporting Sumrok team members). They also replying to emails and phone calls. 1 pm - Lunchtime. Brad usually chooses prepared foods from places like MyFitFoods or Snap Kitchen in Dallas, or FitLife Foods when in the Tampa Bay area. They also frequent Whole Foods and eat from the salad bar or hot bar. 6 pm - Dinner time. They either dine on prepared foods, cook dinner or eat out in local restaurants that offer healthy/ organic dining options. 7 pm -11 pm - Time to relax, read, debrief the days activ- ities, discuss plans for the next day/week. They also enjoy Face-Timing with family and staying connected with them. They catch up on emails and listen to voice-mails from the day. Sometimes they work on the business. Occasionally, they watch a movie on AppleTV. They don’t do sitcoms or watch the news. When in their Florida home, they also get together regularly with Jen’s family in the evenings. 9 pm - Usually they have some sort of low-carb snack like non-fat Greek Style yogurt or a vegan protein shake. 11 pm - The health-conscious couple are usually in bed early. Of course they are not always like his 24/7/365. They enjoy eat- ing out a lot and their favorites are Italian food, Thai, Indian and Mediterranean. Piz- za and red wine is their typical “splurge” meal. Due to our travel schedule, they do their best to choose healthy options. HEALTH+- A Day in the Life of Brad and Jennifer Sumrok - Realty411Guide.com PAGE 40 • 2017 reWEALTHmag.com Workout time with their personal trainer, Robert Terry.

- 41. “TheSecrettoLivingisGiving.”-TonyRobbins Brad and Jennifer Sumrok backstage with their mentor, Tony Robbins.

- 42. F or the leveraged investor, today’s financial tools will continue to provide predictable, stable, and secure double-digit returns for the foreseeable future. In an attempt to put this positive outlook in perspective, let’s con- sider four critical topics. This will help confirm, bring caution, or even deny our opening statement. • Dodd-Frank, CFPB and Government Restrictions • Lending TRID & Non-TRID Leverage • Interest Rates • Non-TRID Lending The Dodd-Frank financial reform created a new layer of government oversight called the “Consumer Finance Protection Bureau” or CFPB. It was signed into existence by former President Obama, as a solution to the financial crisis of 2008. It took full effect in 2013. Will it be changed anytime soon? Not likely, though promised. Keep in mind, Congress seldom “undoes” what it has done and an executive order is pointless. Let’s be clear, the after shocks of 2008 brought about a significant shift within the lending industry. In effect, it made “protection” of the public, a top priority. This was quite a shift from the traditional viewpoint of lending, one based upon risk-taking and risk aversion. Further it locked into place, barriers to lending, which could not be ex- plained away by sound reasoning and good explanation. The pendulum had swung. Yet in response, a dual market for financing was created to meet demand. Let’s develop this. Most Investors of “1 -4 units”, understand 30-year fixed rate mortgages and the rule of 10 financed properties. Most know this market now falls under the new “TRID” rules, or just for fun, TILA RESPA Integrated Disclosures. What is little known, is the plethora of “NON-TRID” lenders. Why so? Because TRID technically, is only for owner-occupied. Yet to keep lives simple, most lending portals now include non-owner, 1 to 4 units. A healthy way to assure liquidity in this market. Beyond this, a number of lenders are providing mortgages for rental units, but ones based upon a modified set of rules. Though these rules are guided by Federal oversight, they are not as restrictive. Hence the num- ber of leveraged properties is more flexible and required levels of cash reserves are less stringent. Bottom line: Markets adapt to con- sumer demand and lending options are available. What about interest rates? Truly a favorite topic of mine. After 35 plus years of success in real estate, driven by ever trending lower rates, we maybe on the verge of a season of rising rates. Should this concern us? My answer is: “No.”. Why so? Because rates are but one component of overall market fundamentals. Fur- ther, rates tend to rise in response to a growing economy, one where wages, property appreciation, and rents are showing real signs of last- ing strength. Thus the key to success, is not rates alone, but instead “locking” in a lending rate below the “cap rate” of the investment. This is the disciple able to push one’s “re- turn-on-capital” into the mid-teens. Often in history, the time to in- vest or shift one’s portfolio, is when rates first begin to rise; when wage growth and increasing property values exceed changes in rates and inflation. Now seems a good time. With this, is the growing aware- ness that today’s interest rates take into account more than just finan- cial fundamentals. They also con- sider the overall economic, social, and political stability of Europe, the Mideast, Russia, China, and else where. This uncertainty may help ex- plains why US rates did not start increasing in 2014, even though GROWTH with Leverageby Michael Ryan Continued on pg. 97 Realty411Guide.com PAGE 42 • 2017 reWEALTHmag.com

- 43. Discover the All NEW BREIA / MD-REIA Mentorship Program REIA CLUB Realty411Guide.com PAGE 43 • 2017 reWEALTHmag.com Learn about the only mentor program in the country that puts up 100% of the funds for every student’s deal! What are the 3 reasons why you should choose a local mentor? Real Estate investing has become one of the most popular ways to get out of the 9-to-5 lifestyle and become financially free. Have you ever heard the saying: There are more self-made millionaires through real estate than all other industries combined? Since the explosion of popular television programming based on people making a lot of money flipping real estate, there are even more people today that are trying and succeeding in the business. Part of the reason for this, and based on the popularity of these television shows, is the fact there are more so called “gurus” or “men- tors” for real estate investing than ever! Every time you get on Facebook or YouTube, there is an advertisement for someone that wants to teach you how to become rich flipping proper- ties using their “system”. The biggest challenges for these national mentors and their “systems”, are also the rea- sons why you should choose a local mentor! HERE ARE THE 3 REASONS WHY YOU SHOULD CHOOSE A LOCAL MENTOR... 1.) YOUR MENTOR HAS TO BE ACCESSIBLE! When learning any trade, it is almost impossible to not have any hands on training involved in the process. This is especially true for Real Estate investing. Your mentor has to be able to show you the ropes firsthand. It is truly more of an apprenticeship than mentoring. Many of those involved with a national mentor com- plain of not being able to actually contact their mentor with questions. More importantly, when it comes time to put a prop- erty in contract to flip for a profit, their mentor is not there to help them negotiate the deal and sell the prop- erty. Even if the national mentor program assigns you to an investor in your state, there is not much guaran- teeing that they will be any more accessible. 2.) YOUR MENTOR HAS TO HAVE EXPERIENCE IN YOUR MARKET! If you are going to flip houses in Houston Texas, don’t you think it would make sense to have a mentor that actually flips houses in Houston? Of course it >