Copy Of Brydges Master 2010

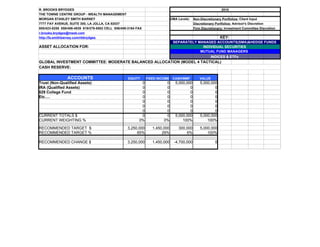

- 1. R. BROOKS BRYDGES 2010 THE TOWNE CENTRE GROUP - WEALTH MANAGEMENT MORGAN STANLEY SMITH BARNEY UMA Levels: Non-Discretionary Portfolios: Client Input 7777 FAY AVENUE, SUITE 300, LA JOLLA, CA 92037 Discretionary Portfolios: Advisor's Discretion 800/423-8258 858/456-4939 619/379-5502 CELL 858/459-3164 FAX Firm Discretionary: Investment Committee Discretion r.brooks.brydges@mssb.com http://fa.smithbarney.com/rbbrydges KEY: SEPARATELY MANAGED ACCOUNTS(SMA)&HEDGE FUNDS ASSET ALLOCATION FOR: INDIVIDUAL SECURITIES MUTUAL FUND MANAGERS INDICES & ETFs GLOBAL INVESTMENT COMMITTEE: MODERATE BALANCED ALLOCATION (MODEL 4 TACTICAL) CASH RESERVE: ACCOUNTS EQUITY FIXED INCOME CASH/MMF VALUE Trust (Non-Qualified Assets) 0 0 5,000,000 5,000,000 IRA (Qualified Assets) 0 0 0 0 529 College Fund 0 0 0 0 Etc…. 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 CURRENT TOTALS $ 0 0 5,000,000 5,000,000 CURRENT WEIGHTING % 0% 0% 100% 100% RECOMMENDED TARGET $ 3,250,000 1,450,000 300,000 5,000,000 RECOMMENDED TARGET % 65% 29% 6% 100% RECOMMENDED CHANGE $ 3,250,000 1,450,000 -4,700,000 0

- 2. EQUITY SUMMARY SECURITY CURRENT $ TARGET % TARGET $ CHANGE $ 1 Year 3 Yr. Annl. 5 Yr. Annl 10 Yr. Annl. DEVELOPED MARKET LARGE & MID CAP 0 26.0% $1,300,000 $1,300,000 U.S. Large Cap 0 8.0% $400,000 $400,000 Large Cap Growth 0 4.0% $200,000 $200,000 Polen Capital Mgmt.-Large Cap Growth 0 39.8% 3.8% 5.0% 3.5% Atalanta Sosnoff- Large Cap Core 0 33.1% -0.3% 6.2% 2.4% Riverbridge Eco Leaders- All Cap Growth 0 43.9% 2.2% 3.8% na Roosevelt Inv Growth- All Cap Core 0 17.8% 1.7% 6.0% 5.2% Clearbridge Advisors- Core Appreciation (UMA) 0 20.2% -0.2% 4.0% na Clearbridge Advisors- Large Cap Growth (MDA/UMA) 0 36.4% -4.1% 0.1% -0.4% Clearbridge Advisors- All Cap Growth (MDA) 0 42.2% -3.2% 1.8% 3.1% Clearbridge Advisors- Multi Cap Growth (MDA/UMA) 0 49.7% -2.2% 3.5% 7.0% ClearBridge Opportunity- All Cap Core (UMA) 0 56.4% -1.8% 3.3% 11.2% Janus Adviser Forty (Large Cap Growth) 0 44.2% 3.4% 7.0% 0.8% JP Morgan US Large Cap Core Plus Select (130/30) 0 36.4% 0.6% na na Alger Capital Appreciation Instl (All Cap Growth) 0 49.1% 3.3% 8.4% -1.3% Wells Fargo Advantage Opportunity Fund (All Cap Core) 0 47.6% -2.4% 2.3% 3.2% Smith Barney Private Client Balanced Equity Model Port. 0 24.7% 2.0% 4.5% na Russell 1000 Growth Index (Large Cap Growth) 0 37.2% -1.9% 1.6% -4.0% Standard & Poors 500 Index (Large Cap Core) 0 26.5% -5.6% 0.4% -0.9% Large Cap Value 0 4.0% $200,000 $200,000 BlackRock Equity Dividend-Large Cap Value 0 20.7% -1.3% 5.6% 6.7% Lord Abbett All Cap Value 0 27.4% -0.1% 4.1% 7.8% Clearbridge Advisors-All Cap Value (MDA/UMA) 0 28.5% -4.2% 1.4% 3.4% BlackRock Equity Dividend 0 22.2% -1.9% 4.9% 5.8% Nuveen Tradewinds Value Opportunities Fund (All Cap Value) 0 51.1% 4.5% 11.3% na Russell 1000 Value Index (Large Cap) 0 19.7% -9.0% -0.3% 2.5% Dow Jones Industrial Average 0 22.7% -3.1% 1.9% 1.3%

- 3. U.S. Mid Cap 0 4.0% $200,000 $200,000 Mid Cap Growth 0 2.0% $100,000 $100,000 Frontier Asset Mgmt.- Mid Cap Growth Equity 0 36.3% 3.4% 7.2% 6.5% ClearBridge- Mid Cap Core 0 38.3% -0.5% 4.2% na Clearbridge Advisors- Multi Cap Growth (MDA) 0 49.7% -2.2% 3.5% 7.0% Clearbridge Advisors- All Cap Growth (MDA) 0 42.2% -3.2% 1.8% 3.1% Goldman Sachs Growth Opportunities (Mid Cap Growth) 0 58.2% 4.4% 4.9% 6.7% Aston/Optimum Mid Cap (Mid Cap Core) 0 66.6% 2.6% 5.9% 10.5% Russell Mid Cap Growth Index 0 46.3% -3.2% 2.4% -0.5% Mid Cap Value 0 2.0% $100,000 $100,000 Kennedy Capital- Mid Cap Value 0 35.5% -0.4% 5.2% na PENN Capital-Mid Cap Core/ Value Bias 0 48.1% -7.1% 3.4% na Clearbridge Advisors-All Cap Value (MDA) 0 28.5% -4.2% 1.4% 3.4% Artisan Mid Cap Value 0 39.3% 0.8% 6.2% na Janus Adviser Perkins Mid Cap Value I 0 30.7% 0.8% 5.5% 11.2% Russell Mid Cap Value Index 0 34.2% -6.6% 2.0% 7.6%

- 4. International Developed 0 14.0% $700,000 $700,000 Europe ex U.K. 0 2.0% $100,000 $100,000 MSCI EMU Index 0 31.4% -6.3% 4.1% 1.3% United Kingdom 0 1.0% $50,000 $50,000 MSCI UK Index 0 43.3% -7.1% 2.4% 1.3% Japan 0 1.0% $50,000 $50,000 MSCI Japan Index 0 6.3% -10.4% -0.8% -3.7% Asia Pacific Ex-Japan 0 1.5% $75,000 $75,000 MSCI Pacific ex-Japan Index 0 72.8% 3.8% 10.9% 15.5% Canada 0 1.5% $75,000 $75,000 MSCI Canada Index 0 56.2% 3.3% 10.8% 8.9% International/ Global Diversified 0 7.0% $350,000 $350,000 Renaissance Investment Mgmt.-International Equity ADR 0 34.2% 0.9% 10.9% 4.9% Harding Loevner International- Growth 0 46.3% -2.1% 7.8% 3.0% Thornburg International-Value 0 44.9% -1.6% 7.4% 7.6% Harding Loevner Global Equity ADR 0 44.6% -0.8% 6.0% 3.4% River Front Investment Group- Global Allocation 0 28.4% -3.1% 3.8% na Clearbridge Advisors- International Core/Growth (MDA) 0 31.2% -2.9% 5.6% 1.7% International (not including USA) Janus Adviser International Overseas Growth (Large Cap Growth) 0 78.3% 2.5% 16.0% 5.0% Allianz NFJ International Value (Large Cap Value) 0 41.8% 0.1% 9.3% na Global Diversified (including U.S.) BlackRock Global Allocation Fund (Tactical Allocation) 0 24.1% 3.3% 7.6% 8.8% MFS International Diversification Fund of Funds 44.3% -4.7% 5.7% na MSCI AC World Index 0 42.1% -3.0% 6.3% 3.1% MSCI EAFE Index 0 32.5% -5.6% 4.0% 1.6%

- 5. DEVELOPED MARKET SMALL CAP 0 7.0% $350,000 $350,000 U.S. Small Cap 0 5.0% $250,000 $250,000 Small Cap Growth 0 2.0% $100,000 $100,000 TCW Small Cap Growth 0 65.0% 6.6% 8.2% -6.9% London Company Small Cap Core 0 39.9% 0.9% 7.1% 14.8% Clearbridge Advisors- Multi Cap Growth (MDA) 0 49.7% -2.2% 3.5% 7.0% Clearbridge Advisors- All Cap Growth (MDA) 0 42.2% -3.2% 1.8% 3.1% TCW Small Cap Growth 0 63.3% 6.0% 8.1% -6.0% Russell 2000 Growth Index 0 34.5% -4.0% 0.9% -1.4% Small Cap Value 0 3.0% $150,000 $150,000 Kayne Anderson Small Cap Qual Value 0 28.3% -2.3% 4.6% 11.3% Clearbridge Advisors-All Cap Value (MDA) 0 28.5% -4.2% 1.4% 3.4% Royce Premier Investment (Small Cap Value) 0 33.3% 2.5% 6.5% 10.7% Russell 2000 Value Index 0 20.6% -8.2% 0.0% 8.3% World ex U.S. Small Cap 0 2.0% $100,000 $100,000 Oppenheimer International Small Company 0 118.3% -5.0% 9.2% 6.3% MSCI EAFE Small Cap Index 0 46.8% -7.2% 4.2% 4.9% EMERGING MARKETS 0 8.0% $400,000 $400,000 Lazard-Emerging Markets 0 79.2% 2.4% 15.5% na Lazard Asset Management Emerging Markets 0 69.8% 5.6% 16.8% 11.5% MSCI Emerging Markets Free Index 0 78.5% 5.1% 15.5% 9.8%

- 6. ALTERNATIVE INVESTMENTS 0 24.0% $1,200,000 $1,200,000 Real Estate & REITs 0 5.0% $250,000 $250,000 INVESCO Realty Real Estate 0 46.7% -14.4% 3.5% 13.2% ING Global Real Estate Fund (Global) 0 44.7% -13.3% 2.0% na Cohen & Steers Realty Majors Index 0 24.9% -15.4% -0.5% 10.5% Commodities: Real Assets/Natural Resources 0 4.0% $200,000 $200,000 PIMCO Commodity Real Return Strategy 0 35.1% -2.9% 0.9% na Goldman Sachs Commodity Index Trust 0 13.5% -7.0% -3.0% 5.1% Gabelli GAMCO Gold Fund 0 35.2% 6.7% 17.5% 20.1% Evergreen Precious Metals Fund 0 32.6% 8.8% 20.1% 22.5% COMEX Gold Trust Index 0 24.0% 19.9% 20.1% 14.3% Newgate Global Resources Portfolio 0 51.0% 0.1% 9.3% na Ivy Global Natural Resources 0 62.6% -3.7% 7.7% 14.1% BlackRock Natural Resources 0 43.8% 2.6% 11.2% 14.9% S&P NA Natural Resources Index 0 37.5% 2.0% 11.1% 9.2% Equity Structured Products 0 0.0% $0 $0 Hedge Funds/Long Short/ Flex Portfolios 0 15.0% $750,000 $750,000 Relative Value/ Event Driven 0 3.0% $150,000 $150,000 Event Driven Icahn - CAI Hedge Forum (Long/Short/Distressed) 0 29.5% na na na Och Ziff (Event Driven) 0 Hedge Premier 23.1% 10.4% York (Event Driven) 0 Hedge Premier 40.4% 7.2% inc. Paulson Advantage-CAI Hedge Forum (Event Driven Global Merger Arbitrage) 0 Hedge Premier 12.0% na na na Paulson Advantage Plus-CAIHedgeForum (Event Driven Multi-Strategy) 0 Hedge Premier 19.5% 59.3% na na Paulson Recovery - CAI Hedge Forum (Distressed) 0 22.3% na na na Relative Value Double Black Diamond (Relative Value) 0 Hedge Premier 27.1% 10.8% Mariner-Tricadia (Relative Value) 0 Hedge Premier 26.3% 21.5% inc. Equity Market Neutral Mutual Funds JP Morgan: Highbridge Statistical Market Neutral Fund 0 -5.0% 1.4% na na JP Morgan Market Neutral 0 7.6% 5.2% 4.1% na HFRI Event Driven/Relative Value FOF Cons Index 9.5% -1.9% 13.6% 3.5% Long/Short Equity 0 3.0% $150,000 $150,000 Front Point Health Care 2X Fund (Directional:Healthcare) 0 Hedge Premier 23.1% 10.5% Front Point Financial Services Fund, LP (Directional: Financial) 0 Hedge Premier 11.5% 18.2% inc. Ivory Flagship Fund (U.S.) 0 Hedge Premier 16.6% 11.2% Maverick (Directional) 0 Hedge Premier 18.1% 3.6% inc. Traxis (Directional) 0 Hedge Premier 34.7% 6.8% Long Short Mutual Funds Baron Partners Fund 0 38.1% -11.7% 0.3% na Diamon Hill Long/Short Equity Fund 0 23.9% -2.1% 5.7% na Tactical Flex Portfolio Mutual Funds JP Morgan U.S. Large Cap Core Plus (130/30 Strategy) 0 36.4% 0.6% na na Ivy Asset Strategy Fund 0 22.4% 7.5% 13.3% 9.3% HFRI Long/Short FOF Strategic Index 13.3% -1.5% 3.3% 3.6%

- 7. Managed Futures 0 4.0% $200,000 $200,000 Multi Manager Citigroup Global Diversified Futures Fund, LP (Diversified) 0 -10.5% 4.3% 7.2% 7.0% Citigroup Orion Futures Fund, LP (Diversified) 0 -5.0% 14.1% 14.8% 13.8% Single Manager Smith Barney Bristol Futures Fund, LP (Energy) 0 12.2% 14.1% na na Smith Barney AAA Energy Fund, LP 0 6.7% 18.8% 31.0% 25.2% Rydex Managed Futures Fund 0 -8.4% na na na Barclay CTA -0.3% 6.4% 5.0% 6.6% Hedge Fund of Funds & Multi Strategy 0 5.0% $250,000 $250,000 Multi Manager: Registered CAI Multi-Advisor Hege Fund Portfolios,G (Multi-Strategy) 0 21.6% 3.7% 5.1% inc. Lazard Alternative Strategies Fund, LLC (Multi Strategy) 0 11.1% 2.3% 4.4% inc. Multi Manager Permal Macro (Global Macro) 0 16.7% 6.4% 7.9% 8.8% Fortress Partners Alternatives Fund, LP (Multi-Strategy Global) 0 na na na na Permal Investment Holdings (Multi-Strategy) 26.3% 0.9% 4.7% 4.7% Single Manager Equity: Multi Strategy SAC Multi-Strategy - CAI Hedge Forum (Global) 0 na na na na Single Manager Fixed Income Permal Fixed Income Holdings N.V. (Multi Strategy Fixed Income) 0 27.1% 4.0% 6.0% 8.9% Goldman Sachs Absolute Return Tracker Fund 0 6.1% na na na Hatteras Alpha Hedged Strategies Fund 0 19.1% -4.6% -0.1% na IQ Hedge Multi-Strategy Tracker ETF 0 10.0% na na na CSFB/Tremont Hedge Fund Index HFRI Multi-Strategy FOF Diversified Fund Index 10.7% -1.3% 2.6% 3.8% HFRI Distressed 29.2% 0.5% 5.0% 9.2% Convertible Arbitrage Equity Market Neutral Risk Arbitrage Global Macro Fixed Income Arbitrage Illiquids 0 0.0% $0 $0 Qualified Purchasers Only Private Equity 0 0.0% $0 $0 Private Equity Single Manager 0 Private Equity Multi Manager 0 Private Real Estate 0 0.0% $0 $0 Real Estate Single Manager Sterling Land & Retail Dev. Opps. LP (Land Acquisition & Shopping Center Development) 0 Real Estate Multi-Manager 0 NCREIF Property Index U.S. Private Equity Index U.S. Venture Capital Index Global (ex- U.S.) Private Equity & Venture Capital Index TOTAL EQUITY 0 65.0% $3,250,000 $3,250,000

- 8. FIXED INCOME SUMMARY CURRENT $ TARGET % TARGET $ CHANGE $ 1 Year 3Yr.Annl 5Yr.Annl 10Yr.Annl CASH/MONEY MKT & SHORT DURATION 5,000,000 6.0% $300,000 ($4,700,000) Money Markets 5,000,000 3% $150,000 ($4,850,000) Western Assets Money Market Fund 5,000,000 Western Assets California Municipal Money Market Fund 0 Western Assest Government Money Market 0 Western Asset/ Citi Institutional Money Market 0 Citi US Treasury Reserves & Premium US Treasury Res. 0 Bank Deposit Program (FDIC Insurance) 0 Dreyfus Institutional Reserves Treasury Pime (IRA's) 0 Investment Grade Short Duration Bonds/CDs 0 3.0% $150,000 $150,000 Legg Mason Partners Short Duration Muni Income 0 4.8% 4.6% 3.7% na PIMCO Short Term Fund & PIMCO Low Duration (UMA) 0 7.3% 3.9% 3.6% 3.6% PIMCO Low Duration (UMA) 13.6% 5.9% 4.2% 4.5% Barclasys Short Treasury Bond (UMA) 0 0.4% 2.8% 3.2% 3.2% T-Bills & Certificates of Deposit (<1 Year Maturity) 0 Outside Money Management Accounts (Bank/Brokerage) 0

- 9. TAXABLE FIXED INCOME 0 18.5% $925,000 $925,000 Global Investment Grade 0 10.0% $500,000 $500,000 Certificates of Deposit (>1 Year Maturity) 0 Mortgage Backed Securities Mortgage Backed Securities 0 PIMCO Mortgage Backed Securities Fund 0 14.8% 7.5% 5.8% na Investment Grade Corporate Bonds Investment Grade Corporate Bonds 0 Madison (Investment Grade Corporate Bonds) 0 11.2% 6.9% 5.4% 8.0% MFS Research Bond Fund 0 21.3% 6.3% 4.8% 6.9% Goldman Sachs $ InvesTop Corporate Index 0 12.8% 5.8% 4.4% 6.3% Preferred Securities Preferred Securities 0 Principal Spectrum Preferred Securities 0 39.9% -2.5% 0.8% 6.0% Principal Funds Preferred Securities 0 54.9% 2.1% 2.9% na Convertible Bonds Calamos Investment Grade Convertible 0 23.6% 1.6% 4.6% 4.2% Calamos Convertible Fund 0 30.9% 1.6% 4.2% 5.2% Multi-Sector Income PIMCO- Total Return 0 15.5% 8.5% 6.6% na Western Asset Core Plus Fixed Income (MDA) 0 16.8% 6.7% na na PIMCO Total Return Bond Fund 0 13.7% 9.1% 6.7% 7.5% PIMCO Unconstrained Bond Fund 0 13.9% na na na Barclays Capital U.S. Aggregate Bond Index 0 5.9% 6.0% 5.0% 6.3% Diversified International Oppenheimer International Bond Fund 0 16.9% 9.1% 8.0% 10.7% Diversified Global Templeton Global Bond Fund 0 18.4% 12.5% 9.7% 11.1% Fixed Annuities New York Life Lifetime Income Annuity 0 Global High Yield 0 2.5% $125,000 $125,000 BlackRock Investment Mgmt. High Yield Bond Fund 0 52.8% 4.3% 5.6% 6.6% Western Asset Global High Yield Bond Fund 0 52.3% 3.0% 4.7% 6.6% Barclays Capital U.S. Corporate High Yield Index 0 58.2% 6.0% 6.5% 6.7% Global Emerging Markets 0 5.0% $250,000 $250,000 Goldman Sachs Emerging Markets Debt Fund 0 36.7% 6.6% 9.1% na MFS Emerging Markets Debt Fund 0 30.6% 7.4% 8.8% 13.9% JPMorgan Emerging Markets Debt Index 0 28.7% 6.9% na na Global Inflation-Linked 0 1.0% $50,000 $50,000 PIMCO Real Return(Global Agency Inflation Indexed Securities) 0 18.7% 7.7% 5.0% 7.8%

- 10. TAX ADVANTAGED FIXED INCOME 0 10.50% $525,000 $525,000 Municipal Bonds 0 7.0% $350,000 $350,000 Municipal Bonds 0 Western Asset Current Market Municipal Portfolio(MDA) 0 6.3% 5.6% 4.3% 4.8% Franklin Federal Intermediate Municipal Bond Fund 0 11.2% 3.9% 3.6% 4.9% Franklin California Tax Free Municipal Income Fund 0 16.6% 2.9% 3.8% 5.4% Franklin California Insured Tax Free Fund 0 8.8% 2.4% 2.9% 5.1% Barclays Capital U.S. Municipal Bond Index 0 12.9% 4.4% 4.3% 5.8% Municipal High Yield 0 2.5% $125,000 $125,000 Franklin California Hi Yield Municipal Fund 0 23.7% 0.7% 2.7% 5.2% Treasury Bonds & U.S. Agency 0 0.0% $0 $0 Treasury Bonds 0 Legg Mason Western Asset Government Securities Fund (US Govt) 0 10.2% 5.5% 4.4% 5.6% Barclays 20+ Year Treasury Index 0 -21.4% 5.0% 4.9% 7.6% Barclays 7-10 Year Treasury Index 0 -6.0% 6.9% 5.1% 6.7% Barclays 3-7 Year Treasury Index 0 -1.6% 7.0% 5.1% 6.2% Inflation Linked 0 1.0% $50,000 $50,000 Barclays TIPS Bond Index(Treasury Inflation Notes) 0 11.4% 6.7% 4.6% 7.7% TOTAL FIXED INCOME/CASH 5,000,000 35.0% $1,750,000 ($3,250,000) TOTAL 5,000,000 100.0% $5,000,000 $0

- 11. MAJOR INDEX PERFORMANCE SUMMARY 1 Year 3 Yr. Annl 5 Yr. Annl 10 Yr. Annl. Standard & Poors 500 23.5% -5.6% 0.4% -0.9% Dow Jones Industrials 22.6% -3.1% 1.9% 1.3% NASDAQ Composite 43.9% -2.1% 0.9% -5.7% Russell 2000 25.2% -7.4% -0.8% 2.2% MSCI EAFE 27.8% -8.7% 0.9% -1.1% MSCI World 26.9% -7.7% 0.0% -1.9% MSCI Emerging Markets 74.5% 2.7% 12.8% 7.3% Barclay Aggregate Bond Index 5.9% 6.0% 5.0% 6.3% LEGG MASON PARTNERS- CLEARBRIDGE: MULTI DISCIPLINE ACCOUNT (MDA) PORT's 1 Year 3 Yr. Annl 5 Yr. Annl 10 Yr. Annl Domestic….(MDA 5A: Clearbridge Advisors-40% Large Cap Growth, 40% All Cap Value, 20% Multi Cap Growth) 36.6% -3.8% 1.4% 3.6% Developed Markets…. (MDA 7A: Clearbridge Advisors-30% Large Cap Growth, 30% All Cap Value, 20% Multi Cap Growth, 20% Intl. ADR Growth) 36.3% -3.5% 2.6% 3.4% Developed Balanced…. (MDA 7A Balanced: Clearbridge Advisors- 70% Equity and 30% Fixed Income) (Taxable or Tax22.7% Advantaged) -1.9% 2.7% 4.3% Income Portfolios…. (MDA: 70% Barclays Agg/ 30% S&P 500) 17.6% 4.7% 5.3% na BLENDED PORTFOLIO RETURNS YTD 2010 YEAR 2009 YEAR 2008 YEAR 2007 YTD YR 09 YR 08 YR 07 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Total Portfolio Returns $0 $0 $0 $0 0.0% 0.0% 0.0% 0.0% LIFE INSURANCE & VARIABLE ANNUITY Acct Value Benefit Insured Premium $0 $0 $0 $0 $0 $0 The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed, and the giving of the same is not deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities.

- 13. ETF I SHARE C SHARE Min.Inv. $50,000 $50,000 $50,000 $50,000 $50,000 $50,000 $50,000 $75,000 $75,000 JCAPZ JLPSX ALARX WOFDX IWB SPY $50,000 $50,000 $50,000 MADVX NVORX IWV DIA

- 14. $75,000 $75,000 $75,000 GGOIX ABMIX IWP $75,000 $75,000 $75,000 ARTQX JMVAX JMVCX IWS

- 15. EZU EWU EWJ EPP EWC $50,000 $50,000 $50,000 $50,000 $250,000 $75,000 JIGFX BIGIX MALOX ACWI EFA

- 16. $75,000 $75,000 $75,000 $75,000 TGSCX $75,000 $75,000 RYPRX OSMYX SCZ $50,000 LZEMX EEM

- 17. $50,000 IGLIX IGCAX ICF PCRPX GSG GLDIX IAU $50,000 IGNIX IGNCX SGLSX MAGRX IGE $250,000 $100,000 $100,000 $100,000 $100,000 $100,000 $100,000 $100,000 HSKSX $500,000 $500,000 $250,000 $100,000 $100,000 BPTRX DHLSX JLPSX IVAEX WASCX

- 18. $5,000 $25,000 $25,000 $25,000 RYMFX $25,000 $100,000 $100,000 $250,000 $100,000 $100,000 $100,000 GJRTX ALPHX QAI $250,000

- 19. SBCX SBCF SMGX CILX $1 Million CIMX CUST BDP DUPX DGS SMDYX PTSPX PLDPX PTLCX SHV

- 20. PMRAX PMRCX $250,000 MRBFX LQD PPSIX PFRCX $100,000 CICVX $125,000 $250,000 PTTPX PUCPX PUBCX AGG OIBYX OIBCX TGBAX TEGBX BHYIX SIHYX JNK GSDIX EMB PRLPX PRTCX

- 21. $100,000 FKITX FCAVX FCAHX FRCIX FRCAX TFI FCAMX FCAHX SGVAX SGSLX TLT IEF IEI TIP

- 22. SPY DIA QQQQ IWM EFA IWV EEM AGG