Steve Miller – Proactive Advisor Magazine – Volume 3, Issue 4

- 1. TRIED &TRUE Short-lived VIX spike pg. 7 A thriving succession plan pg. 3 Active management in plain English pg. 4 July 24, 2014 | Volume 3 | Issue 4First magazine focused on active investment management S T E V E M I L L E R Managing volatility and risk pg. 8

- 3. ohn and I are in the fourth year of our long-term plan for gradually transitioning the practice to John. One of the key things we are doing is allowing for the transition to take place slowly over a long period of time. The goal for our first five years together was to really grow the business with new clients and have John fully introduced to my current clients. As they have become comfortable with John and his contributions, it has been natural for referrals from current clients to flow to him. For me, a priority outcome of the succession is the assurance that my clients will be well taken care of. I looked for someone who would care for my existing client base with the same diligence that I do.This succession is not about simply selling out to another firm or advisor. One of the mistakes I have seen other advisors make is selling their business to someone who is perhaps a very competent advisor, but does not make a total commitment to the transition. Your clients are your clients because of the trust you have earned over time. Your successor needs to pay his dues, so to speak, to build those relationships for himself and the future of the practice. Otherwise, clients see little reason to stick around.” e have the same investment discipline centered around active management, so that piece has been a seamless transition. It is not only about having the clients getting to know me and vice versa, but them feeling confident that the relationship and their investments will be handled in a similar manner moving forward. The transition plan has worked especially well with our small business clients. Debra and I have both been able to focus on our particular strengths in those relationships. I can be the 401(k) specialist for the busi- ness owner and his employees, while Debra can handle the financial planning, buy/sell agreements if needed, and insurance needs. Debra and I both are involved, however, with every aspect of the business, especially asset management.” Making a 10-year succession plan work John Gutfranski, CFP® , AIF® , CRPC® Debra White Stephens, CFP® Houston, TX Cetera Advisor Networks LLC Houston, TX Cetera Advisor Networks LLC J W“ “ Securities and investment advisory services offered through Cetera Advisor Networks LLC, member FINRA, SIPC. Cetera is under separate ownership from any other named entity. Read text only 3July 24, 2014 | proactiveadvisormagazine.com TIPS & TOOLS

- 4. AN ADVISOR’S PERSPECTIVE NOW Active management in plain English Read text only By Greg Gann 4 proactiveadvisormagazine.com | July 24, 2014

- 5. he word “active” certainly has a much more positive connotation than its counterpart, “passive.” But when it comes to investment management, we in the financial services arena use this terminology thinking that our clients understand the meaning behind this jargon. It is my contention that few investors really appreciate the significance of these terms because we do a poor job describing them in ways in which they can relate. As an advocate and practitioner of active management, I will share a couple of ways I have found most successful to communicate the rationale and benefits of active management. First of all, active management has become the term du jour. It has become a hot buzzword. Because so few investors know its meaning, financial advisors can profess to utilize an active investment management approach without being called on it or having to prove it. The first thing that I do when I describe active management is describe passive management and how they differ. Besides investing in an index, passive management assumes that no one can really beat the market over an extended period of time. It also assumes that the correlation of certain asset categories will remain fairly uniform over time. Based on these two fundamental assumptions, a strategic but static model is proposed that incorporates a variety of “style box”-type investments. In making allocations, the model is virtually the same in all market cycles and doesn’t evaluate risks in real time. ALMANAC VS. CURRENT WEATHER FORECAST Active management, on the other hand, evaluates current risks and stages within market cycles in order to make more timely allocations. I describe this distinction using weather analogies. Passive investing is like using a weather almanac rather than a cur- rent forecast to determine what clothing to pack for a trip. In packing, it would not make sense to rely on the almanac because the almanac is a long-term forecast based on averaging years and years of data. For example, the almanac might indicate that weather conditions in Manhattan in July would be sunny and humid with tempera- tures during the day reaching 85-90 degrees. However, a current five-day forecast could track a big storm moving into the area with unusually cold and wet conditions. Just as I wouldn’t pack my suitcase with clothing based on the almanac, I do not think it is wise to allocate an investment portfolio based on long-term historical averages, ignoring current “weather con- ditions” in the market such as current trends, breadth, volatility, or risks of loss. Howard Marks of Oaktree Capital advises, “Never forget the six-foot tall man who drowned crossing the river that was five feet deep on average.” Passive in- vesting deals with data based on averages, and allocates based on those averages. The problem is that very few years follow averages. Moreover, averages ignore the impact of large losses, and the challenges and difficulties associated with making up those losses. Minimizing drawdowns is arguably much more critical than cap- turing all or most of the upside. Current economic and geopolitical factors enhance risk and the likelihood and magnitude of drawdowns, but are ignored and margin- alized by passive investors. Because passive investing deals with averages, and over extended periods of time markets tend to move in a northern (pos- itive) direction, passive investing typically recommends allocations from a long-only perspective. All investing is essentially a bet. Long-only investors bet that the value of an enterprise or indices in which they are investing will increase. Current stages within market cycles, P/E ratios, technical factors and sentiment all impact the overall investment climate and whether the chang- es in that value are likely to move north or south in the foreseeable future. This data and other factors are usually modelled by active managers to determine whether to make trades in real time and/or how to size the trade. By utilizing this data rather than relying exclusively on long-term averages, the active manager might con- clude that the overall market or value of an enterprise is overly extended and therefore ripe for a pullback. In reaching this conclu- sion, the active manager analyzes a larger universe of investment opportunities, and, for instance, might allocate to inverse in- vestment strategies which typically increase in value when the market decreases in value. continue on pg. 11 T Passive investing is like using a weather almanac rather than a current forecast to determine what clothing to pack for a trip. July 24, 2014 | proactiveadvisormagazine.com 5

- 6. An investor should consider the investment objectives, risks, charges, and expenses of The Gold Bullion Strategy Fund before investing. This and other information can be found in the Fund’s prospectus, which can be obtained by calling 1-855-650-7453.The prospectus should be read carefully prior to investing. There is no guarantee that The Gold Bullion Strategy Fund will achieve its investment objectives. Fund gross estimated annual operating expenses = 1.55% Flexible Plan Investments, Ltd., serves as investment sub-advisor to The Gold Bullion Strategy Fund, distributed by Ceros Financial Services Inc. (member FINRA). Ceros Financial Services, Inc. and Flexible Plan Investments, Ltd. are not affiliated entities. Advisors Preferred, LLC is the Fund’s investment adviser. Advisors Preferred, LLC is a wholly-owned subsidiary of Ceros Financial Services, Inc. The principal risks of investing in The Gold Bullion Strategy Fund are Risk of the Sub-advisor’s Investment Strategy. Risks of Aggressive Investment Techniques, High Portfolio Turnover, Risk of Investing in Derivatives, Risks of Investing in ETFs, Risks of Investing in Other Investment Companies, Leverage Risk, Concentration Risk Gold Risk, Wholly-owned Corporation Risk, Risk of Non-Diversification and Interest Rate Risk. “Gold Risk” includes volatility, price fluctuations over short periods, risks associated with global monetary,economic,social and political conditions and developments,currency devaluation and revaluation and restrictions,and trading and transactional restrictions. For more information on the risks of The Gold Bullion Strategy Fund, including a description of each risk, please refer to the prospectus. Visit our website to download our free white paper, The Role of Gold in Investment Portfolios www.goldbullionstrategyfund.com Pure Gold A durable alternative in a changing world www.goldbullionstrategyfund.com Sought after since the beginning of time, gold may offer a valuable hedge should interest rates rise. But, is your allocation to gold tarnished by positions in mining found in many gold mutual or exchange traded funds? The Gold Bullion Strategy Fund (QGLDX), a mutual fund that tracks the daily movement of gold, is designed to: • Provide a defensive hedge to inflation • Diversify a portfolio with a strategic allocation to gold • Offer commodity exposure with no K-1

- 7. he bull market’s continued run in 2014 has been marked by a sustained period of low volatility, with the VIX trading below 20 for most of the year. In fact, last Thursday’s 1.2% decline in the S&P 500, triggered by geopolitical concerns out of Ukraine and the Mideast, was the first 1% move either higher or lower for the index in 62 trading days. According to Bespoke Investment Group, runs like this are infrequent, coming “few and far between” over the course of the last seventy years. The move down was VOTE Managing risk Managing volatility Producing income Last week’s results VIEWER RESPONSE Is there a need to replace tradi- tional diversification and portfolio construction techniques with new products to achieve results? -Vote to see results This week’s poll What is most important to you in selecting investment strategies/products? 59% of advisors globally agreed, according to NATIXIS/Core Data Research 2013 Global Survey of Financial Advisors POLLS 75% 25% Yes No 173 154 95 38 0 62 40 80 120 160 200 ‘44 ‘54 ‘64 ‘74 ‘84 ‘94 ‘04 ‘14 -3.64 Day Of VIX Spike Next Day Next Week One Month Three Month 0.73 0.77 -0.63 1.23 66.7 61.9 Average all occurrences: 22 occurrences 61.9 61.9 -2.02 0.35 0.51 2.56 2.83 71.4 71.4 Average - VIX below 20: 8 occurrences 85.7 71.4 S&P 500 Performance (%) Spike in VIX briefly shatters market calm T Source: Bespoke Investment Group Source: Bespoke Investment Group immediately followed by last Friday’s 1% rebound in the S&P, with traders buying the dip—as has happened so often in the 2012-2014 period. This brief bout of volatility brought with it a 32% spike in the VIX, as it moved from 11 to 14.5. Bespoke notes that this was only the 22nd one-day move of over 30% in the VIX since 1990. Over two-thirds of the time when such one-day spikes occur (including last week), the broad market has snapped back the following day, averaging a gain of 0.7% on the next trading day. S&P 500: TRADING DAYS WITHOUT A 1% GAIN OR LOSS 1944–2014 S&P 500 RETURNS AFTER LARGEST ONE-DAY VIX INCREASES (30%+) 1990–2014 7July 24, 2014 | proactiveadvisormagazine.com TOPPING THE CHARTS Read text only

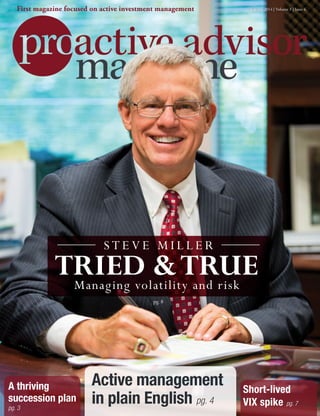

- 8. Have you seen many changes in the business since then? A tremendous amount of change. Probably the two most important things relate to market volatility and the develop- ment of strategies to overcome that. Could you explain that? Since I started in the business, there have been two major market downturns, as we all know. The preparation and readiness for such an event has a much higher priority now than when I first started, which were fairly benign years until 2000. Sure the markets have been performing well for the past four or five years, but that cannot last forever. So the next part of the equation is how do we, as advisors, make sure our clients are pre- pared for the next downturn? When I started in the business, just about everyone was using I work closely with my own client base on their financial and investment needs, but also manage, ultimately, over 175 financial profes- sionals across several different states. I have an excellent team of leaders in my organization who are essential to that management process. When and how did you get started in the business? I grew up on our family farm in Ohio and received an undergraduate degree in Biology and later a Masters in Real Estate. As I was pursuing a couple of different career options after college, I first became a client of World Marketing Alliance Securities, WMAS, which became TFG. I was intrigued by the opportunity to help individuals and their families, so I transitioned into becoming a full-time representative in 1994. It also fit very well with the real estate and sales and marketing background I had acquired. Proactive Advisor Magazine: Steve, can you tell me a little about your current advisory practice? Steve Miller: I am an Investment Advisor Representative and Branch Office Manager for Transamerica Financial Advisors, Inc., Transamerica Financial Group Division, TFG, based in Alpharetta, Georgia, a suburb of Atlanta. BY DAVIDWISMER Read text only Steve Miller’s career in financial services began more than 20 years ago—long enough for him to have endured two major market downturns. Still, transitioning his practice to focus on volatility and risk-managed returns didn’t happen overnight. TRIED &TRUE S T E V E M I L L E R Managing volatility and risk proactiveadvisormagazine.com | July 24, 20148

- 9. a traditional asset allocation model relying on “buy and hold” principles. That is not the case anymore, at least in our practice. For our clients, but especially pre- retirees and those already in retirement, we are focused on risk management first. We collab- oratively develop sound goals and objectives with our clients and a very specific risk profile. From an investment perspective, how do you implement that? We use active investment management and third-party managers. We want to make sure our clients have money managers involved who can bring the most sophisticated strate- gies and a constant market and strategy watch to the table. I am focused on serving my cli- ents in a broad planning capacity and making sure the right strategies are in place, but active managers are the true experts when it comes to the implementation of that. They can help us analyze the specific risk orientation of each client and select strategies for the appropriate portfolio construction. Once the strategies are in place, they continually review and make adjustments as market conditions call for. How did you transition your practice to active management? Frankly, it was a pretty long process. It is hard to just leave traditional practices overnight. And I needed to make sure, in my own fashion, that this was something well-validated and effective. It is interesting that early in my career I had heard of an active manager who coinci- dentally was doing a terrific job for a relative of mine who had a rather sizable portfolio. Therefore, I was very interested when our firm introduced active management as a tool. Some of my clients, including family members, were fully committed to active management. My wife was thrilled with the results she saw during the credit crisis and recession. While she was not in the green for that period, she was not down much and overall in better shape to benefit from the eventual move back to a bull market for stocks and bonds. Of course, this may not be the case for all investors. How do you explain active manage- ment to clients? It all depends on their goals, risk profiles, and a more holistic look at where they want to be in the future. And it also depends on how we might construct their overall finan- cial strategy between insurance products, annuities, and other forms of investments. But even with several annuity options, active management can be incorporated as part of the product advantageously to help with underlying asset growth, and, subsequently, with potentially higher income streams in continue on pg. 10 Steve Miller Grew up in Ohio on the family farm Married for 29 years and father of two B.S. in Biology from Kent State University Masters in Real Estate from Georgia State University Enjoys boating, water skiing, and running 9July 24, 2014 | proactiveadvisormagazine.com

- 10. M U LT I - M A R K E T + MULTI-STRATEGY + MULTI-MANAGER One p rtfolio D Y N A M I C A L LY R I S K - M A N A G E D L E A R N M O R E Past performance does not guarantee future results. The opportunity for profits carries with it the possibility of losses. 800-347-3539 | flexibleplan.com A complete list of all of our recommendations over the last 12 months and Brochure Form ADV Part 2A are available upon request. I do emphasize preservation of capital and using third-party managers to capture reasonable future returns over time. To me, that is the essence of developing a mutually beneficial relationship with clients—sound money management enhances and deepens that relationship. I use active management for clients of all sizes, down to relatively small portfolios. Risk management is not just reserved for the most affluent any more, nor should it be. I explain to all clients, if the ship appears to be going down, do you want to be sitting on the deck in a new chair or heading for a new ship? Hopefully we will not see anything like 2008 any time soon, but we are prepared. And active management is not just for distressed markets, which is sometimes misunderstood. Active managers are skilled in all types of market environments and attempt to protect against market loss and take advantage of market gains. Thank you, Steve. Any final thoughts on your overall investment philosophy? Between my own clients and those man- aged within my organization, we play an important role in the overall financial health of quite a few people and their families. We take that responsibility very seriously. I approach financial and investment planning from a risk first perspective. It is all about managing volatility and risk-managed returns. I do not try and “sell” on the idea of promising a certain level of unrealistically high returns to new or prospective clients. continued from pg. 9 Steve Miller is a Registered Representative and an Investment Advisor Representative with Transamerica Financial Advisors, Inc. Securities and Investment Advisory Services offered through Transamerica Financial Advisors, Inc. (TFA), Transamerica Financial Group Division—Member FINRA, SIPC, and Registered Investment Advisor. Non-securities products and services are not offered through TFA. Photography:ChrisHamilton 10 proactiveadvisormagazine.com | July 24, 2014

- 11. There can be no assurance that any investment product will achieve its investment objective(s). There are risks associated with investing, including the entire loss of principal invested. Investing involves market risk. The investment return and principal value of any investment product will fluctuate with changes in market conditions. Guggenheim Investments represents the investment management businesses of Gug- genheim Partners, LLC. Securities offered through Guggenheim Funds Distributors, LLC. Guggenheim Funds Distributors, LLC is affiliated with Guggenheim Partners, LLC. x0515 #12526 Uncover the True Cost of Trading Mutual Funds and ETFs The reflexive perception that ETFs cost less, simply based on their low expense ratios, and are more cost-effective than mutual funds, is not entirely true. In addition to an expense ratio, there are additional considerations that should be considered when making an informed choice between ETFs and funds— including spreads and commissions. This informative white paper from Rydex Funds provides an in-depth look at the cost of ownership of no-transaction-fee (NTF) mutual funds and ETFs—with a focus on active investing strategies. Request your free copy. Call 630.505.3749 or visit guggenheiminvestments.com/rydex Chicago | New York City | Santa Monica Rydex Funds A Comparison of ETFs and Mutual Funds—The True Cost of Investing “BUY-AND-HOPE” OR RISK MANAGEMENT? No one bets regularly and wins every time. The image that comes to mind when I think of betting, and what I portray to clients, is a roulette wheel with both red and black markers. Very few would bet by putting all their chips exclusively on black or exclusively on red all of the time. They would most likely divvy them up or vary their pattern in recognition that no one color would come up forever. Passive, long-only investing to me is akin to putting all our chips on just red or just black during all market conditions. Markets move in dual directions. They go up and they go down. And, based on the real-time data, we can orient our positions to potentially gain accordingly or at least establish hedges targeted at reducing drawdowns. Passive investing is tantamount to betting the house on red, ignoring the black, and hoping that the wins from hitting red will more than offset the losses from black. Notwithstanding the fact that there are periods when going all red prevails, there are just as many times where it is detrimental. Clearly there will be periods where long-only, full risk-on investing will un- deniably beat a more disciplined active management approach. But ignoring both the potential for drawdowns, as well as the confidence that comes from strategies that hedge risks, seems rather irresponsible. The rationale behind active manage- ment is more than linguistics or what is in vogue. It needs to be expressed in plain English so that our clients appreciate its appropriateness in both navigating all market conditions and our associated value-add. continued from pg. 5 Clients appreciate how active management navigates all market conditions Gregory Gann is a Registered Representative with, and securities are offered through, LPL Financial. Member FINRA/SIPC. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Asset allocation does not ensure a profit or protect against a loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. 11July 24, 2014 | proactiveadvisormagazine.com

- 12. The opinions and forecasts expressed herein are those of the author and may not actually come to pass. Any opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. The analysis and information in this edition and on our website is for informational purposes only. No part of the material presented in this edition or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any portfolio constitutes a solicitation to purchase or sell securities or any investment program. Editor David Wismer Marketing Coordinator Elizabeth Whitley Contributing Writers Greg Gann David Wismer Graphic Designer Roger Ackerman Contributing Photographer Chris Hamilton Photography, Atlanta, GA July 24, 2014 Volume 3 | Issue 4 Proactive Advisor Magazine is dedicated to promoting and educating on active investment management. Distribution reaches a wide audience of financial professionals who advise clients on investments and portfolio management. Each issue features an experienced investment advisor who offers insights on active money management, client service, and investment approaches. Additionally, Proactive Advisor Magazine offers an up-close look at a topic with current relevance to the field of active management. Advertising proactiveadvisormagazine.com/advertising Reprints proactiveadvisormagazine.com/reprints Contact proactiveadvisormagazine.com/contact Proactive Advisor Magazine Copyright 2014 © Dynamic Performance Publishing, Inc. All rights reserved. Reproduction of printed form, whole or in part, without permission is prohibited. It’s OK to ask clients for more assets—really Very few advisors ask their clients for more assets to manage because of a fundamental problem: They may not know how to do so effectively. Who’s afraid of Janet Yellen? Markets yawned at the Fed Chair’s testimony in front of Congress last week, but are longer-term risks skewed toward the ugly end of the probability tail? Advising clients on the tradeoff of ”inflation risk” vs. “market risk” Is it better to preserve capital by overweighting portfolios with conservative investments, or to emphasize purchasing power with more volatile investments like stocks? FPA study: Foundations of effective client communication Insights from the FPA’s trend study cover how advisors communicate with clients, approaches to segmentation, and the importance of systematic review session follow-up. New data shows advisors using more managed account solutions A few years ago, managed accounts had hit a wall. Now the top TAMPs see new business soaring—and other firms are picking up critical mass—as advisors recognize that someone else can manage client assets better and more efficiently. How to choose the best retirement income strategy Among retirement-planning methodologies, systematic withdrawals have been favored over the essential-discretionary approach. Should that be the case in a low interest rate environment? Stay connected 12 L NKS WEEK Read text only