Exercise VIII VIII.A. Accounting Cycle The Accounting Cycle –.docx

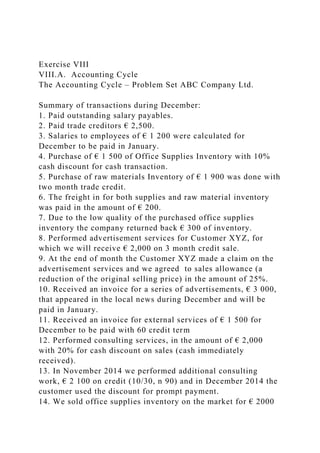

- 1. Exercise VIII VIII.A. Accounting Cycle The Accounting Cycle – Problem Set ABC Company Ltd. Summary of transactions during December: 1. Paid outstanding salary payables. 2. Paid trade creditors € 2,500. 3. Salaries to employees of € 1 200 were calculated for December to be paid in January. 4. Purchase of € 1 500 of Office Supplies Inventory with 10% cash discount for cash transaction. 5. Purchase of raw materials Inventory of € 1 900 was done with two month trade credit. 6. The freight in for both supplies and raw material inventory was paid in the amount of € 200. 7. Due to the low quality of the purchased office supplies inventory the company returned back € 300 of inventory. 8. Performed advertisement services for Customer XYZ, for which we will receive € 2,000 on 3 month credit sale. 9. At the end of month the Customer XYZ made a claim on the advertisement services and we agreed to sales allowance (a reduction of the original selling price) in the amount of 25%. 10. Received an invoice for a series of advertisements, € 3 000, that appeared in the local news during December and will be paid in January. 11. Received an invoice for external services of € 1 500 for December to be paid with 60 credit term 12. Performed consulting services, in the amount of € 2,000 with 20% for cash discount on sales (cash immediately received). 13. In November 2014 we performed additional consulting work, € 2 100 on credit (10/30, n 90) and in December 2014 the customer used the discount for prompt payment. 14. We sold office supplies inventory on the market for € 2000

- 2. through credit card transaction (a straight 2% of credit card services were taken). 15. The cost of office supplies used during December is € 200. 16. The cost of raw materials inventory used during December is € 3 000. 17. In the beginning of October 2014 a subscription rights for local newspaper magazine of € 2 500 was paid for five month term in advance; 18. In the beginning of November 2014 company receives rent for 3 months in advance, €3,000 19. At the end of the month Company repaid to the Bank credit tranche € 500 and paid interest charges (interest rate as of 5% p.a.) 20. Depreciation of equipment for December amounts to € 250. 21. ABC company acknowledged the € 1 500 worth of bad debts in December 2014. Required: a) Prepare the opening journal entry on Dec. 1, 2014. b) Prepare the journal entries for the transactions (1– 21) for the month of December and post them to the T-accounts, opening additional T-accounts for accounts as needed. Cross-reference the entries using the numbers of the transactions above. c) Prepare a trial balance. d) Prepare the adjusting journal entries and record them at the end of December in the T-accounts as well as in the trial balance. e) Prepare the closing entries for the temporary accounts and the Income Statement. f) Prepare the closing entries for the permanent accounts and the Balance Sheet as of Dec. 31, 2014. VIII.B. Valuation of Inventories The inventory of ABC Company on November 30, 2014 shows 500 units at € 100 per unit. A physical inventory on December 31, 2014, shows a total of 700 units on hand. Revenue from

- 3. sales for December totals € 300,000 (= 2,000 units at € 150 per unit). The following purchases were made during December 2014: Dec. 11: 1,100 units at € 110 per unit Dec. 23: 700 units at € 115 per unit Dec. 27: 400 units at € 135 per unit Requirement: 1. Calculate the cost of goods sold for December 2014 and the inventory cost as of December 31, 2014, using the FIFO method and LIFO method. 2. Compute the gross profit for December 2014. VIII.C. Valuation of Inventories Assume a vendor of soft drinks starts out the week with no inventory. He buys and sells cola as follows: · Buys 5 cans on Monday for 40 cents · Buys 4 cans on Tuesday for 30 cents · Buys 2 cans on Wednesday for 50 cents · Sells 10 cans on Thursday for 70 cents Please shows the vendor’s cost of goods sold and ending inventory under the four methods. VIII.D. Cost of goods sold under the periodic system inventory for 2015 The gross sales from whole 2015 period were € 2 500 and the sales returns were 5%. Additionally the company is offering 4% of cash discount of sales to their customers (the cash sales was € 1 000). At the beginning of the period December 31, 2014 the merchandise inventory level was € 500 and during the year 2015 the company purchased € 1 500 of merchandise with 10% cash discount (the cash purchases was € 500). Due to the low quality of the merchandise the company agreed with the suppliers on € 200 purchase allowance. The freight –in cost for the 2015 period were € 50. The ending inventory as of December 31, 2015 level was € 250. Please calculate cost of goods sold and gross profit under the periodic system inventory for 2015.

- 4. AssetsEquities Equipment 2 000Paid-in Capital 3 000 Land1 500Retained Earnings 1 800 Raw materials Inventory 1 800Loan Payable 2 500 Office Supplies Inventory 1 200Salary payables 1 500 Accounts Receivable3 200Accounts payable 3 400 Cash, Bank 4 500Unearned rent revenue2 000 Prepaid expenses 1 500 Allowance for uncollectible accounts 1 500 Total assets15 700Total equities15 700 Balance Sheet on Nov. 30, 2014 EXERCISES IX_ABalance Sheet on Nov. 30, 2014AssetsEquitiesEquipment 1,500Paid-in Capital 4,000Land1,500Retained Earnings 1,300Raw materials Inventory 1,500Loan Payable 3,000Office Supplies Inventory 2,000Salary payables 1,400Accounts Receivable3,000Accounts payable 2,400Cash, Bank 5,600Unearned rent revenue2,000Prepaid expenses 1,000Allowance for uncollectible accounts2,000Total assets16,100Total equities16,100ASSETS ACCOUNTSCASH, BANK OFFICE SUPPLY INVENTORYRAW MATERIALS INVENTORYACCOUNT RECEIVABLESEQUIPMENTLANDPREPAID EXPENSESDtCtDtCtDtCtDtCtDtCtDtCtDtCtEQUITY AND LIABILITIES ACCOUNTSPAID IN CAPITAL RETAINED EARNINGSTAX PAYABLESACCOUNTS PAYABLES LOAN PAYABLE SALARY PAYABLESUNEARNED RENT REVENUEDtCT DtCtDtCtDtCtDtCtDtCtDtCtTEMPORARY ACCOUNTS transactions INCOME STATEMENTEXPENSES REVENUESBalance Sheet on Dec. 30, 2014AssetsEquitiesEquipment Paid-in Capital LandRetained Earnings Raw materials Inventory Loan Payable Office Supplies Inventory Salary payables Accounts ReceivableAccounts payable Cash, Bank Unearned rent revenuePrepaid expenses

- 5. Allowance for uncollectible accountsTotal assets0Total equities0 EXERCISE IX_BFIFO method Valuation of InventoriesUnitsPrice per Unit Total Cost of goods sold Ending balanceBeginning balance Purchase Dec. 11Purchase Dec. 23Purchase Dec. 27Total UnitsPrice per Unit Total Sales revenues Cost of Goods Sold for December Gross Profit for DecemberInventory cost on Dec. 31LIFO methodValuation of InventoriesUnitsPrice per Unit Total Cost of goods sold Ending balanceBeginning balance Purchase Dec. 11Purchase Dec. 23Purchase Dec. 27Total UnitsPrice per Unit Total Sales revenues Cost of Goods Sold for December Gross Profit for DecemberInventory cost on Dec. 31 Inventory_methods_IX_CAmounts i USDMonday Buys 3 cans for 35 centsTuesdayBuys 4 cans for 30 centsWednesdayBuys 4 cans for 40 centsThursdaySells 8 cans for 60 centsnumber of cans purchasedtotal price for purchased cansweighted average for purchased cansLIFO methodFIFO methodWeighted averageSpecific identificationSpecific identificationSales revenues Cost of goods soldTotal CoGS- 0Gross profit- 0Ending inventory - 0 EXERCISES IX_DGross sales Deduct: Sales returns and allowances Cash discounts on salesNet sales Deduct: Cost of goods sold Merchandise inventory, December 31, 2014 Purchases (gross) Deduct: Purchase returns and allowances Cash discounts on purchases Net purchases Add: Freight-in Total cost of merchandise acquired Cost of goods available for sale Deduct: Merchandise inventory, December 31, 2015 Cost of goods sold Gross profit Exercise IX IX.A. Accounting Cycle The Accounting Cycle – Problem Set ABC Company Ltd. Summary of transactions during December: 1. Paid outstanding salary payables.

- 6. 2. Paid outstanding trade creditors. 3. Salaries to employees of € 1 300 were calculated for December to be paid in January. 4. Purchase of € 2 000 of Office Supplies Inventory with 10% cash discount for cash transaction. 5. Purchase of raw materials Inventory of € 2 000 was done with three month trade credit. 6. Due to the low quality of the purchased office supplies inventory the company returned back € 200 of inventory that diminished the accounts payable by that amount. 7. The freight in for both supplies and raw material inventory was paid in the amount of € 400. 8. Performed advertisement services for Customer XYZ, for which we will receive € 4,500 on 3 month credit sale. 9. At the end of month the Customer XYZ made a claim on the advertisement services and we agreed to sales allowance (a reduction of the original selling price) in the amount of 15%. 10. Received an invoice for a series of advertisements, € 2 000, that appeared in the local news during December and will be paid in January. 11. Received an invoice for external services of € 2 000 for December to be paid with 60 credit term 12. Performed consulting services, in the amount of € 5,000 with 10% for cash discount on sales (cash immediately received). 13. In November 2014 we performed additional consulting work, € 2 000 on credit (10/30, n 90) and in December 2014 the customer used the discount for prompt payment. 14. We sold office supplies inventory on the market for € 2500 through credit card transaction (a straight 5% of credit card services were taken). 15. The cost of office supplies used during December is € 800. 16. The cost of raw materials inventory used during December is € 2 000. 17. In the beginning of October 2014 a subscription rights for local newspaper magazine of € 3 000 was paid for three month

- 7. term in advance; 18. In the beginning of September 2014 company receives rent for 5 months in advance, €5,000 19. At the end of the month Company repaid to the Bank credit tranche € 1 000 and paid interest charges (interest rate as of 10% p.a.) 20. Depreciation of equipment for December amounts to € 50. 21. ABC company acknowledged the € 2 000 worth of bad debts in December 2014. Required: a) Prepare the opening journal entry on Dec. 1, 2014. b) Prepare the journal entries for the transactions (1– 21) for the month of December and post them to the T-accounts, opening additional T-accounts for accounts as needed. Cross-reference the entries using the numbers of the transactions above. c) Prepare a trial balance. d) Prepare the adjusting journal entries and record them at the end of December in the T-accounts as well as in the trial balance. e) Prepare the closing entries for the temporary accounts and the Income Statement. f) Prepare the closing entries for the permanent accounts and the Balance Sheet as of Dec. 31, 2014. IX.B. Valuation of Inventories The inventory of ABC Company on November 30, 2014 shows 200 units at € 160 per unit. A physical inventory on December 31, 2014, shows a total of 400 units on hand. Revenue from sales for December totals € 400,000 (= 2,000 units at € 200 per unit). The following purchases were made during December 2014: Dec. 11: 900 units at € 175 per unit Dec. 23: 900 units at € 165 per unit Dec. 27: 400 units at € 180 per unit Requirement:

- 8. 1. Calculate the cost of goods sold for December 2014 and the inventory cost as of December 31, 2014, using the FIFO method and LIFO method. 2. Compute the gross profit for December 2014. IX.C. Valuation of Inventories Assume a vendor of soft drinks starts out the week with no inventory. He buys and sells cola as follows: · Buys 3 cans on Monday for 35 cents · Buys 4 cans on Tuesday for 30 cents · Buys 4 cans on Wednesday for 40 cents · Sells 8 cans on Thursday for 60 cents Please shows the vendor’s cost of goods sold and ending inventory under the four methods. IX.D. Cost of goods sold under the periodic system inventory for 2015 The gross sales from whole 2015 period were € 4 500 and the sales returns were 10%. Additionally the company is offering 10% of cash discount of sales to their customers (the cash sales was € 2 500). At the beginning of the period December 31, 2014 the merchandise inventory level was € 900 and during the year 2015 the company purchased € 2 500 of merchandise with 15% cash discount (the cash purchases was € 1 500). Due to the low quality of the merchandise the company agreed with the suppliers on € 500 purchase allowance. The freight –in cost for the 2015 period were € 150. The ending inventory as of December 31, 2015 level was € 500. Please calculate cost of goods sold and gross profit under the periodic system inventory for 2015. AssetsEquities Equipment 1 500Paid-in Capital 4 000 Land1 500Retained Earnings 1 300 Raw materials Inventory 1 500Loan Payable 3 000 Office Supplies Inventory 2 000Salary payables 1 400 Accounts Receivable3 000Accounts payable 2 400

- 9. Cash, Bank 5 600Unearned rent revenue2 000 Prepaid expenses 1 000 Allowance for uncollectible accounts 2 000 Total assets16 100Total equities16 100 Balance Sheet on Nov. 30, 2014 EXERCISE IIBalance Sheet on Nov. 30, 2014AssetsEquitiesEquipment 6,000Paid-in Capital 5,000Office Supplies Inventory 1,000Retained Earnings 3,600Account Receivables1,000Tax Payable 1,000Cash, Bank 8,600Accounts payable 7,000Total assets16,600Total equities16,600EQUIPMENTPAID IN CAPITAL DtCtDtCT OP. BAL.OP. BAL. OFFICE SUPPLY INVENTORYREATINED EARNINGSDtCtDtCtOP. BAL.OP. BAL.ACCOUNT RECEIVABLESTAX PAYABLESDtCtDtCtOP. BAL.€ 1,000OP. BAL.CASH, BANK ACCOUNTS PAYABLES DtCtDtCtOP. BAL.OP. BAL.transactions 1. Performed consulting services, for which we received € 2,000 cash immediatelyDtCtDtCt2. Received an invoice for a series of advertisements, € 600, that appeared in the local news during December and will be paid in JanuaryDtCtDtCt3. Performed additional consulting work, € 2 500 on credit.DtCtDtCt4. Issued a check for € 800 for rent of shop space for DecemberDtCtDtCt5. Performed advertisement services, for which we received € 1,000 cash immediately.DtCtDtCt6. Paid salaries to employees of € 2,000 for December.DtCtDtCt7. Paid outstanding tax € 1 000DtCtDtCt8. Paid creditors € 2,800.CASH ACCOUNTS PAYABLES DtCtDtCt9. The cost of office supplies used during December is € 450DtCtDtCt10. Depreciation of equipment for December amounts to € 150DtCtDtCtclosing the temporary accounts DtCtDtCtDtCtDtCtDtCtSALARY EXPENSES DEPRECIATION EXPENSES EXPENSES REVENUESTOTAL € 0€ 0€ 0Closing the permament accounts

- 10. EQUIPMENTPAID IN CAPITAL DtCtDtCT CASH RETAINED EARNINGSDtCtDtCtTAX PAYABLESDtCtINVENTORY DtCtACCOUNTS PAYABLES DtCtACCOUNTS RECEIVABLESDtCtBalance Sheet on Dec. 2014AssetsEquitiesEquipment Paid-in Capital Office Supplies Inventory Retained Earnings Accounts Reeceivables Tax PayablesCash, Bank Accounts payable Total assets- 0Total equities- 0 Exercise VII VII.A. Accounting Cycle The Accounting Cycle – Problem Set ABC Company Ltd. Balance Sheet on Nov. 30, 2014 Assets Equities Equipment 2 000 Paid-in Capital 11 000 Land 5 500 Retained Earnings 1 000 Office Supplies Inventory 1 200 Loan Payable 2 000 Accounts Receivable 7 400 Tax payables 900 Cash, Bank 3 000

- 11. Accounts payable 3 200 Prepaid expenses 3 000 Unearned rent revenue 4 000 Allowance for uncollectible Accounts 3 000 Total assets 22 100 Total equities 22 100 Summary of transactions during December: 1. Cash-Purchase of € 1 800 of Office Supplies Inventory 2. Performed consulting services, for which we received € 9,100 cash immediately. 3. Received an invoice for a series of advertisements, € 1 200, that appeared in the local news during December and will be paid in January. 4. In November 2014 we performed additional consulting work, € 2 000 on credit (5/30, n 90) and in December the customer used the discount for prompt payment.. 5. Performed advertisement services for Customer XYZ, for which we will receive € 1,000 on 2 month credit sale. 6. Paid salaries to employees of € 1 200 for December. 7. We sold some of the redundant office supplies inventory on the market –€ 500 through credit card transaction (a straight 3% of credit card services were taken). 8. Received an invoice for external services of € 1 400 for December to be paid with 60 credit term 9. Paid outstanding tax payables. 10. Paid trade creditors € 1,300. 11. The cost of office supplies used during December is € 1,100.

- 12. 12. In the beginning of September 2014 a subscription rights for local newspaper magazine of € 6 000 was paid for half-a year term in advance; 13. In the beginning of October 2014 company receives rent for 6 months in advance, €6,000 14. At the end of the month Company repaid to the Bank credit tranche 500 and paid interest charges (interest rate as of 9 % p.a.) 15. At the end of month the Customer XYZ made a claim on the advertisement services and we agreed to sales allowance (a reduction of the original selling price) in the amount of 20%. 16. Depreciation of equipment for December amounts to € 100. 17. ABC company acknowledged the $2,000 worth of bad debts in December 2014. Required: a) Prepare the opening journal entry on Dec. 1, 2014. b) Prepare the journal entries for the transactions (1. – 17) for the month of December and post them to the T-accounts, opening additional T-accounts for accounts as needed. Cross- reference the entries using the numbers of the transactions above. c) Prepare a trial balance. d) Prepare the adjusting journal entries and record them at the end of December in the T-accounts as well as in the trial balance. e) Prepare the closing entries for the temporary accounts and the Income Statement. f) Prepare the closing entries for the permanent accounts and the Balance Sheet as of Dec. 31, 2014. VII.B. Account Receivables valuation Thomson Corp. had sales of € 100,000 during 2015, including € 60,000 on credit. Balances on Dec. 31, 2014, were Accounts

- 13. Receivable, € 9,000, and Allowance for Bad Debts, € 800 (= credit balance). Data for 2015: collections on accounts receivable were € 56,000. Bad debts expense was estimated at 2 % of credit sales, as in previous years. Write-offs of bad debts during 2015 were € 1,000. Requirements: 1. Prepare all journal entries for 2015. 2. Show the ending balances of the balance sheet accounts on Dec. 31, 2015. VII.C. Aging of accounts receivables The aging of accounts receivable method directly incorporates the customers’ payment histories. As more time elapses after the sale, collection becomes less likely. The $126,000 balance in Accounts Receivable on December 31, 2014, might be aged as shown below. The beginning balance in the Allowance account is amounted to € 1 000. Exercise III Accounting Cycle The Accounting Cycle – Problem Set ABC Company Ltd. Balance Sheet on Nov. 30, 2018 Assets Equities Equipment 5 000 Paid-in Capital 4 000 Office Supplies Inventory 1 000

- 14. Retained Earnings 3 600 Accounts Receivable 1 000 Tax payable 1 000 Cash, Bank 6 600 Accounts payable 5 000 Total assets 13 600 Total equities 13 600 Summary of transactions during December: 1. Cash-Purchase of €1,000 of Office Supplies Inventory 2. At the end of the month Company took out a 9 % p.a., 90 day, €10,000 loan with the Bank 3. Performed consulting services, for which we received € 2,000 cash immediately. 4. Received an invoice for a series of advertisements, € 1 000, that appeared in the local news during December and will be paid in January. 5. Performed additional consulting work, € 1 800 on credit. 6. Performed advertisement services, for which we received € 1,000 cash immediately. 7. Paid salaries to employees of € 2,000 for December. 8. Paid outstanding tax € in the amount 800 9. Paid creditors € 1,300. 10. The cost of office supplies used during December is € 850. 11. Depreciation of equipment for December amounts to € 250. Required: a) Prepare the opening journal entry on Dec. 1, 2018. b) Prepare the journal entries for the transactions (1. – 11.) for

- 15. the month of December and post them to the T-accounts, opening additional T-accounts for accounts as needed. Cross- reference the entries using the numbers of the transactions above. c) Prepare a trial balance. d) Prepare the closing entries for the temporary accounts and the Income Statement. e) Prepare the closing entries for the permanent accounts and the Balance Sheet as of Dec. 31, 2018. EXERCISE IVBalance Sheet on Nov. 30, 2018AssetsEquitiesEquipment 2,500Paid-in Capital 3,000Land1,000Retained Earnings 2,400Office Supplies Inventory 1,200Loan Payable 1,000Accounts Receivable1,400Tax payable800Cash, Bank 3,500Accounts payable 2,400Total assets9,600Total equities9,600ASSETS ACCOUNTSEQUITY AND LIABILITIES ACCOUNTSTEMPORARY ACCOUNTS transactions EXPENSES REVENUESTOTAL Balance Sheet on Nov. 30, 2018 Exercise II Accounting Cycle The Accounting Cycle – Problem Set ABC Company Ltd. Balance Sheet on Nov. 30, 2014 Assets Equities Equipment 6 000 Paid-in Capital 5 000 Office Supplies Inventory

- 16. 1 000 Retained Earnings 3 600 Accounts Receivable 1 000 Tax payable 1 000 Cash, Bank 8 600 Accounts payable 7 000 Total assets 16 600 Total equities 16 600 Summary of transactions during December: 1. Performed consulting services, for which we received € 2,000 cash immediately. 2. Received an invoice for a series of advertisements, € 600, that appeared in the local news during December and will be paid in January. 3. Performed additional consulting work, € 2 500 on credit. 4. Issued a check for € 800 for rent of shop space for December. 5. Performed advertisement services, for which we received € 1,000 cash immediately. 6. Paid salaries to employees of € 2,000 for December. 7. Paid outstanding tax € 1 000 8. Paid creditors € 2,800. 9. The cost of office supplies used during December is € 450. 10. Depreciation of equipment for December amounts to € 150. Required: a) Prepare the opening journal entry on Dec. 1, 2014. b) Prepare the journal entries for the transactions (1. – 10.) for the month of December and post them to the T-accounts,

- 17. opening additional T-accounts for accounts as needed. Cross- reference the entries using the numbers of the transactions above. c) Prepare a trial balance. d) Prepare the adjusting journal entries and record them at the end of December in the T-accounts as well as in the trial balance. e) Prepare the closing entries for the temporary accounts and the Income Statement. f) Prepare the closing entries for the permanent accounts and the Balance Sheet as of Dec. 31, 2014. EXERCISE IIIBalance Sheet on Nov. 30, 2018AssetsEquitiesEquipment 5,000Paid-in Capital 4,000Office Supplies Inventory 1,000Retained Earnings 3,600Accounts Receivable1,000Tax payable1,000Cash, Bank 6,600Accounts payable 5,000Total assets13,600Total equities13,600ASSETS ACCOUNTSCASH, BANK OFFICE SUPPLY INVENTORYACCOUNT RECEIVABLESEQUIPMENTDtCtDtCtDtCtDtCtOP. BAL.OP. BAL.OP. BAL.OP. BAL.EQUITY AND LIABILITIES ACCOUNTSPAID IN CAPITAL RETAINED EARNINGSTAX PAYABLESACCOUNTS PAYABLES LOAN PAYABLE DtCT DtCtDtCtDtCtDtCtOP. BAL. OP. BAL.OP. BAL.OP. BAL.OP. BAL.TEMPORARY ACCOUNTS DtCtDtCttransactions 1. Cash- Purchase of €1,000 of Office Supplies Inventory2. At the end of the month Company took out a 9 % p.a., 90 day, €10,000 loan with the Bank 3. Performed consulting services, for which we received € 2,000 cash immediately4. Received an invoice for a series of advertisements, € 1 000, that appeared in the local news during December and will be paid in January. 5. Performed additional consulting work, € 1 800 on credit6. Performed advertisement services, for which we received € 1,000 cash immediately. 7. Paid salaries to employees of € 2,000 for December8. Paid outstanding tax € in the amount 800

- 18. 9. Paid creditors € 1,300. 10. The cost of office supplies used during December is € 85011. Depreciation of equipment for December amounts to € 250EXPENSES REVENUESTOTAL Balance Sheet on Nov. 30, 2018AssetsEquitiesEquipment Paid- in Capital Office Supplies Inventory Retained Earnings Accounts Receivables Loan Payable Cash, Bank Tax PayablesAccounts payable Total assetsTotal equities Exercise IV Accounting Cycle The Accounting Cycle – Problem Set ABC Company Ltd. Balance Sheet on Nov. 30, 2014 Assets Equities Equipment 2 500 Paid-in Capital 3 000 Land 1 000 Retained Earnings 2 400 Office Supplies Inventory 1 200 Loan Payable 1 000 Accounts Receivable 1 400 Tax payable 800 Cash, Bank 3 500

- 19. Accounts payable 2 400 Total assets 9 600 Total equities 9 600 Summary of transactions during December: 1. Cash-Purchase of €1,500 of Office Supplies Inventory 2. Performed consulting services, for which we received € 1,000 cash immediately. 3. Received an invoice for a series of advertisements, € 200, that appeared in the local news during December and will be paid in January. 4. Performed additional consulting work, € 1 900 on credit. 5. Performed advertisement services, for which we received € 1,000 cash immediately. 6. Paid salaries to employees of € 700 for December. 7. Received an invoice for external services of € 400 for December to be paid with 60 credit term 8. Paid outstanding tax in the amount € 800 9. Paid trade creditors € 1,300. 10. The cost of office supplies used during December is € 1,900. 11. At the end of the month Company repaid to the Bank credit tranche 200 and paid interest charges (interest rate as of 9 % p.a.) 12. Depreciation of equipment for December amounts to € 250. Required: a) Prepare the opening journal entry on Dec. 1, 2014. b) Prepare the journal entries for the transactions (1. – 12) for the month of December and post them to the T-accounts, opening additional T-accounts for accounts as needed. Cross- reference the entries using the numbers of the transactions above.

- 20. c) Prepare a trial balance. d) Prepare the adjusting journal entries and record them at the end of December in the T-accounts as well as in the trial balance. e) Prepare the closing entries for the temporary accounts and the Income Statement. f) Prepare the closing entries for the permanent accounts and the Balance Sheet as of Dec. 31, 2014. Exercise V The Accounting Cycle – Problem Set ABC Company Ltd. Balance Sheet on Nov. 30, 2014 Assets Equities Equipment 2 000 Paid-in Capital 3 000 Land 2 500 Retained Earnings 1 000 Office Supplies Inventory 1 200 Loan Payable 2 400 Accounts Receivable 3 600 Tax payables 900 Cash, Bank 3 900

- 21. Accounts payable 3 700 Prepaid expenses 3 000 Salary payable 1 200 Unearned rent revenue 4 000 Total assets 16 200 Total equities 16 200 Summary of transactions during December: 1. Cash-Purchase of € 1 800 of Office Supplies Inventory 2. Performed consulting services, for which we received € 2,100 cash immediately. 3. Received an invoice for a series of advertisements, € 1 200, that appeared in the local news during December and will be paid in January. 4. Performed advertisement services for Customer XYZ, for which we will receive € 3,000 on 2 month credit sale. 5. Paid salaries to employees of € 1 200 for December. 6. Received an invoice for external services of € 1 400 for December to be paid with 60 credit term 7. Paid outstanding tax payables. 8. Paid trade creditors € 1,300. 9. Account for salaries that have been executed in December for the amount of € 1 300. 10. The cost of office supplies used during December is € 1,100. 11. In the beginning of September 2014 a subscription rights for local newspaper magazine of € 6 000 was paid for half-a year term in advance;

- 22. 12. In the beginning of October 2014 company receives rent for 6 months in advance, €6,000 13. At the end of the month Company repaid to the Bank credit tranche 500 and paid interest charges (interest rate as of 10 % p.a.) 14. Depreciation of equipment for December amounts to € 100. Required: a) Prepare the opening journal entry on Dec. 1, 2014. b) Prepare the journal entries for the transactions (1. – 14) for the month of December and post them to the T-accounts, opening additional T-accounts for accounts as needed. Cross- reference the entries using the numbers of the transactions above. c) Prepare a trial balance. d) Prepare the adjusting journal entries and record them at the end of December in the T-accounts as well as in the trial balance. e) Prepare the closing entries for the temporary accounts and the Income Statement. f) Prepare the closing entries for the permanent accounts and the Balance Sheet as of Dec. 31, 2014. EXERCISE VIIIFIFO method Valuation of InventoriesUnitsPrice per Unit Total Cost of goods sold Ending balanceBeginning balance 900130117000900117000- 00Purchase Dec. 10 1,1001201320001,100132000- 00Purchase Dec. 18 1,00011011000020022000800880003,0003590002,20027100080 088000UnitsPrice per Unit Total Sales revenues 2,200200440000Cost of Goods Sold for December 271000Gross Profit for December169000Inventory cost on Dec. 3188000LIFO

- 23. methodValuation of InventoriesUnitsPrice per Unit Total Cost of goods sold Ending balanceBeginning balance 90013011700010013000800104000Purchase Dec. 10 1,1001201320001,100132000- 00Purchase Dec. 18 1,0001101100001,000110000- 003,0003590002,200255000800104000UnitsPrice per Unit Total Sales revenues 2,200200440000Cost of Goods Sold for December 255000Gross Profit for December185000Inventory cost on Dec. 31104000Gross sales $1,740 Deduct: Sales returns and allowances$70 Cash discounts on sales$100$170Net sales $1 570 Deduct: Cost of goods sold Merchandise inventory, December 31, 20X1$100 Purchases (gross)$960 Deduct: Purchase returns and allowances $75 Cash discounts on purchases $5$80 Net purchases $ 880 Add: Freight-in 30 $ 30 Total cost of merchandise acquired$ 910 Cost of goods available for sale $1,010 Deduct: Merchandise inventory, December 31, 20X2 $ 140 Cost of goods sold $ 870 Gross profit $ 700Balance Sheet on Nov. 30, 2014AssetsEquitiesEquipment 2,000Paid-in Capital 4,000Land2,500Retained Earnings 800Raw materials Inventory 1,200Loan Payable 1,500Office Supplies Inventory 2,000Tax payables900Accounts Receivable3,000Salary payables 800Cash, Bank 4,300Accounts payable 3,000Prepaid expenses 1,000Unearned rent revenue5,000Total assets16,000Total equities16,000 Inventory_methods_Exe_VIIIAmounts i USDMonday Buys 2 cans for 50 100TuesdayBuys 2 cans for 60120WednesdayBuys 3 cans for 70210ThursdaySells 5 cans for 90 450number of cans purchased7total price for purchased cans430weighted average for purchased cans61LIFO methodFIFO methodWeighted averageSpecific identificationSpecific identificationSales revenues 4504504504504502 cans from Monday and 3 cans from Wednesday1 can from Monday and 2 cans from Wednesday 2 cans from TuesdayCost of goods sold1001005021012021012012070140Total CoGS330290307310310Gross profit120160143140140Ending

- 24. inventory 100140122.9120120 EXERCISES VIII_ABalance Sheet on Nov. 30, 2014AssetsEquitiesEquipment 2,000Paid-in Capital 3,000Land1,500Retained Earnings 1,800Raw materials Inventory 1,800Loan Payable 2,500Office Supplies Inventory 1,200Salary payables 1,500Accounts Receivable3,200Accounts payable 3,400Cash, Bank 4,500Unearned rent revenue2,000Prepaid expenses 1,500Allowance for uncollectible accounts1,500Total assets15,700Total equities15,700 EXERCISE VIII_BFIFO method Valuation of InventoriesUnitsPrice per Unit Total Cost of goods sold Ending balanceBeginning balance Purchase Dec. 11Purchase Dec. 23Purchase Dec. 27Total UnitsPrice per Unit Total Sales revenues Cost of Goods Sold for December Gross Profit for DecemberInventory cost on Dec. 31LIFO methodValuation of InventoriesUnitsPrice per Unit Total Cost of goods sold Ending balanceBeginning balance Purchase Dec. 11Purchase Dec. 23Purchase Dec. 27Total UnitsPrice per Unit Total Sales revenues Cost of Goods Sold for December Gross Profit for DecemberInventory cost on Dec. 31Gross sales $1,740 Deduct: Sales returns and allowances$70 Cash discounts on sales$100$170Net sales $1 570 Deduct: Cost of goods sold Merchandise inventory, December 31, 20X1$100 Purchases (gross)$960 Deduct: Purchase returns and allowances $75 Cash discounts on purchases $5$80 Net purchases $ 880 Add: Freight-in 30 $ 30 Total cost of merchandise acquired$ 910 Cost of goods available for sale $1,010 Deduct: Merchandise inventory, December 31, 20X2 $ 140 Cost of goods sold $ 870 Gross profit $ 700Balance Sheet on Nov. 30, 2014AssetsEquitiesEquipment 2,000Paid-in Capital 4,000Land2,500Retained Earnings 800Raw materials Inventory 1,200Loan Payable 1,500Office Supplies Inventory 2,000Tax payables900Accounts Receivable3,000Salary payables 800Cash, Bank 4,300Accounts payable 3,000Prepaid expenses 1,000Unearned rent revenue5,000Total assets16,000Total equities16,000

- 25. Inventory_methods_VIII_CAmounts i USDMonday Buys 5 cans for 40 TuesdayBuys 4 cans for 30WednesdayBuys 2 cans for 50ThursdaySells 10 cans for 70 number of cans purchasedtotal price for purchased cansweighted average for purchased cansLIFO methodFIFO methodWeighted averageSpecific identificationSpecific identificationSales revenues Cost of goods soldTotal CoGS- 0Gross profit- 0Ending inventory - 0 EXERCISES VIII_DGross sales Deduct: Sales returns and allowances Cash discounts on salesNet sales Deduct: Cost of goods sold Merchandise inventory, December 31, 2014 Purchases (gross) Deduct: Purchase returns and allowances Cash discounts on purchases Net purchases Add: Freight-in Total cost of merchandise acquired Cost of goods available for sale Deduct: Merchandise inventory, December 31, 2015 Cost of goods sold Gross profit EXERCISE VAssetsEquitiesEquipment 2,000Paid-in Capital 3,000Land2,500Retained Earnings 1,000Office Supplies Inventory 1,200Loan Payable 2,400Accounts Receivable3,600Tax payables900Cash, Bank 3,900Accounts payable 3,700Prepaid expenses 3,000Salary payable 1,200Unearned rent revenue4,000Total assets16,200Total equities16,200ASSETS ACCOUNTSCASH, BANK OFFICE SUPPLY INVENTORYACCOUNT RECEIVABLESEQUIPMENTLANDPREPAID EXPENSESDtCtDtCtDtCtDtCtDtCtDtCtEQUITY AND LIABILITIES ACCOUNTSPAID IN CAPITAL RETAINED EARNINGSTAX PAYABLESACCOUNTS PAYABLES LOAN PAYABLE SALARY PAYABLESUNEARNED RENT REVENUEDtCT DtCtDtCtDtCtDtCtDtCtDtCtTEMPORARY ACCOUNTS 412transactions 1. Cash-Purchase of € 1 800 of Office Supplies Inventory2. Performed consulting services, for which we received € 2,100 cash immediately3. Received an invoice for a series of advertisements, € 1 200, that appeared in the local news during December and will be paid in January. 4. Performed advertisement services for Customer XYZ, for which

- 26. we will receive € 3,000 on 2 month credit sale. 5. Paid salaries to employees of € 1 200 for December. 6. Received an invoice for external services of € 1 400 for December to be paid with 60 credit term7. Paid outstanding tax payables8. Paid trade creditors € 1,300. 9. Account for salaries that have been executed in December for the amount of € 1 300.10. The cost of office supplies used during December is € 1,10011. In the beginning of September 2014 a subscription rights for local newspaper magazine of € 6 000 was paid for half-a year term in advance;12. In the beginning of October 2014 company receives rent for 6 months in advance, €6,00013. At the end of the month Company repaid to the Bank credit tranche 500 and paid interest charges (interest rate as of 10 % p.a.) 14. Depreciation of equipment for December amounts to € 100. INCOME STATEMENTEXPENSES REVENUESAssetsEquitiesEquipment Paid-in Capital LandRetained Earnings Office Supplies Inventory Loan Payable Accounts ReceivableTax payablesCash, Bank Accounts payable Prepaid expenses Salary payable Unearned rent revenueTotal assets0Total equities0 Exercise VI The Accounting Cycle – Problem Set ABC Company Ltd. Assets Equities Equipment 4 000 Paid-in Capital 3 000 Land 10 200 Retained Earnings 1 000 Office Supplies Inventory

- 27. 2 000 Loan Payable 4 800 Accounts Receivable 3 600 Tax payables 900 Cash, Bank 6 500 Accounts payable 4 100 Prepaid expenses 900 Salary payable 1 400 Unearned rent revenue 12 000 Total assets 27 200 Total equities 27 200 Summary of transactions during December: 1. Purchase of € 1 200 of Office Supplies Inventory with 60 day credit term 1. Performed consulting services, for which we received € 3,900 cash immediately. 1. Received an invoice for a series of advertisements, € 1 500, that appeared in the local news during December and will be paid in January. 1. Performed advertisement services for Customer XYZ, for which we will receive € 1,700 on 2 month credit sale. 1. Paid salaries to employees of € 1 000 for December. 1. Received an invoice for external services of € 1 300 for

- 28. December to be paid with 60 credit term 1. Paid outstanding tax payables. 1. Paid trade creditors € 2,300. 1. The cost of office supplies used during December is € 1,000. 1. In the beginning of September 2014 a subscription rights for local newspaper magazine of € 1 200 was paid for whole year term in advance; 1. In the beginning of October 2014 company receives rent for 8 months in advance, €16,000 1. Salaries to employees of € 1 300 were calculated for December to be paid in January. 1. At the end of the month Company repaid to the Bank credit tranche 1,000 and paid interest charges (interest rate as of 10 % p.a.) 1. Depreciation of equipment for December amounts to € 500. Required: a) Prepare the opening journal entry on Dec. 1, 2014. b) Prepare the journal entries for the transactions (1. – 14) for the month of December and post them to the T-accounts, opening additional T-accounts for accounts as needed. Cross- reference the entries using the numbers of the transactions above. c) Prepare a trial balance. d) Prepare the adjusting journal entries and record them at the end of December in the T-accounts as well as in the trial balance. e) Prepare the closing entries for the temporary accounts and the Income Statement. f) Prepare the closing entries for the permanent accounts and the Balance Sheet as of Dec. 31, 2014.

- 29. EXERCISE VIAssetsOwner`s equity and liabilities Equipment 4,000Paid-in Capital 3,000Land10,200Retained Earnings 1,000Office Supplies Inventory 2,000Loan Payable 4,800Accounts Receivable3,600Tax payables900Cash, Bank 6,500Accounts payable 4,100Prepaid expenses 900Salary payable 1,400Unearned rent revenue12,000Total assets27,200Total equities27,200ASSETS ACCOUNTSCASH, BANK OFFICE SUPPLY INVENTORYACCOUNT RECEIVABLESEQUIPMENTLANDPREPAID EXPENSESDtCtDtCtDtCtDtCtDtCtDtCtEQUITY AND LIABILITIES ACCOUNTSPAID IN CAPITAL RETAINED EARNINGSTAX PAYABLESACCOUNTS PAYABLES LOAN PAYABLE SALARY PAYABLESUNEARNED RENT REVENUEDtCT DtCtDtCtDtCtDtCtDtCtDtCtTEMPORARY ACCOUNTS transactions 1. Purchase of € 1 200 of Office Supplies Inventory with 60 day credit term 2. Performed consulting services, for which we received € 3,900 cash immediately. 3. Received an invoice for a series of advertisements, € 1 500, that appeared in the local news during December and will be paid in January. 4. Performed advertisement services for Customer XYZ, for which we will receive € 1,700 on 2 month credit sale. 5. Paid salaries to employees of € 1 000 for December. 6. Received an invoice for external services of € 1 300 for December to be paid with 60 credit term 7. Paid outstanding tax payables. 8. Paid trade creditors € 2,300. 9. The cost of office supplies used during December is € 1,000. 10. In the beginning of September 2014 a subscription rights for local newspaper magazine of € 1 200 was paid for whole year term in advance; 11. In the beginning of October 2014 company receives rent for 8 months in advance, €16,000 12. Salaries to employees of € 1 300 were calculated for December to be paid in January. 13. At the end of the month Company repaid to the Bank credit tranche 1,000 and paid interest charges (interest rate as of 10 % p.a.) 14. Depreciation of equipment for December amounts to € 500. INCOME STATEMENTEXPENSES REVENUESAssetsOwner`s

- 30. equity and liabilities Equipment Paid-in Capital LandRetained Earnings Office Supplies Inventory Loan Payable Accounts ReceivableTax payablesCash, Bank Accounts payable Prepaid expenses Salary payable Unearned rent revenueTotal assetsTotal equities EXERCIES VIIAging of accounts receivables NameTotal1-30 days31-60 days61-90 daysmore than 90 daysA€ 15,000€ 15,000B€ 24,000€ 24,000C€ 24,000€ 12,000€ 12,000D€ 15,000€ 2,000€ 3,000€ 10,000E€ 12,000€ 3,000€ 5,000€ 3,000€ 1,000Other € 36,000€ 25,000€ 7,000€ 2,000€ 2,000Total € 126,000€ 81,000€ 27,000€ 15,000€ 3,000Historical bad debt percentages1.0%3.0%6.0%60.0%Bad debt allowance to be providedAccount Receivables valuationThomson Corp. had sales of € 100,000 during 2015, including € 60,000 on credit. Balances on Dec. 31, 2014, were Accounts Receivable, € 9,000, and Allowance for Bad Debts, € 800 (= credit balance). Data for 2015: collections on accounts receivable were € 56,000. Bad debts expense was estimated at 2 % of credit sales, as in previous years. Write-offs of bad debts during 2015 were € 1,000. DtCtDtCtDtCtDtCtESTIMATIONS OF BAD DEBT EXPENSEDtCtCREDIT SALESBalance Sheet on Nov. 30, 2014AssetsEquitiesEquipment 2,000Paid-in Capital 8,000Land2,500Retained Earnings 1,000Office Supplies Inventory 1,200Loan Payable 2,000Accounts Receivable7,400Tax payables900Cash, Bank 3,000Accounts payable 3,200Prepaid expenses 3,000Unearned rent revenue4,000Total assets19,100Total equities19,100ASSETS ACCOUNTSCASH, BANK OFFICE SUPPLY INVENTORYACCOUNT RECEIVABLESEQUIPMENTLANDPREPAID EXPENSESDtCtDtCtDtCtDtCtDtCtDtCtEQUITY AND LIABILITIES ACCOUNTSPAID IN CAPITAL RETAINED EARNINGSTAX PAYABLESACCOUNTS PAYABLES LOAN PAYABLE SALARY PAYABLESUNEARNED RENT REVENUEDtCT DtCtDtCtDtCtDtCtDtCtDtCtEND.BAL.€

- 31. 0TEMPORARY ACCOUNTS € 0€ 0transactions 1. Cash- Purchase of € 1 800 of Office Supplies Inventory2. Performed consulting services, for which we received € 9,100 cash immediately3. Received an invoice for a series of advertisements, € 1 200, that appeared in the local news during December and will be paid in January. 4. In November 2014 we performed additional consulting work, € 2 000 on credit (5/30, n 90) and in December the customer used the discount for prompt payment.5. Performed advertisement services for Customer XYZ, for which we will receive € 1,000 on 2 month credit sale. 6. Paid salaries to employees of € 1 200 for December. 7. We sold some of the redundant office supplies inventory on the market –€ 500 through credit card transaction (a straight 3% of credit card services were taken).8. Received an invoice for external services of € 1 400 for December to be paid with 60 credit term9. Paid outstanding tax payables.10. Paid trade creditors € 1,300. 11. The cost of office supplies used during December is € 1,100. 12. In the beginning of September 2014 a subscription rights for local newspaper magazine of € 6 000 was paid for half-a year term in advance;13. In the beginning of October 2014 company receives rent for 6 months in advance, €6,00014. At the end of the month Company repaid to the Bank credit tranche 500 and paid interest charges (interest rate as of 9 % p.a.) 15. At the end of month the Customer XYZ made a claim on the advertisement services and we agreed to sales allowance (a reduction of the original selling price) in the amount of 20%. 16. Depreciation of equipment for December amounts to € 100. INCOME STATEMENTEXPENSES REVENUESAssetsOwner`s equity and liabilities Equipment Paid-in Capital LandRetained Earnings Office Supplies Inventory Loan Payable Accounts ReceivableTax payablesCash, Bank Accounts payable Prepaid expenses Unearned rent revenueTotal assetsTotal equities