Exercise VII VII.A. Accounting Cycle The Accounting Cycle –.docx

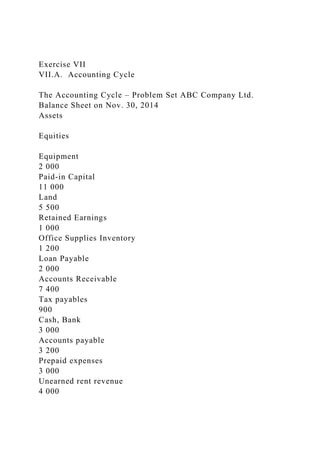

- 1. Exercise VII VII.A. Accounting Cycle The Accounting Cycle – Problem Set ABC Company Ltd. Balance Sheet on Nov. 30, 2014 Assets Equities Equipment 2 000 Paid-in Capital 11 000 Land 5 500 Retained Earnings 1 000 Office Supplies Inventory 1 200 Loan Payable 2 000 Accounts Receivable 7 400 Tax payables 900 Cash, Bank 3 000 Accounts payable 3 200 Prepaid expenses 3 000 Unearned rent revenue 4 000

- 2. Allowance for uncollectible Accounts 3 000 Total assets 22 100 Total equities 22 100 Summary of transactions during December: 1. Cash-Purchase of € 1 800 of Office Supplies Inventory 2. Performed consulting services, for which we received € 9,100 cash immediately. 3. Received an invoice for a series of advertisements, € 1 200, that appeared in the local news during December and will be paid in January. 4. In November 2014 we performed additional consulting work, € 2 000 on credit (5/30, n 90) and in December the customer used the discount for prompt payment.. 5. Performed advertisement services for Customer XYZ, for which we will receive € 1,000 on 2 month credit sale. 6. Paid salaries to employees of € 1 200 for December. 7. We sold some of the redundant office supplies inventory on the market –€ 500 through credit card transaction (a straight 3% of credit card services were taken). 8. Received an invoice for external services of € 1 400 for December to be paid with 60 credit term 9. Paid outstanding tax payables. 10. Paid trade creditors € 1,300. 11. The cost of office supplies used during December is € 1,100. 12. In the beginning of September 2014 a subscription rights for local newspaper magazine of € 6 000 was paid for half-a year term in advance; 13. In the beginning of October 2014 company receives rent for 6 months in advance, €6,000 14. At the end of the month Company repaid to the Bank credit tranche 500 and paid interest charges (interest rate as of 9 %

- 3. p.a.) 15. At the end of month the Customer XYZ made a claim on the advertisement services and we agreed to sales allowance (a reduction of the original selling price) in the amount of 20%. 16. Depreciation of equipment for December amounts to € 100. 17. ABC company acknowledged the $2,000 worth of bad debts in December 2014. Required: a) Prepare the opening journal entry on Dec. 1, 2014. b) Prepare the journal entries for the transactions (1. – 17) for the month of December and post them to the T-accounts, opening additional T-accounts for accounts as needed. Cross- reference the entries using the numbers of the transactions above. c) Prepare a trial balance. d) Prepare the adjusting journal entries and record them at the end of December in the T-accounts as well as in the trial balance. e) Prepare the closing entries for the temporary accounts and the Income Statement. f) Prepare the closing entries for the permanent accounts and the Balance Sheet as of Dec. 31, 2014. VII.B. Account Receivables valuation Thomson Corp. had sales of € 100,000 during 2015, including € 60,000 on credit. Balances on Dec. 31, 2014, were Accounts Receivable, € 9,000, and Allowance for Bad Debts, € 800 (= credit balance). Data for 2015: collections on accounts receivable were € 56,000. Bad debts expense was estimated at 2 % of credit sales, as in previous years. Write-offs of bad debts during 2015 were € 1,000. Requirements: 1. Prepare all journal entries for 2015.

- 4. 2. Show the ending balances of the balance sheet accounts on Dec. 31, 2015. VII.C. Aging of accounts receivables The aging of accounts receivable method directly incorporates the customers’ payment histories. As more time elapses after the sale, collection becomes less likely. The $126,000 balance in Accounts Receivable on December 31, 2014, might be aged as shown below. The beginning balance in the Allowance account is amounted to € 1 000. Exercise III Accounting Cycle The Accounting Cycle – Problem Set ABC Company Ltd. Balance Sheet on Nov. 30, 2018 Assets Equities Equipment 5 000 Paid-in Capital 4 000 Office Supplies Inventory 1 000 Retained Earnings 3 600 Accounts Receivable 1 000 Tax payable 1 000 Cash, Bank

- 5. 6 600 Accounts payable 5 000 Total assets 13 600 Total equities 13 600 Summary of transactions during December: 1. Cash-Purchase of €1,000 of Office Supplies Inventory 2. At the end of the month Company took out a 9 % p.a., 90 day, €10,000 loan with the Bank 3. Performed consulting services, for which we received € 2,000 cash immediately. 4. Received an invoice for a series of advertisements, € 1 000, that appeared in the local news during December and will be paid in January. 5. Performed additional consulting work, € 1 800 on credit. 6. Performed advertisement services, for which we received € 1,000 cash immediately. 7. Paid salaries to employees of € 2,000 for December. 8. Paid outstanding tax € in the amount 800 9. Paid creditors € 1,300. 10. The cost of office supplies used during December is € 850. 11. Depreciation of equipment for December amounts to € 250. Required: a) Prepare the opening journal entry on Dec. 1, 2018. b) Prepare the journal entries for the transactions (1. – 11.) for the month of December and post them to the T-accounts, opening additional T-accounts for accounts as needed. Cross- reference the entries using the numbers of the transactions above. c) Prepare a trial balance. d) Prepare the closing entries for the temporary accounts and the Income Statement.

- 6. e) Prepare the closing entries for the permanent accounts and the Balance Sheet as of Dec. 31, 2018. Exercise VIII VIII.A. Accounting Cycle The Accounting Cycle – Problem Set ABC Company Ltd. Summary of transactions during December: 1. Paid outstanding salary payables. 2. Paid trade creditors € 2,500. 3. Salaries to employees of € 1 200 were calculated for December to be paid in January. 4. Purchase of € 1 500 of Office Supplies Inventory with 10% cash discount for cash transaction. 5. Purchase of raw materials Inventory of € 1 900 was done with two month trade credit. 6. The freight in for both supplies and raw material inventory was paid in the amount of € 200. 7. Due to the low quality of the purchased office supplies inventory the company returned back € 300 of inventory. 8. Performed advertisement services for Customer XYZ, for which we will receive € 2,000 on 3 month credit sale. 9. At the end of month the Customer XYZ made a claim on the advertisement services and we agreed to sales allowance (a reduction of the original selling price) in the amount of 25%. 10. Received an invoice for a series of advertisements, € 3 000, that appeared in the local news during December and will be paid in January. 11. Received an invoice for external services of € 1 500 for December to be paid with 60 credit term 12. Performed consulting services, in the amount of € 2,000 with 20% for cash discount on sales (cash immediately received). 13. In November 2014 we performed additional consulting work, € 2 100 on credit (10/30, n 90) and in December 2014 the

- 7. customer used the discount for prompt payment. 14. We sold office supplies inventory on the market for € 2000 through credit card transaction (a straight 2% of credit card services were taken). 15. The cost of office supplies used during December is € 200. 16. The cost of raw materials inventory used during December is € 3 000. 17. In the beginning of October 2014 a subscription rights for local newspaper magazine of € 2 500 was paid for five month term in advance; 18. In the beginning of November 2014 company receives rent for 3 months in advance, €3,000 19. At the end of the month Company repaid to the Bank credit tranche € 500 and paid interest charges (interest rate as of 5% p.a.) 20. Depreciation of equipment for December amounts to € 250. 21. ABC company acknowledged the € 1 500 worth of bad debts in December 2014. Required: a) Prepare the opening journal entry on Dec. 1, 2014. b) Prepare the journal entries for the transactions (1– 21) for the month of December and post them to the T-accounts, opening additional T-accounts for accounts as needed. Cross-reference the entries using the numbers of the transactions above. c) Prepare a trial balance. d) Prepare the adjusting journal entries and record them at the end of December in the T-accounts as well as in the trial balance. e) Prepare the closing entries for the temporary accounts and the Income Statement. f) Prepare the closing entries for the permanent accounts and the Balance Sheet as of Dec. 31, 2014. VIII.B. Valuation of Inventories The inventory of ABC Company on November 30, 2014 shows

- 8. 500 units at € 100 per unit. A physical inventory on December 31, 2014, shows a total of 700 units on hand. Revenue from sales for December totals € 300,000 (= 2,000 units at € 150 per unit). The following purchases were made during December 2014: Dec. 11: 1,100 units at € 110 per unit Dec. 23: 700 units at € 115 per unit Dec. 27: 400 units at € 135 per unit Requirement: 1. Calculate the cost of goods sold for December 2014 and the inventory cost as of December 31, 2014, using the FIFO method and LIFO method. 2. Compute the gross profit for December 2014. VIII.C. Valuation of Inventories Assume a vendor of soft drinks starts out the week with no inventory. He buys and sells cola as follows: · Buys 5 cans on Monday for 40 cents · Buys 4 cans on Tuesday for 30 cents · Buys 2 cans on Wednesday for 50 cents · Sells 10 cans on Thursday for 70 cents Please shows the vendor’s cost of goods sold and ending inventory under the four methods. VIII.D. Cost of goods sold under the periodic system inventory for 2015 The gross sales from whole 2015 period were € 2 500 and the sales returns were 5%. Additionally the company is offering 4% of cash discount of sales to their customers (the cash sales was € 1 000). At the beginning of the period December 31, 2014 the merchandise inventory level was € 500 and during the year 2015 the company purchased € 1 500 of merchandise with 10% cash discount (the cash purchases was € 500). Due to the low quality of the merchandise the company agreed with the suppliers on € 200 purchase allowance. The freight –in cost for the 2015 period were € 50. The ending inventory as of December 31,

- 9. 2015 level was € 250. Please calculate cost of goods sold and gross profit under the periodic system inventory for 2015. AssetsEquities Equipment 2 000Paid-in Capital 3 000 Land1 500Retained Earnings 1 800 Raw materials Inventory 1 800Loan Payable 2 500 Office Supplies Inventory 1 200Salary payables 1 500 Accounts Receivable3 200Accounts payable 3 400 Cash, Bank 4 500Unearned rent revenue2 000 Prepaid expenses 1 500 Allowance for uncollectible accounts 1 500 Total assets15 700Total equities15 700 Balance Sheet on Nov. 30, 2014 Exercise V The Accounting Cycle – Problem Set ABC Company Ltd. Balance Sheet on Nov. 30, 2014 Assets Equities Equipment 2 000 Paid-in Capital 3 000 Land 2 500 Retained Earnings 1 000 Office Supplies Inventory 1 200 Loan Payable 2 400

- 10. Accounts Receivable 3 600 Tax payables 900 Cash, Bank 3 900 Accounts payable 3 700 Prepaid expenses 3 000 Salary payable 1 200 Unearned rent revenue 4 000 Total assets 16 200 Total equities 16 200 Summary of transactions during December: 1. Cash-Purchase of € 1 800 of Office Supplies Inventory 2. Performed consulting services, for which we received € 2,100 cash immediately. 3. Received an invoice for a series of advertisements, € 1 200, that appeared in the local news during December and will be paid in January. 4. Performed advertisement services for Customer XYZ, for which we will receive € 3,000 on 2 month credit sale. 5. Paid salaries to employees of € 1 200 for December. 6. Received an invoice for external services of € 1 400 for December to be paid with 60 credit term 7. Paid outstanding tax payables. 8. Paid trade creditors € 1,300. 9. Account for salaries that have been executed in December for

- 11. the amount of € 1 300. 10. The cost of office supplies used during December is € 1,100. 11. In the beginning of September 2014 a subscription rights for local newspaper magazine of € 6 000 was paid for half-a year term in advance; 12. In the beginning of October 2014 company receives rent for 6 months in advance, €6,000 13. At the end of the month Company repaid to the Bank credit tranche 500 and paid interest charges (interest rate as of 10 % p.a.) 14. Depreciation of equipment for December amounts to € 100. Required: a) Prepare the opening journal entry on Dec. 1, 2014. b) Prepare the journal entries for the transactions (1. – 14) for the month of December and post them to the T-accounts, opening additional T-accounts for accounts as needed. Cross- reference the entries using the numbers of the transactions above. c) Prepare a trial balance. d) Prepare the adjusting journal entries and record them at the end of December in the T-accounts as well as in the trial balance. e) Prepare the closing entries for the temporary accounts and the Income Statement. f) Prepare the closing entries for the permanent accounts and the Balance Sheet as of Dec. 31, 2014. Exercise IV Accounting Cycle

- 12. The Accounting Cycle – Problem Set ABC Company Ltd. Balance Sheet on Nov. 30, 2014 Assets Equities Equipment 2 500 Paid-in Capital 3 000 Land 1 000 Retained Earnings 2 400 Office Supplies Inventory 1 200 Loan Payable 1 000 Accounts Receivable 1 400 Tax payable 800 Cash, Bank 3 500 Accounts payable 2 400 Total assets 9 600 Total equities 9 600 Summary of transactions during December: 1. Cash-Purchase of €1,500 of Office Supplies Inventory 2. Performed consulting services, for which we received € 1,000 cash immediately.

- 13. 3. Received an invoice for a series of advertisements, € 200, that appeared in the local news during December and will be paid in January. 4. Performed additional consulting work, € 1 900 on credit. 5. Performed advertisement services, for which we received € 1,000 cash immediately. 6. Paid salaries to employees of € 700 for December. 7. Received an invoice for external services of € 400 for December to be paid with 60 credit term 8. Paid outstanding tax in the amount € 800 9. Paid trade creditors € 1,300. 10. The cost of office supplies used during December is € 1,900. 11. At the end of the month Company repaid to the Bank credit tranche 200 and paid interest charges (interest rate as of 9 % p.a.) 12. Depreciation of equipment for December amounts to € 250. Required: a) Prepare the opening journal entry on Dec. 1, 2014. b) Prepare the journal entries for the transactions (1. – 12) for the month of December and post them to the T-accounts, opening additional T-accounts for accounts as needed. Cross- reference the entries using the numbers of the transactions above. c) Prepare a trial balance. d) Prepare the adjusting journal entries and record them at the end of December in the T-accounts as well as in the trial balance. e) Prepare the closing entries for the temporary accounts and the Income Statement. f) Prepare the closing entries for the permanent accounts and the Balance Sheet as of Dec. 31, 2014. Exercise IX

- 14. IX.A. Accounting Cycle The Accounting Cycle – Problem Set ABC Company Ltd. Summary of transactions during December: 1. Paid outstanding salary payables. 2. Paid outstanding trade creditors. 3. Salaries to employees of € 1 300 were calculated for December to be paid in January. 4. Purchase of € 2 000 of Office Supplies Inventory with 10% cash discount for cash transaction. 5. Purchase of raw materials Inventory of € 2 000 was done with three month trade credit. 6. Due to the low quality of the purchased office supplies inventory the company returned back € 200 of inventory that diminished the accounts payable by that amount. 7. The freight in for both supplies and raw material inventory was paid in the amount of € 400. 8. Performed advertisement services for Customer XYZ, for which we will receive € 4,500 on 3 month credit sale. 9. At the end of month the Customer XYZ made a claim on the advertisement services and we agreed to sales allowance (a reduction of the original selling price) in the amount of 15%. 10. Received an invoice for a series of advertisements, € 2 000, that appeared in the local news during December and will be paid in January. 11. Received an invoice for external services of € 2 000 for December to be paid with 60 credit term 12. Performed consulting services, in the amount of € 5,000 with 10% for cash discount on sales (cash immediately received). 13. In November 2014 we performed additional consulting work, € 2 000 on credit (10/30, n 90) and in December 2014 the customer used the discount for prompt payment. 14. We sold office supplies inventory on the market for € 2500 through credit card transaction (a straight 5% of credit card services were taken).

- 15. 15. The cost of office supplies used during December is € 800. 16. The cost of raw materials inventory used during December is € 2 000. 17. In the beginning of October 2014 a subscription rights for local newspaper magazine of € 3 000 was paid for three month term in advance; 18. In the beginning of September 2014 company receives rent for 5 months in advance, €5,000 19. At the end of the month Company repaid to the Bank credit tranche € 1 000 and paid interest charges (interest rate as of 10% p.a.) 20. Depreciation of equipment for December amounts to € 50. 21. ABC company acknowledged the € 2 000 worth of bad debts in December 2014. Required: a) Prepare the opening journal entry on Dec. 1, 2014. b) Prepare the journal entries for the transactions (1– 21) for the month of December and post them to the T-accounts, opening additional T-accounts for accounts as needed. Cross-reference the entries using the numbers of the transactions above. c) Prepare a trial balance. d) Prepare the adjusting journal entries and record them at the end of December in the T-accounts as well as in the trial balance. e) Prepare the closing entries for the temporary accounts and the Income Statement. f) Prepare the closing entries for the permanent accounts and the Balance Sheet as of Dec. 31, 2014. IX.B. Valuation of Inventories The inventory of ABC Company on November 30, 2014 shows 200 units at € 160 per unit. A physical inventory on December 31, 2014, shows a total of 400 units on hand. Revenue from sales for December totals € 400,000 (= 2,000 units at € 200 per unit). The following purchases were made during December

- 16. 2014: Dec. 11: 900 units at € 175 per unit Dec. 23: 900 units at € 165 per unit Dec. 27: 400 units at € 180 per unit Requirement: 1. Calculate the cost of goods sold for December 2014 and the inventory cost as of December 31, 2014, using the FIFO method and LIFO method. 2. Compute the gross profit for December 2014. IX.C. Valuation of Inventories Assume a vendor of soft drinks starts out the week with no inventory. He buys and sells cola as follows: · Buys 3 cans on Monday for 35 cents · Buys 4 cans on Tuesday for 30 cents · Buys 4 cans on Wednesday for 40 cents · Sells 8 cans on Thursday for 60 cents Please shows the vendor’s cost of goods sold and ending inventory under the four methods. IX.D. Cost of goods sold under the periodic system inventory for 2015 The gross sales from whole 2015 period were € 4 500 and the sales returns were 10%. Additionally the company is offering 10% of cash discount of sales to their customers (the cash sales was € 2 500). At the beginning of the period December 31, 2014 the merchandise inventory level was € 900 and during the year 2015 the company purchased € 2 500 of merchandise with 15% cash discount (the cash purchases was € 1 500). Due to the low quality of the merchandise the company agreed with the suppliers on € 500 purchase allowance. The freight –in cost for the 2015 period were € 150. The ending inventory as of December 31, 2015 level was € 500. Please calculate cost of goods sold and gross profit under the periodic system inventory for 2015. AssetsEquities

- 17. Equipment 1 500Paid-in Capital 4 000 Land1 500Retained Earnings 1 300 Raw materials Inventory 1 500Loan Payable 3 000 Office Supplies Inventory 2 000Salary payables 1 400 Accounts Receivable3 000Accounts payable 2 400 Cash, Bank 5 600Unearned rent revenue2 000 Prepaid expenses 1 000 Allowance for uncollectible accounts 2 000 Total assets16 100Total equities16 100 Balance Sheet on Nov. 30, 2014 Exercise VI The Accounting Cycle – Problem Set ABC Company Ltd. Assets Equities Equipment 4 000 Paid-in Capital 3 000 Land 10 200 Retained Earnings 1 000 Office Supplies Inventory 2 000 Loan Payable 4 800 Accounts Receivable 3 600 Tax payables 900

- 18. Cash, Bank 6 500 Accounts payable 4 100 Prepaid expenses 900 Salary payable 1 400 Unearned rent revenue 12 000 Total assets 27 200 Total equities 27 200 Summary of transactions during December: 1. Purchase of € 1 200 of Office Supplies Inventory with 60 day credit term 1. Performed consulting services, for which we received € 3,900 cash immediately. 1. Received an invoice for a series of advertisements, € 1 500, that appeared in the local news during December and will be paid in January. 1. Performed advertisement services for Customer XYZ, for which we will receive € 1,700 on 2 month credit sale. 1. Paid salaries to employees of € 1 000 for December. 1. Received an invoice for external services of € 1 300 for December to be paid with 60 credit term 1. Paid outstanding tax payables. 1. Paid trade creditors € 2,300. 1. The cost of office supplies used during December is € 1,000. 1. In the beginning of September 2014 a subscription rights for local newspaper magazine of € 1 200 was paid for whole year term in advance;

- 19. 1. In the beginning of October 2014 company receives rent for 8 months in advance, €16,000 1. Salaries to employees of € 1 300 were calculated for December to be paid in January. 1. At the end of the month Company repaid to the Bank credit tranche 1,000 and paid interest charges (interest rate as of 10 % p.a.) 1. Depreciation of equipment for December amounts to € 500. Required: a) Prepare the opening journal entry on Dec. 1, 2014. b) Prepare the journal entries for the transactions (1. – 14) for the month of December and post them to the T-accounts, opening additional T-accounts for accounts as needed. Cross- reference the entries using the numbers of the transactions above. c) Prepare a trial balance. d) Prepare the adjusting journal entries and record them at the end of December in the T-accounts as well as in the trial balance. e) Prepare the closing entries for the temporary accounts and the Income Statement. f) Prepare the closing entries for the permanent accounts and the Balance Sheet as of Dec. 31, 2014. Exercise II Accounting Cycle The Accounting Cycle – Problem Set ABC Company Ltd. Balance Sheet on Nov. 30, 2014 Assets

- 20. Equities Equipment 6 000 Paid-in Capital 5 000 Office Supplies Inventory 1 000 Retained Earnings 3 600 Accounts Receivable 1 000 Tax payable 1 000 Cash, Bank 8 600 Accounts payable 7 000 Total assets 16 600 Total equities 16 600 Summary of transactions during December: 1. Performed consulting services, for which we received € 2,000 cash immediately. 2. Received an invoice for a series of advertisements, € 600, that appeared in the local news during December and will be paid in January. 3. Performed additional consulting work, € 2 500 on credit. 4. Issued a check for € 800 for rent of shop space for December. 5. Performed advertisement services, for which we received € 1,000 cash immediately. 6. Paid salaries to employees of € 2,000 for December. 7. Paid outstanding tax € 1 000 8. Paid creditors € 2,800.

- 21. 9. The cost of office supplies used during December is € 450. 10. Depreciation of equipment for December amounts to € 150. Required: a) Prepare the opening journal entry on Dec. 1, 2014. b) Prepare the journal entries for the transactions (1. – 10.) for the month of December and post them to the T-accounts, opening additional T-accounts for accounts as needed. Cross- reference the entries using the numbers of the transactions above. c) Prepare a trial balance. d) Prepare the adjusting journal entries and record them at the end of December in the T-accounts as well as in the trial balance. e) Prepare the closing entries for the temporary accounts and the Income Statement. f) Prepare the closing entries for the permanent accounts and the Balance Sheet as of Dec. 31, 2014.