Complete financial projection for business plan

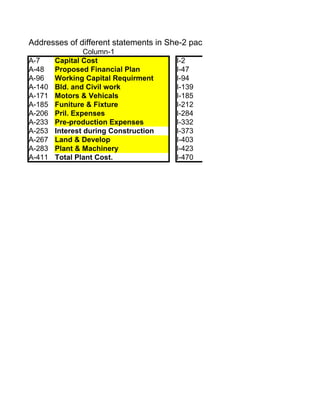

- 1. Addresses of different statements in She-2 package Column-1 Column-2 A-7 Capital Cost I-2 A-48 Proposed Financial Plan I-47 A-96 Working Capital Requirment I-94 A-140 Bld. and Civil work I-139 A-171 Motors & Vehicals I-185 A-185 Funiture & Fixture I-212 A-206 Pril. Expenses I-284 A-233 Pre-production Expenses I-332 A-253 Interest during Construction I-373 A-267 Land & Develop I-403 A-283 Plant & Machinery I-423 A-411 Total Plant Cost. I-470

- 2. he-2 package Column-2 Column-3 Projt. Income Statement W-2 Loan Repayment Projt. Cash Flow W-47 Loan Repayment Projt. Balance Sheet(Asst) W-94 Loan Repayment Projt. Balance Sheet(Liab) W-139 Loan Repayment Depreciation Schedule W-186 IFRR Projected Sales W-232 Cost Benefit Ratio Raw material requirement W-280 Payback Period Manpower requi. W-327 Cost Benefit Ratio Discounted Utilities W-372 Break even analysis Stores & Spares Gen. & Selling Exp. Detailed working Capital

- 3. Financial Analysis 3- . Project Title : Boutique and Garment Factory Location : Distt. Lahore Table-1 CAPITAL COST OF THE PROJECT (Rs. in ,000) Description Local Foreign Total - Land 0 0 Appendix-1 - Building & Civil Works 0 0 Appendix-2 - Plant & Machinery 207 0 207 Appendix-3 - Errection & Installation % of P. & Machin 10 21 21 - Motors & Vehicles 0 0 Appendix-4 - Furniture & Fixture 473 473 Appendix-5 - Preliminary Expenses * take from Appendix-6 3464 3464 Appendix-6 - Pre-production Expenses 77 77 Appendix-7 - Intrest During Construction 0 0 Appendix-8 - Contingencies 424 0 424 Fixed Capital Cost 4666 0 4666 Working Capital 2455 2455 Table-3 Total 7121 0 7121 Construction Period = 1 Year Local Contingencies excluding land & motor & vehicles % 10 Foreign Contingencies % 0

- 4. Financial Analysis 3- . Table-2 PROPSED FINANCIAL PLAN: (Rs. in ,000) Description Local Foreign Total Equity - Local Sponsors 7121 7121 - Foreign Sponsors 0 0 - Bridge Financing 0 0 Total Equity 7121 0 7121 Loans - Foreign Currency 0 0 - Suppliers Credit 0 0 - LMM 0 0 - Long Term Finance 0 0 - Custom Debenture 0 0 Total Debts 0 0 0 Total Investment 7121 0 7121 Debt % 0 0 Equity % 100 7121

- 5. Financial Analysis 3- . Table-3 Working Capital Requirement Description Period(Days) Amount Rs. (000) Raw material imported 0 0 Raw material Local 0 0 Work in Process 0 Packing Material 0 0 Salaries 30 0 Utilities 30 90 Overheads 30 1 Selling & Admin. Expenses 30 196 Finished Goods Inventory 0 0 Accounts Recievable 45 668 Advances & Deposits 500 Cash 1000 Sub Total 2455 Accounts Payable 0 0 Short Term Borrowing @ % of stocks 0 0 Sub Total 0 Net Initial Working Capital 2455

- 6. Financial Analysis 3- . Appendix-2 BUILDING & CIVIL WORKS Description Dimension Area Rate Total Ft. x Ft. Sq. Ft Rs. /Sq.Ft. Rs. (000) Buildings 0 0 0 0 0 Raw Material Store 0 0 0 0 0 Stores & Spares 0 0 0 0 0 Finished Goods Store 0 0 0 0 0 Workshop 0 0 0 0 0 Display shop 0 0 0 0 0 Labratory 0 0 0 0 0 Canteen 0 0 0 0 0 Dispensary 0 0 0 0 0 Admin Block 0 0 0 0 0 Time Office 0 0 0 0 0 Staff Colony-A 0 0 0 0 Staff Colony-B 0 0 0 0 Elecctric Sub-station 0 0 0 0 Toilets 0 15 0 150 0 Cooling Pond 0 0 0 0 Boudary Wall (running feet) 0 0 0 0 Drain (open Excludind Pumps) 1 0 0 0 0 Cooling Tower 1 0 0 0 0 Tubewell 0 Water Tanks(under ground) 0 0 Water Tanks(Over head) 0 0 Internal Roads 0 0 0 0 0 Others 0 0 0 0 0 Total 0 0 Appendix-4 MOTORS & VEHICLES Description NOs. Value Total Rs. (000) Rs. (000) Toyota SA Salon 1975cc 0 0 0 Honda VTI Auto 1590CC 0 0 0 Suzuki Baleno 1300cc JXR 0 0 0 Mercedez Bus 0 0 0 T-3500 Cargo Truck 0 0 0 Fork Lifters 0 0 Tractors (Dozer & Cultivator) 0 0 Total 0 0

- 7. Financial Analysis 3- . Appendix-5 FURNITURE & FIXTURE Description NOs. Value Total Rs. (000) Rs. (000) Computers 5 30 150 Printers (Dot Matrix) 2 6 12 Printer (Laser) 1 20 20 Fax Machine 1 10 10 Type Writer (manual) 0 0 0 Cabnets 6 15 90 Office Tables with Chairs 6 1.5 9 Chairs 12 1 12 Executive Chairs & Tables etc. 5 5 25 Telephones & Exchange 15 Conference Room 40 Air Conditoners 2 20 40 Others 50 Total 473 Appendix-6 PRELIMINARY EXPENSES Description Amount Period * Rate Charged (months) (%) Rs. (000) Project Examination Fee 0 0 0 Commitment Charges - FCY Loan 0 6 0 0 - LMM Loan 0 6 0 0 - LCY Loan 0 6 0 0 - Short Term Finance Certificate 0 6 0 0 Legal Documentation Fee 0 0 Project Supervision Fee 0 0 Company Incorporation 5 Electric Connection 10 Consultancy 0 Others 20 Total 35 * Based on one year construction period.

- 8. Financial Analysis 3- . Appendix-7 PRE-PRODUCTION EXPENSES Description Amount Period Rate * Charged (months) (%) Rs. (000) Salaries 2160 1 15 27 Utilities 191 1 1 0 Administrative Expense 0 1 1 0 Staff Training 0 Travelling/Entertainment etc. 0 Raw Material 0 0 Trial/Commisioning Others 50 Sales of Goods Total 77 * Calculated on the basis of first year expenses Appendix-8 INTEREST DURING CONSTRUCTION Description Amount Period * Rate Charged (months) (%) Rs. (000) FCY Loan 0 0 0 0 LMM Loan 0 0 0 0 LCY Loan 0 0 0 0 Others Total 0 Appendix-1 LAND & DEVELOPMENT Description Area Rate Total (kanals) Rs. (000) Rs. (000) Land 0 0 0 Legal Fee @ 10 % 0 Access Road/Right of Way @ 5 % 0 Developmenr Charges @ 2 % 0 Others Total 0

- 9. Financial Analysis 3- . Appendix-3 PLANT & MACHINERY Description Rate NOs. Rate Total %age Rs. (000) Rs. (000) Main Equipment: (A)- Imported FOB Value: - Rotary Belt Dryer 0 0 0 - Centrifuge 0 0 0 - Rotary Belt Vacuum Filter 0 0 0 - Plate Type Exchanger 0 0 0 - Shell & Tube Exchanger 0 0 0 - Evaporators 0 0 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - - Piping & Valves @ % of Eq. cost 0 0 Subtotal 0 Freight % of FOB 0 0 C&F Value 0 Insurance % of FOB 0 0 CIF Value 0 Duties % of CIF 0 0 Sales Tax % of (CIF + Duties) 0 0 Iqra Surcharge of CIF 0 0 Flood Relief % of CIF 0 0 Import Licence Fee % of C&F 0 0 Bank Charges % of C&F 0 0 Clearing Charges 0.5% of FOB 0 0 Inland Freight * 0 Inland Insurance % of CIF 0 0 Sundry Expenses** 0 Total 0 * Freight is charged Rs. 1000 per ton from Karachi to up country site. ** Sundry Expenses includes Port handling, Octroi etc. Continued....

- 10. Financial Analysis 3- . Description Rate NOs. Rate Total %age Rs. (000) Rs. (000) (B)- Local Equipment: - Juki 0 0 0 - Overloc Machine 0 0 0 #NAME? 0 0 0 - Flate Loc Machine 0 0 0 - Embroidary Machine (Singer) 0 0 0 - Vessels (5 m3) Special 0 0 0 - Pumps (1 hp) 0 0 0 - Pumps (0.5 hp) Special 0 0 0 - Motors (5 hp) 0 0 0 - Generator (5 hp) 0 0 0 - Air Compressor 0 0 0 - Conveyor Belts 0 0 0 - Filters 0 0 0 - 0 - 0 - Piping & Valves @ % of Eq. cost 0 0 Subtotal 0 Inland Freight * 25 Inland Insurance 10 Sundry Expenses** 30 Total (B) 65 Continued....

- 11. Financial Analysis 3- . Description Rate NOs. Rate Total %age Rs. (000) Rs. (000) (C)- Electrical & Instrumentation: Instrumentation including DCS 0 0 Motors/Switch gears/Elect. & Lighting 0 Trasformers 0 Uninterrupted Power Supply(UPS) 1 50 50 Motor Control Centers 0 Total (C) 50 (D)- Utilities Tube Well 0 Boiler ( 10 tons/hr) 0 Water Treatment (200 gpm) 0 Steam & Air lines with accessories % of Eq. 0 0 Insulation (pipes, reactors etc.) % of Eq. 0 0 Water lines 0 Instrument Air compressor 0 Laboratory 0 Cooling Tower 0 Air Conditioning unit 2 20 80 Duct lines 0 Workshop Equipment (lath, tools etc) 0 Photocopy machine 1 10 12 Overhead crane 0 Furnace Oil Tank 0 Paints 0 Generator Others Total (D) 92 Total (B)+(C)+(D) - local Equipment 207 Total (A)+(B)+(C)+(D) - All Equipment 207

- 12. Financial Analysis 3- .

- 13. Financial Analysis 3- .

- 14. Financial Analysis 3- . Table-4 PROJECTED INCOME STATEMENT Rs. (000) Year 1 2 3 4 5 6 7 8 9 10 Capacity Utilization in %age DESCRIPTION 70 80 90 100 100 100 100 100 100 100 Net Sales 4900 5600 6300 7000 7000 7000 7000 7000 7000 7000 COST OF GOODS MANF. - Raw Material 0 0 0 0 0 0 0 0 0 0 - Catalyst - Wages & Salaries 0 0 0 0 0 0 0 0 0 0 - Utilities 989 1110 1231 1352 1352 1352 1352 1352 1352 1352 - Furnace /Vehicle Oil 0 0 0 0 0 0 0 0 0 0 - Stores & Spares 0 0 0 0 0 0 0 0 0 0 - Repair & Maintinance 0 0 0 0 0 0 0 0 0 0 - Packing Material 0 0 0 0 0 0 0 0 0 0 - Depreciation 52 52 52 52 52 52 52 52 52 52 - Manufacturing Overhead % 1 10 12 13 14 14 14 14 14 14 14 C. O. G Manufactured 1051.07 1173.46 1295.84 1418.23 1418.23 1418.23 1418.23 1418.23 1418.23 1418.23 Add: Opening Inventory 0 0 0 0 0 0 0 0 0 0 Total C.O.G. Manufactured 1051.07 1173.46 1295.84 1418.23 1418.23 1418.23 1418.23 1418.23 1418.23 1418.23 Less: Closing Inventory 0 0 0 0 0 0 0 0 0 0 Total Cost of Goods Sold 1051.07 1173.46 1295.84 1418.23 1418.23 1418.23 1418.23 1418.23 1418.23 1418.23 Gross Profit 3848.93 4426.54 5004.16 5581.77 5581.77 5581.77 5581.77 5581.77 5581.77 5581.77 OPERATING EXPENSES - Admin Salaries 2160 2236 2314 2395 2479 2565 2655 2748 2844 2944 - General Expenses 109 124 140 155 155 155 155 155 155 155 - Selling, Marketing Expense 51 58 66 73 73 73 73 73 73 73 Total Operating Expenses 2319.67 2418 2519 2623 2707 2794 2883 2976 3072 3172 Operating Profit 1529.26 2008 2485 2959 2875 2788 2698 2606 2509 2410 NON OPERATING EXPENSES Interest On Loans: - FCY Loan 0 0 0 0 0 0 0 0 0 0 - LMM Loan 0 0 0 0 0 0 0 0 0 0 - LCY loan 0 0 0 0 0 0 0 0 0 0 - Short Term Loan @ % 18 0 0 0 0 0 0 0 0 0 0 - Bridge Financing @ % 18 0 0 0 0 0 0 0 0 0 0 - Debenture 0 0 0 0 0 0 0 0 0 0 Total Interest 0 0 0 0 0 0 0 0 0 0 Profit Before W.P.F & Tax 1529.26 2008 2485.02 2958.84 2875.02 2788.27 2698.48 2605.54 2509.36 2409.81 W.P. Fund % of profit 10 153 201 249 296 288 279 270 261 251 241 Profit before Tax 1376 1808 2237 2663 2588 2509 2429 2345 2258 2169 Tax Provision @ % rate 45 619 813 1006 1198 1164 1129 1093 1055 1016 976 Net Profit after Tax 757 994 1230 1465 1423 1380 1336 1290 1242 1193 R. O. E % 10.63 13.96 17.27 20.57 19.98 19.38 18.76 18.11 17.44 16.75 R. O. I % 10.63 13.96 17.27 20.57 19.98 19.38 18.76 18.11 17.44 16.75

- 15. Financial Analysis 3- . Table-5 PROJECTED CASH FLOW STATEMENT Rs. (000) Year 0 1 2 3 4 5 6 7 8 9 10 Capacity Utilization in %age DESCRIPTION 70 80 90 100 100 100 100 100 100 100 SOURCES OF FUNDS: - Operating Profit 1529 2008 2485 2959 2875 2788 2698 2606 2509 2410 - Depreciation 52 52 52 52 52 52 52 52 52 52 Total Operating Sources 0 1581 2060 2537 3011 2927 2840 2751 2658 2561 2462 - Equity/Stock 7121 0 - FCY Loan 0 - LMM Loan 0 - LCY Loan 0 - Bridge Financing 0 - Debenture 0 Decrease in C. Assets Increase in C. Liabilities 0 0 0 0 0 0 0 0 0 0 Other Incomes Total Sourses of Funds 7121 1581 2060 2537 3011 2927 2840 2751 2658 2561 2462 APPLICATION OF FUNDS Fixed Assets 4666 473 Debt Repayment - FCY 0 0 0 0 0 0 0 0 0 0 - LMM 0 0 0 0 0 0 0 0 0 0 - LCY 0 0 0 0 0 0 0 0 0 0 - Short Term Loan - Bridge Financing 0 - Debenture Interest Payments - FCY 0 0 0 0 0 0 0 0 0 0 - LMM 0 0 0 0 0 0 0 0 0 0 - LCY 0 0 0 0 0 0 0 0 0 0 - Short Term Loan 0 0 0 0 0 0 0 0 0 0 - Bridge Financing 0 0 0 0 0 0 0 0 0 0 - Debenture Tax 619 813 1006 1198 1164 1129 1093 1055 1016 976 W.P.F 153 201 249 296 288 279 270 261 251 241 Investments Increase in C. Assets 1090 -489 11 11 0 0 0 0 0 0 Decrease in C. Liabilities Others Total Appl. of funds 4666 1862 525 1266 1505 1452 1881 1363 1316 1267 1217 Cash Surplus/Defficit 2455 -281 1535 1271 1506 1475 959 1388 1342 1294 1245 Opening Cash 0 2455 2175 3710 4981 6486 7962 8921 10309 11650 12945 Closing Cash Balance 2455 2175 3710 4981 6486 7962 8921 10309 11650 12945 14189

- 16. Financial Analysis 3- . Table-6(a) PROJECTED BALANCE SHEET Year 0 1 2 3 4 5 6 7 8 9 10 Capacity Utilization in %age DESCRIPTION 70 80 90 100 100 100 100 100 100 100 ASSETS: Current Assets: Cash 2455 2175 3710 4981 6486 7962 8921 10309 11650 12945 14189 Account Recievable 0 0 0 0 0 0 0 0 0 0 Inventories - Raw Material 0 0 0 0 0 0 0 0 0 0 - Work in Process 0 0 0 0 0 0 0 0 0 0 - Finished Goods 0 0 0 0 0 0 0 0 0 0 - Packing Material 0 0 0 0 0 0 0 0 0 0 Other Current assets 1090 601 612 623 623 623 623 623 623 623 Total Current Assets 3264 4311 5593 7109 8585 9544 10932 12273 13567 14812 Investments Intangible Fixed assets at Cost 4666 4666 4666 4666 4666 5139 5139 5139 5139 5139 Accum. Depreciation 52 104 156 208 260 312 364 416 468 520 Total Fixed Assets 4614 4562 4510 4458 4406 4827 4775 4723 4671 4619 Total Assets 7878 8873 10103 11567 12990 14371 15706 16996 18238 19431

- 17. Financial Analysis 3- . Table-6(b) PROJECTED BALANCE SHEET Year 0 1 2 3 4 5 6 7 8 9 10 Capacity Utilization in %age DESCRIPTION 70 80 90 100 100 100 100 100 100 100 LIABILITIES & EQUITY: Current Liabilities Bank Borrowing 0 0 0 0 0 0 0 0 0 0 Account Payable 0 0 0 0 0 0 0 0 0 0 Dividend Payable W.P.F Payable Taxes Payable Others Total Current Liabilities 0 0 0 0 0 0 0 0 0 0 Deffereed Liabilities Long Term Debt - FCY 0 0 0 0 0 0 0 0 0 0 - LMM 0 0 0 0 0 0 0 0 0 0 - LCY 0 0 0 0 0 0 0 0 0 0 Total Long-term Liabilities 0 0 0 0 0 0 0 0 0 0 Total Liabilities 0 0 0 0 0 0 0 0 0 0 EQUITY: Capital 7121 7121 7121 7121 7121 7121 7121 7121 7121 7121 Bridge Finance 0 0 0 0 0 0 0 0 0 0 Retained Earning 757 1751 2981 4446 5869 7249 8585 9875 11117 12310 Total Equity 7878 8873 10103 11567 12990 14371 15706 16996 18238 19431 Total Captalization 7878 8873 10103 11567 12990 14371 15706 16996 18238 19431 Assets - Liabilities 0 0 0 0 0 0 0 0 0 0

- 18. Financial Analysis 3- . Appendix-15 DEPRECIATION SCHEDULE Rs. (000) Year % Cost Contin- Total 1 2 3 4 5 6 7 8 DESCRIPTION Rate gencies Cost - Civil Engineering 0 0 0 0 0 0 0 0 0 0 0 0 - Plant & Mach.(at site) 207 21 228 - Errection & Install. 21 2 23 Total Plant & Mach. 0 228 23 250 0 0 0 0 0 0 0 0 - Motors & Vehicles 0 0 0 0 0 0 0 0 0 0 0 0 - Furniture & Fixture 10 473 47 520 52 52 52 52 52 52 52 52 Amortized Expenses - Preliminary Expenses 0 3464 346 3810 0 0 0 0 0 0 0 0 - Pre Production Exp. 0 77 8 85 0 0 0 0 0 0 0 0 - Intrest D. Con. FCY 0 0 0 0 0 0 0 0 0 0 0 LMM 0 0 0 0 0 0 0 0 0 0 0 LCY 0 0 0 0 0 0 0 0 0 0 0 T.Int. during Construct. 0 0 0 0 0 0 0 0 0 0 0 Total Amortized 0 3541 354 3895 0 0 0 0 0 0 0 0 Total Depreciation 4242 424 4666 52 52 52 52 52 52 52 52

- 19. Financial Analysis 3- . Appendix-9 PROJECTED SALES Year Quantity 1 2 3 4 5 6 7 8 9 10 100% Capacity Utilization in %age DESCRIPTION % Rate 70 80 90 100 100 100 100 100 100 100 Export Sales - Product-1 Quantity 0 0 0 0 0 0 0 0 0 0 Value 0 0 0 0 0 0 0 0 0 0 Rebate/Duty Draw Back 0 0 0 0 0 0 0 0 0 0 0 - Product-2 Quantity 0 0 0 0 0 0 0 0 0 0 Value 0 0 0 0 0 0 0 0 0 0 Rebate/Duty Draw Back 0 0 0 0 0 0 0 0 0 0 0 - Product-3 Quantity 0 0 0 0 0 0 0 0 0 0 Value 0 0 0 0 0 0 0 0 0 0 Rebate/Duty Draw Back 0 0 0 0 0 0 0 0 0 0 0 - Product-4 Quantity 0 0 0 0 0 0 0 0 0 0 Value 0 0 0 0 0 0 0 0 0 0 Rebate/Duty Draw Back 0 0 0 0 0 0 0 0 0 0 0 Sub-total 0 0 0 0 0 0 0 0 0 0 Local Sales - Product-1 Quantity 20 14 16 18 20 20 20 20 20 20 20 Value 350 4900 5600 6300 7000 7000 7000 7000 7000 7000 7000 - Product-2 Quantity 0 0 0 0 0 0 0 0 0 0 Value 0 0 0 0 0 0 0 0 0 0 - Product-3 Quantity 0 0 0 0 0 0 0 0 0 0 Value 0 0 0 0 0 0 0 0 0 0 - Product-4 Quantity 0 0 0 0 0 0 0 0 0 0 Value 0 0 0 0 0 0 0 0 0 0 Sub-total 4900 5600 6300 7000 7000 7000 7000 7000 7000 7000 Total Sales 0 4900 5600 6300 7000 7000 7000 7000 7000 7000 7000 Opening Inventory(local) 0 0 0 0 0 0 0 0 0 0 Closing Inventory(local) 0 0 0 0 0 0 0 0 0 0 0 Net Sales 4900 5600 6300 7000 7000 7000 7000 7000 7000 7000 Note: 10 days inventory of local sale.

- 20. Financial Analysis 3- . Appendix-10 PROJECTED RAWMATERIAL REQUIREMENT Year Quantity 1 2 3 4 5 6 7 8 9 10 100% Capacity Utilization in %age DESCRIPTION Rate 70 80 90 100 100 100 100 100 100 100 Imported Rawmaterial - Material-1 Quantity Value Duty/Charges - Material-2 Quantity Value Duty/Charges - Material-3 Quantity Value Duty/Charges - Material-4 Quantity Value Duty/Charges Sub-total 0 0 0 0 0 0 0 0 0 0 Local Rawmaterial - Cotton Quantity 0 0 0 0 0 0 0 0 0 0 0 Value 0 0 0 0 0 0 0 0 0 0 0 - Sil Quantity 0 0 0 0 0 0 0 0 0 0 0 Value 0 0 0 0 0 0 0 0 0 0 0 -Stoon Wash Quantity 0 0 0 0 0 0 0 0 0 0 0 Value 0 0 0 0 0 0 0 0 0 0 0 -Jorjad Quantity 0 0 0 0 0 0 0 0 0 0 0 Value 0 0 0 0 0 0 0 0 0 0 0 - Lilion&ShafonQuantity 0 0 0 0 0 0 0 0 0 0 0 Value 0 0 0 0 0 0 0 0 0 0 0 @ 10 % of all above 0 0 0 0 0 0 0 0 0 0 Sub-total 0 0 0 0 0 0 0 0 0 0 Total Rawmaterial 0 0 0 0 0 0 0 0 0 0 Opening Inventory(lmport) 0 0 0 0 0 0 0 0 0 0 Closing Inventory(lmport) 0 0 0 0 0 0 0 0 0 0 Opening Inventory(local) 0 0 0 0 0 0 0 0 0 0 Closing Inventory(local) 0 0 0 0 0 0 0 0 0 0 Net Rawmaterial 0 0 0 0 0 0 0 0 0 0 Note: 10 days inventory of finished goods.

- 21. Financial Analysis 3- . Appendix-11 MANPOWER REQUIREMENT & COST THEREOFF Year Monthly 1 2 3 4 5 6 7 8 9 10 Salary Capacity Utilization in %age DESCRIPTION NOs. Rs. (000) 70 80 90 100 100 100 100 100 100 100 Factory: Plant Manager 0 0 0 0 0 0 0 0 0 0 0 0 Production Manager 0 0 0 0 0 0 0 0 0 0 0 0 Engineering Manager 0 0 0 0 0 0 0 0 0 0 0 0 Quality Control Mngr. 0 0 0 0 0 0 0 0 0 0 0 0 Assist. Managers 0 0 0 0 0 0 0 0 0 0 0 0 Machine operators 0 0 0 0 0 0 0 0 0 0 0 0 Sub-Engineer 0 0 0 0 0 0 0 0 0 0 0 0 Foremen 0 0 0 0 0 0 0 0 0 0 0 0 Operators/Drivers 0 0 0 0 0 0 0 0 0 0 0 0 Helpers 0 0 0 0 0 0 0 0 0 0 0 0 Peons 0 0 0 0 0 0 0 0 0 0 0 0 Seasonal Labour 0 0 0 0 0 0 0 0 0 0 0 0 Overheads % * 0 0 0 0 0 0 0 0 0 0 0 0 Sub Total 0 0 0 0 0 0 0 0 0 0 0 Admin./Sales: Chief Executive 0 0 0 0 0 0 0 0 0 0 0 0 General Manager 0 0 0 0 0 0 0 0 0 0 0 0 G.M. Marketing 0 0 0 0 0 0 0 0 0 0 0 0 Managers 2 20 480 497 514 532 551 570 590 611 632 654 Assist. Managers 2 12 288 298 309 319 330 342 354 366 379 393 Computor Operators 1 10 120 124 129 133 138 143 148 153 158 164 Clerks/Salesmen 2 8 192 199 206 213 220 228 236 244 253 262 Security Staff 0 0 0 0 0 0 0 0 0 0 0 0 Peons 0 0 0 0 0 0 0 0 0 0 0 0 Drivers 0 0 0 0 0 0 0 0 0 0 0 0 Sweepers 0 0 0 0 0 0 0 0 0 0 0 0 Seasonal Labour 0 0 0 0 0 0 0 0 0 0 0 Overheads * 8 4 1080 1118 1157 1197 1239 1283 1328 1374 1422 1472 Sub Total 7 2160 2236 2314 2395 2479 2565 2655 2748 2844 2944 Total Expenses 7 2160 2236 2314 2395 2479 2565 2655 2748 2844 2944 * Overheads 100 % are calculated on basic salary(Basic salary is 70 % of gross).

- 22. Financial Analysis 3- . Appendix-12 UTILITIES Power/Elecricity: Connected Laod (Kw) = 90 Anual Fixed Charges (Connected Load x 130 x 12) = 140.4 Rs. (000) Anual Variable Charges (Connected Load x 6 x 8 x 1 x 220 x 0.85) = 1212 Rs. (000) Year 0 1 2 3 4 5 6 7 8 9 10 * Capacity Utilization in %age DESCRIPTION 6 month 70 80 90 100 100 100 100 100 100 100 Fixed Charges 70.2 140.4 140.4 140.4 140.4 140.4 140.4 140.4 140.4 140.4 140.4 Variable Charges 121.18 848.23 969 1091 1212 1212 1212 1212 1212 1212 1212 Total 191 988.63 1110 1231 1352 1352 1352 1352 1352 1352 1352 * Fixed cost taken for 6 months during construction & variable cost at 10 % of 100 % Production Level. FUEL Year 0 1 2 3 4 5 6 7 8 9 10 Months Capacity Utilization in %age DESCRIPTION 6 70 80 90 100 100 100 100 100 100 100 Fuel for steam Generation Fuel for Power Generation Fuel for Vehicles * 0 0 0 0 0 0 0 0 0 0 0 Total 0 0 0 0 0 0 0 0 0 0 0 STORES & SPARES, REPAIR & MAINTINANCE Year 1 2 3 4 5 6 7 8 9 10 %age Capacity Utilization in %age DESCRIPTION 70 80 90 100 100 100 100 100 100 100 Stores & Repairs 0 0 0 0 0 0 0 0 0 0 0 Repair & Maitinance 0 0 0 0 0 0 0 0 0 0 0 Total 0 0 0 0 0 0 0 0 0 0 * Stores & Spares are calculated at %age of installed machine cost and with anual increase of 0 % ** Repair & Maintinance are calculated at installed cost of Machinery and Building with anual increase of 0 %

- 23. Financial Analysis 3- . Appendix-13 GENERAL & SELLING/MARKETING EXPENSES Year 1 2 3 4 5 6 7 8 9 10 Expenses Capacity Utilization in %age DESCRIPTION @ 100% 70 80 90 100 100 100 100 100 100 100 General Expenses - Telephone 5 4 4 5 5 5 5 5 5 5 5 - Fax 2 1 2 2 2 2 2 2 2 2 2 - Postage 1 1 1 1 1 1 1 1 1 1 1 - Stationary 10 7 8 9 10 10 10 10 10 10 10 - Travelling 8 6 6 7 8 8 8 8 8 8 8 - Legal Expenses 2 1 2 2 2 2 2 2 2 2 2 - Entertainment 15 11 12 14 15 15 15 15 15 15 15 - Rents 100 70 80 90 100 100 100 100 100 100 100 - Others 12 8 10 11 12 12 12 12 12 12 12 Sub total 109 124 140 155 155 155 155 155 155 155 Selling Expenses - Advertising % of sale 0.13 6 7 8 9 9 9 9 9 9 9 - Commision % 0.1 5 6 6 7 7 7 7 7 7 7 - Discounts % of sales 0.1 5 6 6 7 7 7 7 7 7 7 - Paking Material 0 0 0 0 0 0 0 0 0 0 0 - Others 50 35 40 45 50 50 50 50 50 50 50 Sub total 51 58 66 73 73 73 73 73 73 73 Total 160 182 205 228 228 228 228 228 228 228.1

- 24. Financial Analysis 3- . Appendix-14 Working Capital Requirement Year 1 2 3 4 5 6 7 8 9 10 Period Capacity Utilization in %age DESCRIPTION (Days) 70 80 90 100 100 100 100 100 100 100 CURRENT ASSETS: Raw material imported 0 0 0 0 0 0 0 0 0 0 0 Raw material Local 0 0 0 0 0 0 0 0 0 0 0 Work in Process 0 0 0 0 0 0 0 0 0 0 Packing Material 0 0 0 0 0 0 0 0 0 0 0 Labour 0 0 0 0 0 0 0 0 0 0 0 Utilities 30 90 101 112 123 123 123 123 123 123 123 Factory Overheads 0 0 0 0 0 0 0 0 0 0 0 Selling & Admin. Expenses 0 0 0 0 0 0 0 0 0 0 0 Finished Goods Inventory 0 0 0 0 0 0 0 0 0 0 0 Accounts Recievable 0 0 0 0 0 0 0 0 0 0 0 Advances & Deposits 500 0 0 0 0 0 0 0 0 0 Cash 500 500 500 500 500 500 500 500 500 500 Sub Total 1090 601 612 623 623 623 623 623 623 623 CURRENT LIABILITIES: Accounts Payable 30 0 0 0 0 0 0 0 0 0 0 Short Term Borrowing 60 0 0 0 0 0 0 0 0 0 0 @ % of stocks Sub Total 0 0 0 0 0 0 0 0 0 0 Net Initial Working Capital 1090 601 612 623 623 623 623 623 623 623

- 25. Financial Analysis 3- . Appendix-16 LOAN REPAYMENT SCHEDULE Loan Type : Foreign Currency Total Loan Amount: 0 0 e33 Rate of Interest : 18 % 18 Repayment Period: 3.5 Year A. F = 27.66 9 Grace Period : 0.5 Year 1 Per Year Installments : 12 (half yearly) 2 Total Installments : 36 Installment Amount : 0 (including intrest during construction for half year) Total Amount to be Paid 0 Total Mark-up Amount 0 Rs. (000) Due Date Principal Paid Instal. of Balance Mark-up Installment Yearly Int. D. Cons Interest 1 0 0 0 0 0 0 2 0 0 0 0 0 0 0 3 0 0 0 0 0 0 4 0 0 0 0 0 0 0 5 0 0 0 0 0 0 6 0 0 0 0 0 0 0 7 0 0 0 0 0 0 8 0 0 0 0 0 0 0 9 0 0 0 0 0 0 10 0 0 0 0 0 0 0 11 0 0 0 0 0 0 12 0 0 0 0 0 0 0 13 0 0 0 0 0 0 14 0 0 0 0 0 0 0 15 0 0 0 0 0 0 16 0 0 0 0 0 0 0 17 18 19 20

- 26. Financial Analysis 3- . Appendix-17 LOAN REPAYMENT SCHEDULE Loan Type : LMM Total Loan Amount: 0 Rate of Interest : 8% Repayment Period: 9 Year A. F = 11.65 Grace Period : 1 Year Per Year Installments : 2 (half yearly) Total Installments : 16 Installment Amount : 0 (including intrest during construction for half year) Total Amount to be Paid 0 Total Mark-up Amount 0 Rs. (000) Due Date Principal Paid Instal. of Balance Mark-up Installment Yearly Int. D. Cons Interest 1 0 0 0 0 0 0 2 0 0 0 0 0 0 0 3 0 0 0 0 0 0 4 0 0 0 0 0 0 0 5 0 0 0 0 0 0 6 0 0 0 0 0 0 0 7 0 0 0 0 0 0 8 0 0 0 0 0 0 0 9 0 0 0 0 0 0 10 0 0 0 0 0 0 0 11 0 0 0 0 0 0 12 0 0 0 0 0 0 0 13 0 0 0 0 0 0 14 0 0 0 0 0 0 0 15 0 0 0 0 0 0 16 0 0 0 0 0 0 0 17 18 19 20

- 27. Financial Analysis 3- . Appendix-18 LOAN REPAYMENT SCHEDULE Loan Type : LCY Loan Total Loan Amount: 0 Rate of Interest : 8% Repayment Period: 9 Year A. F = 11.65 Grace Period : 1 Year Per Year Installments : 2 (half yearly) Total Installments : 16 Installment Amount : 0 (including intrest during construction for half year) Total Amount to be Paid 0 Total Mark-up Amount 0 Rs. (000) Due Date Principal Paid Instal. of Balance Mark-up Installment Yearly Int. D. Cons Interest 1 0 0 0 0 0 0 2 0 0 0 0 0 0 0 3 0 0 0 0 0 0 4 0 0 0 0 0 0 0 5 0 0 0 0 0 0 6 0 0 0 0 0 0 0 7 0 0 0 0 0 0 8 0 0 0 0 0 0 0 9 0 0 0 0 0 0 10 0 0 0 0 0 0 0 11 0 0 0 0 0 0 12 0 0 0 0 0 0 0 13 0 0 0 0 0 0 14 0 0 0 0 0 0 0 15 0 0 0 0 0 0 16 0 0 0 0 0 0 0 17 18 19 20

- 28. Financial Analysis 3- . Appendix-19 LOAN REPAYMENT SCHEDULE Loan Type : Total Loan Amount: 0 Rate of Interest : 4% Repayment Period: 8 Year A. F = 0 Grace Period : 1 Year Per Year Installments : 2 (half yearly) Total Installments : 0 Installment Amount : 0 (including intrest during construction for half year) Total Amount to be Paid 0 Total Mark-up Amount 0 Rs. (000) Due Date Principal Paid Instal. of Balance Mark-up Installment Yearly Int. D. Cons Interest 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

- 29. Financial Analysis 3- . Table- 9 INTERNAL FINANCIAL RATE OF RETURN YEAR CAPITAL OPER. DEPREC- TAXES W.P.F NET CASH Discouted value OUTLAY PROFIT ATION FLOW @ % age 175 190 0 7121 -7121 -7121 -7121 1 1529 52 619 153 809 294 279 2 2008 52 813 201 1046 138 124 3 2485 52 1006 249 1282 62 53 4 2959 52 1198 296 1517 27 21 5 2875 52 1164 288 1475 9 7 6 2788 52 1129 279 1432 3 2 7 2698 52 1093 270 1388 1 1 8 2606 52 1055 261 1342 0 0 9 2509 52 1016 251 1294 0 0 10 2410 52 976 241 1245 0 0 S. Value 570 570 0 0 11 -6586.23 -6633.22 I.F.R.R = -1927.279 %

- 30. Financial Analysis 3- . Appendix-20 BENEFIT-COST RATIO * Discounted @ Opp. cost rate % 17 YEAR Project/Production Sales/ Net Discoun- Discoun- Discoun- Discounted value of Cost Benefits Cash ted Cost ted ted Net Discounted net cash flow Flow Benefits Cash Flow @ % age 20 21 0 7121 0 -7121 #N/A #N/A #N/A #N/A #N/A 1 3319 4900 1581 #N/A #N/A #N/A #N/A #N/A 2 3540 5600 2060 #N/A #N/A #N/A #N/A #N/A 3 3763 6300 2537 #N/A #N/A #N/A #N/A #N/A 4 3989 7000 3011 #N/A #N/A #N/A #N/A #N/A 5 4073 7000 2927 #N/A #N/A #N/A #N/A #N/A 6 4160 7000 2840 #N/A #N/A #N/A #N/A #N/A 7 4249 7000 2751 #N/A #N/A #N/A #N/A #N/A 8 4342 7000 2658 #N/A #N/A #N/A #N/A #N/A 9 4439 7000 2561 #N/A #N/A #N/A #N/A #N/A 10 4538 7000 2462 #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A BENEFIT COST RATIO = #N/A I.F.R.R. = #N/A %

- 31. Financial Analysis 3- . Table-8 PAYBACK PERIOD YEAR CAPITAL OPER. DEPREC- TAXES W.P.F NET CASH Payback Balance OUTLAY PROFIT ATION FLOW Years Net Cash Flow 0 7121 -7121 1 1529 52 619 153 809 1.000 -6312 2 2008 52 813 201 1046 1.000 -5266 3 2485 52 1006 249 1282 1.000 -3984 4 2959 52 1198 296 1517 1.000 -2467 5 2875 52 1164 288 1475 1.000 -992 6 2788 52 1129 279 1432 0.693 0 7 2698 52 1093 270 1388 0.000 0 8 2606 52 1055 261 1342 0.000 0 9 2509 52 1016 251 1294 0.000 0 10 2410 52 976 241 1245 0.000 0 S. Value 570 570 Payback Period = 5.693 Years >10

- 32. Financial Analysis 3- . Appendix-21 BENEFIT-COST RATIO * Discounted @ Inflation rate % 10 YEAR Project/Production Sales/ Net Discoun- Discoun- Discoun- Discounted value of Cost Benefits Cash ted Cost ted ted Net Discounted net cash flow Flow Benefits Cash Flow @ % age 20 21 0 7121 0 -7121 #N/A #N/A #N/A #N/A #N/A 1 3319 4900 1581 #N/A #N/A #N/A #N/A #N/A 2 3540 5600 2060 #N/A #N/A #N/A #N/A #N/A 3 3763 6300 2537 #N/A #N/A #N/A #N/A #N/A 4 3989 7000 3011 #N/A #N/A #N/A #N/A #N/A 5 4073 7000 2927 #N/A #N/A #N/A #N/A #N/A 6 4160 7000 2840 #N/A #N/A #N/A #N/A #N/A 7 4249 7000 2751 #N/A #N/A #N/A #N/A #N/A 8 4342 7000 2658 #N/A #N/A #N/A #N/A #N/A 9 4439 7000 2561 #N/A #N/A #N/A #N/A #N/A 10 4538 7000 2462 #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A BENEFIT COST RATIO = #N/A I.F.R.R. = #N/A %

- 33. Financial Analysis 3- . Table-7 BREAKE-EVEN ANALYSIS @ 100 % Production Capacity Fixed Variable Total DESCRIPTION Cost Cost Cost - Raw Material 0 0 - Catalyst 0 0 - Wages & Salaries 0 0 - Utilities 140.4 1212 1352 - Furnace /Vehicle Oil 0 0 - Stores & Spares 0 0 0 - Repair & Maintinance 0 0 0 - Packing Material 0 0 - Depreciation 52 52 - Manufacturing Overhead 10 4 14 - Admin Salaries 2479 2479 - General Expenses 62 93 155 - Selling, Marketing Expense 4 69 73 Interest On Loans: - FCY Loan 0 0 - LMM Loan 0 0 - LCY loan 0 0 - Short Term Loan 0 0 - Bridge Financing 0 0 - Debenture 0 0 W.P. Fund 288 288 Tax Provision 1164 1164 Total 4198 1378 5577 Sales = 7000 Variable Cost = 1378 Contrib. Margin = 5622 Breake-even Point (% age of Capacity Utilization) = 74.7 %

- 34. Financial Analysis 3- .

- 35. Financial Analysis 3- .