OGJ Oman Oct 2014

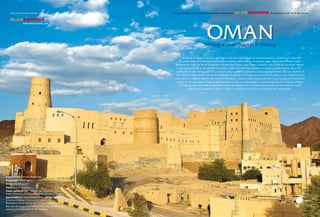

- 1. This special advertisement supplement has been produced by for distribution with Oil & Gas Journal OMAN Writing a new chapter in history All along its rugged coastline, and high in the mountain ranges of its desert quarters, historic port cities and forts bear witness to Oman’s rich heritage of trading and seafaring. In ancient times, dhows from Oman traded frankincense with the far-off kingdoms of Rome and China. Later, Oman would become home to a maritime empire that reached as far as Zanzibar in East Africa. Today, the thriving Sultanate of Oman is reasserting its role at the crossroads of Asia, Europe and Africa and steering a course to a dynamic and prosperous future. The Government of His Majesty Sultan Qaboos bin Said Al Said and its partners in the private sector are investing in new infrastructure and industries, adding value to the country’s oil and gas resources and creating jobs for Oman’s young and resourceful people. At the same time, Oman is applying state-of-the-art technologies to sustain its production of hydrocarbons, developing know-how that is exportable across the Middle East. As traders and travellers from across the world rediscover its legendary charms, Oman is embarking on a new era of growth and opportunity. COVER All production was done by www.elitesections.com Project Director: Nathalie Martin-Bea Photographer: Oscar Segura Writing: Mark Beresford Layout: Antonio Caparros Photos courtesy of: PDO, SOHAR, Oxy, GlassPoint, OOCEP, Daleel Petroleum, Port of Duqm, Oman Ministry of Tourism Special thanks to: Oman Ministry of Oil and Gas, Transport & Communications, Commerce & Industry, the Ministry of Manpower & Oman Society for Petroleum Services. Also special thanks to the team of Oil & Gas Journal for their support and collaboration for this endeavor.

- 2. Energy sector provides the platform for new chapter in history Oman is increasing its output of oil and gas, fueling diversification, and positioning the Sultanate as a major economic and diplomatic player in the region The strategic focus on adding value in the downstream means that increasing its LNG export capacity is not a priority use for Oman’s surging gas output, Al Aufi adds. “We are prioritizing for gas those sectors which create opportunities for employment, knowledge transfer and in-country value,” he says. “Last year was our largest ever in terms of investments,” says Mulham Al Jarf, the Deputy Chief Executive Officer of the government-owned Oman Oil Company (OOC), which is leading the Sultanate’s investment drive in the energy sector. “We are looking at how we can add value to Oman’s resources and take maximum advantage of Oman’s location, which is within a six hours’ flight of two billion people, with three trillion dollars of trade passing through our waters every year.” Increasing investments and production in the upstream are securing new sources of supply to support Oman’s ambitions in petrochemicals, power, metals and other downstream sectors. Oil output has increased by around a third since hitting a low in 2007, led by national oil company Petroleum Development Oman (PDO), which is the largest producer in the country and which has become a global leader in Enhanced Oil Recovery. Meanwhile, the country’s gas production has more than doubled over the course of the last decade. From 2018, the BP-operated Khazzan field, the region’s largest unconventional gas project, will produce over 1 billion cubic feet of gas per day for Oman’s power-hungry industries. The strategic development of Oman’s energy sector is cementing its increasingly important role in diplomacy in the region. Earlier this year, Oman reached a landmark agreement with Iran, under which it will construct a $1 billion pipeline. From as early as 2017, this pipeline will supply the Sultanate with a new source of gas to support its industrial growth, deepening Oman’s economic ties to Iran and helping to normalize international relations in the Middle East. At the same time, as the largest producer of oil and gas in the region that is not a member of OPEC, the Sultanate is a long-standing ally of the US, and it has played a key part in the ongoing rapprochement between Iran and the US. In the event of any further deterioration in the geopolitical situation in the Middle East, Oman is also well positioned to capitalize on its strategic location outside the Strait of Hormuz, and is investing heavily in new shipping, refining and storage infrastructure all along its coast. An oasis of political and economic stability in the Middle East, in recent years the Sultanate of Oman has been focused on using its hydrocarbon resources and strategic location to drive industrial development, create jobs for Omanis and generate value across a wide range of sectors. Oman is actively courting foreign investment to support its growth ambitions, in both the upstream and the downstream. In the upstream, contract terms for international oil companies have become more favorable. Salim Al Aufi, Undersecretary at the Ministry of Oil and Gas, says that the country is in particular interested in attracting investment from small, low-cost operators into mature fields, where they can maximize production and help develop local know-how. To increase foreign investment in other sectors, last year the Sultanate organized a high-level H.E. SALIM BIN NASSER BIN SAID AL AUFI, Ministry of Oil and Gas Undersecretary investment and trade mission that visited three cities in the US, with whom Oman has had a Free Trade Agreement since 2009. “There are a lot of investment opportunities in the downstream that will generate wealth and diversify the economy,” Al Aufi says. “We are very open to discussing these opportunities with potential investors.” PDO sets course for higher production and greater – In Country Value – Oman’s national oil company is applying the latest Enhanced Oil Recovery technologies to sustain long-term production, while developing local suppliers to meet its requirements D O Y with four projects under full-scale implementation. The techniques used cover the full spectrum of thermal, miscible gas injection, and chemical technologies. In the coming years, the deployment of this know-how is set to transform the company’s production profile. “Today’s production and contribution from EOR represents around 11% of our total output,”Restucci says. “By 2023, we estimate it will reach a third of our total production. That significant level of contribution is just around the corner. It is very exciting but equally daunting, so there is a lot of emphasis on making sure that systems are in place, from facilities management to more efficient use of energy and associated technologies.” PDO’s expertise in enhancing recovery and in managing mature fields is partly a reflection of the complexity of the geology of Oman, whose oil and gas reservoirs are generally smaller, deeper and faster maturing than in other areas of the Middle East. By rising to the challenges posed by this geology, PDO has become a world leader in applying technologies to extend field life and performance. “We have made a virtue of necessity,” Restucci says. O U K N O W W H A T I S I N Y O U R D N A ? W E DO After setting an all-time production record in 2013 and adding new oil reserves to its books, Petroleum Development Oman (PDO) is now preparing to raise its long-term production targets. “Since 2005, we have targeted a plateau of 550,000 barrels of oil per day, and we have maintained or exceeded that in the last six years,” says Raoul Restucci, Managing Director. “Our very successful reserves replacement and our EOR program are now enabling us to start thinking about a higher production plateau. We are working on growth projections for review by the Board in the coming year.” PDO currently accounts for around 70% of Oman’s production of crude oil and nearly all of its natural gas. The company is 60% owned by the Government of Oman, with Royal Dutch Shell owning a 34% stake and Total and Partex holding the remaining shares. EOR has been at the heart of PDO’s success in maintaining and increasing its production levels. The company currently has twenty-two EOR projects under review, design, construction, or piloting, RAOUL M. RESTUCCI Petroleum Development Oman Managing Director Photo courtesy of Sohar Port

- 3. priorities. After creating over 10,000 jobs in the last two and a half years, PDO is already meeting its target of adding 4,000 jobs per year outside the company. One of the company’s main strategies for creating employment is to help establish Super Local Community Contractors, which are entirely owned by local shareholders and which hire employees from the community. PDO seconds technical experts to join the companies to ensure they meet all the necessary standards and specifications, provides them with financial consultants and even buys equipment for them. In addition, the company has established vocational training programs for Omanis in activities such as welding, scaffolding and electrical maintenance. All of these programs are certified to the highest international standards. PDO expects Oman’s oil and gas sector to spend $64 billion domestically by 2020; its initiatives to develop the local supplier base will enable thousands of Omanis to access the job opportunities generated by this spending. PDO itself awarded contracts worth more than $3.1 billion to local firms in 2013, and increased its number of Omani employees by 10%, to a new record of 5,762. “In PDO, beyond the delivery of oil and gas, our focus is to make sure the communities in which we operate succeed,” Restucci says. “Job creation and employment are critical to that.” A record year for CSR At the same time as leading Oman’s drive to create greater In Country Value, PDO is also intensifying its activities in the area of Corporate Social Responsibility. In April 2014, the company unveiled its largest ever one-off spending package with a commitment to invest more than $14 million on 13 separate projects. The projects in which PDO will be investing include Muscat’s first drug rehabilitation centre and a new intensive care unit (ICU) at Khoula Hospital in the city. The company will also invest in four new public parks and a multi-purpose hall for social activities and meetings. As part of the package, PDO will provide further support for the disabled and job training for women. In addition, it is giving its backing to an environmental conservation and research project with the Oman Earthwatch Programme. “We are embarking on a step change in our social investment programme and this shows how serious we are about supporting communities both in our concession area and beyond,” Restucci said at the signing ceremony for the agreements. “The funding will provide important amenities, facilities and support and is further evidence of the company’s close collaboration with the Government and NGOs to benefit those in need.” The company has also confirmed that it will soon announce plans for a new Gift To The Nation to mark the 45th anniversary of the rule of His Majesty Sultan Qaboos bin Said in 2015. PDO has a long tradition of marking every five years of the reign with a Gift To The Nation, which have so far included the Oil and Gas Exhibition Centre (1995), Planetarium (2000) and the EcOman Centre (2010). successes, adding 317 million barrels of oil reserves last year alone. In 2013, PDO began first production from the Mabrouk gas discovery that it made the previous year and drilled 20 exploration wells, including 12 conventional oil wells, six conventional gas wells, and two deep unconventional oil wells. In coming years, the company will be focusing more on unconventional oil and on tight gas plays, especially in the deep accumulations around Khulud. “We need to address tight and unconventional opportunities, which tend to be deeper and more complex,” Restucci says. “We have been extremely encouraged by the results we have achieved so far. We believe that our tight gas accumulations will be economically viable. In terms of costs, they are certainly very competitive with alternatives such as imports. Tight gas can create considerable In Country Value for Oman.” Developing In Country Value (ICV), in particular by supporting local businesses, is one of PDO’s major strategic “We are continuously testing new boundaries, and currently have over 70 technology projects underway, many of which are world firsts.” The benefits of this focus on innovation can be seen at the Amal West field in southern Oman, where PDO is using solar energy to produce the steam it injects to enhance oil recovery. This solar steam technology is allowing the company to reduce the amount of gas it needs to create steam, taking full advantage of Oman’s solar resources while freeing up natural gas for other applications that create more value for the country, such as power generation and industrial development. At the same time as developing EOR technologies, PDO is investing in three multi-billion dollar ‘mega-projects’ at the Rabab- Harweel, Yibal Khuff and Badour fields. Restucci says that the Rabab-Harweel Integrated Project is amongst the most complex onshore developments currently underway anywhere in the global oil and gas industry. When fully on stream, sour gas will be produced from very high pressure reservoirs in the Rabab field and then injected into the Harweel oil field, boosting output by up to 250 million barrels of oil. PDO’s leadership in EOR and in managing mature oil fields has not only set the stage for an increase in production targets, but has also invoked global recognition. At the ADIPEC Excellence in Energy Awards, PDO won the ‘Best MENA Oilfield/Gas Field Management Strategy Award’ for Well and Reservoir Management. “The confidence we are gaining with EOR and our excellence in managing wells and reservoir facilities enable us to start building a 10 year plateau which is higher than 550,000 bpd,” Restucci says. The company is also continuing to record major exploratory Saih Rawl project The objective of PDO is to engage efficiently, responsibly and safely in the exploration, production, development, storage and transpor tation of hydrocarbons in the Sultanate of Oman. To achieve this, we aim to fulfill our vision at all times: to be renowned and respected for the excellence of our people and the value we create for Oman and all our stakeholders. www.pdo.co.om A N D w i t h t h i s D N A o u r g row t h i s u n s to p pa b l e

- 4. Independent operators bring new life to the upstream Occidental Oman is one of a new breed of independent operators who are helping Oman develop its technology and know-how Oxy, as the company is known, has been in Oman for over 30 years, operating in the Mukhaizna Field in south-central Oman, and Blocks 9, 27 and 62 in northern Oman. Over the last three de-cades, it has increased its gross annual output from less than 5,000 boepd to some 225,000 boepd, with 123,000 boepd gross daily production coming from Mukhaizna, which Occidental began op-erating in 2005. In addition, Oxy is also running a highly successful exploration program in its operations in northern Oman, with a discovery rate of more than 60%. Technology has been key to the company’s results, especially at the Mukhaizna field, where Oxy has implemented one of the world’s largest steam flood projects to increase oil recovery. To pro-duce feed water for the steam needed for the project, non-potable water from multiple sources, such as water separated from oil pro-duction, is conditioned using various technologies — including some of the largest mechanical vapor compressors ever built. Every day, the company injects more than 600,000 barrels of steam into the reservoir, helping to increase production from Mukhaizna to more than fifteen times its rate when Oxy assumed operations. As the largest independent oil producer in Oman, Occidental Oman is the leader of a growing pack of fast-moving, forward - looking operators who are bringing new thinking and new technologies to the challenges of increasing Omani oil production. “New competition is good for Oman,” says Isam Al Zadjali, Oman Oil Company CEO and former Oxy President. “So ENG. ISAM BIN SAUD AL ZADJALI, OOC CEO far, the country has produced and Former Oxy President only five billion barrels out of a potential 50 billion barrels in place. To find another five billion requires hard work and capital from new sources. It is good for Oman that the country is so attractive to foreign investors and that a lot of companies are now setting up shop here.” Investments in technology and people drive success “We have applied multiple technologies for water treatment,” Al Zadjali explains. “Right from the start, we chose not to rely on one particular technology but to use various water treatment processes, so that if something goes wrong all our eggs are not in one basket. That has been the key to the success of the project. If there is a problem in one of the water treatment processes at Mukhaizna, another technology can step in and make sure that the water is produced.” The second major ingredient to the success of Oxy and other independents in Oman has been the quality of the Sultanate’s human resources. The best technology in the world will be use-less if the right people are not available to implement it and re-spond to any problems, Al Zadjali says. “Mukhaizna is not only a success story for us in achieving our production targets, but it is also a great example of Omani talent in action. The majority of people who operate the field are Omanis whom we have put through a series of different training programs in the US, Europe and also in Oman.” Oxy’s commitment to training and development has trans-formed the shape of its workforce. In September 2005, when Oxy took over operations of Mukhaizna, the company employed less than 300 people. Today, the company has a workforce of more than 3,000 people, of whom over 80% are Omani. “Oman does not have a shortage of talent”, says Al Zadjali, who is the first Omani General Manager of Occidental Oman. “The more locals and nationals that an operator hires, the more it ensures that technology and knowledge remain in the country.” The commitment of independent operators to Omanization and to introducing new technologies bodes well for the future of the Sultanate’s upstream sector. Salim Al Aufi, Undersecretary at the Ministry of Oil and Gas, says that the experience of operating in Oman’s complex fields is also a major advantage for companies when they enter other regions. “A lot of the independent opera-tors are transferring knowledge they have gained by working in Oman to other countries,” he says. “Having Oman on their CV gives them added credibility, so I think we will continue to see independents coming here. We really welcome their technology, knowledge, know-how and their investment in talent.” www.oxy.com INVESTING IN GROWTH OXY OMAN is a dynamic and innovative Oman energy company. Currently at the Mukhaizna Field OXY has implemented an aggressive drilling and development program, including a major pattern VWHDPµRRGSURMHFWIRU(QKDQFHG2LO5HFRYHU(25

- 5. 7KLVSURJUDPSURGXFHVIHHGZDWHUIRUWKH VWHDPQHHGHGIRUWKHSURMHFWDQGDOVRQRQSRWDEOHZDWHUIURPPXOWLSOHVRXUFHVVXFKDVZDWHU VHSDUDWHGIURPRLOSURGXFWLRQ,WLVWKHQFRQGLWLRQHGXVLQJYDULRXVWHFKQRORJLHV¨LQFOXGLQJWKH ODUJHVWPHFKDQLFDOYDSRUFRPSUHVVRUVHYHUEXLOW Occidental Petroleum Corporation (Oxy) plant

- 6. At the cutting edge of EOR, industry trials new technologies Oman is one of the world’s leading test-beds for innovative EOR technologies that will increase oil production and save gas testing ground for enhancements to long-established EOR practices and for the introduction of new technologies. As a result, a new spe-cialist industry is emerging, diversifying the economy and creating high value jobs for Omanis. “We are specializing more and more in EOR for heavy oil,” An-thony Helou, Chief Executive Officer of Synergy Petroleum Inter-national says. Synergy participates in a joint venture that produces in Oman the vacuum insulated tubes used to inject steam down holes for EOR. “Oman has a very diverse and challenging geology for oil extraction, so we provide a unique technology that uses a special micro-porous material which is the best insulating material in the world.” Oman Oil Company Exploration Production (OOCEP) is also gaining experience in EOR at the Medco-operated Karim cluster, in order to increase production from these depleting small and marginal fields. “Oman has a very niche position in prototype and field testing. The Sultanate has been at the forefront of testing steam and polymers, and PDO has made a tremendous effort. We have seen a lot of com-mercialization of prototypes that started in Oman spreading across the region,” Chief Executive Officer Salim Al Sibani says. Across the upstream, from the largest majors and national oil companies to specialist independents, the energy sector is investing in sophisticated Enhanced Oil Recovery (EOR) techniques to maximize production from fast maturing oilfields. These investments have turned the Sultanate into the undisputed centre for EOR research and innovation in the Middle East. “There is a very significant opportunity to create exportable know-how in EOR,” Raul Restucci at PDO says. “EOR is a significant part of our business.” PDO currently has four major EOR field de-velopment projects on-going, at Marmul, Qarn Alam and Harweel, using polymers, steam and chemical injection respectively. “Because Oman has mature reservoirs, it is about 10 to 15 years ahead of the GCC countries,” says Hilal Al Busaidy, CEO and Co- Founder of oilfield services company Gulf Energy. “Oman began using steam flooding for EOR six or seven years ago, while coun-tries such as Kuwait are only now beginning to look at it for their heavy oil fields. Oman is really playing a leading role in exporting EOR technologies to the rest of the region.” The challenges of Oman’s geology, combined with the commit-ment of operators to maximizing recovery, have made the country a By applying 3D seismic technology and running an accelerated field development program in Blocks 3 and 4, CC Energy Development (CCED) has rapidly grown into the fourth largest producer in Oman. Previous operators did not produce meaningful volumes of oil from the area. However when SHAHROKH ETEBAR the privately owned Lebanese CC Energy Develop-ment CEO independent began exploring the region in 2008, it used 3D seismic and appraised and developed the wells in parallel to speed up production. By the beginning of this year, CCED was producing 24,000 bpd from the same blocks. “As soon we discovered oil we started running 3D seismic to better define the structures,” Chief Executive Officer Shahrokh Etebar says. “As we are a small company with a very professional team, we were then able to bring the exploration wells onstream almost immediately, in a safe and environmentally friendly manner. Our goal now is to be producing 50,000 bpd by 2017.” PDO uses solar technology to save gas and increase oil production Perhaps the most innovative and promising EOR trial currently underway in Oman is at Amal West, where PDO is deploying solar energy technology from GlassPoint to produce the steam it needs. A solar steam generation pilot started operating in February 2013, producing low cost steam for use in EOR to extract heavy oil from the reservoirs. In the first year of its operation, the 7MW pilot project produced over 13,000 tons of steam, saving almost one million m3 of gas and 1,800 tons of CO2. The results of the trial exceeded all expectations and performance targets, and PDO is now evaluating how to replicate its success on a larger scale. “Oman has an obvious advantage because of the quality and intensity of the sunlight it is endowed with,” Restucci says. “Our pilot plant, which is the largest in the world, is roughly the size of two football fields. Our next phase is likely going to be a 100 fold increase on that size. It is very exciting.” At Amal West, PDO is partnering with US-based GlassPoint Solar to meet the challenges of generating solar energy in the hot and dusty conditions of the desert. GlassPoint has designed a new system, which is based around the construction of a glasshouse that protects the solar panels from elements such as sand, dust and hu-midity and reduces costs. “It gives us two key advantages,” Rod MacGregor, Chief Executive Officer of GlassPoint explains. “The delicate mirrors, drive systems, and sensors are all indoors, so they do not get exposed to sand and dust. Secondly, the solar mirrors are protected from being blown away by the wind, so we use can about half as much steel and metals than if the mirrors were outside. This really reduces the cost.” “We clean the glasshouse with conventional, simple technology, but we can space these panels close together and do not have to use exotic materials,” Restucci adds. “The principle is very simple, but it has proven to be very reliable and low cost, with high efficiencies and up-times.” The automated system which washes the glasshouse at night also recaptures the water for reuse, which is an advantage in Oman’s dry desert environment. Overall, GlassPoint’s pilot project with PDO recorded 98.6% uptime and maintained regular operations even during severe dust and sand storms. GlassPoint says that by using its solar steam generators, operators can reduce EOR gas consumption by up to 80%. In Gulf Energy we combine the experience of personnel, !rst class equipment with cutting edge technology and a strong emphasis on innovation, reliability, quality, integrity and customer services. This orientation to customer needs and expectations is our mean to position Gulf Energy as one of the most dynamic and fastest growing innovative solution provider in the Energy industry in the Middle East and North Africa (MENA) region. INNOVATIVE INTEGRATED SOLUTIONS Telephone: +968.24390800 (Board) Fax: +968. 24390870 P.O. Box: 786, PC 116, MAF, Sultanate of Oman www.gulfenergy-int.com From its base in Muscat, Gulf Energy has established itself as one of the fastest growing oilfield services companies in the Middle East. Gulf Energy works with nearly all of the major operators in Oman, providing them with cutting edge services ranging from coiled tubing stimulation to enhanced oil recovery, HILAL AL BUSAIDY fracking and logging. The company Gulf Energy CEO now has nearly 800 employees across the region. “We have acquired a lot of know-how in Oman’s mature reservoirs that we can export to countries nearby,” says Hilal Al Busaidy, CEO and Co-Founder of Gulf Energy. More than 80% of Gulf Energy’s employees are Omani nationals. Al Busaidy says that by providing its employees with access to state-of-the-art technologies and with regular training, the company is successfully competing with large multinationals for local talent. As it readies its first public offering, these investments in people and in research and development are preparing Gulf Energy for a period of sustained international growth. Speed and seismic the key to CCED success International growth for Omani oilfield services PDO solar Enhanced Oil Recovery project in southern Oman

- 7. Photo courtesy of GlassPoint here and that will have a direct impact on jobs because we will hire people, as well as a positive indirect impact on the sector, as we will also buy posts from a steel factory in Oman.” GlassPoint has also opened an office in Kuwait and plans to es-tablish subsidiaries in other Gulf countries as it begins to explore opportunities in the region outside the Sultanate. “Oman is a great place to start as it is the industry leader in EOR,” MacGregor says. “Oman has been pushing the technology forward, and that makes it open to new ideas. Because it has taken the initial risk, other countries will be able to use the technology in the future. The market is large enough to be able to start here in Oman and then use it as a launch pad into the region.” “We have a golden opportunity with EOR to develop our talents in Oman and then export that capability outside,” Salim Al Aufi, Undersecretary at the Ministry of Oil and Gas says. “We can become an international exporter of knowledge and talent.” New technologies could create thousands of high-value jobs Oman’s investments in EOR also have potentially far-reaching economic consequences well beyond the upstream. Technologies such as solar energy, polymer and chemical injection can reduce the industry’s dependence on gas for EOR, and make gas available for power, for export as LNG and for downstream industries. PDO has reported what it calls ‘encouraging progress’ at a chemical injection trial at Habhab, and plans to extends its polymer injection schemes in the Marmul and Nimr areas as well as investing in solar. “Today, nearly a quarter of Oman’s gas is used for oil production, and that percentage continues to increase each year,” MacGregor says. “By adopting solar steam generation, oil companies can release these valuable natural gas supplies for use in power generation, desalination or industrial development, diversifying Oman’s growing economy.” Wide-scale deployment of EOR, and in particular of solar EOR, could create thousands of high value jobs in the Sultanate. A report published by consultancy Ernst Young in January 2014 forecast that by making gas savings and creating demand for jobs in the solar supply chain, solar EOR could generate up to 212,000 valuable positions. Following the success of the pilot, PDO’s Restucci says that the company is now analyzing how best to take the technology into the next stage. “We are discussing how we can establish a local supply chain for many of the components–mirrors, aluminum infrastructure, the service industry and the associated employment opportunities that can be created. We are now engaging with contractors, suppliers and Government entities to progress to the next stage. And we are also addressing local supply chain opportunities to secure maximum value beyond the direct impact to the oil and gas industry.” “The goal is to get 80% sourced in Oman and to establish a factory and a localized supply chain,” MacGregor says. “Most of what we need is available in Oman. We will establish manufacturing E F F I C I E N T EFFECTIVE EXCELLENT Abraj Energy Services strives to be a company of excellence providing regional and international Well Engineering Design Consultancy, Well Construction Well Services; devoting all efforts to ensure safe, incident-free operations and customer satisfaction, by utilizing talented and motivated staff, highly experienced manpower, !nest equipment and innovative technology. P.O. Box 1156, P.C. 130, Azaiba, Sultanate of Oman Tel: +968 2450 9999 Fax: +968 2450 9998 E-mail: bdm@abrajoman.com www.abrajoman.com Elite Special 1-3 page.indd 1 5/25/14 3:57 PM Taking the lead in drilling innovation One of the largest drilling contractors in Oman, Abraj Energy Services currently operates a fleet of 13 rigs across the Sultanate for operators including PDO, OOCEP, and Occidental Oman. That number will rise to at least 20 following a series of contract wins, including most recently from BP, crowning a period of rapid growth since Abraj first started activities in 2007. wwww.synergypetroleum.com The success of this young company in the Omani market has been based above all on investment in training and in state-of-the- art drilling technology. For Occidental, Abraj worked with NOV to design the region’s most efficient and sophisticated rigs, automated medium-depth rigs that are much safer and much faster to move than their predecessors. These technological advantages de-liver significant financial benefits for operators; PDO was able to pay for an upgrade to new Abraj rigs out of the savings they realized. “Abraj saved a substantial amount for PDO,” CEO Ramesh Narasimhan says. “The Abraj rig project was then one of two selected on a global basis by Shell. This level of international recognition is a result of the performance of our rigs. We now want to build up our skills and capabilities so that we are as good as anybody worldwide.” Empowered by Innovation Synergy Petroleum International is a world class developer and service provider in the oil gas, power, petro-chemical, and water industries. We strive to meet challenges and provide an effi cient environment for partners while adhering to quality standards. Since its establishment in 2006, Synergy Petroleum International (Synergy) has helped introduce a series of specialist technologies into the Sultanate of Oman’s oil and gas sector. According to Anthony Helou, Executive Director of Synergy, “Synergy likes to invest in cutting edge technology, bring it into Oman and then facilitate its manufacturing or installation”. Synergy is part of Al Taher Group, one of the largest civil contractors in the Omani oil and gas industry. Although Synergy also works as a contractor, the company’s major focus is on investing in the local production of proprietary technology for the Omani and regional markets. Majus Synergy Oman, a joint venture between Synergy and a UK based company, produces specialist vacuum insulated tubing used to enhance oil recovery, making it the sole manufacturer of this type in Oman. Helou says that Synergy is currently in talks with other specialist companies who are seeking to establish themselves in the region “Our aim is to partner with pioneering companies who have unique technologies and are looking to establish themselves in the Middle East.” He added, “We want to be known as the company that introduces innovative technologies that it then manufactures, implements and develops to Oman and the region.” Innovation for sustainable development ANTHONY HELOU Synergy Petroleum Int. Executive Director RAMESH NARASIMHAN Abraj Energy Services CEO

- 8. Dover has also selected Oman as a manufacturing hub for its specialty artificial products. Since 2011, the Dover Artificial Lift joint venture has been producing innovative coiled sucker rods at its plant in the Raysut Industrial Estate in Salalah. At Salalah, Dover benefits not only from proximity to Oman’s southern oil fields but also from world-class port facilities; the plant is the first of its kind in the region a supply chain in Oman for proppants, the material used to help with hydraulic fracturing and stimulation, “we want to find ways to work with companies here on how to manufacture proppant in Oman, rather than import it, creating value in Oman itself. The proppants could also be potentially used by other producers in the country.” Beyond the upstream, unconventional gas will support the development of a range of downstream industries. BP itself has signed a memorandum of understanding with Oman Oil Company (OOC) to develop an acetic acid manufacturing plant in Duqm. “There is potential for gas to provide feedstock for other industrial sectors, such as petrochemicals, which will help create and sustain employment in the country,” Campbell says. “The reliable supply of energy to Oman from the Khazzan project will help enable the country to continue its fantastic record for economic and social development.” To maximize the production flow from their reservoirs, operators in Oman are increasingly using artificial lift technologies such as sucker rods and downhole pumps. In 2010, Dover Middle East, a subsidiary of the Dover Corporation, began operating in the Sultanate to help producers such as PDO and Occidental increase output from their wells and reduce their capital and operating costs. Despite its huge scale, the Khazzan development, located in the southern part of Block 61, represents only a small part of the potential resources of BP’s concession, which is one of the largest unconventional tight gas accumulations in the Middle East. According to some estimates, there could be up to 100 tcf of gas in total in Block 61, distributed across several reservoirs. Campbell says that BP will begin to work on the appraisal of the northern area of Block 61 later this year. “We are all very excited by the potential of BP’s field development plan for the rest of the block,” Al Aufi says. The development of tight gas resources of this size could transform the Omani upstream sector, add value and create new job opportunities across the economy. To ensure that it has the technical and human resources it needs, BP has launched a development program for Omani nationals that will qualify up to 150 technicians, including giving them the chance to work at BP operating facilities elsewhere in the world. The company is also investing in training Omani graduates and mid-career staff; over 70% of BP’s staff in Oman are already Omani nationals. As well as creating high value jobs, investments in unconventional gas will have major knock-on effects on Oman’s energy supply chain. Campbell says that BP aims to help develop and exports much of its output. “Our installations in Oman and the region number in the hundreds of wells,” says Fouad Eid, Regional Vice President of Dover Middle East. “Today we export our Made in Oman coiled rod products mainly to the GCC and our immediate plan is to expand to North Africa. We also aim to invest in the assembly and manufacturing of other artificial lift products in Oman.” A new hub for artificial lift In Khazzan, BP leads the drive towards the last frontier After last year’s milestone agreement, BP is now preparing to unlock the massive unconventional gas reserves of the Khazzan field At the end of 2013, the Government of Oman gave the go-ahead to a project which will transform the Sultanate’s gas supply, position Oman as the regional leader in unconventional gas, and power a new stage of industrial development. The $16 billion development of the Khazzan tight gas field in Block 61, operated by BP, will involve a drilling program of around 300 wells over 15 years and deliver plateau production of one billion cubic feet of gas per day which is a significant contribution to ensuring continuing stable supplies from domestic sources. First gas from Khazzan is expected at the end of 2017, with plateau production set for 2018. In total, the project will produce around 7 trillion cubic feet (tcf) of gas over the next thirty years. BP has already begun drilling the first development wells in what is by far the largest and most technologically demanding project in the Omani upstream. “The reservoirs in Khazzan are located in deep, hard and tight rock, so there are challenges in applying our technology and expertise to unlock the resource,” Dave Campbell, BP’s General Manager in Oman, says. “However we have valuable experience in other parts of BP globally that we will utilise and we also have proven experience here in Oman.” BP has a 60% stake in Khazzan, with the remaining 40% held by the state-owned Oman Oil Company Exploration Production (OOCEP). The UK-based company is a world leader in the development of tight gas resources, deploying technologies such as horizontal drilling and hydraulic fracking to stimulate gas production and increase flows. Campbell says that Oman is set to become a testing ground for advanced technologies and capabilities, as BP looks to maximize the recovery of resources from Khazzan’s deep sandstone reservoirs. “This is a long-term development and we will continuously improve our knowledge and develop our capabilities over the years. As well as bringing in know-how from our other projects, we will also be able to export the knowledge we gain in Oman into other tight gas basins where we operate.” “We expect to see significant levels of technology transfer from BP,” Salim Al Aufi, Undersecretary at the Ministry of Oil and Gas says. “Khazzan will require a lot of new technology and technical know-how.” DAVE CAMPBELL BP Sultanate of Oman General Manager

- 9. OOCEP in the driving seat of unconventional gas development Oman Oil Company Exploration Production (OOCEP) is beginning tight gas production from Block 60, growing Oman’s gas supply and developing its specialist know-how In 2010, with the global economy mired in financial crisis, one of Oman’s newest energy companies made a bold decision. Although Oman Oil Company Exploration Production (OOCEP) had only been incorporated the previous year, OOCEP seized the chance that presented itself when BG pulled out of exploration in Block 60. “When OOCEP was established, we thought that we would be an operator within three years, but in fact we were operating in the very first year,” Chief Executive Officer Salim Al Sibani says. “Block 60 was the perfect opportunity for us, so we took the challenge of operating the asset and went from infancy to maturity almost overnight.” Four years of development later, OOCEP and the Omani economy are now poised to reap the benefits of that decision. After over $1 billion of investment, commercial production from the Abu Tubul tight gas field in Block 60 is due to come onstream in the third quarter of this year, exported to the grid from a gas processing plant via a dedicated 85 kilometre pipeline. “The development of an unconventional field is complex, involving a lot of specialized know-how and drilling services,” Al Sibani says. “Our work on Block 60 has now positioned us to partner with BP and deploy the same know-how on a much larger scale at the Khazzan-Makarem field in Block 61.” OOCEP is the upstream subsidiary of Oman Oil. The company participates in a range of non-operated assets in Oman, including Mukhaizna, Karim, Rima and Block 61, as well as in two assets in Kazakhstan. However, in its core operated assets, it is focused on unconventional hydrocarbon resources that are of strategic importance to Oman as the Sultanate aims to meet rising demand for energy and diversify its sources of production. “For OOCEP, operating Block 60 instead of just observing from a distance gives us invaluable experience,” Al Sibani says. “We want to continue to grow Oman’s gas supply so that we can fuel demand from industry and the rest of the economy.” As production from Block 60 gets underway, OOCEP is already implementing ambi-tious plans for further explo-ration and production. Later this year, the company will be drilling an exploratory well in the northern part of Block 60, where it believes the po-tential gas reserves may be even greater than in the area of its current operations. It will also be drilling in the vast and unexplored Block 42, an area of about 25,600 square kilometres, where OOCEP has acquired new seismic data as it bids to unlock more of Oman’s unconventional gas potential. As a result of these investments, the company’s output is forecast to rise from around 30,000 boepd currently to 100,000 boepd by 2022, driven mainly by its stakes in Block 60 and Block 61. “We are already identifying new leads within Oman, in OOCEP concessions or outside, that could increase our production beyond that timeframe,” Al Sibani says. “We are in particular looking at unconventional potential that was not on the radar until recently.” OOCEP’s investments will also help the Sultanate emerge as a world leader in the technologies needed for the success-ful commercial development of deep tight gas reserves. While much of the world’s current output of unconventional gas, mainly in the US, comes from shallow wells, in Oman tight gas is found much deeper, at nearly 5000 metres in Block 60 and Block 61. “The Sultanate is at the forefront of horizontal, multi-stage frack-ing for deep fields,” Al Sibani says. “Oman now has the potential to commercialize its know-how across the region.” Oman Oil Company Exploration Production LLC (OOCEP) is an upstream oil gas company based in the Sultanate of Oman. OOCEP is a subsidiary of Oman Oil Company with a primary focus on upstream investments as part of OOC’s strategy of pursuing local and international energy related investments. OOCEP’s activities combine the management of investments in non-operated upstream assets in Oman and internationally, as well as operatorship of upstream and service/midstream businesses in Oman. The aim of such investments is to draw upon Oman’s experience in the Oil Gas industry to achieve strong operational results and fi nancial returns, pursue oppor-tunities that will contribute to meeting the future energy needs of the Sultanate, and provide a platform for the professional development of the Omani workforce. Abu Tabul (ABB) and Musandam Gas Plant (MGP), Make the Non Conventional….Conventional Paving the Way for a Brighter Tomorrow... Musandam gas plant overview SALIM AL SIBANI Oman Oil Company Exploration Production CEO

- 10. Daleel Petroleum sets sights on EOR, deeper exploration and unconventional resources Daleel Petroleum is preparing for a new stage of development in its Block 5 concession, and is stepping up its spending on corporate social responsibility In the twelve years since Daleel Petroleum began operations in Oman, it has increased production almost tenfold by drilling more wells and deploying water-flooding techniques. The company is now preparing for a new phase of exploration and for the development of unconventional resources, as it embarks on the next chapter of its concession. “Our first objective is to increase exploration and the second is to acquire more data for deeper prospects,” says Gong Changli, CEO of Daleel Petroleum. “The easy oil will soon be coming to an end and we are now getting ready for EOR and unconventional.” Daleel Petroleum is a joint venture between Mazoon Petrogas SAOC, a subsidiary of Oman’s MB Holding Company, and China National Petroleum Corporation (CNPC). The company was established in 2002 to operate Block 5 in Oman, which Mazoon initially acquired from Japex Oman in 2001. When Daleel took over operation of Block 5, the daily rate of the production from the field was only about 4,500 bpd. Since then, mainly by using horizontal well water-flooding technology, it has increased production up to an average of 40,670 bpd in 2013. Changli says that the company is now beginning to implement its strategy for the remaining years of the concession, which lasts until 2028. Daleel plans to increase its drilling of exploration and development wells, and it is also acquiring new 3D seismic which will help it both with the development of current shallow areas and with the exploration of new prospects. “We hope to start deeper exploration from early 2016,” Changli says. “So far we have been targeting only shallow reservoirs, partly because our old seismic was designed to image only those shallow reservoirs. The new 3D seismic will cover areas up to around 6,000 metres deep.” Daleel Photo courtesy of Daleel Petroleum is also studying the application of various EOR technologies to increase recovery factors from its reservoirs. At the same time, the company is preparing to develop tight gas and unconventional oil reserves in its concession. “The potential sources within block 5 are the deeper prospects and Natih B,” Changli says. “For Natih B, we are currently embarking on laboratory tests and regional studies, building on industry results, to assess the potential for unconventional oil.” As its production rises, Daleel Petroleum is making an increasing contribution to Oman’s economic growth. The company has regularly upgraded its surface facilities to enable it to increase the country’s oil exports; Daleel is currently investing in almost doubling its oil export GONG CHANGLI Daleel Petroleum CEO capacity to 67,000 bpd from 35,500, in preparation for future production growth. The company is also assisting in the wider social development of the Sultanate. In terms of employment, it is committed to hiring increasing numbers of Omanis, especially in managerial positions. Daleel’s Omanization rate will be nearly 90% by the end of 2014, and all department managers are already Omanis; “they are the elite and the backbone of the company,” Changli says. As well as direct employment, Daleel is creating indirect employment opportunities in Oman by supporting the growth of local suppliers, especially small and medium enterprises. Daleel is making all its efforts to source most of its supplies from local businesses, and it has made In Country Value an important factor in its tender procedures. The company also offers trial opportunities to new suppliers and start-ups. Away from the world of business, Daleel is committed to having a favourable impact on Omani society in general. The company invests in community and sustainable development in the areas of health, environment and special community needs, and in particular in education. In collaboration with the Ministry of Higher Education, it sponsors the education of twenty students from underprivileged families, and every summer welcomes a number of undergraduate students onto summer training programs. “This year we have allocated more funds for sustainability projects,” Changli says. “We want to contribute even more to the prosperity of Oman.”

- 11. Aluminium company ramps up production, prepares to take on the world The Oman Aluminium Rolling Company is providing the Sultanate with a new source of export earnings and jobs as a potential world leader in rolled aluminium production. “There are only a handful of companies in the US that can produce what we produce, and they are all older companies who are owned by private equity funds that will not want to invest millions in upgrading their mills to the quality standards that we have,” Marchbanks says. “The US market is wide open for us.” The success of OARC in global aluminium markets will have a very real impact on local employment. When running at full capacity, the rolling mill will directly employ around 250 staff, and all plant operators will be Omani nationals. “One of our key objectives is to create jobs,” Marchbanks says. “It is very rewarding to see how eager the Omanis are to learn, and the pride they take in what they do. The first aluminum coil ever produced in this country was produced here by 100% Omani operators.” Following the start-up of operations at its plant in Sohar in August last year, the Oman Aluminium Rolling Company is now on-course to complete construction works and begin the process of ramping up to an annual production capacity of 140,000 tons of multi-purpose rolled aluminium sheets. Ron Marchbanks, Chief Executive Officer of OARC, says that the company’s rolling mill will be operating at its full capacity in 2016. OARC has already applied for an additional allocation of the natural gas it will need to power all its furnaces around the clock. At the same time as finishing construction of its $385 million plant, OARC has also been producing and shipping test products to potential customers, and is already accepting orders from clients in India, Turkey, the UAE and the US. OARC’s investment in state-of-the-art casting technology and automation has positioned it Commitment, Technology, Innovation and Eco-friendliness All Rolled Into One Committed to protect the environment, through innovative clean technology and an eco-friendly work culture. With an annual capacity of 140,000 tons of multi-purpose aluminium coils, backed by state-of-the- art technology, OARC constantly strives to add value to your lives. We process aluminium, the most recyclable metal in the world. www.oman-arc.com OMAN ALUMINIUM ROLLING COMPANY Al Fardan Building, Meydan Al Azaiba, Muscat - Sultanate of Oman P.O. Box 1865, PC 133 Tel:+968 24621900 sales@oman-arc.com Downstream investment boom diversifies economy and creates regional powerhouse The Sultanate is witnessing an investment surge in downstream industries Located at the crossroads of Asia, the Middle East and Africa, Oman is positioned to become a major center for the downstream industries that depend on secure supplies of energy and raw materials and on easy access to global markets. “We are going to see a lot more investment in downstream,” Dr. Ali Masoud Ali Al Sunaidy, the Sultanate’s Minister for Commerce and Industry, says. “In particular, we expect major investment projects in sectors such as plastics and steel.” Alongside spending from state institutions, foreign investors are also pouring into Oman from all quarters. In April this year, the Omani unit of the giant Indian steel company Jindal Steel Power, Jindal Shadeed, commissioned its Integrated Steel Plant in Sohar, with a capacity to produce two million tons per annum (MTPA) of steel. The plant is Oman’s first and largest steel melting shop, and the third largest steel plant in the Middle East and Gulf region. Jindal Shadeed invested over $800 million in the facility, which began operating just 23 months from the date of commencement of the work site. Earlier, Jindal Shadeed had set up a 1.8 MTPA Direct Reduced Iron plant at the site, which has been operating to its full capacity for the last two years. Speaking at the commissioning, Naveen Jindal, Chairman of Jindal Steel Power said “the commissioning of Jindal Shadeed’s steel melting shop represents one more step in our commitment to build a comprehensive steel manufacturing facility in the Sultanate of Oman. The plant will not only meet the growing steel demand of Oman but will also cater to the needs of entire Gulf region and Middle East.” Jindal originally acquired Shadeed Iron and Steel’s 1.5 MTPA gas-based HBI (hot briquetted iron) plant at Sohar in 2010, for $500 million. Jindal is using the site as a platform to meet strong demand for steel in Middle East and North African countries, where it estimates there is a shortfall of more than 12 million tons. The new plant will also send much of its production to the local market, reducing the need for Oman to import the steel it needs for its current infrastructure investment drive. In recent years, Sohar has emerged as the leading center of downstream activity in Oman, adding value to the Sultanate’s natural resources, especially in the metals and petrochemicals sectors. “Steel and minerals are an important sector for us,” Jamal T. Aziz, Chief Executive Officer of the Sohar Freezone says. “Ferrochrome industries are clustering in the Freezone, using chrome from Oman and adding value to this raw product. The excellent infrastructure available at Sohar can support these industries which are very energy intensive. Also, we expect to have a significant metals cluster expand here as well.” In addition to Jindal, other Indian metals companies to establish themselves in Sohar include Indsil, Dunes, Cabrol and Metkore, joined by Inco of Turkey, Vale of Brazil, and Sohar Aluminium, a major joint venture between Oman Oil, TAQA from Abu Dhabi and global metals giant Rio Tinto. Sohar Aluminium has committed 60% of hot metal output from its smelter to local downstream industries, for the manufacture of aluminium-based products. Also in the metals sector, in June the Sohar Freezone signed a lease agreement to host the biggest metal producer of its kind outside of China, creating 125 local jobs. UK-based Tri-Star Resources, the Oman Investment Fund, and Castell Investments Ltd, will develop a facility capable of producing 20,000 tons of refined metal ingots. One of the materials that the venture will produce is antimony trioxide, and the partners also have the option to develop a gold sulphide treatment plant. “Having a major antimony manufacturing facility at Sohar is significant for global, regional, and local economies. It is also good news for our business operations, and will put Sohar on the map when it comes to metal processing as it adds further value to our ever-growing metals cluster,” Aziz says. Jindal Shadeed Iron and Steel plant in Sohar H.E. DR. ALI MASOUD ALI AL SUNAIDY Minister of Commerce and Industry RON MARCHBANKS Oman Aluminium Rolling Company CEO

- 12. Also in Sohar, Orpic is developing the $3.6 billion Liwa Plastics Project (LPP). This will involve the construction of a steam cracker which will process lighter feedstocks such as ethane from Orpic’s refinery and aromatics plant, and Natural Gas Liquids (NGLs) extracted from natural gas supplies, into a new range of plastics for the local and international marketplaces. The plant will be established in Sohar Industrial Port Area, adjacent to the refinery, and is on schedule for completion during 2018. The massive project will enable the Sultanate of Oman to produce, for the first time, polyethylene, the world’s most popular plastic. The complex will include a 900 thousand ton per year ethylene cracking plant, a High Density Polyethylene (HDPE) unit, a Linear Low Density Polyethylene (LLDPE) unit and a new polypropylene unit that will add to the capacity of the existing polypropylene plant in Sohar. Orpic received approval for LPP’s natural gas allocation from the Ministry of Oil and Gas in 2013. Upon completion of the project, Orpic will have a total annual production capacity of 1.4 million tons of polyethylene and polypropylene, increasing exports and helping to develop downstream industries within Oman. “The project is moving rapidly forward and we are determined to deliver on LPP’s promise for Orpic and for Oman. It will transform our company and deliver a ripple of economic value to the nation,” Musab Al Mahruqi, Chief Executive Officer of Orpic said in March this year. Orpic says that the plastics project will double its profitability, by enabling it to extract significantly more value from every barrel of Omani crude and molecule of gas. Once the project has been completed, Orpic estimates that 350 people will be required to manage the facilities, as well as 150 technicians. The project is also expected to create more than 1,200 indirect jobs in the Sohar area. It is no accident that Sohar is leading the way in the development of Oman downstream industries, from plastics to metals. “We are creating a circle of integration here, processing raw products to create semi-finished products, creating consumer products out of those, and then recycling what remains to complete the circle,” Jamal T. Aziz says. “This is sustainable development in action.” “At Sohar we are benefitting from the politically stable environment in Oman and from our access to raw materials,” he concludes. “Because of our location on the map, we can also be an exporting hub for the region, including the huge markets of India and China.” “Sohar will continue to grow in downstream,” Minister Al Sunaidi forecasts. “We want to use the products of the primary factories in Sohar to create clusters of downstream industries, diversifying the economy and adding exports and new jobs for Omanis. We are already seeing Omani companies buying materials from the primary industries such as steel, aluminium and plastics to convert into new products. We expect a new wave of downstream businesses to come and produce in our industrial estates and free zones.” Orpic produces paraxylene, one of the major raw materials in the production of PTA, which in turn is used to make the widely used plastic PET. “The aromatics plant is going to provide feedstock for a PTA and PET project, producing material which can be used for various applications such as plastic bottles and films,” Jamal T. Aziz says. “As well as PTA and PET, we are also looking at developing the downstream of other petrochemicals and plastics businesses in Sohar, such as polypropylene or polyethylene.” Earlier this year, Orpic signed a $2.8 billion loan agreement which provides it with the finance for a major upgrade of its refinery in Sohar. This will enable it to increase its production of petrochemical feedstocks such as propylene, used to make polypropylene, and to manufacture new products including bitumen, a raw material for the production of asphalt. Orpic says the Sohar Refinery Improvement Project (SRIP) will help maximize the value of Omani crude and support industrial development in the Sultanate. “SRIP is a major project that will expand the capabilities of the refinery and of the petrochemical business in Sohar,” Minister Al Sunaidi says. Petrochemical downstream projects maximize the value of Omani hydrocarbons Output from large metals companies such as Jindal, Vale and Sohar Aluminium is stimulating industrial investment and creating jobs further along the value chain, such as the cables produced by Oman Aluminium Processing Industries (OAPIL). OAPIL, a $40 million joint venture between Oman Cables Industry and Takamul Investments Company of Singapore, uses liquid aluminium from Sohar Aluminium Company to produce around 50,000 metric tons a year of aluminium rods. “There are going to be other new downstream facilities built to use our products,” says Ron Marchbanks, Chief Executive Officer of the Oman Aluminium Rolling Company, which itself transforms metal from Sohar Aluminium into sheets. “I would not be surprised to see other companies considering investing in household foil plants using our products, as well as in other downstream value added opportunities in Oman.” A similar trend is emerging in Oman’s petrochemical sector, where giant production facilities for plastics and the basic building blocks of chemicals are sending their output to local companies in Oman, for transformation into high value products further downstream. In Sohar, the aromatics and polypropylene production plants operated by Oman Oil Refineries and Petroleum Industries Company, or Orpic, provide fuels, chemicals and feedstock to Oman and to the world. Orpic is owned by the Government of Oman and by the Oman Oil Company, and its output forms the foundation of Oman’s rapidly developing plastics industry. For example, SOHAR Port and Freezone set for rapid growth Ten years after the very first vessel docked in Sohar, SOHAR Port and Freezone has grown to serve over two thousand ships annually and is the largest port development site in the world. A joint venture between the Government of Oman and Port of Rotterdam, SOHAR currently receives more than 50 million tonnes of cargo per year, including dry and liquid bulk, containers, and general cargo, all of which is handled at specialist terminals run by some of the world’s leading operators. This list includes Hutchison Whampoa, C. Steinweg Oman, and Oiltanking Odfjell, among others. SOHAR Port is the gateway to the adjacent 45-square kilometer Freezone, which is attracting some of the largest foreign investment projects in Oman, especially in downstream sectors. A wide range of businesses have been drawn by its strategic location and by the combination of abundant low-cost energy, young workforce, customer-orientated approach, and incentives that include 100% foreign ownership and corporate tax holidays of up to 25 years. “The success of the Freezone has been seen in its ability to capitalise on its location, low-cost energy, and its connectivity as a logistics hub,” says Jamal T. Aziz, CEO of SOHAR Freezone. “We are creating opportunities for SME’s and every job created in the Freezone leads to over three created in the surrounding economy”. Double digit growth and sustained investment totalling US$15 billion over the past decade is also having a major impact on the cost of logistics in the Sultanate. Together with its natural deep sea port and increased business interest, the US$130 million expansion and relocation of SOHAR’s container terminal has seen container capacities increased to 1.5 million TEU, which has allowed larger ships to transport goods directly to SOHAR rather than relying on feeder vessels from ports in the UAE. This is bringing down freight costs and reducing costs for businesses and for consumers. As the Sultanate invests in road and rail connections from SOHAR to Saudi Arabia and GCC countries, SOHAR Port and Freezone is becoming a major logistical centre for the region. “We have a potential hinterland of 2.1 billion people and are within easy reach of 3.5 billion consumers,” says André Toet. ENG. JAMAL T. AZIZ Sohar Freezone CEO Jizan refinery ANDRE TOET Sohar Industrial Port Company CEO

- 13. Multi-billion dollar investments in transport build on strategic location logistics needs, but also to improve Oman’s connections to the rest of the region.” The new Oman Rail Company has already received a number of bids for the $15 billion rail project, which will have a total length of 2,244 kilometers and run from the Yemeni border in the south to the UAE border in the north. Construction work is due to begin in early 2015, and the first parts of the network could be operational by as early as 2018, carrying both passengers and freight trains. The Ministry of Transport and Communications is also in charge of projects that aim to increase the capacity of the Sultanate’s road network and make sure that it can manage the on-going surge in freight traffic. The main project in the roads portfolio is the $2.6 billion Batinah expressway, a 265 kilometer, eight-lane highway which will link Muscat to Sohar and to the border with the UAE. The Ministry has launched a series of tenders for the project, which will provide the road capacity needed when the Port of Muscat ends freight operations and transfers all cargo activities to the Port of Sohar, Oman’s main container port. The expressway is due to be completed by the end of 2016. New road and rail links give ports a competitive advantage The development of the road and rail networks is an essential complement to the investments that are being made in Oman’s ports. Oman’s location on major shipping routes, and outside the Strait of Hormuz, where political tensions regularly restrict maritime traffic, delivers the Sultanate with a major competitive advantage. By constructing world-class ports, Oman will be able to serve shippers closer to their trade routes and at lower cost than at the more established, and more congested, ports elsewhere in the region. However, for this vision to materialize, multi-modal land and air links to and from the ports will be crucial. “The rail link to Abu Dhabi and the rest of the GCC will be a massive boost for us,” says André Toet, Chief Executive Officer of the Port of Sohar. “When it opens in 2018 it will ultimately make Sohar a shipping center for the region. There’s also going to be a direct road link from Sohar to Riyadh, which will also increase our transshipment volumes as we take traffic away from Jebel Ali, Dammam and Khalifa.” “Oman is clearly in the best strategic location to be the leading logistics solution for the Middle East. With the multi-modal development in road, rail and air, Sohar can become one of Oman’s leading centers of transport, complementing Salalah and Duqm. Because we reach 2.2 billion people, there are enough growth opportunities for Salalah, Duqm and Sohar.” Shipping lines are also increasingly using the facilities of Oman’s ports for key maritime services. At Duqm, the Oman Drydock Company is already benefitting from a strategic location which enables shipping customers to save time and money on their repairs. Chief Executive Officer Yong Duk Park explains that because Duqm is on the eastern edge of the Arabian peninsula, ships do not need to divert far from the trading routes between the Middle East and Asia; “for a ship repair job that takes two to three weeks, going to Duqm can save customers the four or five days that it takes to go through the straits of Hormuz and back, and that’s a major advantage.” At Sohar, the Oman International Container Terminal (OICT) is also preparing to reap the benefits of investments in multi-modal transport infrastructure. “A port is basically an interface between various modes of transportation, including sea, road and rail networks,” says Captain Rashid Jamil, Chief Executive Officer of OICT. “When we are all connected to the same regional network, the operator with the best and most cost-efficient service will gain. Our target is to attract all of the cargoes consumed within Oman and to use the rail link to move cargo into the UAE.” Oman is investing in world-class transport infrastructure and free zones in order to become a major force in regional transport and logistics As Oman seeks to maximize the potential of its position at the center of global trade routes, in the coming years the Sultanate plans to carry out over $20 billion of investments in rail, road, ports and airports. “Oman is realizing that it is in an important and strategic location and we are gradually trying to improve our connectivity to the rest of the world,” Dr. Ahmed Mohammed Salem Al Futaisi, the Minister of Transport and Communications says. “Our ports connect East and West and are becoming an international hub, and we are also a gateway to the Gulf region.” The Sultanate’s investments in multimodal transport infra-structure aim to enhance its links to the rest of the world, and also to improve connections within the country as a means of creating jobs and driving social and economic development. At the same time as increasing the capacity of ports all along its coastline, from Sohar to Salalah, Oman is also building major new road and rail links from the ports and economic zones to each other and to neighboring countries, reducing the risk of congestion and bottlenecks, cutting the cost of transport and logistics and positioning the Sultanate as a major trading hub for the wider area. The development of a nationwide rail network forms the centerpiece of this vision. “Our railway projects will connect the Omani ports to the GCC countries,” Dr. Al Futaisi says. “Eventually, in the future, they will go through Iraq, Syria, and up through Turkey. The railway infrastructure that we are developing is geared not only to support local transport and OICT container capacity hits new milestone It’s been a landmark year for Oman International Container Terminal (OICT), a joint venture between the Government of Oman, the world’s largest port operator, Hutchison Port Holdings (HPH) and other investors. In May at the Port of Sohar, OICT began operating a new $130 million terminal capable of handling container vessels of up to 11,000 TEUs with drafts of up to 18 metres. When the world-class terminal is fully complete, it will increase OICT’s annual capacity from 500,000 TEUs to 1.5 million TEUs. OICT has been operating in the Port of Sohar since 2007. Its new facility will enable the company to handle the spike in volumes it expects in the second half of this year, when Port Sultan Qaboos in Muscat transfers all its commercial traffic to Sohar. OICT is also considering investing in an additional terminal at the Port. “We will be able to expand our capacity in line with the growth of cargo volumes,” says Captain Rashid Jamil, Chief Executive Officer of OICT. “At the end of all this expansion, the total capacity will be 5 million TEUs. This is a very exciting moment in our history. OICT is working closely with the Government and the port Captain RASHID JAMIL OICT CEO authority in securing a bright future for Oman.” Road infrastructure H.E. DR. AHMED MOHAMMED SALEM AL FUTAISI Minister of Transport and Communications

- 14. In Country Value initiative gains traction across the industry In February 2012, Oman’s Ministry of Oil and Gas launched an In Country Value (ICV) Program that aims to transform the Sultanate’s oil wealth into broader based industrial wealth, by investing in training and developing new industrial capabilities that will sustain economic growth when oil and gas production ends. The ICV strategy will retain spending by the oil and gas industry within Oman, and use that spending to contribute to increasing diversification, raising productivity and developing new businesses. Since the launch of the initiative, the Government, operators, contractors and academia have been working closely together to turn this vision into reality. At the launch of the program, the Ministry established an ICV Committee which is chaired by the Undersecretary Salim Al Aufi. On this Committee, operators and representatives from the mid-stream and downstream have worked together with Government to map potential supply and demand and design an overall strategy. Operators have also drawn up their own individual ICV plans to increase their use of locally sourced goods and services, provide professional training and maximize the employment of Omanis. Many of the operators have appointed ICV managers, while ICV pro-visions have been introduced into oil and gas contracts and systems have been developed to ensure a consistent approach to implementing and measur-ing ICV across the industry. As Oman’s major producer, PDO is spearheading the ICV drive, in partnership with other operators and under the auspices of the Ministry of Oil and Gas. Manag-ing Director Raoul Restucci says that following the Committee’s in-depth analysis of forecast spend-ing, the local industry in Oman is confident that it can deliver the goods and services needed. “We know from the supply side that we have the ability to deliver these opportunities domestically. We have identified 53 categories, covering a large spectrum of manufactured LNG carrier prepares for new demand Since 2003, the Oman Shipping Company has been at the forefront of the development of the Sultanate’s maritime industry, as Oman expands its export industries and demand for shipping services rises rapidly. In partnership with Mitsui O.S.K. Lines, the Government-owned company has grown into TARIK MOHAMED AL JUNAIDI Oman Shipping Co. DEPUTY CEO one of the region’s leading LNG carrier companies. Deputy CEO Tarik Mohamed Al Junaidi says that OSC is well positioned to export any additional LNG from Oman that will become available in the future; “Our aim is to be the preferred carrier employed to lift this LNG out of Oman, and we have all the in-house capabilities and expertise that we need.” The company has also diversified into bulk transport, operating the largest bulk carriers in the world, giant Very Large Ore Carriers (VLOCs) for Brazilian mining company Vale. “LNG is still our backbone, but we expect to grow in dry bulk business as well because of the huge developments that are taking place in Oman,” Al Junaidi says. of the development of Oman’s transport infrastructure, the ports goods and services and training and development,” Restucci says. will all be linked by road and rail and will have specific func-tions,” says Simon Karam, the director of Sarooj Construction and a leading figure in the Sultanate’s construction industry. “Duqm will serve the oil industry, with facilities for refining and storing oil, while Salalah will be more of a transshipment port for getting goods to the rest of the region.” These investments in developing free zones and world-class logistics will also have a major impact on economic growth and job creation across the Sultanate. “One job in the Sohar Freezone creates three jobs in the local economy,” says Jamal T. Aziz, CEO of the Sohar Freezone. “Free zones are beneficial for foreign investors and they are critical to the prosperity of Oman.” Free zones thrive as logistical infrastructure grows rapidly Investments in air transport are also improving connectivity, especially to the new industrial centers of Sohar, Salalah and Duqm. The Oman Airports Management Company (OAMC) is planning major investments in the airports it operates in all three cities, to meet the rise in demand for both passenger and freight traffic, including sea-to-air services. “For both Sohar and Duqm, cargo will be at least as important as passenger traffic,” Engineer Saeed Khamis Al Zadjali at OAMC says. “A multi-modal approach will be required; large volumes of freight will be transported by rail and road but there will also be a specific role for air transport.” In June the Special Economic Zone Authority of Duqm (SEZAD) awarded the third package of Duqm Airport projects, including a passenger terminal and cargo terminal, following the completion of the runway. The initial capacity of the airport will be 500,000 passengers a year. The air cargo terminal will handle about 25,000 tons of cargo per annum. World-class transport infrastructure will be critical to ensuring that these industrial centers continue to drive the expansion and diversification of the Omani economy. For the oil and gas indus-try in particular, investments being made at Duqm will provide the sector with the specific facilities that it needs to import heavy cargo and export oil and refined products. “The Port of Duqm is in the center of international transport flows and will benefit from those streams of traffic of bulk, containers and oil,” Rien Van de Ven, Chief Executive Officer of the Port says. “It will be a very logical hub for oil transport.” In addition to their fast developing transport systems, free zones such as Sohar and Duqm also provide investors with a range of incentives in soft infrastructure, such as 100% foreign ownership, free repatriation of profits, exemption from customs duties, land leases of up to 50 years’ length, company registra-tion in under 48 hours, and simplified and flexible customs pro-cedures. By creating a world-class business environment, these zones are unlocking the potential of the Sultanate as a center for shipping, logistics, and export-based industries. Although there is some degree of competition between them, the various ports and industrial zones in Oman each have differ-ent specialties and complementarities. “Within the overall vision H.E. DR. MOHAMMED BIN HAMAD AL RUMHY Minister of Oil and Gas A new force in ship repairs A little more than three years after beginning its operations, Oman Drydock Company (ODC) is well on its way to be-coming the leading drydock fa-cility in the Middle East. A partnership between South Korea’s Daewoo Shipbuilding and Marine Engineering Co. (DSME) and the Government of Oman, ODC has already repaired over 200 vessels at its massive YONG DUK PARK Oman Drydock Company CEO shipyard at the Port of Duqm. Chief Executive Officer Yong Duk Park says that over 60% of these repairs have been carried out on ships from the oil and gas sector. The Port’s strategic location on Asian shipping routes and the experience and world-class technology contributed by DSME has attracted customers from around the world. ODC also provides services to shipping lines from Greece, the UAE, India and as far afield as the US. ODC is currently expanding into the offshore repair sector and into the LNG carrier repair market. “We know that we can deliver on time, cost, and quality,” Park says. Crossing the Oceans to Secure the Future oman shipping company s.a.o.c. In partnership, Government, operators and contractors are embedding the principles that will help develop a world-class local workforce and supply chain