Here are some key challenges in understanding 'Japan Only' products:- Limited information available in English on clinical/regulatory pathway, indications, market performance etc. - Difficult to evaluate commercial potential without understanding Japanese healthcare system nuances, prescribing practices, reimbursement policies.- Hard to determine intellectual property status, patent expiry timelines which are important for generic/biosimilar market entry planning.- Originator companies may not be open to out-licensing given their focus is domestic Japanese market. Language/cultural barriers also exist.- Limited published literature/conference presentations in English for medical community outside Japan to be aware of such products.- Reproducing Japanese clinical trial data and regulatory

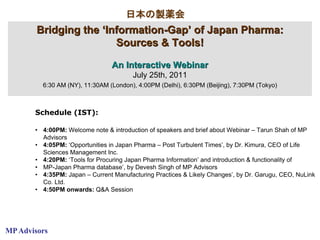

- 1. 日本の製薬会 Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools! An Interactive Webinar July 25th, 2011 6:30 AM (NY), 11:30AM (London), 4:00PM (Delhi), 6:30PM (Beijing), 7:30PM (Tokyo) Schedule (IST): • 4:00PM: Welcome note & introduction of speakers and brief about Webinar – Tarun Shah of MP Advisors • 4:05PM: ‘Opportunities in Japan Pharma – Post Turbulent Times’, by Dr. Kimura, CEO of Life Sciences Management Inc. • 4:20PM: ‘Tools for Procuring Japan Pharma Information’ and introduction & functionality of • MP-Japan Pharma database’, by Devesh Singh of MP Advisors • 4:35PM: Japan – Current Manufacturing Practices & Likely Changes’, by Dr. Garugu, CEO, NuLink Co. Ltd. • 4:50PM onwards: Q&A Session MP Advisors

- 2. Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools! An Interactive Webinar Japan Pharma: Opportunities Post Turbulent Times By Hiromichi Kimura, Ph.D. CEO of Life Science Management, Inc http://www.lsm-jp.com/index_e.html July 25th, 2011 Webinar - Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools!

- 3. Japan Pharma: Key Thoughts • Japanese Pharma market is stable if not rapidly growing; it remains second largest and one of the most predictable markets in the world • Japanese Pharmas have poured enormous amount of money, $40B into foreign Pharmas in last 3 years – will continue this trend for a while. • Because the Japanese government has been committing to double the Japanese generic market, everyone is chasing to grab growth opportunities in Japanese generic market. Webinar - Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools!

- 4. Overview of Japanese Pharma Global Sales of Japanese Pharmaceutical Companies ($b) 1st Tier - Innovation - New Market Development 2nd/3rd Tier - Seeking for Survival Strategy Generic Pharmas - Growth Opportunity Note: 2009, $1=80 Webinar - Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools!

- 5. 1st Tier: M&A Investment for New Technology and Therapeutic Areas Company Acquired Acquisition Cash Paid ($b) Purpose of Acquisition company date Takeda Millennium May-08 11.1 Oncology Plexxikon Feb-11 0.81 Oncology Daiichi Sankyo U3 Pharma May-08 0.30 Oncology/Biologics Astellas OSI Pharma May-10 4.60 Oncology MGI Pharma Jan-08 3.90 Oncology/Vaccine Eisai AkaRx Jan-10 0.25 Leukemia/Oncology Investment for New Market Development Company Acquired Acquisition Cash Paid ($b) Purpose of Acquisition company date Takeda Nycomed May-11 14.0 EU/Emerging Country Daiichi Sankyo Ranbaxy Oct-08 4.6 Emerging Country/Generic Note: $1=80, 1Rupee = $0.023 Webinar - Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools!

- 6. 2nd Tier: Seeking for Survival Strategy Oncology: Looking for alliance partners Kyowa Hakko Kirin, Nippon Kayaku Trying to go beyond critical mass Shionogi, Dainippon Sumitomo Domestic focused companies Ono, Kyorin, Mochida, Kissei, Nippon Shinyaku Company Sales(2010, MKT % of % of Long- Focus Areas $M) Cap($M) Domestic listed Sales Ono 1133 4,233 97% 80-90% Bioactive Lipids, enzyme inhibitors Kyorin 867 980 97% 50% Respiratory, otolaryngology & urology Mochida 627 853 Over 90% 80% Diabetes, obesity, chronic pain Kissei 537 741 Over 90% 62% Genitourinary ,metabolism & endocrinology Nippon 529 582 Over 90% 50% Urology, hematology, obstetrics & Shinyaku gynecology Webinar - Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools!

- 7. Generic Pharma: Growing Opportunities (1) ($b) Japan Rx Drug Market (Sales) Total Rx Market: CAGR 2.0% The Japanese government has been committing to increase the Japanese generic market to 30% of Total Rx Drug in Volume Gx Market: CAGR 16.4% Almost doubled in 4 years Note: $1=80 Precondition: NHIP (Yakka) is stable during the term Webinar - Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools!

- 8. Generic Pharma: Growing Opportunities (2) Japanese Pharmas: 1st Tier: Establish a subsidiary dealing with Generic • Takeda-Aska, Daiichi Sankyo-DS Espha, Eisai-Elmed Eisai 2nd Tier: Move to generic company • Meiji, Kissei, Nippon Chemiphar Overseas Pharmas: M&A/Alliances for entry to Japan Teva: Acquired Taiyo Phama • $500M for 57% of stake of Taiyo. Sanofi Aventis: JV with Nichiiko • Sanofi:51%, Nichiiko: 49% Webinar - Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools!

- 9. 日本の製薬会社 Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools! An Interactive Webinar Introducing Japan Pharma Database [MP-JPD®] & Addressing Unanswered FAQ July 25th, 2011 Devesh Singh Sr. Analyst (Japan Pharma), MP Advisors www.mpadvisor.com devesh@mpadvisor.com ! ! Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools! 1

- 10. Procuring Data & Info.: Japan Specific Challenges Formulating a competitive landscape of various therapeutic classes in Japan is challenging viz a viz the US and EU markets due to: 1. Operations of various MNCs who generate significant amount of revenue but do not disclose their sales – Market Research Agencies have their limitations; no projections 2. Disclosure of Clinical trial data – is limited/not detailed and is shared after a long gap. 3. Lack of equivalent sites such as clinicaltrials.gov, FDA’s Orange book, etc. – company reports, various categories of CT data available at scattered sources. Mostly in Japanese. 4. Very Difficult to get patent expiry info. from JP cos - Multiple patent extension, NO reliable Source in public domain 5. Large contribution of ‘Japan Only’ products - difficult to make competitive landscapes for overseas companies 6. Difference in clinical practices – e.g. GERD (H2 blockers vs. PPI’s) 7. Language Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools! 2

- 11. ‘Japan Only’ Products: Specific Challenges ‘Japan Only’ Products Drug Originator Licensee JP Launch sales Radicut Mitsubishi Tanabe Not licensed 2001 28.0 Coniel KyowppHakko a Not licensed 1991 21.00 Gasmotin Sumitomo Takeda 1998 20.70 Anplag Mitsubishi Tanabe Not licensed 1993 16.9 Ceredist Mitsubishi Tanabe Not licensed 2000 16.3 Prorenal Ono Dainippon Sumitomo 1988 15.4 Depas Mitsubishi Tanabe Not licensed 1984 11.6 Ebastel Sumitomo Meiji Seiku 2005 9.20 Source: MP Advisors, Company reports Dependence on ‘Japan Only’ Products JP focused products Weight of JP Key products sales sales (sold in JP focused products Company (¥b) only) (¥b) (%) Mitsubishi Tanabe 201.10 91.3 45.4% Dainippon Sumitomo 190.80 72.5 38.0% Kyow a Hakko 106.60 22.8 21.4% Kyorin 83.25 Source: MP Advisors, Company reports Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools! 3

- 12. Multiple Patent Extension: Japan Specific Challenges Multiple Patent Extension: Relative Standing Japan US EU Introduction 1988 1984 1993 Maximum 5 years 5 years 5 years period No.of Multiple Only once Only once extension possible No.of patent Multiple Only one Only one eligible for possible extension Source: MP Advisors, Company reports • Basic patent term can be extended multiple times e.g. by adding new indications • Related patents (method of use, mfg. etc.) can also be extended multiple times • JGPMA request to JPO to Limit the extension to only one patent and only once CASE STUDY: Multiple patent extension of levofloxacin (~¥44b FY 03/10 A): Launched in Nov-93; JPO gives two entries for Cravit, showing application in 1990 (reg # 2523210) & 1993 (Reg. # 3244983 )! 1st staphylococcus and other 30 bacterium June 2006 2nd Anthrax, Pest, etc. October 2006 3rd Typhoid Fever , Paratyphoid Fever November 2007 4th Legionella June 2011 Most recently Levofloxacin received mfg. approval for 500mg/100ml IV bags & 500mg/20ml injections in Oct, 2010 Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools! 4

- 13. Making Of MP-JPD® (Secondary Data) A number of reliable secondary sources continuously scrutinized Brands/ Company/ Sales • Crecon consulting Inc. • Japan Pharmaceutical reference (JPR) • Company reports • Drugs in Japan-2011 [本医薬品集フォーラム/監修 ] Patents & R&D/Pipeline • IPDL (Industrial Property Digital Library) • Japan Pharmaceuticals Information Center (JAPIC CTI) • UMIN Clinical Trials Registry (UMIN-CTR) – in case physician belongs to university hospitals • JMA CCT – in case physician belongs to private hospitals Regulatory Related • Korosho / Kosei-roudou-sho (MHLW) • Kiko (PMDA) • Kokuho Chuoukai (NHI) • Chuikyo (Central Social Insurance Medical Council) Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools! 5

- 14. Making Of MP-JPD® (Primary Data) Primary data enriched thru ~25yrs of experience base Primary Data Sources: HISTORIC DATA POINTS • MP proprietary financial models (15+ companies; all majors) • In-house library of clinical data points from global companies PROJECTING FUTURE • Analyst’s projections of sales thru 2016 (~350 key products, ~60% of total market) • Analyst views on NCE/NBE pipeline (viz. based on clinical data analysis, competitive landscape) • Data acquired through interviewing management, supply chain etc - patent expiries (~250), issues related to ongoing trails etc. • Interviews with ‘key opinion leaders’, regulators (views on price cuts, expected regulatory changes and incorporating them in projections) Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools! 6

- 15. MP-JPD® : Addressing FAQ Replace name of any product/ pipeline candidate/ thx. class/ company/ time line etc. (from 1000+ products, 100+ companies & 450+ pipeline candidates) – Illustrative Examples Only 1. What % of sales of Toyama chemical is exposed to generics and what additional % will add-in in next 4 years? 2. There are rumors that MSD is taking over Santen – what could be the rational and synergies between the two for products & pipeline? 3. How many products of Abbott are actually owned by Japanese mfg. & which are these companies? 4. Which companies lead the Chinese medicine market and how it is evolving? 5. How the anti-diabetic market in Japan is evolving? How DPP IV & SGLT-2 inhibitors classes are shaping up & how they going to impact GLP-1 analog class? 6. Does anti-inflammatory segment offer opportunities of API/intermediate supply? 7. What are the opportunities for generic companies in anti-Parkinson's market? 8. What are opportunities for the generics manufacturers in next 5 years – within this what are the opportunities for generic drugs from metabolic & cardiac thx classes? 9. Which companies will hold their patent protected revenues in 2020? Make 1000’s of such questions and MP-JPD® will answer them! Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools! 7

- 16. Bridging the ‘Information-Gap’ of Japan Pharma: Sources & Tools! An Interactive Webinar Current Manufacturing Practices & Forecasting Changes in Practices By Hisamaro Garugu July 25th, 2011 1

- 17. Pressure Points For Acquiring Mfg. Synergies From Overseas Optimizing Cost: A number of pressure points force Japanese companies to search for methods to reduce cost, as little scope of further cost optimization exist from within Japan - • High medical expenditure & govt.’s pro-generic policies • No control on price & biennial price cuts • Lower margins vs. US/EU/ Indian companies – further deteriorating • Increasing long-listed drugs contribution De-Risking of Mfg. Facilities: • Post natural disaster (in March 11), need of decentralizing mfg. capabilities (outside Japan) has intensified Japanese Pharma Need of Growing Global: • Improved technological capabilities in developing countries • Other Jap industries (e.g. automobile) has already been utilizing costs synergy thru overseas alliances – Pharma is legging but will have to join 2

- 18. Biennial Price Cuts – Continuing Pressure to Optimize Cost ‘Yakka-sa’ vs. Price Cuts 25.0 23.1 20.0 17.8 Yakka-sa (%) 14.5 Price cuts (%) 15.0 % value 13.1 10.0 9.5 8.4 7.1 6.5 6.9 9.7 6.3 6.6 6.8 7 5.0 6.7 6.2 6.3 5.2 4.4 4.2 0.0 A 2010 E 1994 A 1996 A 1998 A 2000 A 2002 A 2004 A 2006 A 2008 A 1992A Year Source: MP Advisors, MHLW Price-Cuts are Regular Exercise – But the Threshold is Reached! 3

- 19. De-Risking of Mfg. Facilities Japanese Mfg. Plants Affected During Tsunami/Earthquake in March. 11 Company HQ Name / Nature of Affected Production Facilities / products Astellas Tokyo Nishine (Harnal & antibiotics) & Takahagi (bulk of Harnal) Daiichi Sankyo Tokyo Onahama (API) & Akita (formulation) Eisai Tokyo Kashima plant & Tsukuba labs (R&D Center) Utsunomiya (major plant that makes – Actemra, Neutrogin and Chugai Tokyo Epogin) Out of total major facilities, 2 are located in affected areas – Mitsubishi Tanabe Osaka Kashima (Redicut) & Askana (Ursho). Kanegasaki plant - Bulk chemical manufacturing , antibiotic, Shionogi Osaka analgesics for cancer pain Kyowa Hakko Tokyo Takasaki plant & Fuji plant Kirin2 Sawai Osaka Kanto Towa Osaka Yamagata Nich-Iko Toyama Yamagata factory & Saitama factory Source: MP Advisors, Company Reports 4

- 20. 1/3rd of Current Market* Approaching Patent Expiries Screenshot from MP-JPDB’s Company Analysis Section ~200 products going off patent in next 4yrs (worth ~¥2tr today) will come under generic pressure & their manufacturer will look for cost optimization to remain competitive – foreign alliance for * Excluding long-listed products sales API/intermediates will be one such measure… Source: MP- Japan Pharma Database 5

- 21. Series of Reforms to Shape Future Reforms That Will Increase The Use Of Generic Drugs Near term impact (Already in force) Long term impact (>2yrs+) • Biannual Price Cuts • Patients Co-payment • Reversal Of ‘Check Box’ In Rx Form • Freedom To Stock One Generic Brand • DPC Expansion • DPC For Out-patients • Higher Dispensing Fee • Free Pricing For Generic Drug • Mandatory Approval Of All Strengths • Freedom From Product Detailing Reforms That Will Foster Innovation Near term impact (Already in force) Long term impact (>2yrs+) Reforms That Will Foster Innovation • Increased Number Of Reviewers • Cost Based Pricing • Better Infrastructure & Support for Clinical Trials • No Price Cuts During Patent Period 6

- 22. New Govt. Supply Rules for Generic Manufacturers All Generic manufacturers* must be able to supply all strengths of drugs for which a generic or original drug is legally available in order to maintain stable supplies. This is irrespective of the profitability of a particular drug or dosage form *This is a great burden on a generic drug suppliers in Japan. Countermeasures: • Tie up with local competitors to save cost and time like TOWA, SAWAI and NICHI-IKO at the R & D stage • Branded and Generic Companies look to expand through partnership and M&A with outside firms in order to increase generic product lines, increase production values and stable supply 7

- 23. Master File System for Drug Substance • Foreign manufacturer of drug substance (~API/intermediate) has to apply for MF registration through an in-country caretaker with an address within Japan • MF registration application form, notification, and other related documents shall be written in Japanese. • Before filing MF, it is necessary for a foreign manufacturer to obtain a foreign manufacturer accreditation 8

- 24. GMP Inspection GMP Inspection has been indispensable for marketing approval since revision of pharmaceutical Affairs Law in 2005. Applicant: Marketing authorization holder Inspector: PMDA GMP Inspection conducted for marketing approval or approval of partial changes. - Applicants must submit application documents more than 6 months prior to approval. Periodical GMP Compliance Inspection - Periodical GMP Inspection is conducted every five years following marketing approval. - Generally, Periodical GMP Inspection and Renewal of Accreditation of Foreign Manufacturer are applied at the same time more than 6 months prior to expiry date of accreditation. On-site Inspection: Conducted for about 3 days at foreign manufacturer’s site by PMDA Document Review: The documents submitted by applicant are reviewed by PMDA In the case the documents are insufficient, Additional documents are requested. 9

- 25. Evolving Trends in Mfg. Alliances • Korea and Taiwan are already enjoying formulation production alliances with Japanese pharma • Japan Pharma Inc setting up plants in India • Otsuka had a plant since many years • Eisai has a API to Formulation integrated plant in South India • Daiichi Ranbaxy, Ajinomoto-Granuls India etc. • API come from several countries – Korea and Europe are major ones. China and India just started. • Finishing/packaging are v. imp. whether API or Formulation – snow white, not off-white! 10

- 26. Future Opportunities •The growth rate of generics subset of the market has been increasing over the past three years and this trend is projected to continue. Govt. is pushing for increased usage of generics due rising healthcare cost. •Govt. aims to increase usage of generic drugs to 30% by 2012. •The Japanese Generic market being backed by the Govt. This is encouraging growth by relaxing registration procedures and providing incentives to doctors to prescribe generics. •PMDA has set the goals to reduce review time for priority, standard and generic drugs. 11