Mark tuminello forwards and futures

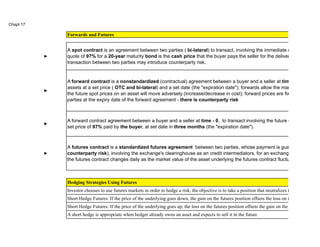

- 1. Chapt 17 ► ► ► ► Forwards and Futures A spot contract is an agreement between two parties ( bi-lateral) to transact, involving the immediate (time - 0) exchange quote of 97% for a 20-year maturity bond is the cash price that the buyer pays the seller for the delivery of $100,000 transaction between two parties may introduce counterparty risk. A forward contract is a nonstandardized (contractual) agreement between a buyer and a seller at time - 0, to transact assets at a set price ( OTC and bi-lateral) and a set date (the "expiration date"); forwards allow the market participant the future spot prices on an asset will move adversely (increase/decrease in cost); forward prices are fixed over the life parties at the expiry date of the forward agreement - there is counterparty risk A forward contract agreement between a buyer and a seller at time - 0, to transact involving the future exchange of a set price of 97% paid by the buyer, at set date in three months (the "expiration date"). A futures contract is a standardized futures agreement between two parties, whose payment is guaranteed by the risk), involving the exchange's clearinghouse as an credit intermediators, for an exchange of a set amount the futures contract changes daily as the market value of the asset underlying the futures contract fluctuates (mark-to-Hedging Strategies Using Futures Investor chooses to use futures markets in order to hedge a risk, the objective is to take a position that neutralizes the risk as far as Short Hedge Futures: If the price of the underlying goes down, the gain on the futures position offsets the loss on the rest of the company's Short Hedge Futures: If the price of the underlying goes up, the loss on the futures position offsets the gain on the rest of the company's A short hedge is appropriate when hedger already owns an asset and expects to sell it in the future

- 2. Long Hedge Futures: A long hedge is appropriate when a company knows it will have to purchase a certain asset in the future and Example A Long Hedge - January 15th A copper fabricator knows it will require 100,00 pounds of copper on May 15th to meet a certain contract. The spot price of copper cents per pound A Long Hedge Startegy January 15: Take a long position in 4 May futures contracts (20,000 contract size) May 15: Close out the position Result: The company ensures that its cost will be close to 120 cents per pound. When interest rates go down, the reverse happens, and the future price goes up; the hedger exposed to lower interest rates should take Example 1: Cost of copper on May 15 is 125 cents per pound; the compnay gains: 100,000 X (1.25 - 1.20) = 5,000 on the future contract; Example 2: Cost of copper on May 15 is 105 cents per pound; the compnay losses: 100,000 X (1.05 - 1.20) = -15,000 on the future Interest rates and future prices move in opposite directions; when interest rates go up, the price of the asset underlying the futures contract to go down; an investor who is exposed to higher interest rates, should hedge by taking a short position

- 4. ► ► ► Profit or Loss on a Futures Position in Treasury Bonds taken on November 15, 2007 Buy (long) or sell (short) December treasury bond futures contract traded on the CBT at a price of 133.1875 ; percent at $100,000 Long position in one bond can be taken at 133.1875% of $100,000 or $133,187.50 Example: $ 100,000.00 90-05 0.15625 90.00 0.9016 $ 9 0,156.25 $ 100,000.00 95.16 0.50 96.00 0.9650 $ 9 6,500.00 ► Cash Price = Quoted Price + 132.3438% 134.0313% Futures Price Payoff Profit Long Position Payoff Loss Futures Price Rise 0 Rates ( r ) $ 843.75 $ (843.75) 133.1875% ( r )Incr. Futures Price Falls ( r ) Decr. Quoted price in dollars and in thirty seconds of a dollar; with face value of $100 Accrued Interest

- 5. 132.3438% 134.0313% See Swaps FM&I Chapter 10 T So KfF r time to maturity price of asset underlying forward contract today delivery price in forward contract value of long forward contract today forward price today risk-free rate of interest per annum today, continuous compounding thru maturity in T years. At contract initiation: F = K; and f = zero 0 Futures Price $ 843.75 Short Position ( r ) Incr. Payoff Profit $ 843.75 Futures Price Falls Rates ( r ) 133.1875% ( r )decr. Payoff Loss Futures Price Rise

- 6. So 40 T 3 months r 0.05 p.a. D 40.5 12 Enter into a forward contract to sell the shares in 3 months Initial CF0 T = 3 mos. 1 -40 0.0 2 0 40.5 SUM -40 40.5 Return: 1.26% A Arbitrage: F 43 B Arbitrage: F 39 Borrow: Sell Forward Contract 40 at .05; buy one share short forward contract in three mos. Initial CF0 T = 3 mos. 1 40 -40.5 2 0 43.0 SUM 40 2.5 A FORWARD CONTRACTS ON A SECURITY THAT PROVIDES NO INCOME Combined Strategies: F = K; and f = zero Buy one stock

- 7. Sell: But Forward Contract Sell So at 40; invest proceeds at .05; buy one share Long forward contract at 39 in three mos. Initial CF0 T = 3 mos. 1 40 40.5 2 0 -39.0 SUM 40 1.5 B

- 8. Example FORWARD CONTRACTS ON A SECURITY THAT PROVIDES A KNOWN CASH INCOME Current Price B = 900 T = 1.0 r = 6 mos. = 0.09 r = 12 mos. = 0.1 Coupon s.a = 40.00 Fo = 1 year = 912.39 f = 0 -900 + 40e^-0.09*0.5+40e^-0.1*1 + Fe-.10*1 f = 0 -900 + 74.43 + 825.57 Fo = 912.39 Arbitrage Opportunity when Forward Price on Coupon Paying Bond Is Too High Buy Bond -900 Borrow Proceeds 6 mos 3a8t. 203.09 40.0 Borrow Proceeds 1 yea8r 6a1t .07.710 952.40 Total Proceeds: 900 Sell Fo 930 At T Recv coupon 2nd. Coupon 40 At T Recv.Fo 930 Profit = 17.60 Arbitrage Opportunity when Forward Price on Coupon Paying Bond Is Too Low Sell Bond Short (owe coup9o0n0s) Invest PV of 40 Proceed-s3 86. 2m3os at 0.09 40.0 Invest Proceeds 1 year- 8a6t 10..7170 952.40 Total Proceeds: 0 Buy Fo -905 At T Pay 2nd. Coupon -40 At T Buy Fo -905 Profit = 7.40 (S - I)^erT

- 9. Portfolio

- 10. Interaction of Interest Rates, Inflation, and Exchange Rates Higher domestic interest rates may attract foreign financial investment and impact the value of the domestic currency Fisher Effect:: the relationship between nominal interest rates (I), real interest rates (RIR), and expected inflation (IP) (1) compensates investors for any reduced purchasing power due to inflationary price (IP) changes, and (2) provide an additional premium above the expected rate of inflation for forgoing present consumption due to the time value of money (which reflects the real interest rate); such that: I = IP + RIR Purchasing Power Parity (PPP) Impact of difference between relative inflation rates between two countries on the currency exchange rate between them: Directly reflected in relative interest rates in these countries: ius = IPus + RIRus and is = IPs + RIRs Assuming: RIRus = RIRs; then ius - is = IPus - IPS; the nominal interest rate spread between the United States and Switzerland reflects the difference in inflation rates Foreign currency exchange rates between two countries adjust to reflect changes in each countries price levels (inflation rates) as consumers and importers switch their demands for goods from relatively high inflation rate countries to low inflation countries. PPP Therom: the change in the exchsnge rate between two countries' currencies is proportional to the difference in the inflation ratres in the two countries; that is: IPus - IPS = ΔS/us/s/Sus/s According to PPP, the most important factor determining exchange rates is the fact that in open economies, the differences in prices (and by implication price level changes with inflation drive trade flows and thus demand for and supplies of currencies Example

- 11. Application of PPP Current spot rate:u$s / s 0.9691 IPs 0.1 Ipus 0.04 IPus - IPS = ΔS/us/s/=Sus/s -0.06 = ΔSus/s/.9691 IPus - IPS = ΔS/us/s/=Sus/s (0.0581) = ΔSus/s Thus; the Swiss Franc now purchases 5.81 cents less 0.9110 against the dollar: Application of PPP: over the course of one year, the Swiss franc will depreciate in value by 5.81% against the U.S. dollar. Law of one Price: in the long-run exchange rates should move toward rates that would equalize the price of an identical basket of goods and services in any two countries. Interest Rate Parity Theorem (IRPT): The relationship that links spot exchange rates, interest rates and forward exchange rates is described as the interest rate parity theorem Current spot rate: u$ s / C 0.9622 6 - mos Forward: u$s / C 0.9586 The forward exchange rate is determined by the spot exchange rate and the interest rate differential between the two countries Investors have an opportunity to invest in domestic or foreign markets, the IRPT implies that, by hedging in the forward exchange rate market, an investor should realize the same returns, whether investing domestically or in a foreign country The hedged dollar return on foreign investments just equals the return on domestic investments IRPT: = 1 + iust = (1/St) X (1 + iukt) X Ft Hedged return on foreign (U.K.) investment Return on U.S. investment =

- 12. Example (iust - iukt)/(1+iukt) = (Ft - St)/St T = 1 month iuk 0.0050 ius 0.0048 = 0.641272284 X 1.005 X 1.5591 St: $1.5594/₤ 1.5594 Ft: 1.5591/₤ 1.5591 -0.000192 -0.000192 100,480.67 Discount spreads betw: dom.and fr. interest rates are equal in perct. terms to the spread bet. Forw. & Spot Exchange Forward and Futures Contracts on Currencies Variable, S, is the current price of dollars of one unit of the foreign currency Variable, K, is the delivery price agreed to in the forward contract A foreign currency has the property that the holder of the currency can earn interest at the risk-free interest rate prevailing in the foreign country; invest in a foreign denominated bond Define rf as the value of this foreign risk-free interest rate with continuous compounding. The two portfolios that enable us to price a forward contract on a foreign currency are: Portfolio A Portfolio B Portfolio A = = One long forward contract plus an of cash equal to Ke^-rT An amount e^-rfT Portfolio B Both portfolios will become worth the same as one unit of the foreign currency at time T; they therefore must be equally valuable at time t.

- 13. f + Ke^-rT = Se^-rfT f = Se^-rfT - Ke^-rT Fo = Se^(r - rf)T The forward price (or forward exchange rate), F, is the value of K that makes f = 0. This is the well known interest rate parity relationship from the field of international finance $ Per Fr. Crry. Fr. Crry per $ Forwards Futures Buys In $ $ Buys Canadian Dollar British Pound Japanese Yen Canadian Dollar $ 0.8378 1 .19 British Pound $ 1.6822 0 .59 Japanese Yen $ 0.0076 1 31.49 Euro area euro $ 1.2819 Euro area euro 0 .78 China Yuan $ 0.1473 China Yuan 6 .79 Swiss Franc $ 0.9691 Swiss Franc 1 .03 If rf > r; F < S and F is always less than S, and that F decreases as the maturity of the contract, T, increases If rf < r; F > S and F is always greater than S, and that F increases as the maturity of the contract, T, increases Example 3 month future contract to buy a S&P 500. Current Price Spot = 0.5243 T = 0.500 r Domestic = 0.072 rf Foreign = 0.036 Fo = 0.5338 F = 0.5338 0.5243 0.27175933

- 14. Are Forward Prices and Future Prices Equal: Ceterus paribus, a long futures contract will be more attractive than a long forward contract; when S is strongly positively correlated with interest rates, futures prices will tend to be higher than forward prices. Ceterus paribus, a long futures contract will be less attractive than a long forward contract; when S is strongly negatively correlated with interest rates, forward prices will tend to be higher than future prices. Stock Index Futures: A stock index tracks the changes in the value of a hypothetical portfolio of stocks The percentage increases in the value of a stock index over a small interval of time is usually defined so that it is equal to the percentage increase in the total value of the stocks comprising the portfolio at that time A stock index is usually not adjusted for cash dividends; dividends are ignored when percentage changes in most indices being calculated. Futures Prices of Stock Indices To a reasonable approximation, the stock underlying the index can be assumed to provide a continuous dividend yield. If q is the dividend yield F = Se^(r-q)T Example 3 month future contract to buy a S&P 500. Current Price S = 400 T = 0.250 r = 0.08 q = 0.03 Fo = F = 405.03 We observe that future prices appear to increase with maturity by an amount by which the risk-free rate exceeds the dividend yield. Futures on Commodities

- 15. Arbitrage arguments can be used to obtain exact futures prices in the case of investment commodities However, it turns out that they can only be used to give an upper bound to the futures price in the case of consumption commodities. Gold and Silver Storage costs can be regarded as negative income. If U is the present value of all storage costs that will be incurred during the life of a futures contract, it follows: F = (S + U)e^rT If storage costs incurred at any time are proportional to the price of the commodity, they can be regarded as providing a negative dividend yield: F = Se^(r+u)T Example 1- year futures contract on gold. Current Price Gold (oz) = 450 T = 0.250 r = 0.07 U (storage per oz) = 2 Fo = U (2e^-0.07) 1.86 F = 484.63 For the consumption commodity: F <= (S + U)e^rT; condition can hold due to users unwilling to sell needed commodity (inventory input to production) Convenience Yield: y Fe^yT = (S + U)e^rt The convenience yield simply measures the extent to which the left-hand side is less than the right-hand side

- 16. The future prices of commodities such as coffee, copper, and crude oil decrease as the maturity of the contract increases; this suggest that the convenience yield, y, is greater than r + u F = Se^(r + u - y) The relationship between future prices and spot prices This cost measures the storage cost plus the interest that is paid to finance the asset less the income earned on the asset. The Cost of Carry Non-dividend paying sto=ck r Stock Index = r - q Currency = r - rf Commodity; w/ storage c=ost r + u Asset Value of Long forward Contract w/ Delivery Price K Forward/Futures Price Provides no income Provides known income with PV I Provides known dividend yield, q no storage Cts.& no income income earned at rate q on the asset proportional finance & storage cost The Cost of Carry Se^ -qT - Ke^ -rT Se^(r -q)T F = Se^cT; for an investment asset F = Se^(c-y)T; for a consumption asset Summary of Results for a Contract with Maturity T on an Asset with Price S S - Ke^ -rT Se^rT S - I - Ke^ -rT (S - I)^ erT Define The Cost of Carry as C

- 17. immediate (time - 0) exchange of assets (securities) and funds (cash). A spot bond delivery of $100,000 face value of the security; (definition - bi-lateral at time - 0, to transact involving the future exchange of a set amount of market participant (the "buyer/seller") to hedge/speculate on the risk that are fixed over the life of the contract; cash is only exchanged between the future exchange of a $100,000 face value 20-year bond from the seller, at a guaranteed by the exchange on which the futures are listed and trade (no-counterparty exchange of a set amount of an asset for a price that is settled daily; The price of fluctuates (mark-to-market). neutralizes the risk as far as possible loss on the rest of the company's business in the cash market on the rest of the company's business in the cash market

- 18. asset in the future and wants to lock in a price now The spot price of copper is 140 cents per pound and the May 15 futures price is 120 5,000 on the future contract; total cost 125,000 - 5,000 = 120,000 -15,000 on the future contract; total cost 105,000 + 15,000= 120,000 underlying the futures contract goes down, this, in turn causes the futures price itself interest rates should take the long-position

- 20. 1 .1541 1,154.06 1 ,177.8125 23.75 1 33,187.5000 0.84375% 117.2500 133.1875 ; percent of the face value of the T-bond futures contract Traders in futures market can be either speculators or hedgers. Speculator in interest rates buys T-bond future at 133.1875 betting interest rates will go down; so as to sell at a higher price at the expiry date of the futures contract 134.0313 Hedger (pension fund) buys (long position) in the T-bond futures as protection against a decrease in fixed rates related to large cash inflow near-term that it plans to invest in long-term bonds. It is concerned that interest rates may fall by the time it can make the investment and wants to lock in the yield

- 21. futures as protection against a decrease in fixed rates related to large cash inflow near-term that it plans to invest in long-term bonds. It is concerned that interest rates may fall by the time it can make the investment and wants to lock in the yield Speculator in interest rates sells (shorts) T-bond future at 133.1875 betting interest rates will go up; so as to buy at a lower price at the expiry date of the futures contract 132.3238 Hedgers (Bond Issuer) take a short position in the T-bond futures contract as protection against a decrease in prices or increase in rates (will sell fixed rate debt in one month at the market); lock-in price (rate). Value of a Forward Contract: F ≠ K; and f ≠ zero

- 22. So 40 T 3 months r 0.05 p.a. D 38 12 Initial CF0 T = 3 mos. 1 -37.53 38.0 2 -40.5 SUM -37.53 -2.50 f = 2.47 Arbitrage: f 2.60 Arbitrage: f 2.40 Borrow: Sell Forward Contract (40.50 - 38)e^-.05*.25 Initial CF0 T = 3 mos. 1 40.00 -40.5 2 -40 3 40.60 SUM 0.00 0.10 A Combined Strategies: Invest PV of Delivery Price 38 at .05 for 3 mos. Enter into a forward contract (value = f) to buy the shares in 3 months 40 at .05; buy one share short forward contract in three mos.

- 23. A more Formal Argument (determining f and F) One long forward contract on the security plus an amount Portfolio A of cash equal to Ke^-rT Portfolio B One security Portfolio A = Portfolio B It follows that: f + Ke^ -rT = S OR f = S - Ke^ -rT (40.50 - 38)e^-.05*.25 f = 2.47 The Forward Price, F, is therefore that value of K which makes f = 0 in the above equation This means that: F = Se^rT S = 40.00 r = 0.05 T = 0.25 F = 40.00 * e^.05*.25 40.50 f = (40.50 - 38)e^-.05*.25 = 2.47 2.47 This equation corresponds to the observation that the value of a long forward contract is equal to the present value of the amount by which the Forward Price exceeds the delivery price.

- 24. Example 4 month forward contract to buy discount bond that will mature in one year. Current Price S = 930 T = 0.333 r = 0.06 F = 948.79 If F (Fo) < 948.79 If F (Fo) > 948.79 Buy Fo Buy (S) Sell S Sell Fo Invest S at r 930 Borrow S at r for 4 mos. At T Recv. 948.79 At T Repay Ln. At T Pay < 948.79 Profit = Fo - Loan Profit = Recv. Amt - Fo Value of a Forward Contract: F ≠ K; and f ≠ zero Current Price B 900 T 1 r = 6 mos. 0.09 r = 12 mos. 0.1 Coupon s.a 40 Delivery 890 Fo 912.4

- 25. The difference between owning one bond $900 today and owning $805.31 (PV of delivery price) plus a forward contract is the present value of the coupon payments. PV of Coupons = 74.43 PV of Delivery P = 805.31 f + 805.31 + 74.43 = 900 f = 20.26 805.31 + 74.43 = 900 f = (912.40 - 890)*e^-10 20.27 The value of a long forward contract can again be shown to be the present value of the extent to which the current forward price exceeds the delivery price. A more Formal Argument: analyzing a forward contract on a security paying known income (I) Portfolio A One long forward contract on the security plus an amount of cash equal to Ke^-rT Portfolio B One security, plus borrowings of amount I at the risk-free rate Portfolio A = Portfolio B f + Ke^-rT = S - I f = S - I - Ke^-rT 825.57 = 825.57 f = 20.26 Fo = (S - I)e^-rT Fo = 912.39 f = (F - K )e^-rT 20.26 Example

- 26. Current Price S 50 T 0.83 r = 3,6,9 mos. 0.08 Div. quarterly 0.75 I 2.162 Fo 51.14 I = 2.162 Fo = 51.14 25.683194 10 month forward contract to buy stock with a price of $50 A more Formal Argument: analyzing a forward contract on a security paying known dividend income (q) Portfolio A One long forward contract on the security plus an amount of cash equal to Ke^-rT

- 27. 0.9801987 26.465364 Portfolio B e^-qT of the security with all income being reinvested in the security Portfolio A = Portfolio B f + Ke^-rT = Se^-qT f = Se^-qT - Ke^-rT Fo = Se^(r-q)T If F < Se^(r-q) buy forward; short the stock If F > Se^(r-q) sell forward; buy stock f = (F - K )e^-rT Example 6 month forward contract to buy a stock that is expected to provide a continuous dividend yield of 4% Current Price S = 25 T = 0.500 r = 0.1 q = 0.04 Delivery Price = 27.00

- 28. f = Se^-qT - Ke^-rT f= -1.18 f = (F - K )e^-rT f= -1.18 Fo = Se^(r-q)T Fo = 25.76 Delivery Price > Fo