Latinports Newsletter July-September 2013

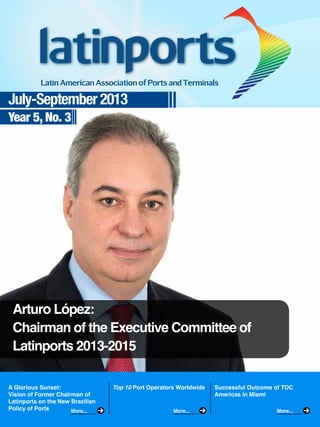

- 1. July-September 2013 Year 5, No. 3 Arturo López: Chairman of the Executive Committee of Latinports 2013-2015 A Glorious Sunset: Vision of Former Chairman of Latinports on the New Brazilian Policy of Ports More... Top 10 Port Operators Worldwide More... Successful Outcome of TOC Americas in Miami More...

- 2. CONTENTS July September 2013 Editorial VIEWPOINT - A Glorious Sunset: Vision of Former Chairman of Latinports on the New Brazilian Policy of Ports ANALYSIS - Brazil and Mexico: Who is the Hare and Who the Turtle? THE INTERVIEW - Ecuadorian Press Interviews the Executive Director of Latinports on the Possible Transfer of the Port of Guayaquil CHAIRMAN AND EXECUTIVE DIRECTION OF LATINPORTS - Arturo Lopez Chairs Executive Committee in Miami - Lectures of the Executive Director OUR MEMBERS - Port of New Orleans Elected as Principal Logistics Leader of the United States - Puerto Solo of Buenaventura Enter to Latinports Cover Arturo López of Mexico, New Chairman of Latinports (2013-2015). He is the President of the Altamira Port Terminal and Founder of the Association of Terminals and Port Operators of Mexico. Design Julian Pineda www.miroamarillo.com studio@miroamarillo.com LOGISTICS AND COMPETITIVENESS - Top 10 Port Operators Worldwide - “Latin America will Leave Underdevelopment in 15 Years”: Carlos Slim - Eclac Lowers Calculation of Latin American Expansion of Brazil and Mexico - Latin American Productivity Challenge

- 3. CONTENTS July- September 2013 WATERWAYS IN LATIN AMERICA - Uruguay and Argentina Agree Deepening Dredging of Shared River - Last Quarter of 2013: Key for the Future of the Magdalena River MARITIME TRANSPORTATION AND PORTS - New Scenario Maintains the Port Sector Active and Profitable at International Level - The Largest Vessel of the World Arrives to its First Destination - The P3 Alliance: How Will it Affect Ports? - Chinese Merchant Vessel makes its First Voyage Through the Arctic LATIN AMERICA AND THE INTERNATIONAL TRADE AGREEMENTS - The Pacific Alliance Represents 50% of Latin American Trade - Mercosur Needs to Reinvent EVENTS - Successful Outcome of TOC Americas in Miami LATIN AMERICAN PORT NEWS Mail

- 4. Editorial Julian Palacio, Executive Director of Latinports July- September 2013 Last August we reached our first four years of existence with great developments and a very promising future, as is the future of Latin America. We have almost 50 members from a dozen countries, have developed four large annual events in different cities of the region (Brasilia, Cartagena, Viña del Mar and Cancun) and, above all, we have released worldwide the benefits of the Latin American Port System, based mainly on public ports with private management terminals, and also their relevance for the development of the foreign trade of our region, considered the region of the future for its great comparative advantages and its relatively stable economies. For the first time, an association involves at the same level two fundamental actors of the activity: governments (ports) and private sector (terminals). And results have been seen. We are decidedly working to offer, as of the first semester of next year, specialized attendance courses at different countries of the region, starting with Mexico, in order to cover in several modules the entire set of activities of the port business, with vision of the future. The objective is strengthening our executives (and subsequently the middle management) in different areas, preparing them to face the challenge required by international trade. In our next newsletter we hope to give you more details on these courses. Profiting of the representative attendance of Latinports members to the TOC Americas held in Miami, event supported by our association, at the close of this edition we held in this city the first meeting of the executive committee with the new chairman, Arturo López, in order to program our activities for the year 2014. We will inform in detail the results of this meeting in the following issue of this newsletter. Until the next!

- 5. Viewpoint July- September 2013 A GLORIOUS SUNSET: VISION OF FORMER CHAIRMAN OF LATINPORTS ON THE NEW BRAZILIAN POLICY OF PORTS Richard Klien, of Brazil’s Multiterminais based in Rio de Janeiro and of Santos Brasil in Santos, shares his views on the new policy for Brazilian infrastructure and its effect on container terminals. President Dilma Rousseff decided that it was time for major reform tos peed up investments in Brazilian Ports, boosting capacity to support the growing economy and lowering port costs. Yhus, on the 20th anniversary of Brazil’s Port Modernisation Law, a new regulatory framework was approved by congress by enacting Presidential Provisory Measure 595/2012 into Port Law 12.815/2013. Under the old Port Law of 1993, all public terminals were tendered for privatisation. Following 15 years of massive investment, the country’s 14 public container terminals are now globally competitive and a source of national pride. They have enabled containeraised trade to expand from one meter boxes in 1997 to 5.5 meters boxes in 2012. Under private management, container terminals have been transformed into modern, state-ofthe-art facilities handling increasing numbers of 300-330 meters long post-Panamax vessels, compared with 210 meters Panamax vessels at the time of privatisations. Berths have been extended and deepened from around 11 meters to 15-16 meters, and in a

- 6. July- September 2013 range ports including Santos, Rio Grande, Rio de Janeiro, Imbituba, Itajaí and Itapoá, for example, terminals are equipped with modern handling technology able to handle 8.000+ teu vessels, such as the 8.208 teu MV Cosco Vietnam, wich are now calling in Brazil on a regular basis. This has required an investment of over $5 billions as today’s prices and further investments will be required for the foreseeable future, not least because of the boom in Brazil’s foreign trade following privatisation. This has increased from $100 billions to around $500 billions –a rate exceeding not only that of Brazil’s GDP but also that of global trade-. In addition, Brazil’s modernised and expanded facilities have increased container vessel productivity five-fold since 1997. “Although we are not big by global standards, we are very proud of the fact that we’re not a kid any longer”, said Klien. Necessary Expansion During the next decade Brazil is going to need M/N Cosco Vietnam extra capacity, wich, with the exception of the new BTP and Embraport terminals coming on-line in Santos, means modernising and expanding the country’s existing container terminals. Conservative estimates judge that this will require and additional investment of US$5.5 billions to increase capacity from 12 millions teu today to 25 millions teu in 2021. The port of Rio de Janeiro is a good example of expanding existing facilities, with its three terminals intending to invest around $500 millions. Libra and Multiterminais’ container terminals at Rio de Janeiro’s Caju quay will extend their quay wall from 1.300 meters to 2.000 meters -1.600 meters for containers and 400 meters for ro-ro vessels-. When completed, this will be the largest continuous quay in South America, able to berth four post-Panamax container ships simultaneously and doubling capacity at the port to 2 millions teu and 326.000 vehicles per annum. Sepetiba’s Tecon is planning to increase its capacity from 400.000 teu to 700.000 teu by extending its quay from 540 meters to 800 meters. In addition Paranaguá, Salvador and the existinc container terminals in Santos –Libra, Santos Brasil and Ecoporto Santos (formerly Tecondi)are well all keen on expanding their quays and adyacent yard áreas. Berth extensions to 400 meters+ and deeping on the quay walls to 15-16 meters, as well as new gantries able to handle vessels with 20+ rows of containers, have become a requirement to service the larger vessels plying the ECSA trade. Theaadditional capacity generated by terminal expansions will reduce unit costs, enabling

- 7. July- September 2013 terminal to reduce box rate charges to shipping lines. Another requirement will be to widen and deeping the access channels and turning basins to accomodate these vessels. The federal government is wholly commited to and has earmarket financial provisions for the dredging programms. Currently, the Ports Ministry is seeking the environmental licences to tender phase two of the dredging programms, with projected completion at major ports slated for the end of 2014. Multiterminais A Rainbow of Opportunities The aim of the new Port Law is to rapidly expand capacity via private investment in both public and private ports. To accelerate investments, it redefines private and public ports. Private terminals are those erected on freehold sites outside of the “public port area”. Public ports and their privatised terminals are those situated on government land managed by the existing Port Authorities (Companhias Docas). Their main policy ammendments are intended to promote construction of new terminals and expansion of existing facilities: · First, private terminals will be able to handle thirt party cargoes and will be allowed to construct facilities outside “public port areas”. Embraport in Santos, for example, owns a freehold area partially outside the public port area, while BTP is within the public port managed by CODESP. · Second, existin privatised terminalsin public ports, situated on public land within the “public port area”, may submit expansion programs with investment commitments to the Port Ministry for approval, thus obtaining an early extension of their contracted 25+25year leases. · Third, new tender bids within the public ports will be awarded to the bidder with the lowest prices or with the maximun volume capacity. Details are still being worked out in the wake of public hearings on the planned terminal tenders in the Port of Santos (state of Sao Paulo) and Belém and Vila do Conde (state of Pará). Small areas are being tendered as large consolidated terminals, as is the case of Saboó quay next to rebranded Ecoporto Santos container terminal on the right bank of the Santos estuary. The ensuing competition between new terminals and expanded existing ones should bring about a reduction in port costs, making Brazilian exports more competitive. Creative Solutions Welcomed A number of solutions to expedite operatios are currently being implemented. The new Port Law

- 8. July- September 2013 port of Rio de Janeiro, according to Klien, “we are facing up to the challenge, building a huge parking building, freeng up much needed yard space for container and Project cargos”. Santos Brasil. instituted obligatory 24/7/365 office hours for customs and other public authorities to match the uninterrupted operations of container terminals. However, few importers or exporters still use the gates during the night. Potentially this provides a lot of extra growth capacity. On-site predelivered inspection (PDI) services will be enhanced, prompting delivery of imported cars directly from the parking building to auto dealers, potentially reducing delivering time for two weeks to 3-4 days. Other terminals along the coast in a similar situation may follow suit. “The only certainty in the logistic business is this: increase quality and reduce costs every day. We are working hard at this”, Klien concluded. Finite space of many ports imposes a need for creative planning to increase capacity. In the Analysis BRAZIL AND MEXICO: WHO IS THE HARE AND WHO THE TURTLE? Thomas Catan, The Wall Street Journal Americas The divergent paths of the emerging markets may be followed through the two largest economies of Latin America: Mexico and Brazil. This is a story similar to the fable of the hare and the turtle. During the last decade, Brazil experienced a boom as a result of the sale of commodities to China. Its expanding middle class indulged with the inexpensive credit from the central banks of

- 9. July- September 2013 developed countries, as they tried to reactivate their economies. Brazil grew at a yearly average rhythm of 3.6% during the last ten years, having reached a maximum of 7.5% in 2010. The Real strengthened. All usual excess signs were evident: Brazilian tourists filled the stores of New York and Miami, while the media reported US$30 pizzas and US$35 martinis in São Paulo. In comparison, Mexico showed a lackluster growth, partly because of its involvement with the weakened economy of the United States. It has also suffered its own avalanche of problems: laws prohibiting foreign investment in the energetic sector, a dysfunctional tax code, a defective education system and an outdated economy, dominated by a handful of quasi-monopolies. It was also the victim of a wave of violence linked to drug traffic, which drove away both tourists and investors. The average economic expansion of Mexico was 2.6% per year in the last decade, while the peso slightly depreciated. The tortilla has now turned. Brazil continues being punished by investors that expect the Federal Reserve of the United States will start dismantling extra easy credit policies, and by China, whose appetite for commodities starts to decrease. Brazil threw away part of its bonanza, having invested little in roads and other infrastructure areas that would support its development. Its government has followed a state economic model, which has reduced competitiveness for many companies abroad. While the companies and households accumulated debt, future growth stopped even more. This resulted in a significant gap that must now be financed with foreign capital. In the meantime, Mexico used its lean years to reform its economy, which includes a reform of legal laws, the education system and the telecommunications, finance and energy sectors of the country. If these reforms are completed, economists foresee that changes will drive the expansion potential of Mexico at a time in which its principal commercial partner, the United States, accelerates its recovery. At the same time, Mexico has maintained a relatively small commercial deficit that may be easily financed by long-term foreign investment in companies and factories. The country does not depend of variable shortterm foreign cash flows, and thus, it has been less affected by turmoil that has recently shaken Brazil and other emerging countries.

- 10. July- September 2013 However, Mexico may still disappoint. Its economy contracted slightly in the second quarter, while Brazil has registered stronger months than foreseen by analysts. The history of the two largest economies of Latin America helps to show why emerging markets are following divergent paths. During the last five years, developing countries such as Brazil, Russia, India, China and South Africa – the so-called BRICS – were the motors of global growth when industrialized economies were fighting the repercussions of the crisis. To drive its weak economies, central banks of the United States, United Kingdom and Japan acquired bonds to reduce their interest rates to historical lows, which sent a wave of cash towards emerging markets that offered higher returns. Now the Fed is giving signs that this year it will start withdrawing its acquisition program of US$85 billion in bonds per month, a trend that is reversing and the money is now leaving the emerging markets. The list of victims is starting to show. Countries with large financing needs, they have great commercial gaps and fiscal deficits. During the last weeks, India, Turkey, Indonesia, South Africa and Brazil have suffered large capital outflows. Others, including Mexico, Philippines, Poland and South Korea have suffered minor cash exodus. In general, they tend to be countries with smaller commercial gaps and relatively lower levels of indebtedness, both at public and private levels. These are also countries that export manufactured goods to recovering economies as the United States and Europe, instead of commodities to China. As opposed to BRICS, its trend has been growing slower over the past years and not accumulating large commercial unbalances or debt. They did not become dependent of China and are not vulnerable to its deceleration. Besides, they have the potential of benefiting from its commercial bonds with developed economies. We may call it the vengeance of the turtles. The Interview ECUADORIAN PRESS INTERVIEWS EXECUTIVE DIRECTOR OF LATINPORTS. “The Port Needs the City and the City Needs the Port” The Executive Director of the Latin American Association of Ports and Terminals (Latinports), which in Ecuador brings together the Under-secretariat of Ports and the Association of Private Terminal Ports, visited Guayaquil. He knows very well the business in Ecuador, as he was counselor in port matters during previous periods. He believes the existing port has for a

- 11. July- September 2013 while. GUILLERMO LIZARZABURO CASTRO lizarzaburug@granasa.com.ec Julián Palacio’s eyes see the port of Guayaquil differently. His vision contrasts with that of the Spanish consultant company, Ineco. He, knowing the port business of Latin America and the world, believes it is not convenient to transfer international port activities to any other area. Ineco, on the contrary, prepared a proposal now assumed by the Ministry of Transportation and Public Works (MTOP, in Spanish) and promoted by a number of authorities; EXPRESO collects his vision. The proposal of Ineco is included in the Strategic Mobility Plan 2013-2037. The plan proposes that the terminals of Guayaquil remain for cabotage and tourism. The new port would be in Posorja or Chanduy (at the mouse of the Guayas River). You have lived several processes, what do you think of this proposal? I was port manager in Colombia and negotiated the concession of the port of Santa Marta, in the Caribbean coast, next to Barranquilla. At the time the Government delivered us the port and among many things gave to us the design of a new berth, as the “port was at the edge of congestion”. When this was analyzed and months went by the result was the decrease of cargo (in storage yards). What was really happening was not the decrease of cargo, but that the port was more efficient. I was port manager for 8 years and the berth was not built. The case of Santa Marta is typical. We found out that the problem was not lack of space, it was inefficiency. Each time more sophisticated equipment is being manufactured and operators are ever better trained. Now they do not have to travel to other countries to receive training as in several countries simulators exist, and I believe Ecuador also has them. Being in a strategic area, as Guayaquil, is the hinterland an added value for the port as well as knowledge, or what is its relevance? The hinterland is the term used to refer to an area of influence of a port, that is, very close to it is the principal consumer, the industry, services, and production center. For the success of the port business local cargo is important and what better local cargo than that of a city; I understand that Guayaquil has 50% of the foreign trade of the country, as this port has an effective cargo that gives it life by itself, it does not have to look for cargo. Therefore, the port already survives and may then dedicate to find more cargo. If a port is built on a certain location with good technical characteristics but no important area of influence, it would be useless. If there is no cargo it will not be good because ports are not magnets. Hutchinson, the principal operator worldwide, where the company has the lower results and where they do less well is in Freeport, Bahamas, because business there is only transshipment, it is marginal, it arrives and departs. The hinterland is a key issue. Hutchinson had the concession of the port of Manta but abandoned it. Now they are looking for a new partner. Until now finding it has failed. Is it advisable to make an investment, a new port, if there is already one that is operating well? For example, Rotterdam, displaced by (ports of) China as the most important port of the world, has lineally speaking an extension of almost 100

- 12. July- September 2013 kilometers and a capacity to extend another 100 km, they are not thinking of moving, but rather developing its present extension. I believe the port of Guayaquil is one of the few cases in Latin America with a capacity of one hundred percent (of growth) in round figures. If you take a look to its plan, these are the results. Current ports have an extension capacity and the famous hinterland. When multinational companies wish to invest they prefer to buy an operating port and not building a new one. In the case of Guayaquil it is one step far from the city. It is not less expensive to build a new port and transfer the cargo there. It is more expensive. Land transportation is much more expensive. Vessel freights are lower. It is preferable to travel a longer distance by ship. Why has Maersk not developed the port at Posorja? Maybe numbers were not correct. What attracts the most are numbers and Guayaquil has so much expansion capacity that I do not see the need of moving the port to another location; rather than beneficial, it will be harmful. n Guayaquil, the most important port is Libertador Simón Bolívar, concessioned to Contecon, but there are other 13 private ports (including two tuna ports) and another grain port, also in concession (Andipuerto). Both handle 70% of the cargo of Ecuador. Entrance to the port of Rotterdam is through a 40 km channel, and that of Guayaquil has 93. Do entry channels make them less competitive? In developed countries, if ports were in the wrong placed they would have been changed. Rotterdam has not moved its port and it was the first sea port of the world until recently. Many ports of the world are river ports: Houston, New Orleans, Hamburg, and Antwerp. There is a very curious case and it is Tiajin, in China, it is 1,600 km from the coast (in one of their mouths) and moves 450 million tons, 13 million TEU (containers). It is the fourth port of the world. It continues operating and growing. River ports are sheltered. Sheltered ports are in interior waters, therefore are not affected by winds or waves. They operate all year round. How do ports located on small spaces become more competitive? An example is Rotterdam; things are handled by robots, this is technology. There are companies that concession dredging. Paraná-Paraguay has concessioned the operation of the Paraná River of 3,000 kilometers from Brazil to Buenos Aires, covering five countries. Barranquilla is located at the mouth of the river, very similar to Guayaquil. Twenty years ago the Magdalena River moved two-times the cargo of Paraguay-Paraná. This one was dredged, concessioned and today they move 20 times more cargo than the Magdalena. Colombia is now working to concession the river. It is being deepened upstream at a cost of 400 million dollars, plus 200 additional millions for its maintenance during 10 years. Only critical points will be dredged. In the future, possibly concessionaries will charge tolls to vessels. In Guayaquil, the trade chamber and ship agents, have called for dredging of the access channel to the port of the city. The idea is to bring the draught up to 10 or 11 meters to allow postpanamax ships to arrive, which can carry between 4,000 and 5,000 containers. The most contentious site is Los Goles. Rocks must be crushed.

- 13. July- September 2013 kvillavicencio@eluniverso.org “To Transfer the Port is Practically a Death Certificate” The Executive Director of the Latin American Association of Ports and Terminals, Julián Palacio, assures that the area of influence or hinterland is what gives weight to the port of Guayaquil. He spoke by telephone with this Newspaper. Katherine Villavicencio The Government of Ecuador states that in the future the port of Guayaquil will be saturated and must leave its current location to be located between Posorja and Chanduy, is this proposal viable? I do not directly know the approach of the government, I know there is a study and that something has been said in this regard. But if I am asked if the port should leave Guayaquil, I would say no. Guayaquil has sufficient capacity to grow for many years (…). The fact of being very close to

- 14. July- September 2013 the city is also a great advantage. The problem now is the draft, but this may be solved with permanent dredging that is what occurs in the large ports of the world and is much cheaper than a new port. What are the implications of building a new port? Building a new port at the mouth of the river, I understand at a distance of 100 kilometers from the existing port, implies that for cargo to arrive to Guayaquil it has to be transported (by road) those 100 kilometers, which is extremely expensive. If what they want is to reduce costs, what will happen is an increase of costs for foreign trade. Now, Posorja is much deeper, certainly yes, but one must also think a little in market economy and must see which is the future of Ecuador in the 20, 30, 50 years to come and if a very deep-water port is justified for some vessels that eventually will not require it. Then, it is not a guarantee? Very large vessels arrive at the ports of very important countries of the world; one may say half a dozen or less. The fact of having a very deep-water port does not mean that very large vessels will arrive, even less if the economy of the country is not that important at global level and if a country as Ecuador, except for oil, does not have production of minerals that implies very large shipments. The proposal is building new facilities and leaving these for cabotage and tourism Yes, but in Ecuador and Latin America in general, mobilization of cabotage and tourism is very little. Having a port exclusively for cabotage and tourism is not justified. If we see the port of Miami, the most important of the world in tourism is the same port for cargo… I insist; if one thinks about completely moving the port, it is almost a death certificate for the existing port of Guayaquil. Post-panamax vessels will start circulating in 2015 and one thinks of relocating it in the future based on this. The ports and vessels must continue growing, but one must not think of the maximum capacity for the post-panamax, as it has to be seen from the point of view of market economy. One must see how many containers will be arriving to or departing from Ecuador per shipment, and this greatly depends on the size of the vessel. Now, a vessel unloads about 350 containers in Guayaquil; a post-panamax transports more than 10,000. Exactly. And at this time in the largest ports of Latin America only 8,000 TEUs vessels are being received (20 feet containers). With dredging I believe the situation of the port will work for several years to come and is significantly less expensive. ECLAC ranking for 2012 placed the port of Guayaquil as No. 8, what factors add up for this position? The most important is there is cargo in the port hinterland (area of influence)… In the case of Guayaquil the greatest advantage is that the city of Guayaquil is perhaps the most important industrial center of Ecuador and entering and departing from it most of the foreign trade of Ecuador.

- 15. July- September 2013 CHAIRMAN AND EXECUTIVE DIRECTION OF LATINPORTS ARTURO LOPEZ CHAIRS EXECUTIVE COMMITTEE IN MIAMI On the occasion of TOC Americas held in Miami from September 30 to October 3, presided by Arturo Lopez of Mexico, the executive committee of Latinports was held at this city with the presence of the executive director, Julián Palacio and the following members of the association: Jorge Lecona, president of Hutchison for Latin America; Melvin Wegner, president of the Neltume Investments (Ultramar Group) of Chile, Jorge Mello, president of Companhia Docas do Río de Janeiro, and Andreas Klien of Multiterminais, Brazil. Julián Palacio took advantage of this opportunity to meet with the Minister of Canal Issues, Roberto Roy, and with the new Vice-president of Planning and Market Analysis of the Panama Canal Authority (and member of the executive committee of Latinports), Oscar Bazán. Buenaventura XXI Century: Colombian Gateway in the Pacific LECTURES OF THE EXECUTIVE DIRECTOR II International Construction Congress in Panama Upon his return from TOC Americas in Miami, the executive director of Latinports stopped in Panama at the invitation of the Colombian multinational cement company Argos and presented the conference “Port Development in Latin America”. As moderator of the panel of maritime shipping lines, the executive director of Latinports, Julián Palacio, participated in the symposium “Buenaventura 21st Century: Colombian Gateway in the Pacific”, held in Buenaventura, Colombia in August, where he had an entertaining and enlightening debate with the managers of CMACGM and Evergreen.

- 16. July- September 2013 OUR MEMBERS PORT OF NEW ORLEANS NAMED TOP LOGISTICS LEADER IN THE UNITED STATES Inland Port, in its edition for the third quarter of 2013, reported that the important economic magazine Business Facilities, ranked the Porto of New Orleans No.1 on its listo f top logistics leaders, outpacing all other port metro áreas in the United States. “With its proximity to the center of the U.S. via a 14,500-mile inland waterway system, six Class 1 railroads and a nexus of interstate highways, New Orleans is the porto f choise for the movement of everything from steel, rubber an manufactured goods to commodities like coffeee”, said Jack Rogers, Editor-in-Chief of Business Facilities. Porto of New Orleans President and CEO, Gary LaGrange, said the ranking is appreciated but not surprising. “It is an honor to be recognized by a respected economic development publication such as Business Facilities”, LaGrange said. “Howevwer, the Port’s superior connectivity is no secret to shippers and our customers worldwide.” PUERTO SOLO OF BUENAVENTURA ENTER TO LATINPORTS As of October the Sociedad Portuaria Puerto Solo of Buenaventura, on the Colombian Pacific will be part of the corporate members of Latinports. This multipurpose port project with emphasis on containers and hydrocarbon already has a 20-year concession with the possibility of extending it for

- 17. July- September 2013 10 more years, granted by the National Agency of Infrastructure and has its corresponding prefeasibility studies and designs. It has a privileged location between the containers terminal TCBuen (with which it may eventually integrate) and Sociedad Portuaria de Buenaventura, with an approach depth of 16/18 meters and a turning basin of 700 meters, a berthing line of 1,500 meters and a total area of 150 hectares for storage and logistics activities. This project is of great importance because of the recent creation of The Pacific Alliance, which capital in Colombia is precisely Buenaventura as was decided by the President of the Republic, Juan Manuel Santos. LOGISTICS AND COMPETITIVENESS “TOP 10” PORT OPERATORS WORLDWIDE PSA International, Hutchison Ports, APM Terminals and DP World continue being the four principal actors in terms of TEU movements but with variable levels of activity, as stated in the annual report of the global terminal operators of Drewry Maritime Research, quoted by Mundo Marítimo. DP World and APM Terminals remain very active in terms of acquisitions, liquidations and development of greenfield projects, Hutchinson is somewhat less active in this matter and PSA even less, and ICTSI and TIL also remain relatively active in terms of portfolio expansion, states the report. There is a clear focus towards growing opportunities in emerging markets by the international port operators seeking to expand. In the meantime, large shipping lines have been selling their participations in terminals to obtain more liquidity – but maintaining majority control. Business involving CMA CGM Terminal Link and MSC/TIL has been the most significant. As a result, most shipping operators have seen little changes in terminal investments, adopting a holding policy rather that an expansion one, states Drewry. Many actors not currently under the category of Drewry as international terminal operators are rapidly growing and have a great interest in international expansion, including China Merchants, Gulftainer, Bolloré and Yildirim. Others as GPI, SAAM Puertos, Ultramar and Ports America are also making selective expansions or seeking to participate in new projects, as mentioned by the report.

- 18. July- September 2013 “Within the select club of international port operators there is an extensive variety of strategies and levels of activity. Some operators remain active with their current investments, while others are seeing little changes. More activity of mergers and acquisitions is highly probable, especially investments of the shipping lines. Besides, now waiting are a number of avid new actors, some of which will qualify very soon as international operators”, said the editor of the report, Neil Davidson. “LATIN AMERICA WILL LEAVE UNDERDEVELOPMENT IN 15 YEARS”: CARLOS SLIM Carlos Slim, permanent president of the Carso Group, assured that “Mexico and Latin America have an income per capita of 10 thousand dollars, and since it is expected to grow 4 or 5 percent, in 10 years we will arrive to 15 thousand dollars and will break the barrier of underdevelopment”, Milenio informed at the annual Mexico 21st Century meeting, organized by Telmex Foundation, Slim assured it would be Worth mentioning is that most of these large world operators are present in Latin America.

- 19. July- September 2013 interesting to have a model of a country without utopias, but based on reality, that may leave underdevelopment at a time it has an appropriate social-political environment. “Advantage must be taken of these periods of abundant and inexpensive financial resources in the long-term to overcome all the backwardness we have, which will allow us to accelerate our growing level 4 or 5 percent, as I mentioned, but there must be a development scheme with at least a 15-year vision in order to know where to make greater emphasis and encourage this development”, explained the businessman. He detailed that one must have a clear vision of this new civilization, what goals we may reach and what instruments we have to use to attain them; “of course, the core of all of this is education and on the other hand a quality employment, both competitive and remunerated”. ECLAC REDUCES CALCULATION OF LATIN AMERICAN EXPANSION AS PER BRAZIL AND MEXICO He stated that for all countries it is very important to create an economic, political and social environment allowing to encourage investment and also to create new activities to generate new jobs. “In five or ten years new jobs will be in information technology, information activities, education, health, tourism and entertainment; there are billions of persons in the world that are left out of modernity and in self-consumer conditions and we have to incorporate them to the market, education and modern work”, he emphasized. We must see what is coming and what is happening in an environment where technology continues advancing at an accelerated rate, added the entrepreneur, as there are billions of people communicated, but today the greatest effort of all countries is a universal access to bandwidth and internet and what this may offer free of cost. Latin Business Chronicle, quoting Reuters, informed that ECLAC cut in July its growing estimates for Latin America and the Caribbean to 3.0 percent in 2013 as it expects a lower expansion of Brazil and Mexico, in the midst of the moderation of internal demand and weak exports in the region. In a document, the Economic Commission for Latin America and the Caribbean (ECLAC) reduced 0.5 percent points its expansion forecast for the block and noted some weaknesses as the high dependency on exports to Europe and China, and the increasing growth of the current account deficit. “The growth fall compared to the last estimate (3.5 percent last April) is mostly due to the low expansion of Brazil and Mexico”, explained ECLAC in its report. The multilateral organization emphasized that Brazil, the

- 20. July- September 2013 principal economy of the region, will grow 2.5 percent this year from a previous estimate of 3.0 percent. The entity also cut its growth forecast of the Mexican GDP to 2.8 percent for this year, from a previous provision of 3.5 percent. ECLAC maintained its 3.5 percent growth calculation for Argentina in 2013. The organization emphasized that the region shows some weaknesses that could affect it in the short- and long-term, compared to the present negative external scenario, therefore it is necessary to extend and diversify the sources of expansion, said the executive secretary of ECLAC, Alicia Bárcena. “We need a social pact to increase investment and productivity and to change the patterns of production to grow in equal conditions”, she stated. BRAZIL RECOGNIZES IT IS FACING A “MINI CRISIS” 2.21% to 2.20%. Based on a report disclosed by the Central Bank of Brazil, experts also raised their inflation forecasts for 2014 from 5.80% a week ago to 5.84% in current report, and reduced economic growth for next year from 2.50% to 2.40%. New forecasts are shown in the edition published by the Focus newsletter, a study prepared every week by the Central Bank among economists and analysts of a hundred financial institutions. Brazilian economy is facing a “mini crisis”, stated on Monday the Minister of the Treasury of this country, Guido Mantega, quoted by El Cronista. At a meeting with entrepreneurs in São Paulo, Mantega added that despite challenges of the recent exchange rate volatility and a weak economic growth, both internal and external, Brazilian economy remains solid. The declarations of the Secretary of State coincided with the forecasts of the economists of the Brazilian financial market that raised its inflation forecast for this year from 5.74% to 5.80%, and reduced the economic growth estimate from LATIN AMERICAN PRODUCTIVITY CHALLENGE Latin American competitiveness in global economy continues blocked by the slow growth in productivity. This is the conclusion of the last global competitiveness report published every year by the World Economic Forum (WEF). The report highlights the healthy rhythm of economic growth – that although slower than the last decade, still exceeds that of most advanced economies – and the solid macroeconomic conditions that have led to this growth. However, the region suffers an

- 21. July- September 2013 investments in infrastructure in the region will amount to 200 billion dollars in the coming years. infrastructure deficit and a lasting productivity improvement. LATIN AMERICAN ECONOMIES WILL DEPEND ON INFRASTRUCTURE INVESTMENTS Infrastructure investment in Latin American countries, where it is presumed that sector development is 20 years behind compared to China, will allow economic growth continuity. So was stated by Latin American and Chinese experts during the 5th Forum of Investors of Latin America and China held in mid-September in Peking, as informed by Latin Business Chronicle, quoting Portafolio of Colombia, which in turn quoted the news from EFE. Many countries of the region prepare different and important investment projects to reach the required infrastructure and to be competitive in the future, states the chief of the Department of Infrastructure of the InterAmerican Development Bank (IDB), Jean Marc Aboussouan. “The entire region has a great potential”, stated Aboussouan, who calculated For the Director of the Latin American and Chinese Program of Inter-American Dialogue, Margaret Myers, the momentum for the development of infrastructure in the region is something “Latin America wishes and desperately needs” and China has considered and developed financing options. “I believe the lack of a good infrastructure for a rapid development of the region is the main challenge it has”, stated Myers. Despite global deceleration, the economic activity in Latin America during the last decade has reduced poverty from 48 to 29 percent, and increased its middle class in 50 percent (from 103 million persons to 152 millions). However, to continue its economic takeoff requires reducing the gap in matters of infrastructures, such as transportation, telecommunications, water and energy. “There is a lack of railways, airports, ports, metro stations, buses, energy plants that need to be developed. Governments are starting to see that if they want their economies to continue growing, they need to support the sector and this is a great

- 22. July- September 2013 opportunity”, stated on the other hand the director of the company Samcorp, Lawrence Lam. He considers this is a difficult decision for governments that sometimes have to face the opposition of groups of interest but it “has to be done” and in the long term will also bring new opportunities to said groups. According to figures of the Latin American Development Bank (CAF), the region requires an increase in infrastructure investments from 3 percent of the GDP to 6 percent. The hundred most important and urgent infrastructure projects for Latin America and the Caribbean, which average growth was 3 percent last year, is expected to move to 3.5 percent in 2013, requiring investments for 250 billion dollars, as established by the Latin American Leadership Forum held in May 2012 in Lima. WATERWAYS IN LATIN AMERICA URUGUAY AND ARGENTINA AGREE DEEPENING DREDGING OF SHARED RIVER According to the report of Terra.com, the Uruguayan government announced it has agreed with its Argentinean peer to “elevate” to 25 feet deep the dredging of the Uruguay River at the border, decision that streamlines the historical and intricate negotiation between both nations in relation to shared maritime routes. The Administration Commission of the Uruguay River approved “elevating at both Party States the Dredging and Beaconing Project” to “23 feet of navigation (25 feet depth)”, stated the communication of the Uruguayan Foreign Ministry. The decision complies with an agreement between both governments that was reached in 2011 “contemplating all the technical, economic, and environmental aspects” for the “prompt concretion” through an international tender for works. Dredging will allow “arrival of overseas vessels to port terminals of Fray Bentos”, which will improve “competitiveness of ports there located. It will also improve competitiveness of the port of Paysandú for river transportation in smaller ships and barges”, added the communication. During the last years the historical port rivalry between Buenos Aires and Montevideo potentiated due to negotiations about dredging a binational maritime channel, the Martín García,

- 23. July- September 2013 at the shared Río de la Plata. While the Uruguay River was an actor of the extended bilateral dispute on the installation of a cellulose plant in the Uruguayan margin, which maintained frontier passages closed for several years, and having brought the case to the Court of The Hague, the latter resolved that the plant does not contaminate and ordered periodical supervisions by both countries. LAST QUARTER OF 2013: KEY FOR THE FUTURE OF THE MAGDALENA RIVER Executive Director of Latinports, Julián Palacio (right), aboard a tugboat on the Magdalena river, talks with the President of Colombia, Juan Manuel Santos (center) and the General Director of Cormagdalena (left), during the launch of the project’s navigation upstream from the waterway. The Colombian Government will award works for US$600 millions for the improvement of the navigability of the Magdalena River, announced President Juan Manuel Santos in the National Transportation Congress, according to news published in Portafolio. “The river as a waterway will stop being a dream and will become a reality”, stated Santos. According to the news, before the end of the year it will be known the group that will make the channeling works of 256 kilometers between Barrancabermeja (Santander) and Puerto Salgar (Cundinamarca) will be known, and also which will be in charge of the maintenance of the navigable channel until Barranquilla. This has been considered a strategic project for the country as it seeks the extension of the navigable sector of the principal Colombian tributary and achieving a minimum depth of 8 feet in order to transport cargoes of up to 7,200 tons per convoy.

- 24. July- September 2013 Positive impact on the economy and the environment Works on the Magdalena River are important for the country – and especially for seven departments, which include the stretch to be extended both wide and deep – not only because competitiveness will be gained upon decrease in transportation costs as it will allow moving from 2 to 8 million tons per year by the tributary, but also the positive environmental impact upon decreasing carbonic gas generation of trucks carrying cargo today, as noted by environmental authorities. Argentina Advises In September was entered in Bogotá the first phase of the work plan of the Binational Technical Adviser Commission ArgentinaColombia, by which Argentina advises Colombia in the reactivation of the navigation by the Magdalena River. During the meeting, Augusto García, director of Cormagdalena, socialized the process and advancements of the project, stating the importance of the infrastructure work leaded by Cormagdalena with the total support of the national government. Conclusions of this activity were informed that the works of this binational commission will continue, according to the needs of Cormagdalena, on the following issues: - Accompaniment and advice in the bidding process for the channeling works and maintenance of the river. - Accompaniment and advice in the revision of the regulations to adjust them to the conditions generated upon the future reactivation of navigability. - Need to define a policy for preventive fishing activity in light of dredging campaigns to be done. - Exchange of experiences to strengthen institutionalizing maritime and river authorities on the river. MARITIME TRANSPORTATION AND PORTS NEW SCENARIO MAINTAINS THE PORT SECTOR ACTIVE AND PROFITABLE AT INTERNATIONAL LEVEL So that everything stays the same, everything must change. This law of life applies to everything, including the containers industry. To remain dynamic and profitable, the containers transportation industry must adjust to satisfy market needs, which is increasing the size of ships and containers demand. The senior analyst of ports and terminals of Drewry Maritime Research, Neil Davidson, quoted

- 25. July- September 2013 by Mundo Marítimo, highlights that “operators of container terminals remain highly successful and active, but changes are coming: changes in the ownership of ships as shipping lines when seeking cash flow are obliged to sell their participations in terminals and, at the same time, terminal operators seek expansion opportunities; and changes in the operations and infrastructure as ever larger vessels must be accommodated not only in Europe and Asia, but worldwide”. For the containers transportation industry to remain competitive, it must not only accept these changes but incorporate them, as in the midterm they shall define the market. Larger vessels: More containers Although there is a consensus regarding containers demand will not increase at the momentum it did in the decades of 1990 and 2000, it is expected that global port demand will exceed 800 million TEUs per year in 2017, with an increase of 5% per year, according to Drewry Maritime Research. To place this growth in context, 186 million TEUs represented in this THE LARGEST VESSEL OF THE WORLD ARRIVES TO ITS FIRST DESTINATION The largest structure navigating over the seas, the Triple E Maersk Mc-Kinney Moller, completed its inaugural voyage at the port of Rotterdam (Holland). The vessel of the Danish company Maersk was built in the port of Daewoo Shipbuilding and Marine Engineering in South Korea, and may transport up to 18,000 containers of 6.1 meters, equal to 36,000 sedan vehicles, accommodated in the steel structure increase are more than the total cargo handled in North America, Europe and the Middle East as a whole. At the same time, the size of vessels continues to increase. The largest containership of the world has increased fourfold in size since 1992 and the route Asia-Europe has doubled in the last 10 years. This has triggered the creation of greater alliances, being the most notorious the association between Maersk, MSC and CMA CGM. Most probably, the unrestrained increase of vessels in secondary routes will cause even more problems and challenges than the monsters of 18,000 TEU in the Asia-Europe route. The trend will not take long to reach Latin American ports and the WCSA route, as regional ports should not wait for larger vessels and greater demand to knock at their doors to take action on the matter… They must start preparing as of now: more infrastructures are the key for the future. 400 meters long (length). It is expected that in less than a month the second cargo vessel of the Triple E series, which will be called the Majestic Maersk and has already been delivered, will arrive to Copenhagen (Denmark), headquarters of the company and on this vessel will take place a public exhibition. To have an idea of the magnitude of this means of transportation, it must be mentioned that its

- 26. July- September 2013 structure is that of four soccer fields placed in a row, and its height from the lower base of the hull to the control tower antennas is 73 meters. Although the vessel will remain most of the time sailing, the crew has access to electronic mail and to Skype to remain in contact with their families. Another of the characteristics of this vessel is it may be operated by a crew of only 13 persons, although in exceptional cases it may have a maximum crew of 34. The company said that in the future average regular missions will have 22 crewmembers. Notwithstanding these superlative figures when speaking of this vessel, of which the company ordered the construction of 19 more vessels to replace its less efficient fleet, the Triple E concept, as stated by a spokesman of the company to El Tiempo, “relates to a greater efficiency in the use of fuel, less emissions of contaminant gases and a lower speed for a greater performance, among other issues”. Likewise, Louise Münter, communications director of Maersk, said “the vessel will operate at first trade routes between Asia and Europe, but will not arrive to American destinations”. The commitment of the Danish company, which has almost 15 percent of the containers transportation of the world and is the largest of the sector, is that trade of goods in the coming years will grow around 10 percent. “It will take several years for large cargo containerships, as the Triple E, to arrive to Latin America, as the traffic of goods in this region of the world is still small”. So was said to EL TIEMPO by Domingo Chinea, manager of Sociedad Portuaria of Buenaventura, who assured that although economies such as Brazil, Chile, Mexico, Colombia and Argentina have grown, they receive vessels with a maximum capacity of 9,500 containers. The Triple E, as those just released by Maersk, “will arrive to the region in about 20 years”, estimated Chinea.

- 27. July- September 2013 THE P3 ALLIANCE: HOW WILL PORTS BE AFFECTED? The recent decision of Maersk Line, MSC and CMA CGM to form a mammoth vessel sharing alliance in the three major east-west trades has stirred up shippers, but the port sector must be equally concerned, Drewry informed. As announced, this three megalines intend to share vessels in the Asia-Europe, Transpacific and Transatlantic trades from 2Q 14. A total of 255 ships will be operated in 29 loops with a combined capacity of 2.6 million TEU. The ramifications of the consolidation for the port industry are enormous. Each of the three carriers already operates more ULCVs than anyone else, so catering for their combined cargo handling requirements will be on a scale never seen before. Not surprisingly, views are divergent on whether the three will consolidate/rationalize their port calls, therefore. Whilst economies of scale are there for the taking, it will result in tampering with the well-established berthing windows of each schedule, and the feeder/ intermodal connections of each carrier, which will, presumably, remain separate. Moreover, all three have ‘family connections’ to terminal operating companies, so choosing the best port and terminal will not only come down to the best for each job. Maersk is connected to APM Terminals, MSC to Terminal Investments Limited (TIL), and CMA CGM to Terminal Link, and each has particular port preferences. For example, APM Terminals has a presence in Bremerhaven, where Maersk has more than 10 port calls a week, but not Hamburg, and MSC prefers Antwerp over Rotterdam. The following table shows this picture in more detail in the Far East, Europe and North America. For ports and terminals to be selected for the P3 network, the main criteria will be the ability to handle ULCVs efficiently, with little margin for error. Quays will have to be long and deep, and each terminal will have to be equipped with cranes capable of spanning around 21-22 rows across deck. A minimum of three to five of these are required for the efficient handling of the large box ships. The following table indicates what is currently available at present in this respect. Will not include the vast majority of Latin American ports

- 28. July- September 2013 Although services from Asia to the US East Coast via either Los Angeles or the Panama Canal will be included in the P3 Alliance, Container Management informed that Robert van Trooijen, president of Maersk Line for Latin America and the Caribbean, has confirmed that P3 will not include Latin American ports with the exception of Mexico’s Altamira and Veracruz, as the Asia–Latin America and Latin America-Europe routes are not part of the operational alliance. CHINESE MERCHANT VESSEL MAKES ITS FIRST VOYAGE THROUGH THE ARCTIC (northeast) to the Behring Strait. Upon crossing this strait, the freighter took the North-East sea route bordering the northern coasts of Siberia and then surrounding Norway, having arrived in September to its port of destination, Rotterdam. This polar shortcut by the Arctic, possible during the summer months thanks to global warming and melting is, according to Cosco, a “golden route” that saves between 12 to 15 days compared to traditional routes. The first voyage through the Arctic of a Chinese commercial freighter shows the polar ambitions of Peking and opens the possibility for the first world exporter to deliver its goods quicker, as stated by experts, informed Mundo Marítimo that got the news from AFP. Last August, a giant Chinese freighter from maritime transportation Cosco departed from the port of Dalian The North-East sea route, in which Russia

- 29. July- September 2013 facilitates navigation by imposing rental of the icebreaker, should have an ever more important role in international exchanges. “This will potentially transform the scheme of world trade”, stated Sam Chambers of the SinoShip magazine. Around 90% of Chinese commercial exchange is done by sea and in this country some persons consider that seven years from now, between 5% and 7% of international trade of the second economy of the world could transit by the Arctic. The opening of the Arctic “will considerably reduce maritime distances between Chinese, European and North American markets”, explained Qi Shaobin, professor of the University of the Sea of Dalian, quoted by the Chinese press. For China, the new North-East sea route allows preventing delays at the Suez Canal and reduces in several thousand kilometers its journeys to Europe, its first commercial partner. Savings, especially in fuel, will be considerable. Last year, China exported to the European Union 290 billion Euros (US$ 386.6 billion) in merchandises. Peking expects that this polar shortcut will also benefit the development of the northeastern ports of the country. On the other hand, China, the first consumer of energy worldwide, covets the large hydrocarbon reserves which would house the Arctic. These resources are ever more accessible because of the decrease of the polar cap. Peking is playing its cards in this region and, after several years of a diplomatic campaign, it obtained in May the status of observer at the Arctic Council, an intergovernmental cooperation forum. “The opening of the new sea transportation route shows that China is more involved in matters of the Arctic Ocean”, confirmed Zhang Yongfeng, researcher based in Shanghai, specialized in sea transportation. However, the immediate scope of polar shortcuts downplays. “In the short-term, the economic interest on sea transportation is not truly great”, he states. “The navigation period of the passage is relatively short and port infrastructures along the way are incomplete”, explains Zhang. In fact, traffic through arctic waters is yet incipient if compared with traditional routes via the Panama Canal (15,000 movements per year) or the Suez Canal (19,000). The volume of goods transported by the NorthEast route should multiply in the coming years: from 1.26 million tons last year, it will move to 50 million tons in 2020, according to the Federation of Norwegian Shipowners.

- 30. July- September 2013 LATIN AMERICA AND THE INTERNATIONAL TRADE AGREEMENTS THE PACIFIC ALLIANCE REPRESENTS 50% OF LATIN AMERICAN TRADE fuel and mining, agriculture and manufactured products; therefore its offer is complementary to the Asia Pacific markets. The strong trade of the block is supported, for example, in Chile with 22 trade agreements with more than 60 countries. Colombia and Mexico, as such, have 12 Free Trade Agreements (FTA) with 30 and 40 markets at global level, respectively, while Peru has 15 trade agreements with 50 countries. Worth noting is that the Gross Domestic Product (GDP) of the four countries of the group represent 35% of the total GDP of Latin America and the Caribbean, and its average growth rate was 5% in 2012, higher than the 3.2% entered worldwide during that year. Latin Business Chronicle, news taken from El Mercurio/GDA, informed that the economic weight of the Pacific Alliance (PA) in Latin America stands on various facets, especially when speaking of trade, as the block integrated by Chile, Peru, Mexico and Colombia concentrated 50% of flows to and from the region in 2012. Besides, the countries of the Alliance represent 26% of total flows of Direct Foreign Investment of Latin America and the Caribbean. According to last year registrations of each member country of the group, consolidated exports of the economic group to the world amounted to US$556 billion, while imports amounted to US$551 billion. Thereby, half of regional trade involved markets of the Pacific. The principal exports to countries of the PA are As an economic block, Colombia, Chile, Mexico and Peru add up a total population of more than 209 million persons, which represents more than 36% of Latin American total. Likewise, the GDP per capita of the Alliance arrives to US$10,011. Panamá sees the Pacific Alliance as a Development Factor of the Canal On the other hand, La Prensa informed that Vice-minister of Foreign Affairs of Panama, Mayra Arosemena, emphasized during the Ibero-American Summit in Madrid the importance of the Pacific Alliance as user of the Panama Canal and the interest this integration project has beyond the continent. In an interview with Efe, the Vice-minister

- 31. July- September 2013 enter as full-right member to the commercial block of the Pacific, to which Costa Rica will join in the first place after ratifying its agreement with Colombia. affirmed that the Pacific Alliance is acquiring “a global importance” and therefore many countries want to participate as observers, such as the European Union, Australia, or New Zealand. Panama only lacks signing a commercial promotion treaty with Mexico to MERCOSUR NEEDS TO REINVENT Mercosur arrived to its 45th Presidential Summit with the challenge of overcoming its persistent conflicts and asymmetries, and advancing in the negotiations of the agreement with the European Union (EU), a step that would also revive its regional leadership, threatened by The Alliance will become the second world user of the Panama Canal, and the Vice-minister declared it is of the utmost importance for them. “Panama became the transit zone between Asia and Europe and therefore we are a country that accepts foreigners as part of our lives”, she stated. She also assured that the Pacific Alliance has as one of its axes facilitating and greater cooperation among Central American countries, giving the example of Honduras and Guatemala that are now in the process of complying with necessary requirements to enter into this treaty. initiatives as the Pacific Alliance, as informed by Latin Business Chronicle with news from EFE. The block formed by Argentina, Brazil, Uruguay, Venezuela and Paraguay (suspended a year ago), was created 22 years ago, but the internal disputes and stagnant negotiations with other blocks, as the EU, have diminished the relevance of its integration proposal. “Mercosur has to reconsider what the years of stagnancy in negotiations really suppose because, otherwise, these opportunities will be profited by the countries of the Pacific Alliance”, formed by Chile, Colombia, Mexico and Peru, declared recently the State Secretary of Commerce of Spain, Jaime García-Legaz. According to experts, the ideological tone assumed by Mercosur in the last years has caused this block to fall behind important

- 32. July- September 2013 commercial negotiations. “Evidently, political changes occurred in member countries have included changes in the viewpoint of trade (…) Two examples are the decision of Argentina of not complying with certain clauses and the entry of Venezuela to Mercosur”, assured the economist and researcher Hernando Zuleta, professor of the Colombian Universidad de los Andes. The dynamics of Mercosur, an economic zone with 270 million inhabitants (70 percent of total South American population) has been further affected by exchange and commercial restrictions, which manifest in closed or protectionist measures among partners. “Many times, foreign trade of the block operates as in a centralized planned economy. This, which is fatal in terms of efficiency, facilitates negotiations: ‘Send me meat and I will send you oil’”, stated Zuleta. Under these terms, Mercosur, that within its economic and political model has “not demonstrated an interest in opening its borders”, could strengthen under the “natural” leadership of Brazil, the largest Latin American economy, said, on the other hand, Martín Ibarra, president of Ibarra y Araújo, consultant firm in international businesses. However, for Zuleta “during the last years Brazil has not been the main character in adopting changes” but, on the contrary, Argentina was the “determinant” in matters as the suspension of Paraguay and the entrance of Venezuela. A recent report of the National Industry Confederation (CNI) of Brazil assures this country and its partners of Mercosur will remain “isolated” if no alternatives are procured to sign new commercial agreements. Brazil “risks losing more space in its exports markets if it does not fully enter the global game of seeking new international trade partnerships”, stated CNI when referring to the Pacific Alliance, “countries that altogether have 35 percent of Latin American Gross Domestic Product (GDP) and 3 percent of world trade”. The same report considered that all above mentioned countries have free trade agreements with the United States and the EU, in which Brazil is not included and that only has “22 preferential agreements, most of them of little relevance”. Comparing Mercosur with the Pacific Alliance, García-Legaz believes the latter, despite being only one year old, “is a winning alliance of countries betting on strong institutions, market economy, and free trade”. Lack of progress in commercial matters of Mercosur is of great concern above all to Uruguay and Paraguay, the two minor economies that seek to extend and diversify its markets and that have started to see an alternative in the Pacific Alliance, in which they have already been admitted as observers.

- 33. July- September 2013 Events SUCCESSFUL OUTCOME OF TOC AMERICAS IN MIAMI Victor Gallardo of containers. The 2013 version of the conference and exhibition TOC CSC (Container Supply Chain) Americas was as its predecessors, a total success. More than 400 international delegates attended the two axes conferences (cold chain and containerized logistics chain), highlighting a large Latin American audience from Mexico and the Caribbean to Chile, which meant more than 50% of total assistance to the conferences, thanks to the efficient management of the TOC representative for Latin America and director of the publication Mundo Marítimo of Chile, Víctor Gallardo. During the event, held on October 1-3 in Miami, sponsored by the Port of Miami and the support of Latinports, attendees could learn about and share with the principal actors of the containers transportation industry, also having the opportunity to discuss the best practices to handle perishable cargo and the logistics chain Executive Director of Latinports among Top Rapporteurs As in previous years, the 2013 version had an important quota of world-category rapporteurs who presented important topics on the industry, as for example, in reference to large containerships and mega hubs. The executive director of Latinports, Julián Palacio, presented an interesting conference on the decline of the commercial relationship of the United States with Latin America and the boom of China in relation with the region. Conferences were complemented with traditional networking activities and an exhibition hall that was a complete success. Visitors were able to see and compare equipment and services among more than 70 exhibition companies. Worth noting was that the event had the important presence of representatives of manufacturers of cutting

- 34. July- September 2013 edge equipment, recognized worldwide, and the important participation in the exhibition of ports and operators of the region. Visitors to the exhibition could also enjoy for the first time the conference TECH TOC, technical seminars on technology, productivity and port services, where renowned specialists shared their knowledge of the business with those present. Miami Airport Convention Center TOC CSC Americas 2014 After the success of Miami 2013, the next organizer will be the Colombian Port of Cartagena, where will take place this important event in October 2014. More than 30 stands have already been reserved and more than 100 persons have pre-registered one year in advance. Do not miss the TOC CSC Americas 2014 conference that promises to be the most successful to date. Wait for... Organized by TOC Events Worldwide With the sponsorship of the Panama Canal and the support of Latinports

- 35. July- September 2013 Latin American Port News Argentina Buenos Aires Receives the Largest Vessel that has Arrived to Latin America Brazil Tender for 50 New Private Terminals in Brazil The tender process has started for the first 50 private use terminals (TUPs) that are to be built in Brazil under the new Ports Law, with a majority of them to be constructed in the North Region, Port Finance International informed. Representing a private investment of approximately $4.9 billions, the 50 new terminals are expected to handle 105 million tonnes a year of general cargo, containers, solid and liquid bulk. On July 25 this year the largest vessel ever to call at the Port of Buenos Aires and in South America, the 322 meters long Cap San Nicholas, owned by Hamburg Süd, was handled at the APM Terminal 4 facility in buenos Aires. This was the first of six 9.700 TEs capacity Cap San class vessel that will be introduced by Hamburg Süd’s Asia/South Africa/East Coast South America service. Brazil’s President Dilma Rousseff unveiled the list of tenders on July 3rd: 27 terminals will be set up in the North Region (totalling $ 0.8 billion in investment); 12 terminals in the Southeast Region ($2.1 billions); five in the South Region ($68.2 million); three in the Northeast Region ($2 billions); and three more in the Central-West Region ($19.5 million). The National Agency of Water Transportation (Antaq) has already received 123 requests to operate these new TUPs. The government says that if other companies express their interest, it may include them in the process. The deadline for submission of proposals is August 5th and the issuance of permits will begin on September 21st. The process will last no more than 120 days, says the Brazilian government. Once a building authorisation is granted, the concessionaire will have three years to start operating the terminal. The initiative aims at increasing Brazil’s port capacity and increasing competition.

- 36. July- September 2013 Chile Chile Announces Development of Investments for more than US$1.8 billion in Projects for Modernization of Ports According to a communication of the Presidency of the Republic, the program started in 2011 includes awarding concessions for 8 of the 10 state ports: Iquique, Antofagasta, Coquimbo, Valparaíso, San Antonio, Talcahuano, Puerto Montt and Chacabuco. “We are improving competitiveness of the country and repositioning Chile as a leading site in the regional market of ports”, explained the Minister of Transportation and Telecommunications, Pedro Pablo Errázuriz. Materialization of the greatest modernization program of port infrastructure since the approval of the Law for the Modernization of the State Port Sector of 1997 was presented by the President of the Republic, Sebastián Piñera, altogether with the Minister of Transportation and Telecommunications, Pedro Pablo Errázuriz, in Valparaíso. “We have consolidated a successful model of growth starting concession processes at 8 of our 10 state ports, with investment projects higher than US$1.8 billion”, explained Minister Errázuriz. The chief of Transportation stated in detail that through this program of investments the capacity of cargo transfer of the country will increase in more than 40 million tons, assuring that the different regions will have the port services they require in the short- and medium-term. “In this way we are improving competitiveness of the country and repositioning Chile as a leading position in the regional market of ports”, explained the authority. The infrastructure modernization program started in 2011 with the award of concessions for the ports of Coquimbo, San Antonio and Talcahuano, investment amounting to US$543.9 millions. In 2013, Terminal 2 of the Port of Valparaíso was granted, a project with investments of US$507 millions. In the meantime, in the coming months the tender for berthing fronts is under process at the ports of Iquique, Antofagasta, Puerto Montt and Chacabuco, with investments amounting to US$556 millions. Pedro Pablo Errázuriz explained that this program is framed within a global process of the Ministry of Transportation and Telecommunications that has enabled giving a turn to port planning, by incorporating a strategic and integral view to resolve the needs of today, but especially to face requirements for the next decades. In this sense, Errázuriz anticipated that this semester will be presented the National Plan for Port Development (PNDP, in Spanish). “This is the instrument that will allow assuring investment plans of the port system as a whole, including road and railway

- 37. July- September 2013 solutions, and also extension zones and logistics support. The PNDP will mark the route for the development of the port industry for the next decades as support for national economic growth”, added the Minister of Transportation. Large Scale Port Errázuriz furthermore confirmed that works are rapidly underway in the project of the Large Scale Port to be built in the Region of Valparaiso in response to the growth projected for port demand in the central macro-zone, that is, from the regions of Coquimbo to the Maule. In this respect, he stated, there are location options at the coast of Valparaíso and San Antonio, and the decision to be adopted on the construction site of the new port will be made according to the equilibrium between technical, logistics, economic and social factors. “In particular, as a country we need that the new terminal complies with the highest standards of design and port equipment; with safe and efficient turning areas; with good roads and railway connectivity, and besides with the capacity to grow at reasonable prices, among other characteristics”, stated Minister Errázuriz. Colombia ICTSI and PSA Join Forces for Buenaventura Project International Container Terminal Services Incorporated (ICTSI) and PSA International (PSA) disclosed the signing of an agreement to jointly develop, construct and operate a new container terminal at the Colombian Pacific port of Buenaventura, Alphaliner informed in mid-September. The agreement involves PSA’s investment in Sociedad Puerto Industrial Aguadulce S.A. (SPIA), an indirect subsidiary of ICTSI, which holds the 30 - year concession for the so-called ‘Aguadulce Port Project’ granted by National Infrastructure Agency. Under the terms of the agreement, PSA indirectly acquired a 45.64% share in SPIA. ICTSI and PSA will thus be equal partners in the terminal development vehicle, whereas local partners continue to hold the remaining 8.72%. Aguadulce will be the third container terminal at Buenaventura, adding to Port Society of Buenaventura, into which DP World this year bought in, and to the 2011-launched TCBuen Terminal. Contrary to all previous terminals at Buenaventura, which have been built on the southern side of the tidal bay on which the city is located, the Aguadulce terminal will be built further north. This means that all surrounding infrastructure such as roads and electricity supply have to be developed in parallel. An official launch date for the new terminal has not been provided, but a construction period of two to three years seems realistic for a greenfield development.

- 38. July- September 2013 Pacific invests US$1 billion in infrastructure Portafolio informed that through the firm Pacific Infrastructure, controlling 41.4 percent of outstanding shares, Pacific Rubiales Energy are currently investing $1 billion in the country, only in infrastructure. It is also promoting a possible mega-work in the railway sector that if successful, would imply a similar amount for an important investment in this system. So was affirmed by the president of Pacific Infrastructure, Juan Ricardo Noero, who states that, in particular, this will amount to US$ 500 million for Puerto Bahía, a new import and export terminal of liquids with storage facilities and cargo handling for 3.3 million barrels. Besides, 400 million dollars will go to Olecar, a 130 km pipeline, with an initial transportation capacity of 300,000 barrels per day, connecting the facilities of Puerto Bahía and Coveñas. No coal will be transported, but it will handle three types of cargo: containers, general cargo and bulk cargo. The firm is also promoting the project for a railway interconnecting Cartagena and Barranquilla with the hinterland, and its final plan could takeoff in the short-term. Total short-term investments of the company, states Noero, amount to $1 billion in expansion works for the target sector. The company also reached an agreement with the International Finance Corporation (IFC), branch of the World Bank, to enter as partner with an investment of $150 million. This allowed the IFC in August to hold 27.2 percent of the subscribed capital of Pacific Infrastructure. “We believe that the best way for the development of the country is through projects that make life easier for consumers, as the construction of roads, ports and railways generates employment, investment, confidence, lower transportation costs and will attract other industries to our businesses, especially in the Department of Bolívar”, he said. Resources of the private bank and funds of capital are also being used to finance investments as they are aware that large-size works, especially roads and ports, are moving forward. Ecuador Third concession process of the port of Manta will start in November Mundo Marítimo, quoting the newspaper Hoy of Guayaquil, informed that delivery of the