Weitere ähnliche Inhalte Ähnlich wie NewBase 11-January-2023 Energy News issue - 1582 by Khaled Al Awadi_compressed.pdf (20) Mehr von Khaled Al Awadi (20) Kürzlich hochgeladen (20) 1. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 1

NewBase Energy News 12 January 2023 No. 1582 Senior Editor Eng. Khaed Al Awadi

NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE

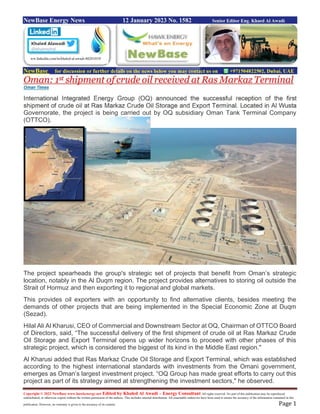

Oman: 1st shipment of crude oil received at Ras Markaz Terminal

Oman Times

International Integrated Energy Group (OQ) announced the successful reception of the first

shipment of crude oil at Ras Markaz Crude Oil Storage and Export Terminal. Located in Al Wusta

Governorate, the project is being carried out by OQ subsidiary Oman Tank Terminal Company

(OTTCO).

The project spearheads the group's strategic set of projects that benefit from Oman’s strategic

location, notably in the Al Duqm region. The project provides alternatives to storing oil outside the

Strait of Hormuz and then exporting it to regional and global markets.

This provides oil exporters with an opportunity to find alternative clients, besides meeting the

demands of other projects that are being implemented in the Special Economic Zone at Duqm

(Sezad).

Hilal Ali Al Kharusi, CEO of Commercial and Downstream Sector at OQ, Chairman of OTTCO Board

of Directors, said, “The successful delivery of the first shipment of crude oil at Ras Markaz Crude

Oil Storage and Export Terminal opens up wider horizons to proceed with other phases of this

strategic project, which is considered the biggest of its kind in the Middle East region."

Al Kharusi added that Ras Markaz Crude Oil Storage and Export Terminal, which was established

according to the highest international standards with investments from the Omani government,

emerges as Oman’s largest investment project. “OQ Group has made great efforts to carry out this

project as part of its strategy aimed at strengthening the investment sectors," he observed.

ww.linkedin.com/in/khaled-al-awadi-80201019/

2. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 2

Al Kharusi pointed out that the basic construction works of the first phase were completed and that

the commissioning of the terminal would encourage investors from across the world to invest in

other phases of the project.

Meanwhile, Salem Marhoon Al Hashemi, General Manager of Ras Markaz Terminal, expressed his

delight at the successful commissioning of commercial operations at the project and the reception

of the first shipment of crude oil.

"The capacity of Ras Markaz Crude Oil Storage and Export Terminal is subject to technical

considerations and the preferences of investors. The basic construction works of the first phase

included all the work requirements of crude oil storage terminals in the world according to the

approved international standards. The terminal will be ready to receive 26.7 million barrels of crude

oil. More storage tanks could also be added to meet any further investment demands," he added.

Ras Markaz project is situated in Al Wusta Governorate. It aims to store and blend all kinds of crude

oil in big quantities, thanks to its advanced infrastructure that is capable of meeting the future

demands of local and international markets.

3. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 3

Oman: Masirah Oil completes Oman Block 50 drilling campaign

Source: Masirah Oil

Masirah Oil, a subsidiary of Rex Internatioal, has announced the completion of the 4Q 2022 drilling

campaign, which consisted of a workover of the Yumna-3 well and drilling of the Yumna-4

well. Operations were conducted in Block 50 offshore Oman.

The workover of Yumna-3 consisted of replacing the electrical submersible pump (ESP) in

the well. With the new ESP, Yumna-3 is now producing an average of 4,050 bopd as compared

to 3,590 bopd with the previous ESP.

Yumna-4 was drilled as a dual objective well to test (a) the eastern extension of the Aruma

reservoirs of the Yumna Field and (b) an exploration target below and north-east of the field.

The well was successful at the Aruma level, where it penetrated 9.6 metres of net oil

pay, consistent with the pre-drill prognosis. The well was completed for production and has

flowed at 4,050 bopd. The flow rate has yet to stabilise.

After drilling to the Aruma target and setting a 9 5/8” casing, the well was deepened and

directionally drilled to the north-east to test a structural closure in the Khufai carbonate formation at

about 3,000 metres. The well reached a total depth of 3,416 metres. Oil shows were encountered

in the Khufai and 16.5 metres of core was recovered from the formation. The core has been sent to

a laboratory for detailed analysis. However, the planned formation evaluation programme could not

be completed due to a stuck wireline tool which could not be fished (recovered) from the borehole.

Results of the core analysis will likely determine if additional drilling / evaluation of this Khufai

prospect is justified. Masirah Oil is the Operator and holds a 100 per cent interest in Block 50 Oman.

4. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 4

China Scoops Up Rare Russian Oil as Top Buyer Boosts Imports

Bloomberg + NewBase

China is importing a wider variety of Russian crudes, including the lesser-known Arco grade, just as

the nation doubles down on purchases.

Buyers snapped up three cargoes of crude from the Arctic including the highly sulfurous and dense

Arco variety for arrival this month or in February, according to Vortexa Ltd., with data showing the

first China-bound flows in November. Traders said the purchases may displace some Middle

Eastern barrels, such as Iraq’s Basrah Heavy.

Another data and analytics firm, Kpler Ltd., said China’s latest round of purchases included

Varandey and a lighter variety known as Novy Port.

Beijing’s warm relations with Moscow have seen it boost imports of Russian oil since the outbreak

of the Ukraine war, replacing European and US buyers. The unusual purchases of Arctic oil come

after China’s daily crude and condensate imports hit the second-highest on record last month,

according to Kpler.

5. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 5

Independent processors have sought to use up import quotas since late last year as the nation

pivoted away from Covid Zero, aiding demand.

“The rerouting of Arctic grades is absolutely taking place,” said Viktor Katona, Vienna-based lead

oil analyst at Kpler, highlighting the date when EU sanctions on Russian crude imports came into

force. “Russia’s Arctic grades were among the Europe-oriented streams that since Dec. 5 have to

find new homes elsewhere, and in all of those cases, it’s pretty much an India and China split.”

Sellers are indicating a discount of at least $10 a barrel to the ICE Brent price for March-arriving

Arco on a delivered basis, more affordable than comparable grades, traders said. Brent futures

were last near $79 a barrel.

Arco is pumped from the Prirazlomnoye field in the Arctic, and it is among three grades shipped out

of Murmansk, along with Varandey and Novy Port. Six vessels that loaded cargoes from Murmansk

last month were headed to India, another big buyer of Russian barrels amid the Ukraine war,

Bloomberg tracking data show. Varandey has become popular with Indian users.

While Varandey is relatively well-known to Asian buyers, Arco and Novy Port are less familiar in the

region. Most Arco used to go to the UK and the Netherlands, while Novy Port also had a focus on

Dutch buyers, Katona said.

China this week issued around 112 million tons of crude-import quotas to refiners and traders in its

latest allocation for this year. The sizable quota, coupled with a generous fuel-export concession,

could support the nation’s crude purchases as well as refinery run rates in the coming months.

6. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 6

Russian Oil Small Gain Sales Can't Reverse Grinding Downtrend

Julian Lee - (Bloomberg)

Russia's oil exports made a small gain last week, but not by enough to prevent what appears for

now to be a downtrend in the nation's shipments to a diminished group of buyers.

Aggregate flows of Russian crude rose by 197,000 barrels a day, or 8%, in the seven days to Jan.

6. Pacific shipments were up by 200,000 barrels a day from the previous week, while those from

the Arctic gained by 143,000 barrels a day, more than offsetting a decline in volumes leaving the

Black Sea.

The increase didn't prevent the country's four-week average, which smooths out peaks and troughs

in what are noisy weekly data, from decreasing for the fourth straight week. And it is apparent that

those countries that provided a lifeline for Moscow are starting to look less supportive than they

were last year.

That could spell trouble for Russia, which hasn't managed to diversify its pool of buyers since Europe

all but halted purchases early last month.On a four-week average basis, the total seaborne flow to

Jan. 6 was down by more than 500,000 barrels a day from a plateau level of about 3 million in the

second half of last year, dropping below 2.5 million for the first time since Bloomberg began

compiling the data at the start of 2022.

This measure will almost certainly rise in the coming week, as a mid-December, weather-related

slump that saw weekly flows collapse by more than half, falls out of the calculation.

7. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 7

The volume of crude on vessels heading to China, India and Turkey, the three countries that

emerged as the only significant buyers of displaced Russian supplies, plus the quantities on ships

that are yet to show a final destination, fell for the fourth straight time in the four weeks to Jan. 6 to

average 2.31 million barrels a day. That’s down by 140,000 barrels a day from the period to Dec.

30, and the lowest in 10 weeks.

With most of the ships yet to show destinations likely to end up in India or China, the slump in flows

to Turkey was particularly dramatic. Imports from Russia, which rose to almost 400,000 barrels a

day in September, slumped to just 21,000 barrels a day over the past four weeks, vessel-tracking

data monitored by Bloomberg show. That’s even lower than they were before Moscow’s troops

invaded Ukraine last February.

Inflows to the Kremlin's war-chest from crude export duties plunged. While lower flows and an

easing of crude prices have played a part in that drop, so too has a change in the formula used to

calculate duty rates, as the country continues its long shift away from taxing exports by increasing

the burden on production.

The European Union’s import ban on Russia crude has led to much longer voyages for shipments,

with journeys now taking an average of 31 days from Baltic ports to India, compared with just seven

days from the same terminals to Rotterdam and about half that to Poland. That’s putting more

pressure on the dwindling fleet of ships whose owners are willing to haul Russian cargoes.

The country is increasingly reliant on its own ships and a so-called “shadow fleet” of usually older

ships owned by small, often unknown companies that have sprung up in recent months. European-

8. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 8

owned tankers can still carry Russian crude, as long as it is sold at a price below a $60 a barrel cap,

introduced at the same time as the import ban. But few are now doing so.

There has also been a resurgence in ship-to-ship transfers of cargoes in the Mediterranean, with

cargoes either being combined onto larger vessels or shifted from ice-class tankers onto other

vessels in order to free up those vessels needed for operations in the Baltic in the winter months.

That has been visible both off the Spanish north African city of Ceuta and off the Greek coast near

Kalamata.

The VLCC Lauren II has completed the transfer of three 100,000-ton cargoes at Ceuta and the Sao

Paulo took two before heading through the Suez Canal. Lauren II is now riding too deep in the water

to pass through the canal and is likely to head around Africa to Asia.

Elsewhere, shuttle tankers that haul Russia’s Sokol crude are waiting much longer than usual to

transfer cargoes to other ships off the South Korean port of Yeosu, reducing the number of cargoes

they are able to lift each month.

Tankers hauling Russian crude are becoming more cagey about their final destinations. Vessels

carrying almost 25 million barrels of Russian crude, the equivalent of 880,000 barrels a day of

exports, left port showing no clear final destination in the four weeks to Jan. 6. It remains likely that

many leaving Baltic and Black Sea terminals will begin to signal Indian ports once they pass through

the Suez Canal.

Crude Flows by Destination:

On a four-week average basis, overall seaborne exports fell by 159,000 barrels a day. At 2.481

million barrels a day, four-week average flows are the lowest since Bloomberg began compiling

Russian crude exports in detail at the beginning of last year. Shipments to Europe have dried up

almost completely, while those to Asia also slipped. Exports declined even as pipeline supplies to

9. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 9

Germany halted from the beginning of the year, freeing up as much as 300,000 barrels a day more

crude for delivery to coastal export terminals.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. These are shipments made

by KazTransoil JSC that transit Russia for export through Ust-Luga and Novorossiysk.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since

the invasion of Ukraine by Russia, Kazakhstan has rebranded its cargoes to distinguish them from

those shipped by Russian companies. Transit crude is specifically exempted from the EU sanctions.

Four-week average shipments to Russia’s Asian customers, plus those on vessels showing no final

destination, which typically end up in either India or China, edged lower fell for a second week in

the period to Jan. 6. While the volume heading to India appears to have slumped, history shows

that most of the cargoes on ships initially showing no final destination end up there.

The equivalent of more than 480,000 barrels a day was on vessels showing destinations as either

Port Said or Suez, or which have already been or are expected to be transferred from one ship to

another off the South Korean port of Yeosu. Those voyages typically end at ports in India and show

up in the chart below as “Unknown Asia” until a final destination becomes apparent.

The “Unknown” volumes, running at almost 400,000 barrels a day in the four weeks to Jan. 6, are

those on tankers showing a destination of Gibraltar, Malta or no destination at all. Most of those

cargoes go on to transit the Suez Canal, but some could end up in Turkey. An increasing number

are being transferred from one vessel to another in the Mediterranean for onward journeys to Asia.

Russia’s seaborne crude exports to European countries fell to 146,000 barrels a day in the 28 days

to Jan. 6, with Bulgaria the sole European destination. These figures do not include shipments to

Turkey.

10. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 10

A market that consumed more than 1.5 million barrels a day of short-haul crude, coming from export

terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by

long-haul destinations in Asia that are much more costly and time-consuming to serve.

No Russian crude was shipped to northern European countries in the four weeks to Jan. 6.

Exports to Mediterranean countries continued to fall, slipping to 21,000 barrels a day on average in

the four weeks to Jan. 6 setting a new post-invasion low. Flows to the region fell for a ninth week.

Turkey was the only destination for Russian seaborne crude into the Mediterranean, but flows there

are also dwindling. Turkey was one of the countries that boosted imports after Moscow’s troops

invaded Ukraine, and it is surprising to see flows falling so fast now, as the country is not a party to

the EU’s import ban and had been seen as a key market for the country’s crude after European

buyers shunned Russian crude.

Flows to Bulgaria, now Russia’s only Black Sea market for crude, fell for a second week, slipping to

146,000 barrels a day. Bulgaria secured a partial exemption from the EU ban, which should support

inflows now that the embargo has come into force.

Flows by Export Location

Aggregate flows of Russian crude rose by 197,000 barrels a day, or 8%, in the seven days to Jan.

6. Increases in Pacific and Arctic shipments were partly offset by a decline in volumes leaving the

Black Sea, which were down by 146,000 barrels a day. Shipments from the Baltic were unchanged

from the previous week.

Figures exclude volumes from Ust-Luga and Novorossiysk identified as Kazakhstan’s KEBCO

grade.

11. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 11

Export Revenue

Inflows to the Kremlin's war chest from its crude-export duty fell by $52 million, or 48%, to $57 million

in the seven days to Jan. 6, while the four-week average income fell by $22 million to $88 million.

The big drop reflects a change in the way duty is calculated that came into effect at the start of

January.

The January duty rate is $2.28 a barrel, based on an average Urals price of $57.5 a barrel, according

to figures from the Russian Ministry of Finance. The drop from $5.91 a barrel in December is due in

part to a change in the formula used to calculate duty rates for 2023, with the country moving away

from taxing exports and shifting the burden to production as part of its multi-year tax maneuver. The

plan sees export duty phased out entirely by the start of 2024.

Origin-to-Location Flows

The following charts show the number of ships leaving each export terminal and the destinations of

crude cargoes from the four export regions.

A total of 26 tankers loaded 19.7 million barrels of Russian crude in the week to Jan. 6, vessel-

tracking data and port agent reports show. That’s up by 1.3 million barrels, or 8%, from the previous

week. Destinations are based on where vessels signal they are heading at the time of writing, and

some will almost certainly change as voyages progress. All figures exclude cargoes identified as

Kazakhstan’s KEBCO grade.

The total volume on ships loading Russian crude from Baltic terminals was unchanged from the

previous week, but still about 300,000 barrels a day down from the levels seen for much of 2022.

12. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 12

Shipments from Novorossiysk in the Black Sea fell back in the period to Jan. 6 after two weeks of

gains. Almost half of the volume lifted is on tankers yet to signal a destination.

Arctic shipments jumped to their highest in two months, with three suezmax tankers leaving from

Murmansk during the week. All are heading to Asia via the Suez Canal.

Flows from the Pacific rose to a four-week high, with shipments of Sokol crude resuming after no

cargoes were loaded in the final week of 2022.

All Sokol cargoes are shuttled to an area off the South Korean port of Yeosu, where they are

transferred to other ships for onward delivery. Shuttle tankers are now often waiting for several days

before transfers take place, reducing the number of cargoes they can load. These cargoes are the

ones with unknown destinations, with all recent ones eventually heading to India or China.

Note: This story forms part of a regular weekly series tracking shipments of crude from Russian

export terminals and the export duty revenues earned from them by the Russian government.

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia

and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

Note: Data on crude flows can also be found at {DSET CRUDE }. The numbers, which are generated

by a bot, may differ from those in this story.

Note: Aggregate weekly seaborne flows from Russian ports in the Baltic, Black Sea, Arctic and

Pacific can be found on the Bloomberg terminal by typing {ALLX CUR1 }.

13. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 13

India expects utilities' annual coal demand to surge about 8%

after renewables shortfall. Reuters + NewBase

The world's third-largest energy consumer and emitter of greenhouse gases has been clinging to

coal for energy security

India expects its power plants to burn about 8% more coal in the fiscal year ending March 2024,

according to a senior government official and a power ministry presentation, after the country missed

its 2022 renewable energy goal by more than 30%.

The world's third-largest energy consumer and emitter of greenhouse gases has been clinging to

coal for energy security as it tries to get its economy back on track after a COVID slowdown and

stave off power shortages that led to idled factories and villages without electricity during a blistering

heatwave.

India expects utilities' coal demand to reach 821 million tonnes in 2023-24, according to the

presentation. The government official said that would be about 8% more than demand during this

fiscal year.

Two government officials familiar with the matter said that because of COVID constraints, India

added only 120 gigawatts (GW) of renewable energy to its power grid by 2022, short of its target of

175 GW.

At the same time, an uptick in economic activity and the heatwave during the first quarter triggered

a surge in power demand - an increase the government expects to persist in 2023-24, according to

the senior official and the presentation, seen by Reuters.

FILE PHOTO: A man walks past heaps of burning coal to make it for

domestic use such as for cooking purposes at Dhanbad district in the

eastern Indian state of Jharkhand September 20, 2012.

14. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 14

India is expected to produce 1,255 terawatt-hours (tWh) of power using coal in 2023-24, the official

said, compared with 1,180 tWh of power from coal this fiscal year. The government hopes to add

16 GW of renewable energy in the next fiscal year, a 13% increase in current installed capacity.

The federal power ministry did not immediately respond to a request seeking comment, but has said

India would continue to depend on coal but gradually cut down on its usage.

State-run Coal India, which accounts for 80% of India's coal production, is seen supplying 620

million tonnes to the power sector in 2023-24, compared with a projected 580 million tonnes in 2022-

23, according to the presentation, made to the federal power minister on Dec. 29.

Coal India, the world's largest miner, is expected to produce 770 million tonnes of coal in 2023-24,

leaving it with more to sell at higher margins to the non-power sector.

India is expected to

produce about 735 million

tonnes of domestic coal in

the 2022-23 fiscal year,

according to the

presentation.

The government has

estimated that the coal

demand can't be met

through domestic sources

and because of logistical

challenges, and has asked

power plants to import 6%

of their requirement.

Availability of trains for

transportation of coal were

at least 11% short of

targets on an average

during both the first and

second half of the 2022-23

fiscal year, according to the

presentation.

The federal push to increase imports by the world's second-largest coal importer could drive up

global demand prices as China ends its zero-COVID policy and attempts to ramp up industrial

activity.

China and India together account for three-fourths of electricity consumption in Asia-Pacific, with

coal fuelling more than 70% of India's power generation. Coal-fired power plants, which account for

more than three-fourths of India's use of the polluting fuel, ramped up generation by about 10% in

2022 to address higher demand.

Utilities would need 453 trains during the first half of 2023-24 for domestic and imported coal to be

transported, 68 trains more than the December average of 385 trains, according to the presentation.

(Reporting by Sudarshan Varadhan in Singapore. Additional reporting by Sarita Chaganti Singh in

New Delhi. Editing by Gerry Doyle).

15. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 15

NewBase January 11 -2023 Khaled Al Awadi

NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE

Oil slips as U.S. crude, fuel inventories reignite demand concerns

Reuters + NewBase

Oil prices fell on Wednesday, erasing the previous session's gains, after industry data showed an

unexpected build in crude and fuel inventories in the United States, the world's biggest oil user,

which reignited worries about fuel demand.

U.S. West Texas Intermediate (WTI) crude futures fell 59 cents, or 0.8%, to $74.53 a barrel at 0134

GMT, while Brent crude futures were down 62 cents, or 0.8%, at $79.48 a barrel.

U.S. crude stocks jumped by 14.9 million barrels in the week ended Jan. 6, sources said, citing data

from the American Petroleum Institute (API). At the same time, distillate stocks, which include

heating oil and jet fuel, rose by about 1.1 million barrels.

Analysts polled by Reuters expected crude stocks to fall by 2.2 million barrels and distillate stocks

to drop by 500,000 barrels.

Traders will be looking out for inventory data from the U.S. Energy Information Administration due

later on Wednesday to see if it matches the preliminary view from API.

Oil price special

coverage

16. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 16

The oil market has been pulled lower by worries about U.S. interest rate hikes to curb inflation which

would trigger a recession and curtail fuel demand, offsetting hopes for fuel demand growth in China,

the world's second largest oil consumer, as it eases COVID-19 curbs and resumes international

travel.

"Monday's news that China had issued a fresh batch of import quotas suggests the world's large

importer is ramping up to meet higher demand," ANZ Research analysts said in a note.

The big focus this week is on U.S. inflation data, due on Thursday. If inflation comes in below

expectations that would drive the dollar down, analysts said. A weaker dollar can boost oil demand

as it makes the commodity cheaper for buyers holding other currencies.

17. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 17

Average cost of wholesale U.S. N. gas in 2022 highest since 2008

EIA.com

In 2022, the wholesale U.S. natural gas spot price at the national benchmark Henry Hub in Louisiana

averaged $6.45 per million British thermal units (MMBtu), the highest annual average—in both real

and nominal terms—since 2008, based on data from Refinitiv Eikon.

The 2022 average Henry Hub real natural gas spot price increased over 53% from 2021, the fourth-

largest year-over-year increase in natural gas prices on record, behind only 2000, 2003, and 2021.

On a daily basis, the Henry Hub spot natural gas price ranged from $3.46/MMBtu to $9.85/MMBtu,

reflecting significant day-to-day price changes.

During the first quarter of 2022, declining U.S. natural gas production due to production freeze-offs

in January and February and high net withdrawals of natural gas from storage caused the natural

gas price to increase.

Continued high demand for U.S. liquefied natural gas (LNG) exports in Europe and rising, weather-

driven demand for natural gas in the United States led to relatively wide Henry Hub price ranges in

February and March, between $4.03/MMBtu and $6.70/MMBtu. Despite these price fluctuations,

the $4.67/MMBtu average spot price was lower in the first quarter of 2022 than during the rest of

the year.

In May, weather-related demand for natural gas for electricity generation and increased uncertainty

around working natural gas storage injections led to an increase in natural gas prices. The Henry

Hub natural gas spot price increased above $9.00/MMBtu in early June, but it then fell by 40% by

July 4 because of a fire and the subsequent shutdown of the Freeport LNG export terminal.

18. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 18

The shutdown reduced U.S. LNG exports by about 2 billion cubic feet per day (Bcf/d), and more

natural gas was diverted to underground storage.

The Henry Hub natural gas spot price began to rise again in July and peaked on August 22, 2022,

at $9.85/MMBtu, 60% higher than the daily Henry Hub natural gas spot price at the beginning of the

year.

The natural gas spot price decreased late in the third quarter because of high natural gas production

and the resulting above-average storage injections in September. By November, working natural

gas in underground storage was close to the previous five-year average.

The Henry Hub natural gas spot price reached an annual low of $3.46/MMBtu on November 9, down

65% from August 22. The natural gas price began to increase again in December because of

dropping winter temperatures that increased demand for natural gas for heating.

Capacity constraints also affected natural gas prices throughout the year on a regional level; for

example:

Prices at key Appalachian trading hubs continued to remain at a $0.68/MMBtu average

discount to Henry Hub according to pricing data from Natural Gas Intelligence due to limited

pipeline takeaway capacity in the region.

The spot price at the Waha Hub in West Texas averaged $1.26/MMBtu below the Henry Hub

in 2022, largely due to limited pipeline takeaway capacity in the region and to periods of

pipeline maintenance that decreased takeaway capacity.

Several pricing hubs in the western United States averaged over $48/MMBtu above Henry

Hub on December 21 due to colder-than-normal temperatures and regional pipeline

constraints.

19. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 19

NewBase Specual Coverage

The Energy world –January -11 -2023

ENERGY – LIFE

UK’s new energy security strategy and climate change?

After weeks of rumour and speculation, Boris Johnson’s plan for how the UK can ensure its energy

security amid climate change, a cost-of-living crisis and Russia’s invasion of Ukraine has finally

been published.

The government’s energy security

strategy, released in full on Thursday afternoon, is

shaped by ambitious – yet vague – promises for

nuclear power and offshore wind, with little

mention of new measures for energy efficiency or

onshore wind.

It says some 95 per cent of the country’s electricity

could come from low-carbon sources by 2030,

ahead of the government’s existing aim of

decarbonising the sector by 2035.

Just days after the release of an Intergovernmental

Panel on Climate Change (IPCC) report on tackling climate change, the strategy also commits to

holding a new licensing round for North Sea oil and gas and promises to “remain open-minded”

about fracking.

In its initial assessment of the strategy, the government’s adviser the Climate Change Committee

(CCC) says the proposals, if enacted, “would bring us closer to meeting the net-zero challenge”.

However, it adds that “it is disappointing not to see more on energy efficiency and on supporting

households to make changes that can cut their energy bills now”.

Overall, experts tell Carbon Brief that, despite being framed as a response to the energy crisis, the

strategy contains very little in the short-term to help struggling people with their bills or wean the

nation off Russian fossil fuels.

We have to be smarter in our planning and more efficient in our use of energy – nuclear presents a

big opportunity to do that and the co-benefits of heating will reduce the cost.

Some climate measures that enjoy high public support, such as onshore wind power and solar,

receive less attention in the strategy than nuclear power, one of Johnson’s “big bets” for securing

the UK’s future energy security.

Below, Carbon Brief analyses all the key elements of the UK’s energy security strategy and explains

the origin of the various “ambitions” it contains.

Nuclear

Many publications led their pre-release coverage of the energy strategy by reporting on Johnson’s

“big bet” on nuclear power. The press release for the strategy – the basis for this reporting – does

not put forward clear targets for nuclear power expansion.

20. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 20

Instead, it says the government has “an ambition” to produce “up to 24GW” [gigawatts] of nuclear

power by 2050. If achieved, this would “present up to around 25 per cent of our projected electricity

demand”, the press release notes.

This ambition is more than double the 10GW of nuclear power that the CCC expects under its

central scenario for how the UK can get to net-zero by 2050 in the most cost-effective manner, as

shown by the purple bars in the Carbon Brief chart below. In its initial response to the strategy, the

CCC says the government’s ambitions for nuclear “clearly go beyond” its own proposals.

The chart also shows the range of capacity expected by 2050 for solar (yellow), offshore wind (red),

onshore wind (blue) and gas or biomass with carbon capture and storage (CCS, grey) under

scenarios from the UK government’s Department of Business, Energy and Industrial

Strategy (BEIS), when compared with those produced independently by the CCC, National Grid

Electricity System Operator (NGESO) and the Energy Systems Catapult (ESC).

UK electricity generation capacity in 2050, GW, for a range of technologies in scenarios published by the CCC,

NGESO, BEIS and ESC. Source: Carbon Brief analysis of published scenarios. Chart by Joe Goodman for Carbon

Brief using Highcharts.

The government’s strategy does not specifically include ambitions for 2030. (In March,

the Guardian reported that officials were mulling a target of 16GW of nuclear power for 2030.)

The press release is also not clear on how many nuclear reactors the government is planning for in

the coming decades.

21. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 21

It says the government “will work to progress a series of projects as soon as possible this decade”,

including at the Wylfa nuclear site in Anglesey, north Wales. (A planned scheme at Wylfa is one of

several to have been shelved in recent years.)

It adds the plans “could mean delivering up to eight reactors”, which it claims would be the equivalent

of “one reactor a year”. (Several publications misinterpret this as a government pledge to build one

reactor a year.)

However, the strategy itself says the possibility of eight reactors is dependent on “the pipeline of

projects” and it is clear that most would not be built this decade.

The strategy repeats the government’s existing “intend[ion]” to take one nuclear project to a final

investment decision “this parliament” – no later than 2024 – and widely understood to be the

Sizewell C scheme in Suffolk.

The strategy says that, in addition to this, a further two projects would be signed off during the “next

parliament”. (However, it cannot bind the winner of the next election.)

It says this ambition includes small modular reactors (SMRs) – nuclear fission reactors that are

smaller than conventional nuclear reactors, but have not yet been proven to work commercially at

scale.

“Nuclear power is already part of the energy mix in the UK, but we can be much smarter in its use.

At present, 65 per cent of the energy generated is lost as waste heat – that energy can be used for

industrial processes, such as producing green hydrogen, or even for directly heating homes in the

local region. We have to be smarter in our planning and more efficient in our use of energy – nuclear

presents a big opportunity to do that and the co-benefits of heating will reduce the cost.”

It also states with high confidence that nuclear power “continues to be affected by cost overruns,

high up-front investment needs, challenges with final disposal of radioactive waste, and varying

public acceptance and political support levels”.

22. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 22

In its scenarios for how the UK can reach net-zero, the CCC estimates that the cost of generating

nuclear power will far exceed that of renewables in 2050. Under its central scenario for net-zero in

2050, it estimates a cost of £85 per megawatt hour (MWh) for nuclear, with offshore wind and solar

costing £40/MWh.

Offshore wind

The energy security strategy’s second “big bet” sets a “new ambition” to achieve “up to” 50GW of

offshore wind power by 2030. This would be “more than enough to power every home in the UK”,

the government says in its press release.

(Homes only account for a third of electricity use in the UK, but 50GW of offshore wind would

generate roughly 75 per cent of current demand and more than 60 per cent of the level expected in

2030.)

Of this 50GW, the government “would like to see” up to 5GW from floating windfarms – offshore

projects in deep waters where turbines are mounted on a floating structure rather than fixed to the

ocean floor.

The strategy continues:

“Our history of North Sea oil and gas expertise enables us to rapidly deploy our rich expertise in

sub-sea technology and maximise our natural assets. Already, just off the coast of Aberdeenshire,

we have built the world’s first floating offshore windfarms. There will be huge benefits in the Irish

and Celtic Sea.”

This ambition is higher than the government’s previous pledge to build 40GW of offshore wind power

by 2030. This pledge was first mentioned in the Conservative’s 2019 election manifesto and

repeated in Johnson’s 10-point climate plan released in 2020.

In its initial assessment of the energy security strategy, the CCC says that, along with nuclear power,

the government’s ambitions for offshore wind “go beyond” its own proposals. The statement from

the CCC adds:

“The new commitments are hugely ambitious – they would see the UK produce more electricity from

offshore wind in 2030 [around 240 terawatt hours] than it has produced from gas in any year in

history. Government, business and industry will need to focus relentlessly on delivery at a scale and

pace as yet unseen.”

The press release for the strategy says its ambitions will be “underpinned by new planning reforms

to cut the approval time for new offshore wind farms from four years to one year”. The strategy itself

adds that the government will establish “a fast track consenting route for priority cases where quality

standards are met” for offshore wind.

It plans to achieve this “by amending Planning Act 2008 so that the relevant secretary of state can

set shorter examination timescales”, it adds. In a statement, Sir John Armitt, chair of the National

Infrastructure Commission, says the government “should be credited with its scale of ambition to

expand offshore wind”, adding:

“The challenge is to take these stretching targets and turn them into delivery of cheaper electricity

into people’s homes as quickly as possible.”

As the chart above shows, scenarios for net-zero by 2050 involve up to 140GW of offshore wind,

meaning continued expansion would be needed beyond the 50GW by 2030.

Onshore wind

23. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 23

Onshore wind plays a much more muted role in the energy strategy than pre-release rumours and

reporting had suggested, despite the fact that it is the second-cheapest way to generate electricity

in the UK after solar.

The press release for the strategy dedicates just one line to onshore wind:

“We will be consulting on developing partnerships with a limited number of supportive communities

who wish to host new onshore wind infrastructure in return for guaranteed lower energy bills.” The

strategy itself expands on this, saying that the government “will not introduce wholesale changes to

current planning regulations for onshore wind, but will consult this year on developing local

partnerships”.

It also says this consultation “will consider how clear support can be demonstrated by local

communities, local authorities and MPs”.

The strategy adds that “the government recognises the range of views on onshore wind”. This is

despite official polling showing 80 per cent of the public support onshore wind (see below),

compared with 37 per cent for nuclear and 17 per cent for fracking.

Share of respondents to the latest government public attitudes tracker, %, that support (blue) or oppose (red)

different energy sources in the UK. Those that neither support nor oppose each technology are shown in light grey

and those that do not know dark grey. Source: BEIS. Chart by Joe Goodman for Carbon Brief using Highcharts.

On 2 April, just days ahead of the strategy’s release, many publications speculated that the

government had plans to triple onshore wind power generation by 2035 as part of the energy

security strategy.

24. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 24

Leaked official documents relating to the strategy from March, handed to the i newspaper and

others, appeared to recommend an increase in onshore wind power from around 15GW today to

30GW in 2030 and 45GW in 2035.

The leaked document also recommended the establishment of an “onshore wind task force” to,

among other things, create a “more facilitative planning policy” for onshore wind in England. (David

Cameron imposed an effective ban on onshore wind in England in 2013.)

None of these plans are mentioned in the final strategy. (On 4 April, the Times reported that Johnson

had dropped his plans for onshore wind in favour of new nuclear power.)

Dr Rebecca Windemer, a lecturer in environmental planning at the University of West England,

described the lack of policy reform included in the strategy as “extremely disappointing”. She tells

Carbon Brief:

“Under the current policy new wind farms can’t be developed in 89 per cent of local authorities in

England, despite a widespread desire to do so. Changing the planning policy would enable wind

farms to be developed in locations where they are wanted and also enable more communities to

develop and own their own turbines.”

The auction is currently capped at a maximum of 5GW of onshore wind and solar combined, despite

the nearly 11GW of such projects that already have planning permission and could be built quickly,

if given a route to market.

However, Carbon Brief understands that the government could still choose to raise the cap on

onshore renewables, ahead of the auction, via a “budget revision notice”.

The strategy also commits to include onshore wind in future CfD rounds. In February, the

government announced that these would now take place annually.

Solar

The strategy contains some new measures to promote solar power, which is the cheapest and most

popular energy technology – and the fastest to build. However, as with other aspects of the plan,

experts noted that it lacks concrete proposals.

The press release for the strategy says the government will “look to increase” the UK’s current

14GW of solar capacity – including both large-scale projects and rooftop solar panels – which

“could” grow up to five times by 2035, taking it to 70GW.

The strategy itself is similarly vague in its ambitions, stating “we expect” a fivefold increase over this

period.

An earlier version of the document, shared by the i newspaper, included more specific targets,

notably setting firm goals of 50GW of solar capacity by 2030 and 70GW by 2035.

However, this is missing from the final document and there are few details of what will drive the

expected uptick in solar, limited to a handful of consultations and vague pledges.

Under its central scenario for net-zero, the CCC envisages 85GW of solar power in the UK by 2050.

Scenarios from other organisations, including BEIS, see up to 90GW of solar power by 2050, as the

chart above shows.

In a briefing ahead of the strategy, trade association Solar Energy UK called on the government to

commit to a target of 40GW by 2030 and 54GW by 2035, and the organisation welcomed the plan

when it emerged.

25. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 25

However, its chief executive Chris Hewett tells Carbon Brief that 50GW would be feasible by 2030,

if grid constraints were addressed.

The earlier draft of the strategy was clear that the way to achieve its proposed goals would be

through large-scale ground-mount solar, which it referred to as “the cheapest form of electricity

generation”.

It said the government would need to take forward the “vast majority” of proposed projects and show

“clear support” through a communications effort.

However, as with onshore wind, such projects have caused disquiet within the Conservative party,

with backbenchers – including former health secretary Matt Hancock – vocally opposing solar

projects in their constituencies.

The final strategy appears to shift the focus more towards smaller-scale rooftop solar, with the press

release stating that the government would “[consult] on the rules for solar projects, particularly on

domestic and commercial rooftops”.

For ground-mounted projects, the government says it will hold a consultation to “[amend] planning

rules to strengthen policy in favour of development on non-protected land” and “[encourage] large-

scale projects to locate on previously developed, or lower value land”.

These words are accompanied by the caveat that the government will “[ensure] communities

continue to have a say and environmental protections remain in place”. Juliet Phillips, a senior policy

advisor at thinktank E3G, tells Carbon Brief this wording “[leaves] the door ajar for nimbyism”.

Energy efficiency

Perhaps the most significant omission from the report is any new funding commitment to boost

energy efficiency and help insulate the nation’s leaky housing.

26. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 26

This is widely viewed as among the fastest and most cost-effective solutions to the current energy

crisis, as it would reduce overall demand and, therefore, save people money on their bills as well

as cutting the need for fossil-fuel imports.

The UK could reduce its consumption of Russian gas by 80 per cent this year through measures to

improve energy efficiency and cut energy demand, according to thinktank E3G.

The absence of such measures in the strategy has, therefore, been described by many as a “huge

missed opportunity”.

Among those who have shown support for more energy-efficiency funding are No 10 and

BEIS (reportedly), the Climate Change Committee (CCC), a former Conservative energy minister,

the chair of the BEIS select committee, various think tanks, environmental NGOs and many energy

researchers.

Despite plenty of positive language around home insulation, including the statement that “every

therm of gas saved grows our energy security and brings jobs to the UK”, there is no new money in

the strategy to support the required renovations.

Media outlets have reported that this is due to the Treasury under chancellor Rishi Sunak opposing

any new measures to support this sector.

During the 2019 general election, the Conservatives committed to:

“Help lower energy bills by investing £9.2bn in the energy efficiency of homes, schools and

hospitals.”

However, the Conservative-led governments over the past decade have a litany of unsuccessful

forays into energy efficiency behind them, from David Cameron’s pledge to cut the “green crap” that

saw loft and cavity wall insulation rates drop by 92 per cent and 74 per cent in 2013, to the £1.5bn

Green Homes Grant which ended up being cancelled after just six months in 2021.

Most recently, in his Spring Statement, Sunak announced a reduction in the VAT paid when having

insulation and low-carbon technologies installed in homes. This pledge is repeated in the new

strategy.

While this was portrayed as a way of saving people money, it was viewed as a policy that primarily

benefited wealthy, comfortable households rather than those struggling with energy bills.

All in all, with the cost of living soaring, the 2019 manifesto pledge to “help lower energy bills” with

energy-efficiency investment seems more relevant than ever.

According to the Daily Telegraph, both No 10 and Kwarteng’s team had advocated for an expansion

of the Energy Company Obligation (ECO) scheme, which is currently the UK’s main policy for

improving home insulation.

As it stands, the scheme, which prioritises low-income and vulnerable households, requires large

energy suppliers to install insulation in low-quality housing. It receives £1bn each year, funded with

a levy on energy bills, but the new proposal involved an additional £200m of public funds going into

it so that it could be expanded to more households.

However, according to reports, the Treasury opposed this idea, choosing instead to stick to the

spending announcements from the autumn budget, which themselves were first announced last

October in the heat and buildings strategy and deemed insufficient by experts.

27. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 27

Ana Musat, head of policy at the Aldersgate Group, tells Carbon Brief that expanding the scope of

ECO to cover more homes would have been welcome.

She adds that any successor to the Green Homes Grant should also be accompanied by regulatory

levers, such as tightened Minimum Energy Efficiency Standards (MEES).

Dr Fraser Stewart, a social and energy justice researcher for energy thinktank Regen, tells Carbon

Brief that on top of “grants and subsidies for those inclined to do work themselves”, more expansive,

inclusive policies are also necessary:

“For a just transition on the scale we need and to help people crucially struggling with the crisis now,

we need to reach people and communities across the spectrum.”

He proposes funding local authorities to deliver efficiency, supplementing “underfunded and poorly

promoted” existing schemes, such as the Social Housing Decarbonisation fund and a national

promotional campaign for these schemes.

Instead of any of these measures, the strategy reiterates many past commitments, announces a

new £30m heat pump innovation competition and a new “energy advice service” that consumers

can contact to help navigate the “unknown territory” of home insulation.

The document also lacks any substantial measures to cut consumer demand for energy – moves

which would have the most immediate impact on saving people money and reducing reliance on

Russian gas.

Pointing to her organisation’s proposal for nine measures to cut demand, including expanding the

Boiler Upgrade Scheme and launching a public information campaign, Juliet Phillips from E3G tells

Carbon Brief:

“Even Kwasi Kwarteng has admitted the strategy is, at best, a “medium-term” plan, rather than

focused on supporting struggling households. With estimates that one in three households will fall

into fuel poverty if energy bills hit £3,000 later this year – as experts are warning they might – this

means the strategy totally fails to speak to the moment.”

Hydrogen

The prime minister’s final “big bet” after nuclear and offshore wind, as reported by newspapers in

the run up to the strategy, is a pledge to double the UK’s target for hydrogen production to “up to

10GW” by 2030.

This builds on the previous pledge of 5GW announced in the prime minister’s 10-point plan in 2020.

As it stands, UK production of low-carbon hydrogen is close to zero.

Experts broadly welcomed the ambition of the new target, but they noted that there was an urgent

need to begin demonstrating hydrogen projects across the nation, prioritising hard-to-decarbonise

areas such as heavy industry.

The strategy itself does not mention using hydrogen to heat homes, but the press release talks

about this “potentially” being an option.

Moreover, according to Adam Bell, head of policy at the consultancy Stonehaven, the mere raising

of the target would provide a boost to hydrogen in heating, as injecting it into the gas grid could

provide a straightforward option for large volumes of hydrogen.

28. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 28

While many experts – and the recent IPCC report – suggest hydrogen should be prioritised for other

sectors rather than heating, the government has currently left the door open for this application, with

a decision currently delayed until 2026.

The strategy says the UK is well-placed to exploit “all forms” of low-carbon hydrogen production –

referring to both “green” hydrogen made with renewable power, and “blue” hydrogen made using

natural gas with carbon capture and storage (CCS).

According to the documents, “at least half” of the 10GW will come from “electrolytic” – green –

hydrogen.

While the EU has opted to primarily focus on green hydrogen, the UK’s decision to pursue blue as

well has been contentious, as unlike the green variety, it is not zero-carbon and would maintain

reliance on gas.

Prof Jim Watson, professor of energy policy at University College London, tells Carbon Brief:

“I think the continuing commitment to blue hydrogen as well as green hydrogen in the UK…[is]

problematic. Why is it a good idea to use gas to produce hydrogen which would be used to replace

gas?”

The strategy says that to support its target it will run “annual allocation rounds for electrolytic

hydrogen, moving to price competitive allocation by 2025 as soon as legislation and market

conditions allow”. This builds on a business model mentioned in previous government strategies.

North Sea oil and gas

In the energy security strategy, the UK government describes gas as “the glue that holds our

electricity system together” and says “it will be an important transition fuel”.

The strategy says that the North Sea Transition Authority (until recently known as the Oil and Gas

Authority) plans to “launch another licensing round” for North Sea oil and gas projects in “the

autumn”, claiming:

“This will mean more domestic gas on the grid sooner.”

But it is worth noting that, according to official data, it takes an average of 28 years for an exploration

licence to lead to oil and gas production. Because of this, any licence awarded in the autumn may

not be contributing to supply until the 2040s or 2050s – doing little to reduce reliance on Russian

fossil fuels in the short term.

The strategy also says the government will establish “gas and oil new project regulatory

accelerators” to “facilitate the rapid development of projects”. It claims this “could take years off the

development of the most complex new opportunities”.

The UK government has previously said that new licensing rounds can only take place if the oil and

gas sector can pass a “climate compatibility checkpoint” that “ensures” any new production is in line

with the country’s goal of reaching net-zero emissions by 2050. The new strategy reaffirms this

commitment, saying the North Sea Transition Authority will take the checkpoint into account.

The final details of how this checkpoint will work in practice has not yet been announced. (Earlier

this year, Carbon Brief took an in-depth look at whether new oil and gas licences can ever be

“climate compatible”.)

29. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 29

The recent IPCC report on how to tackle climate change is among high-level scientific assessments

to conclude that, globally, continued fossil fuel expansion is not compatible with efforts to keep

global warming to 1.5C, the aspiration of the Paris Agreement.

In their response to the strategy, many commentators pointed out that the government’s

recommitment to fossil fuels comes just days after the release of the IPCC report.

Tessa Khan, an environmental lawyer and director of the campaign group Uplift, tells journalists:

“The fact that this strategy has been published just days after the IPCC made it clear that already-

planned fossil fuel projects will take us past safe climate limits makes it all the more galling.”

The press release for the strategy notes that the plans for a new licensing round also hinge on the

government’s view “that producing gas in the UK has a lower carbon footprint than imported from

abroad”.

Recent analysis by the CCC found that the emissions intensity of oil and gas produced by the UK

is lower than the global average.

However, it is worth noting that the UK is not currently outperforming its biggest import

partner, Norway, when it comes to oil and gas production standards.

In addition, its current plan for slashing production emissions in the North Sea is not ambitious

enough, when compared to CCC scenarios for how the UK can reach net-zero.

The strategy says the government plans to “further” reduce production emissions by “driving rapid

industry investment in electrifying offshore production”.

Fracking

In the weeks leading up to the strategy’s launch one of the most hotly debated topics among

ministers and commentators has been fracking.

Banned in England since 2019, due to public outcry following minor earthquakes – of magnitude

2.9 – at a test site in Lancashire, fracking remains one of the least popular energy technologies in

the country, supported by just 17 per cent of the population (see chart above).

30. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 30

Nevertheless, the extraction of shale gas from UK soil has been a consistently popular idea among

certain right-wing factions of the Conservative party, tabloid newspapers and climate sceptics.

This has become all the more apparent since Russia’s invasion of Ukraine, which has seen these

groups seek to argue that an end to the moratorium is necessary to ensure a secure domestic

supply of gas, independent of Russia.

Only two shale gas exploration wells have ever been drilled and tested in the UK. Researchers have

argued that it is highly unlikely the industry will get off the ground.

Even if the England moratorium were lifted, it would take years of drilling before significant volumes

of gas could be extracted, by which time – under the UK’s net-zero strategy – the nation would have

reduced its reliance on gas. This was a point made by the CCC in a 2021 letter to Kwarteng, in

which it also said:

“The moratorium on UK shale production should not be lifted without an in-depth independent review

of the evidence on the climate impact.”

While Kwarteng himself has said that fracking is not the answer to the UK’s energy crisis, in an

apparent bid to appease backbenchers he wrote a letter to the British Geological Survey (BGS) the

day before the strategy was announced requesting a report on the current state of scientific

knowledge around fracking and earthquakes.

The questions being explored by BGS in this review include whether there are new techniques

available that reduce earthquake risk, whether modelling of such risk has improved and whether

areas outside Lancashire – where exploratory wells were previously drilled – would be less prone

to earthquakes.

It asks if ministers could, on the basis of improvements in the past three years, be “completely

confident” about modelling of seismic events and their predictability.

31. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 31

When they were underway, fracking activities in the UK were placed under a system in which

seismic activity that breached a certain, fairly low, threshold meant activities had to be paused.

(Notably, the 2.9-magnitude event triggering the ban was well above this threshold.)

Prof John Loughhead, industrial chair in clean energy at the University of Birmingham and chief

scientific adviser at BEIS from 2016 to 2020, tells Carbon Brief that as far as he knows none of the

factors leading to this earthquakes or the monitoring of them have changed, meaning the BGS

review is unlikely to yield much:

“To the best of my personal knowledge, I don’t think any substantive new information or

understanding or insight has arisen…and I don’t think there has been any significant research

activity on fracking because the government said ‘we don’t want to do it’.”

In the end, the strategy says the government will “[remain] open-minded about our onshore

reserves”, citing the “impartial technical review” by BGS. It adds that: “Any exploration or

development of shale gas would need to meet rigorous safety and environmental protection both

above ground and sub-surface.”

Ultimately, while the inclusion of fracking appears to show some compromise with pro-fracking

elements in society, Prof Michael Grubb of UCL says environmentalists “shouldn’t be too worried”

about the decision:

“Whatever the government does, don’t hold your breath for shale to be – if and when anything

actually emerges – anything more than an uneconomic trickle. It sure won’t help with our energy

prices.”

NewBase Energy News 12 January 2023 - Issue No. 1582 call on +971504822502, UAE

The Editor:” Khaled Al Awadi” Your partner in Energy Services

NewBase energy news is produced Twice a week and sponsored by Hawk Energy Service – Dubai, UAE.

For additional free subscriptions, please email us.

About: Khaled Malallah Al Awadi,

Energy Consultant

MS & BS Mechanical Engineering (HON), USA

Emarat member since 1990

ASME member since 1995

Hawk Energy member 2010

www.linkedin.com/in/khaled-al-awadi-38b995b

32. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 32

Mobile: +971504822502

khdmohd@hawkenergy.net or khdmohd@hotmail.com

Khaled Al Awadi is a UAE National with over 30 years of experience in the Oil & Gas

sector. Has Mechanical Engineering BSc. & MSc. Degrees from leading U.S.

Universities. Currently working as self leading external Energy consultant for the

GCC area via many leading Energy Services companies. Khaled is the Founder of

the NewBase Energy news articles issues, Khaled is an international consultant,

advisor, ecopreneur and journalist with expertise in Gas & Oil pipeline Networks,

waste management, waste-to-energy, renewable energy, environment protection

and sustainable development. His geographical areas of focus include Middle East,

Africa and Asia. Khaled has successfully accomplished a wide range of projects in